Hello, market enthusiasts! A day of high stakes and high peaks marked Monday's market activity. Here's your rundown of today's market dynamics.👋📊

Debt Ceiling Dilemma: The Stakes are High🙌

The ongoing U.S. debt ceiling impasse continues to be a major focal point. As per recent updates, the dialogue between the Biden administration and GOP leaders seems to be in a stalemate. As the deadline approaches, the market continues to experience ripples of anxiety.

Tech Stocks: The Uproar🦁🔥

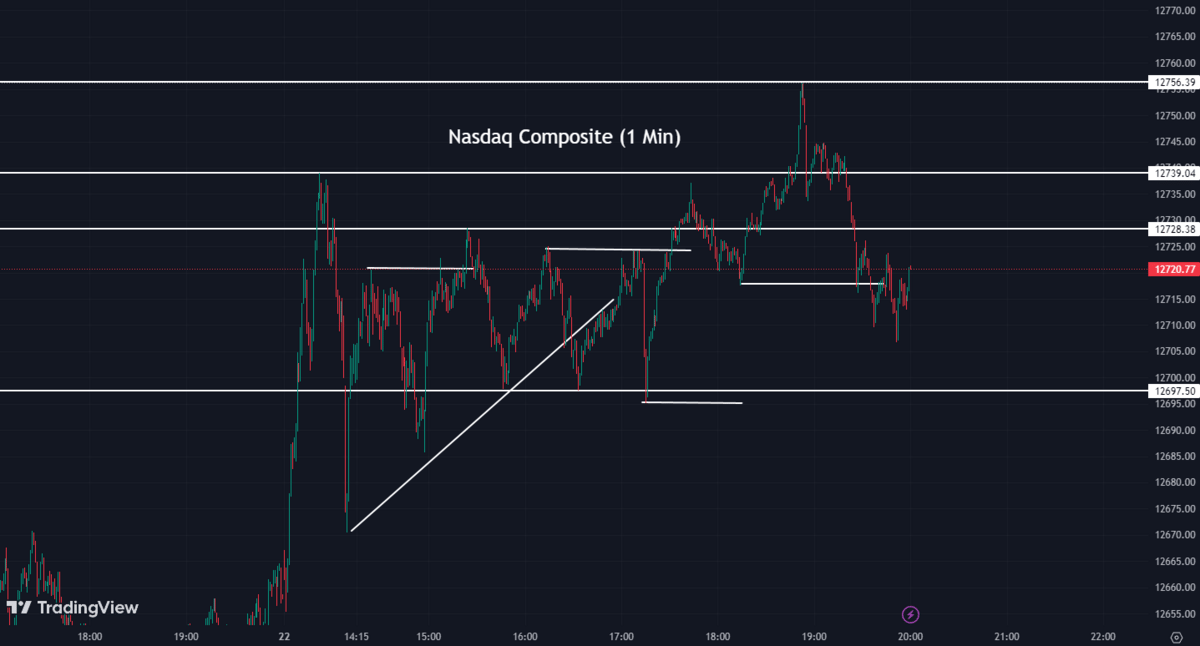

In spite of the overall market turbulence, tech stocks demonstrated resilience. The Information Technology sector saw an uptick of 0.13%, indicating investors' faith in tech firms' ability to deliver strong growth. This optimism was echoed in the Nasdaq Composite Index, which closed up 0.50% ending at 12,720 points.

Market Indices: A Mixed Bag💰🔄

The other major indices weathered the debt ceiling storm.

