Hello, traders! As we wind down for the evening, let's take a deep dive into the noteworthy events that have shaped the financial markets today!

Impact of OPEC+ Policies on Oil Prices 🌍🛢️

OPEC+, responsible for 40% of global crude oil production, kept its planned output cuts steady but Saudi Arabia, the top oil exporter, surprised the market with additional voluntary cuts in July. This decision led to a rise in oil prices with some predicting potential deficits and higher prices in 2023. However, some viewed this unilateral move as a failure to unite OPEC+ members and warned of a weak market and a potential drop below $70 per barrel.

Oil’s Impact on the US Stock Market ⛽️💰

US stock market indices dipped due to weaker-than-expected economic data, with uncertainty around future Federal Reserve decisions on interest rate hikes. However, crude prices saw an upward trend, following Saudi Arabia's decision to cut oil output by another 1 million barrels per day starting in July. Investors are keeping a close watch on economic data releases, which could impact the direction of the Federal Reserve's interest rate policy.

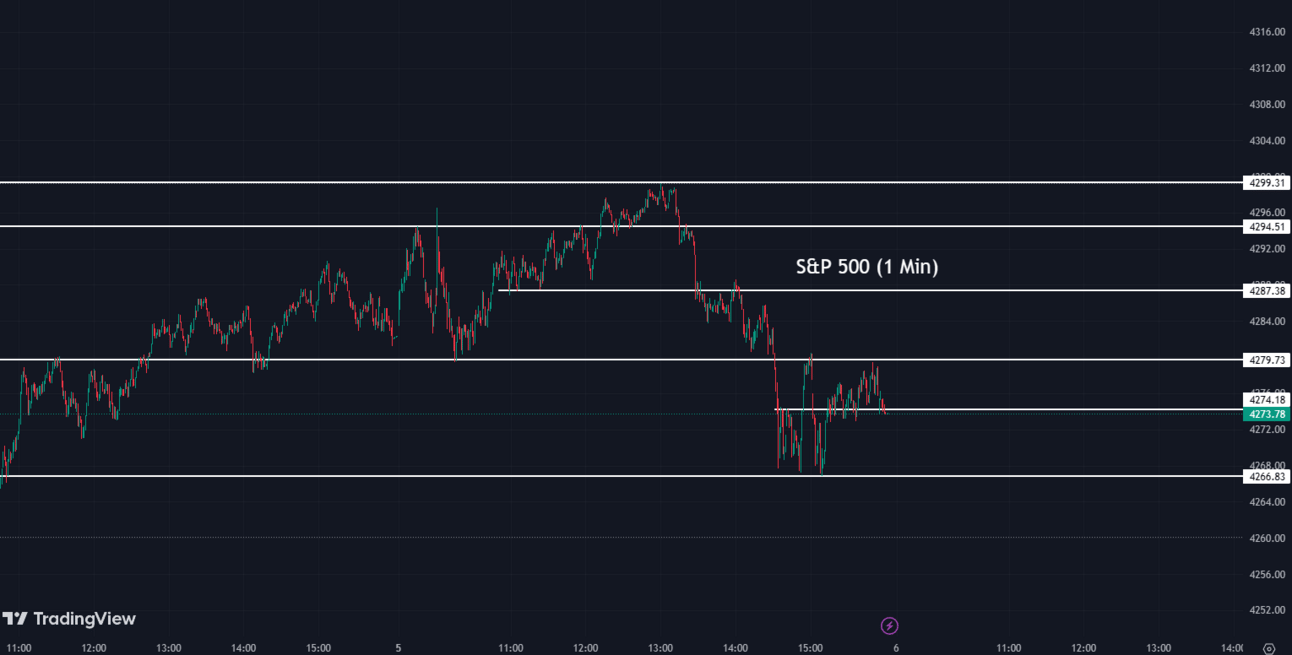

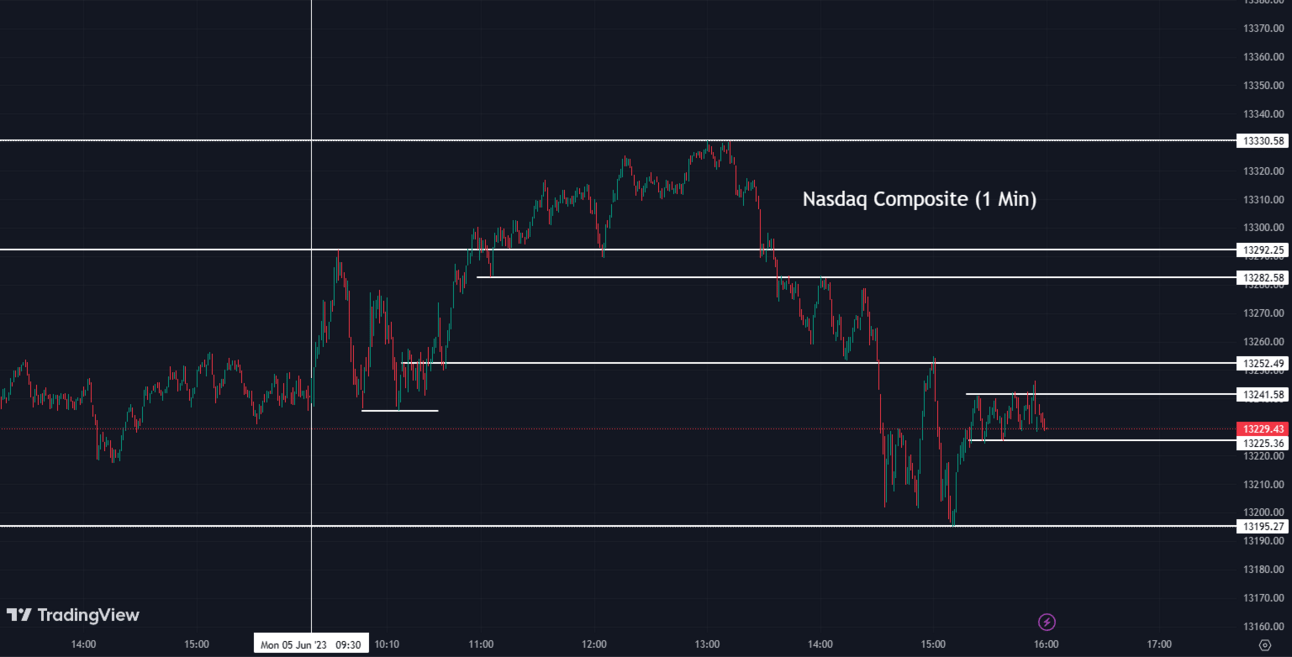

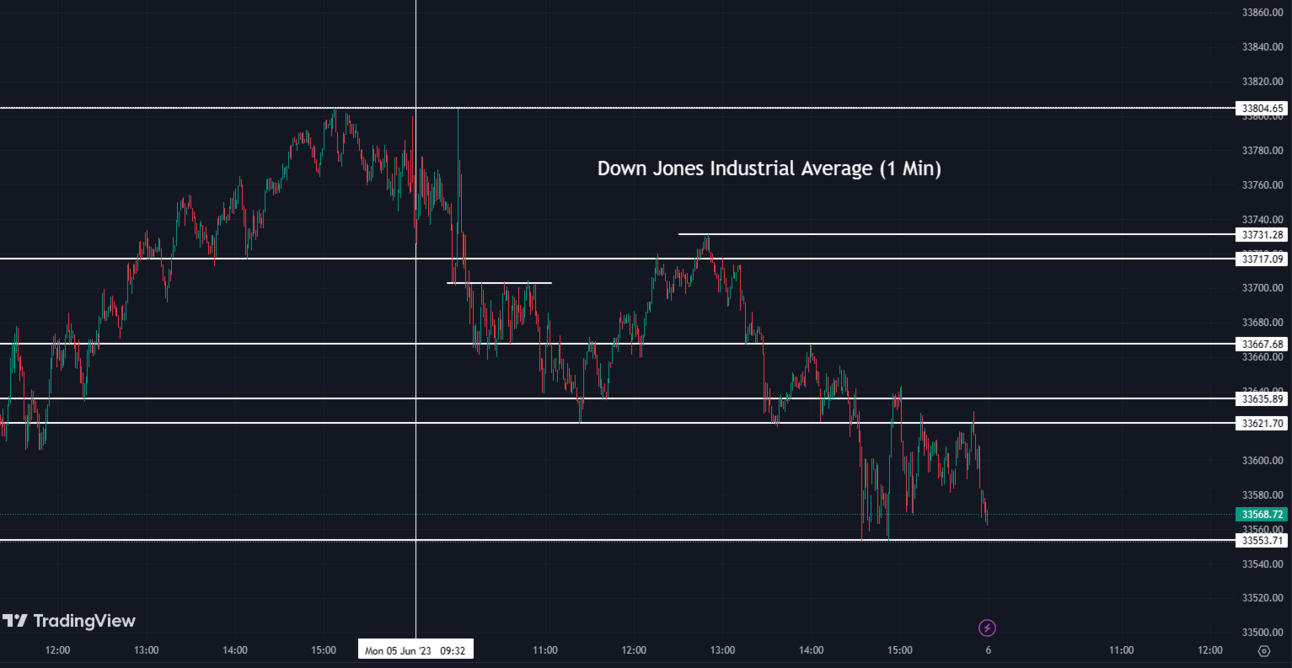

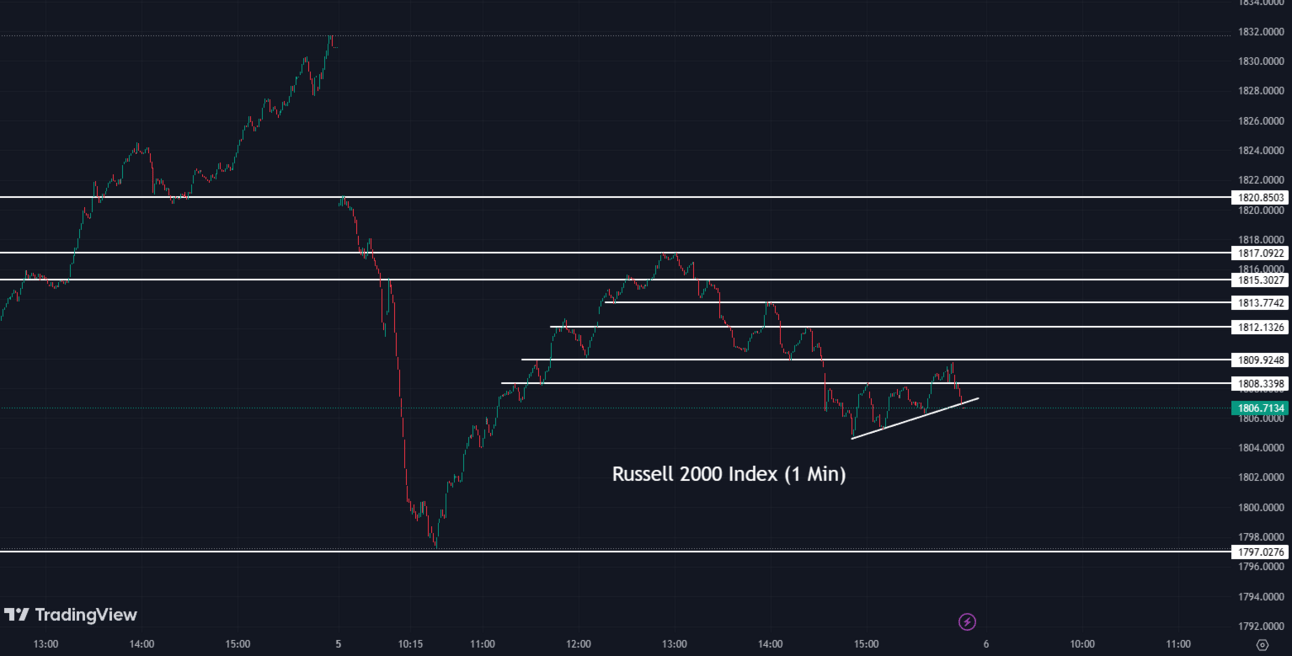

Indexes 📉📊

