Hello, traders! As the day draws to a close, we warmly welcome you to join us for an insightful recap of the noteworthy events that have shaped the financial markets today.

Indexes 📈⬆️

On Tuesday, after a seven-day decline, the Dow Jones Industrial Average experienced an upward movement as Wall Street prepared for the conclusion of the first half of the year, leading investors to reenter the tech stock market. Now, let's explore how the market performed today...

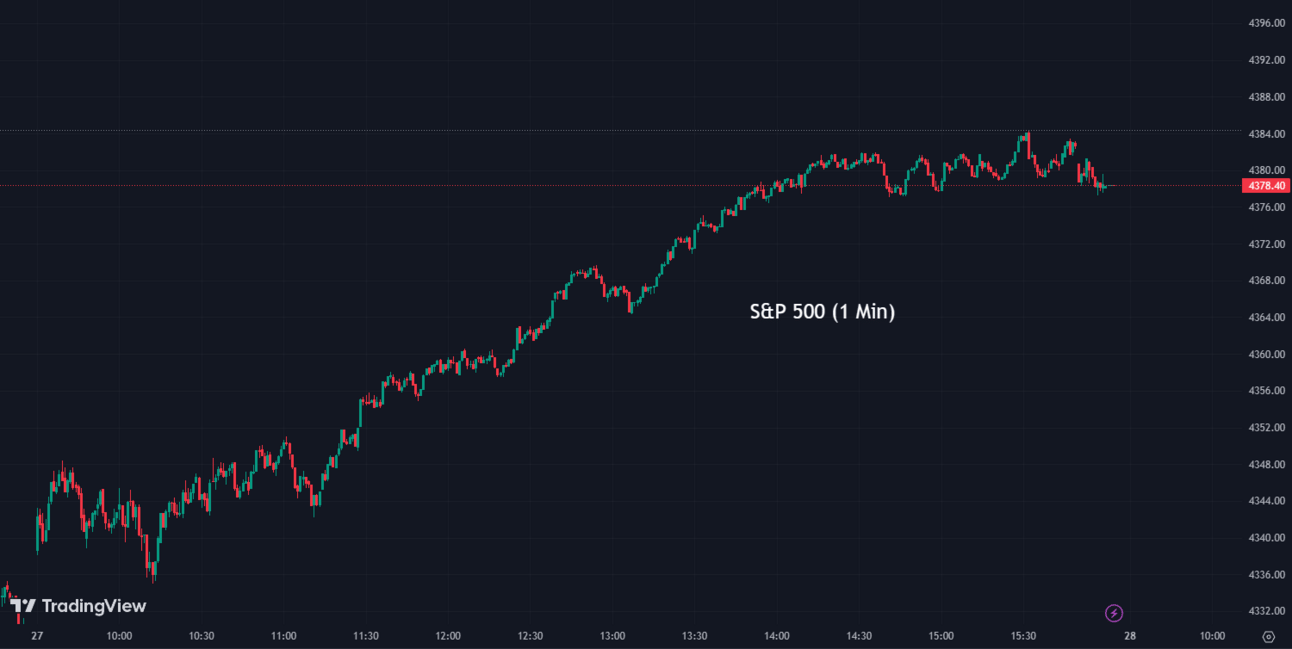

The S&P 500 (SPX) was up +1.15% coming to a conclusion at 4,378

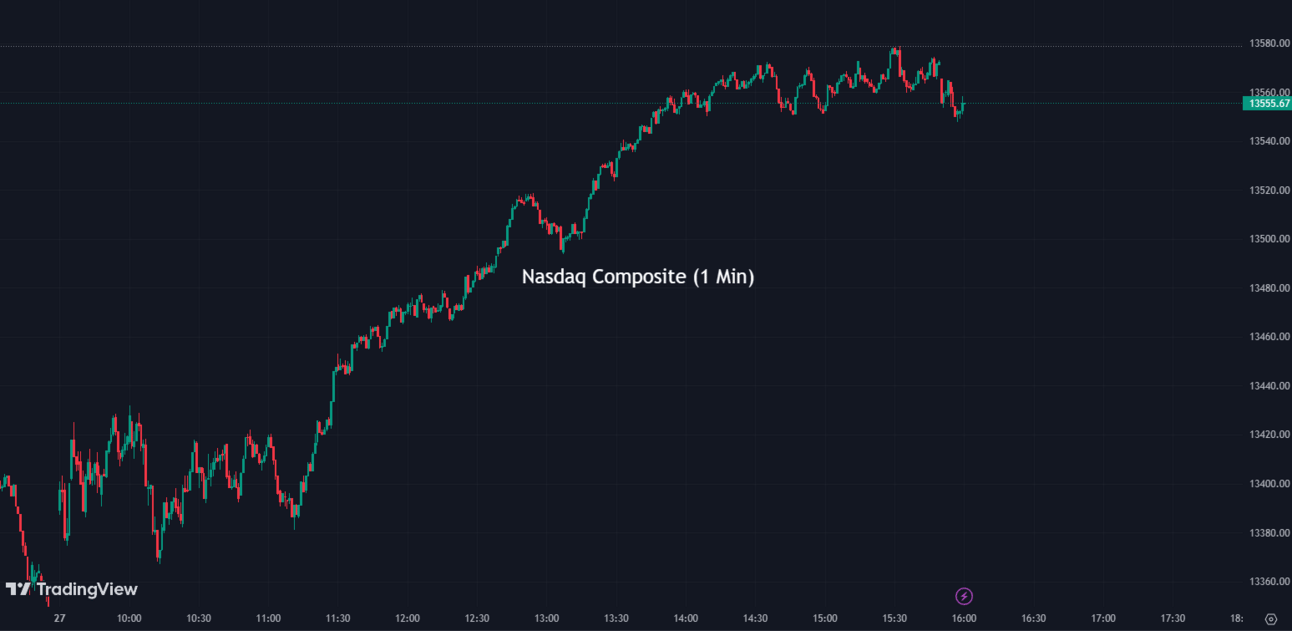

The Nasdaq Composite (IXIC) escalated by +1.65% to settle at 13,555

The Dow Jones Industrial Average (DJI) climbed +0.63% ending the day at 34,066

The Russell 2000 (RUT) increased by +1.46% to finish at 1,849

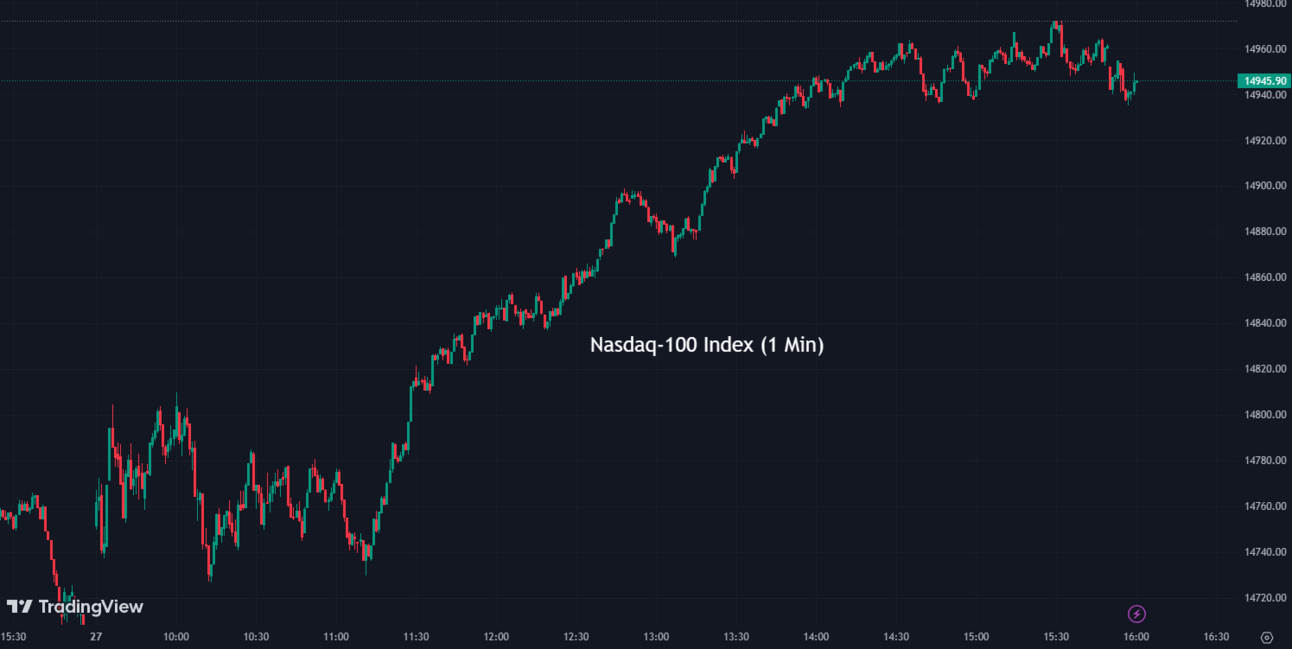

The Nasdaq-100 (NDX) rose +1.75% to conclude at 14,945

New Law Combats Online Retail Theft and Counterfeits, Mandates Transparency for Online Marketplaces 🛍️🔍

The Inform Consumers Act, a new law aimed at addressing organized retail theft and counterfeit sales on online platforms, has become effective today. The bipartisan bill mandates online marketplaces like Amazon (AMZN) and eBay (EBAY) to verify and disclose information about high-volume third-party sellers to prevent the sale of stolen or harmful products. Violations can result in fines exceeding $50,000 per instance. The act was passed in response to concerns raised by retailers and trade groups regarding the increase in retail theft facilitated by lenient regulations for online third-party sellers. The act aims to increase transparency and hold these platforms accountable by empowering the Federal Trade Commission and state attorneys general. However, critics argue that the act may impose burdens on small businesses. Platforms will need to collect, verify, and disclose information such as contact details, bank account information, and tax IDs for third-party sellers meeting specific transaction volumes to comply with the new requirements.

AMZN:

129.18 ▲ +1.85 (+1.45%) Today

29.10 ▼ -0.08 (-0.062%) After Hours

EBAY:

44.47 ▲ +1.01 (+2.32%) Today

43.46 ▼ -1.01 (-2.27%) After Hours

Hello once again 👋! Before we continue with tonight's recap, I wanted to share some great news. We now have a new newsletter available, designed specifically to assist you all in growing financially free. It's a wonderful way to stay informed and engaged. Even better, as a gesture of gratitude, we are offering a limited-time deal. You can now enjoy a 20% lifetime discount on your subscription!

