Hey there, fellow traders! As the week draws to a close, let's take a breather and dive into the exciting events of the day. Buckle up, because today was nothing short of extraordinary!

Treasury Yields Rise on Fed Pause Expectations, Inverted Curve Raises Concerns 💰 📈

Treasury yields rose on Friday as the market anticipated that the Federal Reserve would pause its aggressive interest rate hikes while maintaining a hawkish stance against high inflation. Yields initially dipped after Canada reported unexpected job losses and an increase in unemployment. The market expects the Fed's language to be hawkish if policymakers decide to skip a rate hike at their upcoming meeting. The yield curve remains inverted, which historically has been a predictor of recessions. Fed fund futures indicate a high probability of the benchmark interest rate remaining unchanged. The release of CPI and PPI data next week could impact expectations for Fed policy. The Treasury will also conduct significant bond auctions.

US Markets Hit New Highs, Global Stocks Rise 🌍📈

US markets achieved new yearly highs, propelling global markets to a 13-month high. Tesla's surge boosted the S&P 500 and Nasdaq Composite. European markets dropped, but Asian stocks outside of Japan climbed. Investors believe the Federal Reserve will refrain from boosting interest rates, citing low unemployment claims and concerns about market liquidity. Treasury yields and the US dollar both rose. The Turkish lira hit a new low, as bitcoin plummeted due to Binance's deposit restriction. Crude oil prices fluctuated in response to reports of a possible nuclear deal between the United States and Iran. Brent crude oil prices ended 1.3% lower.

Indexes 📈💼

The indices mostly finished up today, with the S&P 500 reaching its highest level since August 2022 and recording its fourth straight week of gains, while the Nasdaq concluded its seventh consecutive week of gains. Investors are now looking ahead to the upcoming inflation data and the Federal Reserve’s latest policy announcement. Now, let's explore how the market performed today...

