Hello, investors! As we wind down for the evening, let's take a deep dive into the noteworthy events that have shaped the financial markets today.

AI Stocks Soaring, with Nvidia Leading 🚀📈

The spotlight is increasingly on artificial intelligence (AI) stocks as Nvidia, Google, Microsoft, Amazon, and Apple capture the market's attention, these five companies together have grown their market cap to 9 trillion. Nvidia's shares skyrocketed, driven by a surge in demand for its AI chips and pushing it toward a rare $1 trillion valuation. Nvidia also made a new all-time high today with its previous being in 2021. This remarkable performance underscores the growing importance of AI in our global economy. Nvidia's AI technology is viewed as a cornerstone in potentially saving both the market and the wider economy.

AI Explosion: Potential Lifeline for the Economy? 💥🤖

The rapid evolution of AI technology could potentially rescue the market and the overall economy from a financial downturn. AI technology is poised to boost productivity and create new job sectors, acting as a significant buffer against economic challenges. In particular, Nvidia's AI-driven demand surge is seen as a key factor in bolstering the market's resilience.

Debt Ceiling Standoff Continues ⚖️🕒

House Republican negotiators are nearing an agreement with the White House to raise the debt ceiling, but government spending for upcoming years remains a major point of contention. The leaders are optimistic about passing the agreement through both the Republican House and Democratic Senate before the approaching deadline to avoid a potential government default. If negotiations fail, the Biden administration has a backup plan based on the 2011 debt-ceiling impasse, while Wall Street is preparing a crisis response plan to maintain smooth financial market operations.

U.S Economy Surpasses Expectations 💪🌟

On another note, the debt ceiling crisis in the U.S. economy is showing signs of resilience. Latest GDP and jobs data have surpassed expectations, providing a counter to looming recession fears.

Indexes: A Mixture of Events 📊🔄

While the Dow Jones Industrial Average has fallen for its fifth consecutive day due to the debt ceiling talks, the S&P 500, the Nasdaq Composite, and the Nasdaq-100 have all closed the day in the green due to the recent Nvidia surge along with other tech and AI-related events.

