Hello, traders! As we wind down for the evening, let's take a deep dive into the noteworthy events that have shaped the financial markets today!

World Bank's New Economic Projections 📊🌐

According to the World Bank, the world economy is expected to remain weak for the next two years. The analysis suggests that increasing interest rates will likely slow down both consumer spending and company investments, potentially leading to financial instability. The Global Economic Prospects report predicts a slowdown in global growth from 3.1% in 2022 to 2.1% in 2023, with a slight recovery to 2.4% in 2024. Notably, around 65% of nations are expected to experience a significant growth slowdown. The World Bank is concerned about poorer economies due to their high borrowing costs and increased risk of financial crises. Furthermore, the ongoing epidemic and the situation in Ukraine are negatively impacting global poverty reduction efforts, with the poorest countries projected to face a 6% decline in incomes by 2024 compared to 2019.

Indexes 📈💰

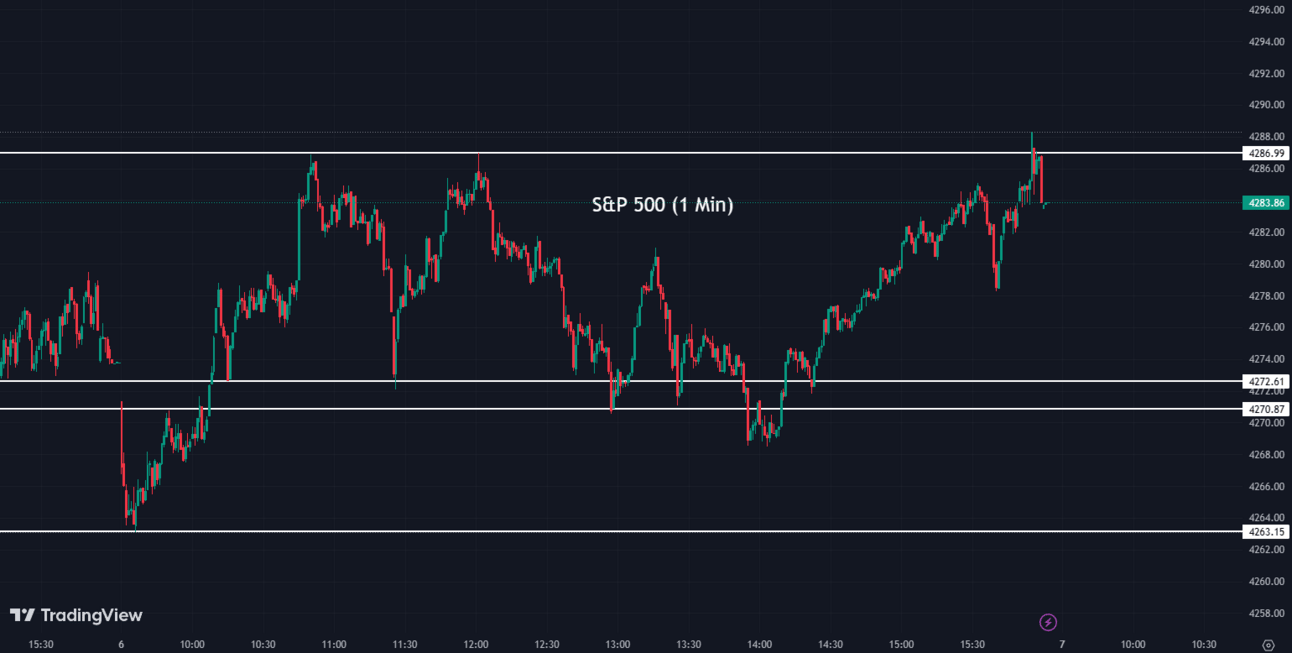

The S&P 500 closed the day at its highest level of the year, exceeding all prior highs in 2023. Furthermore, the SP 500 reached its highest closing point for a broad-market index since August 2022. Now, let's explore how the market performed today...

