Hello, traders! As we wind down for the evening, let's take a deep dive into the noteworthy events that have shaped the financial markets today!

Indexes 📈 💰

All the indices showed positive movement today, with the S&P 500 reaching its highest level in 2023. The Dow Jones Industrial Average extended its winning streak for the third consecutive day. Traders are eagerly awaiting next week's release of key inflation data and the Federal Reserve's latest policy announcement. Now, let's explore how the market performed today...

The S&P 500 (SPX) was up +0.62% coming to a conclusion at 4,293

The Nasdaq Composite (IXIC) escalated by +1.02% to settle at 13,238

The Dow Jones Industrial Average (DJI) climbed up +0.50% to finish at 33,833

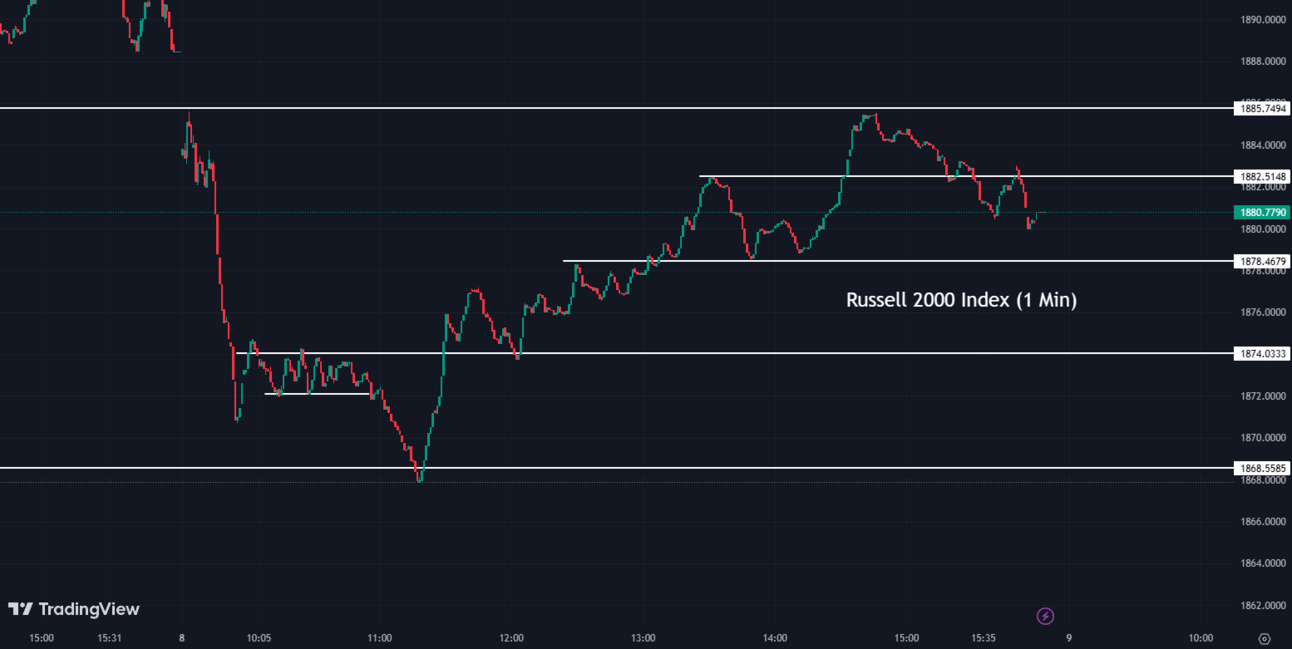

The Russell 2000 (RUT) fell -0.22% to end the day at 1,880

The Nasdaq-100 (NDX) was up +1.27% to conclude at 14,484

Meta's Ambitious AI Efforts 🤖🚀

At a recent meeting, Meta (META) CEO Mark Zuckerberg highlighted the company's significant advances in generative AI technology. Additionally, Meta stated that it is creating a tool for Instagram users that allows photo modification through text prompts. The company also plans to incorporate AI-powered chatbots in its Messenger and WhatsApp services and to use AI to construct 3D objects in the Metaverse.

META:

264.58 ▲ +0.98 (+0.37%) Today

263.02 ▼ -1.56 (-0.59%) After Hours

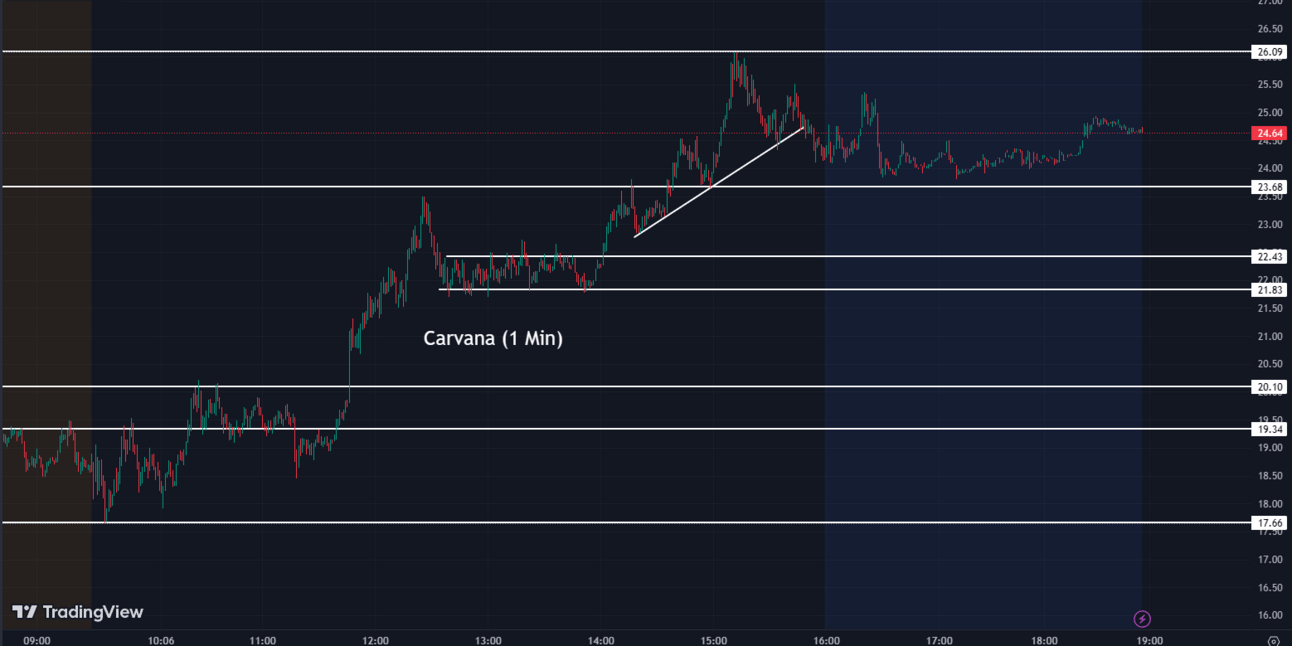

Carvana Skyrockets 🚗📈

Carvana (CVNA), an online used-car retailer, saw its shares surge by 56% after the company updated its outlook. This was attributed to effective cost-reduction strategies, leading to a predicted adjusted EBITDA of over $50 million and a record-breaking gross profit per unit above $6,000 for Q2 2023. After a 98% drop in shares in 2022, Carvana's shares have recovered more than 400% since 2023 began, thanks to significant cost-cutting efforts. The rally has put pressure on short sellers, leading to a short squeeze. The company faced challenges last year, including layoffs and concerns about bankruptcy.

CVNA:

24.27 ▲ +8.74 (+56.28%) Today

25.20 ▲ +0.97 (+4.00%) After Hours

AstraZeneca Receives FDA Recommendation 💊🏥

The FDA's independent advisory panel has unanimously recommended the approval of nirsevimab, an antibody developed by AstraZeneca (AZN) and marketed by Sanofi (SNY). This treatment is aimed at protecting infants from respiratory syncytial virus (RSV), a leading cause of hospitalization among newborns in the U.S. If approved, nirsevimab would be the first such protection for all infants against RSV, with the FDA expected to make a decision by the third quarter of this year.

AZN:

74.25 ▲ +0.94 (+1.28%) Today

74.58 ▲ +0.34 (+0.45%) After Hours

SNY:

51.54 ▲ +0.66 (+1.30%) Today

51.80 ▲ +0.26 (+0.50%) After Hours

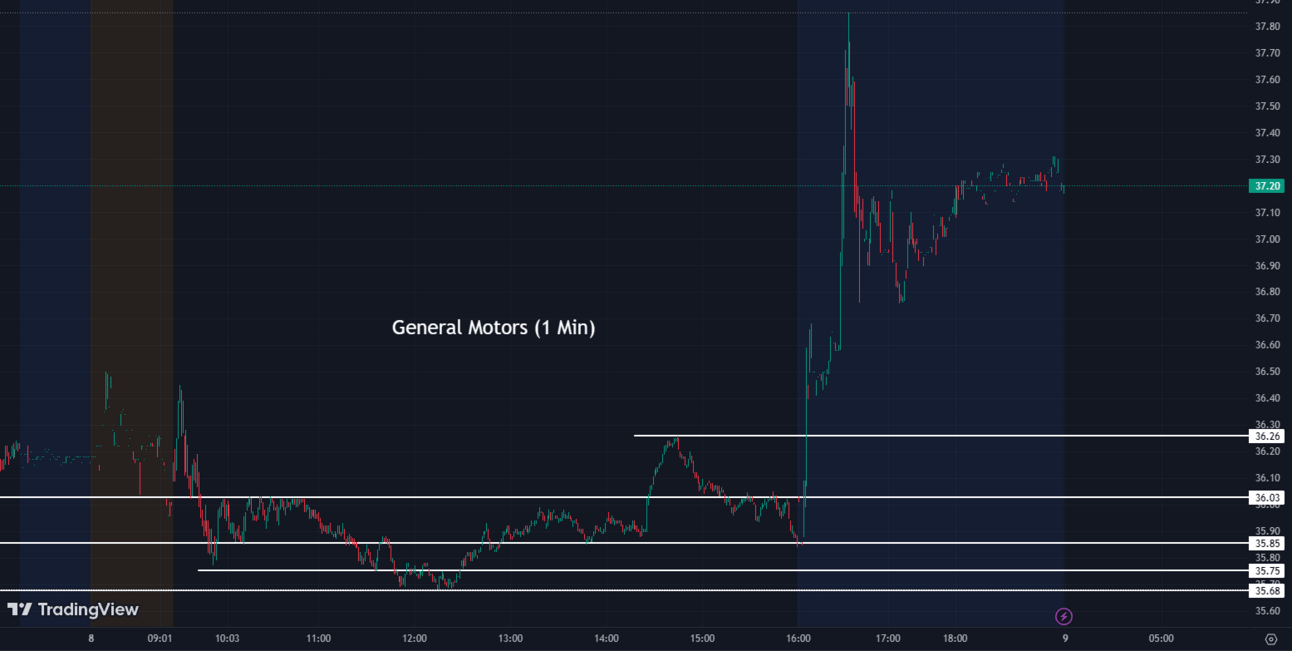

General Motors’ Big Escalade Investment 🚘💰

General Motors (GM) has announced a significant investment of $500 million in its new Cadillac Escalade large SUV line, signaling the automaker's intent to continue its dominance in the luxury SUV market. On another note, the company has also revealed its intention to begin manufacturing consumer electric vehicles. Sales of the company's large SUVs totaled around 279,000 vehicles last year, accounting for approximately 12% of GM's sales and contributing substantially to its profits.

GM:

35.85 ▼ -0.37 (-1.02%) Today

37.17 ▲ +1.32 (+3.68%) After Hours

General Motors and Tesla Partnership 🌐🔋

General Motors (GM) has partnered with Tesla (TSLA) to use its North American charging network and technologies, following Ford's lead. GM vehicles will be able to access Tesla's fast chargers using an adapter and GM's EV charging app starting in 2024. From 2025, GM will also install Tesla's North American Charging Standard (NACS) in its EVs instead of the industry-standard CCS port. This collaboration puts pressure on other automakers and the U.S. government to adopt Tesla's charging technology. The announcement was made during a live discussion on Twitter Spaces between GM CEO Mary Barra and Tesla CEO Elon Musk.

GM:

35.85 ▼ -0.37 (-1.02%) Today

37.17 ▲ +1.32 (+3.68%) After Hours

TSLA:

234.86 ▲ +10.29 (+4.58%) Today

246.69 ▲ +11.83 (+5.04%) After Hours

Warner Bros-Discovery's Stock Continues to Rise 🎥📈

Warner Bros.-Discovery (WBD) shares have been increasing for the second consecutive day as the business pays down its debt. Since the completion of the merger last year, the company has undergone layoffs and expenditure cuts in an effort to reduce its $49.5 billion debt. In the second quarter, they were able to pay down $2.05 billion in debt.

WBD:

14.02 ▲ +0.90 (+6.86%) Today

14.13 ▲ +0.11 (+0.78%) After Hours

Bunge's $30 Billion Deal 🤝📜

Bunge Ltd (BG), a U.S. grains merchant, is nearing a merger with Glencore-backed Viterra to create an agricultural trading giant worth over $30 billion. Bunge plans to finance the deal with stock, cash, and bank-debt financing. If negotiations conclude successfully, the deal could be approved as early as this weekend. The merger will be closely scrutinized by antitrust regulators due to its potential impact on global food markets, particularly amidst the ongoing war in Ukraine.

BG:

91.18 ▼ -3.01 (-3.20%) Today

Unchanged in After Hours

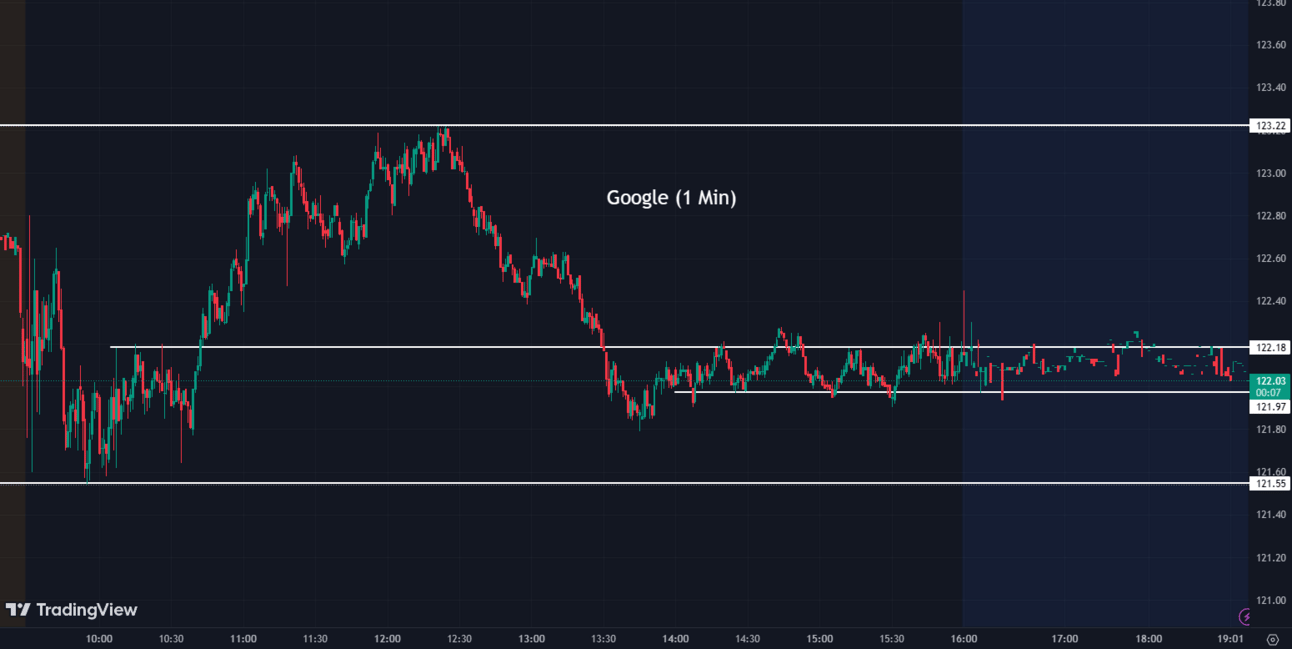

Google Encourages Return to Office 🏢👨💼

Google (GOOG) is tightening its return-to-work policies, making office attendance a potential component of employee performance reviews. Employees are expected to comply with a three-day minimum for in-office work, with full-time remote arrangements only considered in exceptional cases. This move, backed by Google's belief in the benefits of in-person collaboration, aims to increase office occupancy, which remains below 50% despite companies' efforts to bring employees back into the workplace.

GOOG:

122.67 ▼ -0.27 (-0.22%) Today

122.48 ▼ -0.19 (-0.15%) After Hours

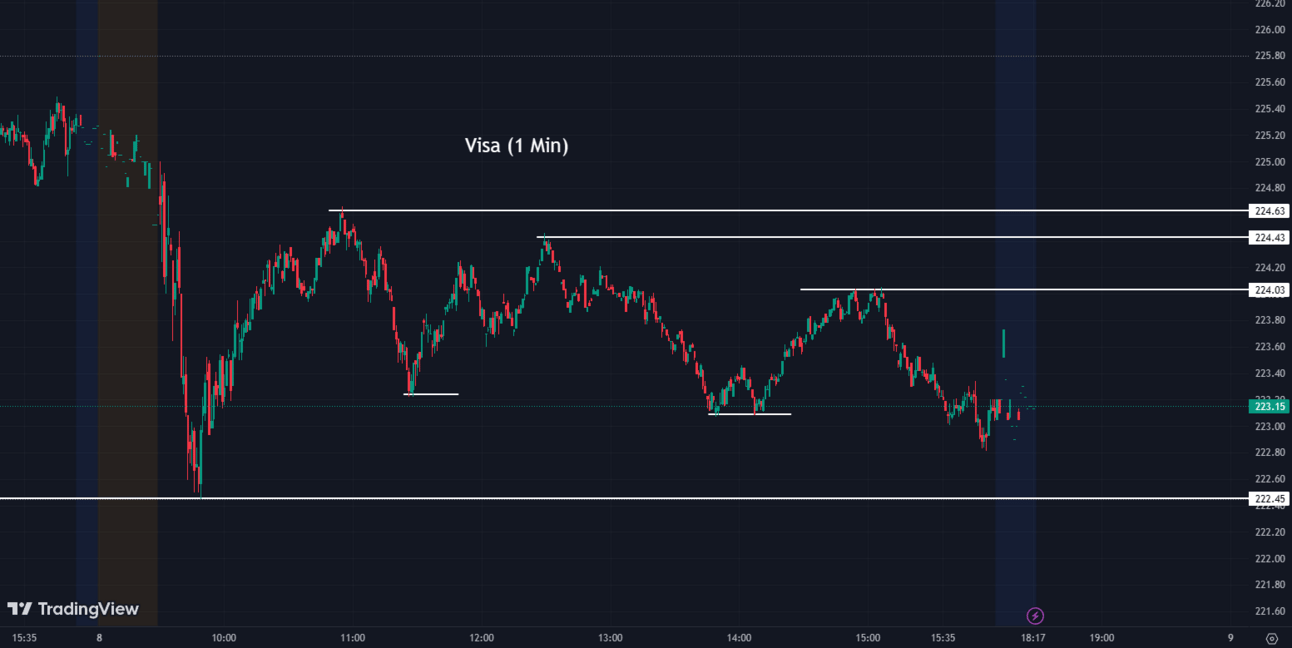

Mastercard and Visa Stocks Dip 💳📉

A bill to increase competition among credit-card networks is expected to be reintroduced in Congress, causing shares of Visa (V) and Mastercard (MA) to fall. The proposed legislation would allow merchants to use alternative networks for processing payments, potentially reducing fees. However, there are doubts about the bill's chances of passing due to congressional reluctance and concerns about unintended consequences.