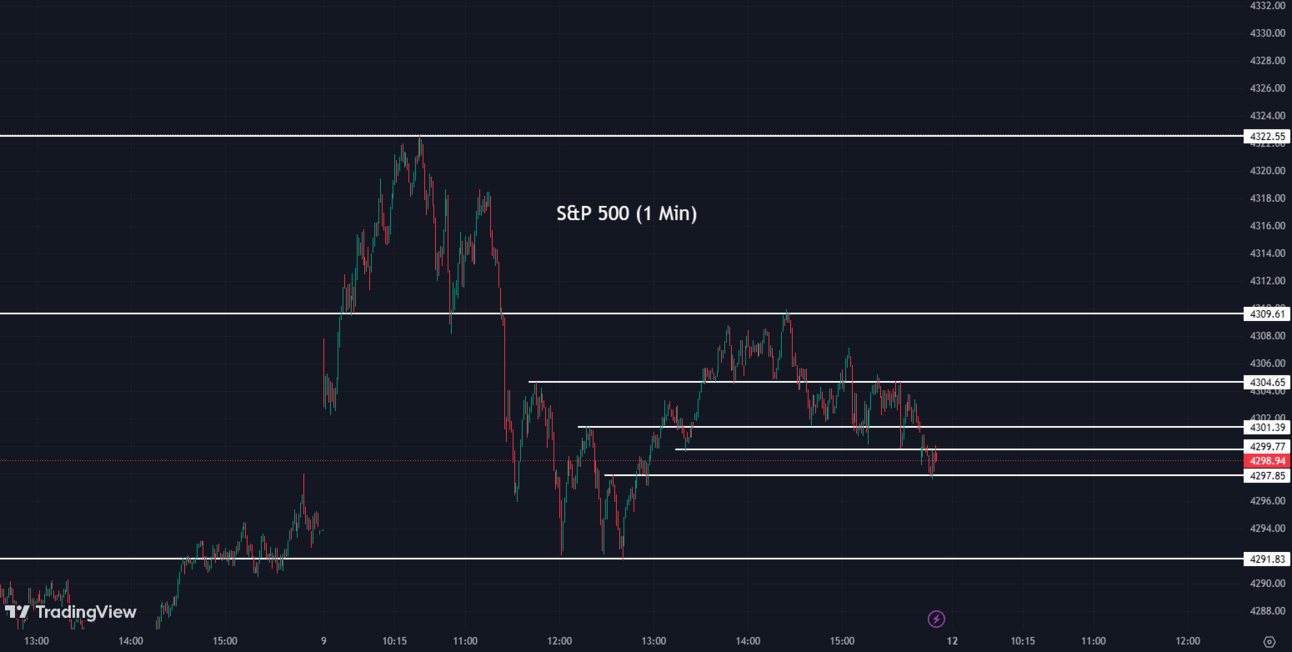

The S&P 500 (SPX) was up +0.11% coming to a conclusion of 4,293

The Nasdaq Composite (IXIC) escalated by +0.16% to settle at 13,259

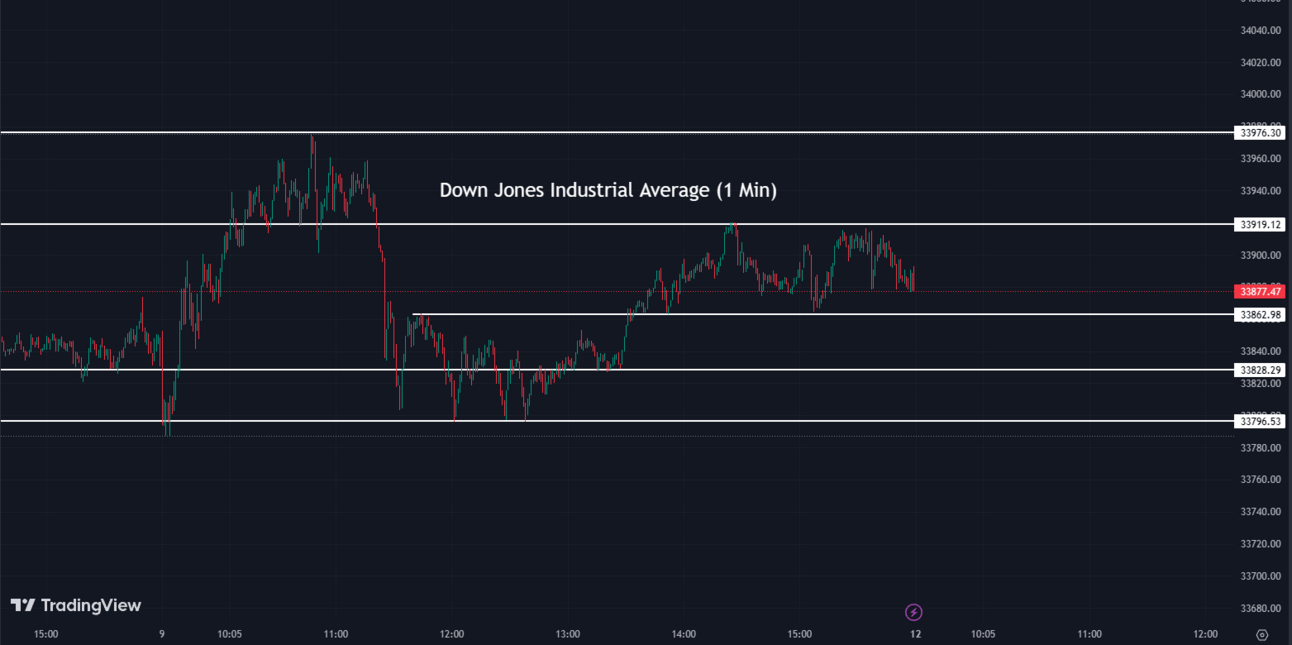

The Dow Jones Industrial Average (DJI) climbed up +0.13% to finish at 33,876

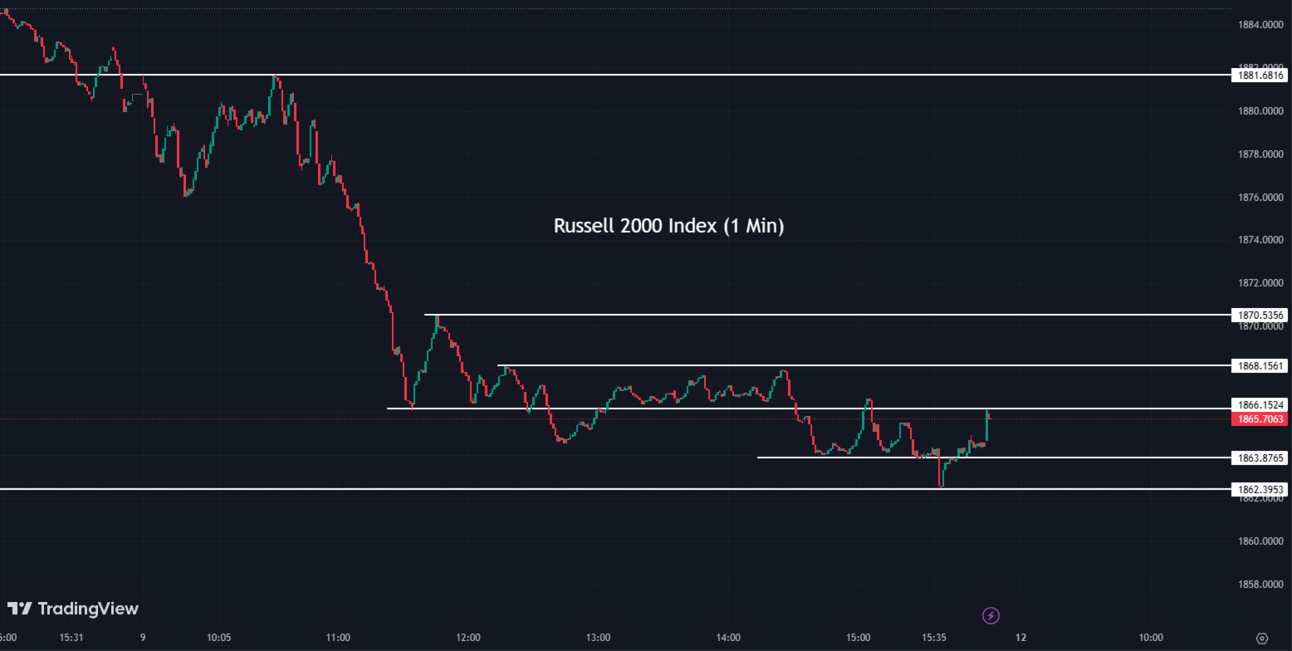

The Russell 2000 (RUT) fell -0.80% to end the day at 1,865

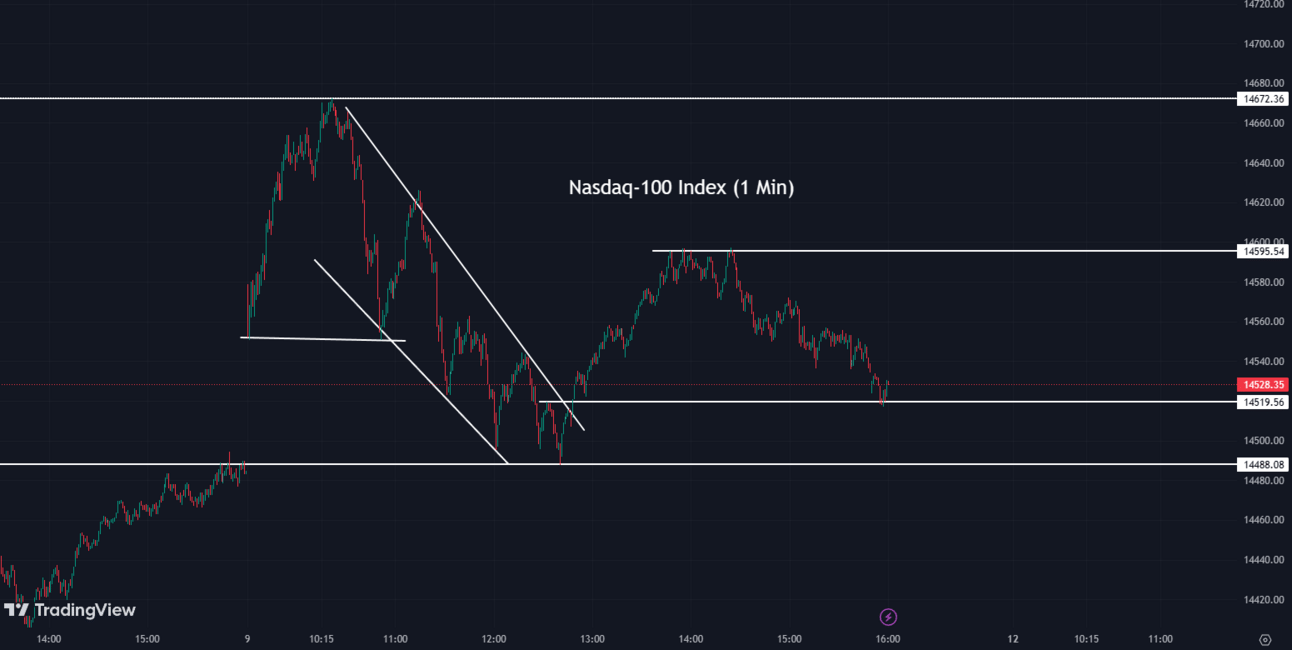

The Nasdaq-100 (NDX) increased by +0.30% coming to a close at 14,528

Retailers Enhance Shopping Experience with Virtual Storefronts 🖥️🛒

Retailers are using virtual storefronts to gamify shopping, boost engagement, and enhance loyalty. J. Crew has launched a virtual beach house in partnership with Obsess, offering an immersive experience for its customers. The virtual stores, including those for brands like American Girl, Ralph Lauren, and Coach, feature games and scavenger hunts, resulting in better conversions and increased engagement. By creating more immersive digital experiences, retailers aim to provide a unique and engaging alternative to the traditional online shopping interface.

Binance.US Suspends Trading in USD Amid Regulatory Scrutiny 🛑💵

Binance.Us, the American branch of Binance, has suspended all trading in U.S. dollars after its banking partners severed ties following the Securities and Exchange Commission's (SEC) lawsuit against the firm. Accused of mishandling customer funds and misleading regulators, Binance.Us has transitioned into a "crypto-only exchange" and encouraged users to withdraw their U.S. dollars. Despite this, the company assured customers their funds are secure, backed by 1:1 reserves, as it navigates the recent wave of regulatory scrutiny affecting the crypto industry.

DISH Network Stock Falls on Asset Sale Struggles and Bankruptcy Speculation 📉📺

DISH Network Corp (DISH) stock is trading lower amid struggles to sell assets and speculation of possible bankruptcy. Doubts are rising about the company's ability to complete its 5G wireless network buildout. CEO Charlie Ergen is reportedly trying to sell non-core assets and seeking regulatory extensions. Customer cord-cutting and failed talks with Amazon add to the challenges.

DISH:

6.55 ▼ -0.88 (-11.84%) Today

6.53 ▼ -0.02 (-0.31%) After Hours

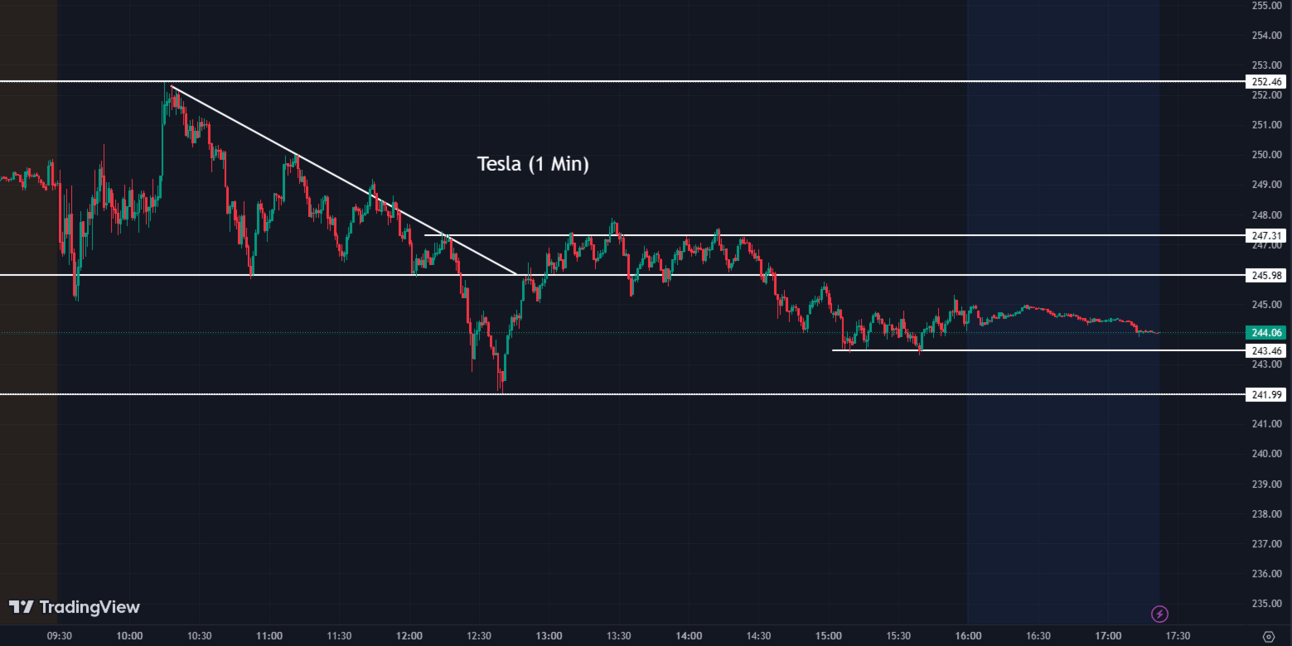

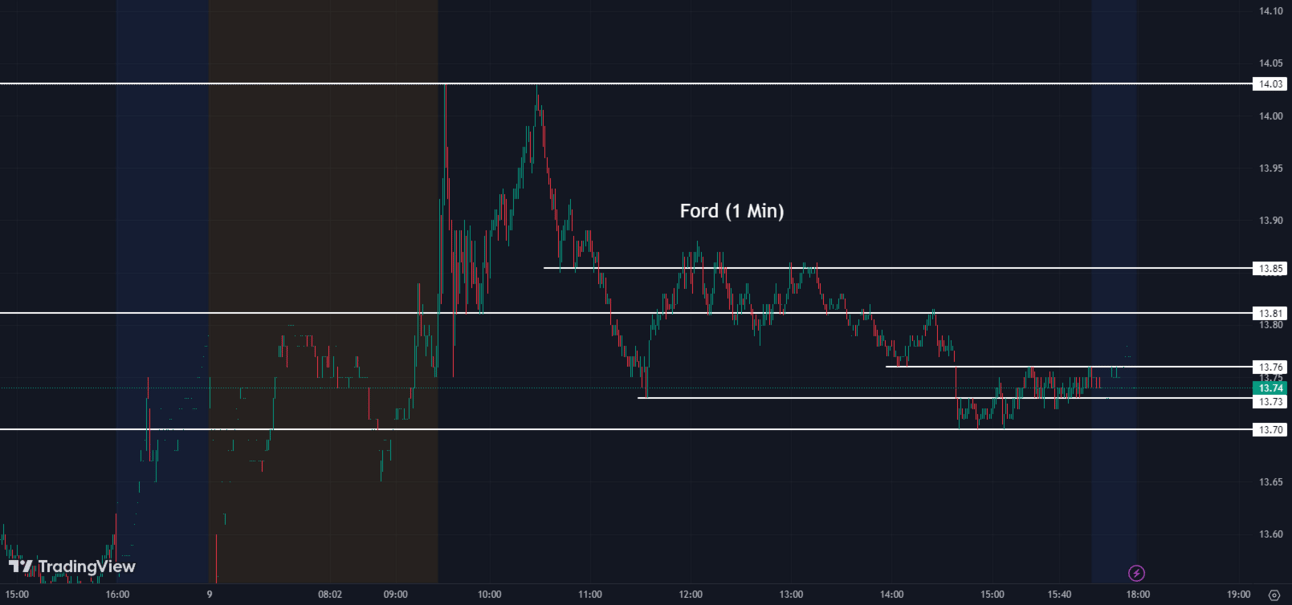

Tesla On Track For Winning Streak After General Motors Charging Deal 🏎️🔋

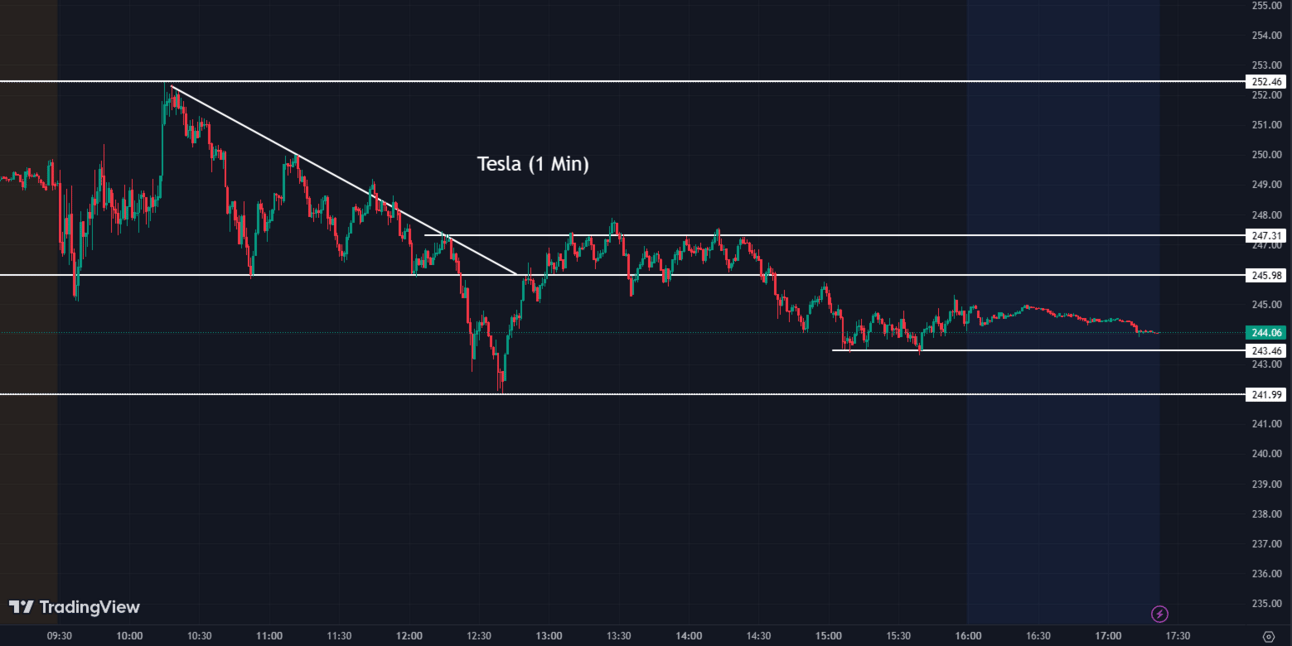

Tesla (TSLA) continues to make headlines as the company enjoys a significant upturn in its stock market fortunes. After the company's partnership announcement with General Motors (GM) and Ford (F) to build a shared EV charging network, both automakers will install a specific charging port manufactured by Tesla beginning in 2025. This winning streak equals its longest run since January 2021 and signals strong investor confidence in Tesla's growth and profitability.

