Good evening, investors! Let's delve deeper into the major events that shaped the financial markets today.👋

DeSantis Launches White House Bid🏛️🗳️

Florida Governor Ron DeSantis has officially launched his White House bid. In the early stages of his campaign, DeSantis is positioning himself as a staunch conservative and a vocal critic of the current administration's policies. With a strong following among the Republican base and proven electoral success in Florida, he brings formidable competition to the upcoming presidential race. His platform emphasizes a tough stance on immigration, a commitment to low taxes, and an unflinching support for law enforcement.

Fed Officials Reconsidering Rate Hikes👀📈

In light of recent Federal Reserve (Fed) meeting notes, it appears that officials are reassessing the necessity for further rate hikes. The Fed is carefully evaluating various factors, including inflation trends and labor market conditions, to align its monetary policy with the rapidly evolving economic scenario. The notes reveal a potentially cautious approach by the central bank towards future monetary adjustments, impacting investor sentiments.

Debt Ceiling Talks Stall, Adding Market Uncertainty💰🤔

The standstill in debt ceiling talks continues to unsettle the financial markets. A faction within the Republican party is resisting further negotiations, elevating the risk of a government default. With the June 1st deadline nearing, a U.S. default could trigger wide-ranging economic consequences. The deadlock underscores the high-stakes interplay of politics and economics in the present financial climate.

