As we approach the end of the week and the end of the first half of the year, let's embark on a comprehensive review of the significant events that have shaped the financial markets today!

Supreme Court Rejects Biden's Student Loan Forgiveness Plan ❌🎓

In a significant blow to student loan borrowers, the Supreme Court on Friday struck down President Biden's federal student loan forgiveness plan, citing the president's lack of authority to cancel such a massive amount of consumer debt without Congressional authorization. The decision, widely predicted, upholds the legal standing of GOP-led states that had challenged the relief program, potentially affecting tens of millions of borrowers who had been promised up to $20,000 in debt cancellation. Despite criticism from borrowers and advocates, the Court held that the plan could cause substantial harm to states, including Missouri, by reducing profits at local higher education loan authorities.

Inflation Pressures Ease as Consumer Spending Slows in May 💰🛑

Inflation pressures mildly subsided in May, according to a Commerce Department report, as consumer spending saw a significant slowdown. The core personal consumption expenditures (PCE) price index, a metric closely observed by the Federal Reserve, increased by 0.3% for the month, which aligns with Dow Jones' estimates. The year-over-year core PCE inflation rose by 4.6%, slightly below expectations. However, when volatile food and energy components were factored in, inflation appeared considerably softer, with an increase of only 0.1% for the month and 3.8% from a year ago. Although personal income grew by 0.4%, exceeding estimates, consumer spending only rose by 0.1%, a considerable drop from the 0.6% increase in April. These figures point to the possibility of consumers slowly easing back on spending and increasing their savings as prices continue to rise.