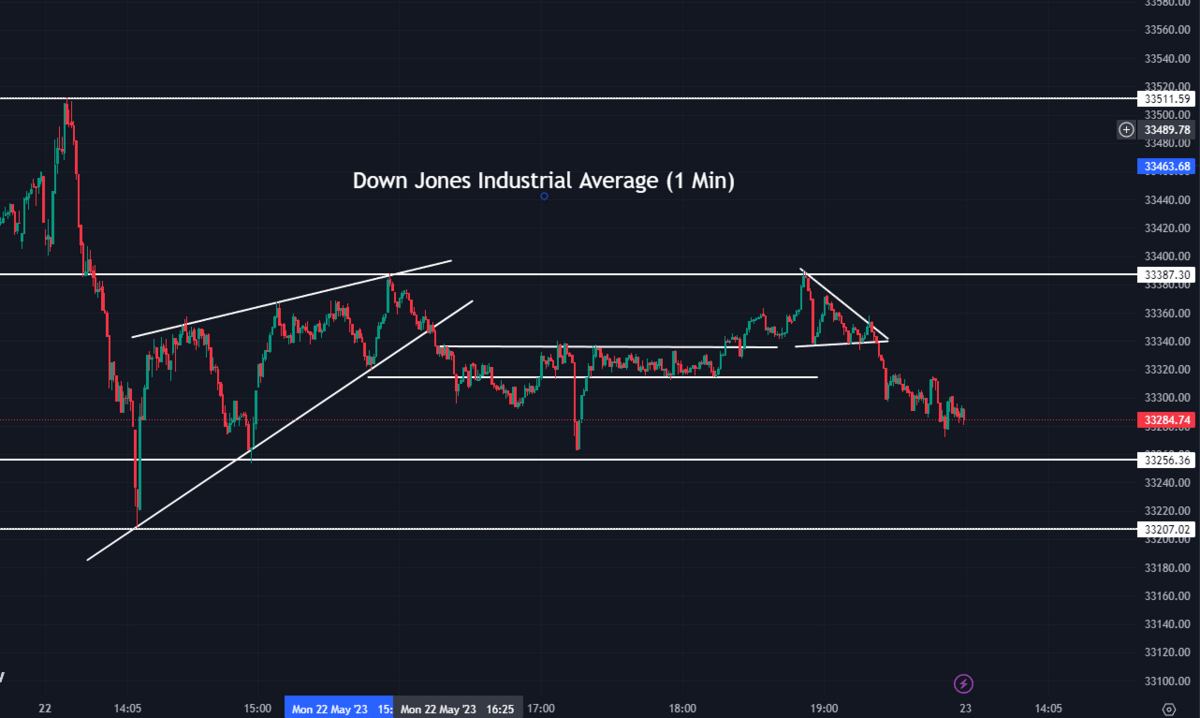

The Dow Jones Industrial Average closed down -0.42% at 33,286 points.

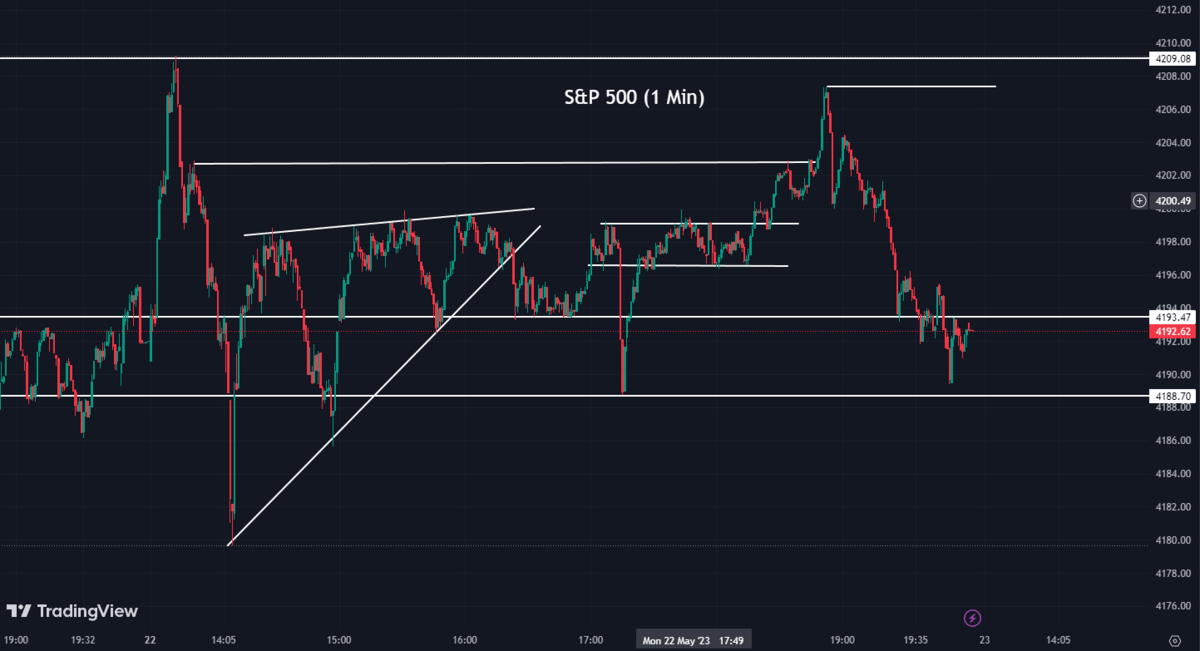

The broader S&P 500 Index also saw an increment of 0.02%, ending the day at 4,192 points.

