Hello, traders! As the day winds down, we're delighted to have you here for a captivating rundown of the key happenings that have made their mark on the financial markets today.

Federal Reserve Chairman Powell Signals Potential Aggressive Interest Rate Hikes Amidst Strong Labor Market 💼📊

Federal Reserve Chairman Jerome Powell signaled the likelihood of multiple and potentially aggressive interest rate hikes due to a robust labor market. His remarks echoed the sentiment expressed during the June policy meeting, indicating a potential half-percentage point increase by the end of 2023. Since March 2022, the Federal Reserve has been gradually raising rates, and there is speculation about two additional hikes. While Powell cautioned about the possibility of an economic downturn resulting from these increases, he also emphasized the resilience of the banking industry despite recent challenges like the closure of Silicon Valley Bank.

23 U.S. Banks Pass Federal Reserve Stress Test 🏦📈

In a positive outcome for the banking industry, all 23 of the U.S. banks included in the Federal Reserve’s annual stress test have successfully cleared the test, even under a severe recession scenario. These banks demonstrated the ability to maintain minimum capital levels while continuing to provide lending support to consumers and corporations, despite projected losses of $541 billion. The stress test, initially introduced in response to the 2008 financial crisis, plays a crucial role in determining the amount of capital that banks can allocate to shareholders through activities like buybacks and dividends. However, despite the overall success, the banking sector remains under scrutiny, particularly following the collapse of three mid-sized banks earlier this year. In light of the stress test results, banks are expected to disclose their updated plans for buybacks and dividends after regular trading closes on Friday. Analysts anticipate that these plans will likely be conservative, given the uncertainties surrounding upcoming regulations and potential risks of a future recession.

