Hey, fellow traders! As we approach the end of the week, let's take a breather and dive into the exciting events that unfolded today!

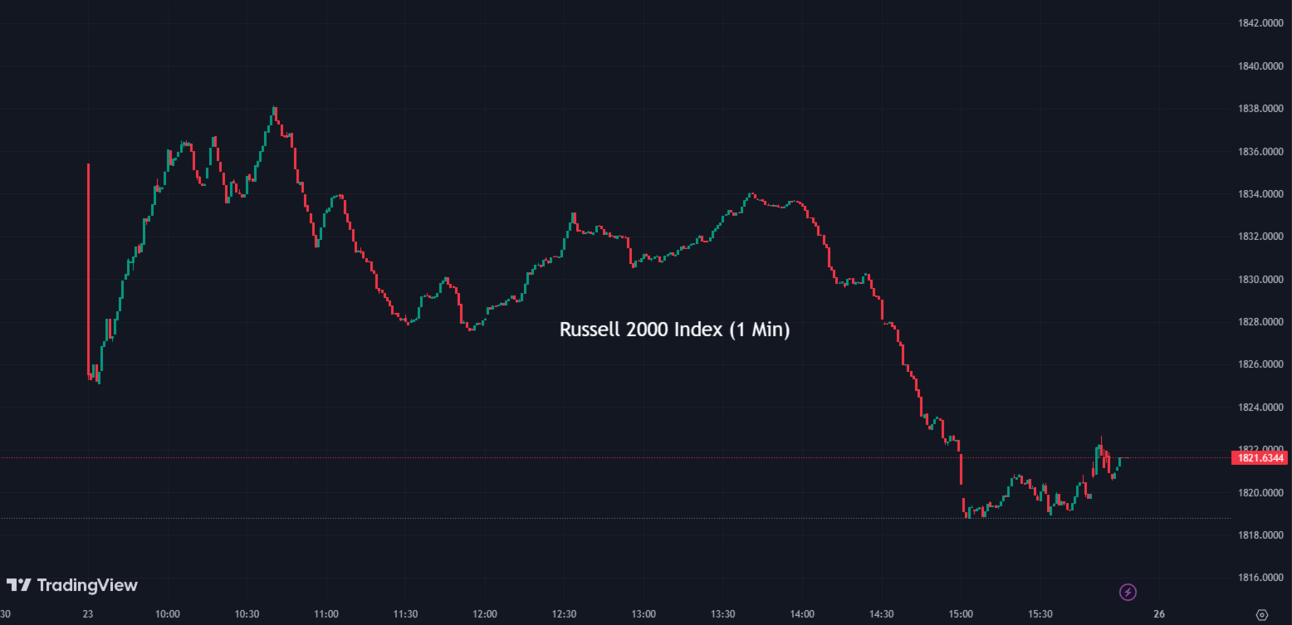

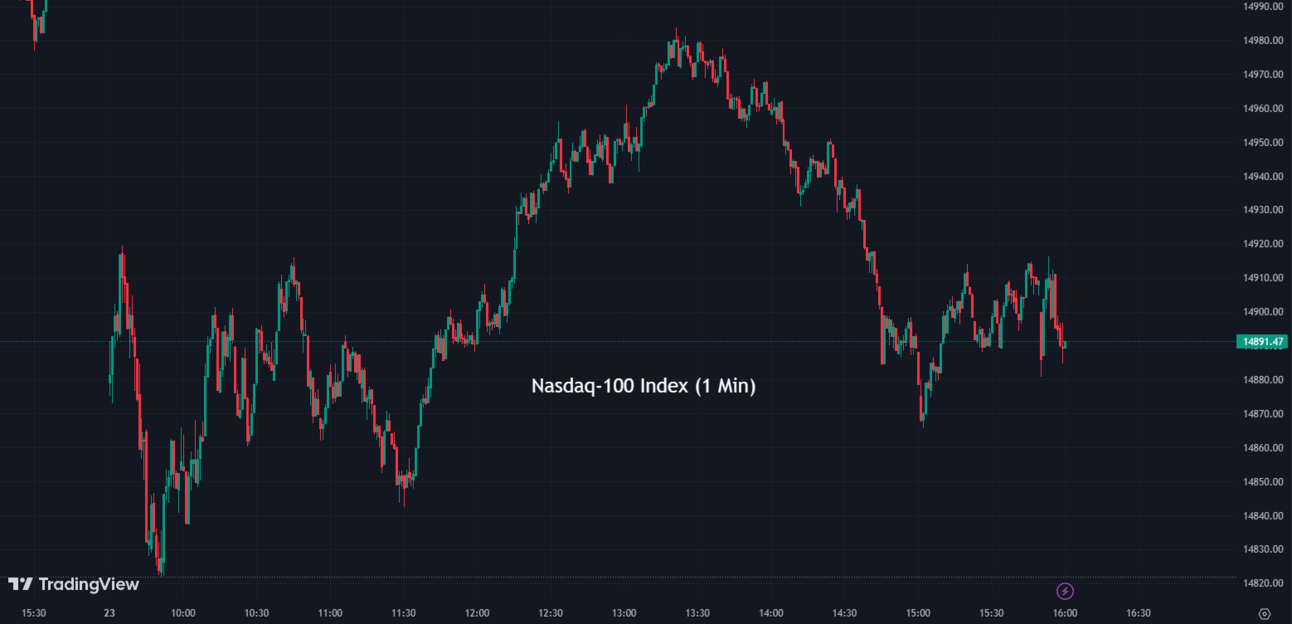

Indexes 📉🔻

The indices fell today, marking a losing week as the momentum from a recent rally that had propelled the broader market appeared to fade. Now, let's explore how the market performed today...