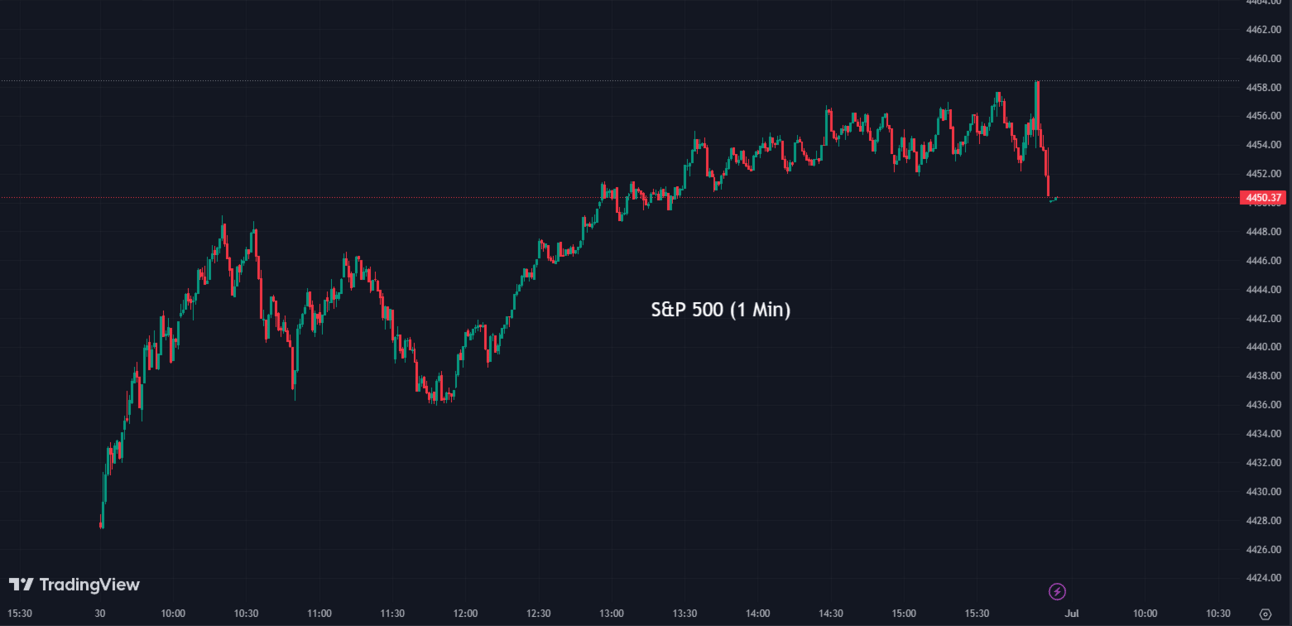

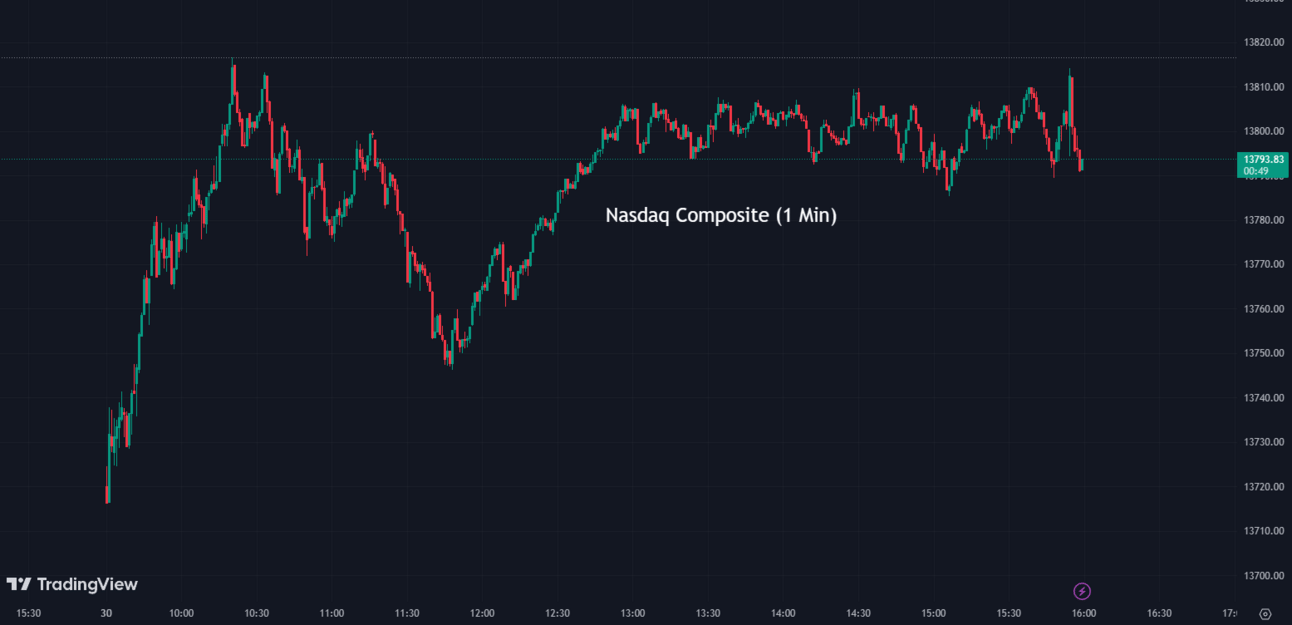

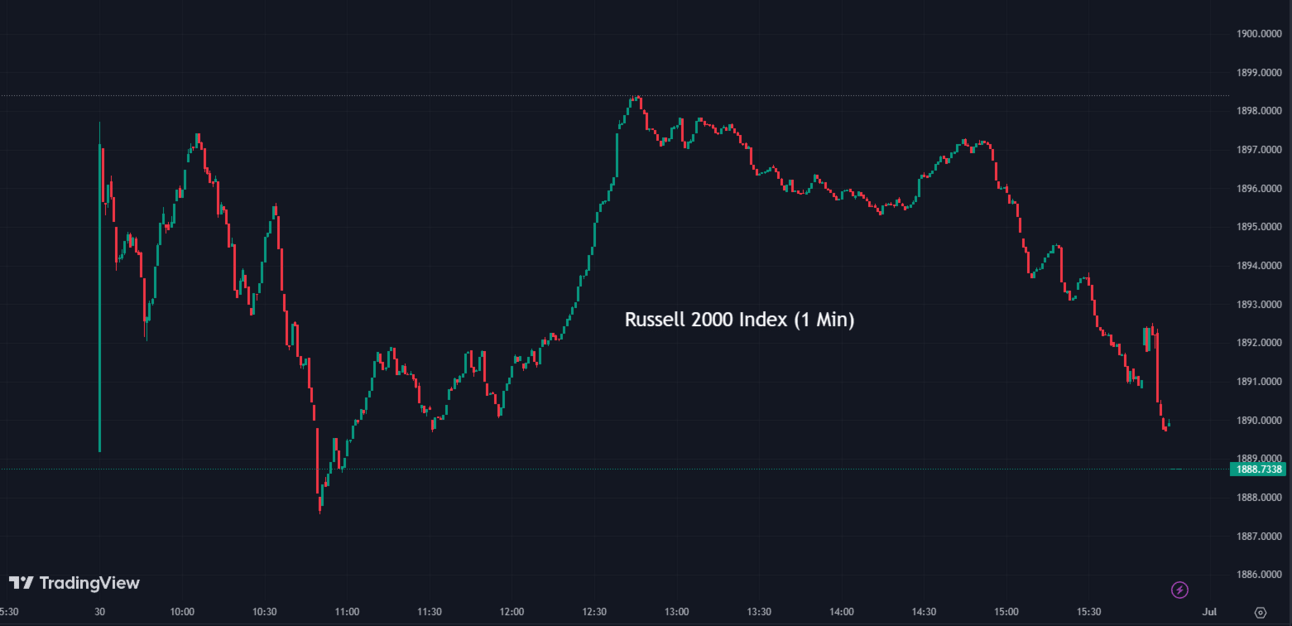

Indexes 📈💹

The indices witnessed a surge, with technology companies continuing their remarkable performance, marking a powerful start to the year and the Nasdaq Composite's strongest first half since 1983. Now, let's explore how the market performed today...

The S&P 500 (SPX) was up +1.23% coming to a conclusion at 4,450

The Nasdaq Composite (IXIC) escalated by +1.45% to settle at 13,787

The Dow Jones Industrial Average (DJI) climbed +0.84% ending the day at 34,407

The Russell 2000 (RUT) increased by +0.38% to finish at 1,888

The Nasdaq-100 (NDX) rose +1.60% to conclude at 15,179

Hello there, everyone👋! For those who may have missed it, we're thrilled to introduce an incredible newsletter that's tailored to guide you on your journey toward financial freedom. But here's the best part: as a token of our appreciation, we're offering a limited-time deal that you won't want to pass up. Enjoy a remarkable 20% lifetime discount on your subscription! It's our way of thanking you all for your continued support. Click the link below to discover the wealth of benefits that await you.

Apple's Market Valuation Hits $3 Trillion 🚀🍏

Apple's (AAPL) market valuation hit $3 trillion on Friday. This would be the second time Apple has hit a $3 trillion cap, but the first time it carried through the close. Despite minimal involvement with AI, unlike competitors such as Microsoft (MSFT), Google (GOOGL), and Nvidia (NVDA), Apple's success has been driven by its resilience in navigating supply chain disruptions due to COVID lockdowns in China, a robust iPhone business, and an anticipated entry into the AR/VR headset market with its Vision Pro.