The S&P 500 (SPX) popped up 0.88% coming to a conclusion at 4,151

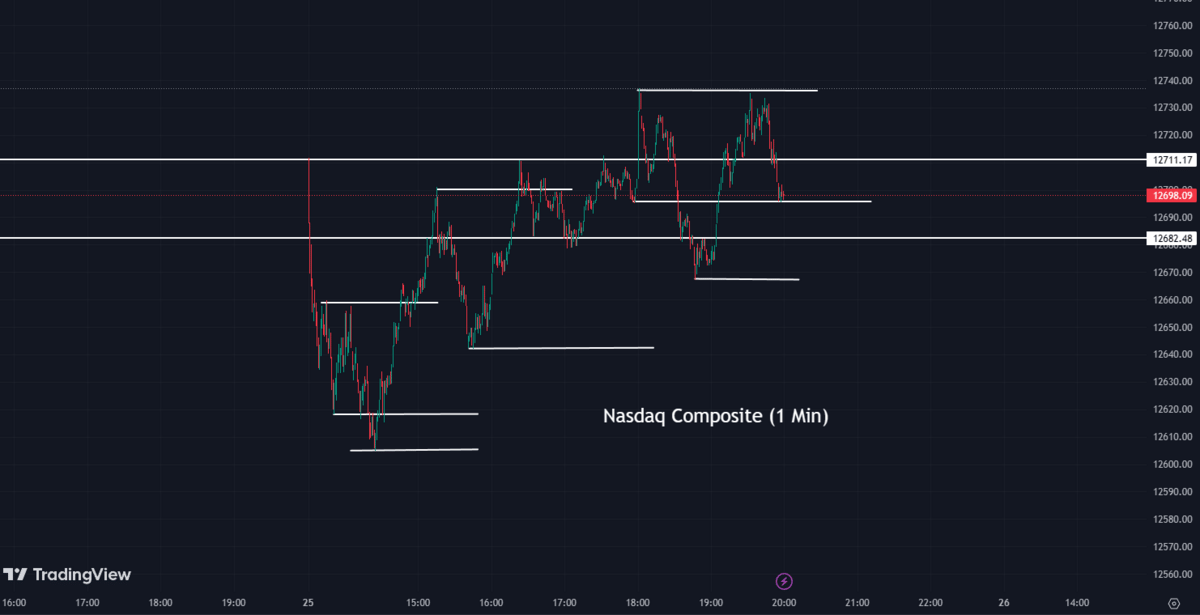

The Nasdaq Composite (IXIC) jumped up 1.71% to finish at 12,698

The Dow Jones Industrial Average (DJI) dropped 0.11% to end the day at 32,764

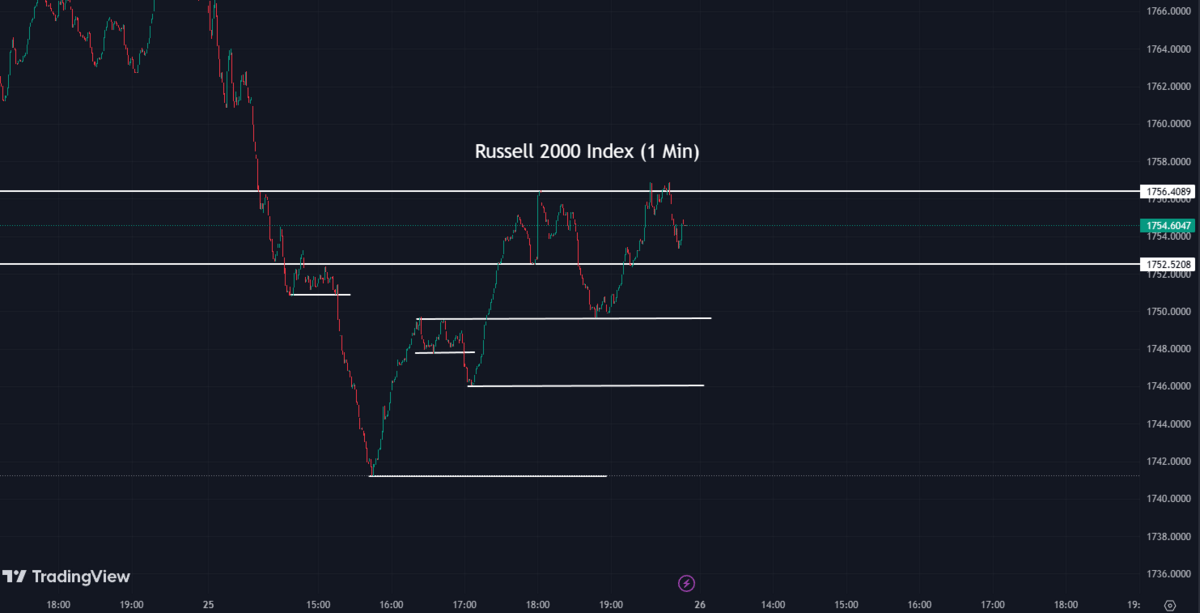

The Russell 2000 (RUT) pulled back 0.70% to settle at 1,754

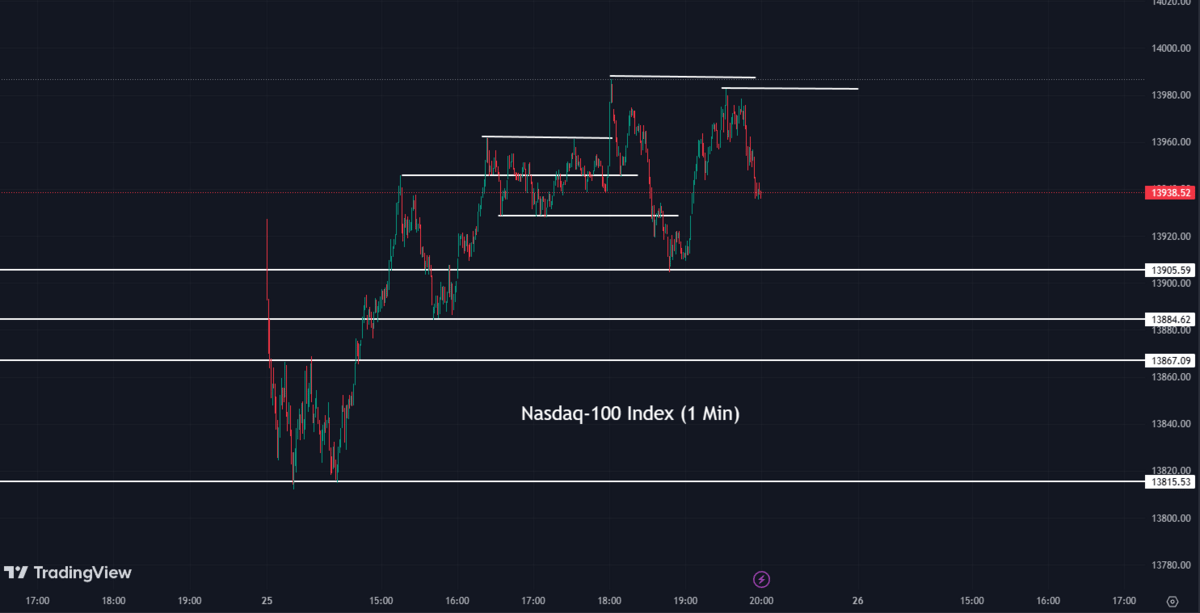

The Nasdaq-100 (NDX) was up 2.46% coming to a conclusion at 13,938