Indexes 📈📉

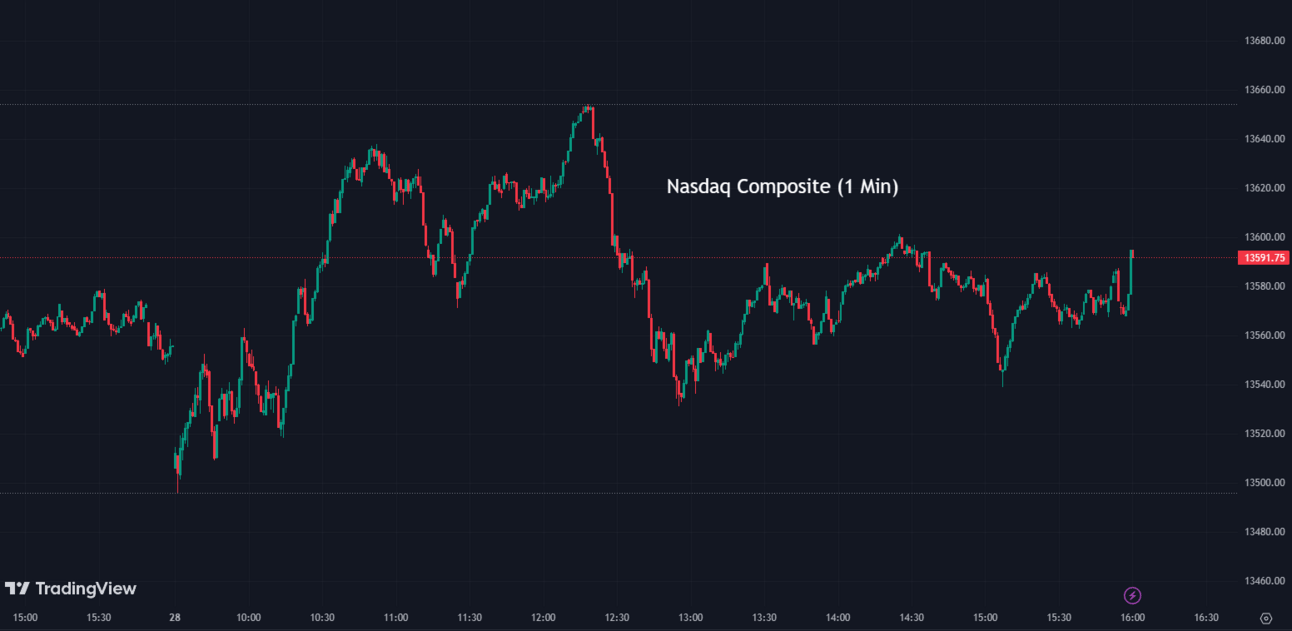

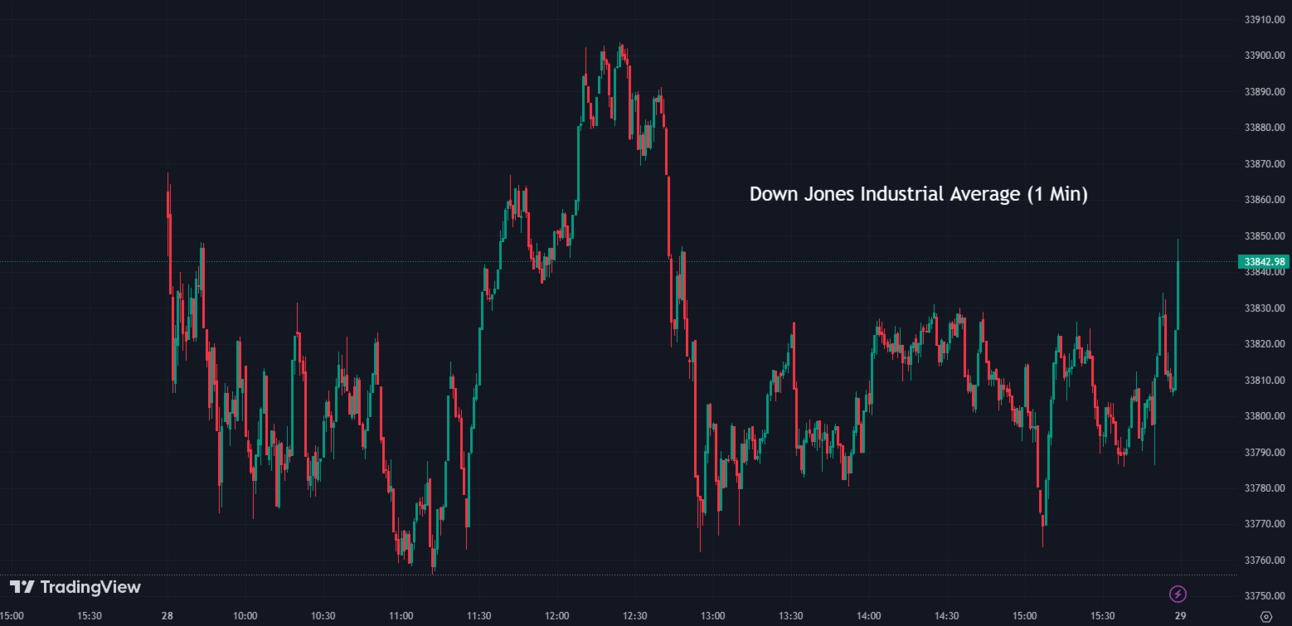

The indices were mixed today, the S&P 500 was little changed as traders closely analyzed the most recent remarks on the future pace of monetary policy by Federal Reserve Chair Jerome Powell. Now, let's explore how the market performed today...

The S&P 500 (SPX) was down -0.04% coming to a conclusion at 4,376

The Nasdaq Composite (IXIC) escalated by +0.27% to settle at 13,591

The Dow Jones Industrial Average (DJI) fell by -0.22% ending the day at 33,852

The Russell 2000 (RUT) increased by +0.47% to finish at 1,858

The Nasdaq-100 (NDX) rose +0.12% to conclude at 14,964

Wells Fargo Upgrades Pinterest, Citing Amazon Partnership and Revenue Growth Potential 💪🔝

Pinterest (PINS) received an upgrade to an "Overweight" rating by Wells Fargo analyst Ken Gawrelski due to its partnership with Amazon (AMZN), improved user engagement trends, and an increased ad load, which are expected to drive revenue growth beyond market expectations. The analyst raised the price target from $23 to $34, leading to a 6% increase in Pinterest's stock price to approximately $28. Pinterest's CEO, Bill Ready, has been focused on making the platform more shoppable and promoting it as a positive social media platform to attract more advertisers. Ready's leadership and strategic initiatives, such as outsourcing monetization and the partnership with Amazon, are anticipated to generate significant revenue and margin growth for the company.