AAPL:

193.97 ▲ +4.38 (+2.31%) Today

193.88 ▼ -0.095 (-0.049%) After Hours

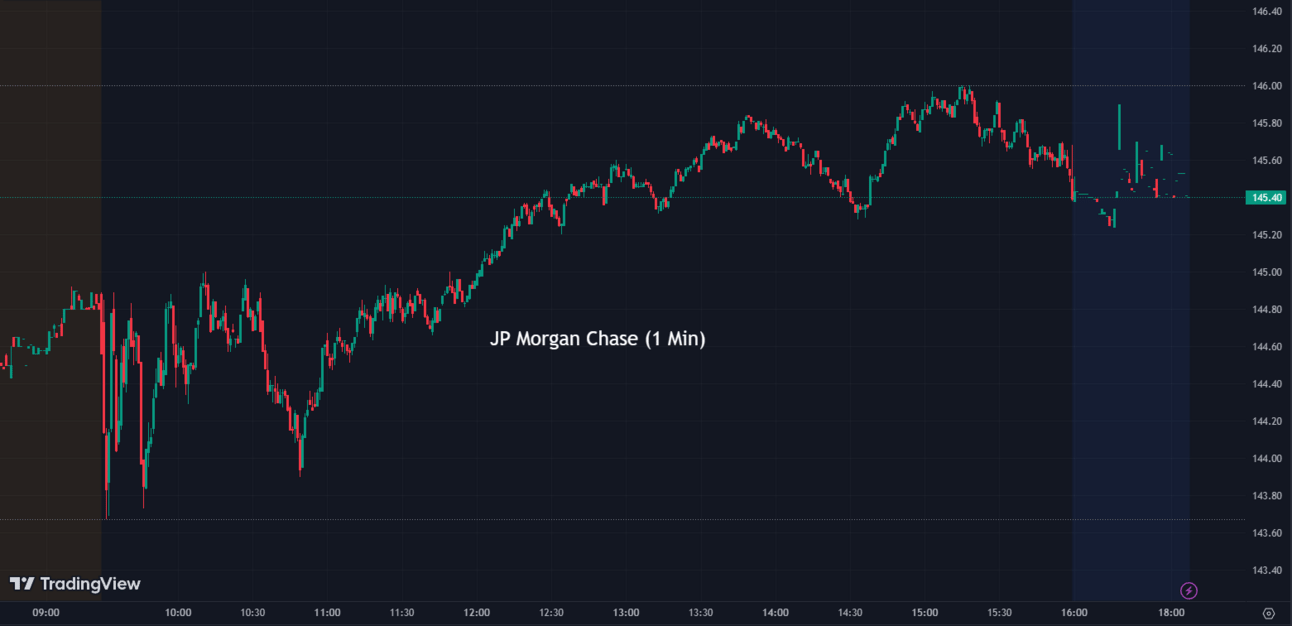

U.S. Banks Boost Dividends After Fed Stress Test Clearance 💰📈

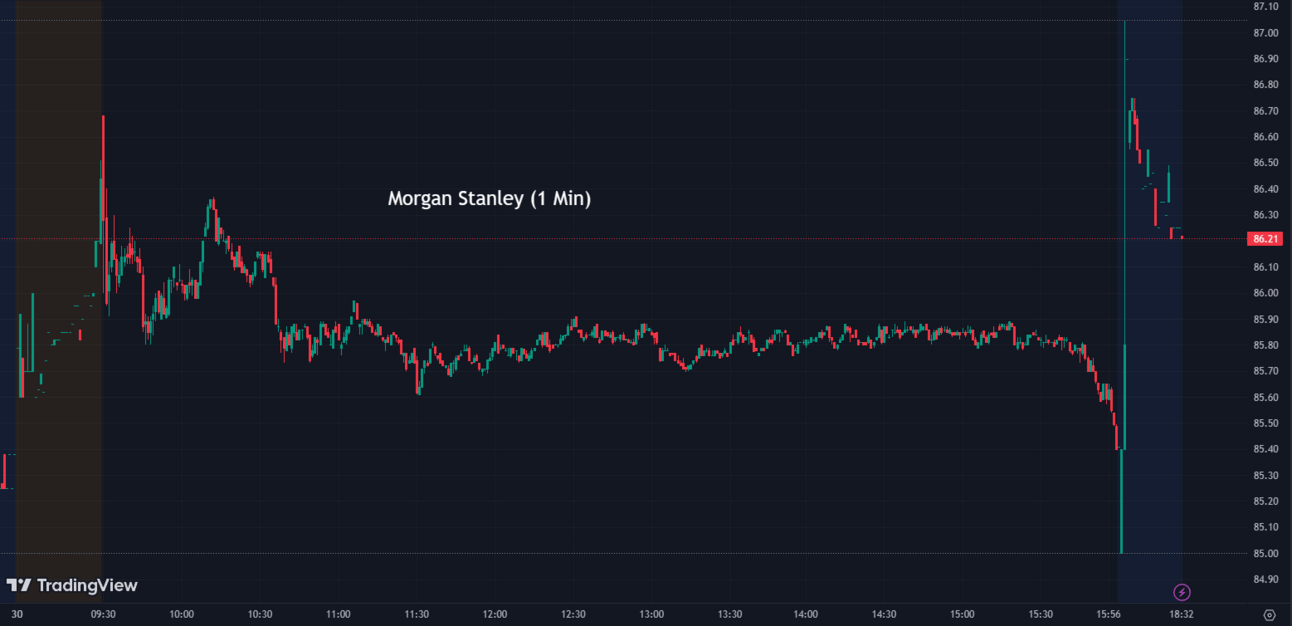

Prominent U.S. banks, including JPMorgan Chase (JPM), Wells Fargo (WFC), and Morgan Stanley (MS), have announced plans to increase their quarterly dividends, following successful clearance of the Federal Reserve’s annual stress test. JPMorgan intends to up its payout from $1 to $1.05 per share, starting in the third quarter. Wells Fargo aims to raise its dividend from 30 cents to 35 cents per share, and Morgan Stanley from 77.5 cents to 85 cents per share. Conversely, Citigroup (C) announced a modest increase from 51 cents to 53 cents per share. All banks, however, refrained from specific plans to increase share repurchases. Analysts anticipate banks to be more cautious with their capital-return plans this year due to upcoming international banking regulations that will likely increase capital requirements for major global firms like JPMorgan.