Volvo Secures Access to Tesla Charging Stations in Landmark EV Partnership 🔌🚗

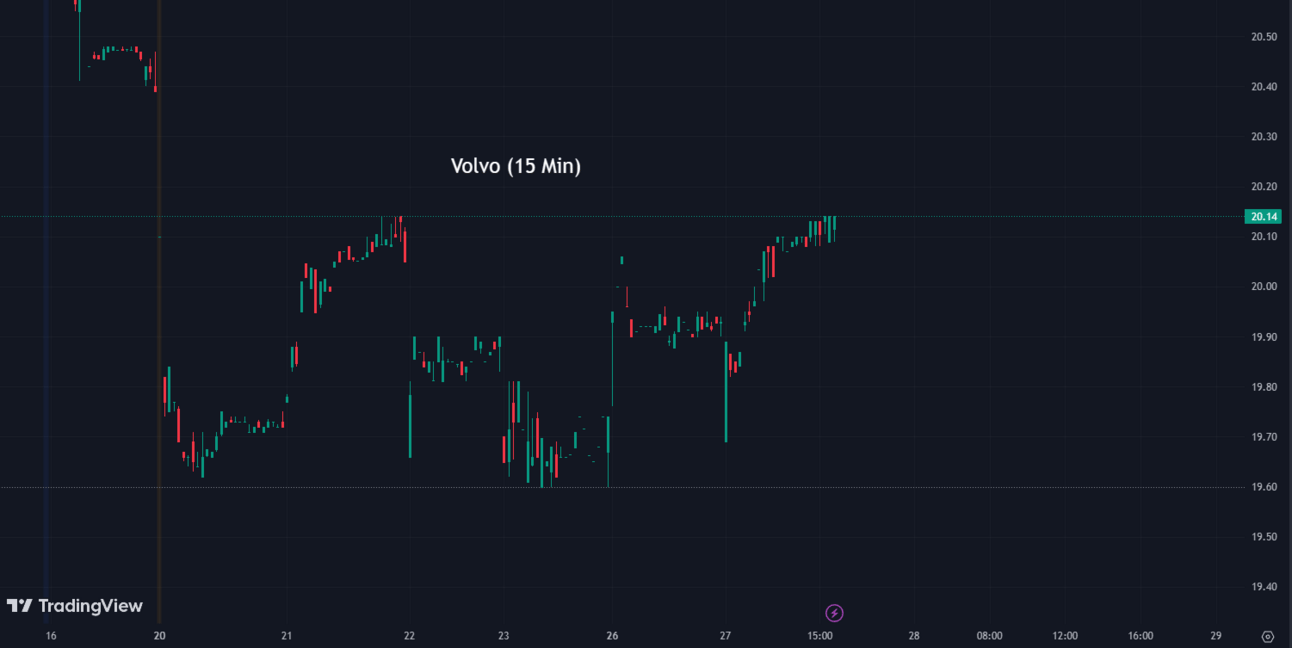

Volvo Cars (VLVLY), has signed a significant agreement with Tesla (TSLA) that will grant Volvo's electric vehicle drivers in North America access to approximately 12,000 Tesla charging stations. The deal will come into effect next year and involves fitting Volvo's EVs with Tesla-designed plugs, known as the North American Charging Standard (NACS), starting in 2025. This agreement aligns with similar recent moves by Ford, General Motors, and Rivian. Volvo becomes the first European EV manufacturer to commit to the NACS charging standard for its EVs in North America, demonstrating its commitment to facilitating a seamless EV driving experience. Volvo EV drivers will be able to use Tesla's Superchargers with an adapter starting in 2024, and the locations of Tesla charging stations will be included in Volvo's proprietary app. This deal reflects Tesla's decision last year to make its NACS charging plug design available for anyone to adopt.

VLVLY:

20.14 ▲ +0.21 (+1.06%) Today

No movement in after-hours trading

TSLA:

250.21 ▲ +9.16 (+3.80%) Today

250.33 ▲ +0.12 (+0.048%) After Hours

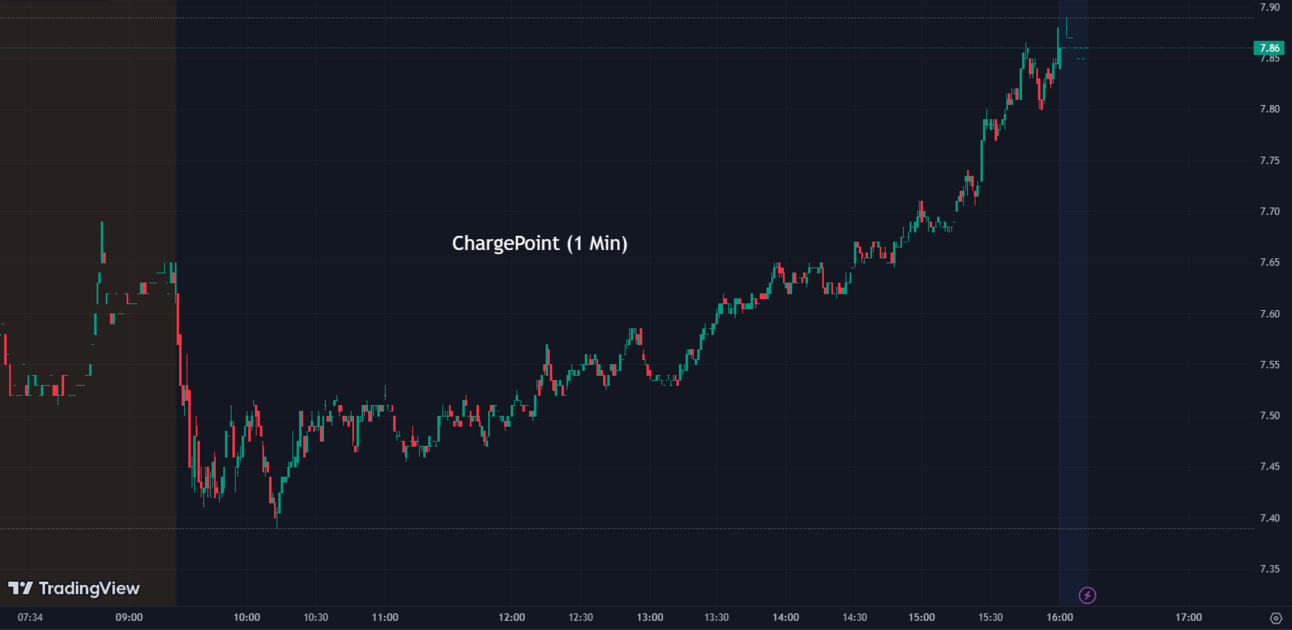

ChargePoint Embraces Tesla's NACS Standard for Enhanced Electric Vehicle Charging Solutions ⚡🔋

ChargePoint (CHPT), a leading provider of electric vehicle charging solutions, has announced its support for NACS, the charging standard developed by Tesla. This decision means that ChargePoint will offer NACS connector options for new orders and customers with installed CP6000, CPE 250, or Express Plus products. According to ChargePoint, this development will allow customers to meet the charging requirements of any electric vehicle in any parking space.