V:

223.10 ▼ -2.17 (-0.96%) Today

222.90 ▼ -0.15 (-0.067%) After Hours

MA:

367.52 ▼ -3.87 (-1.04%) Today

Unchanged in After Hours

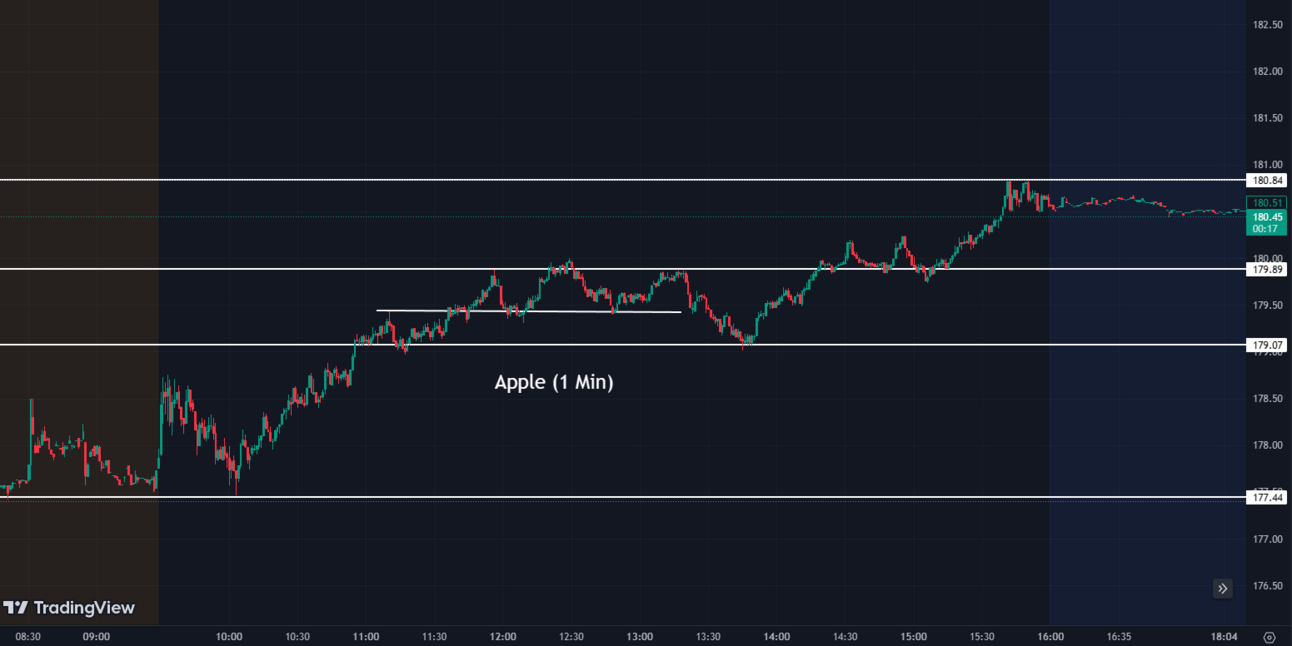

Apple's Competition 🍎👥

Apple (AAPL) has officially entered the AR/VR headset market with its Vision Pro, although the company distances itself from competitors like Meta. Apple avoids terms like "headset" and "virtual reality," instead referring to the Vision Pro as a "spatial computer" and emphasizing augmented reality capabilities. Unlike Meta, Apple does not mention plans for the metaverse and focuses on connecting people in the real world. The Vision Pro is priced at $3,499, positioning it as a premium device. The success of Apple's differentiated approach remains to be seen when the Vision Pro launches next year.

AAPL:

180.57 ▲ +2.75 (+1.55%) Today

180.50 ▼ -0.07 (-0.039%) After Hours

After Hour Movers 🕒📊

DocuSign's stock (DOCU) rally lost momentum as executives discussed challenging macro conditions, leading to smaller deal sizes and lower expansion rates. The company reported strong fiscal first-quarter results, with a net income of $539,000 and adjusted earnings doubling to 72 cents per share. Revenue also increased to $661.4 million. Despite the positive numbers, shares pared back gains and closed up 5%. DocuSign provided a revenue forecast of $675 million to $679 million for the next quarter and $2.71 billion to $2.73 billion for the year.

DOCU:

58.48 ▲ +1.26 (+2.20%) Today

61.45 ▲ +2.97 (+5.08%) After Hours

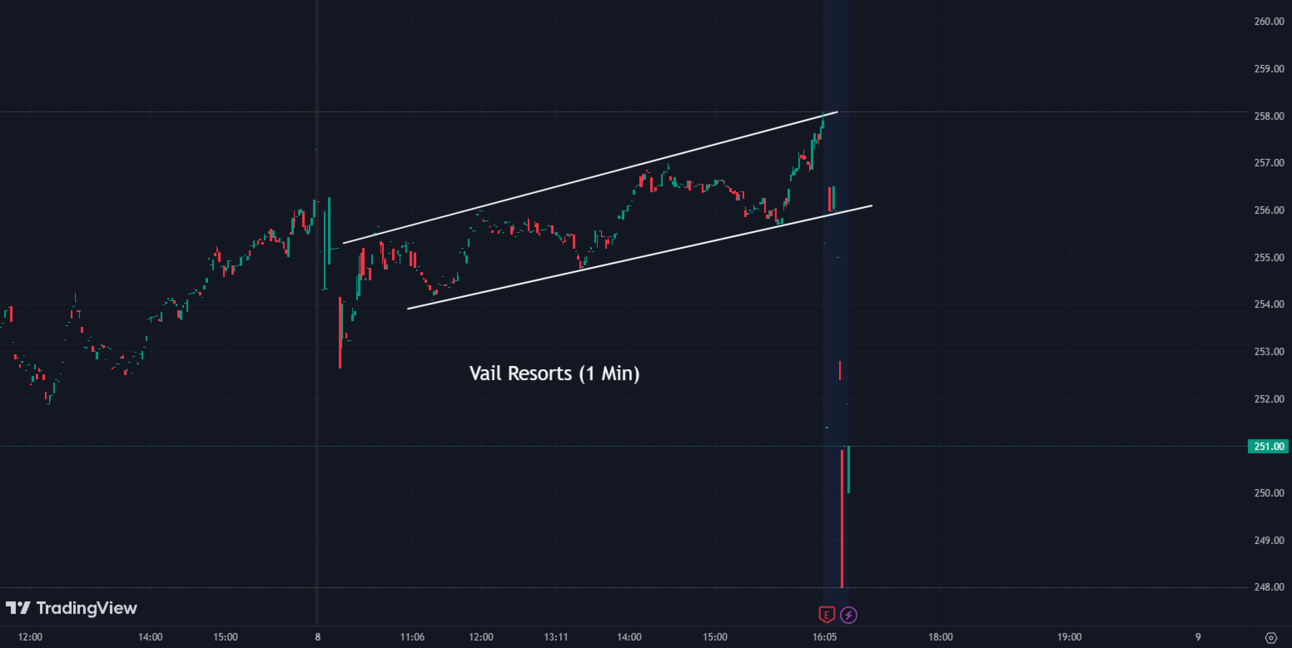

Vail Resorts (MTN) stock slid 2% after missing revenue and earnings per share expectations. The company reported earnings per share of $8.18 on revenue of $1.24 billion, lower than expected. CEO Kirsten Lynch highlighted strong growth in visits and spending compared to the prior year, but weather disruptions in the second quarter affected performance. Vail Resorts remains focused on returning capital to shareholders and bought back 1.8 million shares. Shares are up 8% year-to-date.

MTN:

258.04 ▲ +1.86 (+0.73%) Today

252.00 ▼ -6.04 (-2.34%) After Hours

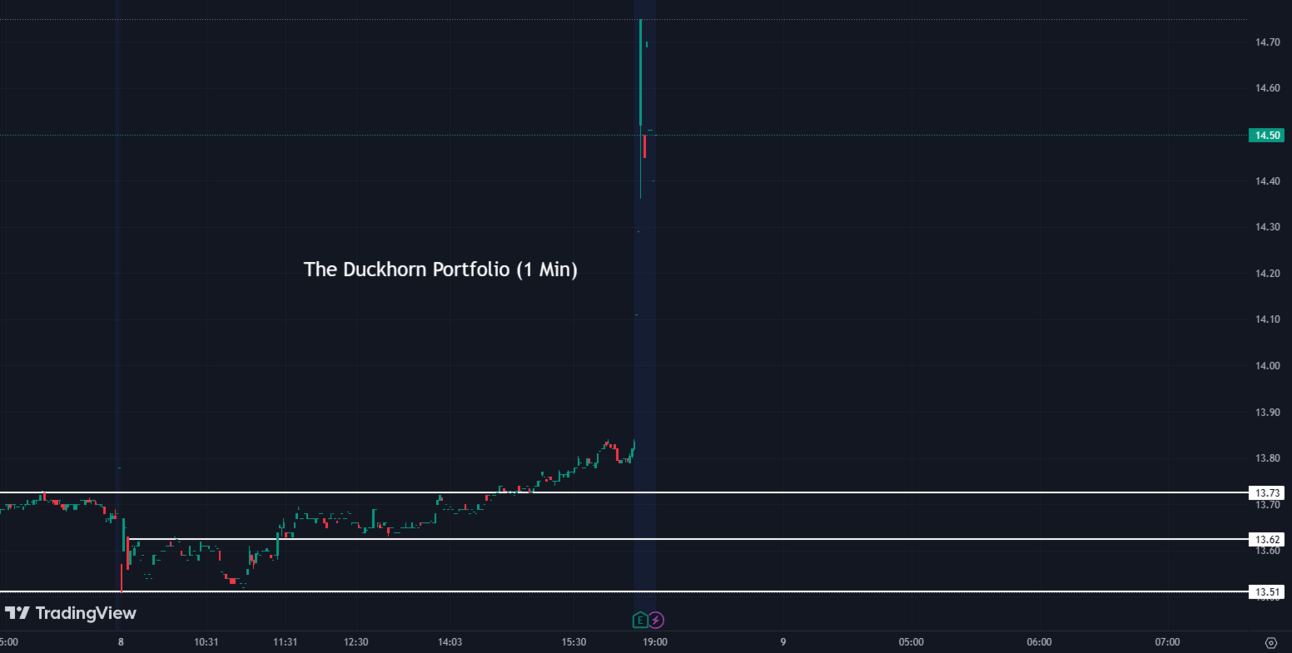

Duckhorn Portfolio (NAPA) shares rallied 5.50% after hours as the company raises its full-year sales forecast, increases its profit outlook, and reports better-than-expected quarterly results. The positive performance is attributed to price increases and the resilience of wine enthusiasts who are willing to pay more despite inflation. Duckhorn now expects full-year sales of $400 million to $404 million and adjusted earnings per share between 64 cents and 66 cents. In the fiscal third quarter, the company reported net income of $16.8 million, or 15 cents a share, with net sales of $91.2 million. Analysts had predicted adjusted earnings per share of 12 cents on revenue of $89.8 million.