The indexes experienced a decline today, largely influenced by news related to oil, which resulted in some fluctuations. However, it's worth noting that the S&P 500 reached its highest level for intraday trading in 9 months. Now, let's examine how everything ultimately closed.

The S&P 500 (SPX) was down 0.20% coming to a conclusion at 4,273

The Nasdaq Composite (IXIC) fell 0.086% to settle at 13,229

The Dow Jones Industrial Average (DJI) dipped 0.59% to finish at 33,562

The Russell 2000 (RUT) dropped by 1.32% ending the day at 1,806

The Nasdaq-100 (NDX) heightened by 0.07% to conclude at 14,556

SEC Lawsuit against Binance and CEO Changpeng Zhao ⚖️💼

The US Securities and Exchange Commission (SEC) has sued Binance, one of the world's largest cryptocurrency exchanges, and its CEO Changpeng Zhao, citing violations of US securities laws. The SEC alleges that Binance offered trading in digital assets that are securities under US law without complying with the requisite legal requirements. The lawsuit has sent shockwaves through the cryptocurrency industry.

Apple's WWDC 2023 Unveilings 🎮🍏

At the 2023 World Wide Developer Conference (WWDC), Apple (AAPL) announced significant updates to its software ecosystem and unveiled Apple's Vision Pro, a cutting-edge virtual reality headset for $3,499. This marked the tech giant's first major product launch since the Apple Watch in 2014. As part of the announcement, Apple showcased a new partnership with Unity, a platform widely used for creating and operating real-time 3D content. The anticipation surrounding the VR headset has already driven Apple shares to new highs, highlighting the market's faith in the company's continued innovative expertise.

AAPL:

179.58 ▼ -1.37 (-0.76%) Today

179.18 ▼ 0.40 (-0.22%) After Hours

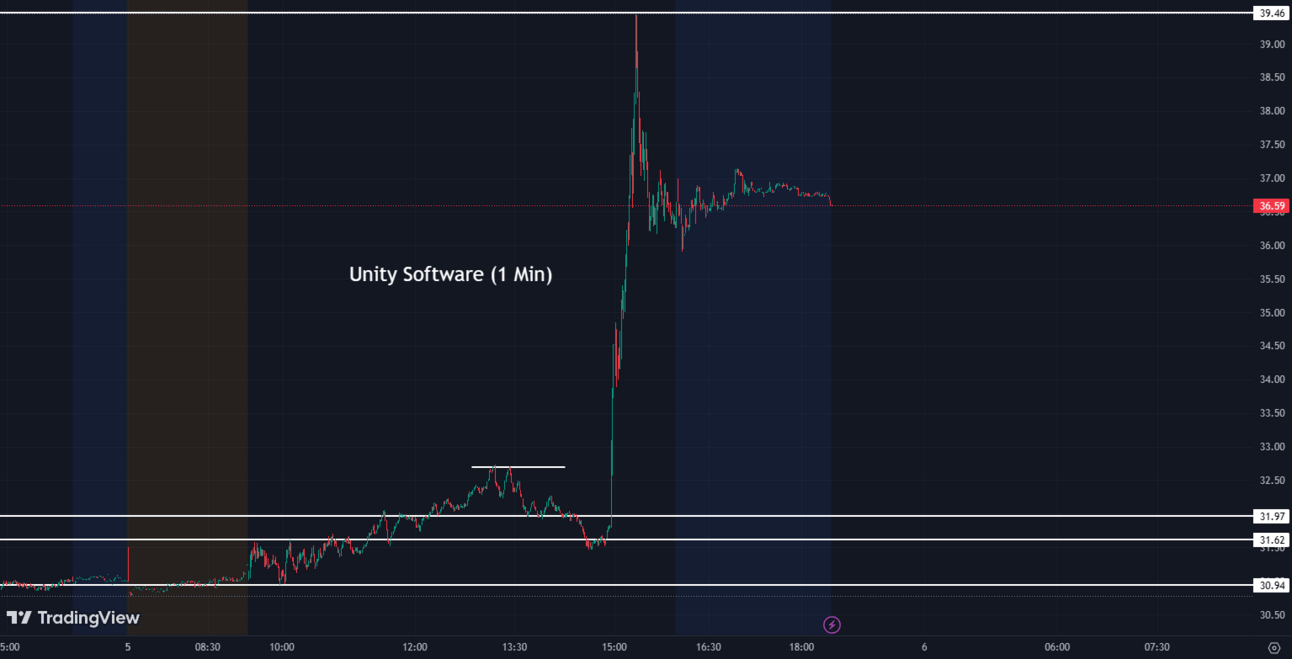

Collaboration Between Unity and Apple Vision Pro 🤝🍎

Unity (U), a prominent player in game development software, experienced an impressive 26% boost in share price as a result of Apple's disclosure of their joint efforts on the new Apple Vision Pro headset. This critical partnership announcement briefly paused trading, resulting in Unity's most significant stock rise since its 2020 IPO. Endeavoring to foster a vibrant third-party app ecosystem for the high-end $3,499 device, Apple is joining forces with industry leaders such as Adobe, Cisco, and Microsoft for Vision Pro app development. Although previously hampered by Apple's iOS privacy adjustments that affected its app ad incorporation, Unity now stands as an essential ally for Apple in upgrading device capabilities.