TSLA:

244.40 ▲ +9.54 (+4.06%) Today

243.79 ▼ -0.61 (-0.25%) After Hours

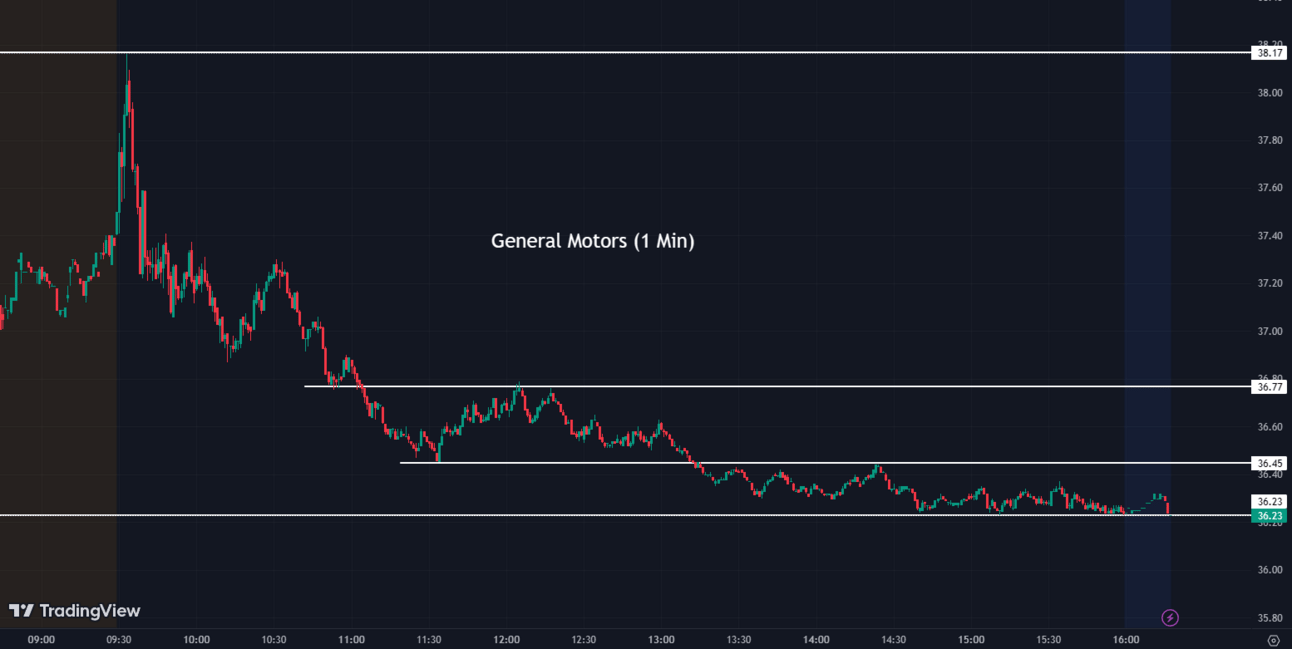

GM:

36.24 ▲ +0.39 (+1.09%) Today

36.28 ▲ +0.05 (+0.14%) After Hours

F:

13.74 ▲ +0.16 (+1.18%) Today

13.73 ▼ -0.005 (-0.036%) After Hours

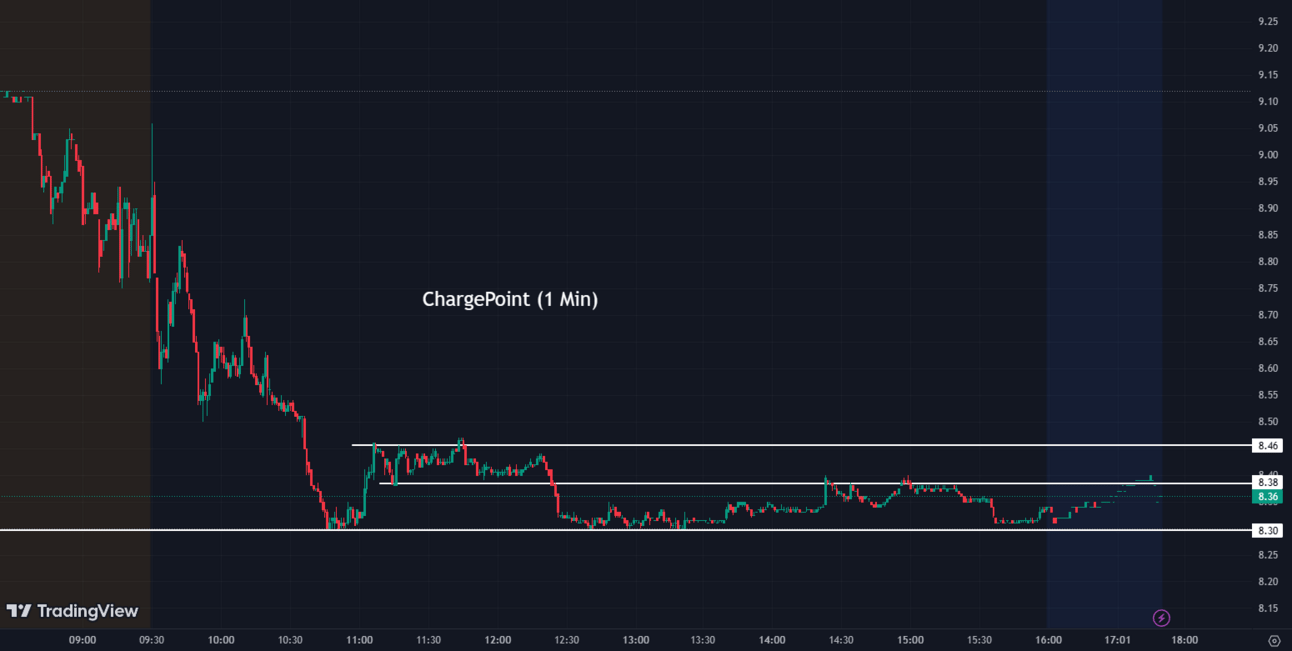

General Motors's Adoption of Tesla's Supercharger Network Impacts EV Charging Stocks 🚗🔌

Shares in EV charging station manufacturers EVgo (EVGO), ChargePoint (CHPT), and Blink Charging (BLNK) have plunged following General Motors' decision to adopt its electric vehicles to use Tesla’s Supercharger network. General Motors's move, similar to a previous one by Ford Motor, is putting pressure on other EV charging companies.

EVGO:

3.84 ▼ -0.51 (-11.72%) Today

3.83 ▼ -0.01 (-0.26%) After Hours

CHPT:

8.33 ▼ -1.28 (-13.32%) Today

8.37 ▲ +0.03 (+0.36%) After Hours

BLNK:

5.96 ▼ -0.71 (-10.64%) Today

No price change after hours

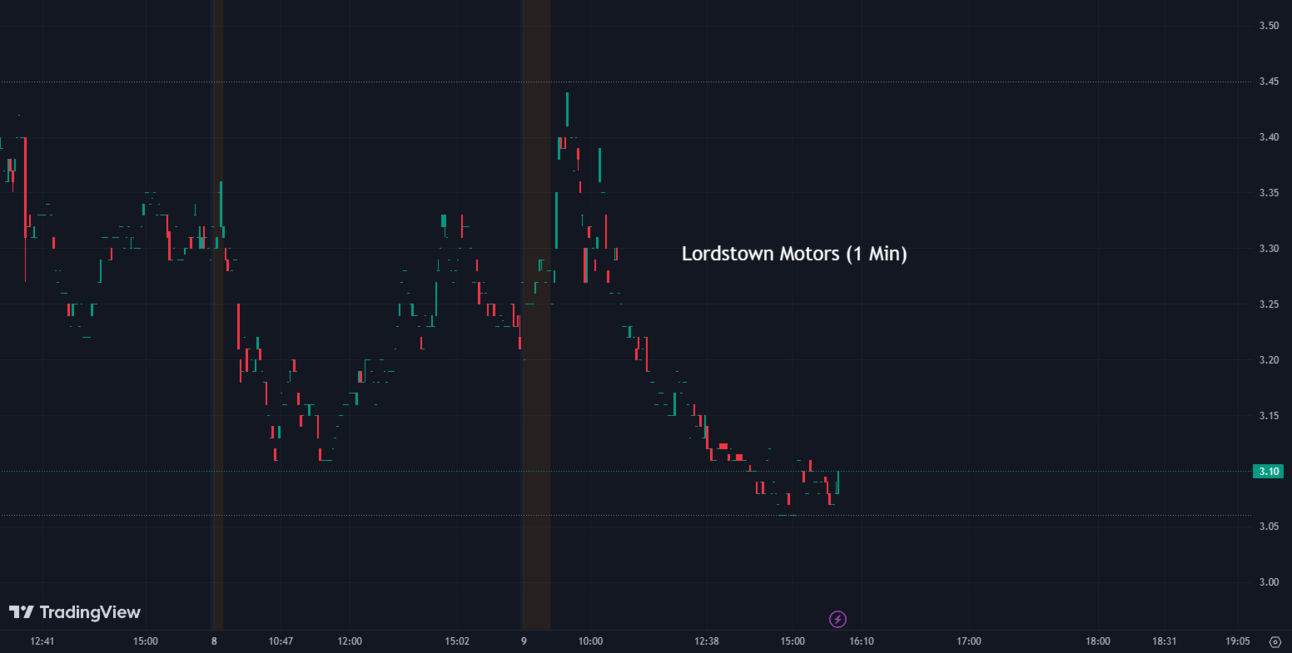

Lordstown Motors Plans Legal Action ⚖️🚗

Lordstown Motors (RIDE), a beleaguered EV manufacturer, is on the verge of suing Foxconn, the Taiwanese tech giant that was once seen as a lifeline. This comes after Lordstown revealed on May 1st that Foxconn threatened to pull out of a $47 million investment agreement following Lordstown's stock falling below $1 and triggering a Nasdaq delisting warning. Foxconn had initially agreed to buy the EV maker's factory in Ohio and 10% of its common stock, but with the breach of the agreement due to Lordstown's stock tumble, Foxconn issued a warning of agreement termination. Lordstown, grappling with repeated production delays, financial struggles, and internal scandals, announced it would sue Foxconn if the company rescinded the investment. The company has also initiated a 1:15 reverse stock split in an attempt to salvage its deal with Foxconn and avoid bankruptcy.

RIDE:

3.08 ▼ -0.12 (-3.75%) Today

3.12 ▲ +0.04 (+1.29%) After Hours

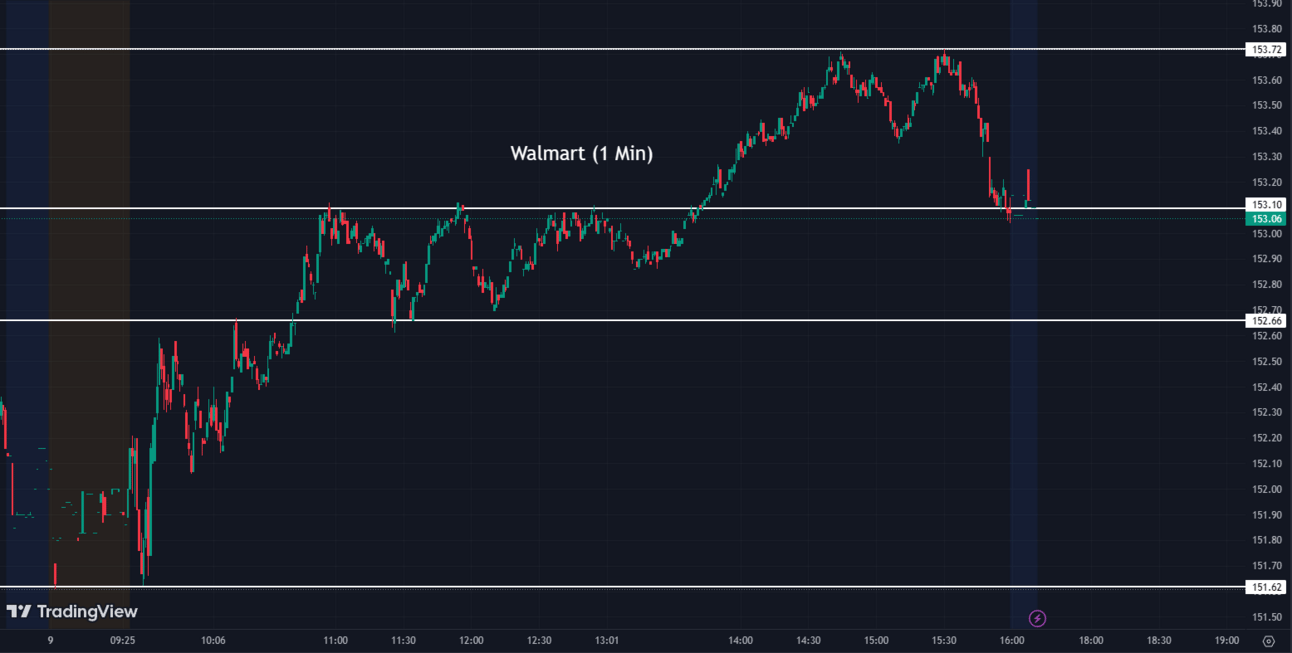

Walmart Expands HIV Outreach Program 🌍🏥

Walmart (WMT) plans to expand its specialty HIV outreach program to nearly a dozen states this year. The company has trained its pharmacists on HIV treatments and aims to engage patients in testing and accessing treatments. This initiative follows similar efforts by CVS (CVS) and Walgreens (WBA) to reduce the HIV epidemic. Walmart's expansion aims to improve access to HIV medications and support services, particularly in communities affected by the virus.

WMT:

153.10 ▲ +0.93 (+0.61%) Today

153.16 ▲ +0.07 (+0.046%) After Hours

Planet Labs Faces Revenue Guidance Reduction and Increased Losses 📉💸

Shares of Planet Labs dropped 30% after it lowered its annual revenue guidance. The company reduced its fiscal year 2024 revenue forecast from $225 million to $235 million, down from $248 million to $268 million. Planet also projected wider losses on an adjusted EBITDA basis. Despite this, the CEO mentioned strong demand for their data solutions driven by global events. The company reported revenue of $52.7 million for the first quarter, a 31% increase year-over-year. Planet's customer base grew to 903, with defense and intelligence accounting for 44% of revenue.

PL:

3.40 ▼ -1.50 (-30.51%) Today

3.45 ▲ +0.04 (+1.17%) After Hours

FDA Advisory Group Backs Eisai and Biogen's Alzheimer's Drug, Leqembi ✅💊

An independent FDA advisory group has unanimously backed Eisai and Biogen's (BIIB) Alzheimer's medicine, Leqembi, possibly paving the way for final approval of the treatment on July 6. If it is approved by the FDA, Medicare has agreed to fund the medicine. The Medicine will come at a large cost of $26,500 per year. Due to conflicts of interest that resulted in recusals, the decision was made by a very tiny advisory group of six members. Despite the unanimous approval, Leqembi's approval has not been without controversy, due to the high danger of brain swelling and bleeding, as well as uncertainties about its therapeutic effectiveness.

BIIB:

308.88 ▲ +3.98 (+1.31%) Today

306.50 ▼ -2.38 (-0.77%) After Hours

Netflix Sees Substantial Subscriber Gains After Password Sharing Crackdown 🔒🔑

Netflix (NFLX) shares reached a 16-month high following its recent crackdown on password sharing. The enforcement of stricter rules, pushing users outside the account holder's home to acquire personal subscriptions, resulted in the company's best sign-up streak in four years. This move is expected to boost Netflix's overall subscriber gains, which are anticipated to rise by 3.43 million over the quarter ending in June. The crackdown on password sharing is viewed as a strategy to offset lost revenues from the estimated 100 million households that were previously accessing the service without payment.

NFLX:

420.02 ▲ +10.65 (+2.60%) Today

420.02 ▲ +0.005 (+0.0012%) After Hours

PacWest Commences Sale of $5.7 Billion Portfolio 💼💰

PacWest Bancorp (PACW) has completed the first phase of its $5.7 billion loan portfolio sale to real estate investment company, Kennedy Wilson Holdings, in a strategic move to bolster its liquidity. The first tranche, acquired by Kennedy Wilson (KW) and its affiliate Fairfax Financial Holdings (FRFHF), totaled $3.25 billion in commitments and $1.8 billion in principal balances. This comes as part of PacWest's strategy to refocus on relationship-based community banking, following runs on deposits that destabilized several regional lenders earlier this year. Additional loans valued at $800 million are expected to be sold by the end of July.