CHPT:

7.88 ▲ +0.46 (+6.13%) Today

7.84 ▼ -0.03 (-0.38%) After Hours

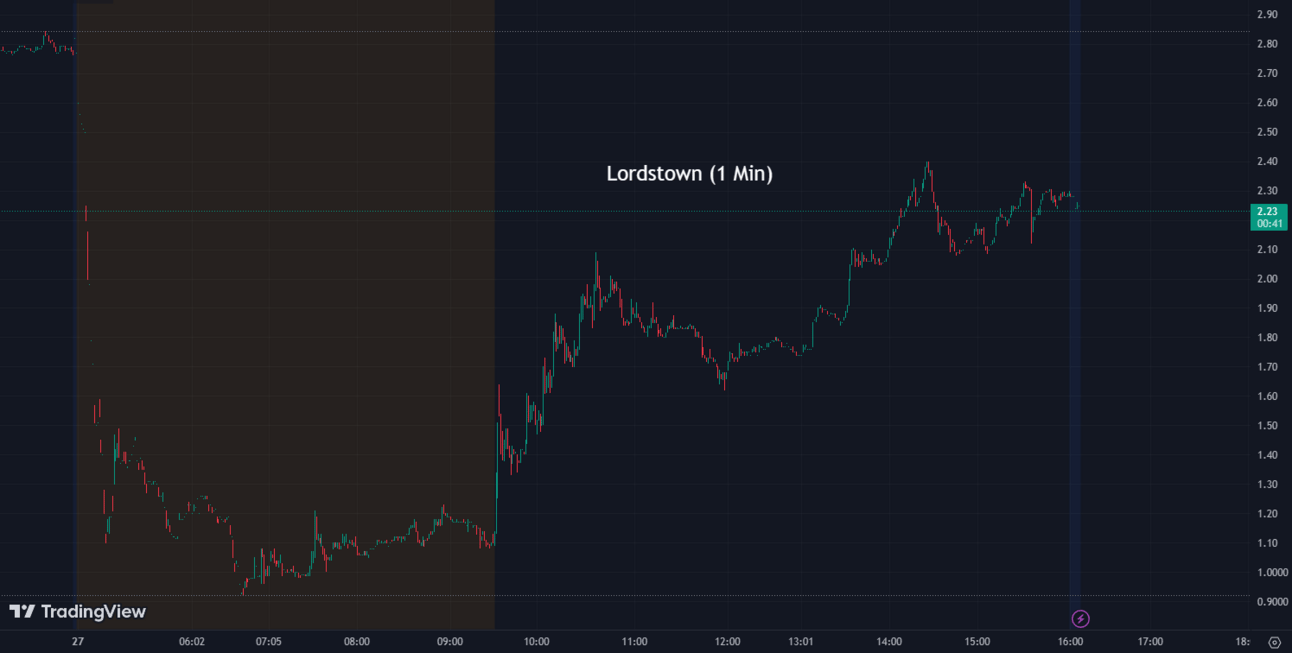

Lordstown Motors Files for Chapter 11 Bankruptcy Amidst Dispute with Foxconn and Production Suspension 💼⛔

Struggling electric truck manufacturer Lordstown Motors (RIDE) has filed for Chapter 11 bankruptcy protection and intends to sell its assets. The company's financial troubles have been exacerbated by a dispute with Taiwanese manufacturer, Foxconn, over-promised investments. Lordstown has accused Foxconn of fraud and failing to fulfill an agreement to invest $170 million in the company. Consequently, Lordstown's shares have dropped by approximately 17%. Despite receiving regulatory approval for Foxconn's investment in April, the payment was not received, leading to a financial crunch and the suspension of production for the company's Endurance electric pickup.

RIDE:

2.29 ▼ -0.47 (-17.18%) Today

2.24 ▼ -0.05 (-2.18%) After Hours

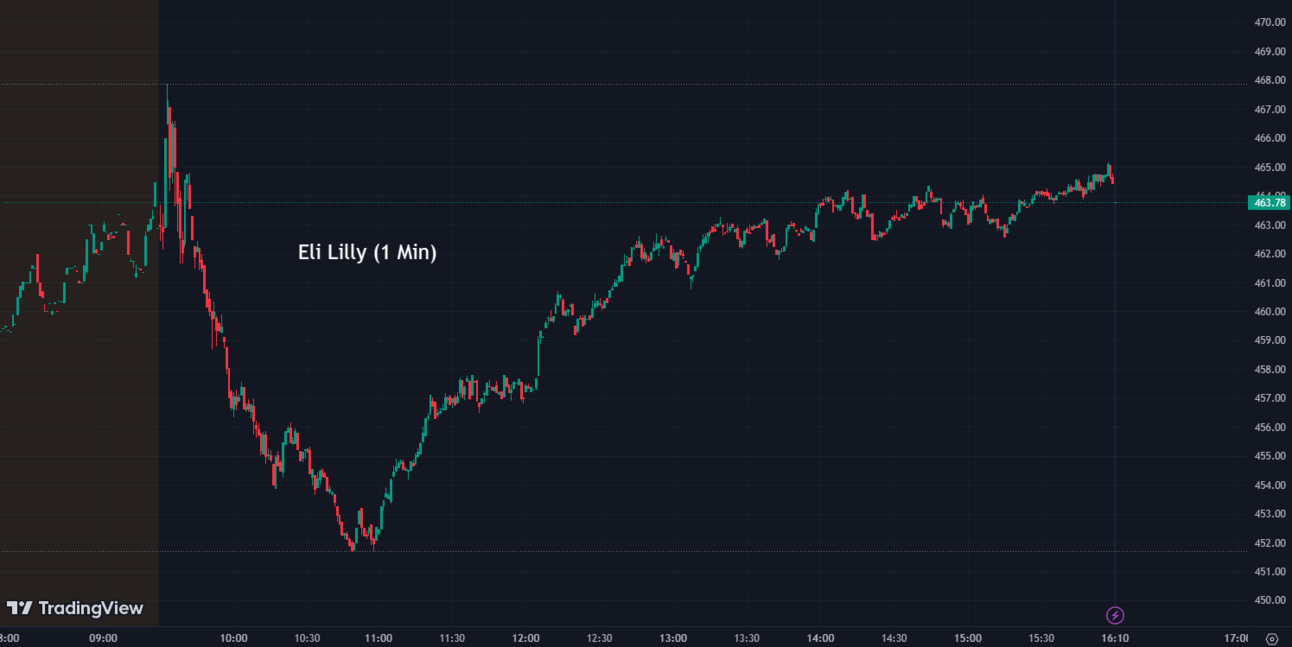

Eli Lilly's Groundbreaking Obesity Drug Shows Remarkable Weight Loss Results 🔬💊

Eli Lilly's (LLY) experimental obesity drug, retatrutide, has demonstrated remarkable results, with patients losing up to 24% of their weight after nearly a year of treatment. This represents the most significant reduction observed in the obesity drug space to date. The mid-stage clinical trial involved 338 obese or overweight adults who received either a placebo or retatrutide weekly. Patients receiving retatrutide experienced an average weight loss of 17.5% after 24 weeks and 24.2% after 48 weeks. Researchers noted that the average weight loss did not appear to plateau even after 48 weeks, suggesting that longer-term studies may yield even more substantial results. Retatrutide, like Eli Lilly's other obesity drug, Mounjaro, and Novo Nordisk's, Wegovy, works by modifying patients' eating behaviors and reducing appetite by mimicking certain gut hormones. However, retatrutide mimics three different hunger-regulating hormones, leading to more potent effects on appetite and food satisfaction.

LLY:

464.65 ▲ +11.89 (+2.63%) Today

452.76 ▼ -11.74 (-2.53%) After Hours

$8.9 Billion Johnson & Johnson Settlement Threatened by Talc Lawsuits and Bankruptcy Filings ⚖️🧴

A proposed $8.9 billion settlement by Johnson & Johnson (JNJ) is at risk this week due to thousands of lawsuits alleging that its talc products cause cancer. The focus is on whether a J&J subsidiary can resolve the lawsuits by filing for bankruptcy for the second time. The first attempt was dismissed because J&J subsidiary LTL Management was not considered to be insufficient financial distress to warrant bankruptcy protection. The decision on whether to dismiss LTL's second bankruptcy filing is expected by early August.

JNJ:

163.27 ▼ -0.36 (-0.22%) Today

163.59 ▲ +0.30 (+0.18%) After Hours

Walgreens Warns of Lower Profits Amid Declining Vaccine Demand and Weaker Consumer Spending 🔻💉

Walgreens Boots Alliance (WBA) has issued a warning that its profits are likely to be lower than initially anticipated due to declining demand for COVID-19 vaccines and weakening consumer spending. In the most recent quarter, Walgreens administered 800,000 COVID-19 vaccines, which represents an 83% decline compared to the same period last year. As a result, Walgreens has revised its full-year adjusted earnings per share guidance. The company's stock value dropped nearly 10% following this announcement.

WBA:

28.64 ▼ -2.95 (-9.34%) Today

28.67 ▲ +0.03 (+0.10%) After Hours

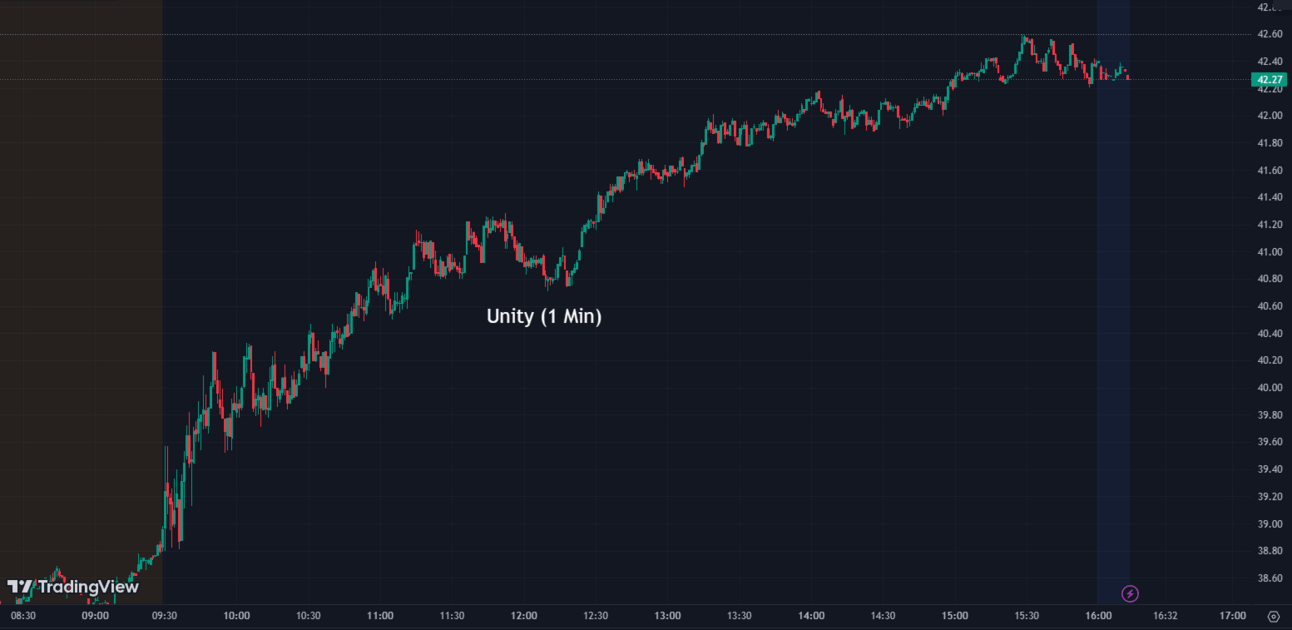

Unity Soars as it Unveils AI Marketplace for Game Development Advancements 🎮🤖

Unity (U), a gaming tool maker, witnessed a 15% increase in its shares after announcing the launch of a marketplace for artificial intelligence software. The AI software available on the market is expected to accelerate and enhance game development. This move aligns with Unity's optimism about the potential of AI in the gaming industry.