PINS

28.13 ▲ +1.73 (+6.55%) Today

28.18 ▲ +0.04 (+0.14%) After Hours

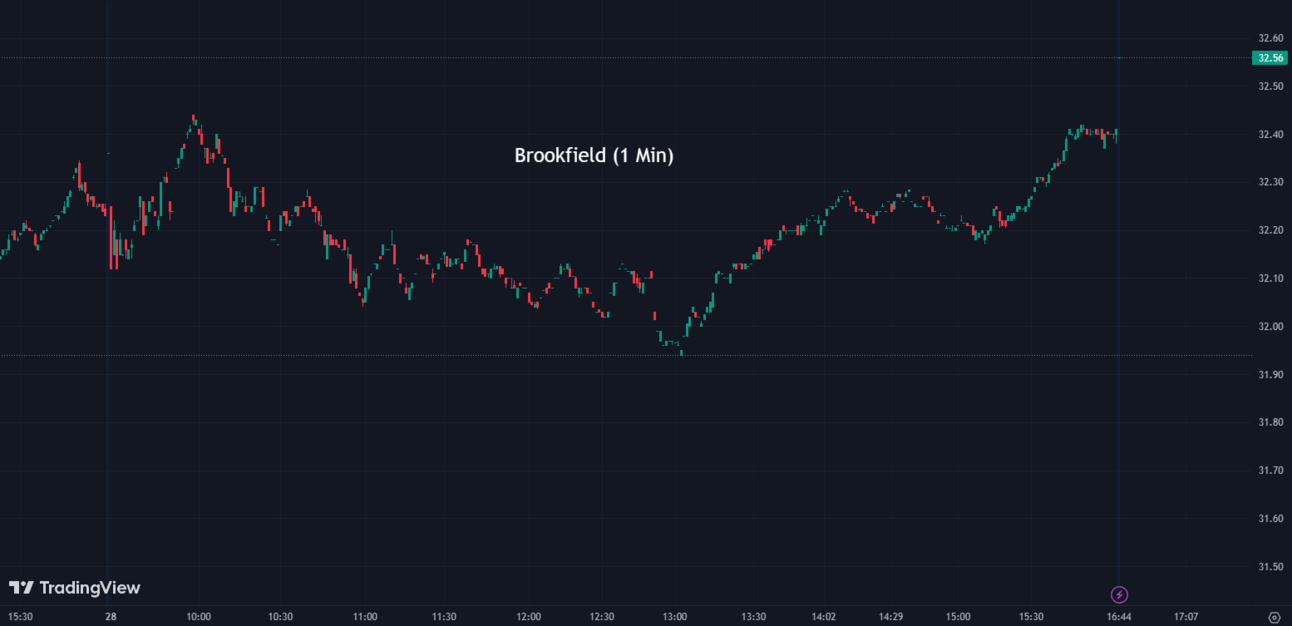

Brookfield Emerges as Top Acquirer with $50 Billion Worth of Deals, Focusing on Value-based Assets 💼🏢

Brookfield (BN), a Canadian investment firm, has emerged as the most active acquirer this year, announcing over $50 billion worth of purchases since January, three times the deal volume of its competitors. The firm executed two of the three largest global takeovers this year, including a $13 billion acquisition of Triton International Ltd and a $12 billion purchase of Australian utility Origin Energy Ltd. Recently, Brookfield made a $4.3 billion offer for American Equity Investment Life Holding Co this week, potentially increasing its assets under management to $900 billion. Brookfield's acquisition spree is driven by its focus on value-based assets that are still available at favorable prices.

BN:

32.42 ▲ +0.18 (+0.56%) Today

32.96 ▲ +0.55 (+1.69%) After Hours

Joby Aviation Soars as FAA Approval Enables Testing of Electric Air Taxis 🔋🚁

Joby Aviation (JOBY), witnessed a remarkable 40% surge in its shares after receiving crucial approval from the Federal Aviation Administration (FAA) to test its electrically powered air taxis. This milestone allows Joby to conduct tests on production-line air taxis, surpassing the previous limitation of demonstrating hand-made prototypes only. The FAA approval propels Joby toward its ambitious goal of producing "tens" of aircraft this year, with the broader aim of launching commercial flights by 2025. Joby's air taxis are uniquely designed for vertical lift-off, similar to a helicopter, and feature a flight mode resembling a small plane. They can handle a payload of 1,000 pounds, addressing prior concerns about their capacity. Toyota Motor, Joby's largest external investor, plans to further enhance its involvement by joining Joby's board and supporting its production capabilities, reinforcing Joby's promising trajectory.