U:

36.29 ▲ +5.29 (+17.06%) Today

36.68 ▲ 0.36 (+0.99%) After Hours

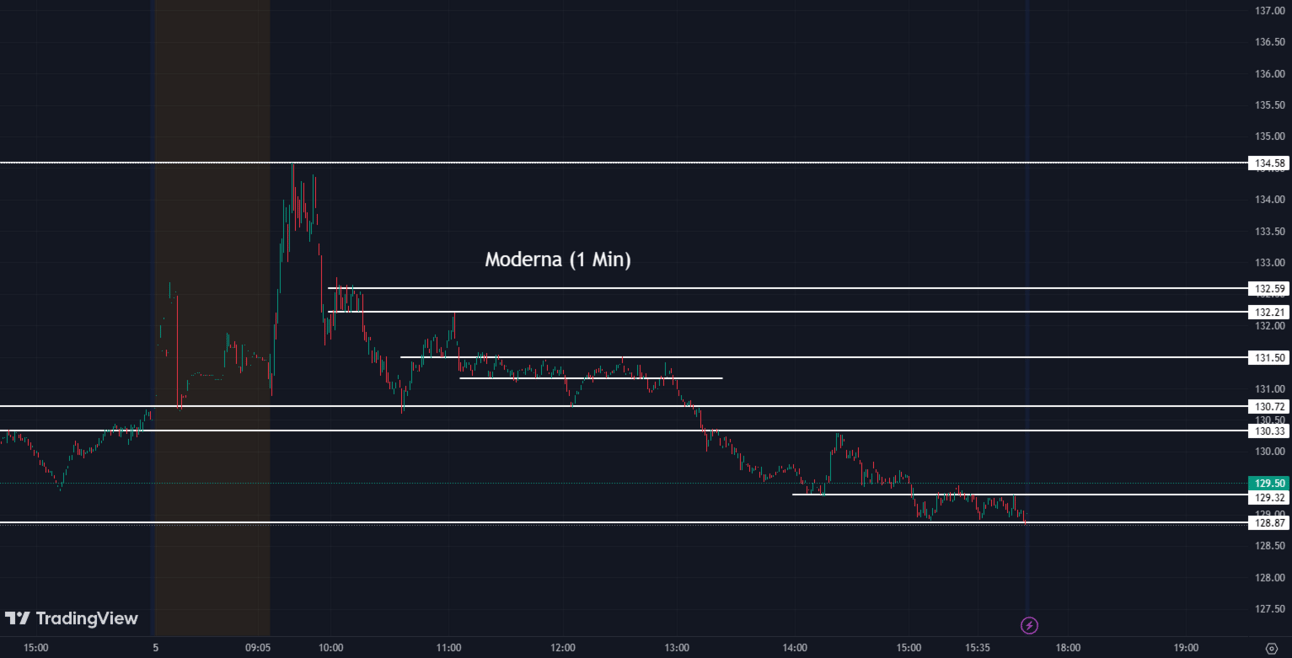

Breakthrough in Cancer Treatment: Moderna and Merck's Vaccine 🧬🔬

Moderna (MRNA) and Merck (MRK) have collaborated on a groundbreaking vaccine that significantly reduces skin cancer spread. The results of the trial showed that the vaccine, in combination with Merck's Keytruda, halted the progression of skin cancer in a significant number of patients. This innovative approach to cancer treatment could revolutionize the healthcare industry, and the news led to a noticeable jump in Moderna's shares.

MRNA:

128.90 ▼ -1.61 (-1.23%) Today

129.23 ▲ 0.33 (+0.26%) After Hours

MRK:

113.11 ▲ +0.59 (+0.52%) Today

113.10 ▼ 0.01 (-0.0088%) After Hours

GM's Heavy-duty Pickup Trucks Investment 🚛💰

General Motors (GM) revealed plans to invest $1 billion into the development and production of new heavy-duty pickup trucks. This decision underlines GM's confidence in the high-demand, high-margin segment of pickup trucks amid a shifting consumer preference toward electric and autonomous vehicles. The announcement aligns with GM's strategy of leveraging its core business to fund future innovations.

GM:

34.15 ▼ -0.14 (-0.39%) Today

34.18 ▲ 0.05 (+0.15%) After Hours

Intel's Struggles Amid Apple's Transition 🔌💻

Intel (INTC) shares experienced a notable decline of 4.6% following Apple's decision to transition all its computers to its own silicon chips. The move signifies a significant loss for Intel, which has been Apple's primary chip supplier for many years, and raises questions about Intel's growth prospects as more companies consider developing in-house silicon solutions.