NAPA:

13.83 ▲ +0.15 (+1.10%) Today

14.59 ▲ +0.76 (+5.50%) After Hours

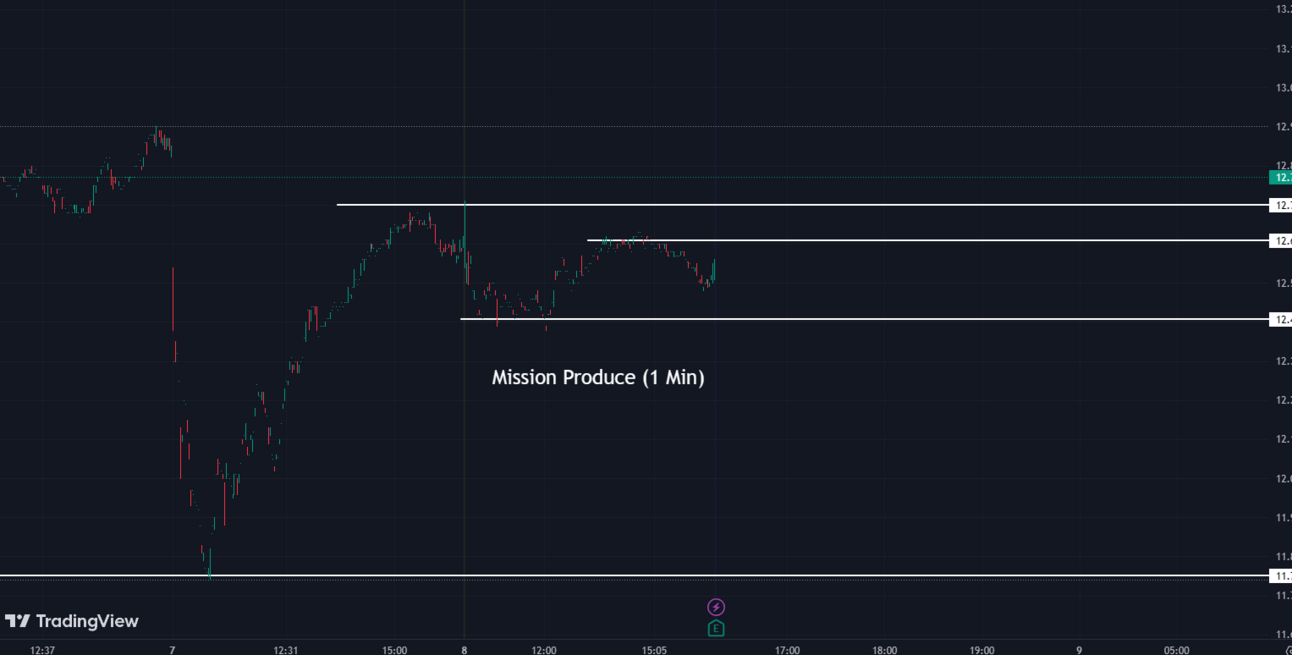

Mission Produce (AVO) reports fiscal second-quarter results that beat estimates, as lower avocado prices lead to increased product sales but a decline in revenue. The company reports a net loss of $4.6 million, or 7 cents a share, compared to a profit of $2.4 million, or 3 cents a share, in the same quarter last year. Sales decreased by 20% to $221.1 million due to falling avocado prices and higher Mexican harvest volumes. Despite the short-term impact on margins, Mission Produce sees a more rational pricing environment beneficial for long-term consumption growth and market penetration. The company's shares rose 3.39% after hours.

AVO:

12.52 ▼ -0.07 (-0.56%) Today

12.94 ▲ +0.42 (+3.39%) After Hours

Tesla (TSLA) will open its fast-charging network to General Motors' electric vehicles next year, allowing General Motors (GM) EV drivers access to Tesla's network of 12,000 "Superchargers" in North America. GM will initially require an adapter but plans to equip its EVs with the same inlet standard by 2025. Following the announcement, GM shares rallied nearly 4% and Tesla shares jumped 5% in after-hours trading. The collaboration aims to expand access to fast chargers and potentially establish a single North American charging standard.