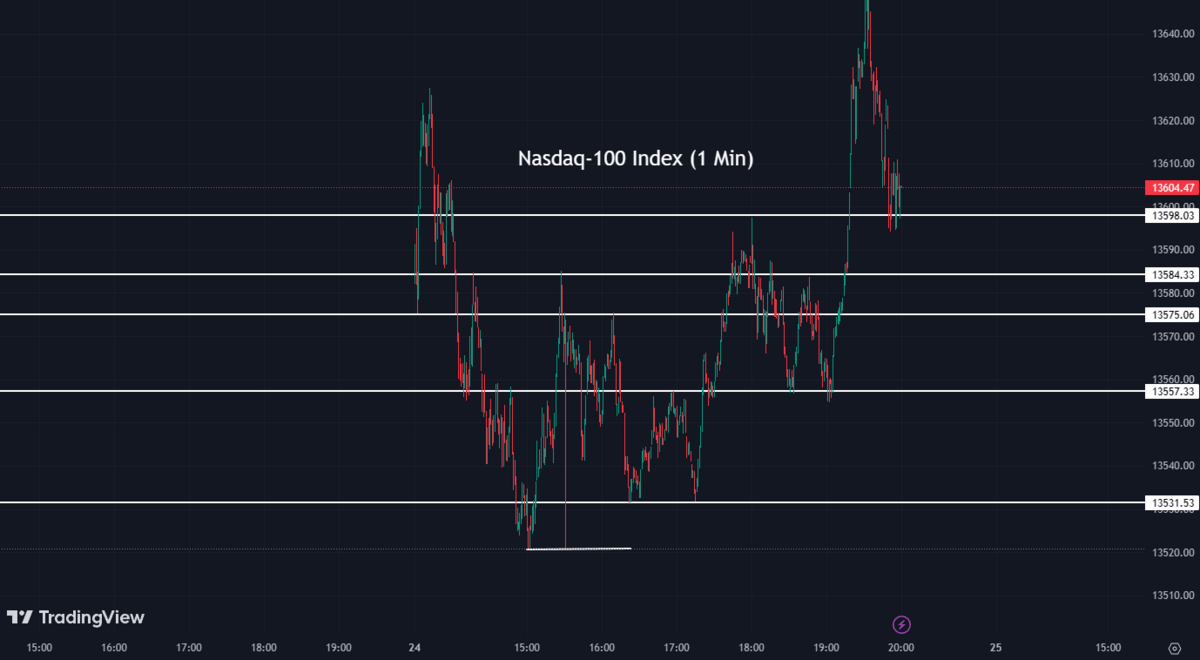

Indexes Continued Fall⛔️📉

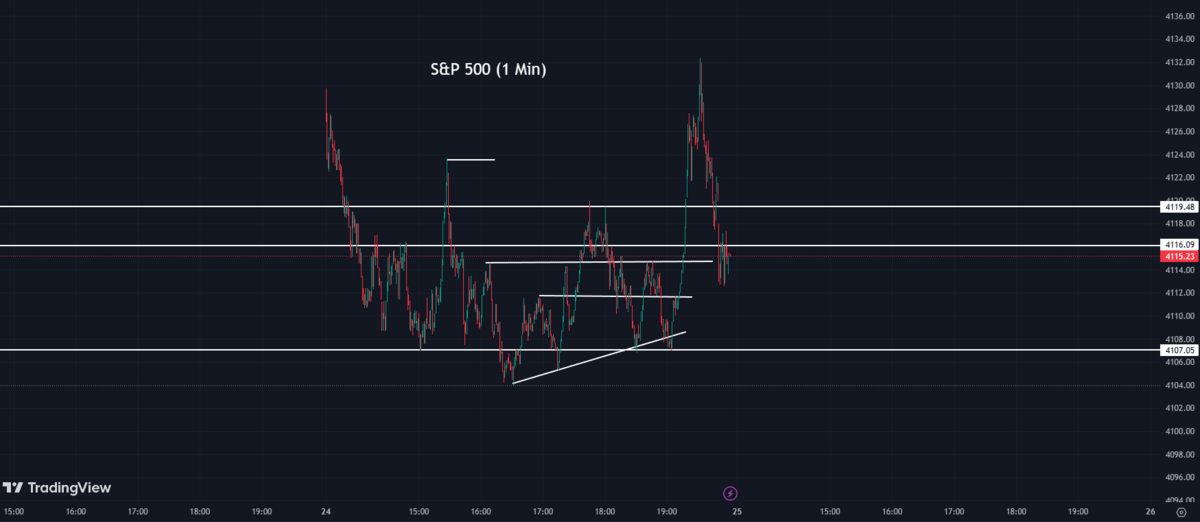

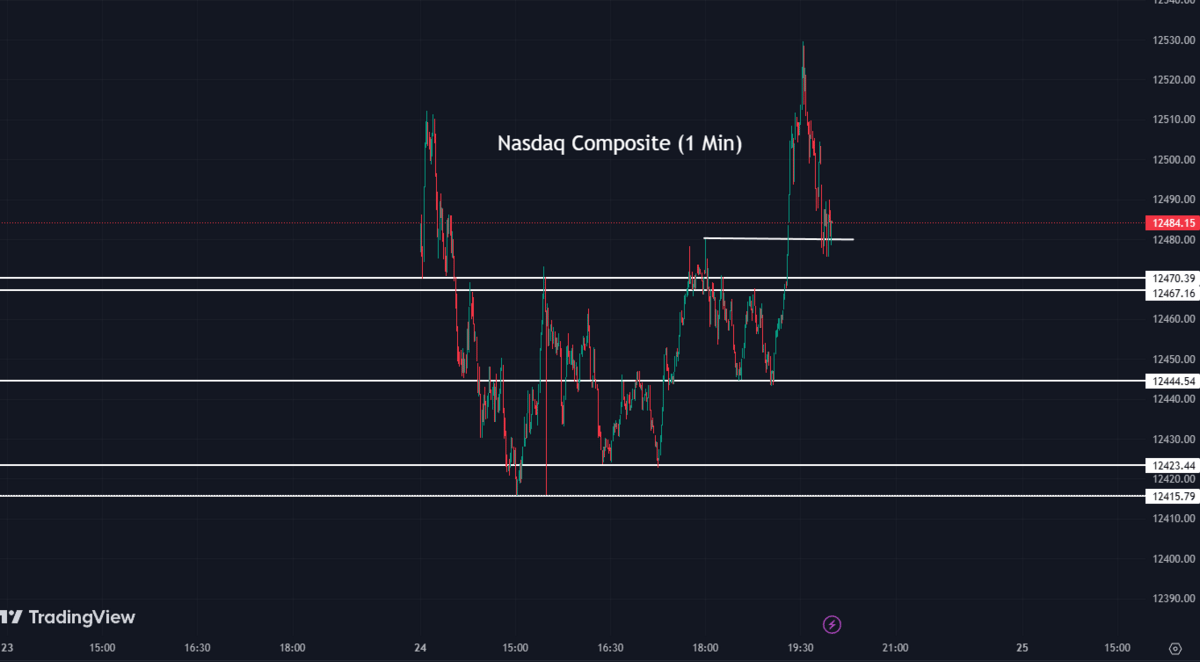

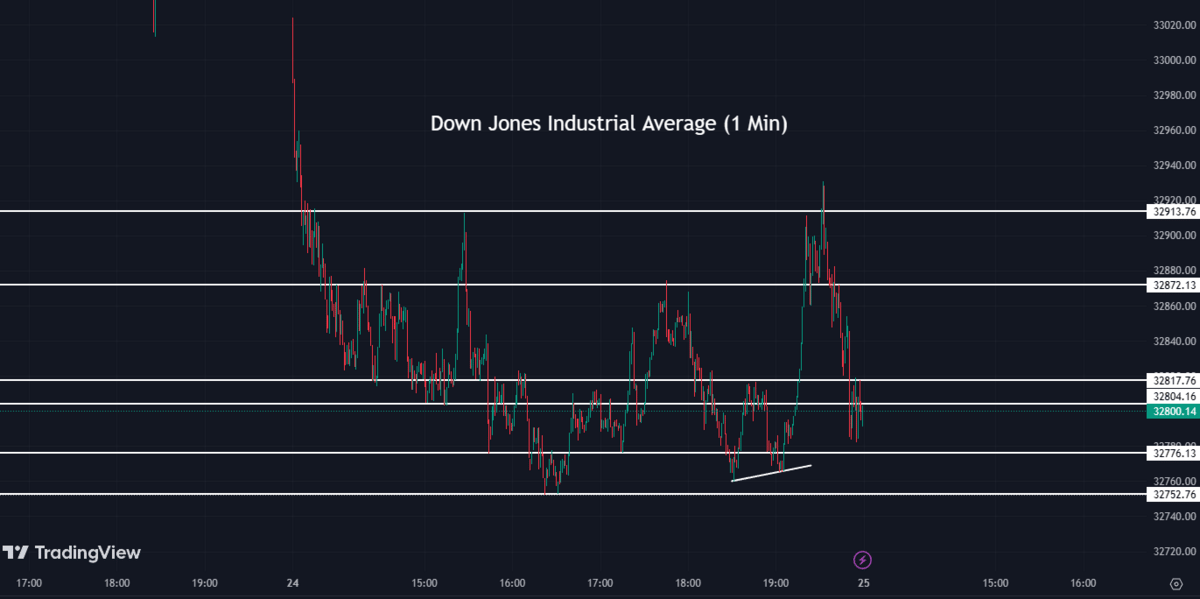

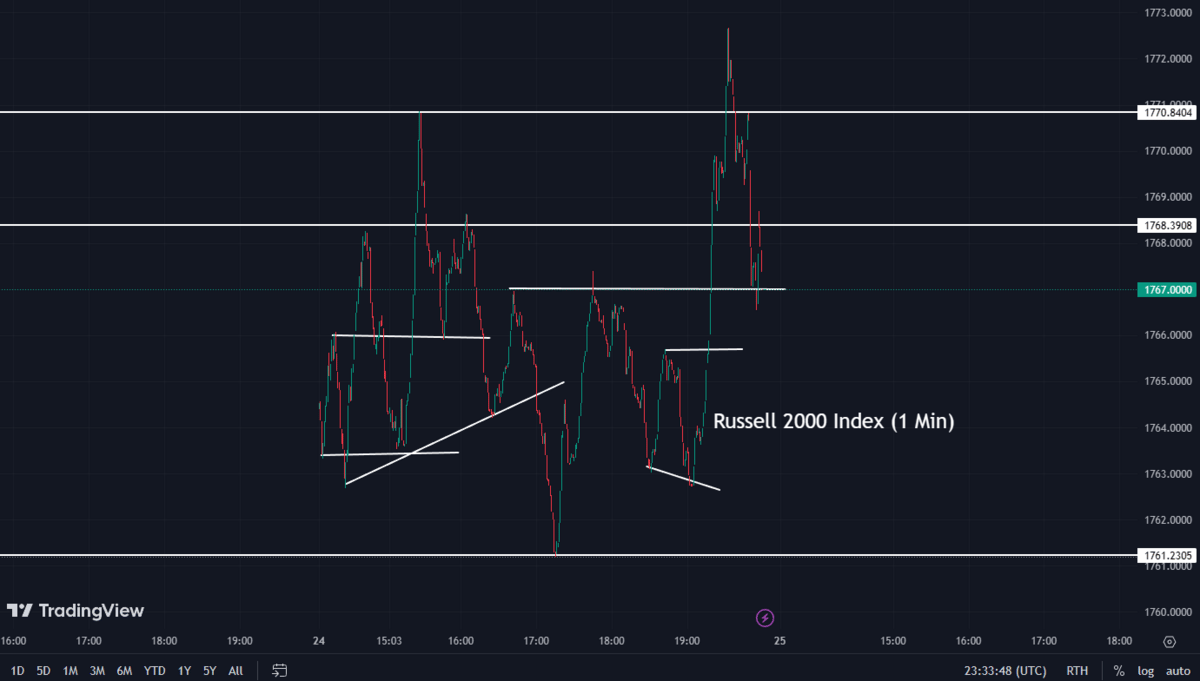

The Dow Jones Industrial Average fell for its fourth consecutive day. The reason for this? Lawmakers cannot compromise on a deal regarding the country's debt ceiling, increasing panic involving a potential default. Let’s take a look at how all the Indices played out today…

The S&P 500 (SPX) dropped 0.73% coming to a conclusion at 4,115

The Nasdaq Composite (IXIC) was down 0.61% to close at 12,484

The Dow Jones Industrial Average (DJI) pulled back 0.77% to end the day at 32,799

The Russell 2000 (RUT) was down 1.16% to settle at 1,767

The Nasdaq-100 (NDX) was down 0.50% coming to a conclusion at 13,604

Nvidia Continues Upward Surge💻💥

Nvidia's stock soared toward an all-time high after the tech giant shattered earnings and guidance estimates, propelled by its accelerated push into artificial intelligence (AI). Nvidia is now barreling toward a rare milestone: a $1 trillion valuation due to its robust earnings and promising outlook. The company’s executives are predicting record revenues. NVDA shares surged more than 20% in after-hours trading following the announcement of Q1 earnings that surpassed Wall Street estimates.

NVDA:

305.38 ▼ -1.50 (-0.49%) today

379.21▲ 73.83 (+24.18%)After Hours

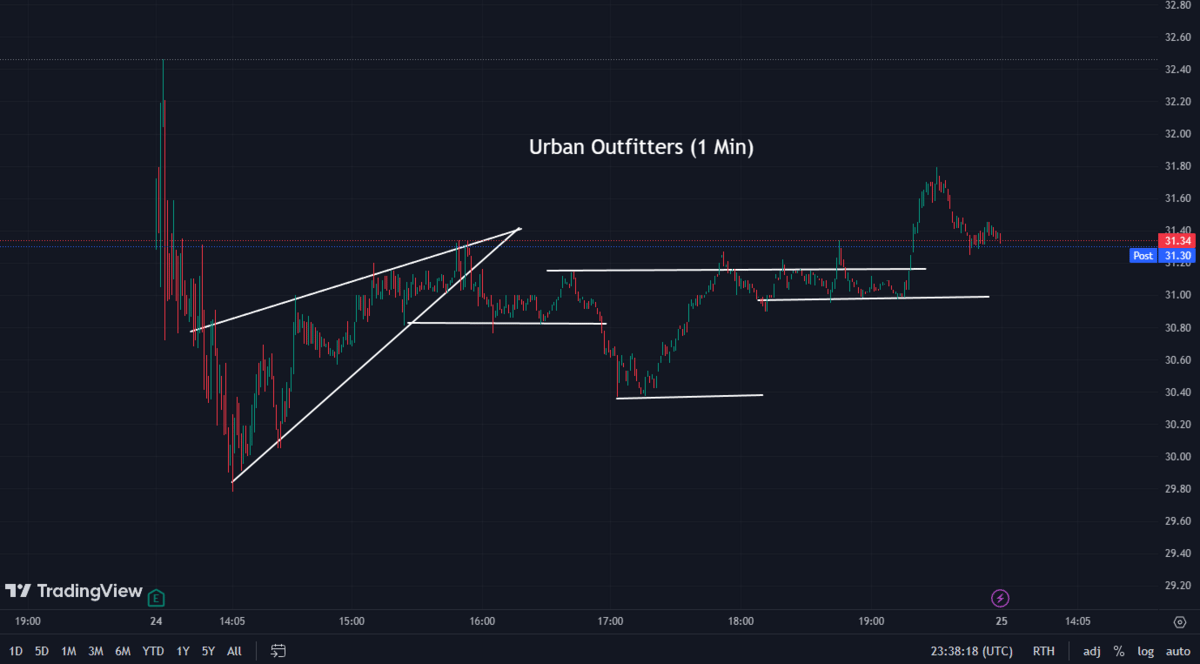

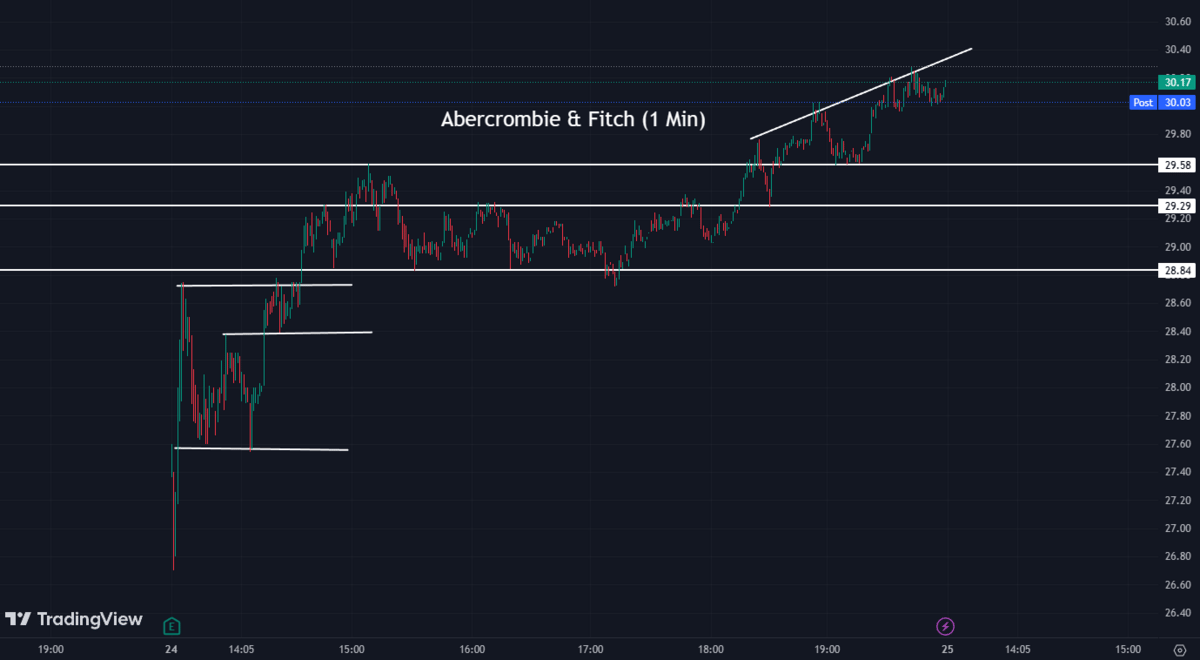

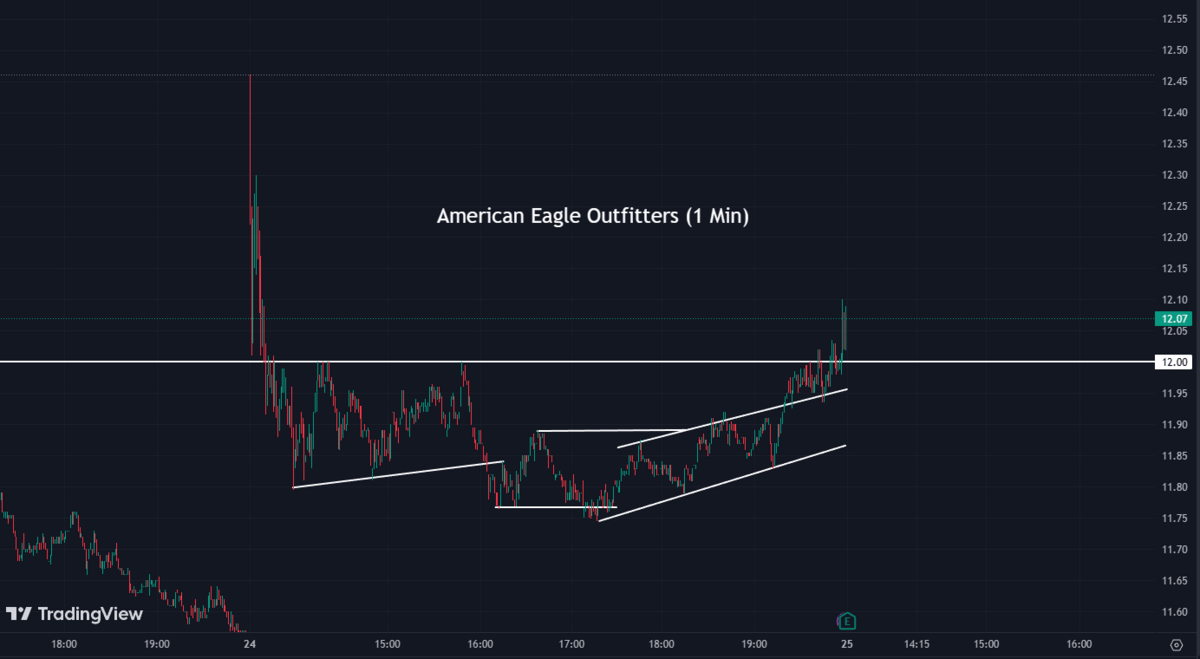

Retail Gains Momentum Amid Pandemic Recovery🛍️💪

In retail news, Urban Outfitters (URBN) and Abercrombie & Fitch (ANF) shares soared, signaling a bright spot for the sector amid the ongoing recovery from the COVID-19 pandemic. However, not all retailers enjoyed the upward trend, with American Eagle Outfitters (AEO) seeing a significant drop after its earnings report.