The S&P 500 (SPX) was down -0.77% coming to a conclusion at 4,348

The Nasdaq Composite (IXIC) fell by -1.01% to settle at 13,492

The Dow Jones Industrial Average (DJI) dropped by -0.65% ending the day at 33,727

The Russell 2000 (RUT) slid by -1.44% to finish at 1,821

The Nasdaq-100 (NDX) declined by -1.00% to conclude at 14,891

Hello once again 👋! Before we continue with tonight's recap, I wanted to share some great news. We now have a new newsletter available, designed specifically to assist you all in growing financially free. It's a wonderful way to stay informed and engaged. Even better, as a gesture of gratitude, we are offering a limited-time deal. You can now enjoy a 20% lifetime discount on your subscription to the newsletter.

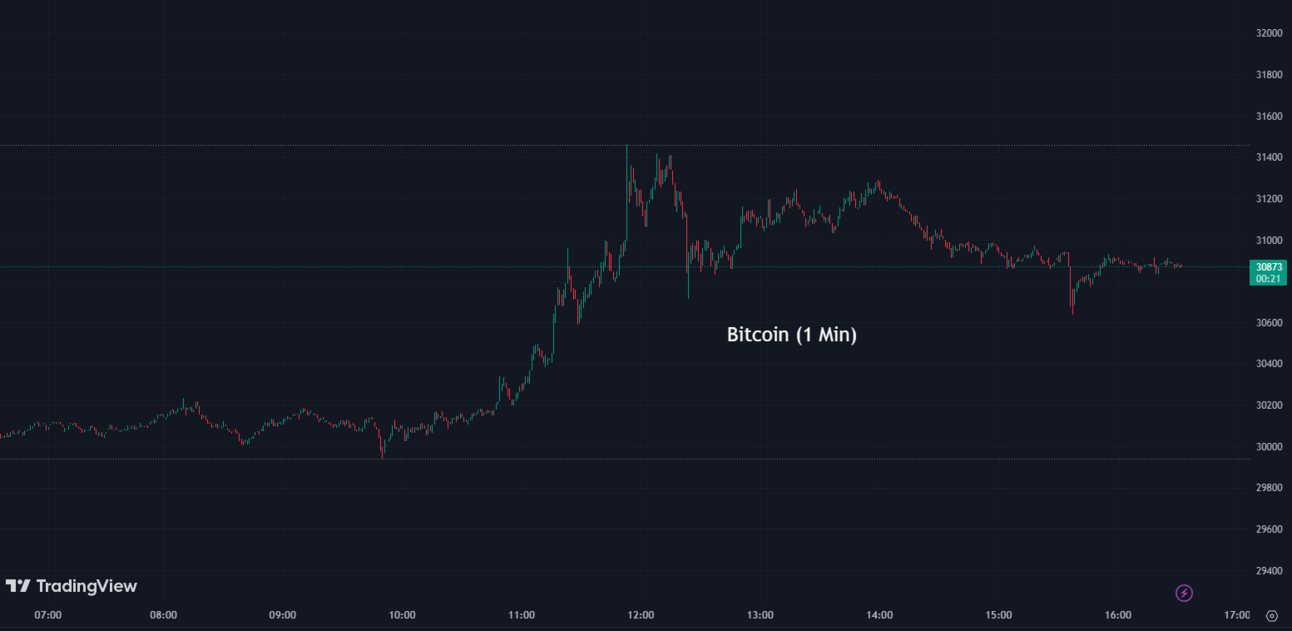

Bitcoin Soars Past $31,000 📈💯

Bitcoin surpassed $31,000 on Friday, indicating a weekly increase of 17%, driven by institutional investments in the cryptocurrency space. The surge was propelled by major players in asset management and retail investing committing to incorporate cryptocurrencies into their business operations, indicating increased maturity and regulation within the crypto ecosystem. The rise in Bitcoin's value was also linked to the recent filing by BlackRock (BLK), the world's largest asset manager, for the first spot Bitcoin exchange-traded fund in the United States, which prompted other institutions to follow suit. These developments have generated positive sentiment and investor confidence in the crypto industry, leading to a significant surge in Bitcoin's value.