INTC:

29.86 ▼ -1.45 (-4.63%) Today

29.78 ▼ 0.08 (-0.27%) After Hours

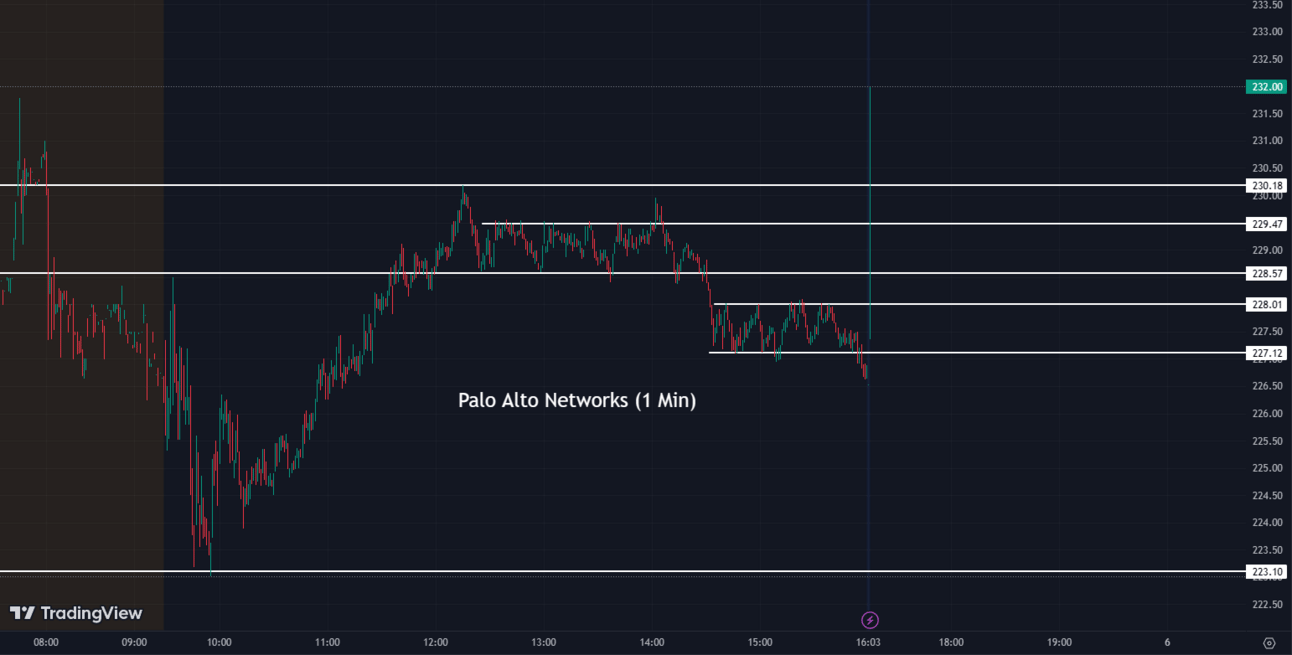

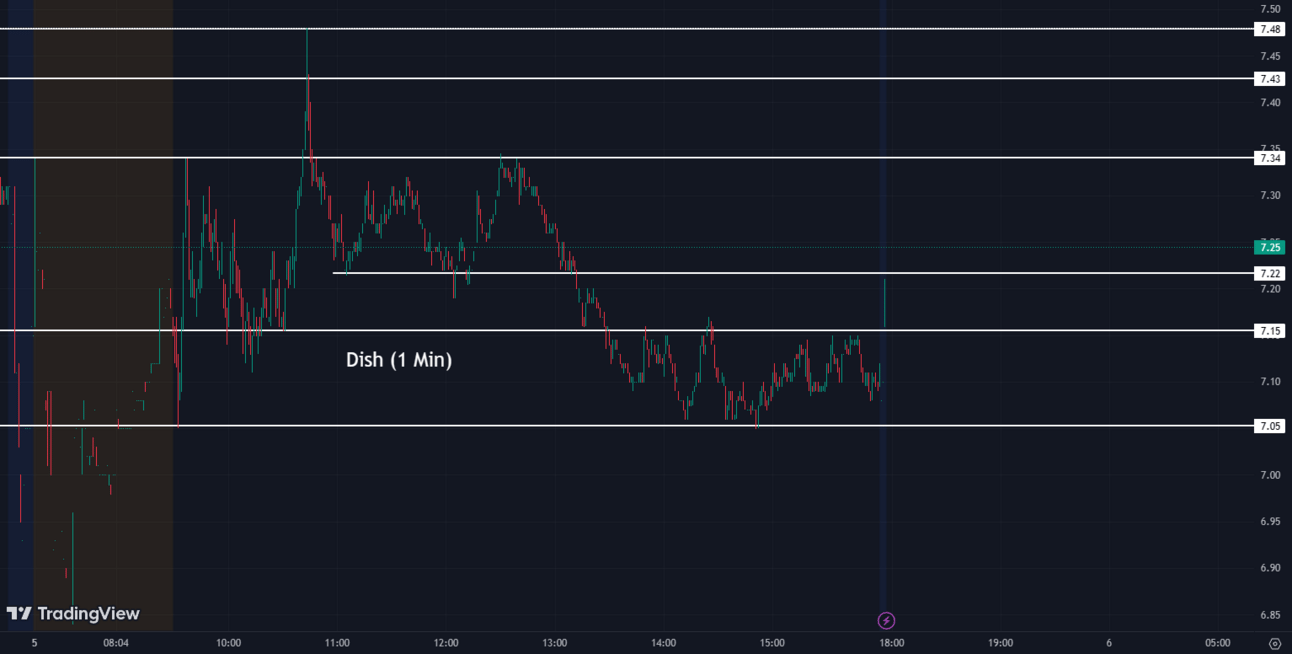

Palo Alto Networks Joins S&P 500 🌟🆙

Cybersecurity giant Palo Alto Networks (PANW) is scheduled to join the S&P 500 index on June 20th, replacing Dish Networks (DISH). In turn, Dish Networks will succeed Cutera (CUTR) in the S&P SmallCap 600. This inclusion in the S&P 500 could enhance Palo Alto Networks' visibility among investors and potentially drive demand for its shares, considering the significant number of funds that track the S&P 500

PANW:

226.79 ▲ +9.55 (+4.40%) Today

227.00 ▲ 0.21 (0.093%) After Hours

DISH:

7.10 ▼ -0.20 (-2.74%) Today

7.25 ▲ 0.15 (+2.11%) After Hours

CAVA's Upcoming IPO 📈📆

With its upcoming US Initial Public Offering (IPO), the quick-service restaurant chain, CAVA, aims for a substantial $2.12 billion valuation.

