Week Of April 17th

Big Earnings Ahead

Q1 Earnings

The Q1 earnings are expected to decline by an expected 6.5% this quarter when annualized and will be the 2nd largest drop ever recorded, second only to the one seen in Q1 of 2020 due to the shock of the Coronavirus pandemic.

While this is bad, the actual earnings surprises as reported by about 5% of companies that have reported their earnings are quite robust.

About 90% of the S&P500 companies reported for Q1 have reported an earnings surprise to the upside. In fact, the number of companies that have reported an earnings surprise remains well above their 10-year average at 77%.

Big Earnings start the week of April 24th with large tech names reporting.

Weekly Plan:

Scenario 1: Daily Close over $4186 can send us higher with a ton of key resistances above.

This current area around $4176 and $4186 is major resistance.

Scenario 2: Move under $4121 and $4094 sends us lower and that has been a key support that can unwind us a little bit lower into $4,000.

IF LEVELS ARE BROKEN I WILL BE UPDATING!

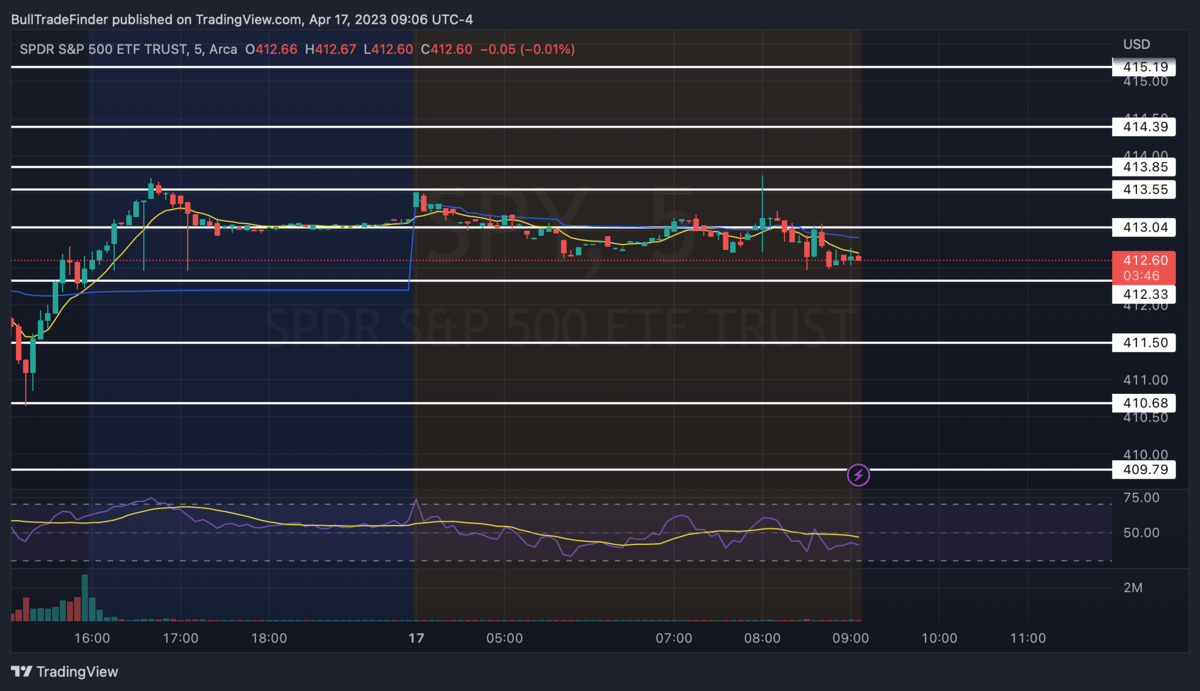

$SPY for SPY traders here is a lot of levels to watch here that line up with some futures levels stated above. $413.55-$413.85 is $4176-$4178.

Thank you all for signing up!

Will only work to do better for you all going forward. Our only goal is to add value to everyone’s trading with key levels and the ability of learning charts and price action.

Please Share Our Newsletter it will be much appreciated!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of TradingView. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.