Hello, traders! As we wind down for the evening, let's take a deep dive into the noteworthy events that have shaped the financial markets today!

Market Overview 💸💱

The financial market on May 31st, 2023, experienced substantial volatility, with investors eyeing the imminent House vote on a bill that seeks to raise the debt ceiling and curb government expenditure. This legislation, which could have broad economic implications, involves measures such as a temporary suspension of the debt limit, reductions in Democratic-backed domestic initiatives, a raised age requirement for food aid eligibility, and a resumption of federal student loan repayments. While the bill enjoys bipartisan support and is expected to pass, its negotiation has drawn criticism from conservative members, testing Republican Speaker Kevin McCarthy's ability to unify his party.

In addition to the debt ceiling considerations, remarks from Federal Reserve officials, Richard Jefferson, and Patrick Harker, suggesting a pause in the tightening of monetary policies in June, have added to the investment community's watchfulness. The consistently strong jobs data — indicative of a robust economic recovery — is another area of focus for investors. Despite these positive indicators, some market observers are warning of a possible liquidity squeeze threatening the stock market after the debt ceiling deal is enacted, contributing to the ongoing market fluctuations.

Indexes 📉🔗

The indices fell on May 31, 2023, as investors remained vigilant about the ongoing debt ceiling debate. Now, let's explore how the market performed today...