JOBY:

8.96 ▲ +2.58 (+40.30%) Today

8.97 ▲ +0.01 (+0.11%) After Hours

Apple Approaches $3 Trillion Market Cap as Stock Surges to Record High 🍎💰

Apple (AAPL) experienced a significant surge in its stock price, reaching an intra-day record high and bringing the tech giant close to achieving a $3 trillion market capitalization. This increase occurred despite Apple's recent quarterly report indicating a decline in revenue and profits. However, the company's strong financial position, demonstrated through consistent stock buybacks and meeting analysts' expectations, has solidified its reputation as a safe investment during a period of global economic uncertainty. Apple's shares have seen an impressive 51% jump in 2023, driven in part by the successful launch of an expensive augmented-reality headset, seen as the company's riskiest move since the introduction of the iPhone. The upward trajectory of Apple's stock also reflects market optimism regarding the potential of artificial intelligence.

AAPL:

189.25 ▲ +1.19 (+0.63%) Today

189.19 ▼ -0.06 (-0.032%)After Hours

Potential U.S. Export Restrictions on Advanced Chips Could Impact Nvidia and AMD, Amplifying Tech Competition and Trade Tensions 🌐💻

The U.S. government is considering additional restrictions on the export of advanced computing chips to China, a move that could impact companies like Nvidia (NVDA) and AMD (AMD). Already, Nvidia had to create a modified version of its A100 chip for the Chinese market due to existing controls. The potential restrictions have led to a decline in the share prices of Nvidia, AMD, and other chipmakers, reflecting the broader context of increasing competition and concerns about cybersecurity between the United States and China.

These developments are fueled by concerns within U.S. political circles about the potential misuse of Nvidia's semiconductors, which play a crucial role in advancing artificial intelligence (AI). The Biden administration has engaged in discussions regarding stricter limits on exporting such chips to China. If these policies are implemented, they could have significant implications for the global race in AI development, potentially hindering China's ability to keep up with tech giants like Google and Microsoft-backed OpenAI, and escalating trade tensions between the two nations. Furthermore, these stricter export controls may pose challenges to mitigation efforts aimed at finding common ground.

NVDA:

411.17 ▼ -7.59 (-1.81%) Today

412.28 ▲ +1.11 (+0.27%) After Hours

AMD:

110.17 ▼ -0.22 (-0.20%) Today

110.38 ▲ +0.21 (+0.19%) After Hours

Overstock.com Acquires Bed Bath & Beyond's Intellectual Property and Digital Assets to Revive Falling Sales 💰📈

Overstock.com (OSTK), is undergoing a significant transformation. In a move aimed at reviving falling sales, Overstock has acquired the intellectual property and digital assets of Bed Bath & Beyond for $21.5 million. As a result, Overstock will now operate under the Bed Bath & Beyond brand, with the transition set to occur in the coming weeks. The relaunch of the Bed Bath & Beyond website will begin in Canada, followed by a rollout in the United States. This strategic decision comes as Overstock reported a decline in revenue in Q1 2023. Despite this, Overstock's shares have experienced a notable surge this year. Notably, Overstock will not be acquiring any physical Bed Bath & Beyond stores as part of this agreement.

OSTK:

25.54 ▲ +1.47 (+6.11%) Today

26.98 ▲ +1.44 (+5.64%) After Hours

Warner Bros. Discovery Enlists Spielberg and Scorsese for Film Curation at TCM 🎬🎞️

Warner Bros. Discovery (WBD) has made a strategic move by enlisting renowned filmmakers Steven Spielberg and Martin Scorsese to provide input on film curation at Turner Classic Movies (TCM), the cable-TV network. This initiative follows a series of layoffs and management changes at TCM, which raised concerns among fans about the network's future. Spielberg and Scorsese will collaborate closely with Warner Bros. Motion Picture Group chiefs Mike De Luca and Pam Abdy, leveraging their vast cinematic experience. In a show of support for TCM, Warner Bros. Discovery has reportedly increased its investment in the network by 30%, demonstrating a commitment to preserving the classic film channel's legacy.