The S&P 500 (SPX) was up +0.24% coming to a conclusion at 4,283

The Nasdaq Composite (IXIC) escalated by +0.36% to finish at 13,276

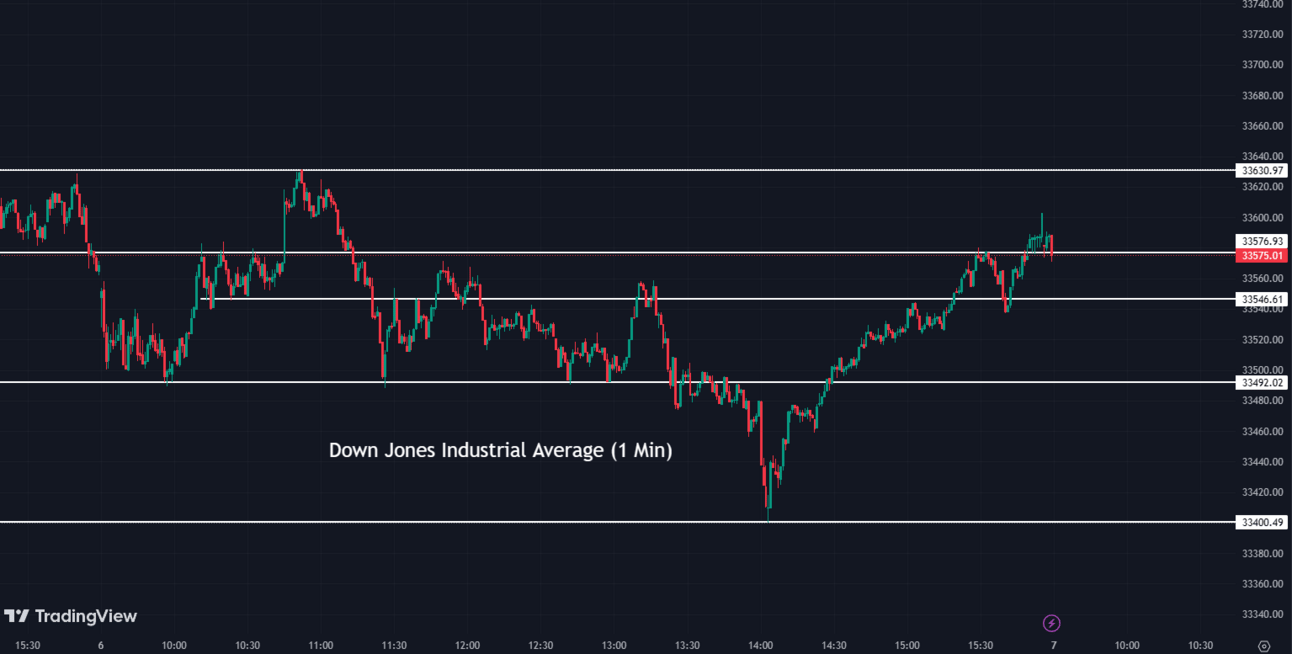

The Dow Jones Industrial Average (DJI) climbed up +0.03% to settle at 33,573

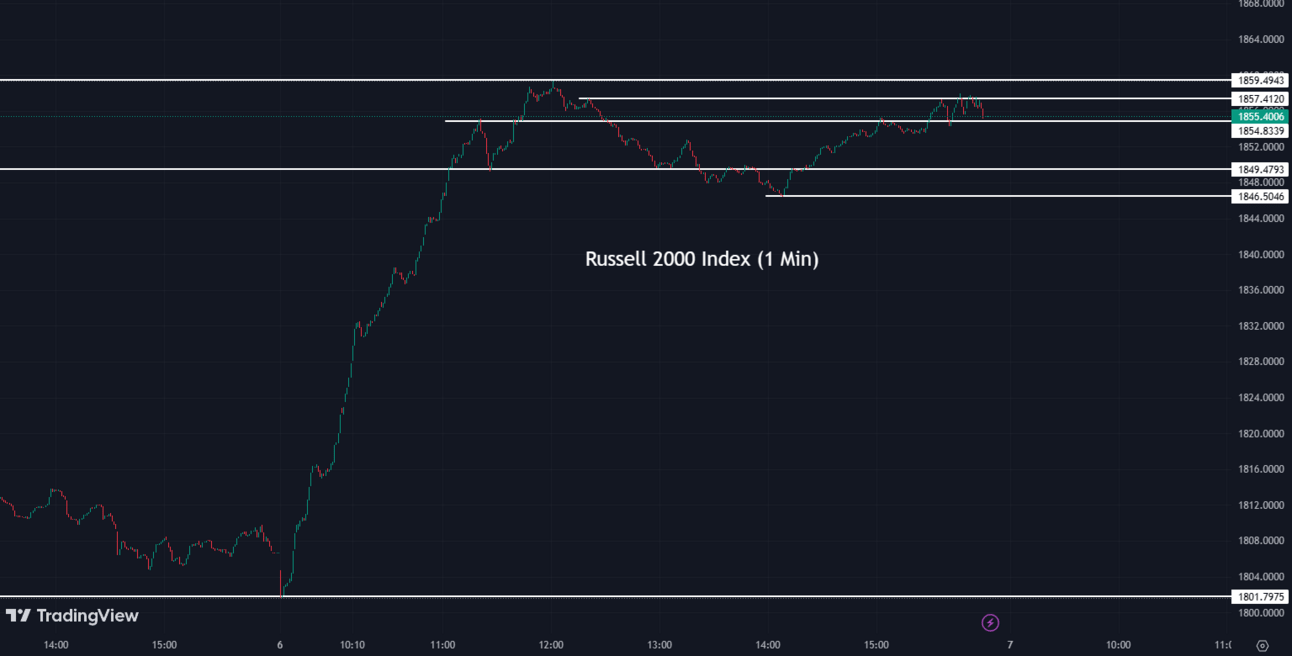

The Russell 2000 (RUT) surged +2.69% to end the day at 1,855

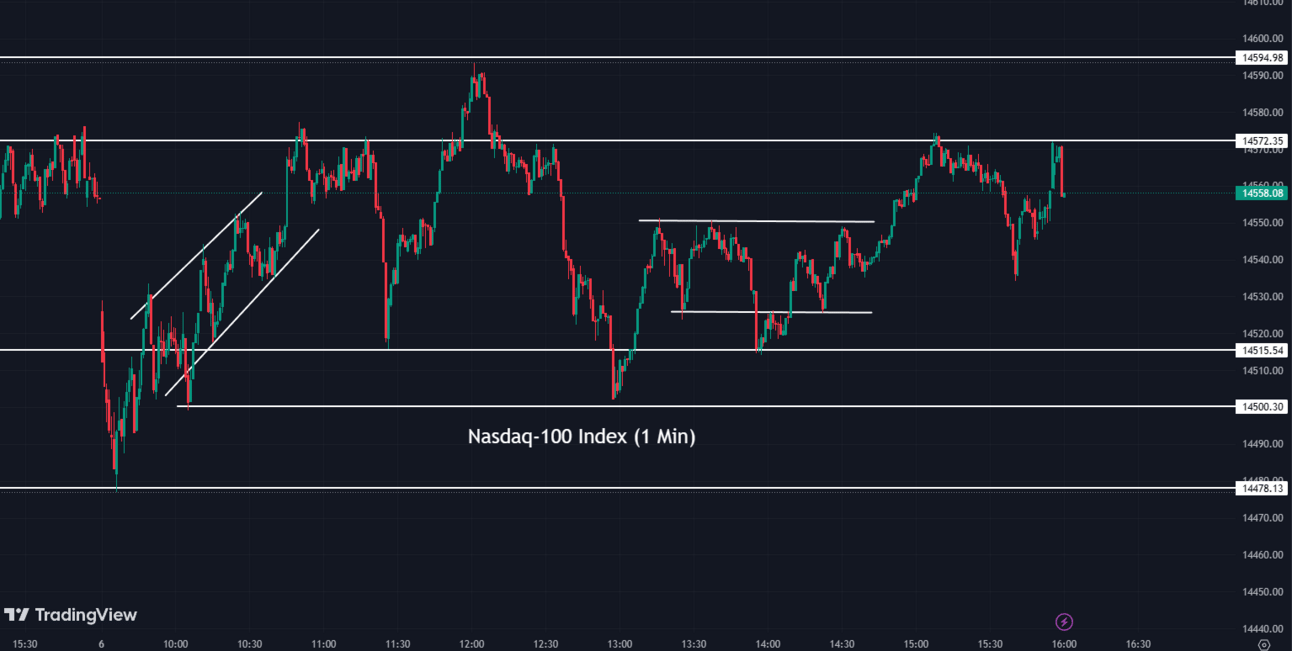

The Nasdaq-100 (NDX) was up +0.01% to conclude at 14,558

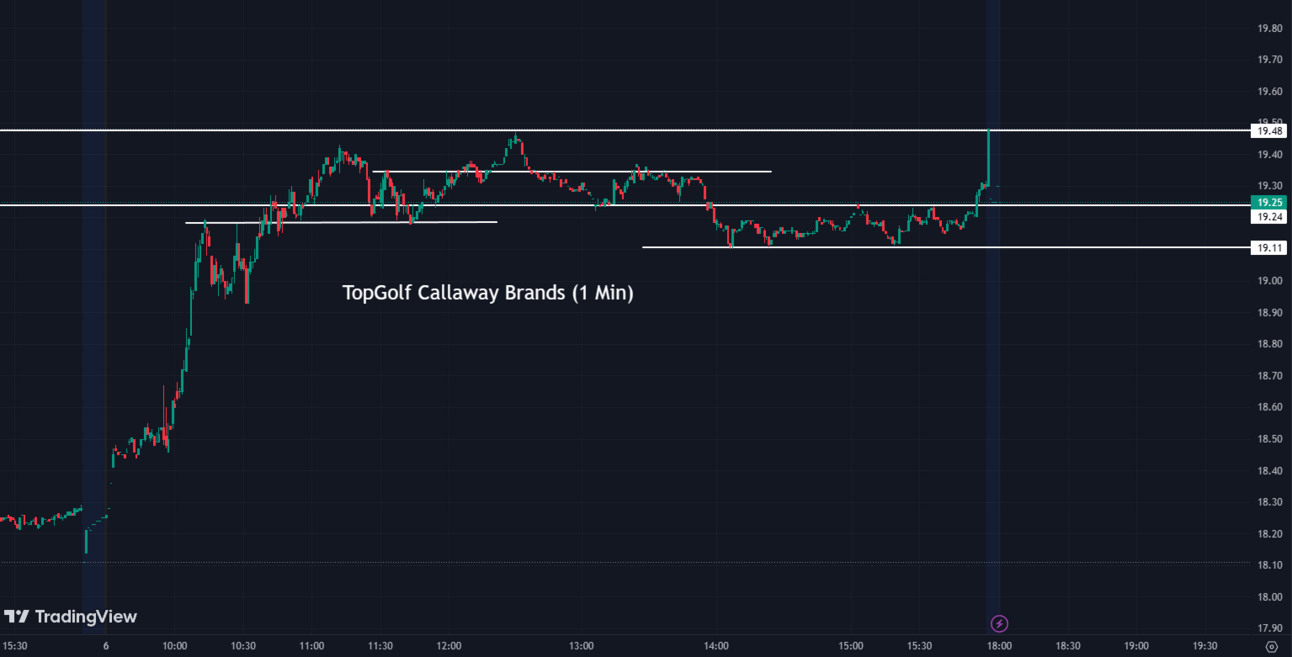

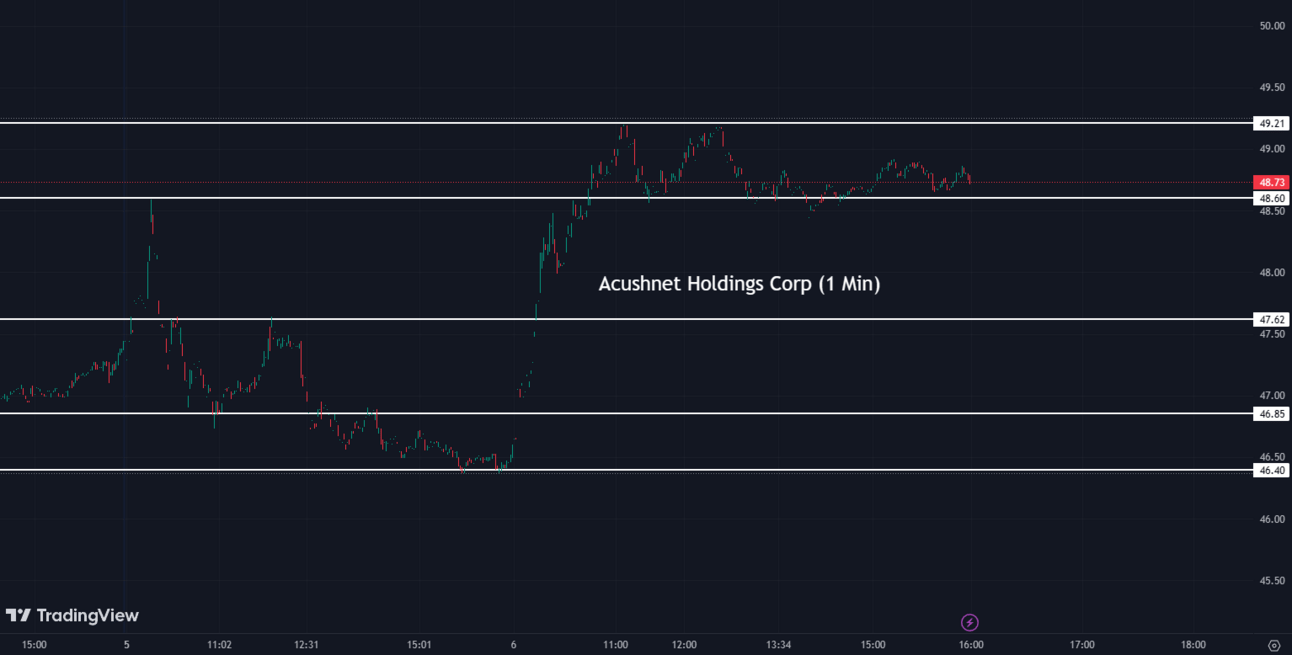

PGA Tour's New Merge with Saudi-backed Liv Golf ⛳🌍

The PGA Tour has revealed plans to join with LIV Golf, which is financed by Saudi Arabia, in an intriguing move for the golfing industry. By merging the PGA Tour's established influence with Liv Golf's strong financial support, this merger is anticipated to produce a global golfing powerhouse. Popular golf stocks, such as Topgolf Callaway Brands (MODG) and Acushnet Holdings Corp. (GOLF), rose after the news broke. The merger is anticipated to offer both organizations new opportunities and has the potential to change the face of professional golf.

MODG:

19.30 ▲ +1.01 (+5.52%) Today

19.26 ▼ -0.04 (-0.21%) After Hours

GOLF:

48.73 ▲ +2.11 (+4.53%) Today

48.99 ▲ +0.26 (+0.53%) After Hours

SEC Makes Major Moves Against Crypto Exchanges 🔍💼

