Hello, traders! As we wind down for the evening, let's take a deep dive into the noteworthy events that have shaped the financial markets today!

Debt Ceiling Negotiations and IRS Cut 🏛️💼

On the U.S. debt ceiling front, negotiators have made significant strides toward reaching a deal. The current proposal suggests a substantial $21.4 billion cut in IRS funding. The potential impacts of this deal are far-reaching, including an end to the IRS enforcement surge and a decrease in yields on bills due in June. Despite the progress made, the deal still requires congressional approval. Based on updated estimates from the U.S. Department of the Treasury, the bill needs to be approved by the Republican-controlled House and the Democrat-majority Senate before June 5. This is the earliest possible date when the U.S. could face a financial shortfall. The House has an unsettled plan to vote on the bill Wednesday evening. While there is cautious optimism about avoiding a U.S. default, investors remain vigilant about the negotiations' final outcomes and the possible implications on the U.S. economy.

Debt Ceiling Talks Impact Treasury Yields 🗣️📊

U.S. Treasury yields experienced significant movement today due to the ongoing negotiations surrounding the debt ceiling. The yields on Treasury bills due in June fell due to optimism that Congress will pass the deal to raise the country's debt ceiling and avoid a potential default. While some investors had been concerned about the potential for a U.S. default if a debt ceiling agreement wasn't reached, the developments on a possible deal eased some of these fears. The decreasing yield suggests that the risk of a short-term default is lessening, although the situation remains dynamic and subject to ongoing negotiations. Financial experts continue to watch the fluctuations in Treasury yields as they are key indicators of market sentiment towards the state of the U.S. economy and its fiscal health.