Nvidia Dominates as Nasdaq Futures Rise 📈💻

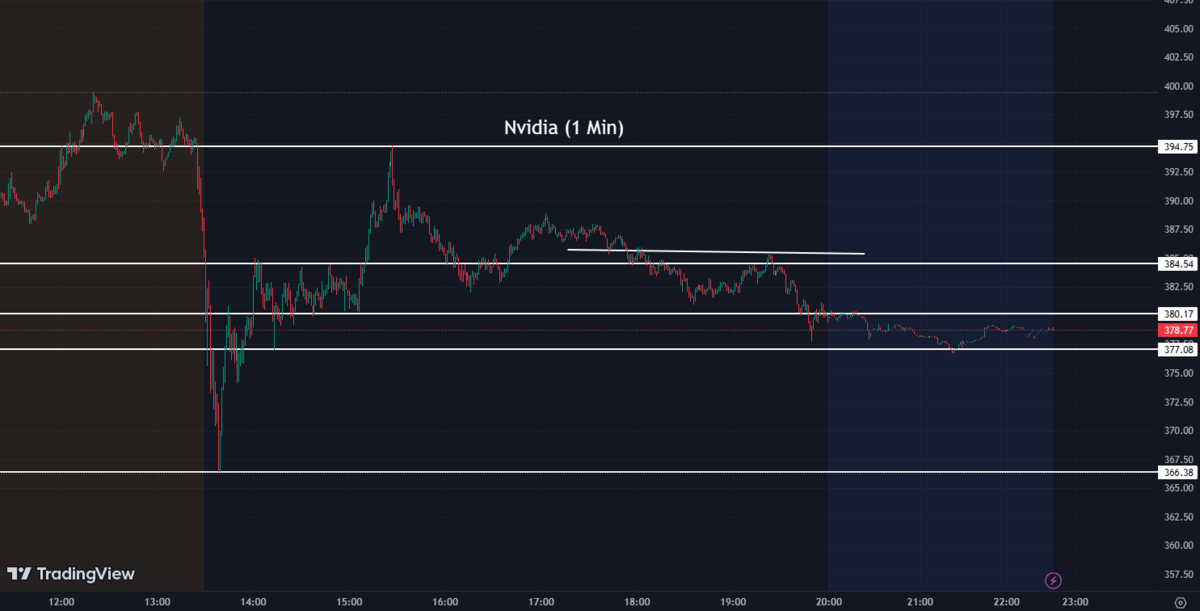

Nvidia's (NVDA) breakthrough performance drove a surge in Nasdaq futures. The company's shares have seen a remarkable rise, reflecting the bullish sentiment in the market toward its focus on AI and chip technology. This rise highlights the significant impact that tech giants like Nvidia can have on broader market trends.