GM:

35.85 ▼ -0.37 (-1.02%) Today

37.17 ▲ +1.32 (+3.68%) After Hours

TSLA:

234.86 ▲ +10.29 (+4.58%) Today

246.69 ▲ +11.83 (+5.04%) After Hours

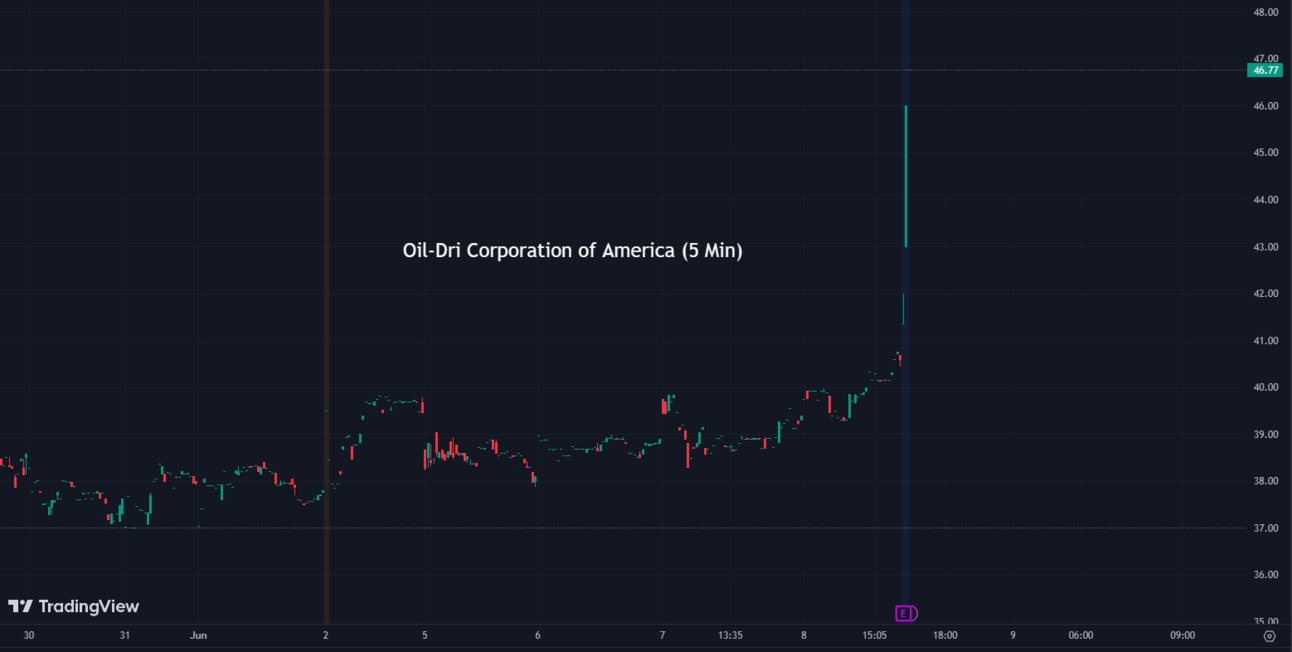

Oil-Dri Corporation of America (ODC) announced its financial results for the third quarter and first nine months of fiscal year 2023. Consolidated net sales for the third quarter reached $105.4 million, a 23% increase over the previous year, driven by pricing actions and sales growth in various product lines. The company achieved a record gross profit of $27.5 million, a 76% increase, and a consolidated net income of $8.5 million, compared to a net loss of $2.1 million in the same period last year. The Business to-Business Products Group and Retail and Wholesale Products Group both saw significant revenue growth and improved operating income. The company's strategic initiatives aim to enhance revenue, volume, and profitability in the coming months.

ODC:

40.55 ▲ +1.28 (+3.26%) Today

46.90 ▲ +6.35 (+15.66%) After Hours

Argan (AGX) reported a fiscal first-quarter profit of $2.1 million, equivalent to 16 cents per share. The company, which specializes in building energy plants, generated revenue of $103.7 million during the period. Argan shares have increased by 20% since the start of the year. In the final minutes of trading on Thursday, the company's shares reached $44.35, marking a nearly 8% rise in the past 12 months.

AGX:

44.24 ▼ -0.21 (-0.47%) Today

43.00 ▼ -1.24 (-2.80%) After Hours

American Software (AMSWA) reported a fiscal Q4 net income of $2.9 million, or 8 cents per share. Adjusted earnings were 12 cents per share, with $29.9 million in revenue. Full-year profit was $10.4 million, or 31 cents per share, on $123.7 million in revenue. The company expects full-year revenue of $120 million to $126 million.

AMSWA:

13.42 ▼ -0.09 (-0.67%) Today

11.98 ▼ -1.44 (-10.73%) After Hours

Designer Brands (DBI) reported weaker sales and higher expenses, resulting in a 10.7% decline in total sales to $742.1 million. The company lowered its annual EPS guidance below consensus estimates. Analysts are concerned about its reliance on Camuto Group's growth, considering challenges in the footwear industry.

DBI:

8.65 ▲ +1.44 (+19.97%) Today

8.89 ▲ +0.24 (+2.77%) After Hours

Sectors 💼🏦

7 out of the 11 sectors closed in the green today, with Consumer Discretionary leading the way up by +1.56% and Real Estate falling back by -0.62%.

Conclusion 👋

Today, the market experienced positive movement, with the S&P 500 reaching its highest level in 2023. Key highlights include Meta's AI advancements, Carvana's raised Q2 guidance, AstraZeneca's FDA recommendation, and GM's investment in the Escalade line. Warner Bros.-Discovery also saw notable developments. Other news includes Bunge's potential merger, Google's return-to-office policy, Apple's entry into the AR/VR headset market, and stock movements after hours.

Thank you all for signing up!

Will only work to do better for you all going forward. Our only goal is to add value to everyone’s trading with key levels and the ability of learning charts and price action.

Please Share Our Newsletter it will be much appreciated!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of TradingView. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.