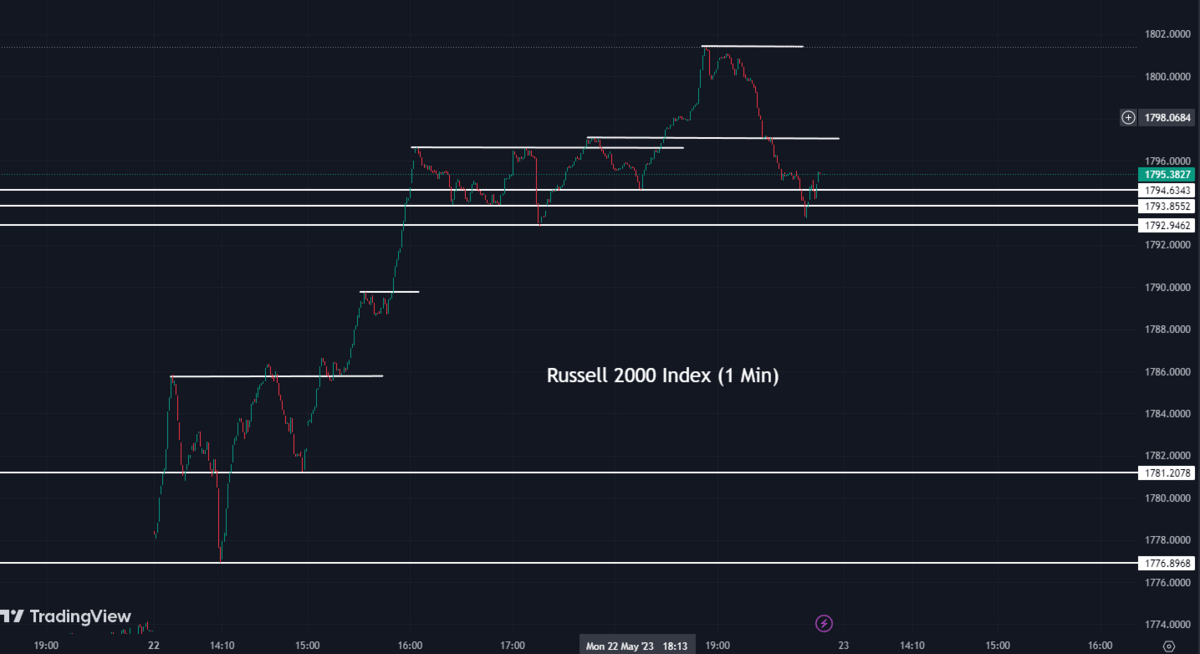

The Russell 2000 Index increased by 1.22% to conclude at 1,795 points.