After-Hour Stocks Making Moves 🌙📈

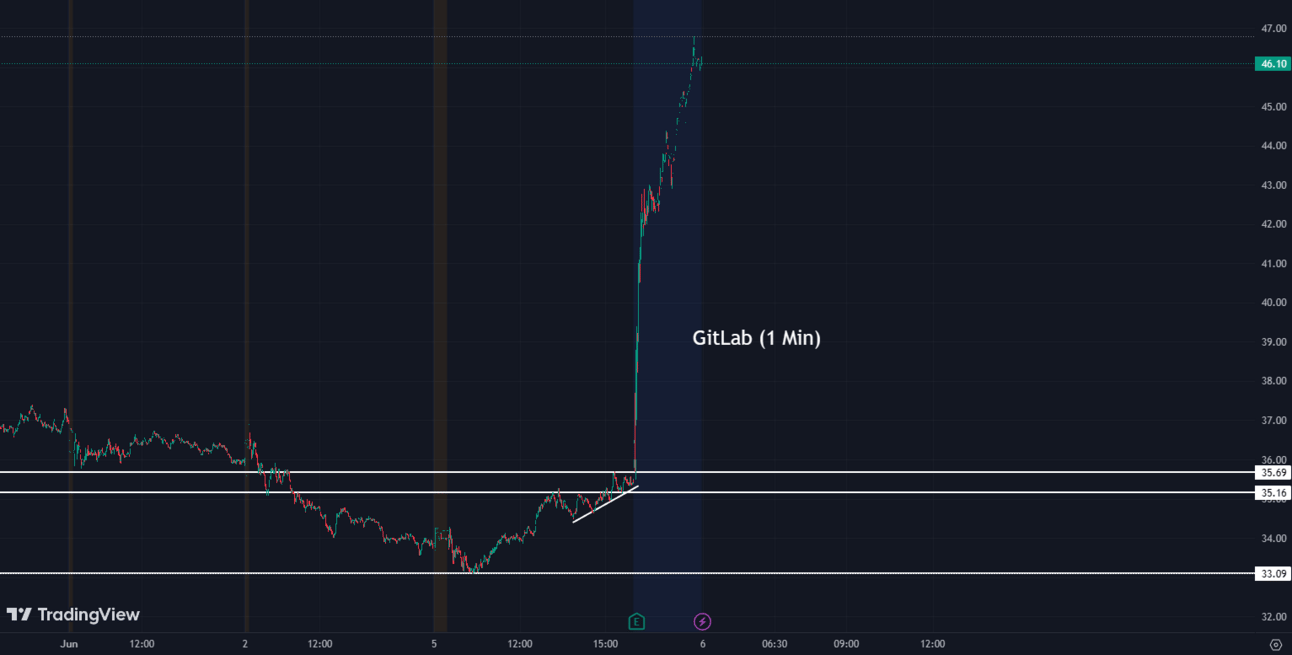

GitLab (GTLB) - GitLab Inc.'s stock price surged by 30% after exceeding expectations in its latest financial results. The data developer's revenue increased, and its AI-powered platform is driving innovation. This optimistic forecast led to a 30% stock price surge and an upward revision of full-year guidance.

GTLB:

35.40 ▲ +1.67 (+4.95%) Today

46.35 ▲ 10.95 (+30.93%) After Hours

Sprinklr (CXM) - Sprinklr reported strong Q1 results, exceeding forecasts and projecting higher profit and revenue for the fiscal year. The company's AI-powered service in the contact center space was highlighted as a disruptive force. Increased subscription revenue drove profitability in Q1.

CXM:

13.50 ▲ +0.32 (+2.43%) Today

14.15 ▲ 0.66 (+4.89%) After Hours

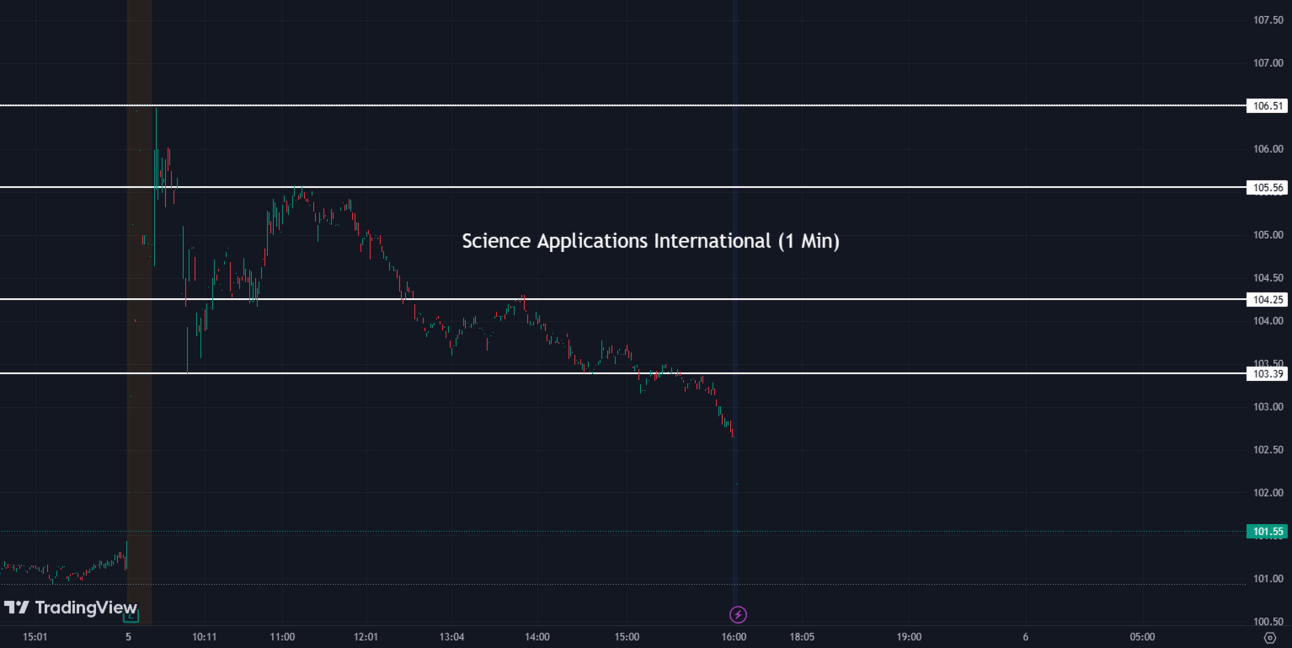

Science Applications International (SAIC) - Science Applications International, an IT services provider, has raised its revenue and earnings guidance for fiscal 2024 following better-than-expected first-quarter results. The company now projects higher revenue of $7.13 billion to $7.23 billion and adjusted earnings of $7 to $7.20 per share. This positive outlook led to a 3.3% increase in the company's premarket trading.

SAIC:

102.65 ▲ +1.20 (+1.18%) Today

102.80 ▲ 0.15 (+0.15%) After Hours

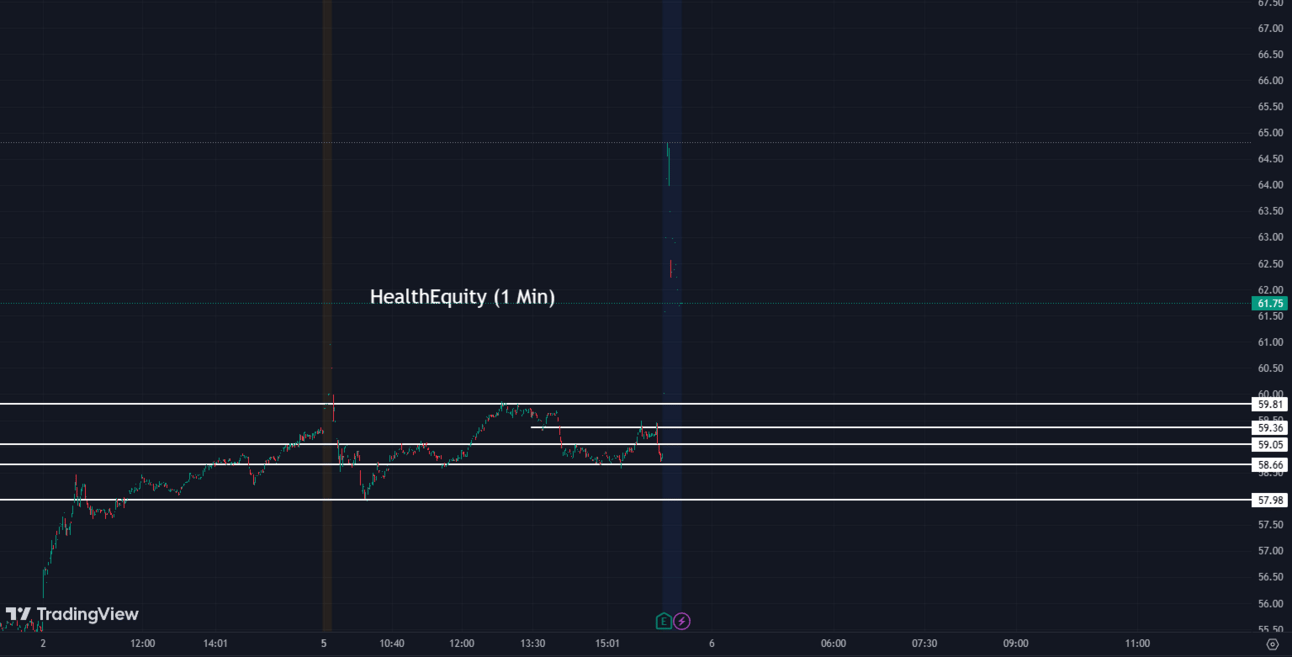

Healthequity (HQY) - HealthEquity Inc. reported strong fiscal first-quarter earnings with a profit of $4.1 million (5 cents per share) and exceeded revenue estimates by generating $244.4 million. Adjusted earnings reached 50 cents per share. The company provided a full-year earnings outlook of $1.88 to $1.97 per share, with projected revenue between $975 million and $985 million.

