Hey there, traders! As the day winds down, come join us for a thorough rundown of the notable events that have shaped the financial markets today.

Indexes 📉📈

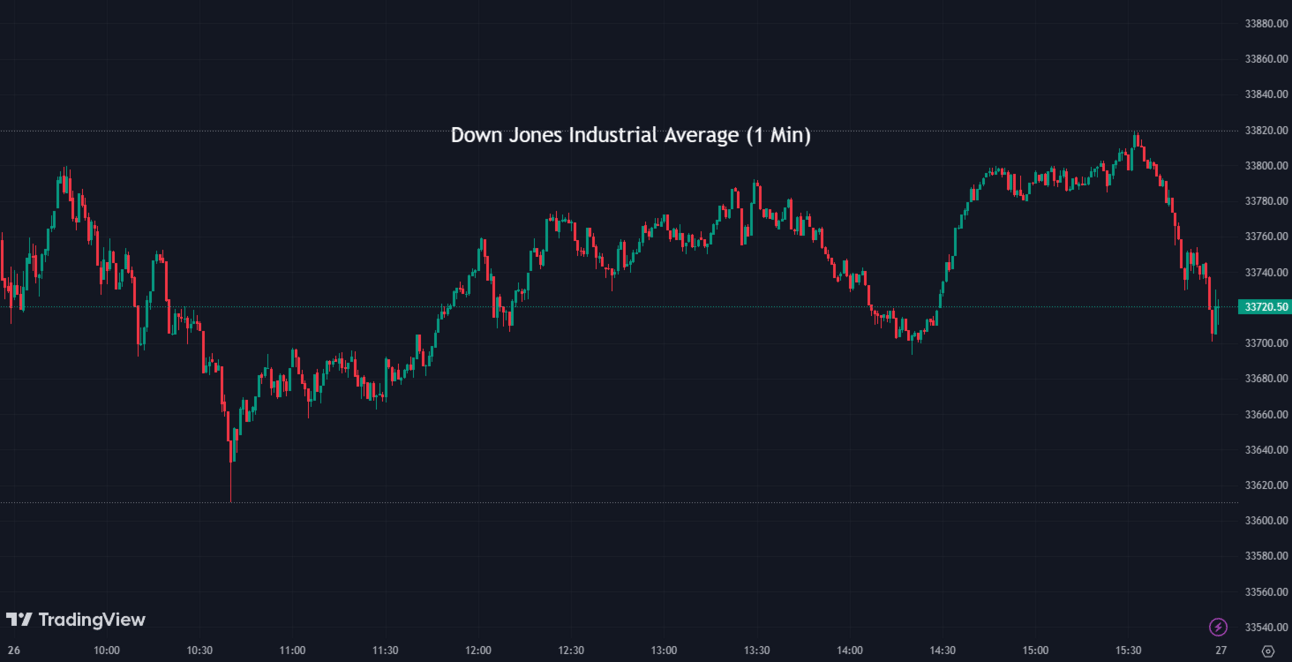

Most of the indices experienced a decline today, as tech stocks faced a drop and investors analyzed the potential market implications of the brief confrontation to Vladimir Putin by armed mercenaries in Russia over the weekend. Now, let's explore how the market performed today...

The S&P 500 (SPX) was down -0.45% coming to a conclusion at 4,328

The Nasdaq Composite (IXIC) fell by -1.16% to settle at 13,335

The Dow Jones Industrial Average (DJI) dropped by -0.04% ending the day at 33,714