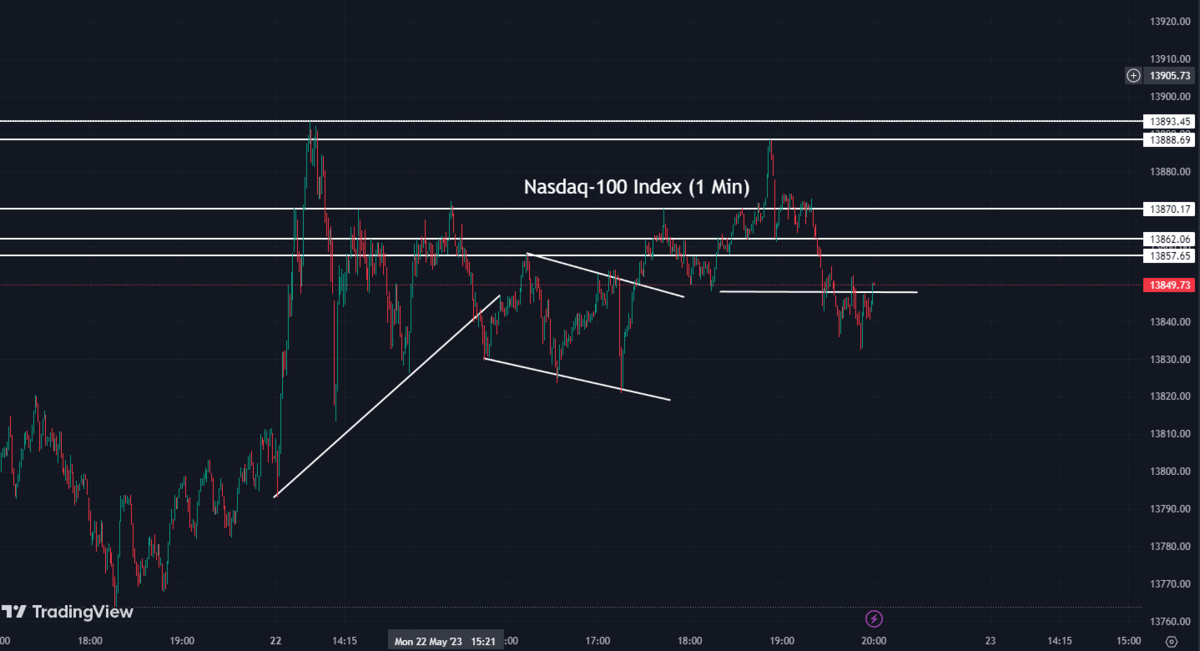

Finally, the Nasdaq-100 Index finished up 0.34%, ending at 13,849 points. This is a significant milestone, as it marks the highest level since August.

Marathon Petroleum: Fueling Gains⛽📈

Marathon Petroleum outperformed its competitors, with shares up by 0.29% to end at $110.64. The company outperformed certain rival companies. Marathon Petroleum's shares rose by 0.29% to end at $110.64, whereas Exxon Mobil Corp. (XOM) experienced a 1.21% decline to $104.97 and Chevron Corp. (CVX) fell 1.80% to $152.44. This indicates that Marathon Petroleum displayed better performance compared to these specific competitors.