Bitcoin

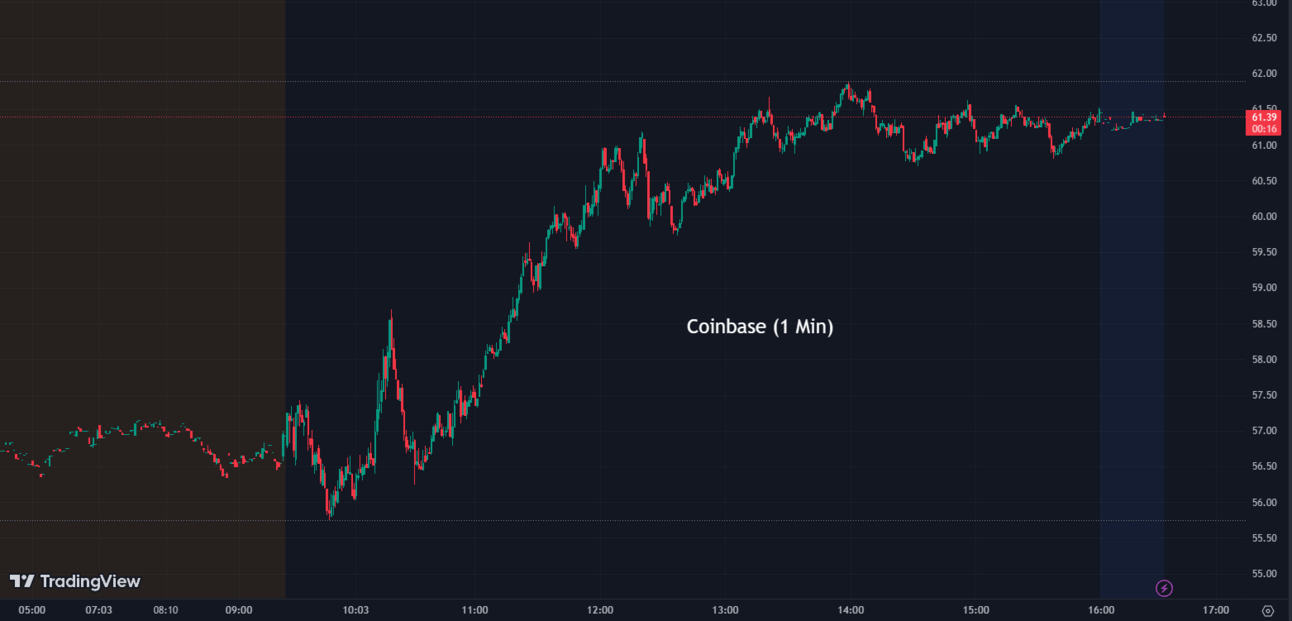

U.S. Supreme Court Affirms Coinbase's Arbitration Power, Pauses Lawsuits ⚖️🏛️

The ability of a Coinbase (COIN) unit to direct customer and employee disputes into arbitration has been affirmed by the U.S. Supreme Court in a 5-4 ruling. This significant decision temporarily pauses lawsuits filed in federal courts while the defendant appeals to transfer the case to arbitration. Justice Brett Kavanaugh, who authored the court's opinion, argued that this ruling is crucial for maintaining the benefits of arbitration, including improved efficiency, reduced expenses, and a less intrusive discovery process. Coinbase is currently involved in a dispute with Abraham Bielski, who claims to have lost $31,000 to a scammer and believes Coinbase should compensate him. Additionally, Coinbase faces another lawsuit alleging that it organized a $1.2 million Dogecoin sweepstakes without adequately disclosing that participants were not required to buy or sell the cryptocurrency. This decision aligns with the Supreme Court's ongoing trend of strengthening companies' authority to enforce arbitration clauses under the 1925 Federal Arbitration Act.

COIN:

61.47 ▲ +3.98 (+6.92%) Today

61.30 ▼ -0.17 (-0.28%) After Hours

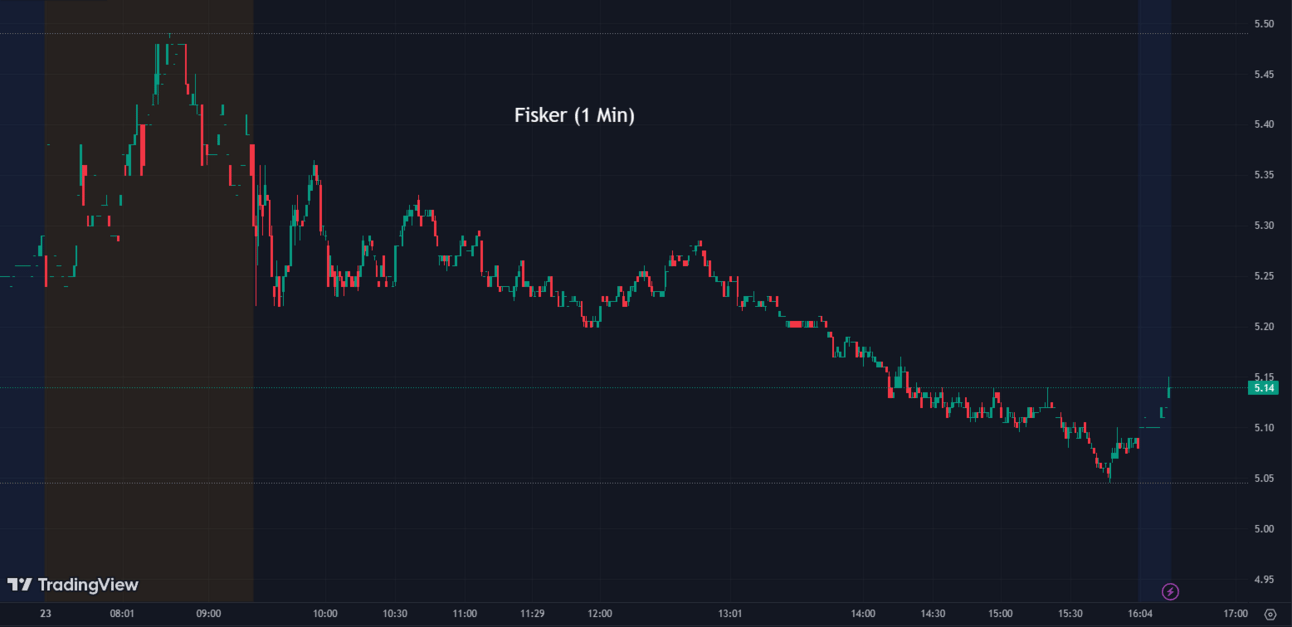

Fisker Commences First U.S. Deliveries, Expands Global Reach 🚗🌎

Fisker (FSR), an electric vehicle maker, has announced the commencement of its first deliveries in the United States. The company will deliver 22 Ocean One SUVs in Los Angeles, marking a significant milestone in Fisker's expansion. This development comes after the company faced delays earlier this year due to issues with software integration. Despite these challenges, Fisker denied any speed limitations on their vehicles and reassured customers that the problems were being resolved through over-the-air updates. In addition to the U.S., Fisker has already begun delivering vehicles in Europe and plans to initiate deliveries in China by the first quarter of 2024. With a projected steep increase in production in Q3 and a target of manufacturing 6,000 vehicles per month for the remainder of the year, Fisker aims to meet the demand from its combined 70,000 reservations and orders for the Ocean SUV and its upcoming compact EV SUV, the PEAR.

FSR:

5.08 ▼ -0.15 (-2.96%) Today

5.13 ▲ +0.045 (+0.88%) After Hours

UAW President Criticizes $9.2B Loan for Ford-SK On Battery Venture, Raises Labor Concerns 👥⚡

Shawn Fain, the president of the United Auto Workers (UAW) union, has strongly criticized the U.S. Energy Department's decision to provide a $9.2 billion loan to a joint venture between Ford Motor (F) and South Korea's SK On, which aims to build three battery plants in the United States. Fain labeled the loan as a "giveaway" and claimed that it disregards wages, working conditions, union rights, and retirement security. He also indicated that it would result in jobs with below-average pay. The issue of wage standards at these battery joint venture plants is expected to be a central point of contention in the upcoming contract negotiations with the Detroit Three automakers. Despite the controversy, the BlueOval SK joint venture is proceeding with the construction of battery plants in Kentucky and Tennessee, supported by the largest government auto lending program ever.

F:

14.02 ▼ -0.17 (-1.23%) Today

14.01 ▼ -0.01 (-0.071%) After Hours

Goldman Sachs Faces Potential Write-down on GreenSky Acquisition Amid Underwhelming Bids 🏦💸

Goldman Sachs is likely to incur a substantial write-down for its 2021 acquisition of fintech lender GreenSky due to underwhelming bids for the business. Goldman Sachs acquired GreenSky, based in Atlanta, for $2.24 billion in an effort to expand into the consumer finance sector. However, a strategic shift prompted by mounting losses and dysfunction within Goldman's consumer division has led to the decision to sell the business. Bidders in the initial round included KKR, Apollo Global Management, Sixth Street Partners, Warburg Pincus, and Synchrony Bank. The bids, however, fell below Goldman's expectations, and the bank is currently engaged in ongoing negotiations to increase the selling price. If a deal is reached at the current valuation, Goldman may be compelled to acknowledge a significant write-down that will impact its financial performance.