HQY:

58.84 ▼ -0.42 (-0.71%) Today

61.63 ▲ 2.79 (+4.74%) After Hours

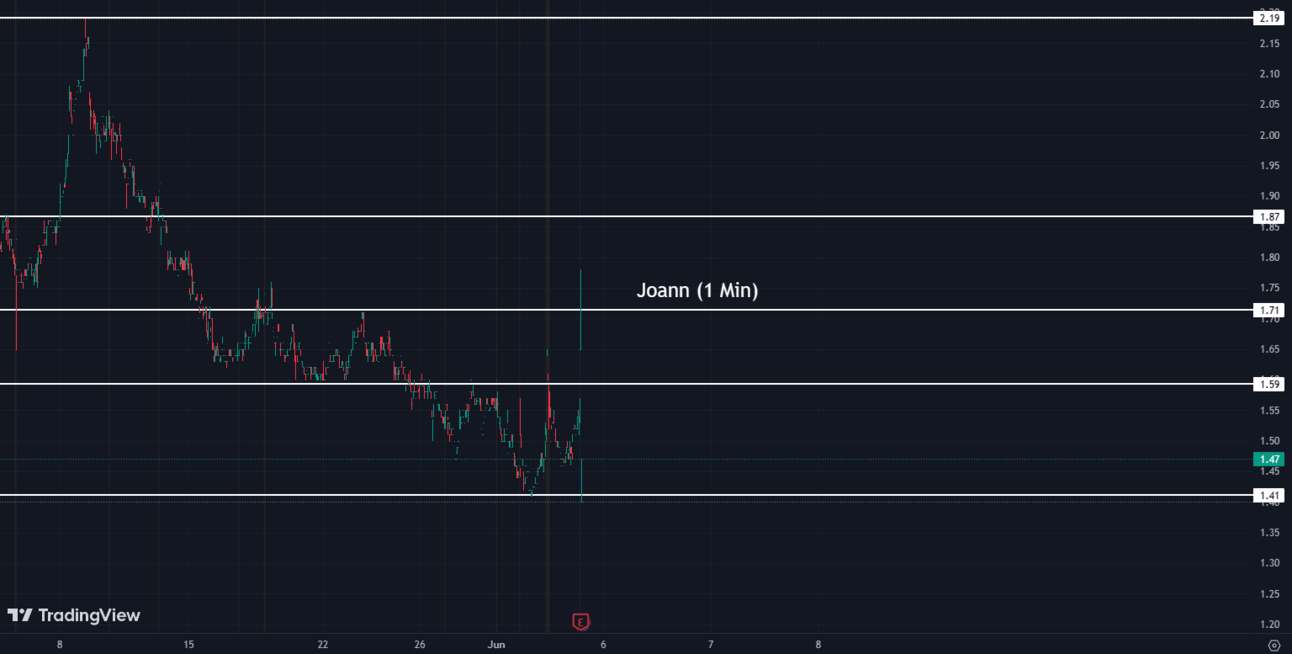

Joann (JOAN) - JOANN Inc. posted disappointing quarterly results, reporting a loss of $0.93 per share, which was worse than the anticipated loss of $0.62 according to Zacks Consensus Estimate. The company's revenues for the quarter stood at $478.1 million, falling below expectations. Furthermore, the stock has experienced a 47% decline this year. The company's earnings outlook is negative, and it currently holds a Zacks Rank #4 (Sell).

JOAN:

1.61 ▲ +0.10 (+6.62%) Today

1.56 ▼ 0.05 (-3.11%) After Hours

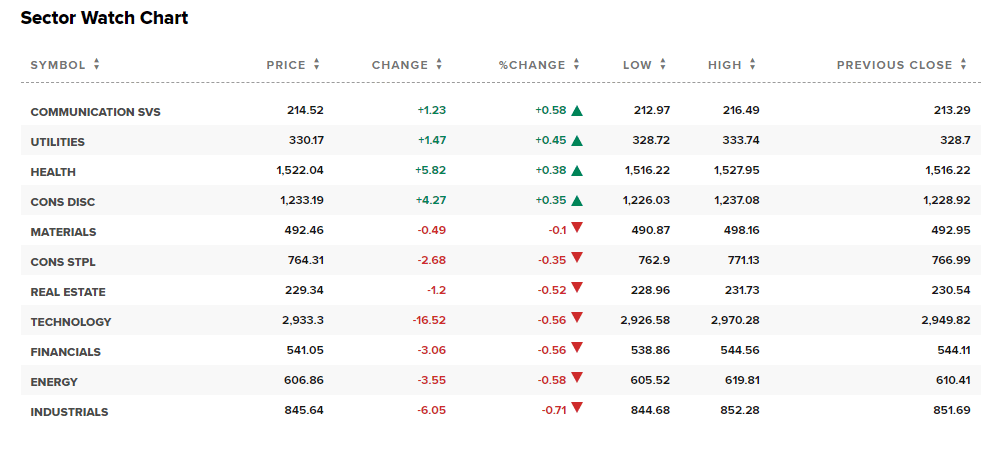

Sectors 🏭🏗️

4 out of the 11 sectors closed in the green today, with Communication Services leading the way, up 0.58%, while Industrials lagged behind, down 0.71%

European Market Decline 🌍📉

The pan-European Stoxx 600 index ended the day with a 0.5% decline, despite Saudi Arabia's decision to cut oil output and OPEC+'s production cut plans, resulting in a slip of 0.27% in oil and gas stocks. The travel and leisure sector also saw a dip of 1.3%, mainly influenced by a 3.3% drop in Air France KLM. Investors are closely monitoring the latest inflation data, which indicates the lowest level since February 2022. Meanwhile, the European Central Bank (ECB) has hinted at continuing the rate-hiking cycle. In contrast, the Asia-Pacific markets mostly experienced an upswing, boosted by the resolution of the U.S. debt ceiling issue, while U.S. equity futures remained stable.

Conclusion 👋

Despite oil prices making only modest moves after OPEC's decision to cut production, tech stocks surged, led by Apple following announcements at WWDC 2023. However, the broader stock market showed signs of struggle, with several sectors experiencing drops. Despite the mixed performance across industries, investors seem to be maintaining a cautiously optimistic outlook, navigating a complex economic landscape that continues to evolve.

Thank you all for signing up!

Will only work to do better for you all going forward. Our only goal is to add value to everyone’s trading with key levels and the ability of learning charts and price action.

Please Share Our Newsletter it will be much appreciated!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of TradingView. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.