The S&P 500 (SPX) was down 0.61% coming to a conclusion at 4,179

The Nasdaq Composite (IXIC) fell 0.63% ending the day at 12,935

The Dow Jones Industrial Average (DJI) dropped 0.41% to finish at 32,908

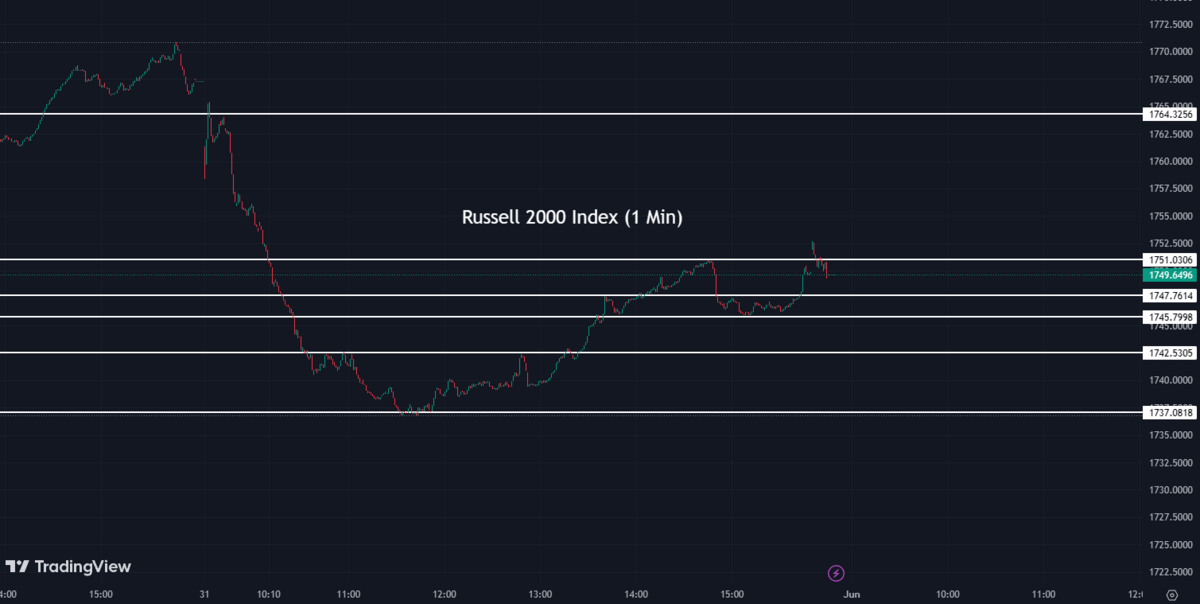

The Russell 2000 (RUT) dropped by 1.00% to settle at 1,749

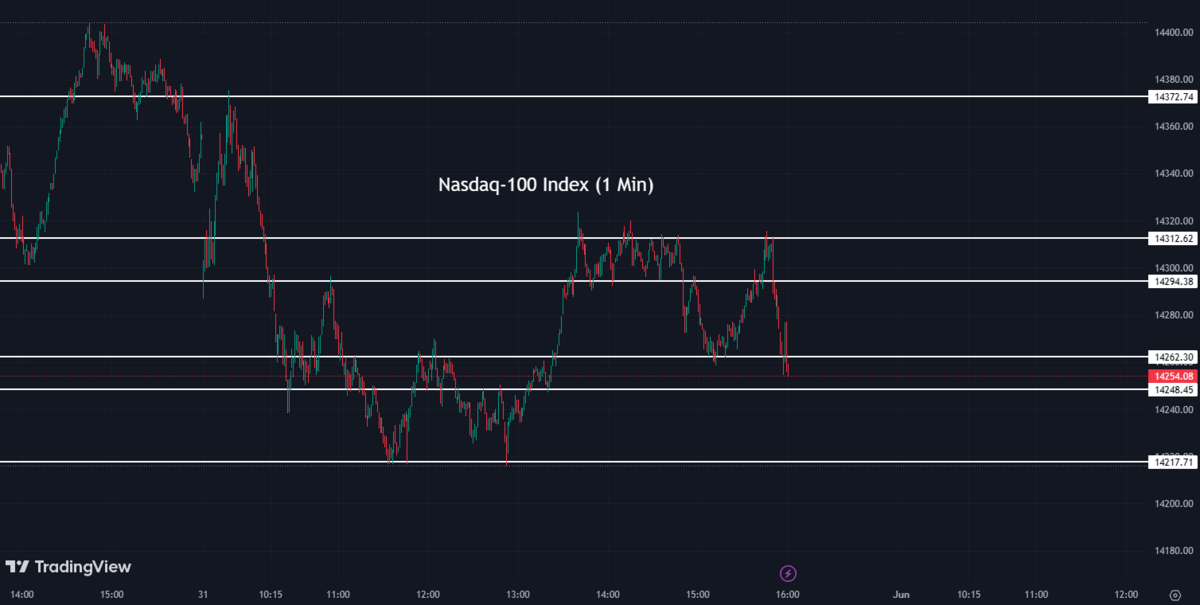

The Nasdaq-100 (NDX) fell by 0.70% to conclude at 14,254

Company Highlights 🏆🌟

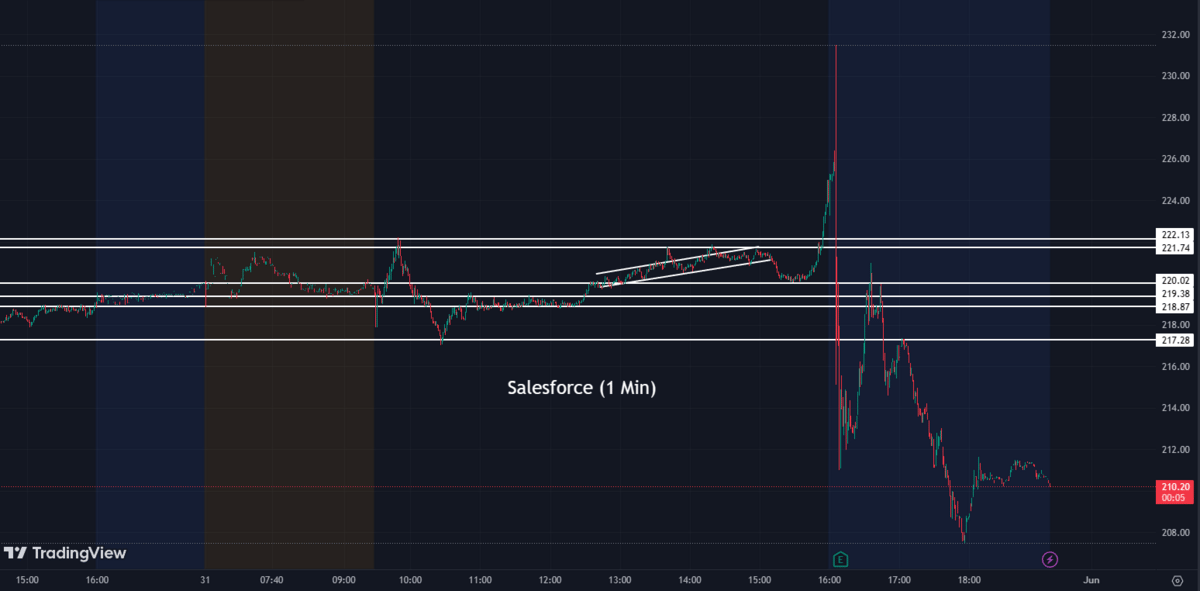

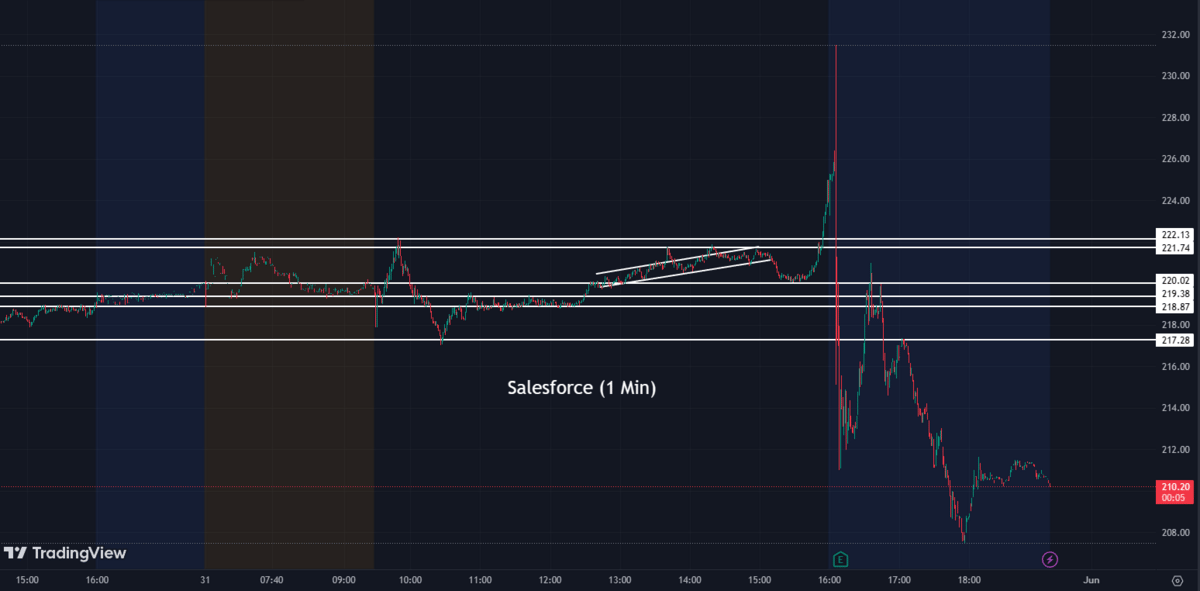

Salesforce (CRM) - Salesforce announced Q1 earnings that beat analyst expectations but shares dropped due to higher-than-anticipated capital costs. The company reported