The U.S. Securities and Exchange Commission (SEC) has acted decisively against two major cryptocurrency exchanges, adding to the already heated debates surrounding digital asset regulations. The SEC has requested an emergency order to freeze the U.S. assets of Binance, by trading volume. The request forms part of an ongoing investigation into the company's operations.

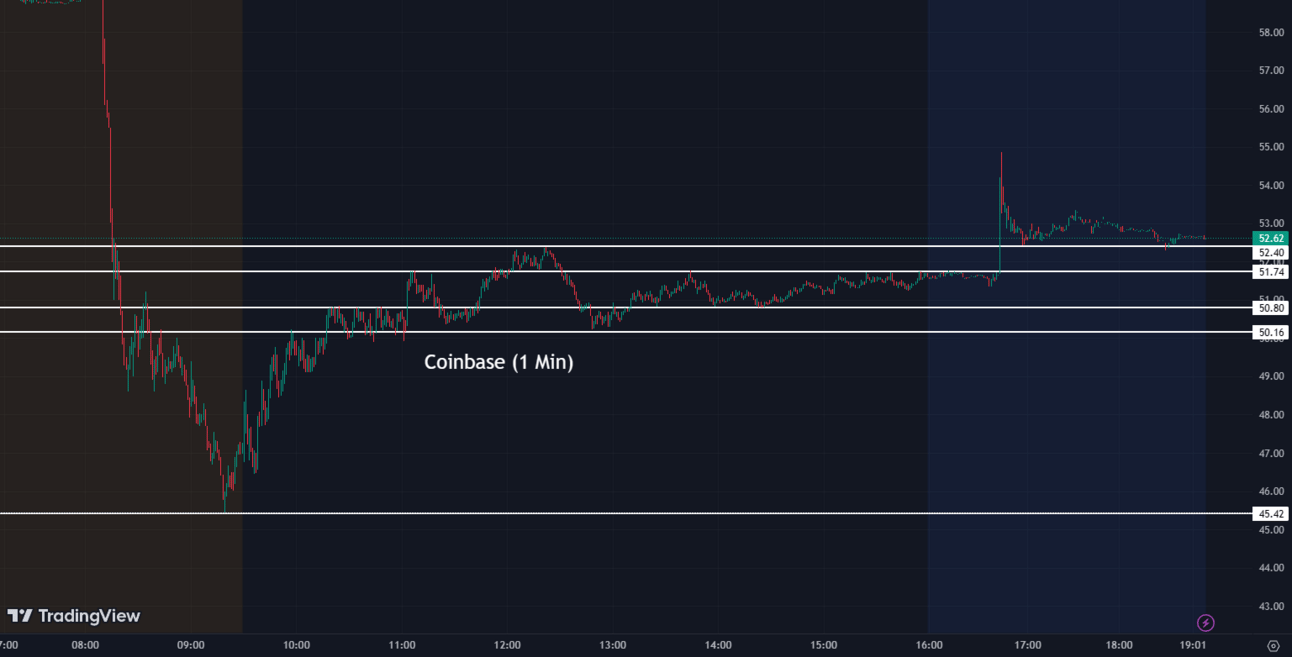

SEC Files Lawsuit Against Coinbase📜👨⚖️

The U.S. Securities and Exchange Commission (SEC) has taken legal action against cryptocurrency exchange Coinbase (COIN), accusing it of engaging in activities as an unregistered broker and exchange. As a consequence, Coinbase's stock price has plummeted by 12%. SEC chair Gary Gensler argues that Coinbase and similar platforms are blending multiple functions, drawing a parallel to the New York Stock Exchange running a hedge fund. The lawsuit claims that Coinbase has repeatedly violated U.S. securities laws, primarily through its prime brokerage, exchange, and staking programs. The SEC maintains that 13 cryptocurrencies offered by Coinbase meet the criteria for being classified as securities. Despite these allegations, Coinbase continues to conduct its business as usual and is advocating for legislation that ensures equitable and transparent regulations.