WBD:

12.45 ▲ +0.18 (+1.47%) Today

12.42 ▼ -0.03 (-0.24%) After Hours

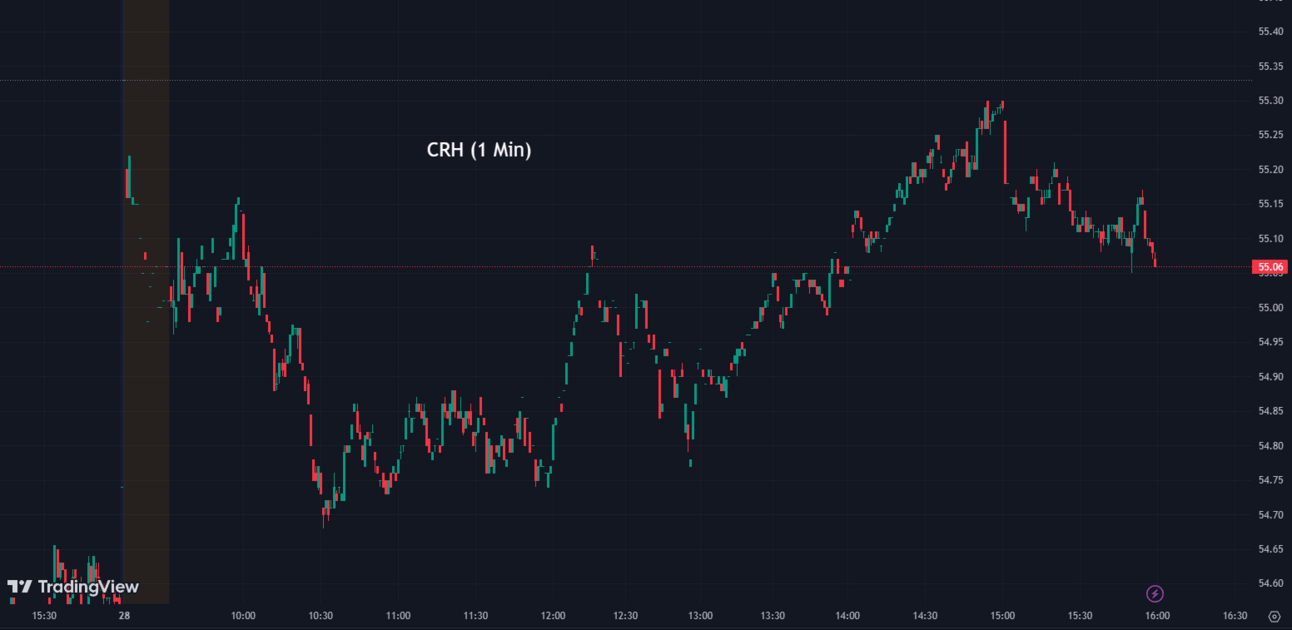

CRH's Dominance in Asphalt Road Surfacing and the Potential Impact of Infrastructure Investment 🚧🛣️

Approximately 2.8 million miles or 94% of U.S. roads are surfaced with asphalt, largely due to the significant presence of Irish company CRH (CRH) in this sector. In 2022, CRH generated $10.2 billion from paving roads in the U.S. and Canada. The recent passing of the $1.2 trillion Infrastructure Investment and Jobs Act is expected to increase federal funding for highways by 40% to 50%, signaling a potential golden age for infrastructure, according to Randy Lake, COO of CRH. To fulfill environmental commitments, CRH and other companies are transitioning toward more sustainable practices, such as producing warm mix asphalt with lower carbon emissions and increasing the usage of recycled asphalt pavement. However, transportation agencies remain cautious about using more than 25% recycled pavement due to past experiences of accelerated degradation. The industry aims to raise the recycled asphalt content to about 50% to meet sustainability targets while reducing costs.