NVDA:

379.80 ▲ +74.42 (+24.37%) Today

378.60▼ 1.20 (0.32%) After Hours

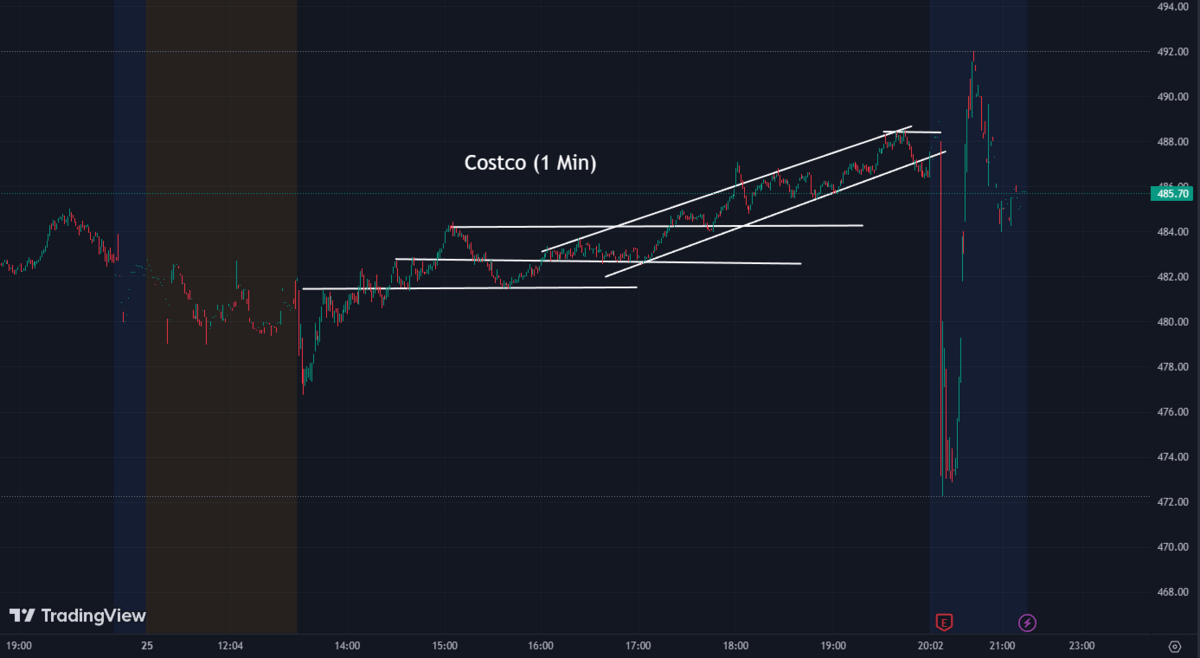

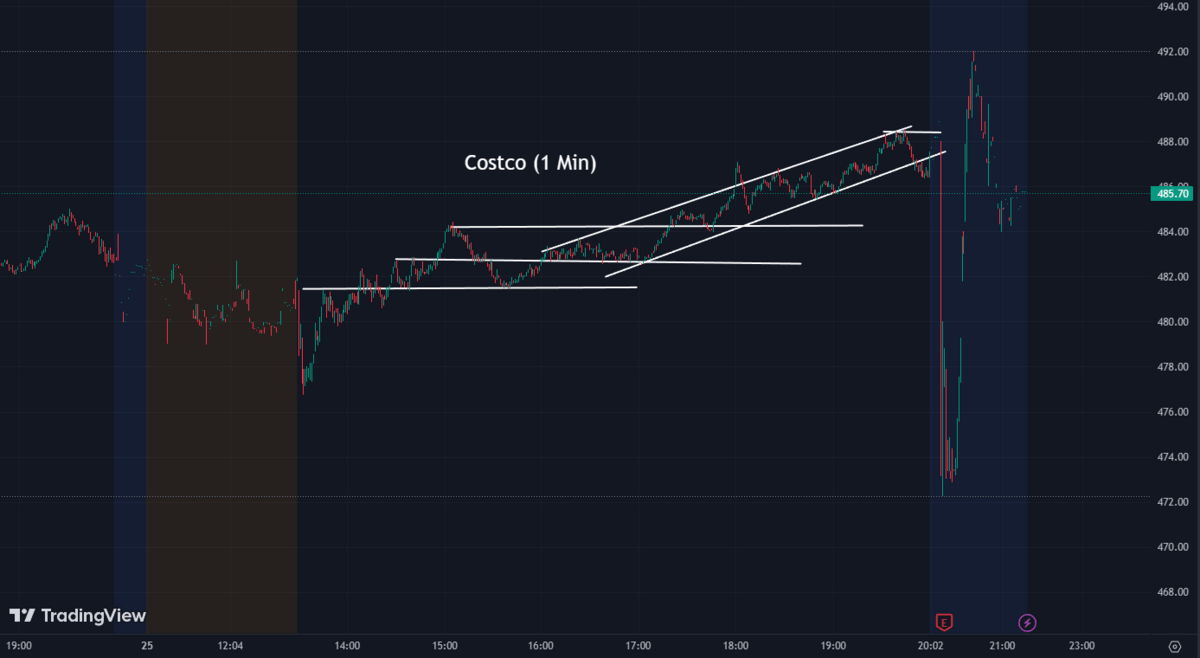

Costco Faces Setbacks in Earnings Report 🏪💰

Costco's (COST) latest earnings have come in under projections, which has led to a slide in the company's stock value. Despite its efficient operations and strong customer loyalty, a slowdown in spending has resulted in earnings that missed market expectations. Following the announcement, Costco's share prices fell in after-hours trading.

COST:

486.55 ▲ +3.79 (+0.79%) Today

485.65▼ 0.90 (0.18%) After Hours

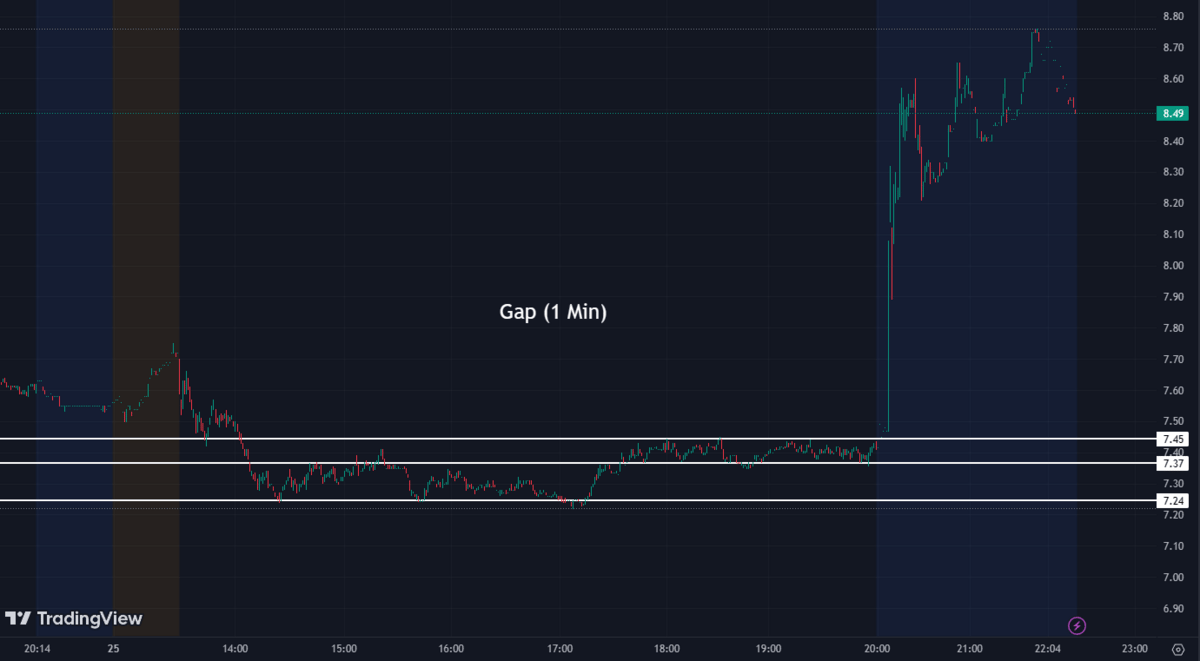

Gap's Earnings in the Spotlight 💼🌟

In other retail news, Gap announced its Q1 earnings today. The company's results are being closely watched for their potential to influence trends in the retail sector and the broader market.

GPS:

7.42 ▼ -0.20 (-2.56%) Today

8.51▲ 1.09 (14.69%) After Hours

After-Hours Trading sees Significant Shifts 🌙🕒

Gap (GPS) - Gap's stock soared 15% in after-hours trading after a strong quarterly earnings report, indicating improved profit margins. Sales revenue fell slightly short of expectations at $3.28 billion compared to the predicted $3.29 billion.