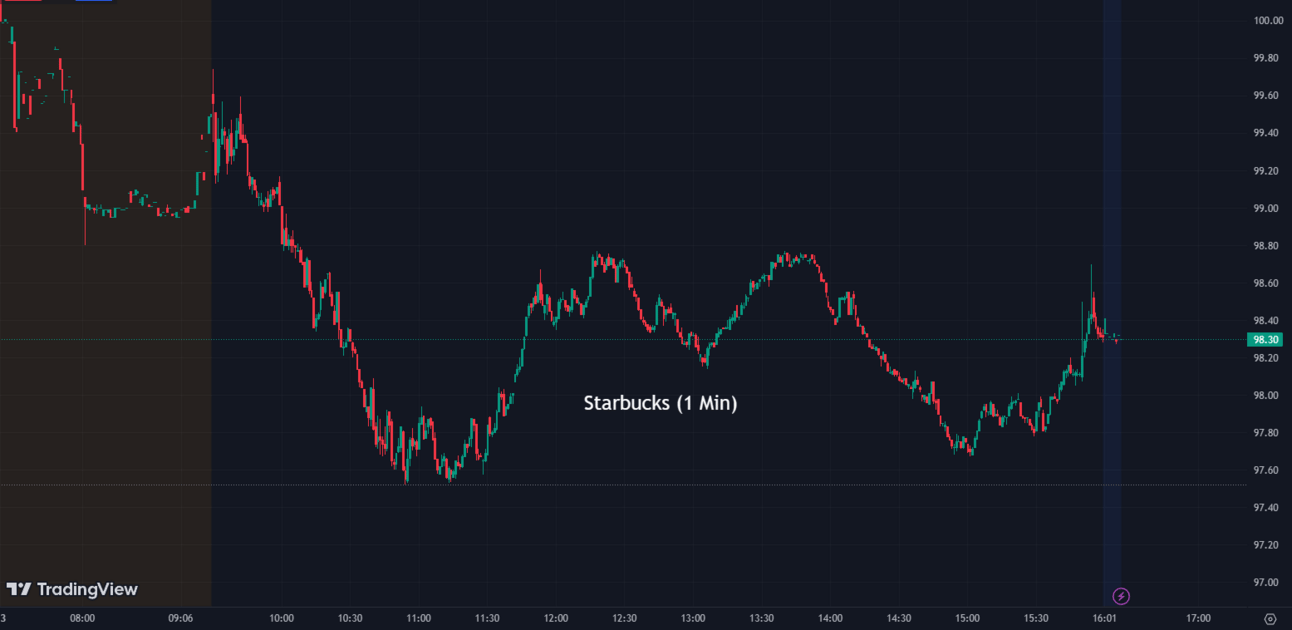

Starbucks Workers United Plans Strike ☕️🚫

Starbucks (SBUX) stores across the United States are poised to go on strike, led by the union Starbucks Workers United, following allegations that some stores were prohibited from displaying Pride month decorations. Approximately 150 locations are expected to participate in the strike, representing nearly 3,500 workers. The union alleges that Starbucks has failed to permit Pride Month decorations in dozens of its stores. On the other hand, Starbucks said it had not revised its guidelines for store decorations and continues to support the LGBTQ+ community. The company accuses Workers United of spreading false information about its benefits, policies, and negotiation efforts. Starbucks workers are also striking over allegations of delayed contract negotiations.

SBUX:

98.34 ▼ -2.51 (-2.49%) Today

98.41 ▲ +0.07 (+0.071%) After Hours

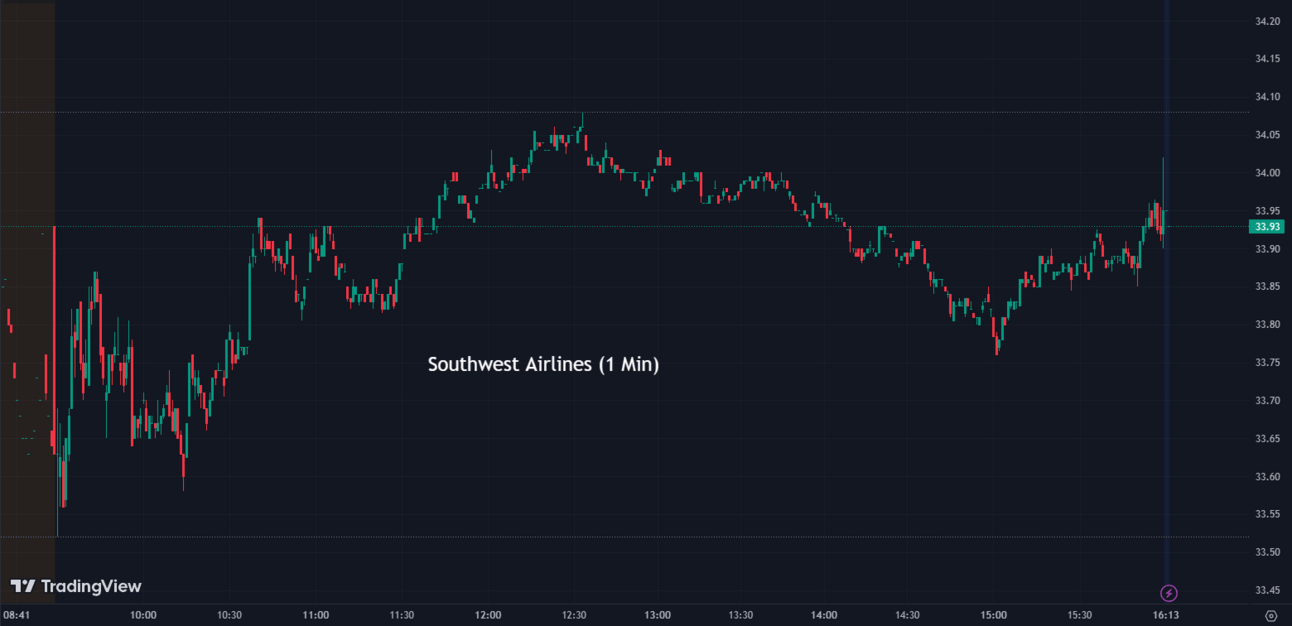

Southwest Airlines Reaches Labor Deal with Mechanics Union 🔧🤝

Southwest Airlines (LUV) has announced a tentative agreement with the union representing its mechanics, aircraft inspectors, maintenance controllers, and training instructors. The deal, which impacts over 2,800 employees, still requires ratification by the employees themselves. The company's leadership emphasized the crucial role played by these employees in ensuring aircraft safety and efficiency. Meanwhile, ongoing negotiations for labor deals with unions representing pilots and flight attendants are continuing, indicating a comprehensive effort to review and update employment conditions throughout the airline.