CRH:

55.06 ▲ +0.49 (+0.90%) Today

55.88 ▲ +0.82 (+1.49%) After Hours

Fanatics Makes Bold Moves for PointsBet 🔥⚽️

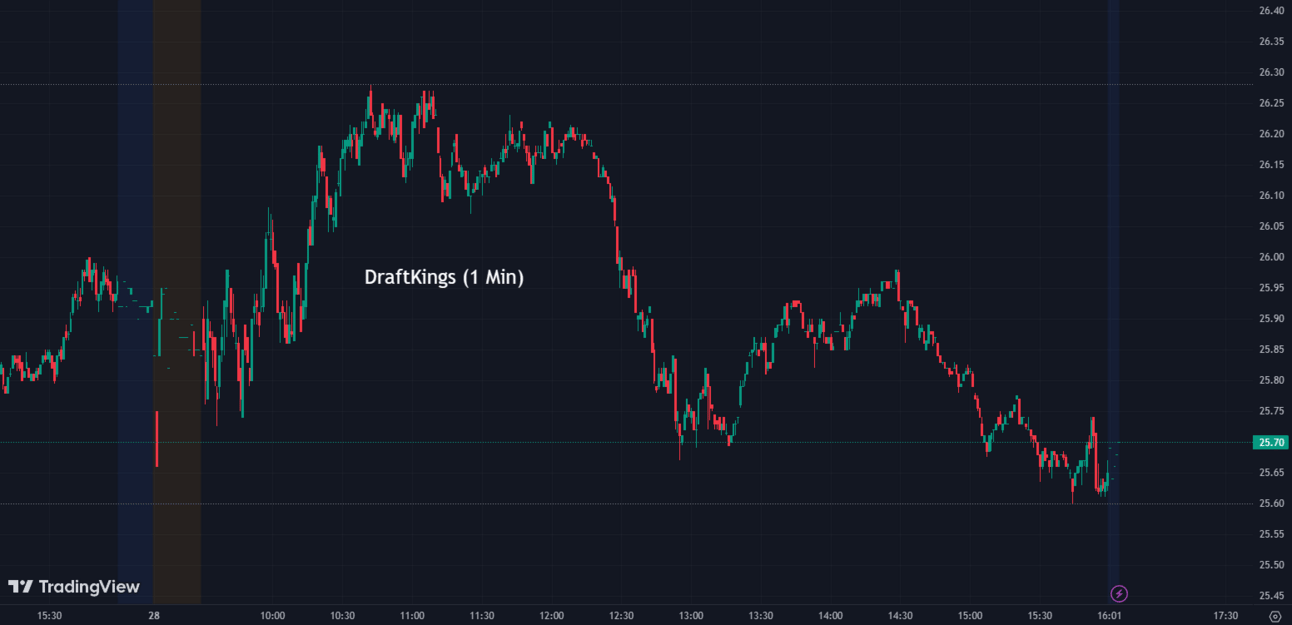

Sports platform giant Fanatics has raised its bid by 50% to $225 million in an attempt to acquire PointsBet's U.S. assets, outbidding DraftKings' (DKNG) non-binding offer of $195 million. The improved proposal has garnered unanimous support from PointsBet's board, with a formal vote scheduled for Thursday night. If approved by PointsBet's shareholders and regulators, the deal will provide Fanatics with valuable U.S. real estate by granting access to 15 states where PointsBet, the seventh-largest U.S. sports betting operator, currently operates. Fanatics CEO Michael Rubin views this proposed offer as a strategic move to strengthen the company's market position and counter competition from DraftKings.

DKNG:

25.66 ▼ -0.30 (-1.16%) Today

25.68 ▲ +0.021 (+0.08%) After Hours

After Hour Movers 🌃🌠

Micron Technology (MU) reported Q3 FY2023 results that exceeded analyst expectations, with revenue reaching $3.75 billion, although it marked a significant year-on-year decline. The company provided guidance for the next quarter, expecting revenue of around $3.9 billion, aligning with analyst estimates. Despite experiencing a GAAP loss of $1.9 billion, Micron's CEO expressed confidence in the industry's recovery, anticipating improved margins as the supply-demand balance gradually restores. However, the recent decision by the Cyberspace Administration of China was highlighted as a headwind impacting their outlook. Overall, Micron's results were mixed, but the stock reacted positively, indicating potential market optimism.