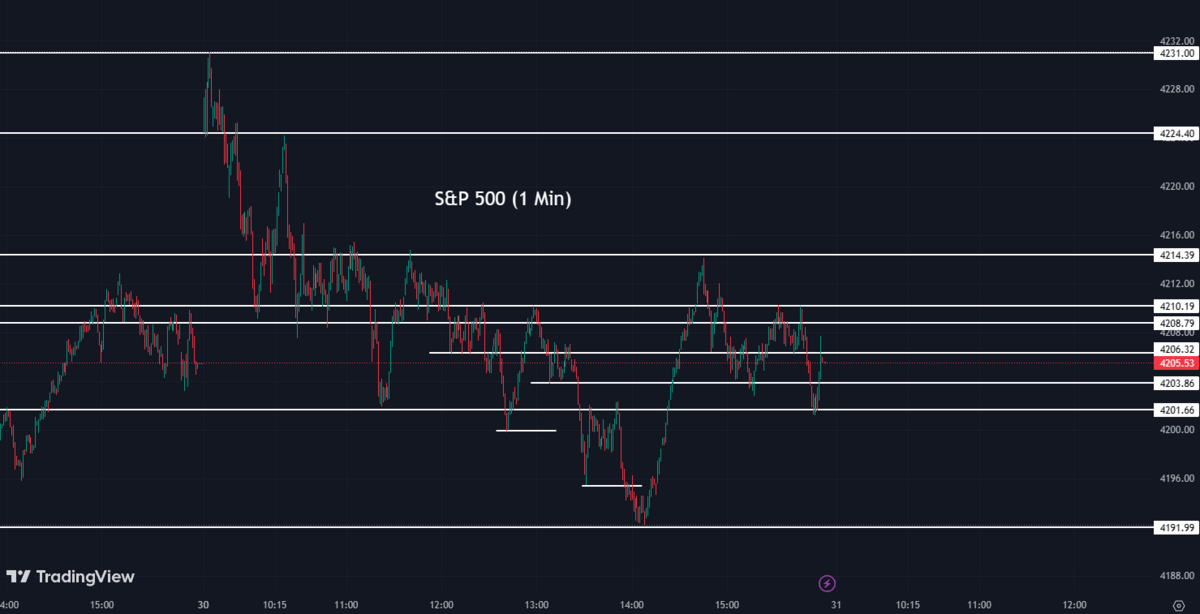

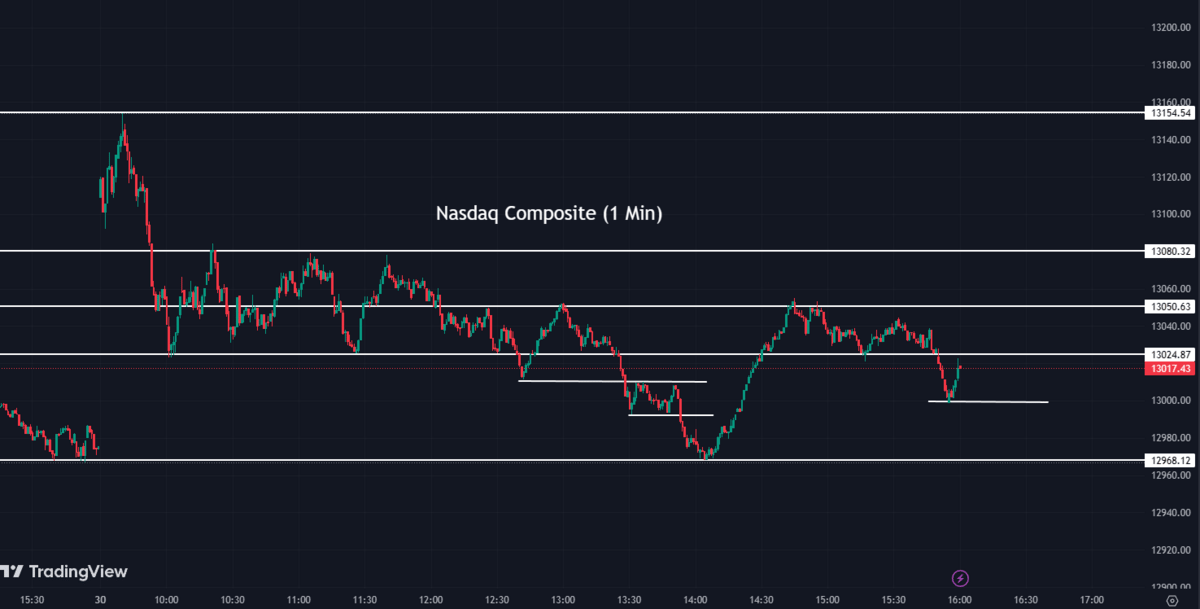

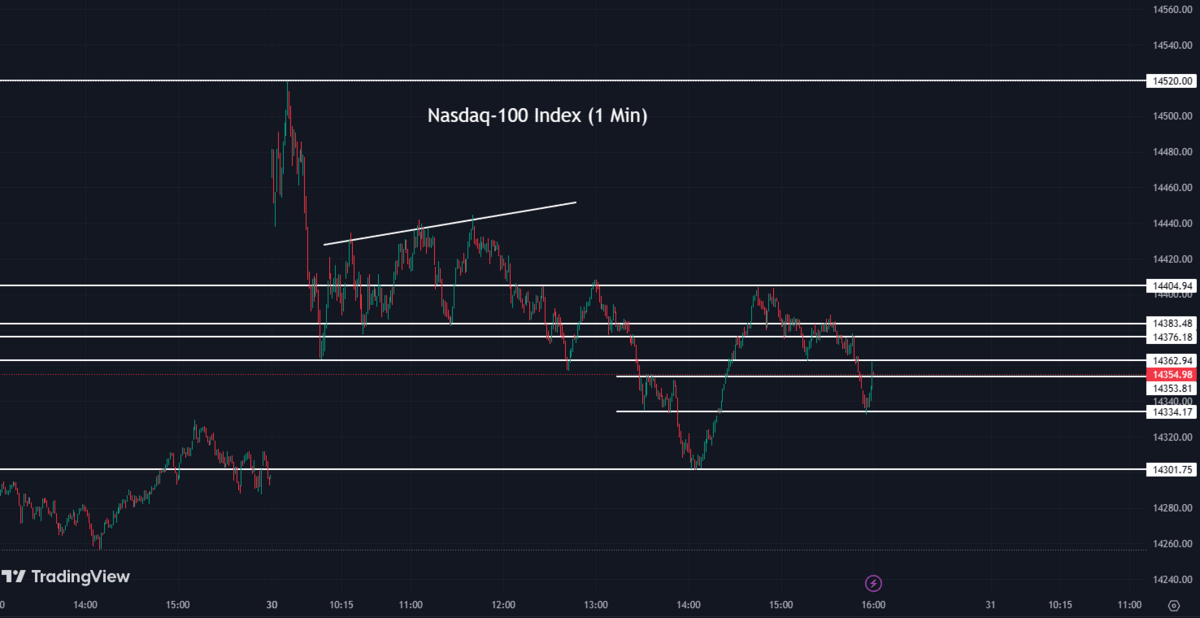

Indexes: Up and Down 📈 📉

The indices mostly closed up today. The Dow Jones Industrial Average fell due to the unsettled deal on raising the U.S. debt ceiling. Now, let's examine the final outcomes…

The S&P 500 (SPX) was up 0.002% coming to a conclusion at 4,205

The Nasdaq Composite (IXIC) jumped up 0.32% ending the day at 13,017

The Dow Jones Industrial Average (DJI) dropped 0.15% to finish at 33,042

The Russell 2000 (RUT) fell by 0.32% to settle at 1,767

The Nasdaq-100 (NDX) increased by 0.40% to conclude at 14,354

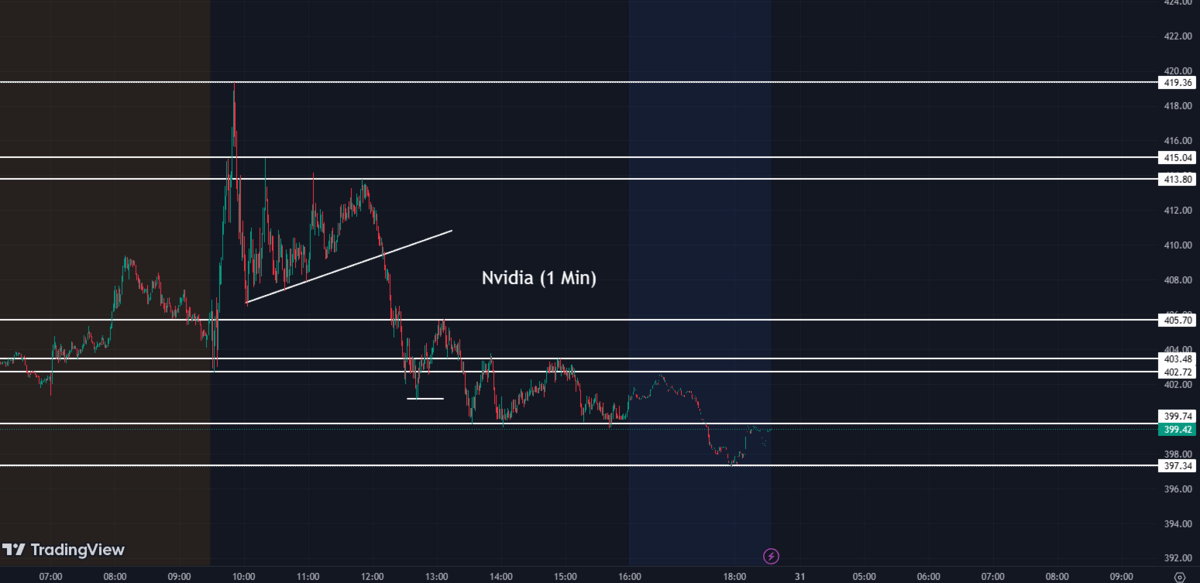

NVIDIA’s Continued Soar💻📈

The technology sector was in the limelight today as NVIDIA (NVDA) is now the sixth U.S. company to reach the $1 trillion market cap milestone at the market opening before slipping to $990 billion by the close of trading. This spike in Nvidia's market cap was primarily driven by its strong quarterly earnings, which significantly beat consensus estimates. The company forecast $11 billion in sales for the second quarter of fiscal 2024 alone, 50% higher than consensus estimates of $7.15 billion. The rise in Nvidia's stock price is also due in part to the growing importance of GPUs in the fields of artificial intelligence and cryptocurrency mining.