Costco (COST) - Costco’s shares dipped 0.2% as its revenue fell below the forecast. While revenue for the fiscal third quarter reached $53.65 billion, it missed the projected $54.57 billion. However, Costco's adjusted earnings per share of $3.43 exceeded expectations.

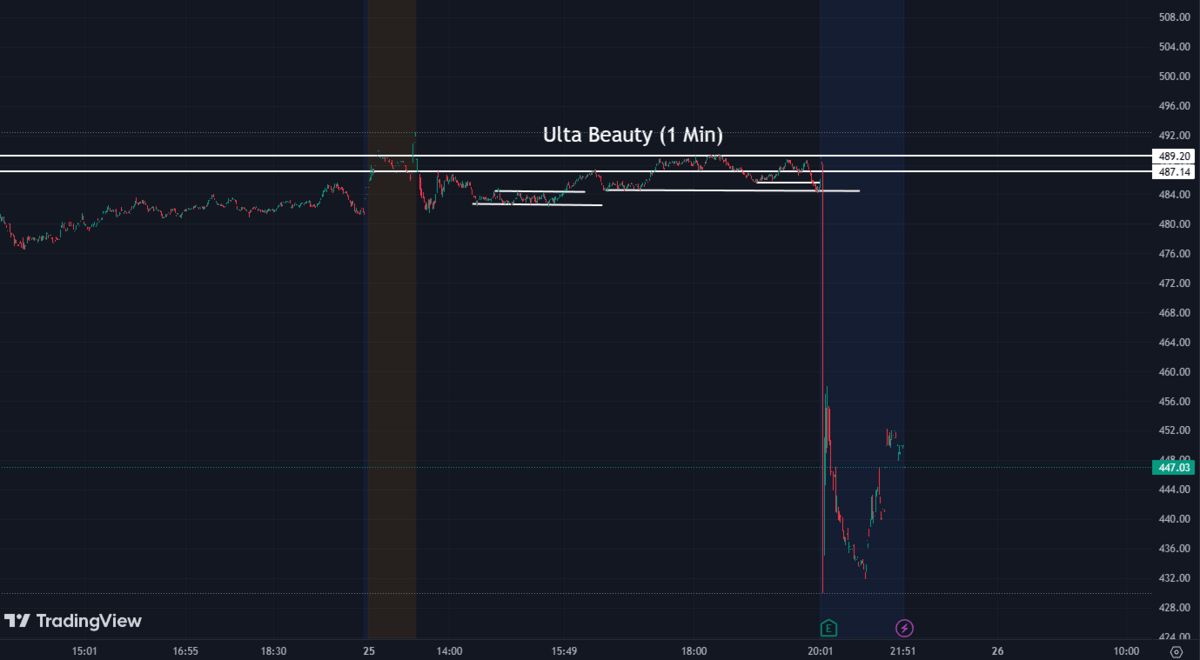

Ulta Beauty (ULTA) - Ulta's stock dropped 8% in after-hours trading as it maintained earnings and same-store sales predictions for the year. Revenue slightly surpassed estimates at $2.63 billion, and earnings per share of $6.88 exceeded Refinitiv's prediction of $6.87.