COIN:

51.61 ▼ -7.09 (-12.09%) Today

52.70 ▲ +1.09 (+2.11%) After Hours

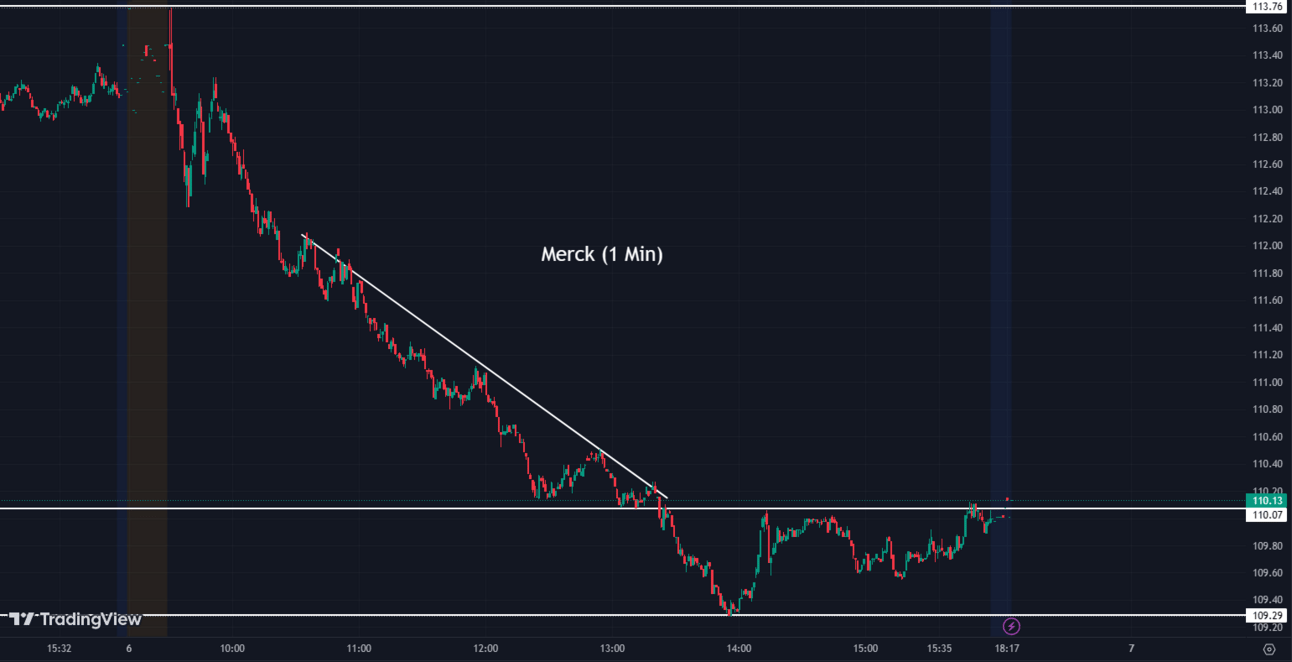

Merck's Lawsuit Against Biden Administration Over Medicare Drug Price Negotiations 💊💰

Regarding the Inflation Reduction Act, the pharmaceutical corporation Merck (MRK) has filed a lawsuit against the Biden administration. With the help of this law, Medicare will be able to significantly lower prescription drug costs for seniors. Merck claims that this practice is unlawful and violates the Fifth Amendment because it has extortion-like characteristics. In order to stop the US Department of Health and Human Services from requiring Merck's involvement, the corporation is requesting a court injunction. The government is attempting to address the rising costs of prescription pharmaceuticals during the time of this lawsuit, but the pharmaceutical industry claims that this move could obstruct the development of new drugs.

MRK:

110.00 ▼ -3.11 (-2.75%) Today

110.10 ▲ +0.09 (+0.082%) After Hours

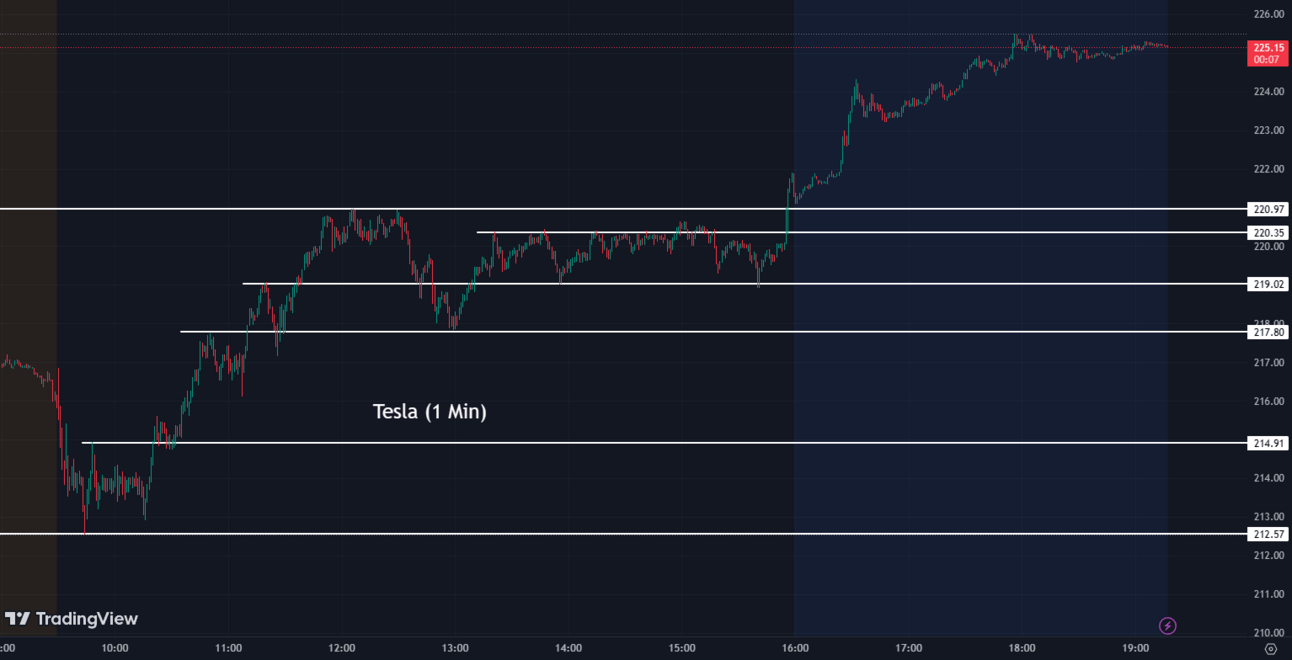

Tesla's Tax Credit Eligibility Raises Questions 🚗💰

Tesla (TSLA), the dominant player in the electric vehicle market, has been in the spotlight recently with its announcement that the Model 3 vehicle trims might qualify for the complete tax credit offered by the IRA. The tax credit, aimed at promoting electric vehicle adoption, plays a significant role in making electric vehicles more affordable for consumers and could impact Tesla's sales and financials.