JPM:

145.46 ▲ +2.03 (+1.42%) Today

145.50 ▲ +0.06 (+0.041%) After Hours

WFC:

42.69 ▲ +0.24 (+0.57%) Today

42.75 ▲ +0.07 (+0.16%) After Hours

MS:

85.39 ▲ +0.15 (+0.18%) Today

86.16 ▲ +0.76 (+0.89%) After Hours

C:

46.04 ▼ -0.25 (-0.54%) Today

46.03 ▼ -0.01 (-0.022%) After Hours

Fox News Settles with Former Producer Abby Grossberg in Dominion Voting Systems Defamation Case 🦊💼

Fox News (FOX) has agreed to a $12 million settlement with former producer Abby Grossberg, who alleged the network pressured her into providing misleading testimony in the Dominion Voting Systems defamation case. The settlement follows a $787.5 million settlement agreement between Fox and Dominion in April over false claims that Dominion's voting machines affected the 2020 presidential election results. Grossberg, once a producer for former prime-time host Tucker Carlson, has withdrawn her claims following the settlement, expressing optimism that the resolution signifies a positive step in Fox News' treatment of women and minorities in the workplace.

FOX:

31.89 ▼ -0.22 (-0.69%) Today

Price remains unchanged in after-hours

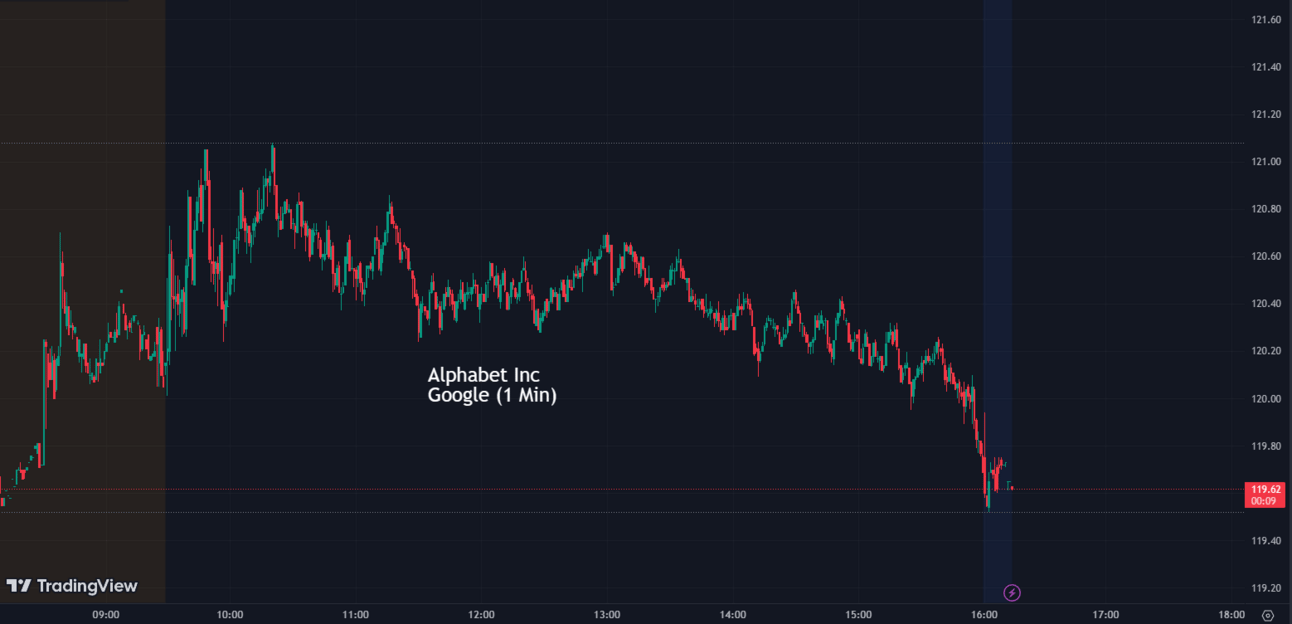

Google and Meta Block Links to Canadian News Outlets in Response to Bill C-18 📰🚫

Following the passage of the new bill C-18, Google (GOOGL) announced it would stop linking to Canadian news outlets. This legislation requires companies like Google and Meta (META) to pay media outlets when they link to news in search or feeds, with an expected annual revenue of around $329 million for Canadian newsrooms. In response to the law, Google's global affairs president, Kent Walker, called the framework "unworkable," and Meta also announced a similar blocking action.

GOOGL:

119.70 ▲ +0.60 (+0.50%) Today

119.72 ▲ +0.02 (+0.017%) After Hours

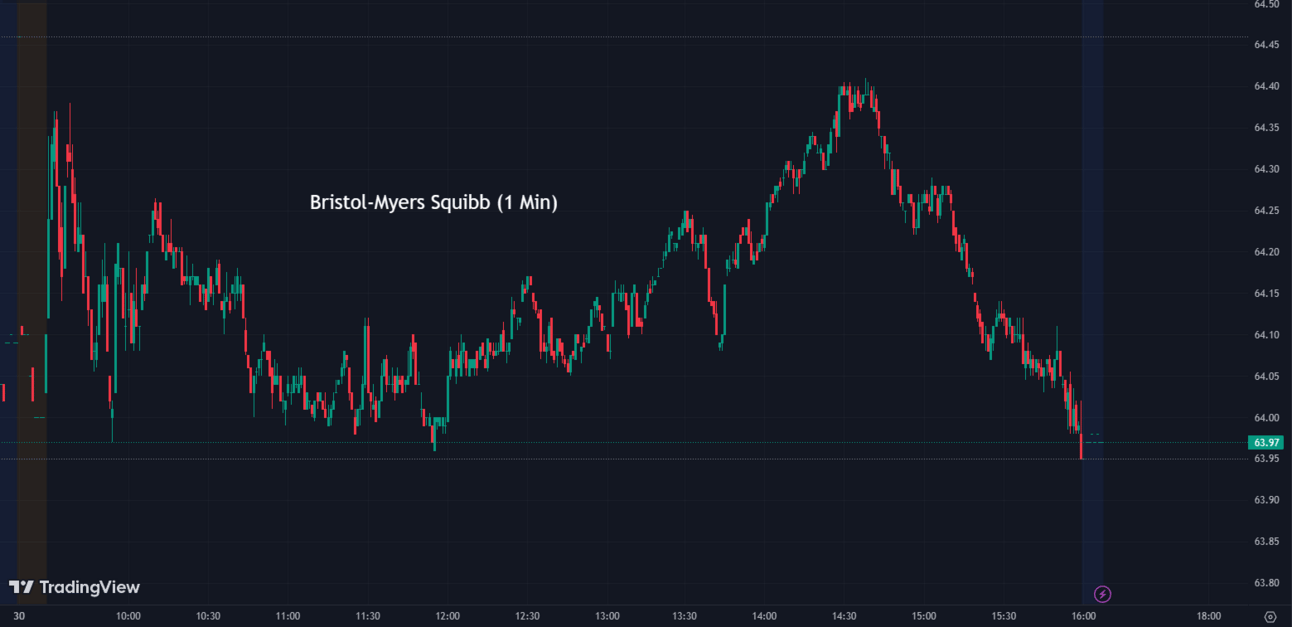

Aurinia Pharmaceuticals Explores Strategic Alternatives, Including Potential Buyout 🏛️💊

Aurinia Pharmaceuticals (AUPH) announced its exploration of strategic alternatives, including a potential buyout from believed, Bristol Myers Squibb (BMY), which led to a surge in Aurinia Pharmaceuticals stock. The company's product Lupkynis, a treatment for lupus nephritis, is seen as a valuable addition for companies with rheumatology or nephrology medications. The company's recent settlement of a patent dispute over Sun Pharmaceuticals' Cequa and the winning of a new patent for Lupkynis likely increase its attractiveness to potential buyers. Analysts suggest a fair takeover price would be around $18-$20 per share, possibly reaching into the high $20 to low $30 range.

AUPH:

9.68 ▲ +0.52 (+5.68%) Today

9.78 ▲ +0.10 (+1.03%) After Hours

BMY:

63.94 ▼ -0.06 (-0.094%) Today

63.97 ▲ +0.02 (+0.031%) After Hours

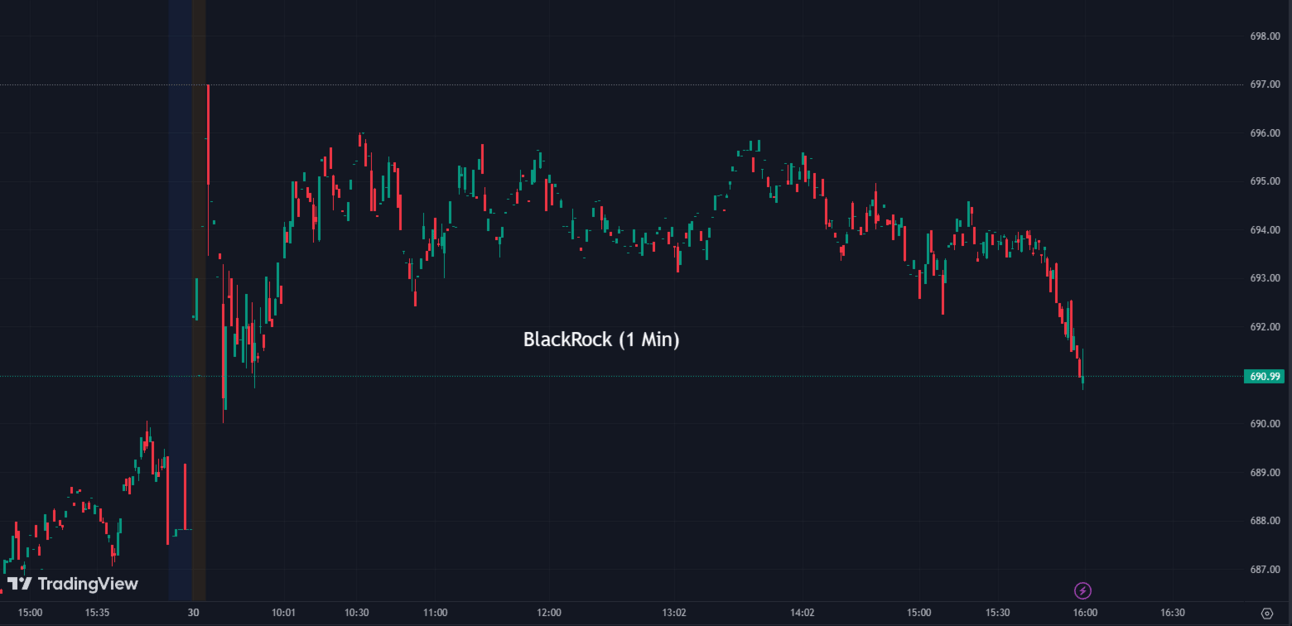

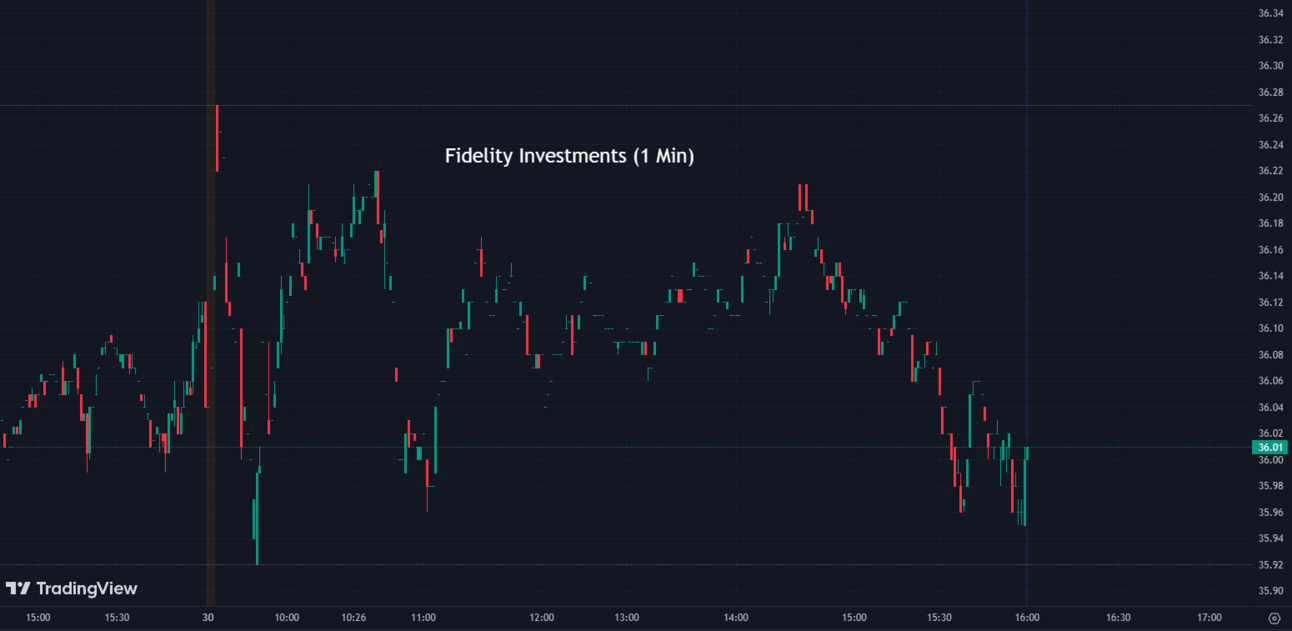

SEC Requests Clarity on Filings for First US Bitcoin ETF 💰📄

The US Securities and Exchange Commission (SEC) has requested further clarity on asset managers' filings to launch the first US Bitcoin exchange-traded fund. Exchanges such as Nasdaq and Cboe Global Markets (CBOE) filed applications on behalf of BlackRock (BLK) and Fidelity Investments (FNF). Despite around 30 attempts for a Bitcoin product, regulatory opposition citing market concerns and lack of investor protections has been a significant barrier. Both Nasdaq and Cboe intend to revise and refile their applications based on SEC feedback and discussions.

CBOE:

138.01 ▲ +2.25 (+1.66%) Today

138.46 ▲ +0.45 (+0.33%) After Hours

BLK:

691.47 ▲ +3.26 (+0.47%) Today

696.50 ▲ +5.36 (+0.78%) After Hours

FNF:

36.00 ▼ -0.04 (-0.11%) Today

35.59 ▼ -0.41 (-1.14%) After Hours

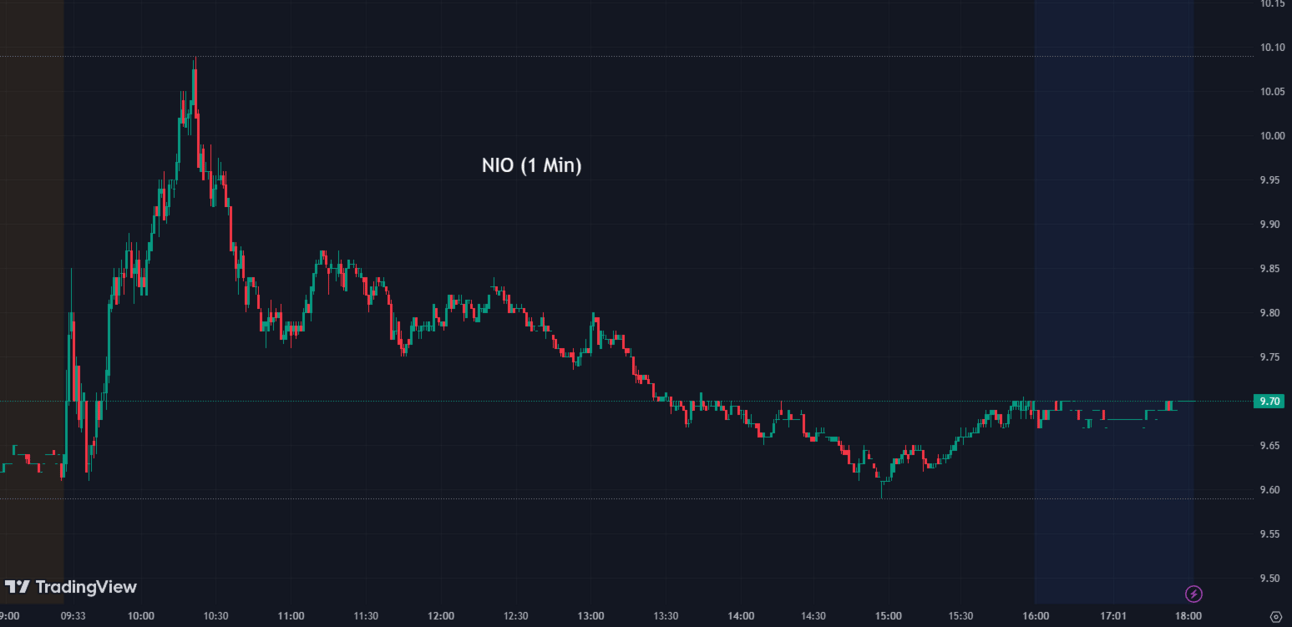

XPeng's G6 SUV Launch Triggers Stock Surge 🚗📣

Chinese EV maker XPeng (XPEV) saw a 13% rise in its stock following the launch of its new mid-sized SUV, the G6, which is priced 20% lower than Tesla's (TSLA) Model Y. The G6 starts at $28,950 compared to the Model Y's $47,240. This development also led to a notable gain in the shares of NIO (NIO) and Li Auto (LI), Xpeng's peers. The Chinese EV market is currently amidst a pricing war, initiated by Tesla's decision to slash prices last year. Notably, BYD (BYDDY) and NIO, two significant competitors, also cut their vehicle prices. XPeng's decision to competitively price its SUV aims to boost sales and meet its ambitious 2023 delivery target of 200,000 units, a 66% YoY increase from 2022.

