Stock Market Analysis for May 17, 2023 🌙📈

As the trading day concluded on Wall Street on May 17, 2023, the varied performance of the stock market provided ample food for thought for investors.

Why is this market activity significant?

Breaking down the closing figures of the stock market gives us important insights into the current health of the global economy. The fluctuations we've seen today could potentially have wide-reaching effects across different sectors. It's this potential impact that makes our comprehensive review of the post-market landscape vital. 💹

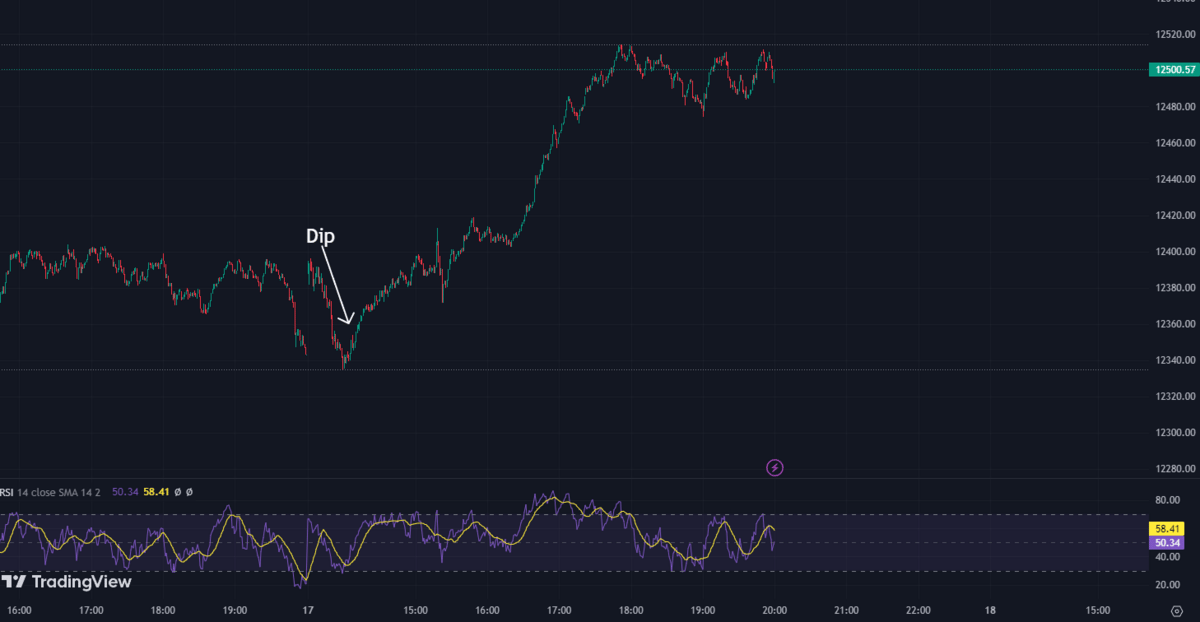

Nasdaq Composite Chart: A Downturn

Key developments from today's trading include:

Large-cap technology stocks did not perform to expectations, which resulted in a 0.2% dip in the Nasdaq Composite.