LUV:

33.93 ▼ -0.35 (-1.02%) Today

33.78 ▼ -0.15 (-0.44%) After Hours

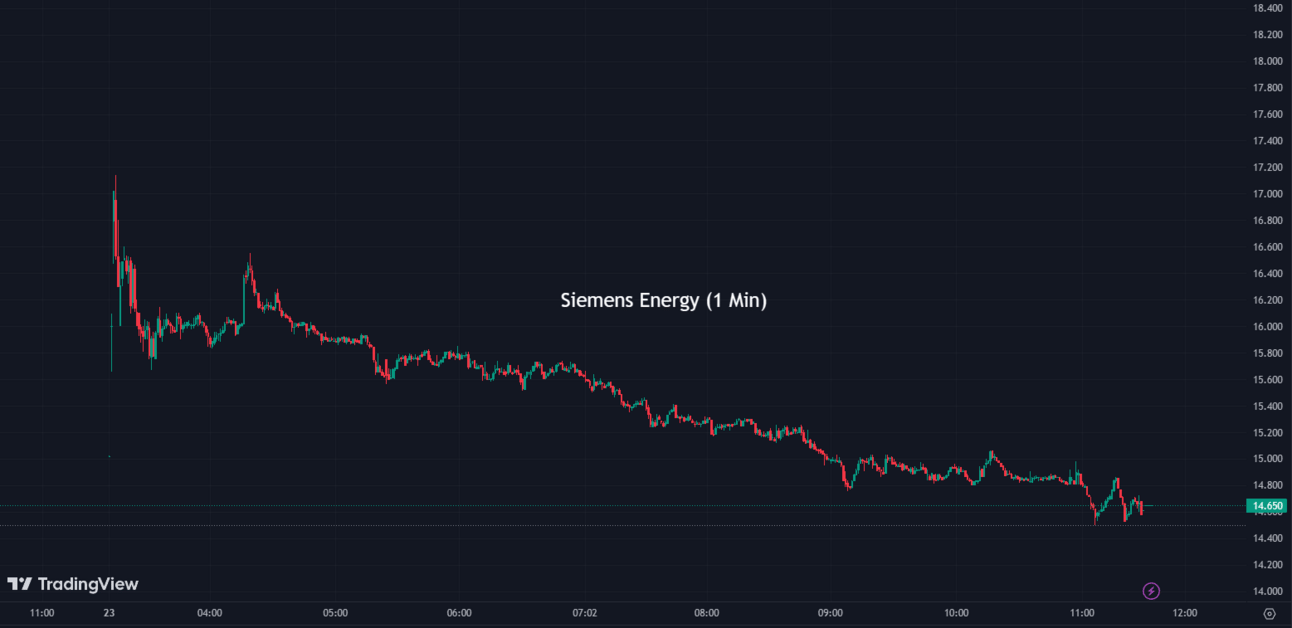

Siemens Energy Shares Plunge on Wind Turbine Issues ⚙️🌬️

Siemens Energy (XETR:ENR) suffered a significant setback as its shares plummeted over 37% due to the retraction of its profit forecast, resulting from costly and unexpected issues at its wind turbine unit, Siemens Gamesa. A concerning rise in the failure rates of wind turbine components necessitated an "extended technical review," which is projected to incur costs exceeding 1 billion euros. Siemens Energy acknowledges the seriousness of these quality issues and anticipates that resolving them will come at a high financial cost.

ENR:

14.65 ▼ -8.73 (-37.34%) Today

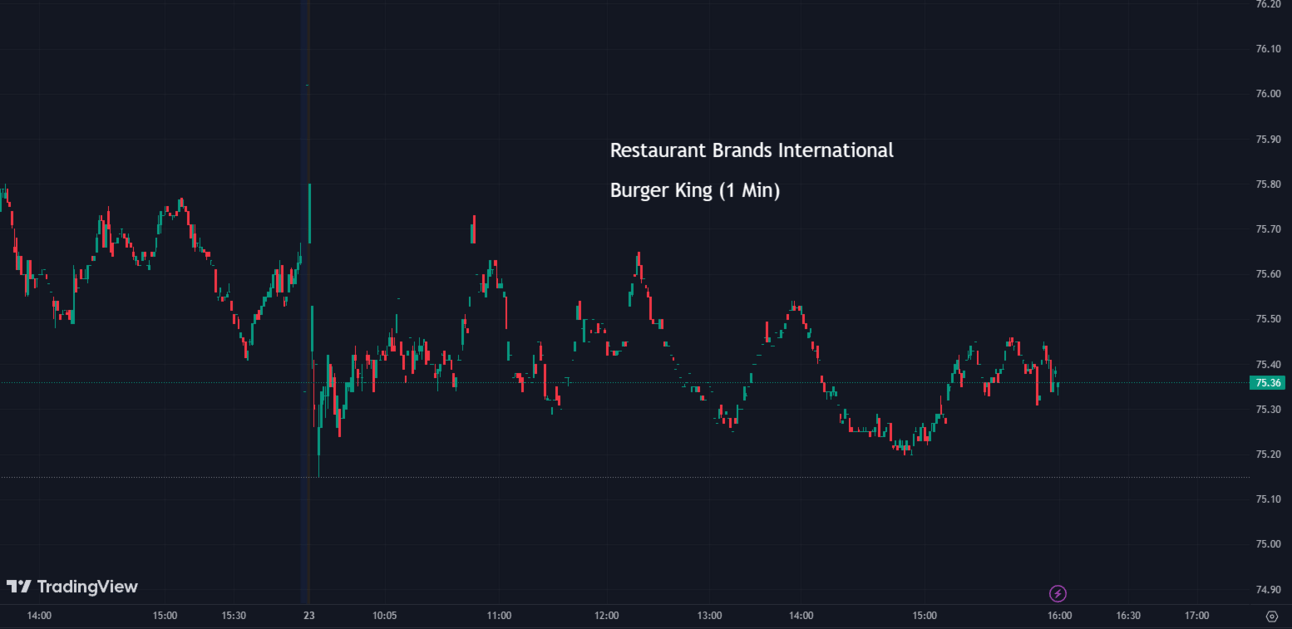

Burger King's Turnaround Plan Shows Promising Results 🍔💪

Burger King's (QSR) recent turnaround plan for its U.S. business has shown promising signs of improving franchisee profitability and boosting sales. Initiated in September of last year, the $400 million turnaround strategy was developed in collaboration with franchisees following several years of disappointing sales performance. The plan involves substantial investments in restaurant renovations and marketing, operational enhancements, menu revisions, and a particular focus on promoting the Whopper, the chain's flagship burger. Early results are encouraging, with U.S. same-store sales growing by 8.7% in the first quarter, indicating the potential success of the plan.

QSR:

75.35 ▼ -0.29 (-0.38%) Today

75.02 ▼ -0.33 (-0.44%) After Hours

Virgin Galactic Stock Falls After Stock Offering 📉⬇️

Virgin Galactic (SPCE), the space travel company founded by billionaire Sir Richard Branson, experienced an almost 20% decline in its stock price after announcing the completion of a $300 million stock offering and plans for an additional $400 million offering. The raised capital will be allocated to developing its spaceship fleet, expanding its commercial operations, and addressing general corporate matters. Virgin Galactic's journey has been a rollercoaster ride due to the anticipation surrounding the upcoming launch of its commercial space tourism service.

SPCE:

4.32 ▼ -1.00 (-18.80%) Today

4.37 ▲ +0.025 (+0.58%) After Hours

Notable Movers of the Day 📈📉

CarMax (KMX) shares popped 10% after beating the consensus estimate of analysts for its first-quarter revenue. CarMax posted $7.69 billion, higher than the $7.49 billion anticipated by analysts polled by StreetAccount.

KMX:

86.29 ▲ +7.97 (+10.18%) Today

86.30 ▲ +0.09 (+0.10%) After Hours

C3.ai (AI) shares sank more than 10.84% after Deutsche Bank reiterated its sell rating on the heels of the company’s investor day. “Until we get more comfort in some of the leading indicators, magnitude of new deals, and signs of sustained new business traction we maintain our Sell rating,” the bank said.

AI:

33.38 ▼ -4.06 (-10.84%) Today

33.26 ▼ -0.13 (-0.39%) After Hours

GSK (GSK) shares gained 5% after GSK announced the first legal settlement over allegations its Zantac heartburn medication causes cancer.

GSK:

36.40 ▲ +1.72 (+4.96%) Today

36.19 ▼ -0.19 (-0.52%) After Hours

Under Armour (UA), shares dropped 3.31% after being downgraded by Wells Fargo to equal weight from overweight. The Wall Street bank said Under Armour had overexposure to North America, excess inventory, and a CEO at the helm for just six months.

UA:

6.57 ▼ -0.23 (-3.31%) Today

6.59 ▲ +0.029 (+0.43%) After Hours

Accenture (ACN) shares fell 2.83% Friday after TD Cowen downgraded Accenture to market perform from outperform, citing a tepid outlook from the company in its earnings report earlier this week.

ACN:

298.57 ▼ -8.68 (-2.83%) Today

The stock shows no significant movement in after-hours trading

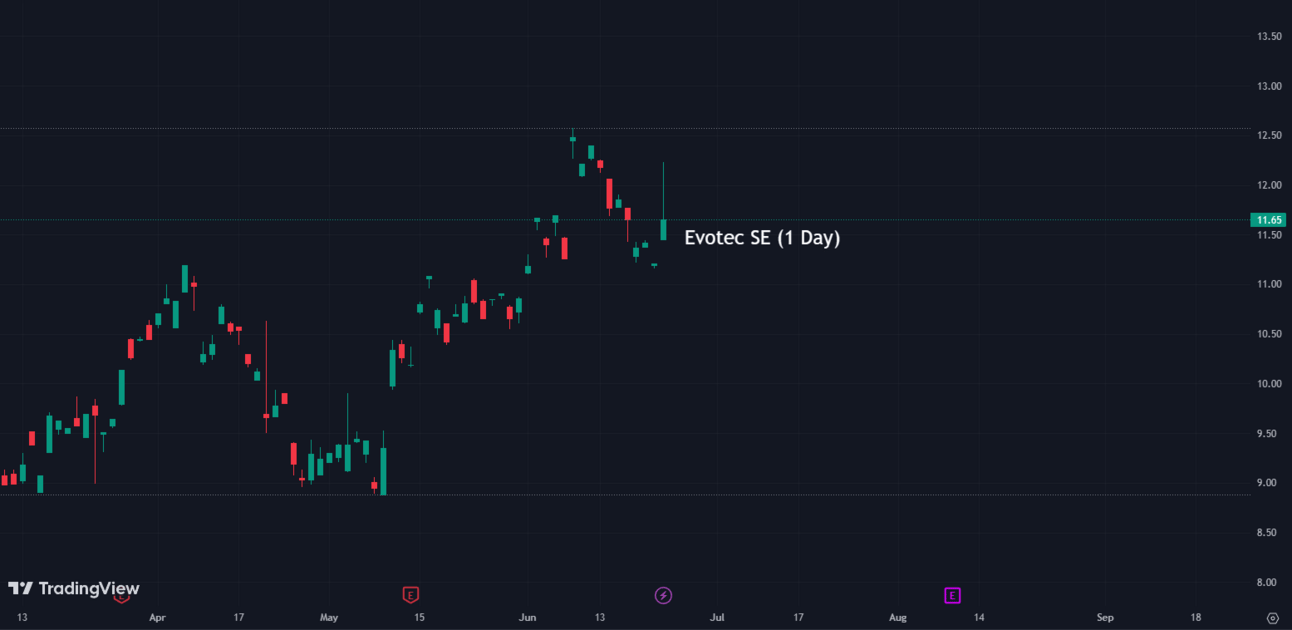

Evotec SE (XETR:EVT) shares rose 4.22% following an upgrade to overweight from equal weight by analysts at Morgan Stanley. The firm said Evotec looks well-positioned to capitalize on AI.

EVT:

21.25 ▲ +0.86 (+4.22%) Today

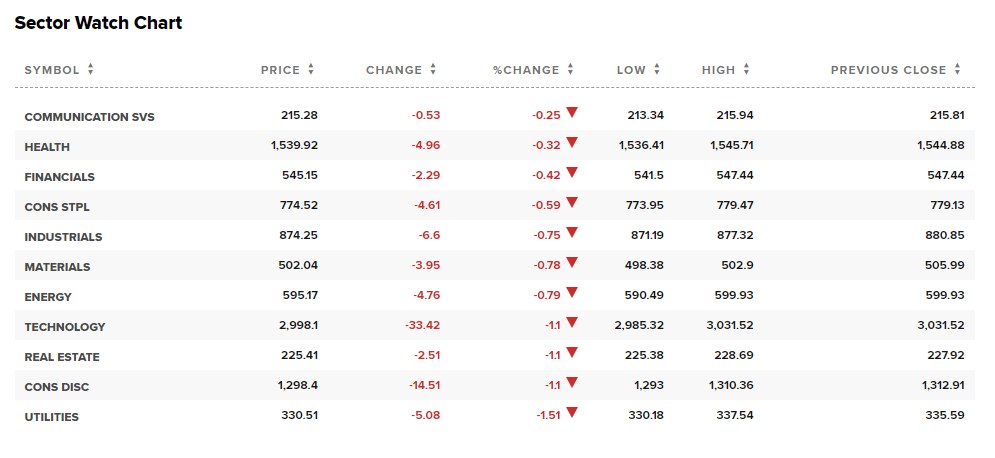

Sectors 📞🔌

Every sector experienced a decrease, with Communication Services having the smallest loss of -0.25%, while Utilities saw the largest decrease, down 1.51%.

Conclusion 👋

To wrap it up, the indices fell, indicating a losing week and a potential slowdown in the market rally. Coinbase's arbitration power was affirmed by the U.S. Supreme Court, while Fisker commenced U.S. deliveries. The $9.2 billion loan for the Ford-SK battery venture faced criticism from the UAW president. Bitcoin surged, driven by institutional investments and regulatory advancements. Goldman Sachs may incur a write-down for its GreenSky acquisition. Starbucks workers planned a strike, and Southwest Airlines reached a labor deal with its mechanics’ union. Siemens Energy shares plunged due to wind turbine issues. Burger King's turnaround plan showed promise, while Virgin Galactic's stock fell after a stock offering. CarMax beat revenue estimates, C3.ai shares sank, and GSK settled legal claims over Zantac. Under Armour, shares dropped after a downgrade, and Accenture shares fell following a downgrade. Evotec SE shares rose following an upgrade. Hope you all have a great weekend and see you next week!

Thank you all for signing up!

Will only work to do better for you all going forward. Our only goal is to add value to everyone’s trading with key levels and the ability of learning charts and price action.

Please Share Our Newsletter it will be much appreciated!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of TradingView. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.