Weekly Plan April 24th

The market's nosedive has taken it far from the average, and the key metric ATR (Average True Range) is now below 30. 👀

Why does ATR matter?

Many traders and algorithms rely on ATR to determine their trades' viability, and it often dictates if they'll abstain as well. That's why I track ATR in almost all the markets I trade in. 💰

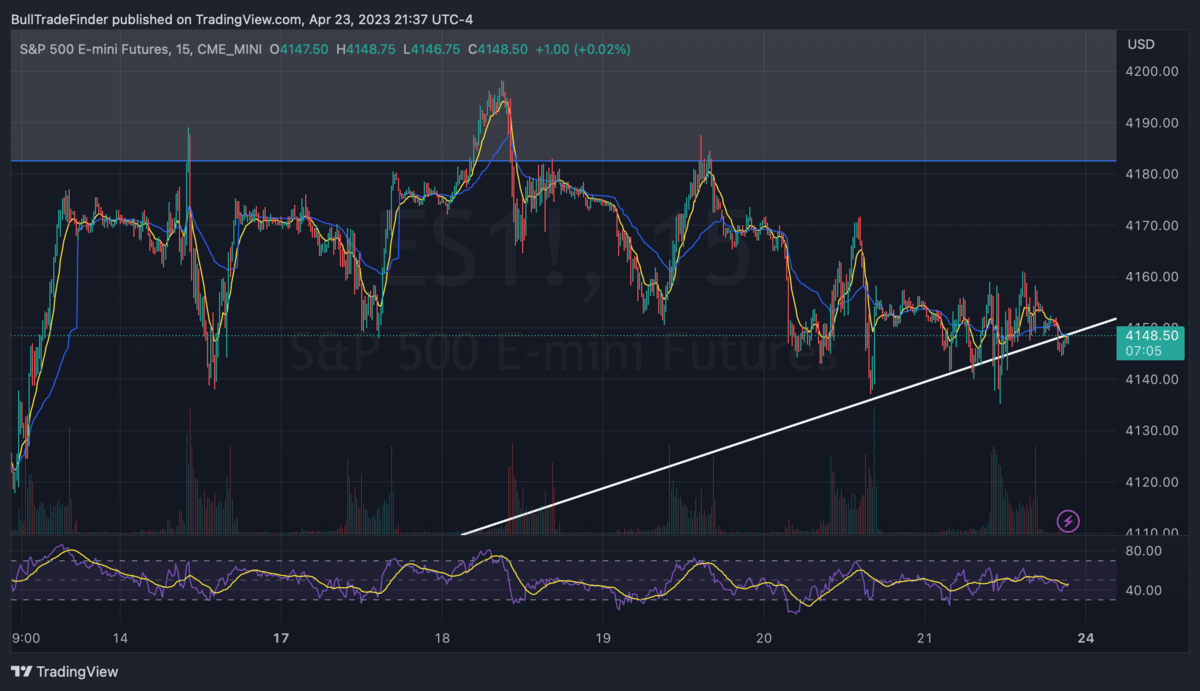

Choppy $ES_F Chart

📅Upcoming market events to watch out for👀:

-Tues: US Central Banker consumer confidence & Aussie CPI

-Wed: EIA inventories for oil markets

-Thurs: US pended home sales & GDP

-Fri: the highlight of the week, is the core PCE index.

These events build up to May 3rd FOMC & also challenge 'Sell in May and Go Away' seasonality forces.📈

For next week, I'm eyeing the 4130 level, with the current trading price at 4150. Here's the plan:

Scenario 1: If bears do not breach 4130 early, we may retest 4186-4200 level on a daily time frame.

Scenario 2: D1 close below 4130? Next stop is 4094. Let's see what happens!

AMZN Earnings

Short term, it's risky to be bearish before the earning report, but staying above 102 could fill the gaps around the 110+ zone. This is just my personal opinion - some are bearish. But I don't think AMZN's earnings will be the catalyst for change. Maybe it'll come with AAPL's earnings and May FOMC. Stay tuned for my thoughts next week.

Thank you all for signing up!

Will only work to do better for you all going forward. Our only goal is to add value to everyone’s trading with key levels and the ability of learning charts and price action.

Please Share Our Newsletter it will be much appreciated!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of TradingView. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.