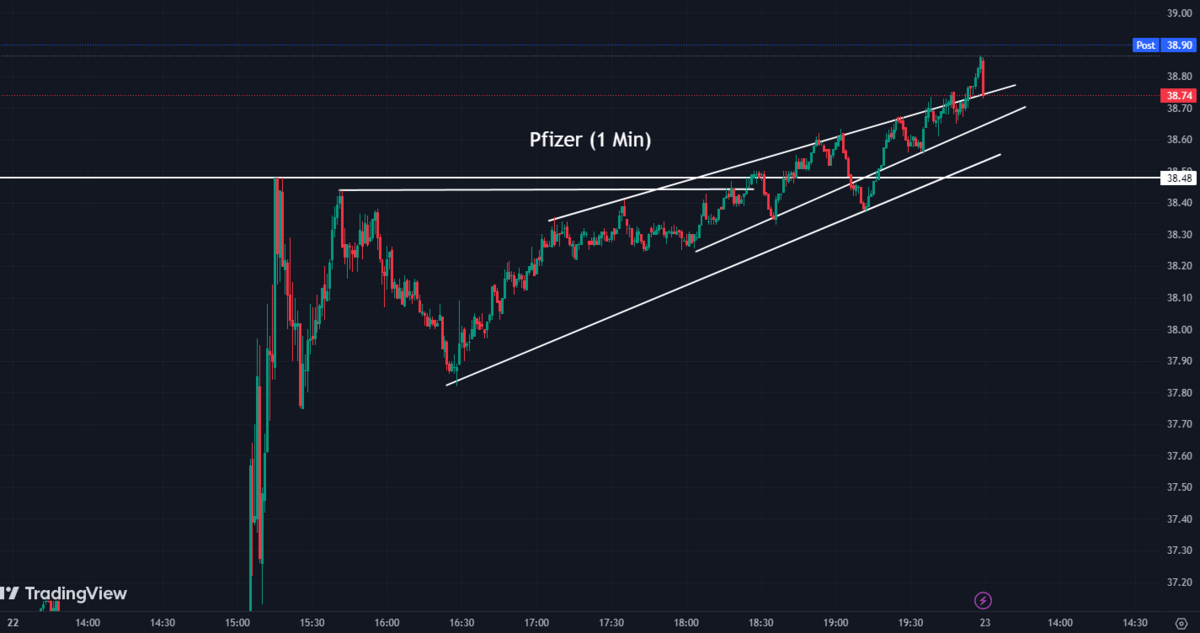

Pfizer: The Upwards Spiral🌀🚀

Pfizer stock (PFE) gained 5.37%, ending the day at $38.75, following the announcement of positive results from its oral drug's weight loss trials. These promising results further support Pfizer's standing in the pharmaceutical industry.

Microbot Medical: Skyrocketing Success📈🚀

Microbot Medical (MBOT) emerged as Monday's star performer. Its shares rocketed 159.35% to close at $3.19, propelled by news of a technological breakthrough and a $1.4 million direct offering of common stock.

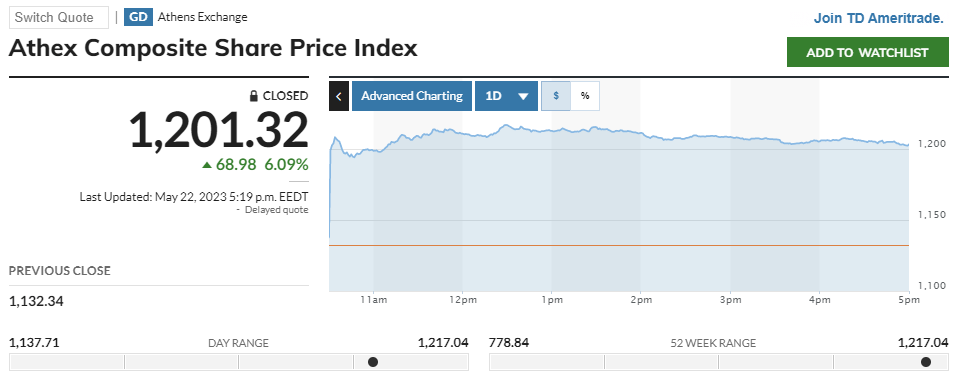

Greek Stocks: Election Afterglow🌞🌅

Greek equities saw a significant surge, with the Greek Athex Composite (GD) up 6.09% closing at 1,201$, and the Global X MSCI Greece ETF (GREK) was up 7.50% closing at 34.39$.

The cause for this?

The recent Conservative party election victory led by Prime Minister Kyriakos Mitsotakis.

Sector Performance: The Full Spectrum✨🌞

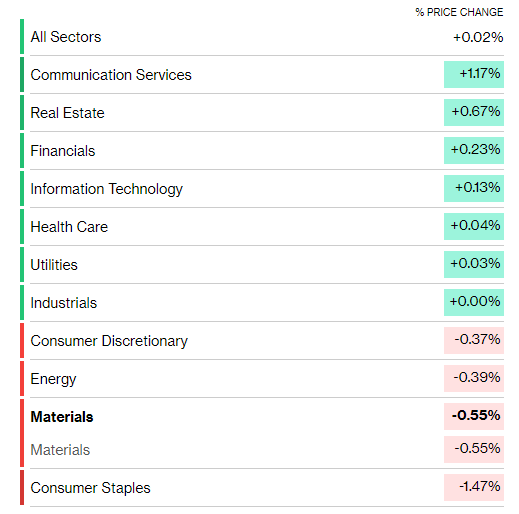

Performance across sectors was diverse, reflective of the market's multifaceted nature. Communication Services led the way with a 1.17% increase, followed by Real Estate, up 0.67%, and Financials up 0.23%. Conversely, Materials and Consumer Staples fell by 0.55% and 1.47% respectively.

Closing Remarks👋🎉

Monday exhibited a combination of market dynamics, from resilience and volatility to a remarkable tech rally. As we progress through the week, we'll continue to observe these narratives and their potential market impacts.

Thank you all for signing up!

Will only work to do better for you all going forward. Our only goal is to add value to everyone’s trading with key levels and the ability of learning charts and price action.

Please Share Our Newsletter it will be much appreciated!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of TradingView. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.