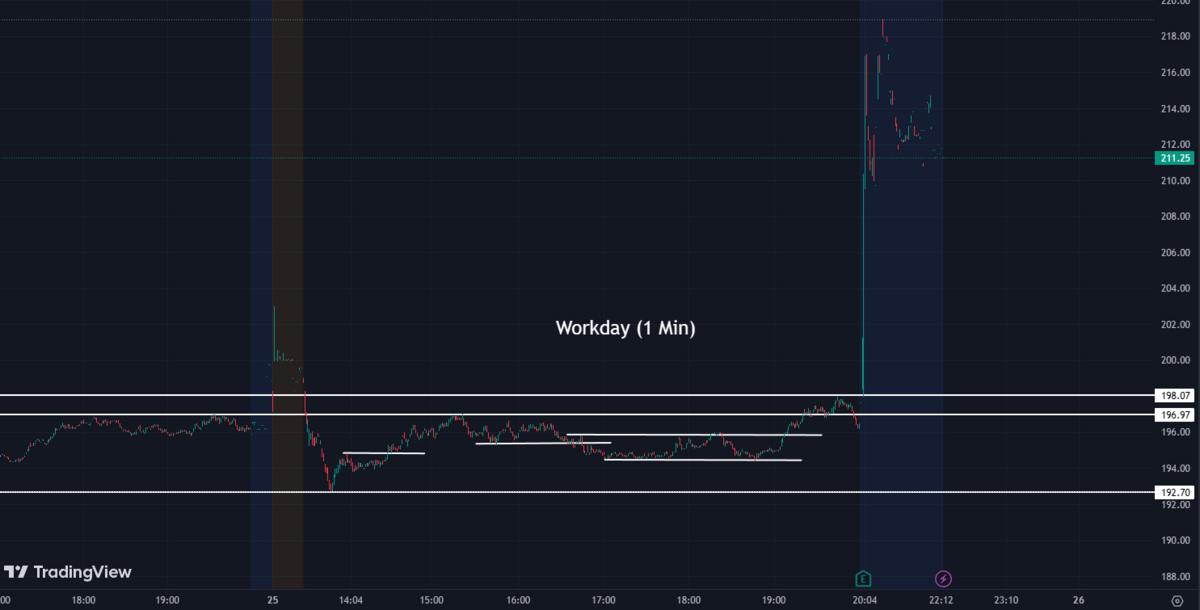

Workday (WDAY) - Workday's stock gained 7% after a strong earnings report and the announcement of a new CFO. Adjusted earnings per share of $1.31 surpassed expectations, and revenue slightly exceeded forecasts at $1.68 billion.

Marvell Technology (MRVL) - Marvell's shares surged 17% as it exceeded analysts' predictions for the first quarter. With adjusted earnings of 31 cents per share and revenue of $1.32 billion, Marvell outperformed expectations.