MU:

67.07 ▲ +0.28 (+0.42%) Today

67.81 ▲ +0.74 (+1.10%) After Hours

H.B. Fuller (FUL) reported fiscal second-quarter earnings of $40.4 million, equivalent to 73 cents per share. However, when adjusted for one-time gains and costs, earnings stood at 93 cents per share. Unfortunately, these results fell short of Wall Street expectations, as analysts had predicted earnings of $1.01 per share. The company's revenue for the quarter was $898.2 million, which also missed Street forecasts. Three analysts surveyed by Zacks had expected revenue of $964.2 million. Looking ahead, H.B. Fuller anticipates full-year earnings in the range of $3.80 to $4.20 per share.

FUL:

64.67 ▲ +0.31 (+0.48%) Today

64.30 ▼ -0.34 (-0.53%) After Hours

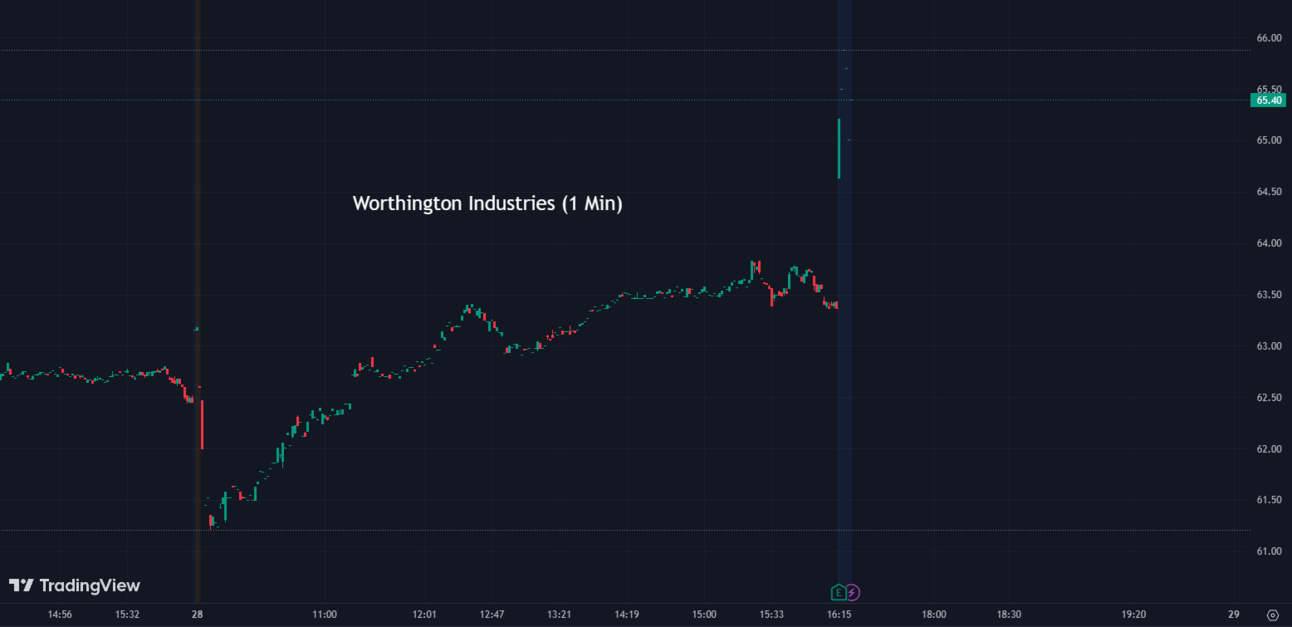

Worthington Industries (WOR) announced a profit of $129.9 million, or $2.61 per share, for its fiscal fourth quarter. When adjusted for one-time gains and costs, earnings were $2.74 per share. The Columbus, Ohio-based metal manufacturer reported revenue of $1.23 billion for the period. For the full year, the company's profit was $256.5 million, or $5.19 per share, with revenue totaling $4.92 billion.

WOR:

63.35 ▲ +0.88 (+1.41%) Today

65.30 ▲ +1.93 (+3.05%) After Hours

BlackBerry (BB) reported its first-quarter fiscal 2024 financial results, with total revenue of $373 million. The company saw sequential revenue growth in its Cybersecurity business unit, driven by increased billings and pipeline in core verticals, particularly government. However, there were temporary delays in new IoT programs impacting revenue. BlackBerry remains optimistic about long-term trends supporting its IoT and Cybersecurity units and expects to achieve revenue consensus for both this fiscal year. Notable announcements included completing a patent sale, releasing an advanced operating system, and expanding its cybersecurity solutions portfolio.