U:

42.40 ▲ +5.67 (+15.44%) Today

42.45 ▲ +0.07 (+0.17%) After Hours

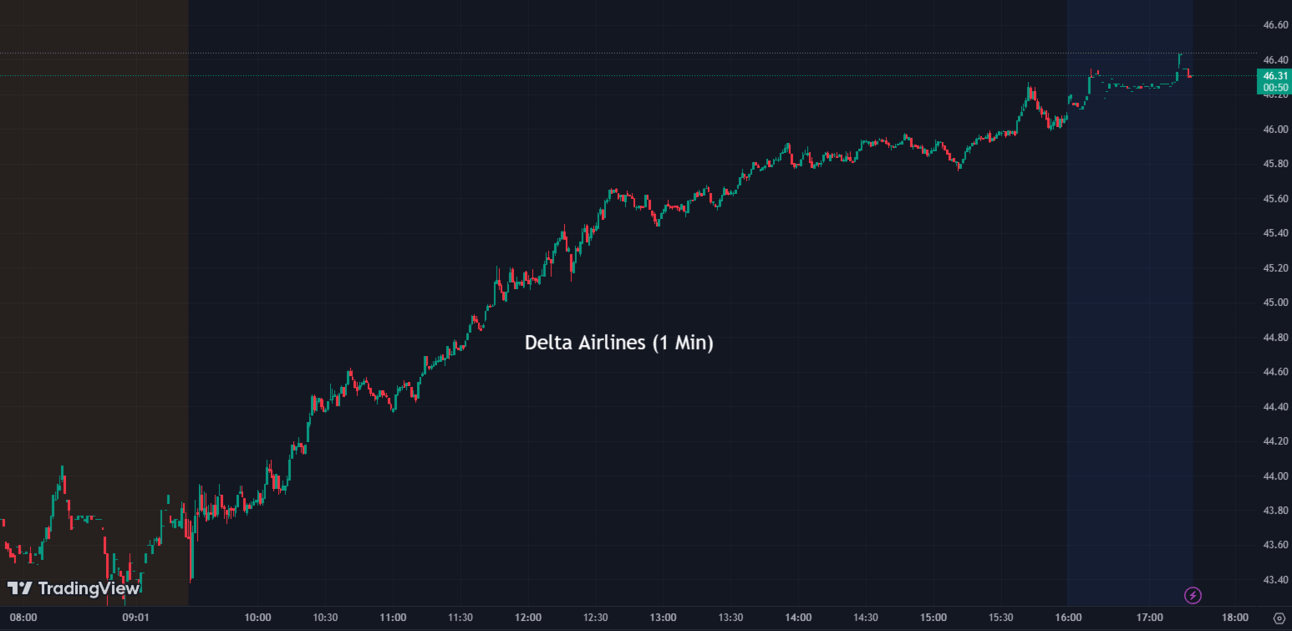

Airline Sector Soars ✈️📈

The airline sector is experiencing a significant rally, with Delta Airlines (DAL) leading the way. Delta has raised its financial outlook for 2023, expecting an operating profit margin at the higher end of the previously announced 10% to 12% range. The company also anticipates reaching the upper limit of its earnings forecast of $5 to $6 per share and generating around $3 billion in free cash flow. This positive outlook has led to a 6% increase in Delta's shares. Other airlines like United (UAL) and American (AAL) have also benefited from this positive sentiment along with JetBlue's (JBLU) shares surging by 8.82%, potentially in response to Delta's optimistic projections.

DAL:

46.09 ▲ +2.95 (+6.84%) Today

46.25 ▲ +0.16 (+0.35%) After Hours

UAL:

56.03 ▲ +2.71 (+5.08%) Today

56.14 ▲ +0.11 (+0.20%) After Hours

AAL:

17.35 ▲ +0.91 (+5.54%) Today

17.34 ▼ -0.0085 (-0.049%) After Hours

JBLU:

8.76 ▲ +0.71 (+8.82%) Today

8.75 ▼ -0.01 (-0.11%) After Hours

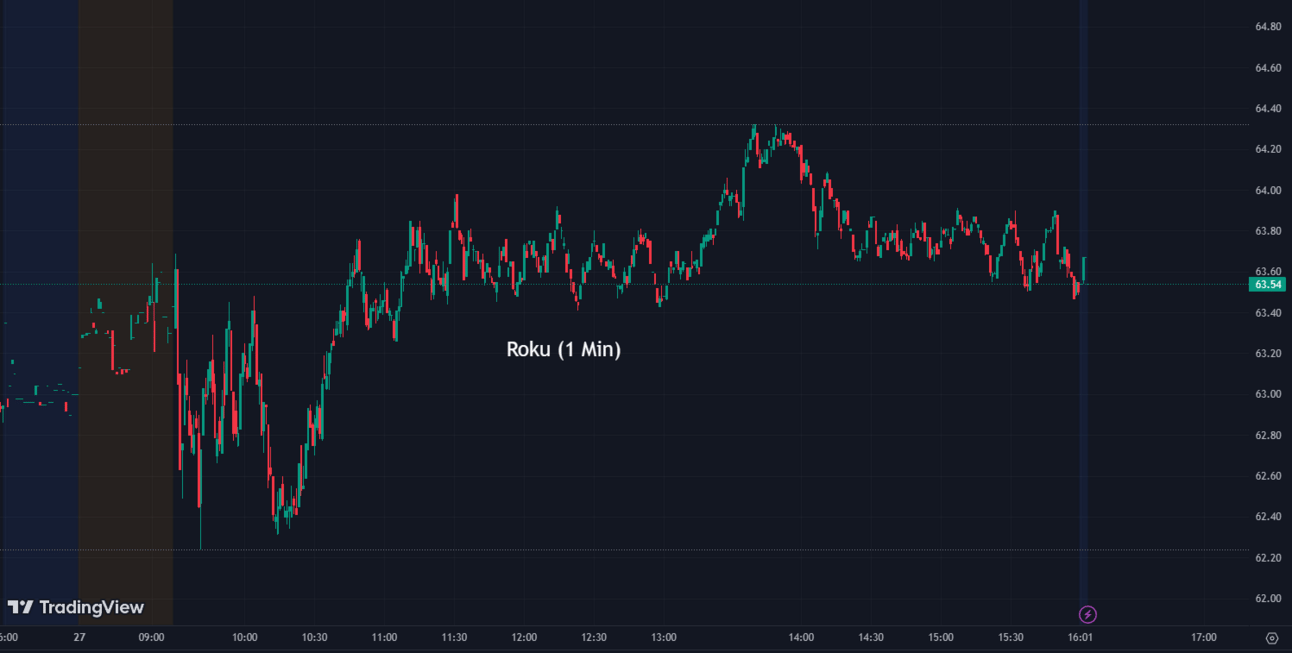

Roku Secures Milestone Deal as U.S. Streaming Home for Formula E Auto Racing 🏎️📺

Roku (ROKU), the streaming platform, has secured its first-ever live sports rights package deal by becoming the U.S. streaming home for the electric vehicle-powered auto racing series, Formula E. Starting with the upcoming season, the Roku channel will offer both live coverage and on-demand replays of 11 races. Starting in January, CBS will broadcast five races live, and they will also be available for streaming on Paramount+ via Roku. This partnership signifies Roku's entry into live sports broadcasting and provides Formula E with an opportunity to expand its U.S. audience.

ROKU:

63.51 ▲ +0.57 (+0.91%) Today

63.59 ▲ +0.08 (+0.13%) After Hours

Costco Implements Stricter Rules on Membership Card Sharing, Cracks Down on Abuse ����

Costco (COST) has implemented stricter rules against membership card sharing by checking for photo IDs at self-checkout registers, even for customers using someone else's membership card. This increased enforcement is a response to the rise in card-sharing abuse following the expansion of self-checkout services in more Costco stores. The company said in a statement, “We don’t feel it’s right that non-members receive the same benefits and pricing as our members.” Costco's business model heavily relies on membership fees, which cover company expenses and enable low pricing. The crackdown on card-sharing abuse comes as membership-based warehouse clubs continue to attract more customers, although they face challenges from changing consumer spending habits focused on experiences like travel and dining out.

COST:

530.33 ▲ +6.91 (+1.32%) Today

529.16 ▼ -1.17 (-0.22%) After Hours

Yellow Stock Plummets as $137 Million Lawsuit against Teamsters Threatens Survival 💰📉

Yellow (YELL), a less-than-truckload carrier, experienced a significant drop in its stock price following the announcement of a $137 million breach of contract lawsuit against the International Brotherhood of Teamsters. Yellow Corp. claims that the union obstructed proposed changes crucial to the company's survival, resulting in a loss of $137.3 million in adjusted EBITDA and a $1.5 billion decline in enterprise value. The proposed changes, part of an overhaul called "One Yellow," include the consolidation of its four LTL operating companies, closure of excess terminals, and redefinition of work rules for drivers, all of which the union rejected. The carrier warned that it could run out of cash by mid-July, potentially leading to liquidation. As a result of the announcement, Yellow Corp.'s shares dropped by 21%.

YELL:

0.99 ▼ -0.28 (-21.75%) Today

0.99 ▼ -0.0038 (-0.38%) After Hours

UBS Announces Massive Job Cuts at Credit Suisse Following Emergency Takeover 🔴💼

UBS Group AG (UBS) plans to cut over half of Credit Suisse Group AG's workforce following an emergency takeover. The job cuts will primarily affect employees in the investment banking sector in London, New York, and certain parts of Asia. The reductions will occur in three rounds scheduled for July, September, and October. Following the rescue of Credit Suisse, UBS aims to save around $6 billion in staff costs by reducing the combined headcount by approximately 30%, equivalent to 35,000 employees. However, UBS's plans have already resulted in the departure of top-performing bankers, who have either left or been poached by competitors.

UBS:

19.89 ▲ +0.33 (+1.69%) Today

19.85 ▼ -0.03 (-0.15%) After Hours

After Hour Movers 🏃♂️💥

Theriva Biologics (TOVX) announced that its lead clinical candidate, VCN-01, has been granted orphan drug designation by the U.S. Food and Drug Administration (FDA) for the treatment of pancreatic cancer. VCN-01 is currently being evaluated in an ongoing clinical study, where it is administered intravenously in combination with standard-of-care chemotherapy as a first-line therapy for specific pancreatic cancer patients. This designation follows the FDA's previous grant of orphan drug designation to VCN-01 for the treatment of retinoblastoma, a rare eye cancer. Orphan drug designation is granted by the FDA to therapies that address rare diseases or conditions.

TOVX:

0.82 ▲ +0.11 (+15.49%) Today

1.35 ▲ +0.52 (+63.12%) After Hours

Jefferies Financial Group (JEF) reported its Q2 earnings, which missed expectations. The decline was attributed to subdued M&A activity and low capital market issuances. The company expressed confidence in realizing value from its merchant banking portfolio. Jefferies increased its share repurchase authorization to $250 million. Q2 GAAP EPS was $0.05, revenue was $1.04 billion, and the annualized return on adjusted tangible equity was 0.7%.

JEF:

31.93 ▲ +0.41 (+1.28%) Today

31.69 ▼ -0.25 (-0.78%) After Hours

AeroVironment (AVAV) reported a fiscal fourth-quarter loss of $160.5 million, resulting in a loss of $6.31 per share. Adjusted earnings were 99 cents per share, falling short of Wall Street expectations of $1.02 per share. The company's revenue for the quarter was $186 million, surpassing Street forecasts of $165.7 million. For the full year, AeroVironment reported a widened loss of $176.2 million, or $7.04 per share, with revenue of $540.5 million. The company expects earnings in the range of $2.30 to $2.60 per share and revenue in the range of $630 million to $660 million for the upcoming year.