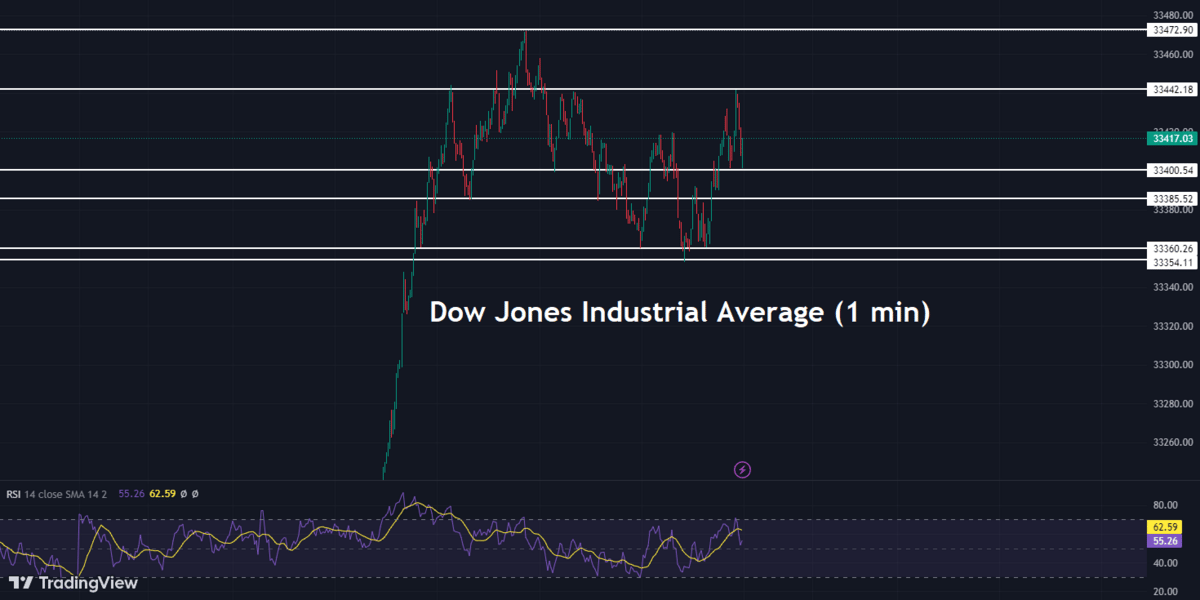

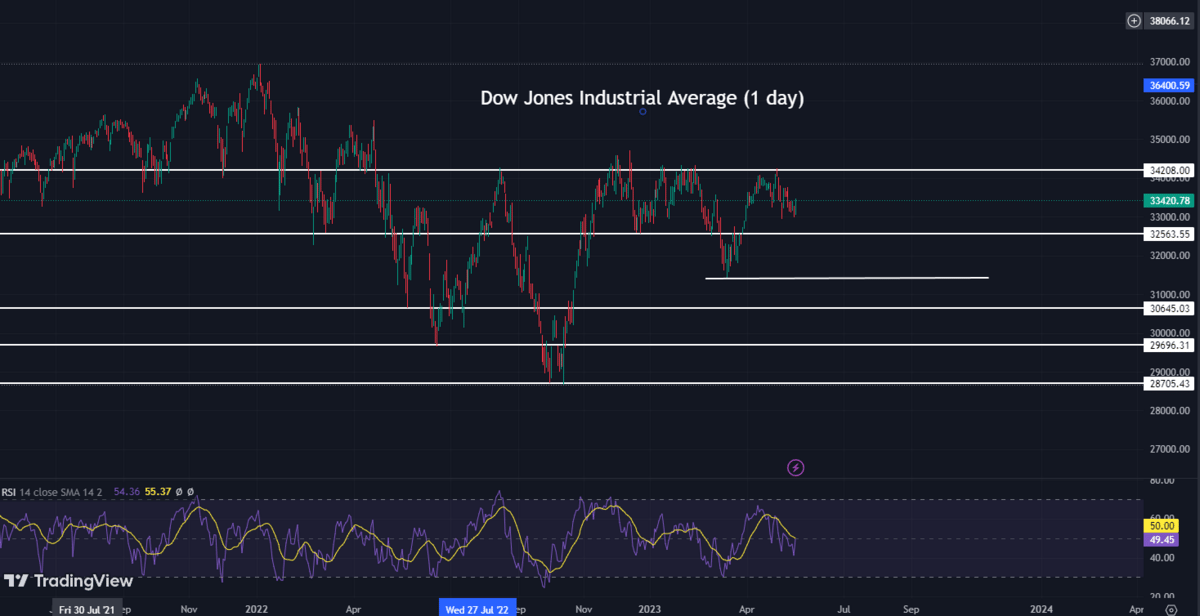

Contrasting this, the Dow Jones Industrial Average showed a positive trend, rising significantly, propelled by over 400 points due to encouraging sentiment around the debt ceiling talks.

European indexes presented a mixed outlook, demonstrating the complexity of global markets.

These factors offer a view into the current state of the market and create expectations for what might unfold tomorrow. 🌐

The performance of large-cap technology stocks and regional banks was of particular interest today, offering indicators that could affect the market's course tomorrow.

Dow Jones: A Strong Performance

In times of uncertainty, there can be a tendency to lean towards a bearish view. However, the strong performance of the Dow Jones today suggests an alternative perspective. This is merely one interpretation, and other views may exist. The performance of the Dow Jones does not predict the future course of the market alone. The wider economic context and ongoing political events will also play crucial roles. Keep an eye out for my analysis tomorrow.

Thank you all for signing up!

Will only work to do better for you all going forward. Our only goal is to add value to everyone’s trading with key levels and the ability of learning charts and price action.

Please Share Our Newsletter it will be much appreciated!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of TradingView. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.