PACW:

8.53 ▼ -0.59 (-6.47%) Today

8.50 ▼ -0.03 (-0.35%) After Hours

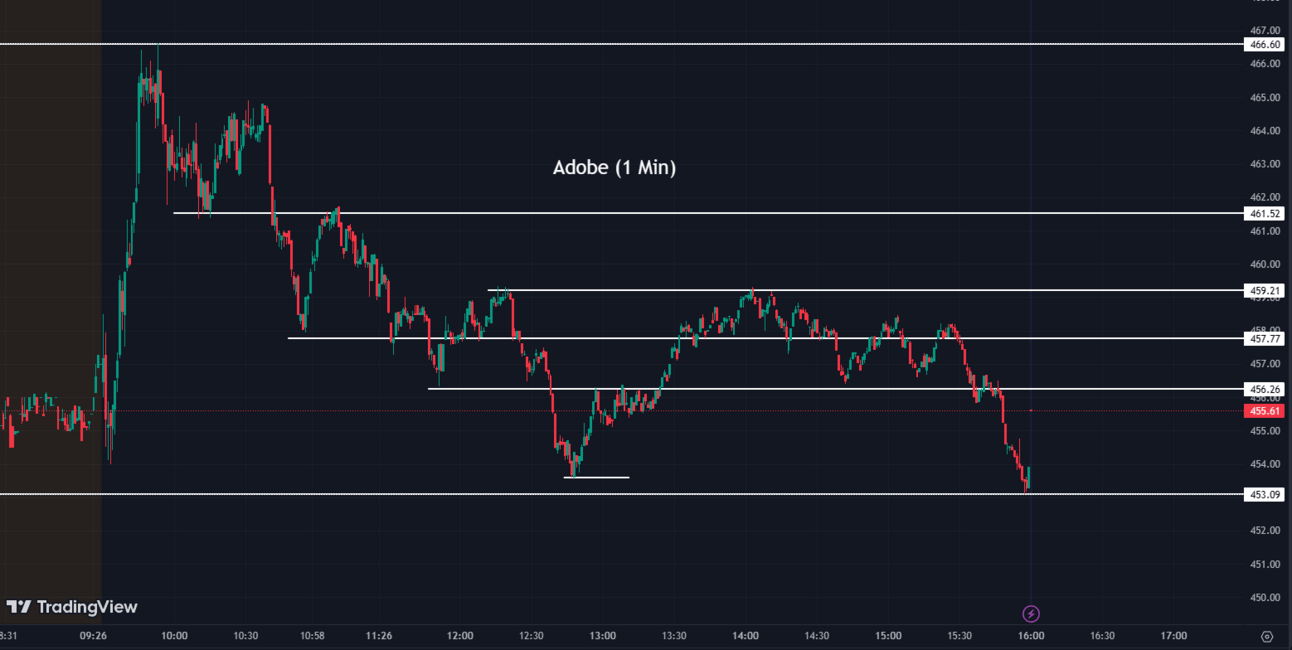

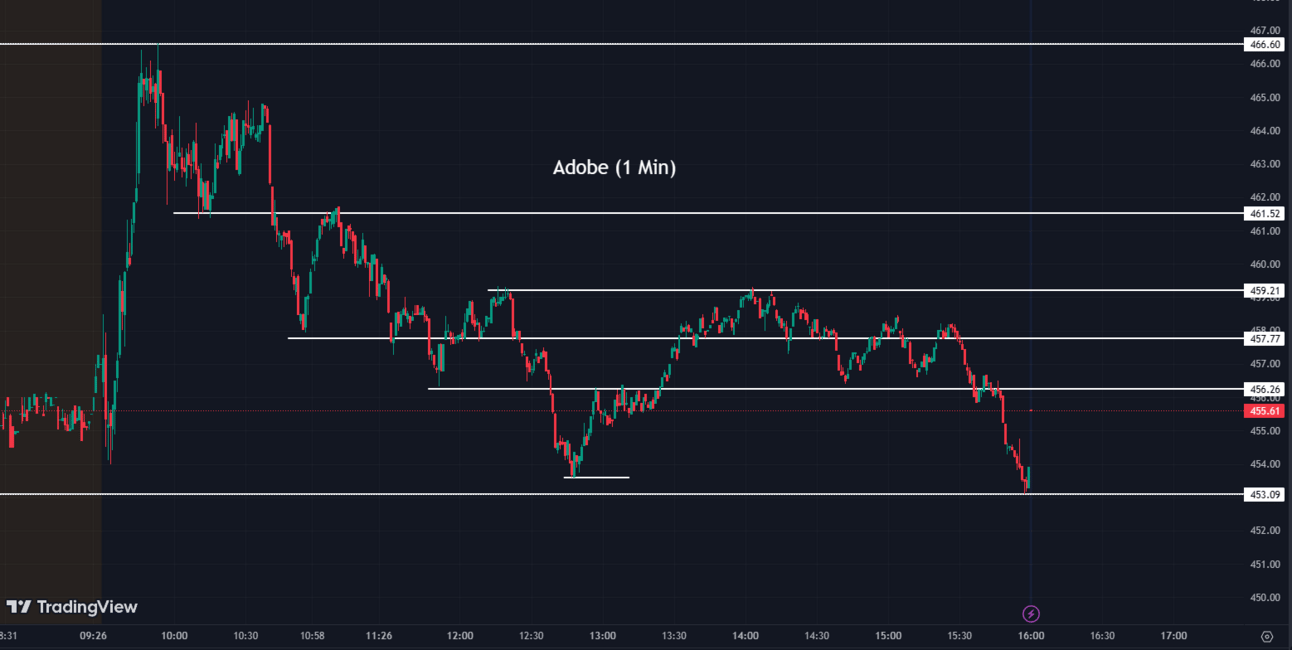

Adobe Thrives on AI News 🤖🚀

Shares of Adobe closed at their highest price in over a year on Friday, following an upgrade by an analyst due to growing optimism about the company's AI product, Firefly. Adobe shares rallied up to 6% to a daily high of $466.59, with the trading session closing at $454, marking the highest close since April 2022. The software company recently announced plans to monetize its AI content-creation tool, Firefly, by launching Firefly for Enterprise in the latter half of 2023. A Wells Fargo analyst upgraded Adobe's stock, citing confidence in AI acting as a tailwind for Adobe.

ADBE:

454.00 ▲ +14.97 (+3.41%) Today

455.90 ▲ +1.90 (+0.42%) After Hours

Notable Movers of The Day 🚀🔥

Braze (BRZE), the consumer engagement platform, experienced a significant surge of over 18% in its shares. The company reported a non-GAAP loss of 13 cents per share and revenue of $101.8 million, surpassing analyst expectations of a loss of 18 cents per share and revenue of $98.8 million. Goldman Sachs, reaffirming its positive outlook, maintained a buy rating on Braze, citing the potential of artificial intelligence to enhance the company's market position.

BRZE:

39.43 ▲ +5.49 (+16.18%) Today

39.32 ▼ -0.11 (-0.28%) After Hours

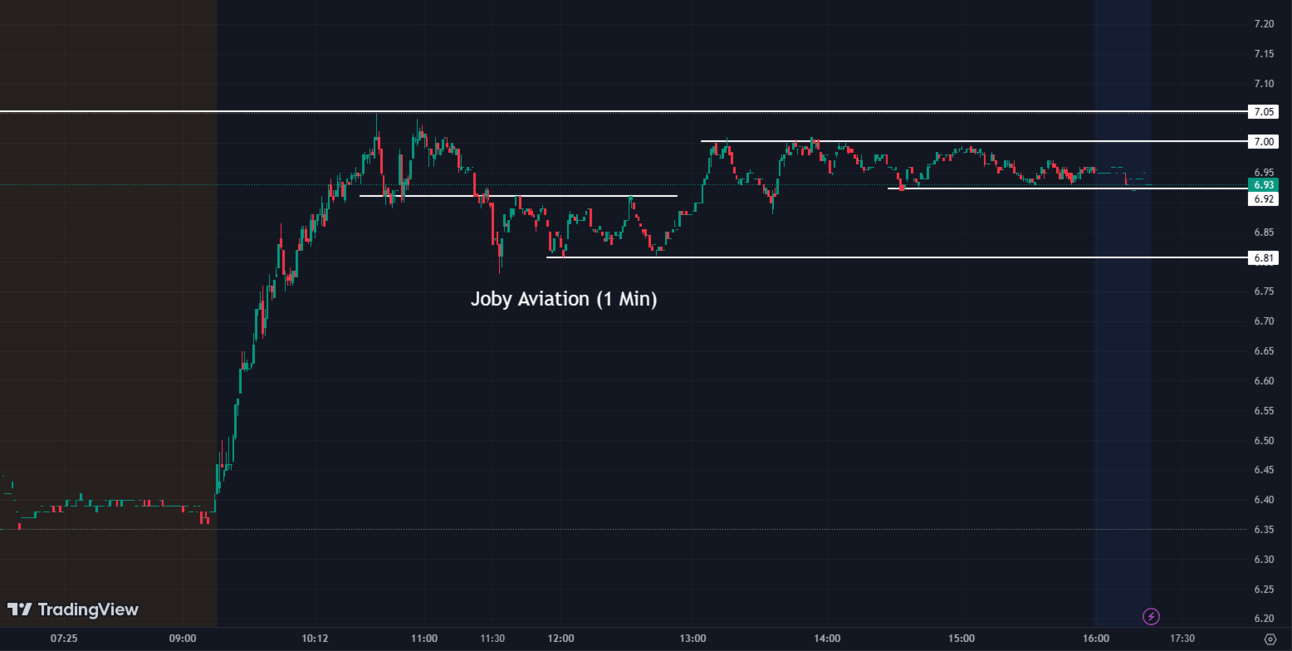

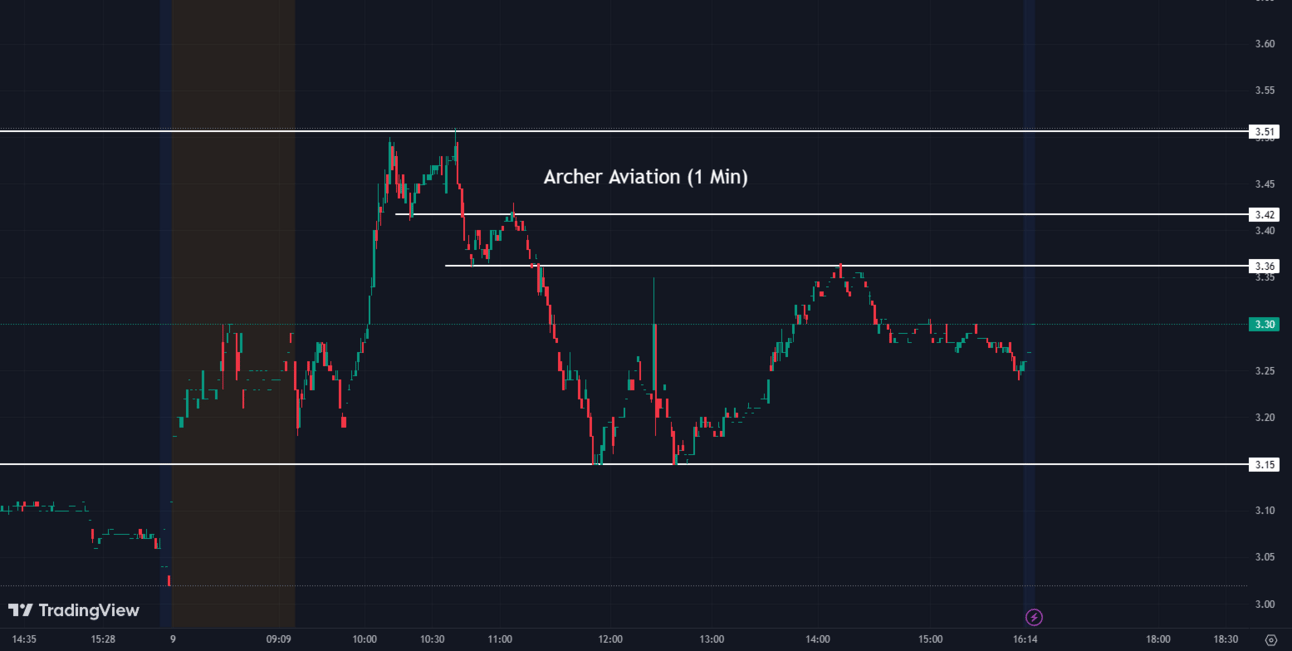

In other investing news, Joby Aviation (JOBY) and Archer Aviation (ACHR) received a buy rating from Canaccord Genuity, highlighting their long-term potential in the urban air mobility sector. As a result, Joby Aviation shares soared by 11.18%, while Archer shares rose by 6.54%.

JOBY:

6.96 ▲ +0.70 (+11.18%) Today

No price change after hours

ACHR:

3.26 ▲ +0.20 (+6.54%) Today

3.35 ▲ +0.10 (+3.08%) After Hours

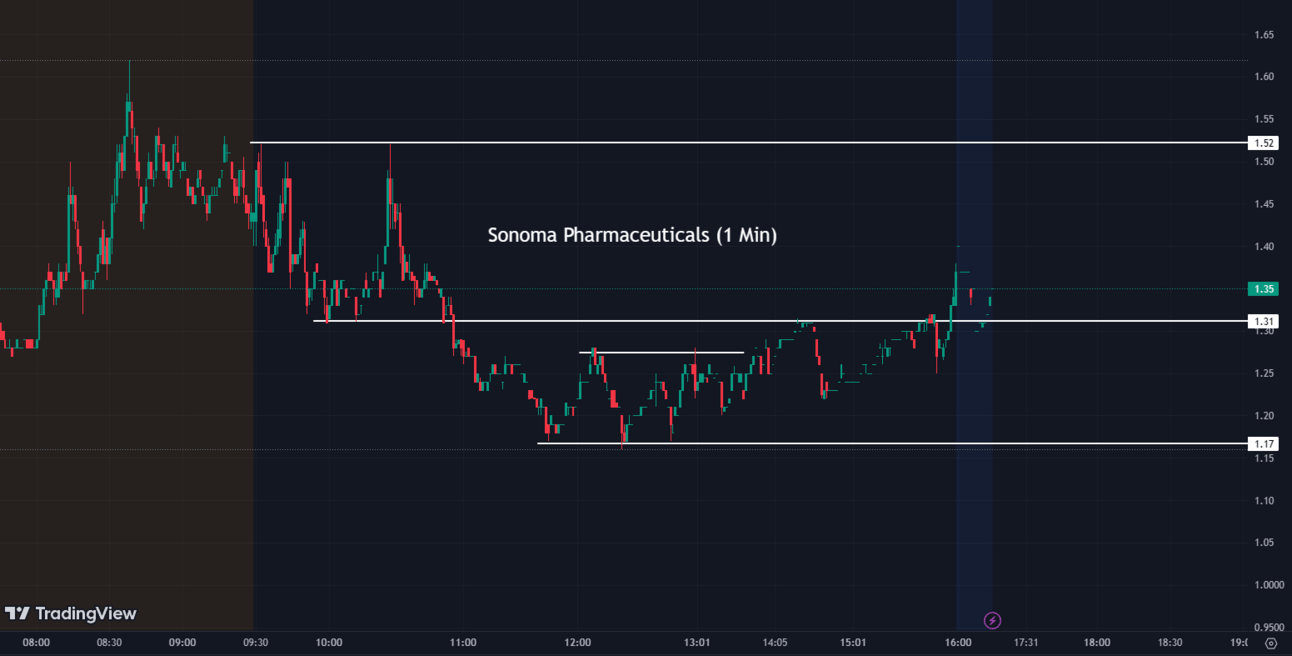

Sonoma Pharmaceuticals (SNOA) witnessed a significant surge of 44% in its shares following the announcement of an intraoperative pulse lavage irrigation treatment that could replace IV bags for certain surgical procedures.