AVAV:

90.32 ▲ +0.06 (+0.066%) Today

94.71 ▲ +4.39 (+4.86%) After Hours

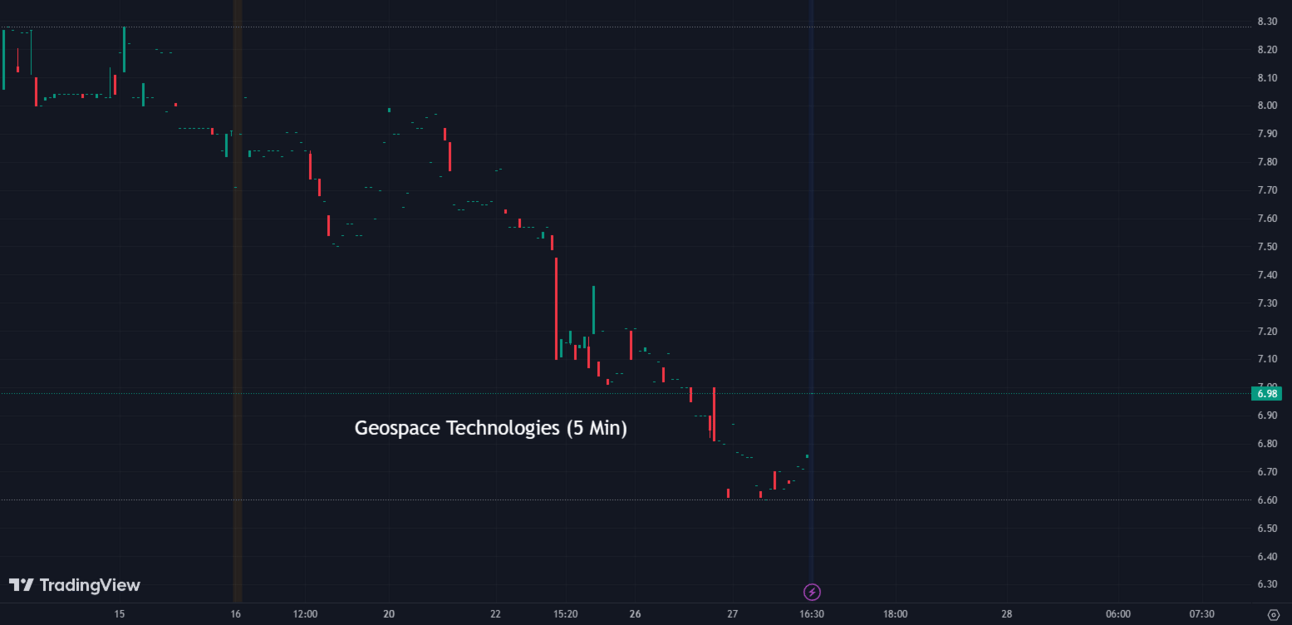

Geospace Technologies (GEOS) announced on Tuesday that it has extended the rental contract duration with an international marine geophysical services provider for its new product called Mariner. Mariner is a wireless seismic data acquisition system designed for shallow water seabed applications. The contract extension is expected to generate revenue of approximately $20 million. The delivery of the Mariner units is scheduled for Geospace's first quarter of 2024.

GEOS

6.71 ▼ -0.085 (-1.25%) Today

7.13 ▲ +0.41 (+6.18%) After Hours

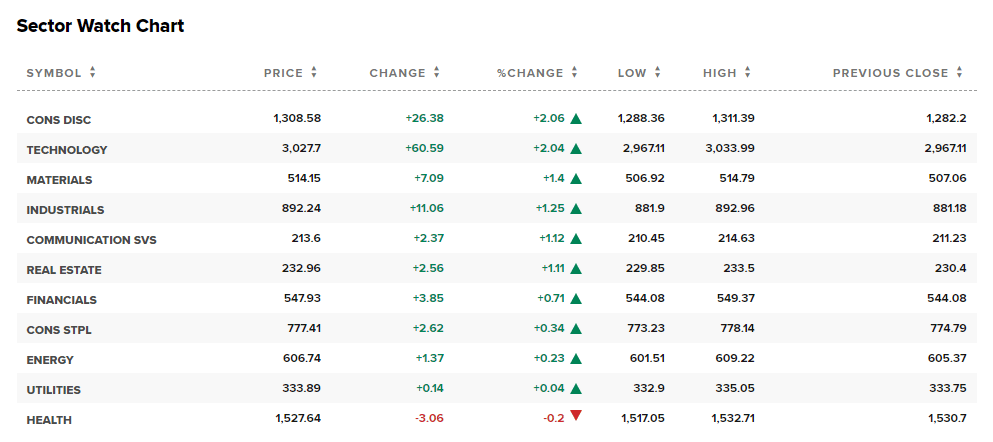

Sectors 🛍️⚕️

Out of the 11 sectors, 10 closed in positive territory today, with Consumer Discretionary leading the way with a gain of 2.06%, while Health saw a decline of -0.2%.

Conclusion 👋

Today's recap of the financial markets highlights several noteworthy events. The housing market is showing promising signs of recovery, with home prices on the rise and strong demand from homebuyers despite challenges such as high mortgage rates and low inventory. The stock market experienced a positive day, with the Dow Jones Industrial Average ending its seven-day decline and investors reentering the tech stock market. The passage of the Inform Consumers Act brings new regulations for online marketplaces, aiming to combat retail theft and counterfeits while increasing transparency. ChargePoint's support for Tesla's NACS standard enhances electric vehicle charging solutions, and Volvo's agreement with Tesla grants its EV drivers access to Tesla's charging stations. On the other hand, Walgreens warns of lower profits due to declining vaccine demand, and struggling companies like Lordstown Motors face bankruptcy filings and production suspensions. Roku secures its first live sports rights package with Formula E, while Eli Lilly's experimental obesity drug shows remarkable weight loss results. Yellow faces a significant decline following a breach of contract lawsuit, and UBS plans to cut jobs after taking over Credit Suisse. Overall, today's events reflect a mix of positive developments, challenges, and regulatory changes across various sectors of the financial markets.

Thank you all for signing up!

Will only work to do better for you all going forward. Our only goal is to add value to everyone’s trading with key levels and the ability of learning charts and price action.

Please Share Our Newsletter it will be much appreciated!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of TradingView. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.