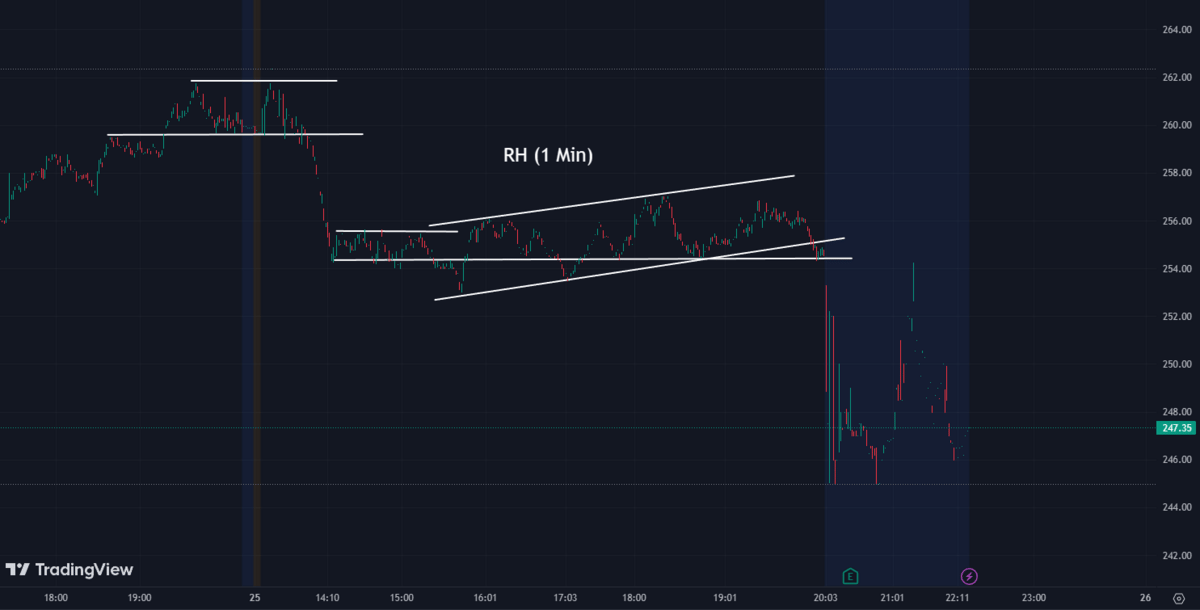

RH (RH) - RH's shares slid 3% in after-market trading due to lower revenue projections for the current quarter. However, its impressive first-quarter earnings of $739 million surpassed the predicted $727 million.

Wearable Devices (WLDS) Stock Skyrockets 🚀💥

Wearable Devices (WLDS) stock surged over 200% today. This significant increase was spurred by investor confidence in the company's progress and its recent success in materializing its underlying ambitions.

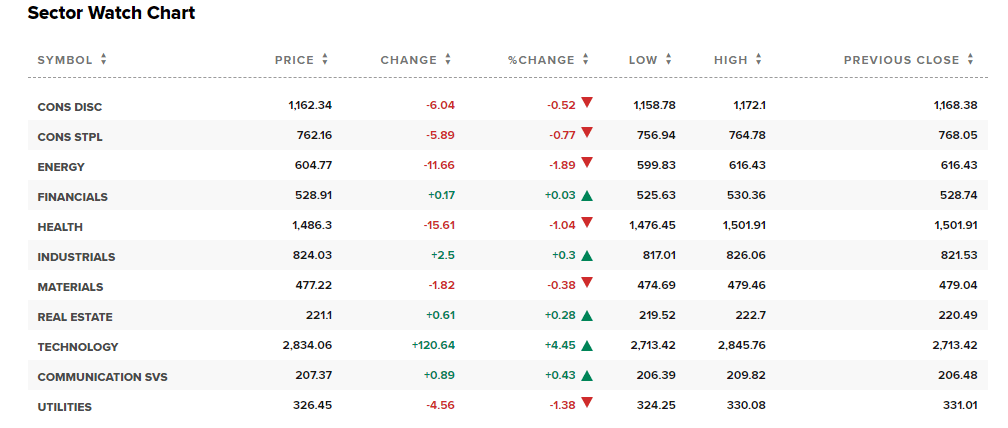

Sectors 🏬🌐

5 out of 11 sectors closed green today including, Technology up 4.45%, Communication Services up 0.43%, Industrials up 0.3%, Real Estate up 0.28%, and finally Financials up 0.03%. Energy lagged behind, coming in last among all the sectors, down 1.89%.

Conclusion 👋

As we wrap up another bustling day in the financial markets, it's clear that artificial intelligence and tech stocks continue to shape the direction of the market. With the debt ceiling negotiations ongoing, the resilience of the US economy and the performance of individual stocks, especially in the retail sector, remain key areas to watch. Stay tuned for more updates tomorrow. As always, invest wisely!

Thank you all for signing up!

Will only work to do better for you all going forward. Our only goal is to add value to everyone’s trading with key levels and the ability of learning charts and price action.

Please Share Our Newsletter it will be much appreciated!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of TradingView. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.