TSLA:

221.31 ▲ +3.70 (+1.70%) Today

225.22 ▲ +3.92 (+1.77%) After Hours

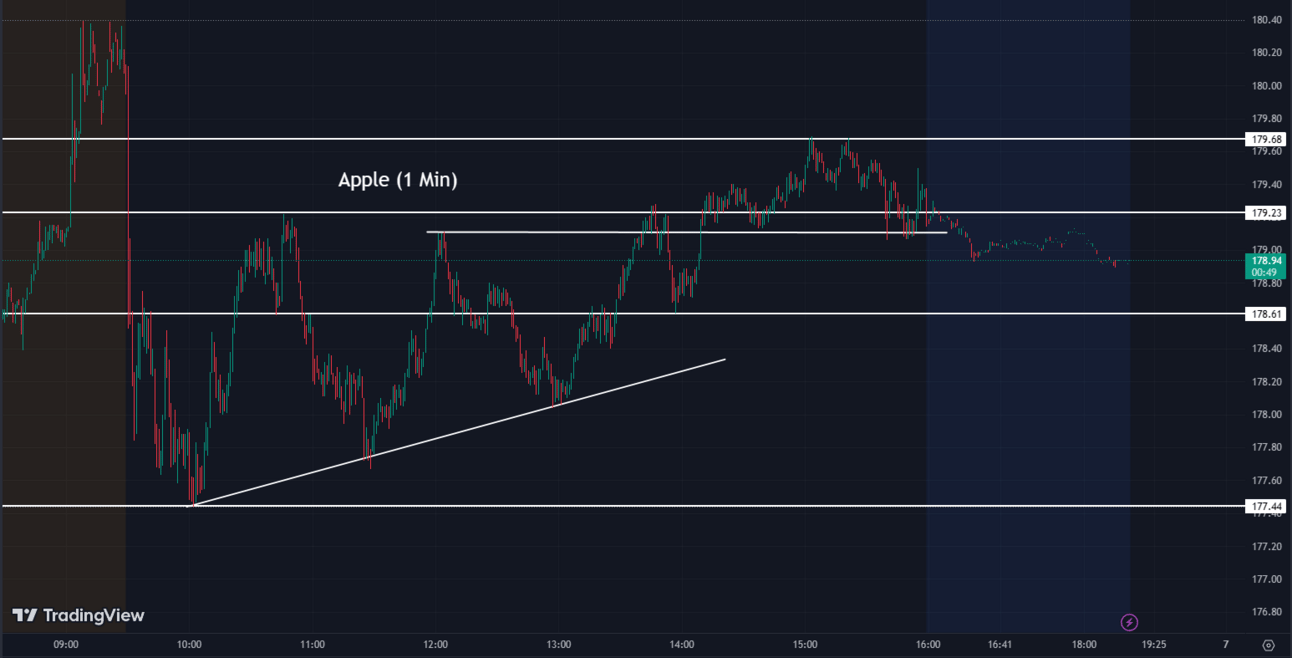

Apple's Stock Sees Movement Amid Analyst Downgrade 🍎📉

Apple's stock (AAPL) is in the spotlight as shares inch lower following an analyst downgrade. Despite the bearish outlook from the analyst, many investors and market experts view this as an opportune moment to buy into the stock at a lower price, given the company's consistently strong fundamentals. On the product side, Apple's Vision Pro has garnered positive reviews, impressing tech enthusiasts with its advanced capabilities. However, experts argue that the product needs a broader range of compatible apps to ensure its commercial success.

AAPL:

179.21 ▼ -0.37 (-0.21%) Today

178.99 ▼ -0.22 (-0.12%) After Hours

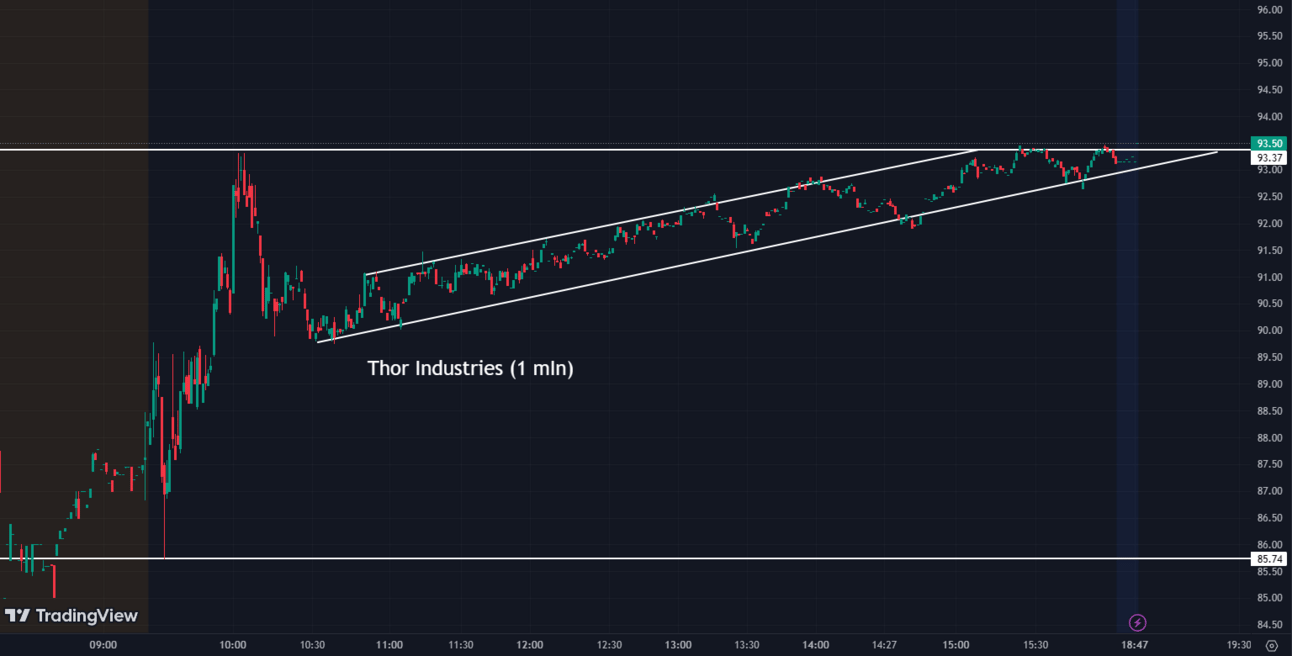

Thor Industries' Stock Sees Unanticipated Surge ⚡️🏢

Thor Industries (THO), the RV manufacturer, reported better-than-expected results for its third quarter, despite a challenging market environment, resulting in a 17.67% stock increase. While North American sales dipped, European sales rose by 20%, helping to offset the decline. The company revised its full-year guidance, forecasting revenue of $10.5 to $11 billion and earnings per share of $5.80 to $6.50. With expectations of a profit rebound next year.