The Russell 2000 (RUT) was up +0.09% to finish at 1,823

The Nasdaq-100 (NDX) declined by -1.36% to conclude at 14,689

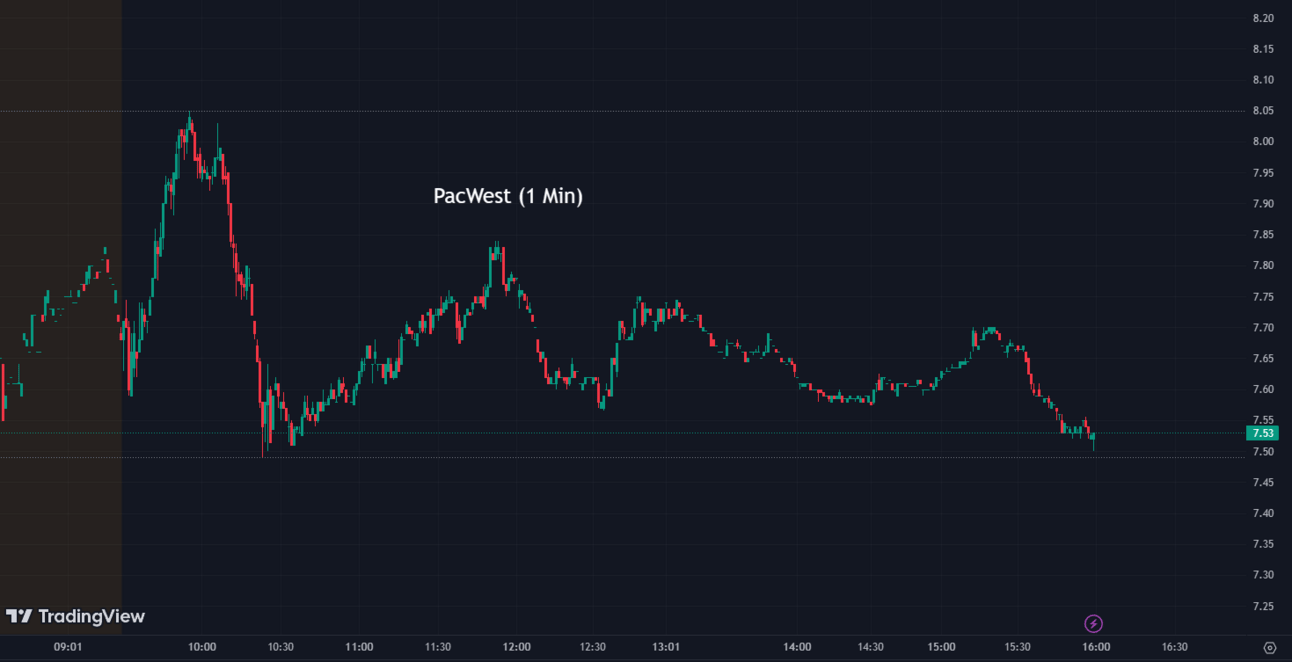

PacWest Announces $3.5 Billion Loan Sale Amid Regional Banking Turmoil 💼💰

To recover from the recent turmoil in the banking industry, PacWest (PACW), a regional lender, has revealed its plan to sell $3.5 billion worth of loans to Ares Management. This strategic move boosted PacWest's shares by 4% during Monday afternoon trading, offering relief to the bank, which had suffered significant losses following the failure of Silicon Valley Bank in March. The stock rally reflects renewed optimism in the regional banking sector, with stabilized deposit withdrawals and a gain in the KBW Regional Bank Index (BKX). However, challenges such as high-interest rates and stronger capital requirements for banks with over $100 billion in assets remain, as warned by Wedbush analyst David Chiaverini.

PACW:

7.52 ▲ +0.29 (+4.01%) Today

7.53 ▲ +0.0085 (+0.11%) After Hours

Oil Edges Higher Amid Unsettled Global Scenarios 🛢️🌍

After the brief uprising in Russia, oil prices experienced a slight increase while the dollar weakened making oil more appealing to global importers, offsetting the impact of the geopolitical events. The uprising in Russia has not significantly disrupted oil markets, indicating that economic factors currently have a stronger influence. However, analysts are factoring in the potential for further civil unrest in their oil market analyses. Oil prices have declined this year due to robust exports from Russia, monetary tightening in the US, and a sluggish economic recovery in China.