BB:

5.00 ▼ -0.055 (-1.09%) Today

5.39 ▲ +0.38 (+7.58%) After Hours

American Outdoor Brands (AOUT) saw its shares rise over 8% in after-hours trading as the company reported quarterly sales that surpassed expectations and delivered a surprise adjusted earnings per share (EPS). Despite an 8% drop in sales to $42.2 million, the maker of outdoor products and accessories managed to narrow its loss to $3.8 million, or 29 cents per share, compared to a loss of $76.7 million, or $5.71 per share, in the same quarter last year. Adjusted for one-time items, the company posted earnings of 6 cents per share. Chief Financial Officer Andrew Fulmer expressed confidence in the company's brands and anticipated potential net sales growth of up to 3.5% for fiscal 2024 compared to fiscal 2023.

AOUT:

7.97 ▲ +0.33 (+4.32%) Today

8.61 ▲ +0.64 (+8.03%) After Hours

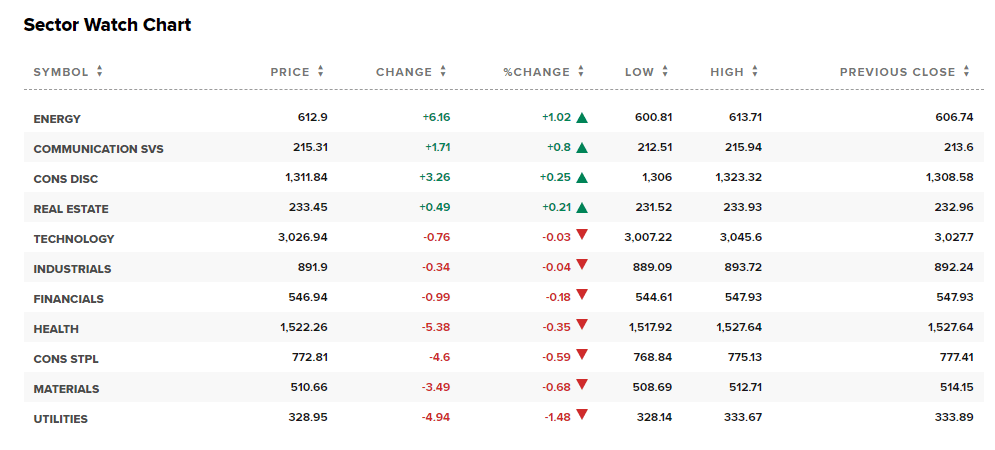

Sectors

Out of the 11 sectors, 4 closed in positive territory today, with Energy leading the way with a gain of +1.02%, while Utilities saw a decline of -1.48%.

Conclusion 👋

To wrap it up, Federal Reserve Chairman Jerome Powell's signaling of potential aggressive interest rate hikes amidst a strong labor market reflects the central bank's cautious approach to managing inflationary pressures. The successful passing of the Federal Reserve's stress test by all 23 U.S. banks indicates the sector's resilience and ability to withstand adverse economic scenarios. The mixed performance of the stock market indices reflects the uncertainty surrounding future monetary policy decisions. Upgrades in Pinterest's rating and Overstock.com's acquisition of Bed Bath & Beyond's assets aim to drive growth and revive falling sales. Joby Aviation's FAA approval marks a significant milestone in the development of electric air taxis. Apple's surge in stock price reflects market optimism despite a decline in revenue. Potential U.S. export restrictions on advanced chips may impact companies like Nvidia and AMD, intensifying competition and trade tensions with China. Warner Bros. Discovery enlisting Spielberg and Scorsese strengthens Turner Classic Movies' future, and CRH's dominance in asphalt road surfacing aligns with the potential growth in infrastructure investments. Fanatics' bid for PointsBet competes with DraftKings, and after-hours movers show mixed results for companies like Micron Technology, H.B. Fuller, and Worthington Industries. Finally, BlackBerry's financial results highlight sequential revenue growth in its Cybersecurity unit, and American Outdoor Brands' positive earnings surprise leads to a rise in share price.

Thank you all for signing up!

Will only work to do better for you all going forward. Our only goal is to add value to everyone’s trading with key levels and the ability of learning charts and price action.

Please Share Our Newsletter it will be much appreciated!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of TradingView. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.