XPEV:

13.43 ▲ +1.60 (+13.52%) Today

13.48 ▲ +0.06 (+0.45%) After Hours

NIO:

9.70 ▲ +0.30 (+3.25%) Today

9.70 ▲ +0.01 (+0.10%) After Hours

LI:

35.10 ▲ +0.81 (+2.36%) Today

35.07 ▼ -0.031 (-0.088%) After Hours

BYDDY:

64.15 ▲ +1.42 (+2.26%) Today

64.05 ▼ -0.10 (-0.16%) After Hours

ESPN, Owned by Disney, Announces Layoffs of On-Air Personalities in Cost-Cutting Effort 📺👥

ESPN, a part of Disney (DIS), is laying off about 20 on-air personalities including NBA analysts Jeff Van Gundy and Jalen Rose, as part of its cost-cutting measures to meet its financial targets for 2023 and beyond. The cuts, targeting high-salary employees, also include the long-time reporter and anchor Suzy Kolber, NFL analyst Steve Young, and host Max Kellerman. This move follows Disney's recent round of layoffs involving 7,000 employees as the media giant seeks to boost free cash flow amidst slowing streaming growth.

DIS:

89.26 ▲ +0.31 (+0.35%) Today

89.02 ▼ -0.26 (-0.29%) After Hours

Medicare Removes Confidentiality Requirement on Drug Price Negotiations with Pharmaceutical Companies 💊��

Medicare lifted its confidentiality requirement that prevented pharmaceutical companies from publicly discussing drug price negotiations. Initially, Medicare had forbidden companies from disclosing information related to the lower price offered by the government for targeted drugs, among other details. This led drugmakers to sue the federal government, arguing that the requirement violated the First Amendment. The revised guidance allows companies to disclose information regarding ongoing negotiations at their discretion.

Notable Movers of the Day 📈📉

Carnival’s (CUK) stock climbed more than 9% after Jefferies upgraded to buy from hold, citing leadership changes and an improved outlook.

CUK:

16.97 ▲ +1.43 (+9.20%) Today

16.93 ▼ -0.02 (-0.12%) After Hours

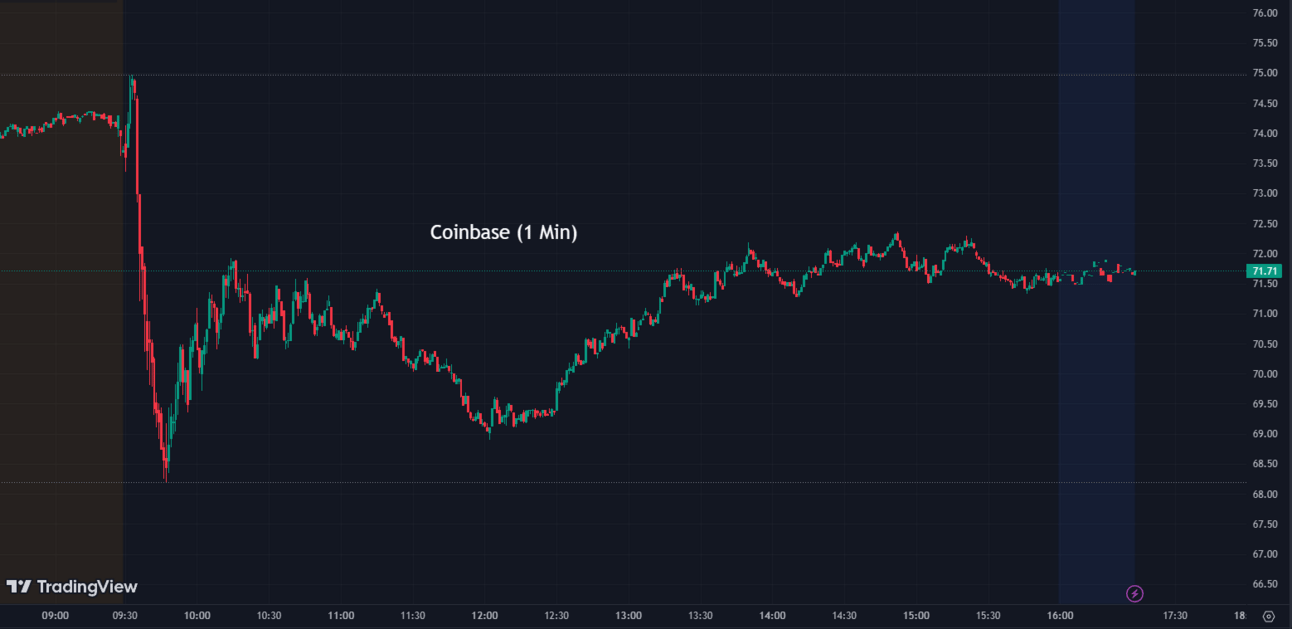

Coinbase’s (COIN) shares slid 1%, pressured by a dip in the bitcoin price that followed a Wall Street Journal report that the U.S. Securities and Exchange Commission is calling recent bitcoin exchange-traded funds filings inadequate. Coinbase is the crypto custody partner for BlackRock, whose bitcoin ETF filing earlier this month set off a wave of followers and a rally in the price of bitcoin and Coinbase shares.