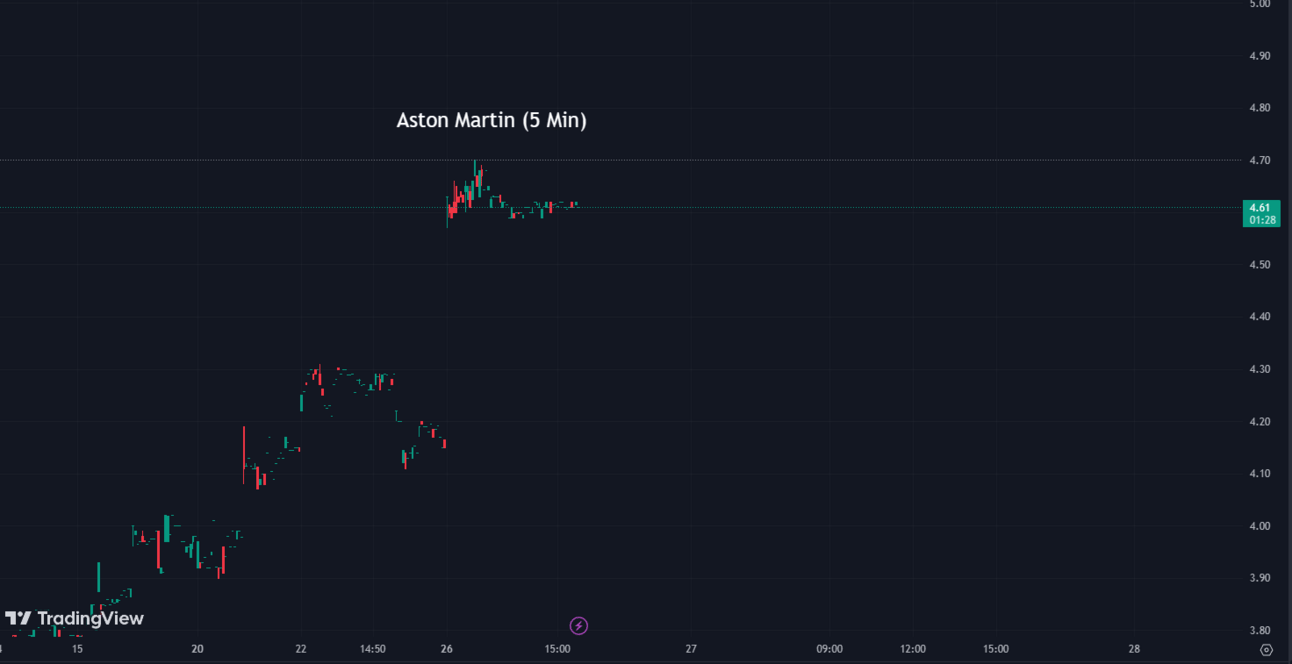

Aston Martin and Lucid Announce Game-Changing EV Deal 🚗🤝

Aston Martin (ARGGY), the British luxury automaker, and Lucid Motors (LCID), an electric vehicle manufacturer, have announced a "long-term strategic technology partnership." This collaboration propelled the shares of both companies on Monday. Aston Martin will gain access to Lucid's highly acclaimed high-performance drive unit, battery technology, and Wunderbox inverter. As part of the agreement, Aston Martin will issue new shares to Lucid and make phased cash payments totaling around $232 million. Furthermore, Aston Martin has committed to spending at least $225 million on Lucid's powertrain components. This partnership sets the stage for Aston Martin's ambitious goal of becoming fully electric by 2030.

ARGGY:

4.61 ▲ +0.46 (+11.08%) Today

No movement in after hours

LCID:

5.55 ▲ +0.08 (+1.46%) Today

5.63 ▲ +0.085 (+1.53%) After Hours

KPMG to Lay Off 5% of U.S. Workforce Amid Economic Headwinds 🏢🔻

KPMG, a global accounting giant, has announced layoffs affecting 5% of its U.S. workforce, citing "economic headwinds" and historically low attrition rates. This decision comes as the second wave of job cuts by the firm within the fiscal year, following a 2% reduction in the U.S. workforce in February. The layoffs are viewed as a long-term measure to ensure the firm's continued success, considering predictions of an economic downturn later in the year. Other "Big Four" accounting firms, including Ernst & Young and Deloitte, have also reported job cuts this year.