earnings of $1.69 per share and $8.25 billion in revenue. However, the shares dropped in extended trading due to higher-than-anticipated capital costs. Despite raising its earnings forecast for the 2024 fiscal year, the shares faced a slight dip.

CRM:

224.20 ▲ +5.33 (+2.44%) Today

211.49 ▼ 11.89 (-5.32%) After Hours

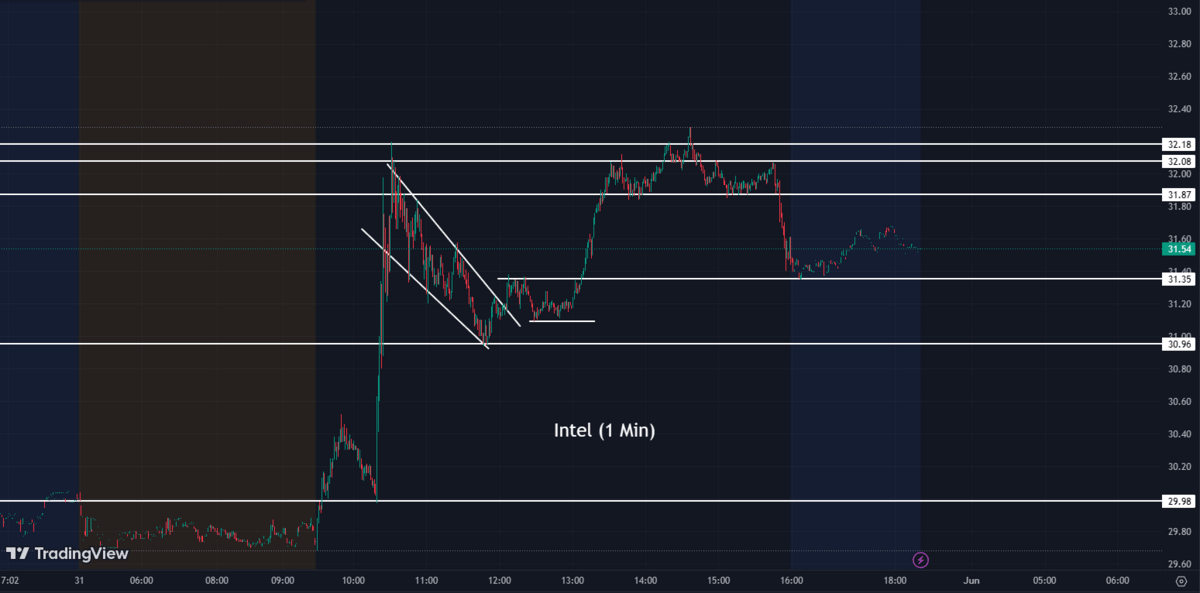

Intel (INTC) - Intel's shares rose on upbeat comments from its CFO, who highlighted Intel's competitive edge and potential growth opportunities in AI, data center, and 5G segments. However, the specifics of the statement and the degree to which it might impact Intel's overall strategic direction remain to be seen.

INTC:

31.44 ▲ +1.45 (+4.83%) Today

31.51 ▲ 0.07 (+0.22%) After Hours

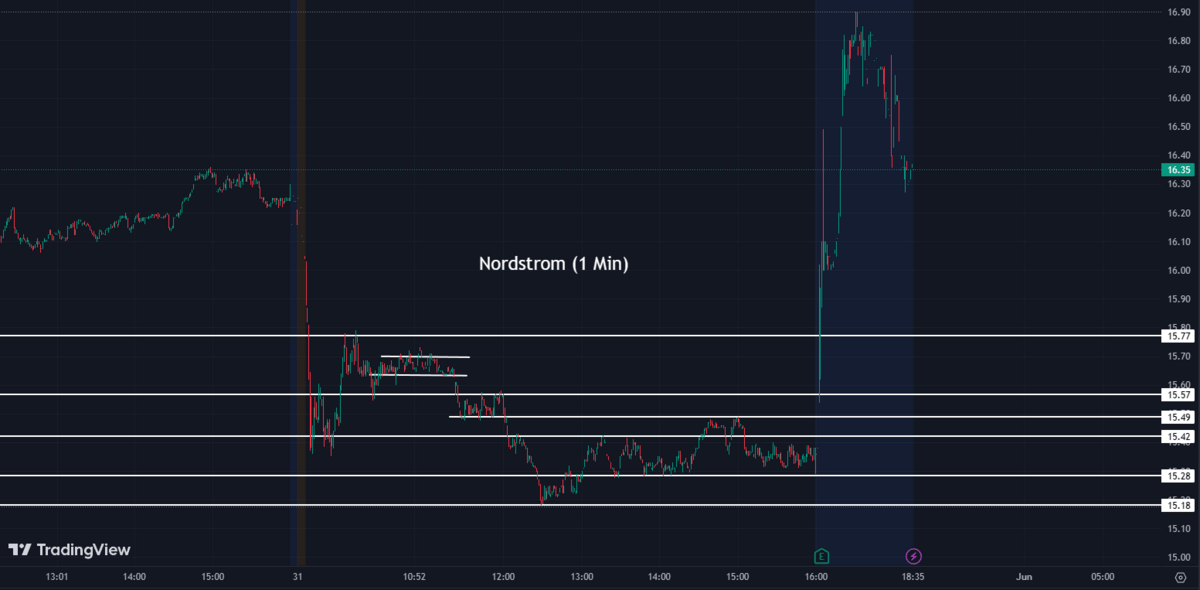

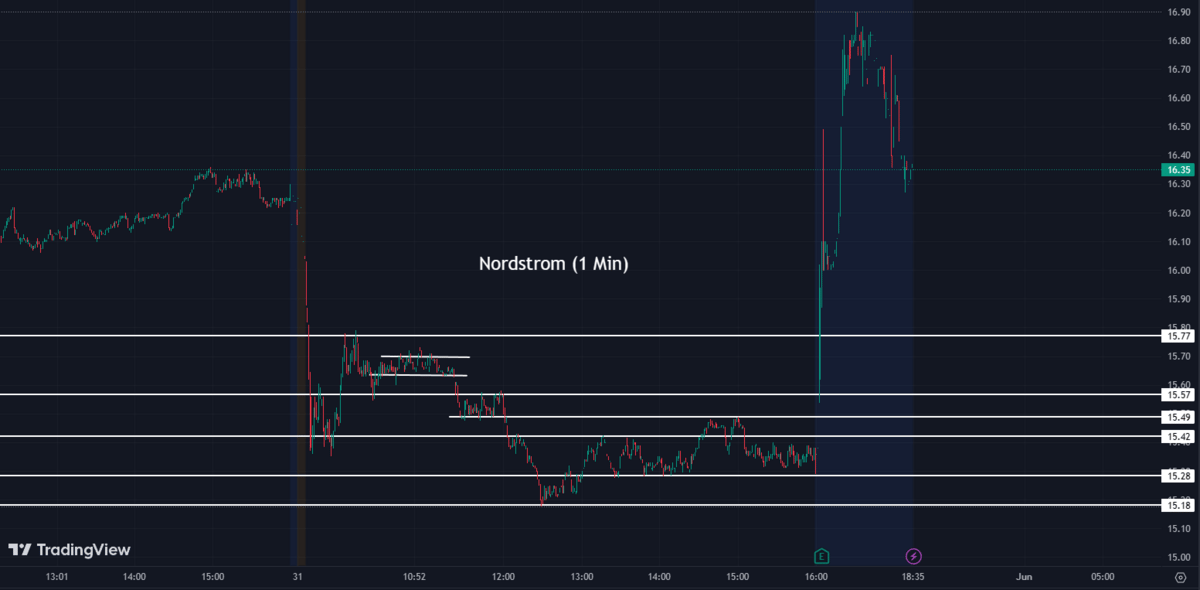

Nordstrom (JWN) - Nordstrom, the luxury department store chain, delivered solid first-quarter results, surpassing sales expectations. This positive performance has been attributed to successful sales events, the introduction of new brands, and a rebound in demand for apparel. The strong Q1 performance led to a surge in the company's stock after the announcement.

JWN:

15.29 ▼ -1.01 (-6.20%) Today

16.36 ▲ 1.06 (+6.93%) After Hours

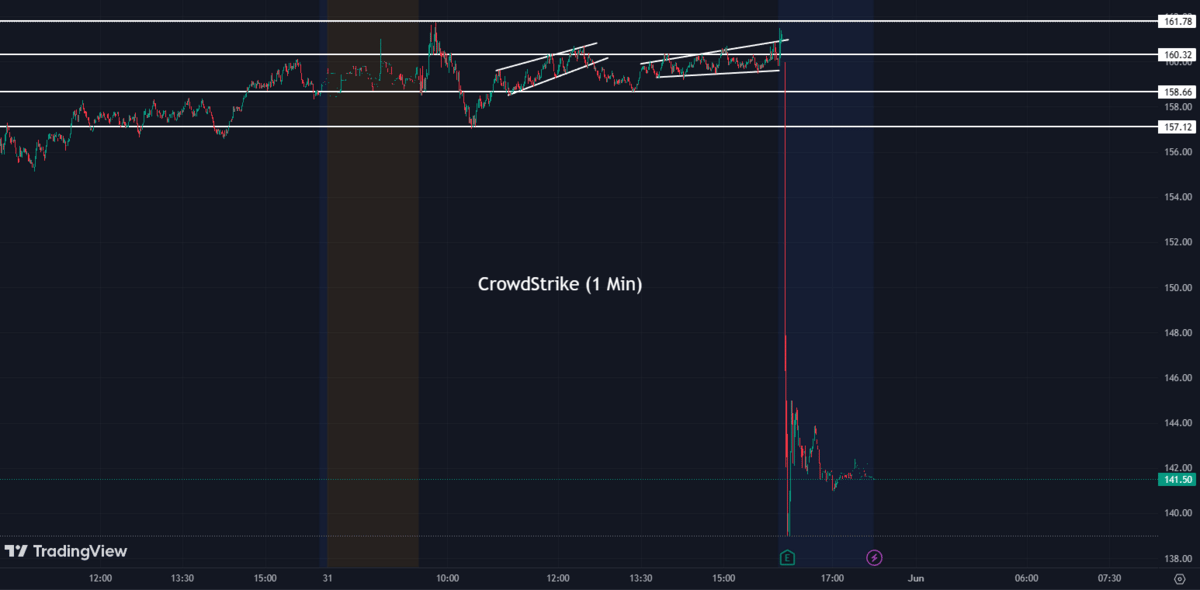

CrowdStrike (CRWD) - CrowdStrike, a leader in the cybersecurity space, reported impressive first-quarter results with revenue and earnings exceeding expectations. However, despite a strong financial performance, CrowdStrike's stock dipped in the aftermath of the report. The company anticipates a robust demand for its cybersecurity solutions given the current digital landscape characterized by an escalating number of cyber threats.

CRWD:

160.13 ▲ +1.54 (+0.97%) Today

141.79 ▼ 18.34 (-11.45%) After Hours

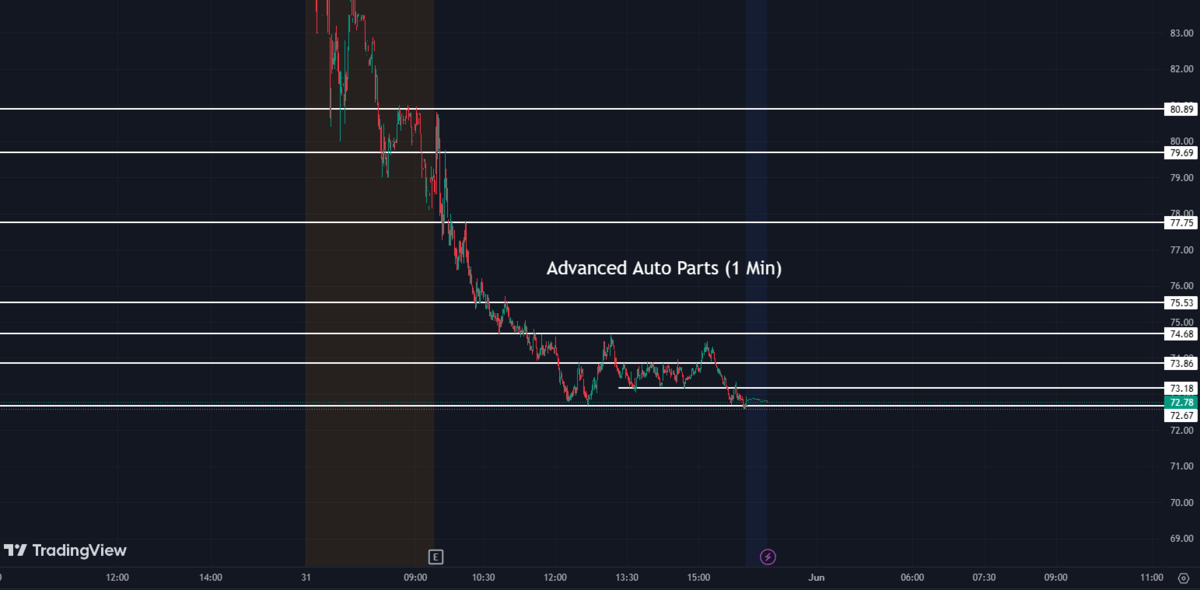

Advance Auto Parts (AAP) - Advance Auto Parts experienced a drastic slump as its shares closed down 35% after the company announced a reduction in guidance and dividend. Additionally, the company reported disappointing first-quarter earnings, failing to meet both its earnings per share and top-line revenue targets. This news undoubtedly shook investor confidence in the short term.

AAP:

72.93 ▼ -39.27 (-35.00%) Today

72.87 ▼ 0.02 (-0.027%) After Hours

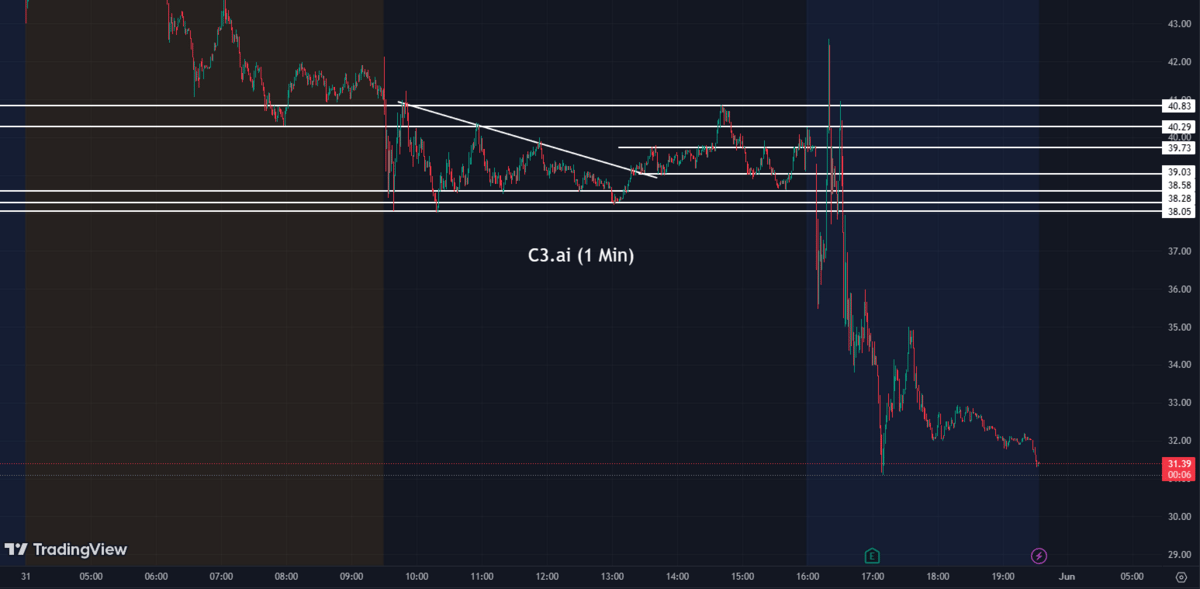

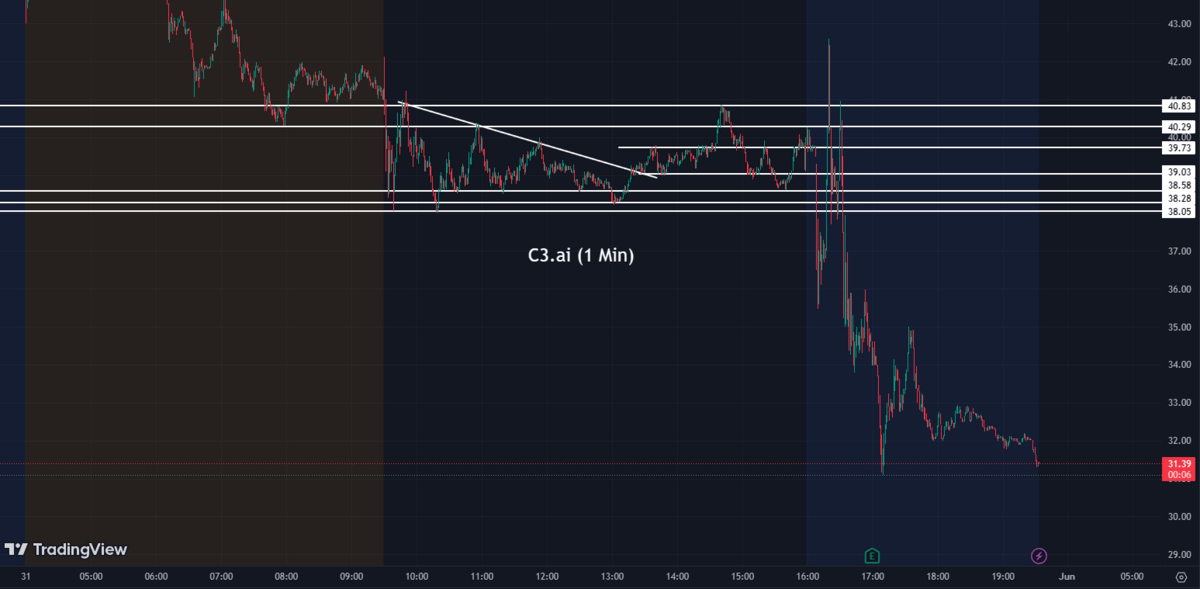

C3.ai (AI) - C3.ai reported fourth-quarter earnings that beat expectations, yet its shares collapsed by more than 12%. However, the company announced on Tuesday a new product is planned to launch on the Amazon AWS Marketplace. Nonetheless, the drop may be attributed to concerns about the company's future growth trajectory in a fiercely competitive AI market.

AI:

40.01 ▼ -3.94 (-8.96%) Today

32.07 ▼ 7.94 (-19.84%) After Hours

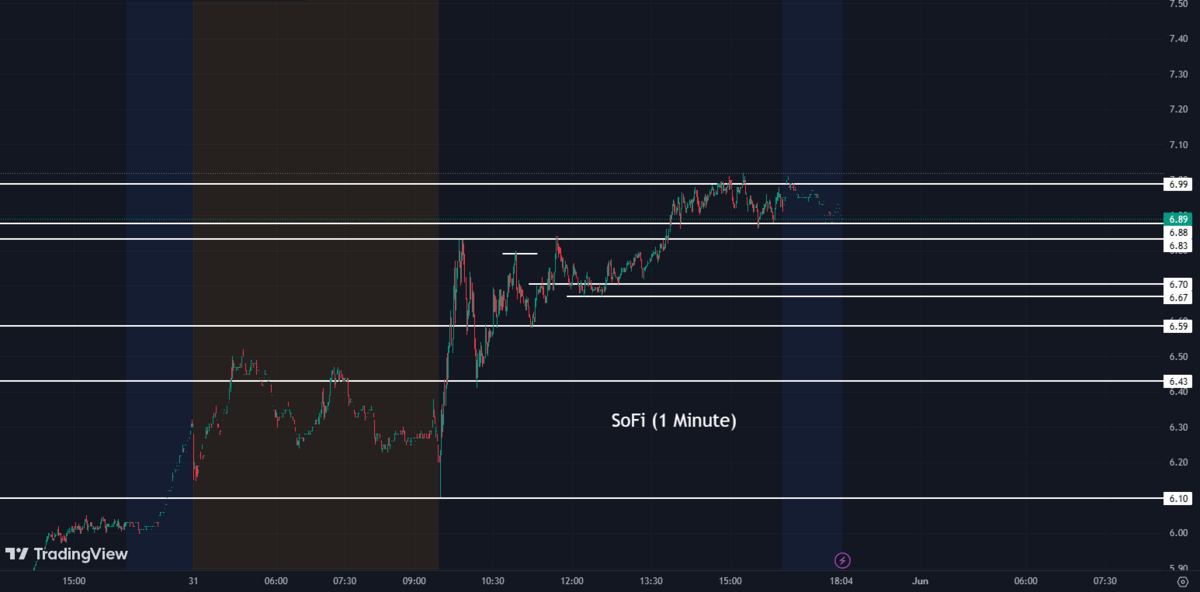

SoFi (SOFI) - SoFi's stock surged on Wednesday due to optimism surrounding the company's ability to capitalize on the upcoming termination of the student-loan payment moratorium. This unexpected surge is a direct result of a provision in the debt-ceiling deal. The provision indicates that the temporary suspension of student-loan payments by the federal government, implemented during the pandemic, is nearing its end.

SOFI:

6.94 ▲ +0.91 (+15.09%) Today

6.89 ▼ 0.045 (-0.65%) After Hours

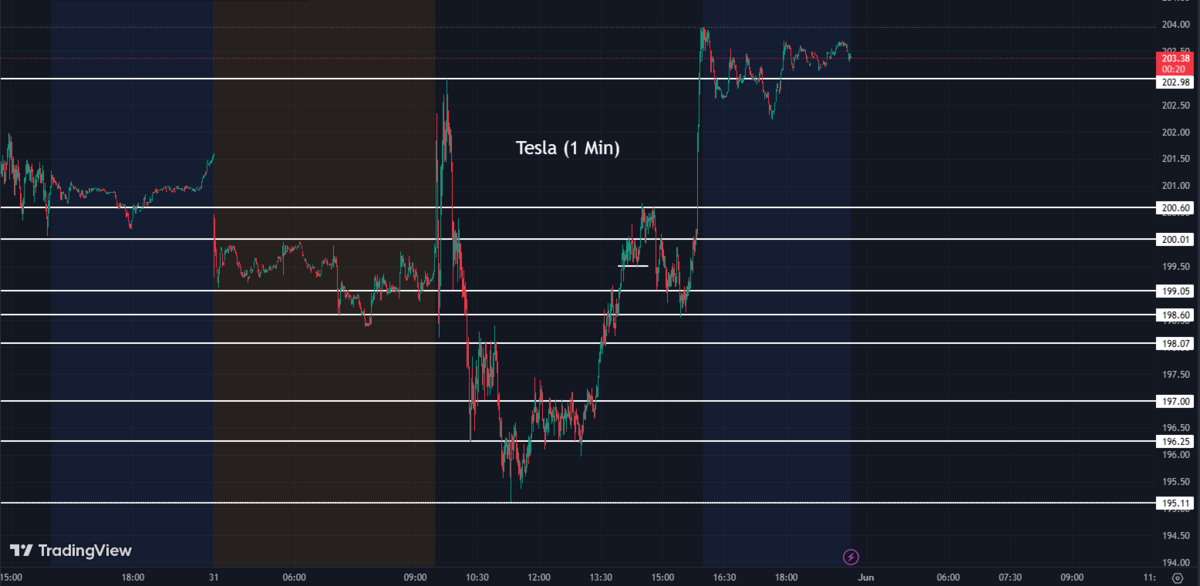

Tesla (TSLA) - Tesla is once again making waves, as CEO Elon Musk announced plans to unveil a new variant of the Model 3. The automaker's stock is approaching a buy point as investors and Tesla enthusiasts eagerly await further details about the upcoming model. Last week, the company's shares jumped 7.2%, and on Tuesday they rose by 4.1%. Currently, the stock is gradually passing the 200-day simple moving average, marking the first time since September.

TSLA:

203.93 ▲ +2.77 (+1.38%) Today

203.25 ▼ 0.68 (-0.33%) After Hours

After Hour Movers 🌙📊

Nordstrom (JWN) - Nordstrom's stock surged 9% in after-hours trading following better-than-expected sales in the fiscal first quarter, surpassing Wall Street's projections. Despite anticipating slower sales and a decline in spending, Nordstrom maintained its full-year outlook, displaying confidence in its long-term prospects.