URBN:

31.35 ▲ +4.69 (+17.59%) today

31.27▼ 0.08 (-0.26%) After Hours

ANF:

30.17 ▲ +7.16 (+31.12%) today

30.03▼ 0.13 (-0.43%) After Hours

AEO:

12.07 ▲ +0.52 (+4.50%) today

10.00▼ 2.07 (-17.15%) After Hours

Snowflake Shares Melt As Investors React to Earnings Report❄📉️

Snowflake's (SNOW) shares took a hit after their earnings report, revealing the challenges that high-growth tech companies face in an increasingly competitive market. The data warehousing company reported a larger-than-expected loss, causing shares to plunge nearly 12% in after-hours trading.

SNOW:

177.17 ▲ +2.01 (+1.15%) today

155.94▼ 21.20 (-11.97%) After Hours

Kohl's Beats Earnings Estimates💼💯

In a bright spot for the retail industry, Kohl's Corporation (KSS) posted stronger-than-expected earnings for the first quarter of 2023. KSS opened up today at 22.32 and closed at 20.73 ending the day with a more than 7% increase.

KSS:

20.73 ▲ +1.46 (+7.58%) today

20.69▼ 0.03 (-0.14%)After Hours

After-hours stocks to watch🕒🔍

Nvidia's stock experienced a significant surge of 24% in after-hours trading. The chipmaker provided strong revenue guidance for the fiscal second quarter and surpassed expectations for both revenue and earnings in the first quarter. The stock has more than doubled in value this year.

Snowflake witnessed an 11% decline after hours. The cloud computing company provided lower-than-expected guidance for second-quarter product revenue, despite beating analysts' expectations for earnings and revenue in the first quarter.

American Eagle Outfitters shares declined by 15% as the company projected a decrease in second-quarter revenue, contrary to consensus expectations of a 1.6% increase. While the clothing retailer's per-share earnings aligned with estimates, its revenue exceeded expectations.

Guess? saw a 3% increase in shares after the apparel company raised its dividend and revised its full-year earnings and revenue guidance upwards.

e.l.f. Beauty experienced a 10% surge in extended trading. The cosmetics company reported fiscal fourth-quarter earnings that exceeded expectations for both revenue and earnings. Analysts had projected earnings of 20 cents per share on revenue of $156 million, while e.l.f. Beauty reported adjusted earnings of 42 cents per share on revenue of $187 million

The One and Only🌟

Among the 11 sectors, energy emerged as the sole sector to close positively today, leading the way with a 0.44% increase. Real estate experienced a notable decline of 2.22%, lagging behind other sectors.

Oil Prices Rise Amid Tightening Supply⛽️🔒

Oil prices witnessed a significant upswing due to concerns over tightening supply. Brent crude oil climbed 2% to $78.36 a barrel. The price of July delivery for Nymex crude oil increased by 1.5% to reach $73.98 per barrel. In the United States, there was a notable decrease in crude oil supplies during the week ending on May 19th. Approximately 12.5 million barrels were drawn down, bringing the total inventory to 455.2 million barrels, as reported by the EIA. The EIA also stated that gasoline stocks in the U.S. experienced a decline of 2.1 million barrels, reaching a total of 216.3 million barrels. Additionally, distillate stockpiles decreased by 600,000 barrels to 105.7 million barrels.

Conclusion👋

Today's financial markets were shaped by a range of events, from Governor Ron DeSantis' White House bid to the ongoing uncertainty surrounding debt ceiling talks. Tech giant Nvidia's impressive earnings propelled its stock to new heights, while the retail industry showed signs of recovery with both wins and losses among major companies. As investors, it's important to stay vigilant, adapt to market changes, and make informed decisions to navigate the evolving financial landscape.

Thank you all for signing up!

Will only work to do better for you all going forward. Our only goal is to add value to everyone’s trading with key levels and the ability of learning charts and price action.

Please Share Our Newsletter it will be much appreciated!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of TradingView. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.