Apple's Forthcoming Products 📱⌚️

Apple has an extensive product roadmap for the upcoming year. The tech giant is planning to launch the new Apple Watch Ultra and iPhone 15 in the fall. Work is also underway for a second-generation Vision Pro and a lower-end model. In addition, Apple is developing new M3-powered laptops and OLED-screen iPads, with expected shipping dates in the next year. The company has scheduled the launch of new 24-inch iMacs, and early development has begun for a larger 30-inch iMac. Moreover, Apple intends to release the MacBook Pro in 13-, 14-, and 16-inch variants, all powered by the new M3 chipset. The company is closely monitoring the response to its Vision Pro in the virtual reality space and plans to expand access to the headset to select developers starting next month.

AAPL:

185.27 ▼ -1.41 (-0.76%) Today

185.40 ▲ +0.13 (+0.07%) After Hours

Meta Launches VR Subscription Service 👓🌐

Meta has announced the new Meta Quest+, its new virtual reality subscription service. For a monthly fee of $7.99, users can access two new titles each month, and the service is compatible with all of Meta's headsets. This offering represents Meta's latest effort to generate recurring revenue from its Reality Labs unit.

META:

54.06 ▲ +0.73 (+1.37%) Today

279.28 ▲ +0.81 (+0.29%) After Hours

Novo Nordisk's Obesity Pill Shows Promise 💊🌟

Late-stage clinical trials of Novo Nordisk's high-dose experimental obesity pill have demonstrated promising results, with overweight or obese adults achieving an average weight loss of around 15%. The pill is an oral version of semaglutide, the active ingredient found in other successful weight loss injections, Ozempic and Wegovy. The company plans to submit an application for FDA approval later this year. These positive results play a crucial role in Novo Nordisk's efforts to maintain its leading position in the thriving weight loss drug market, especially with emerging competition from Pfizer and Eli Lilly. Additionally, the new high-dose pill could provide a more convenient alternative to weekly injections for the treatment of obesity, potentially revolutionizing obesity management.

NVO:

157.21 ▼ -1.86 (-1.17%) Today

157.50 ▲ +0.28 (+0.18%) After Hours

Pfizer Halts Development of Obesity and Diabetes Pill, Shifts Focus 🛑💊

Pfizer has decided to discontinue the development of its experimental obesity and diabetes pill, lotiglipron, due to elevated liver enzymes observed in patients during mid-stage clinical studies. Instead, the company will focus on its other oral obesity drug, danuglipron, which is currently undergoing a fully enrolled phase two clinical trial.

PFE:

36.90 ▼ -1.40 (-3.66%) Today

36.82 ▼ -0.07 (-0.19%) After Hours

Japanese Government Fund Proposes $6.3B Buyout of Key Chip Firm JSR 💾💼

The Japanese Investment Corp., a fund supported by the Japanese government, has put forward a proposal to acquire JSR (TYO: 4185), a crucial player in the semiconductor supply chain, for approximately 903.9 billion yen ($6.3 billion). This move aligns with global initiatives to secure domestic chip industries and supply chains, particularly in areas where countries have traditionally held strengths. JSR specializes in photoresists, in which Japan holds a leading global position. The potential acquisition highlights the ongoing technological competition between the U.S. and China, with countries like Japan taking steps to ensure control over key technological resources.

TYO: 4185

3,934 ▲ +700.00 (+21.64%) Today

Market Closed

IBM to Acquire Apptio for $4.6B 💰💻

IBM has announced its intention to acquire software company Apptio from Vista Equity Partners for $4.6 billion. Apptio offers financial and operational IT management and optimization software, serving over 1,500 clients, including tech giants such as Amazon (AMZN), Microsoft (MSFT), and Google (GOOGL). The acquisition, expected to close in the latter half of this year, is part of IBM's continued investment in AI and IT automation software.

IBM:

131.35 ▲ +1.92 (+1.48%) Today

131.40 ▲ +0.06 (+0.046%) After Hours

Jesse Watters Replaces Tucker Carlson on Fox News Primetime Slot 📺🦊

Fox News has announced that Jesse Watters will take over the network's 8 p.m. ET primetime slot, replacing Tucker Carlson. This change follows Carlson's departure from the network due to a $787.5 million settlement in Dominion Voting Systems' defamation lawsuit. Since Carlson's departure, the network has experienced a decline in ratings.

