Understanding Chart Patterns in Trading

Chart patterns are essential tools for traders to analyze price action and predict potential market movements. These patterns form as a result of price fluctuations driven by supply and demand dynamics. Recognizing these formations can give traders an edge in making informed decisions.

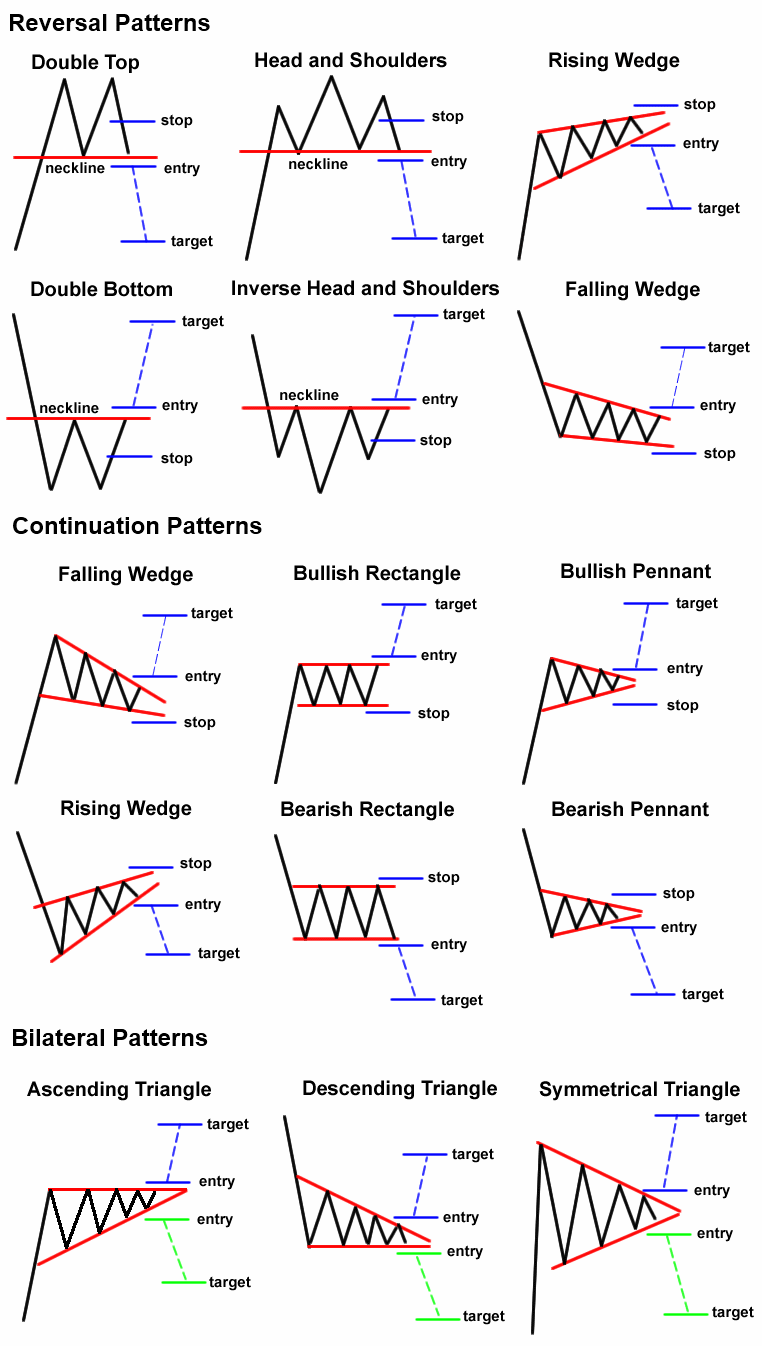

Types of Chart Patterns

1. Reversal Patterns

Reversal patterns signal a potential change in trend direction.

Head and Shoulders: A bearish reversal pattern that appears at the end of an uptrend. It consists of three peaks, with the middle peak (head) being higher than the two side peaks (shoulders). A break below the neckline confirms the reversal.

Inverse Head and Shoulders: The bullish counterpart of the head and shoulders pattern, signaling a reversal from a downtrend to an uptrend.

Double Top & Double Bottom:

A double top occurs after an uptrend, forming two peaks at a resistance level, indicating a possible downward reversal.

A double bottom forms two troughs at a support level, signaling a potential upward reversal.

2. Continuation Patterns

These patterns suggest that the existing trend will continue after a brief pause.

Flags and Pennants: These patterns typically form after a strong price move, followed by consolidation, and then a breakout in the direction of the prior trend.

Ascending and Descending Triangles:

Ascending triangle: Bullish pattern with a rising support level and horizontal resistance, often leading to a breakout to the upside.

Descending triangle: Bearish pattern with a declining resistance level and horizontal support, usually resulting in a breakdown.

Symmetrical Triangle: A neutral pattern where the price converges, leading to a breakout in either direction depending on momentum.

3. Bilateral Patterns

These patterns indicate that the price could break out in either direction, making them more unpredictable.

Symmetrical Triangle (as mentioned above)

Rectangle: A price range where the market moves sideways, with a breakout either above resistance (bullish) or below support (bearish).

How to Use Chart Patterns in Trading

Confirm with Volume: A breakout or breakdown with high trading volume adds reliability to the pattern.

Wait for a Breakout Confirmation: Avoid entering trades too early. Confirm the move before taking a position.

Set Stop Losses: Use key support or resistance levels to define your risk.

Combine with Other Indicators: Chart patterns work best when used with technical indicators like moving averages, RSI, or MACD.

Understanding and identifying chart patterns can greatly improve trading decisions. While no pattern guarantees success, mastering these formations can help traders better anticipate price movements and manage risk effectively.

Interested in Trading LIVE with us DAILY?💰

Join us at https://whop.com/bulltradefinder to take advantage of profitable trades and learning to grow into becoming a better trader! 🚨

Interested in Automated Trading with a 80-89% Probability of Success?👇

Please Share Our Newsletter it will be much appreciated!

Thank you all for signing up!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of TradingView. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.