NVDA:

401.11 ▲ +11.65 (+2.99%) Today

399.19 ▼ 1.92 (-0.48%) After Hours

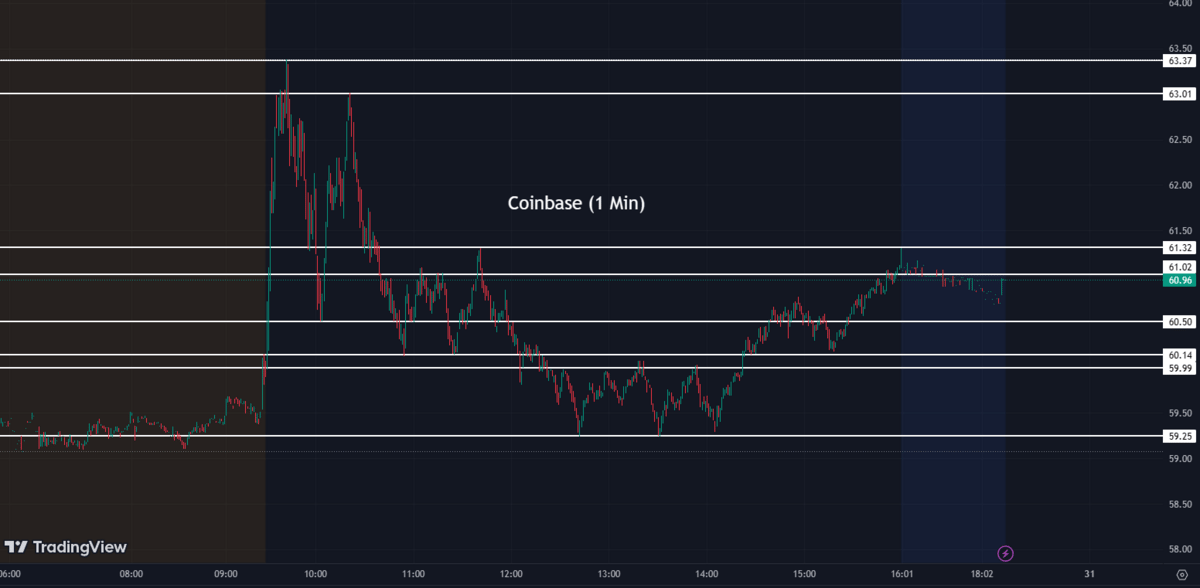

Coinbase Surges on Analyst Upgrade💰💪

In the cryptocurrency space, Coinbase's stock (COIN) experienced a significant uptick of 7.5% following an analyst upgrade. This positive endorsement signals growing confidence in the crypto market and in Coinbase's ability to navigate this volatile sector. The analyst highlighted Coinbase's robust user base, strong security, and effective regulatory compliance as key strengths that position it well for future growth. The company raised its revenue projections for Coinbase in the fiscal years 2023 and 2024, establishing Coinbase as a robust channel to gauge sentiments regarding the cryptocurrency market.

COIN:

61.17 ▲ +4.25 (+7.47%) Today

60.86 ▼ 0.31 (-0.51%) After Hours

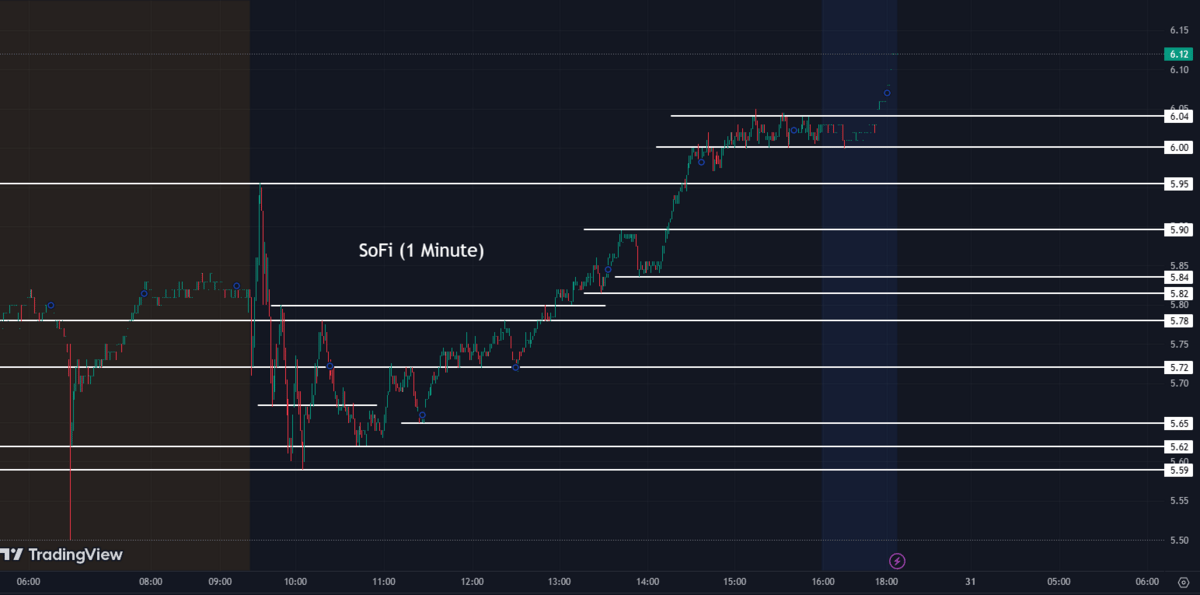

SoFi: Reshaping Student Loan Refinancing 🎓💼

SoFi, (SOFI) the online personal finance company, is gaining traction thanks to its student loan refinancing services. SoFi has been proactive in addressing the massive student loan debt problem, offering refinancing options that aim to lessen the financial burden on borrowers. Its consumer-first approach is attracting a growing number of users, thereby driving SoFi's stock upwards. As a fintech company, SoFi is in a unique position to provide innovative solutions to long-standing financial challenges, making it a company to watch in the financial sector.

SOFI:

6.03 ▲ +0.62 (+11.46%) Today

6.24 ▲ 0.21 (+3.48%) After Hours

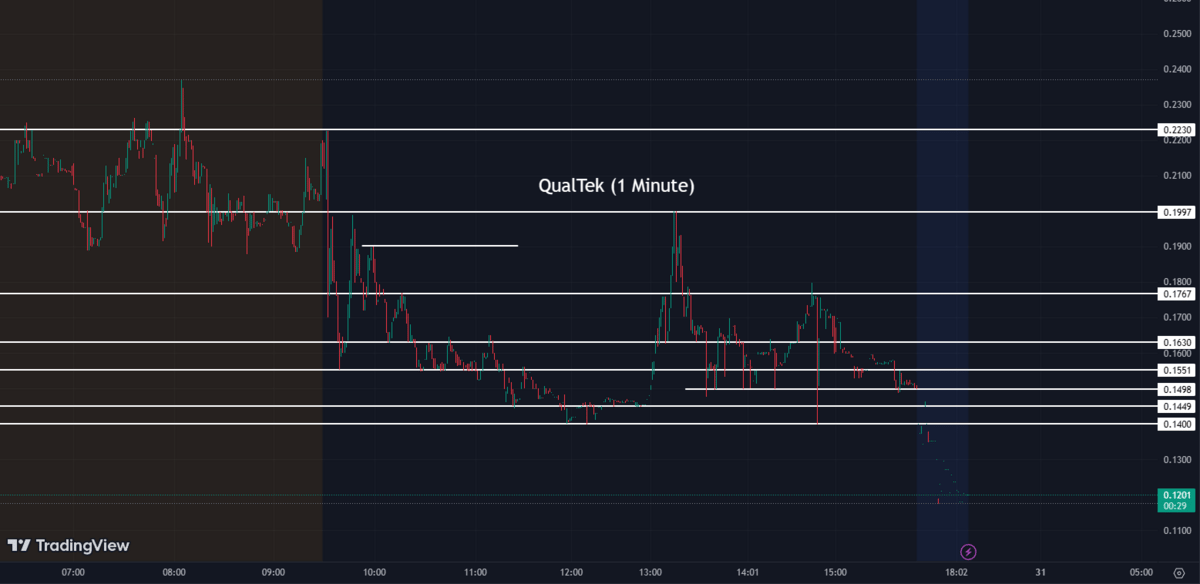

Today’s Top Gainer 🚀📈

QualTek Services (QTEK) experienced a significant surge today ending up 95.82% to finish at 0.15. The surge is likely driven by the substantial increase in trading volume, with more than 5.4 million shares traded compared to the average daily volume of approximately 653,000 shares.