THO:

93.15 ▲ +13.99 (+17.67%) Today

93.47 ▲ +0.32 (+0.34%) After Hours

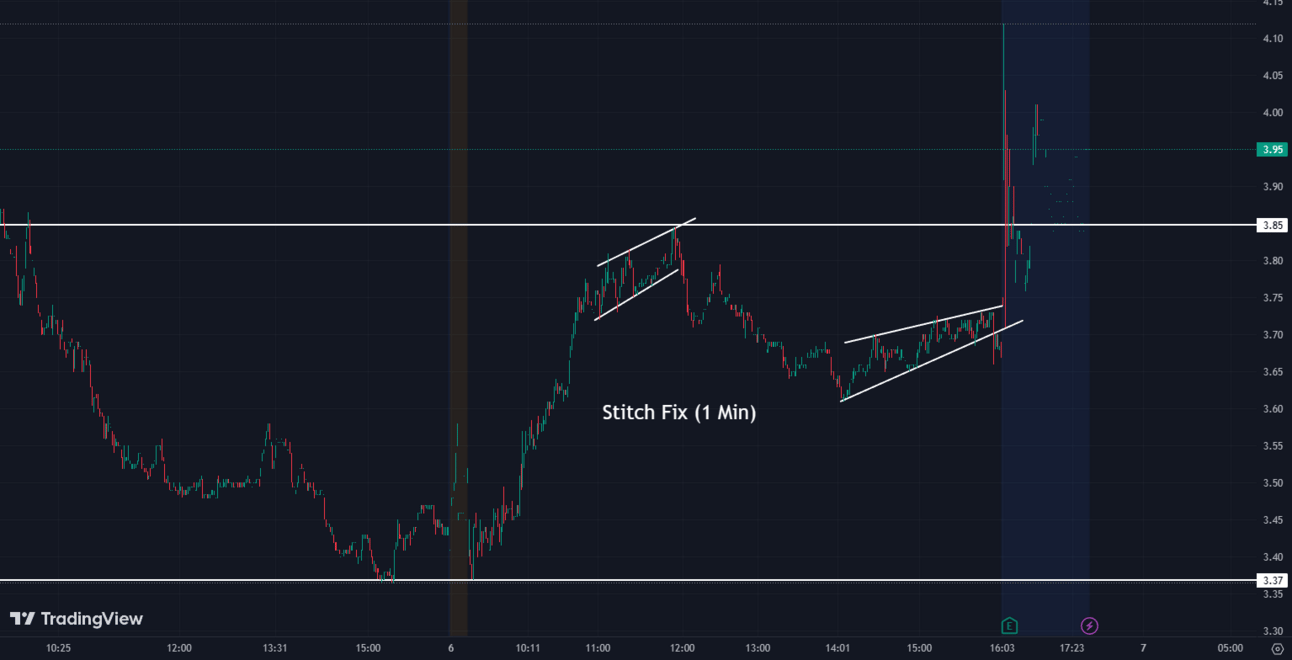

Stocks Making Moves After-Hours 🎢🌃

Stitch Fix stock (SFIX) rallied as the company beat third-quarter expectations and announced plans to scale back operations. They will close a distribution center in Dallas, let a lease expire, and consider exiting the U.K. Q3 results showed a net loss of $21.8 million and a 20% revenue decline. Active clients dropped by 11%. Fourth-quarter sales are expected to be between $365 million and $375 million. The company has faced challenges with cautious consumers and declining clothing prices.

SFIX:

3.68 ▲ +0.24 (+7.13%) Today

3.86 ▲ +0.18 (+4.89%) After Hours

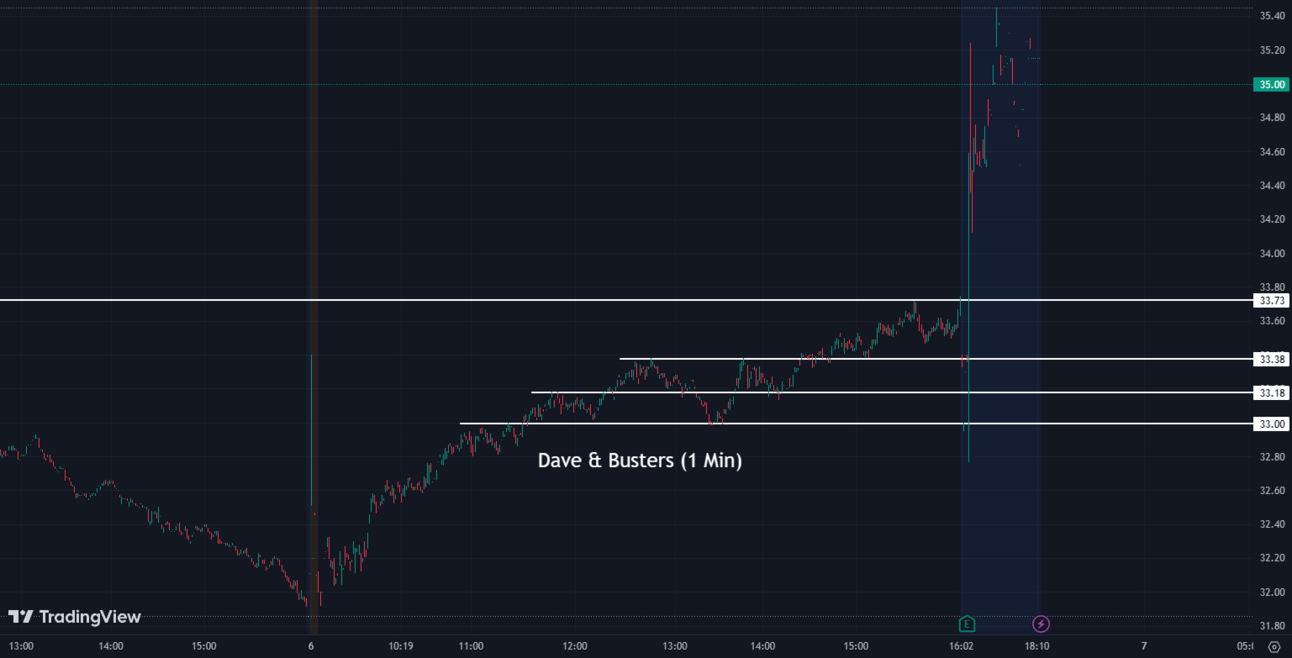

Dave & Buster's stock (PLAY) soared after the company reported record Q1 sales and topped earnings per share projections. Sales in the first quarter totaled $597.3 million, a 3.8% increase over the previous year. To $182.1 million, adjusted EBITDA climbed by 29.8%. The corporation announced a $100 million share repurchase program and expanded globally. After-hours trading saw a 2.25% increase in shares.

PLAY:

33.74 ▲ +1.82 (+5.70%) Today

34.97 ▲ +1.23 (+3.65%) After Hours

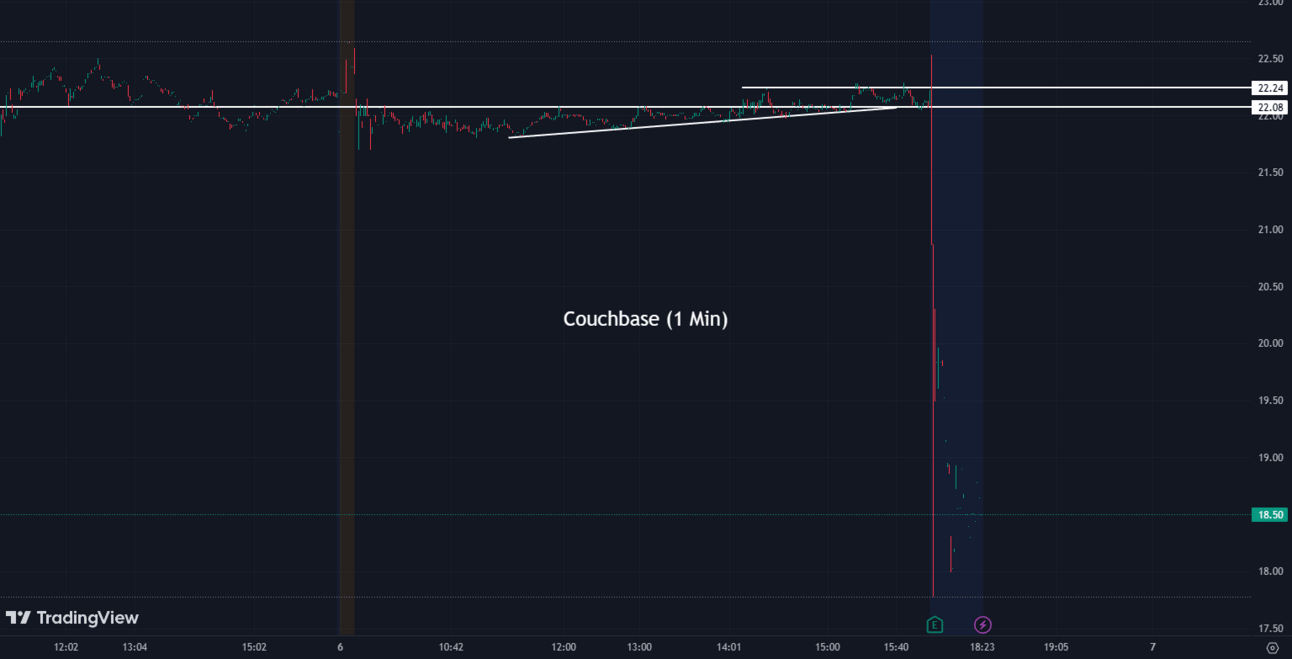

Couchbase, Inc. (BASE) reported a wider loss in Q1 and projected lower revenue figures for Q2 and the full year compared to estimates. The stock price dropped 14.53% to $19.00 in after-hours trading. Q1 net loss was $21.8 million ($0.48 per share) but adjusted loss of $0.27 beat estimates. Revenue increased to $40.9 million, surpassing consensus. Q2 revenue is expected to be $41.2 million to $41.8 million, and full-year revenue is projected to be $171.7 million to $174.7 million, both lower than estimates.

BASE:

22.23 ▲ +0.03 (+0.14%) Today

18.34 ▼ -3.89 (-17.50%) After Hours

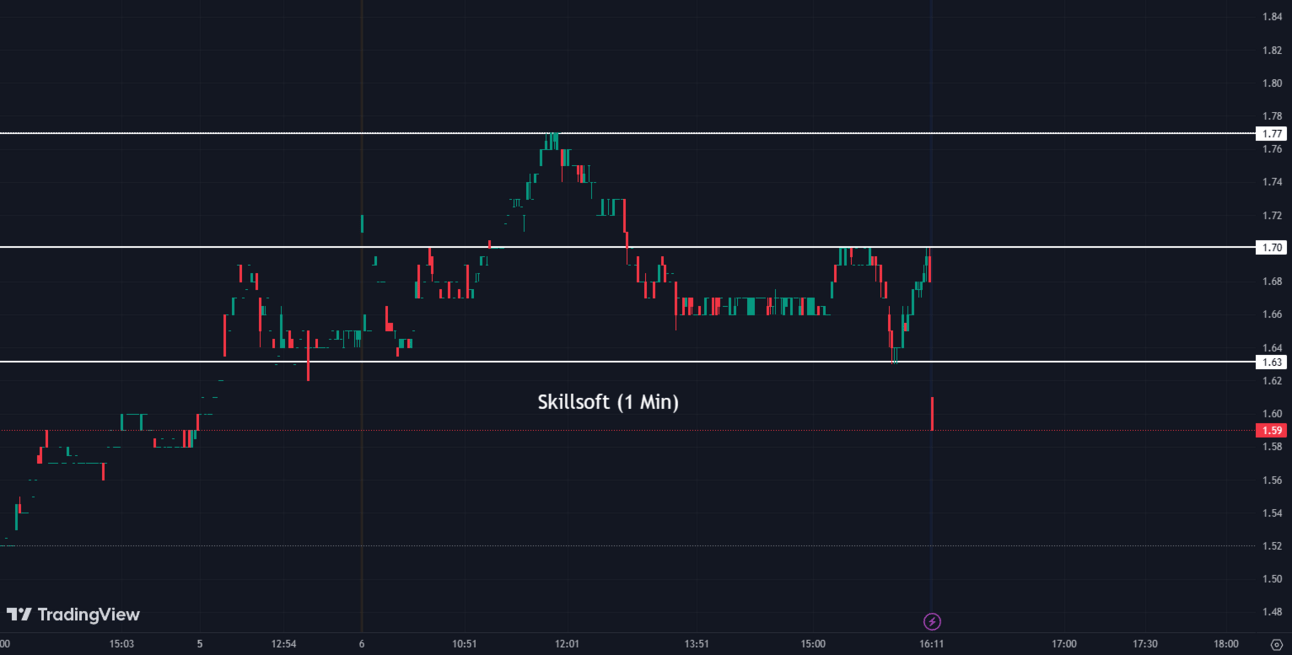

Skillsoft Corp. (SKIL) reported a wider loss for the first quarter and revenue that fell below Wall Street estimates. The company's net loss for the quarter was $44.2 million, or $0.27 per share, compared to a loss of $21.6 million, or $0.15 per share, in the previous year. Analysts had expected a loss of $0.18 per share. Net revenue was $135.5 million, slightly below the consensus estimate of $136.5 million. The stock closed at $1.68, up 2.44%.

SKIL:

1.68 ▲ +0.04 (+2.44%) Today

After Hours is unchanged

Limoneira Co. (LMNR): In its fiscal second quarter, Limoneira Co. (LMNR) recorded a loss of $1.6 million, or 10 cents per share. Earnings per share were adjusted to 21 cents. The company's sales for the quarter was $48.1 million, which fell short of Wall Street expectations. Analysts predicted $48.4 million in sales.

LMNR:

16.47 ▲ +0.50 (+3.13%) Today

16.40 ▼ -0.07 (-0.42%) After Hours

Yext Inc. (YEXT) saw a 15% surge in its stock after exceeding expectations for its fiscal 2024 first quarter and raising its revenue and profit guidance for the year. The company reported a breakeven per-share loss of $400,000, while adjusted earnings were 9 cents per share. Revenue rose 1% to $99.5 million. Yext's CEO highlighted their strong position in utilizing AI and related technologies. The revised guidance for fiscal 2024 predicts revenue of $404 million to $407 million, with adjusted EPS of 28 to 29 cents.

YEXT:

9.60 ▲ +0.37 (+4.01%) Today

10.89 ▲ +1.29 (+13.44%) After Hours

Chico's FAS, Inc. (CHS) reported Q1 revenue of $534.74 million, down 1.1% YoY, missing expectations. Comparable sales decreased 0.6% compared to last year. Gross profit increased by 210 basis points, primarily due to higher retail prices and cost savings. EPS of $0.32 beat estimates and increased 14.3% YoY. Chico's FAS lowered its FY23 outlook for sales and EPS. The company expects Q2 sales of $545 million to $565 million and EPS of $0.25 to $0.30. CHS shares rose by 5.73% to $5.17 following the announcement.