JWN:

15.29 ▼ -1.01 (-6.20%) Today

16.36 ▲ 1.06 (+6.93%) After Hours

Salesforce (CRM) - Despite exceeding expectations and raising earnings guidance, Salesforce experienced a 5% decline in its stock value. This was attributed to higher-than-expected capital expenditures for the latest quarter, which raised concerns among investors.

CRM:

224.20 ▲ +5.33 (+2.44%) Today

211.49 ▼ 11.89 (-5.32%) After Hours

CrowdStrike (CRWD) - CrowdStrike's stock dropped almost 12% in after-hours trading after reporting a slowdown in revenue growth. Although quarterly revenue increased by 42% year-over-year, it was lower than the growth rate reported in the same quarter the previous year, leading to investor concerns.

CRWD:

160.13 ▲ +1.54 (+0.97%) Today

141.79 ▼ 18.34 (-11.45%) After Hours

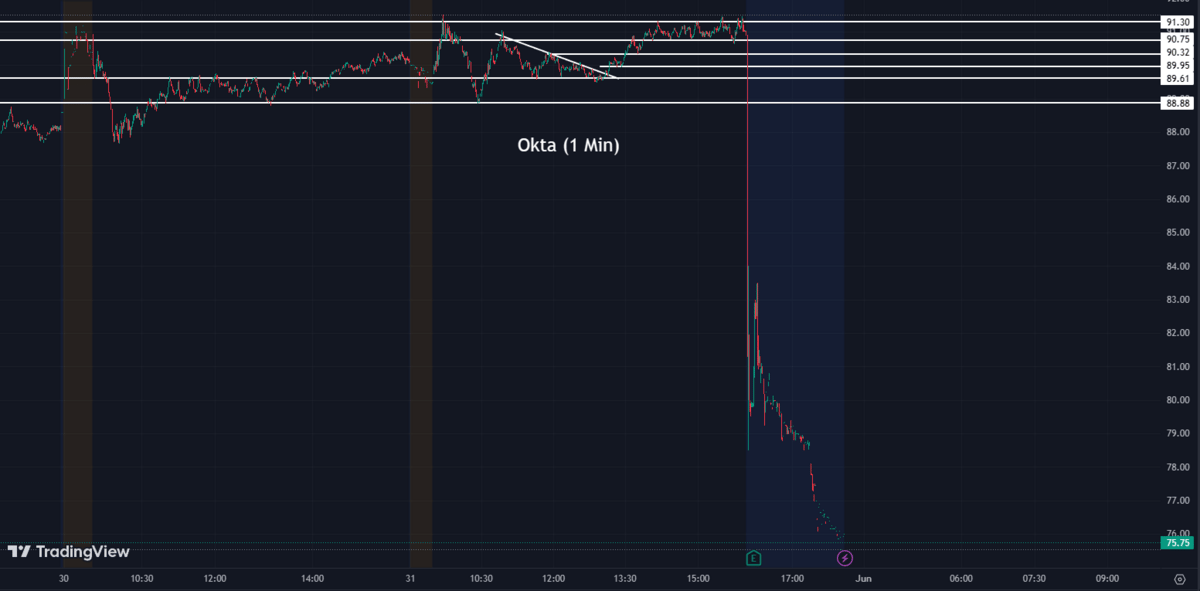

Okta (OKTA) - Despite a strong quarterly report, shares of Okta declined by 16% in after-hours trading. The stock drop was influenced by the company's cautionary statement about rising "macroeconomic pressures," which affected investor sentiment.

OKTA:

90.90 ▲ +0.79 (+0.88%) Today

76.21 ▼ 14.69 (-16.16%) After Hours

C3.ai (AI) - C3.ai witnessed a significant 19% decline in its shares, even after beating expectations for its fiscal fourth quarter. The stock drop was driven by lower-than-expected revenue projections for the upcoming fiscal quarter.

AI:

40.01 ▼ -3.94 (-8.96%) Today

32.04 ▼ 7.97 (-19.92%) After Hours

Chewy (CHWY) - Shares of Chewy surged approximately 13% as the company reported earnings that exceeded analysts' predictions. The better-than-expected performance and revenue outperformance contributed to increased investor confidence.

CHWY:

29.49 ▼ -0.71 (-2.35%) Today

33.55 ▲ 4.06 (+13.77%) After Hours

Pure Storage (PSTG) - Pure Storage's shares rose by 7% after surpassing analysts' expectations in the latest quarter. The company reported stronger-than-anticipated earnings, driving positive investor sentiment.

PSTG:

28.81 ▼ -0.59 (-2.01%) Today

30.75 ▲ 1.96 (+6.81%) After Hours

Sectors 💡⚡

4 out of the 11 sectors closed green today, with Utilities coming in first and Energy coming in last.

Conclusion 👋

Overall, the market remained cautious and vigilant, closely monitoring the debt ceiling debate and its potential impact on the economy. Investors reacted to company-specific news and quarterly earnings reports, contributing to fluctuations in individual stocks. As the market navigates these uncertainties, it will continue to be important for investors to stay informed and adapt their strategies accordingly.

Thank you all for signing up!

Will only work to do better for you all going forward. Our only goal is to add value to everyone’s trading with key levels and the ability of learning charts and price action.

Please Share Our Newsletter it will be much appreciated!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of TradingView. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.