QTEK:

0.15 ▲ +0.073 (+95.82%) Today

0.11 ▼ 0.036 (-24.00%) After Hours

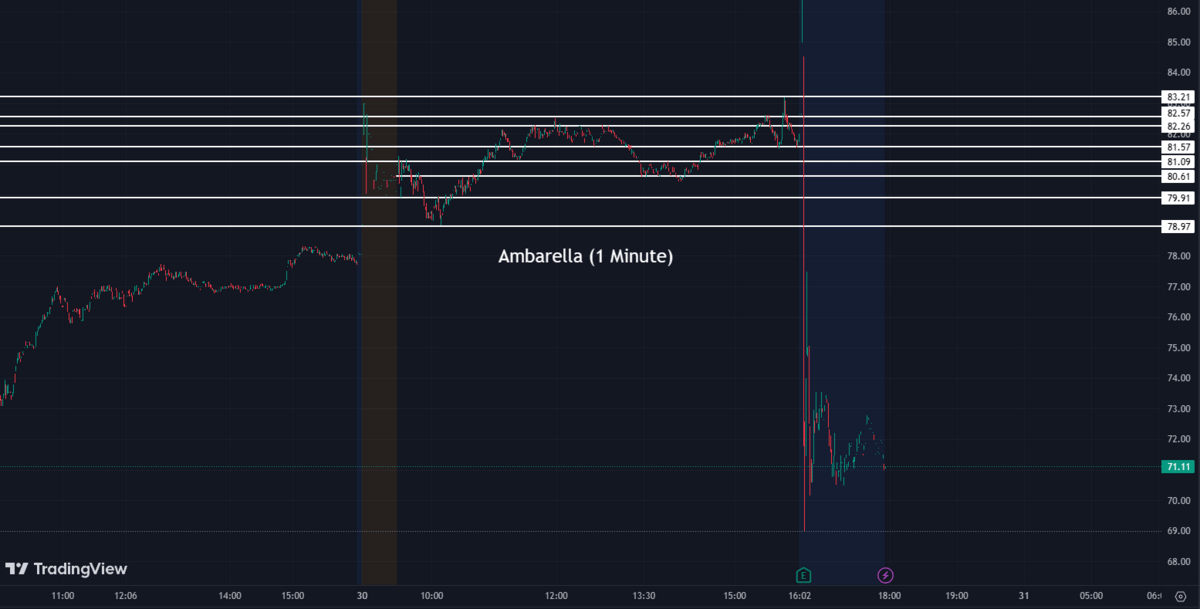

After-Hour Movers 🌙💸

Ambarella's (AMBA) chip stock saw a 13% decline in extended trading after providing second-quarter revenue guidance of $60 million to $64 million, which fell short of the expected $67.2 million. However, they reported a smaller-than-expected adjusted loss in the first quarter.

AMBA:

81.96 ▲ +4.22 (+5.43%) Today

70.72 ▼ 11.24 (-13.71%) After Hours

Box, (BOX) the cloud company, witnessed a 3% increase in after-hours trading as it exceeded estimates in its fiscal first quarter. Box reported $252 million in revenue and 32 cents in adjusted earnings per share, surpassing the projected $249 million in revenue and 27 cents per share.