COIN:

71.55 ▼ -0.88 (-1.22%) Today

71.84 ▲ +0.29 (+0.41%) After Hours

Bright Health Group’s (BHG) shares added 10% after the health insurer announced a deal to sell its California Medicare Advantage business to Molina Healthcare for roughly $600 million.

BHG:

12.11 ▲ +1.19 (+10.90%) Today

12.11 ▼ -0.11 (-0.90%) After Hours

Nike (NKE) shares fell 2.5% after Nike posted its first earnings miss in three years and reported a decline in margins for its fiscal fourth quarter, which it attributed to higher product input costs, elevated freight, and logistics costs, an uptick in promotions, and unfavorable currency exchange rates.

NKE:

110.35 ▼ -3.02 (-2.66%) Today

110.55 ▲ +0.18 (+0.16%) After Hours

Pacific Biosciences (PACB) stock popped 1.37% after Goldman Sachs initiated coverage at a buy, noting the company could be at an inflection point with a new sequencing instrument.

PACB:

13.30 ▲ +0.18 (+1.37%) Today

13.23 ▼ -0.07 (-0.53%) After Hours

Meta’s (META) stock added 2% after the U.K.’s Competition and Markets Authority closed its investigation into the company’s sale of Giphy to Shutterstock.

META:

286.98 ▲ +5.45 (+1.94%) Today

286.82 ▼ -0.15 (-0.054%) After Hours

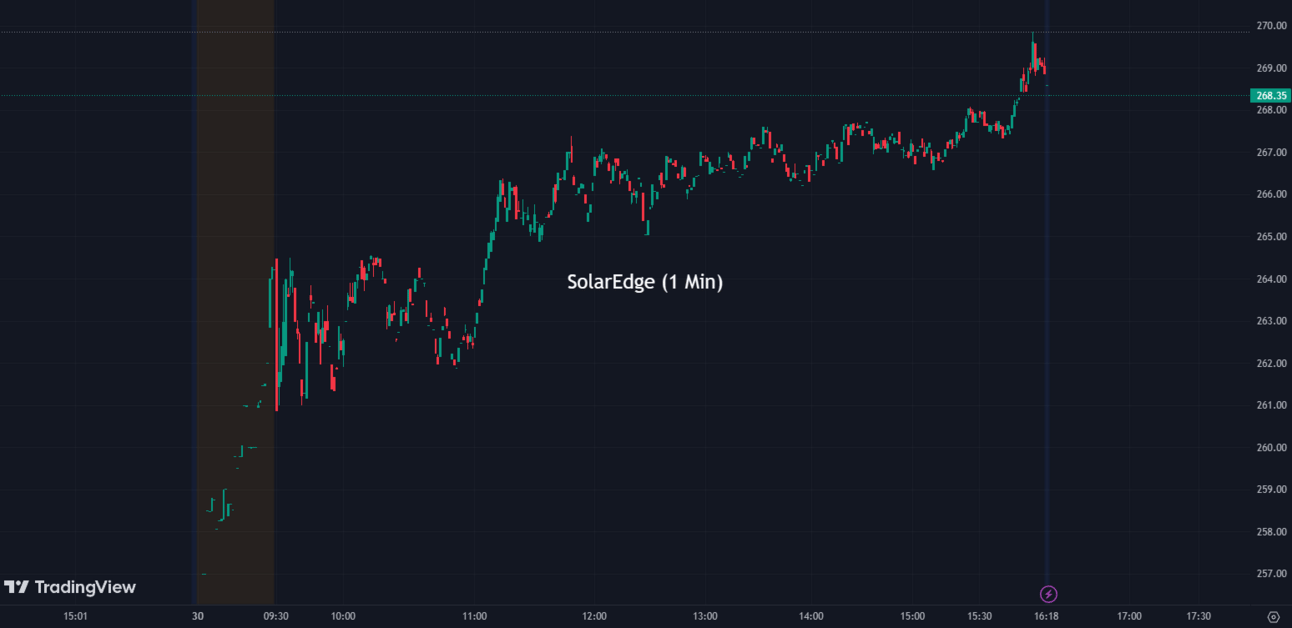

SolarEdge’s (SEDG) stock rose 5.94% after Bank of America raised its price target to $396 from $379. The new target implies an upside of more than 50% from Thursday’s close. The bank also said it has a healthy diversified structural growth story.

SEDG:

269.05 ▲ +15.09 (+5.94%) Today

268.45 ▼ -0.60 (-0.22%) After Hours

Sectors 🏠💻

Today, all of the 11 sectors closed in positive territory, with Technology taking the lead by gaining an impressive +1.82%. On the other hand, Real Estate, at the bottom of the pack, still managed to see a respectable increase of +0.51%.

Conclusion 👋

To wrap it up, the first half of the year witnessed significant events that shaped the financial markets. The Supreme Court's rejection of President Biden's student loan forgiveness plan highlighted the limitations of executive authority and the potential impact on borrowers. Inflation pressures eased as consumer spending slowed, indicating a cautious approach by consumers amid rising prices. The stock market saw a surge, with technology companies leading the way, and Apple's market valuation reached a historic $3 trillion. Additionally, various developments such as settlements, dividend boosts by banks, exploration of strategic alternatives by pharmaceutical companies, regulatory requests for Bitcoin ETF filings, layoffs in the media industry, and new legislation affecting Google and Meta highlighted the evolving landscape of business and finance. Hope you all have a great weekend and see you next week!

Thank you all for signing up!

Will only work to do better for you all going forward. Our only goal is to add value to everyone’s trading with key levels and the ability of learning charts and price action.

Please Share Our Newsletter it will be much appreciated!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of TradingView. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.