FOX:

31.07 ▲ +0.44 (+1.44%) Today

30.68 ▼ -0.39 (-1.26%) After Hours

Tesla Downgraded by Goldman Sachs Amid Mixed Market Reactions 🚗📉

Goldman Sachs has downgraded Tesla (TSLA) stock from a 'buy' to a 'neutral' rating, marking the latest in a series of downgrades for the electric vehicle giant. However, Goldman Sachs has raised its price target for Tesla to 248, up from 185, indicating a nuanced long-term perspective on the company. According to Goldman Sachs analyst Mark Delaney, the downgrade is primarily driven by the market already factoring in Tesla's long-term opportunities. Delaney also pointed out that ongoing price cuts and discounts may continue to put pressure on Tesla's gross margins.

Meanwhile, Cathie Wood's Ark Investment Management continues to sell off Tesla shares, signaling mixed sentiment in the investment community. On the other hand, Deutsche Bank maintains a more positive outlook, maintaining a 'buy' rating and raising its Tesla stock price target from 200 to 230.

TSLA:

241.05 ▼ -15.55 (-6.06%) Today

241.15 ▲ +0.10 (+0.041%) After Hours

After Hour Movers 💤🏃♂️

ReShape Lifesciences (RSLS) announced that it has submitted a Premarket Approval supplement application to the US Food and Drug Administration for its upgraded Lap-Band 2.0, which incorporates band-reservoir technology. The medical device company anticipates receiving feedback from the FDA by the end of the year. The Lap-Band 2.0 offers postoperative adjustability to optimize individual comfort and enhance therapy effectiveness. Following this news, the company's shares surged by 26% in after-hours trading.

RSLS:

1.77 ▲ +0.09 (+5.36%) Today

1.76 ▲ +0.01 (+0.57%) After Hours

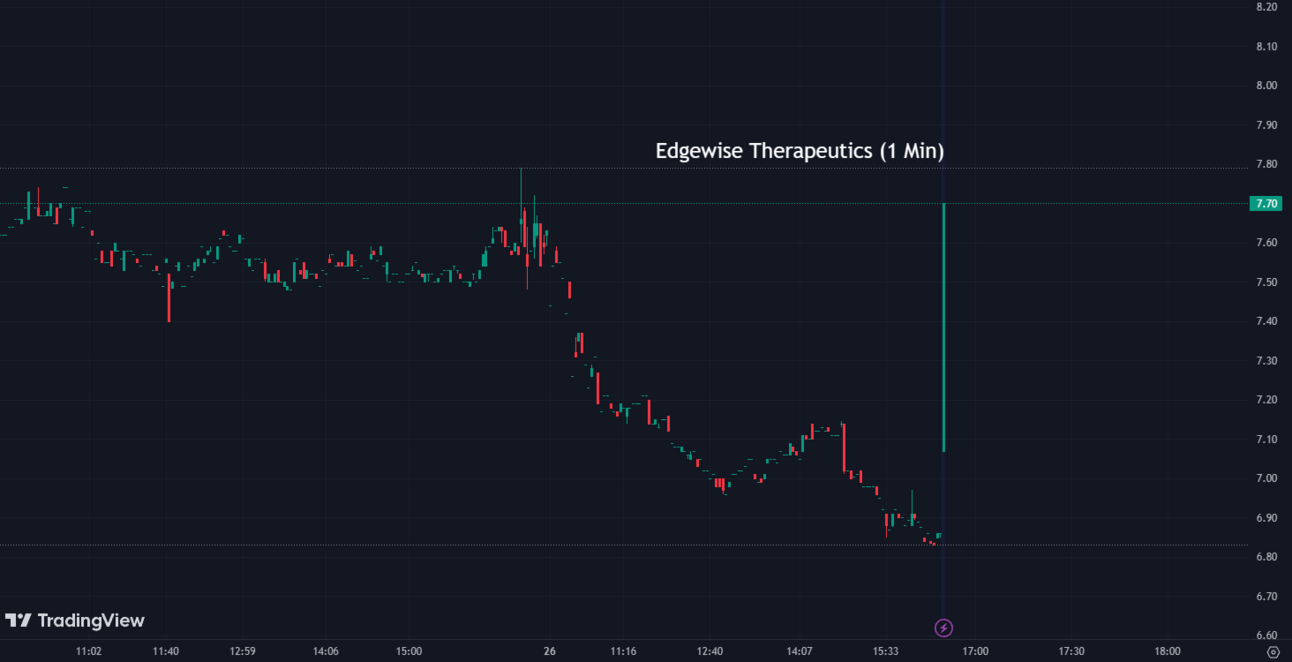

Edgewise Therapeutics (EWTX) announced positive topline results from a 12-month open-label study of EDG-5506 in adults with Becker Muscular Dystrophy (BMD). The study showed that EDG-5506 was well-tolerated at all doses. The company is now enrolling patients with BMD in the Canyon Phase 2 trial, which includes a pivotal cohort called Grand Canyon. This update highlights the progress and potential of Edgewise Therapeutics' treatment for BMD.

EWTX:

6.86 ▼ -0.74 (-9.74%) Today

7.37 ▲ +0.51 (+7.47%) After Hours

Sectors

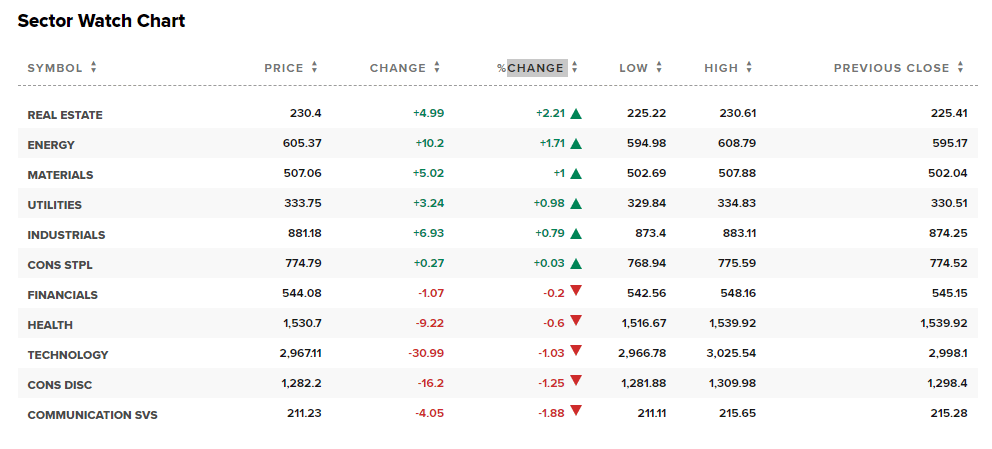

Out of the 11 sectors, 6 closed in positive territory today, with Real Estate leading the way with a gain of 2.21%, while Communication Services saw a decline of -1.88%.

Conclusion 👋

To wrap it up, President Joe Biden's $42 billion plan to provide high-speed internet access to all American households by 2030 represents a significant investment in America's infrastructure. The initiative, funded through the Bipartisan Infrastructure Law and managed by the U.S. Department of Commerce, aims to bridge the digital divide and ensure that underserved areas have access to reliable internet connectivity. This plan, likened to Franklin D. Roosevelt's efforts to electrify rural America in the 1930s, demonstrates Biden's commitment to improving the lives of Americans and promoting equitable access to technology. By allocating funds to each state and prioritizing areas with inadequate internet speeds, the plan seeks to address the current disparities and create opportunities for economic growth and development. With this initiative, President Biden aims to lay the foundation for a more connected and inclusive future, setting the stage for his reelection campaign and emphasizing the importance of investing in America's infrastructure.

Thank you all for signing up!

Will only work to do better for you all going forward. Our only goal is to add value to everyone’s trading with key levels and the ability of learning charts and price action.

Please Share Our Newsletter it will be much appreciated!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of TradingView. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.