BOX:

28.02 ▲ +0.28 (+1.01%) Today

28.75 ▲ 0.73 (+2.61%) After Hours

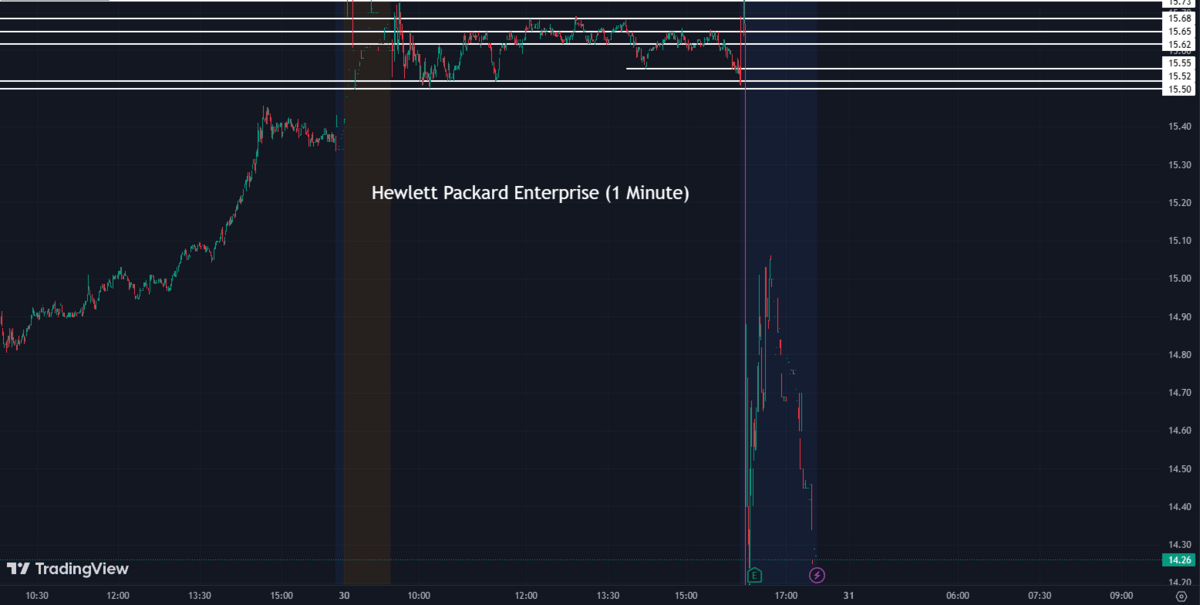

Hewlett Packard Enterprise (HPE), the technology services company, experienced a 7% decrease in its stock price after the market closed due to mixed results in its fiscal second quarter. HP Enterprise reported $6.97 billion in revenue and 52 cents in adjusted earnings per share, surpassing expectations of 48 cents per share but falling short of the expected $7.31 billion in revenue.

HPE:

15.52 ▲ +0.18 (+1.17%) Today

14.29 ▼ 1.23 (-7.93%) After Hours

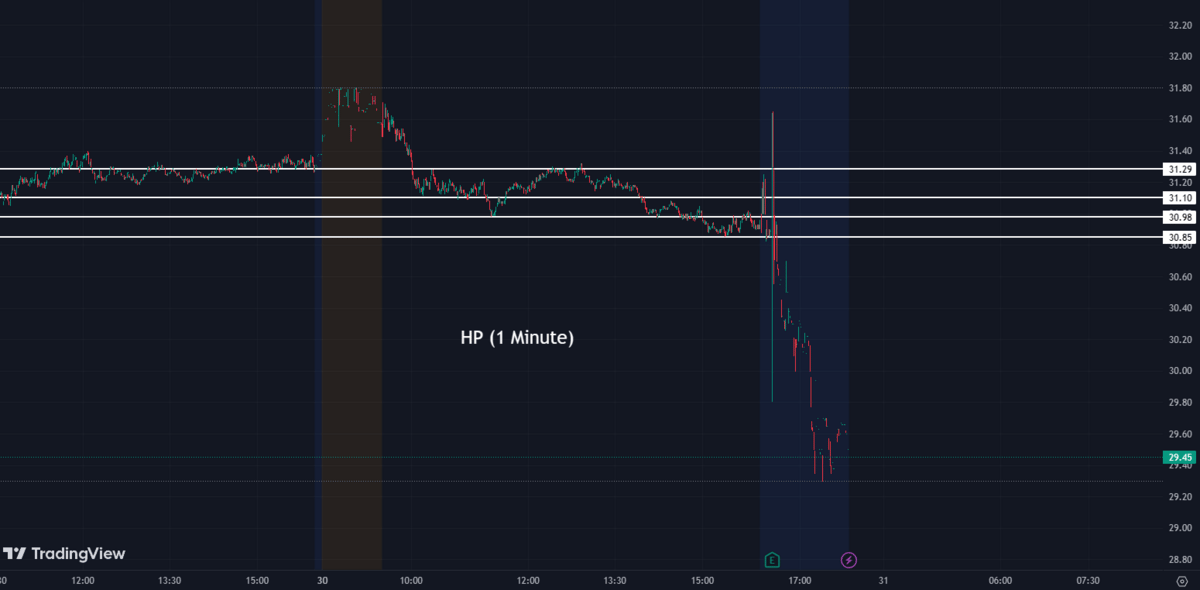

HP Inc, (HPQ) the tech hardware stock, had a modest 2% decline in extended trading after releasing a mixed fiscal second-quarter report. HP reported 80 cents in adjusted earnings per share, surpassing estimates by 4 cents. However, their $12.91 billion in revenue fell short of the expected $13.07 billion.

HPQ:

30.94 ▼ -0.36 (-1.15%) Today

29.57 ▼ 1.36 (-4.40%) After Hours

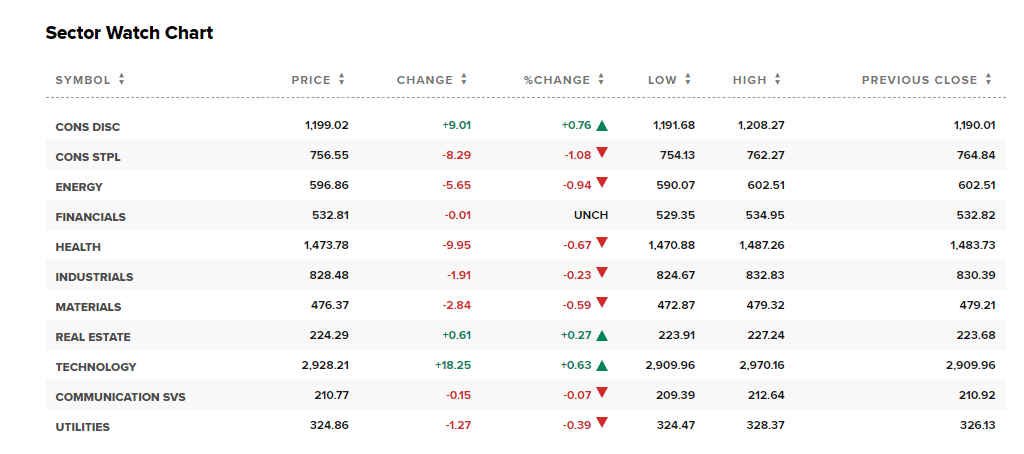

Sectors 🏦🌐

Out of the 11 sectors, 3 closed in the green today. The Consumer Discretionary sector led the way, gaining 0.76%, while the Consumer Staples sector lagged behind, declining by 1.08%.

Oil Industry ⛽🛢️

Oil prices fell today due to market skepticism surrounding the ongoing U.S. debt ceiling deal. Both U.S. and global prices reached their lowest levels since May 4th, with the front-month Nymex crude for July delivery closing down 4.4% and July Brent crude closing down 4.6%. Despite these concerns, Saudi Arabia and OPEC continue to exert influence over the trajectory of the global oil industry. As negotiations progress, market participants remain attentive to potential ripple effects on the commodities market.

Conclusion👋

Ongoing negotiations regarding the U.S. debt ceiling have shown promising progress, with a proposal for a significant IRS funding cut. Beware of the potential impacts of the deal, the latest developments, and their implications for the economy. While Treasury yields and stock indices respond to the negotiations, market participants remain watchful of the outcomes and their consequences on various sectors. Additionally, notable movements in tech stocks like NVIDIA, Coinbase, and SoFi are covered, along with updates on the oil industry.

Thank you all for signing up!

Will only work to do better for you all going forward. Our only goal is to add value to everyone’s trading with key levels and the ability of learning charts and price action.

Please Share Our Newsletter it will be much appreciated!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of TradingView. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.