CHS:

5.41 ▲ +0.52 (+10.63%) Today

5.38 ▼ -0.03 (-0.55%) After Hours

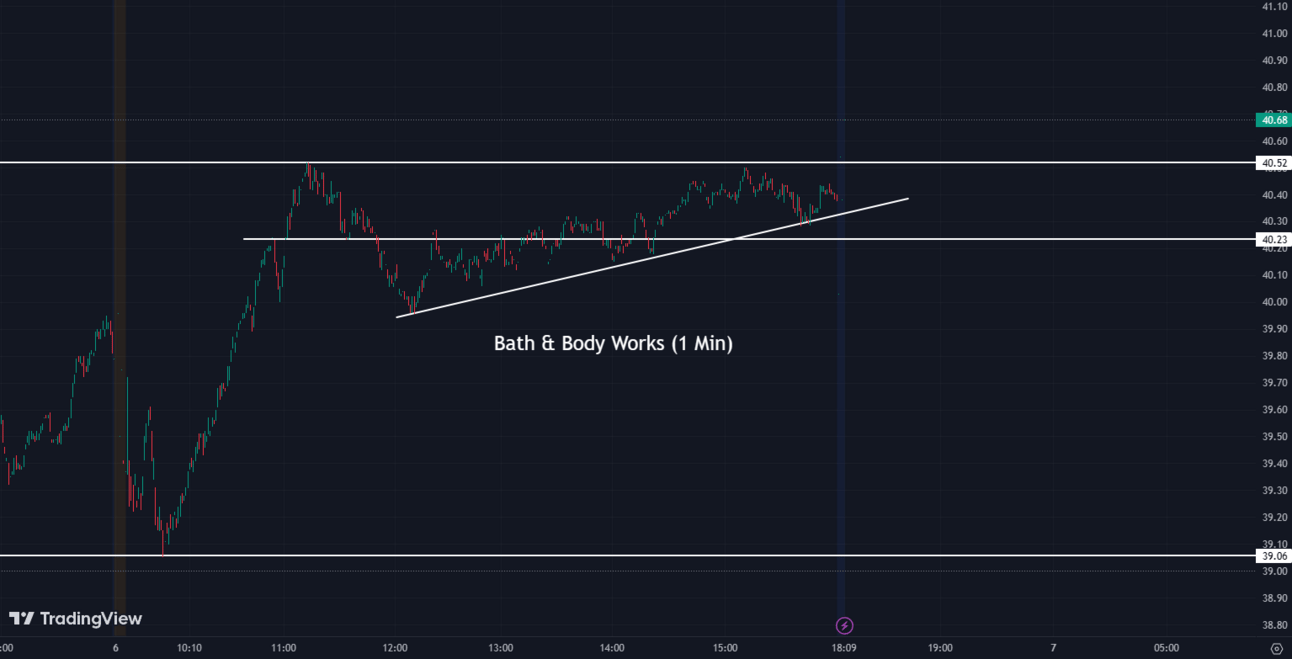

Bath & Body Works Inc. (BBWI) has mixed analyst opinions, with some rating it as a "buy" and others as a "hold." The stock's average price target is $46.00, higher than the current market price. BBWI has experienced recent gains and is trading above its 50-day moving average. There have been insider trading activities. The company's profitability and liquidity ratios are favorable. However, the stock remains far from its 52-week high.

BBWI:

40.38 ▲ +0.58 (+1.46%) Today

40.68 ▲ +0.30 (+0.74%) After Hours

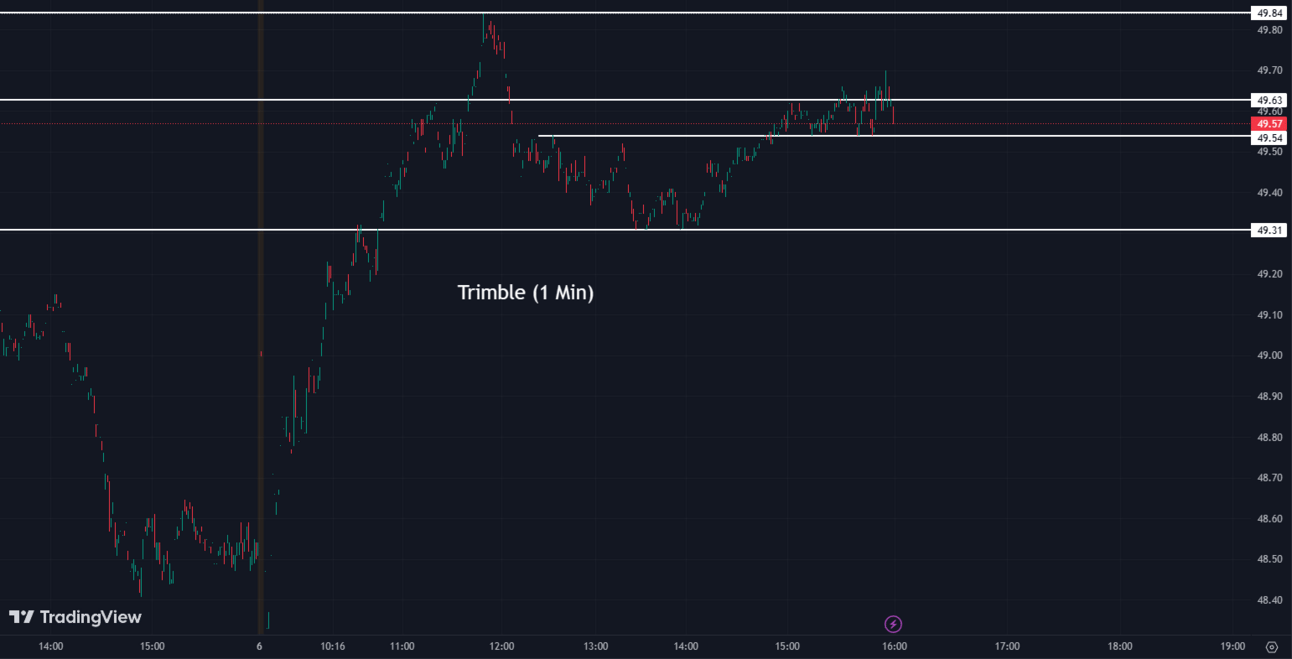

Trimble Inc. (TRMB) is a key player in the Smart Agriculture market, which is projected to reach USD 21.12 billion by 2029 with a CAGR of 10%. The company provides innovative solutions and technologies for precision farming and agricultural management, contributing to the industry's growth and the adoption of efficient farming practices.

TRMB:

49.58 ▲ +1.06 (+2.18%) Today

50.77 ▲ +1.19 (+2.40%) After Hours

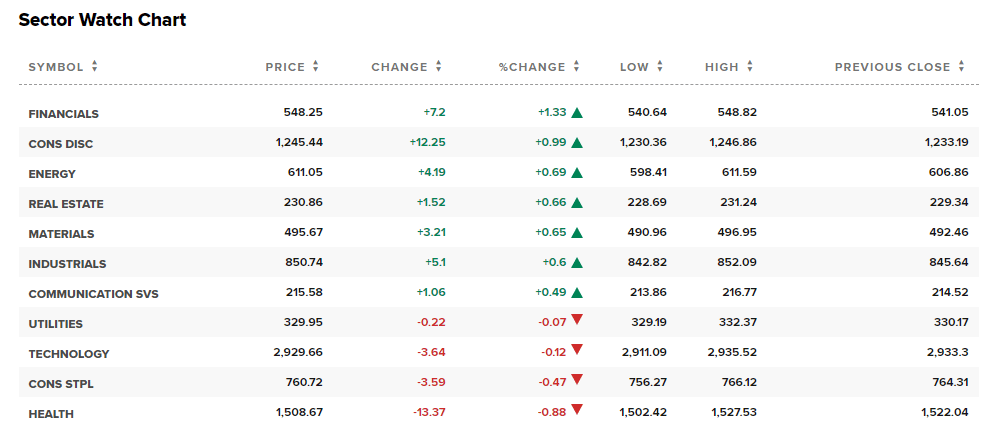

Sectors 🏛️🏥

7 out of the 11 sectors closed in the green today, with Financials leading the way up by +1.33% and Health falling back by -0.88%.

Conclusion 👋

The stock market continues to showcase its resilience and adaptability, with stocks closing higher and the S&P 500 edging towards a bull market. While individual stock performances have been mixed, the overall market sentiment remains positive. The ongoing economic recovery, coupled with strong corporate earnings, continues to drive the bull market.

Thank you all for signing up!

Will only work to do better for you all going forward. Our only goal is to add value to everyone’s trading with key levels and the ability of learning charts and price action.

Please Share Our Newsletter it will be much appreciated!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of TradingView. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.