SNOA:

1.40 ▲ +0.43 (+44.33%) Today

1.30 ▼ -0.10 (-7.14%) After Hours

Tesla (TSLA) experienced a 4% rally, and General Motors (GM) gained nearly 1% after announcing a partnership that grants General Motors access to Tesla's North American charging stations. General Motors CEO Mary Barra stated that this collaboration would save the company up to $400 million of its previously planned $750 million investment in expanding electric vehicle charging infrastructure.

TSLA:

244.40 ▲ +9.54 (+4.06%) Today

243.79 ▼ -0.61 (-0.25%) After Hours

GM:

36.24 ▲ +0.39 (+1.09%) Today

36.28 ▲ +0.05 (+0.14%) After Hours

DocuSign (DOCU) shares declined by 2.50% after CEO Allan C. Thygesen expressed caution due to a more moderate pipeline, cautious customer behavior, smaller deal sizes, and lower volumes. Although DocuSign exceeded expectations in its fiscal first-quarter results, reporting adjusted earnings of 72 cents per share on $661 million in revenue compared to analysts' estimates of 56 cents per share and $642 million in revenue, the cautious outlook impacted investor sentiment.

DOCU:

57.02 ▼ -1.46 (-2.50%) Today

56.87 ▼ -0.15 (-0.26%) After Hours

Adobe (ADBE) saw a 3.5% increase in its shares as Wells Fargo upgraded the software stock to an overweight rating, citing the potential of artificial intelligence to drive further upside for the company.

ADBE:

454.00 ▲ +14.97 (+3.41%) Today

455.90 ▲ +1.90 (+0.42%) After Hours

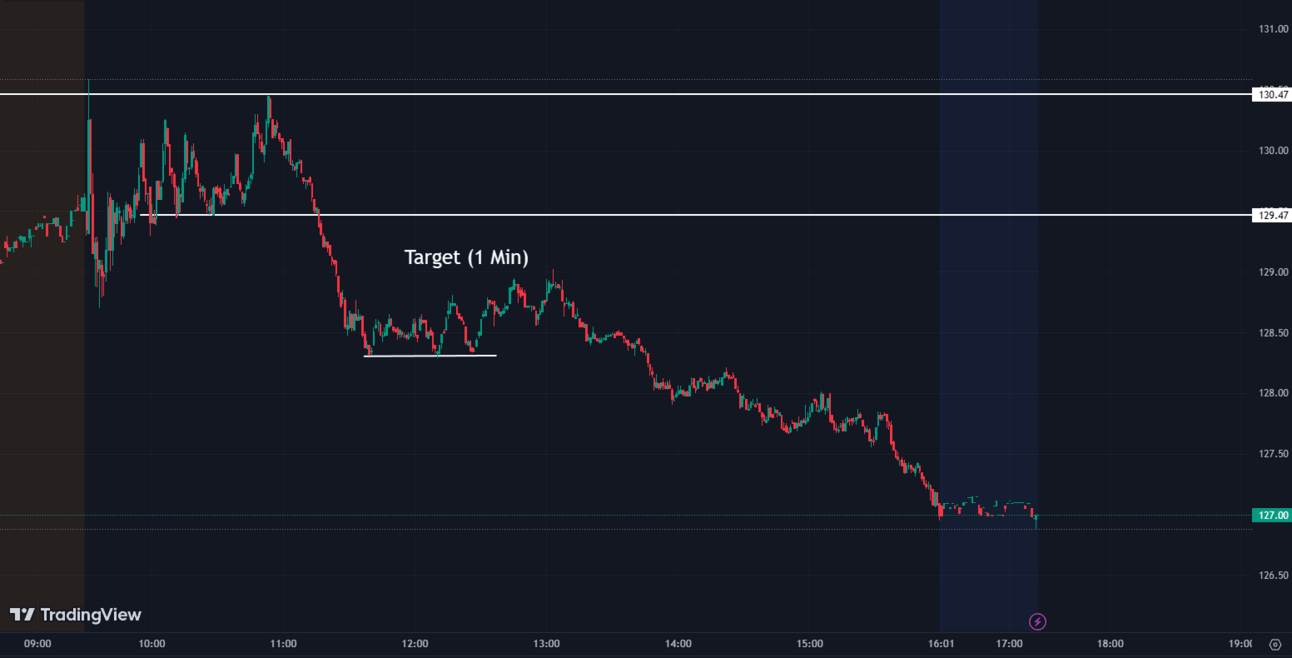

Target's (TGT) shares declined by 3% after Citi downgraded the retail stock from a buy to a neutral rating, suggesting that sales at the big-box merchandiser may have reached their peak.

TGT:

126.99 ▼ -4.28 (-3.26%) Today

126.81 ▼ -0.18 (-0.14%) After Hours

AI-focused company Symbotic (SYM) marked another 4.61% rise, reaching an all-time high. The company, specializing in AI-enabled technology for supply-chain operations such as warehouses, has seen its stock surge over 250% this year.

SYM:

43.09 ▲ +1.90 (+4.61%) Today

43.00 ▼ -0.09 (-0.21%) After Hours

E-commerce platform Etsy (ETSY) received a 4.5% boost following a reiterated outperform rating from JPMorgan Chase.

ETSY:

43.09 ▲ +1.90 (+4.61%) Today

43.00 ▼ -0.09 (-0.21%) After Hours

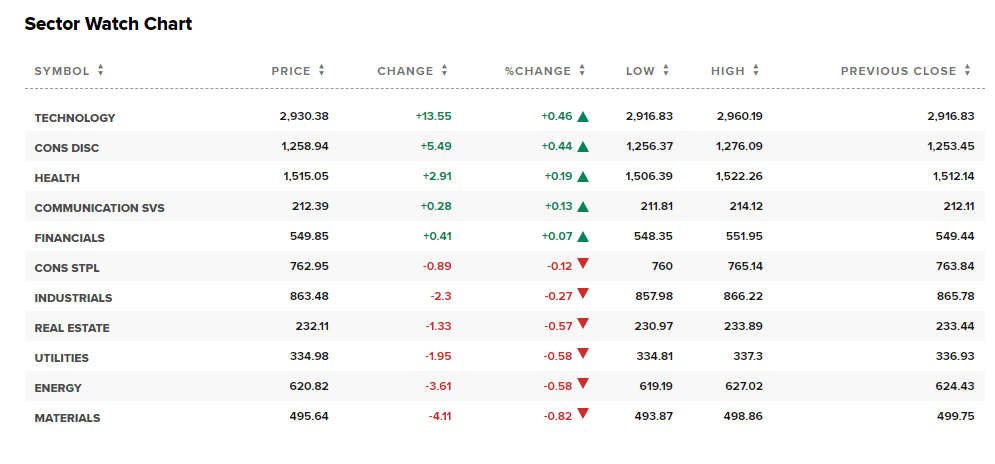

Sectors 🧱📱

5 out of the 11 sectors closed in the green today, with Technology leading the way up by +0.46% and Materials falling back by -0.82%.

Conclusion 👋

Well, traders, it has been an eventful day in the trading world with various noteworthy developments, let’s take one last look. Treasury yields rose on expectations of a Fed pause, while concerns were raised over the inverted yield curve. US markets hit new highs, boosting global stocks. Retailers are enhancing the shopping experience with virtual storefronts. Binance.Us suspended trading in USD amid regulatory scrutiny. DISH Network stock fell due to struggles in selling assets and bankruptcy speculation. Tesla continued its winning streak with a charging deal with General Motors. General Motors' adoption of Tesla's Supercharger network impacted other EV charging stocks. Lordstown Motors plans legal action against Foxconn. Walmart is expanding its HIV outreach program. Planet shares tumbled after lowering revenue guidance. An FDA advisory group backed Eisai and Biogen's Alzheimer's drug. Netflix saw substantial subscriber gains after cracking down on password sharing. PacWest commenced the sale of a loan portfolio. Adobe thrived on positive AI news. Notable movers of the day include Braze, Joby Aviation, Archer Aviation, Sonoma Pharmaceuticals, and DocuSign. Hope you all have a good weekend!

Thank you all for signing up!

Will only work to do better for you all going forward. Our only goal is to add value to everyone’s trading with key levels and the ability of learning charts and price action.

Please Share Our Newsletter it will be much appreciated!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of TradingView. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.