Hey there, traders! As the day winds down, come join us for a thorough rundown of the notable events that have shaped the financial markets today.

Fed Chairman Powell Provides Assurance to Small Banks on Capital Requirements Amid Regulatory Evaluation 🎩📣

Federal Reserve Chairman Jerome Powell confirmed that new capital requirement regulations, aimed at ensuring financial institutions maintain a specific level of capital, will not impact banks with assets under $100 billion. This follows industry turmoil in March and subsequent scrutiny of financial regulation and supervision. However, the Basel III international standards might be applied to banks in the $100 billion to $250 billion asset range, as noted by FDIC Chair Martin Gruenberg. Despite the exemption for smaller banks, the proposed changes mark a shift in regulatory thinking that Powell has supported in the past. While some criticize these moves as restrictive, Powell underscores their importance for maintaining the stability of larger banks and preventing unexpected failures.

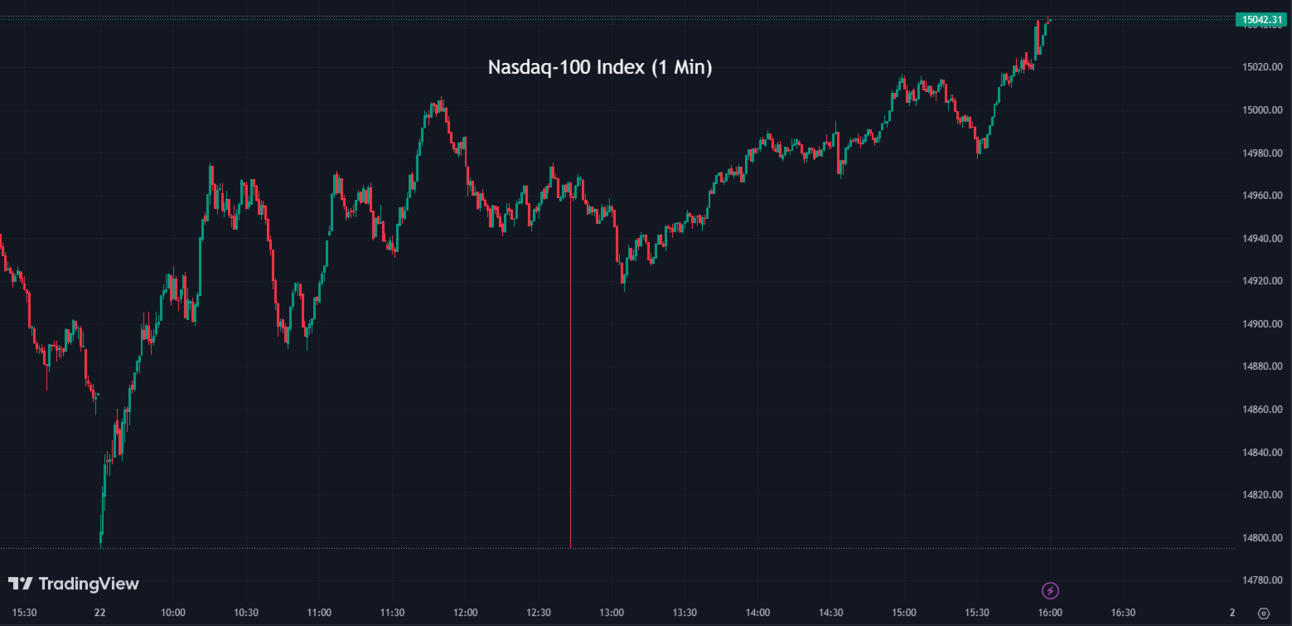

Indexes 📈📉

The indices were mixed today; however, the S&P 500 ended its 3-day losing streak. Here's how the indices played out today…

The S&P 500 (SPX) was up +0.37% coming to a conclusion at 4,381

The Nasdaq Composite (IXIC) climbed +0.95% to settle at 13,630

The Dow Jones Industrial Average (DJI) dropped by -0.01% ending the day at 33,946

The Russell 2000 (RUT) fell by -0.80% to finish at 1,848

The Nasdaq-100 (NDX) increased by +1.18% to conclude at 15,042

J.P. Morgan Securities Fined $4 Million by SEC for Massive Email Deletion Violation 💰💼

J.P. Morgan Securities LLC, a subsidiary of JPMorgan Chase, has been fined $4 million by the SEC for the unintentional deletion of approximately 47 million emails from early 2018. These emails, which were legally required to be retained, were sought in multiple regulatory investigations. The deletion occurred in 2019 and included communications from around 7,500 employees who regularly interacted with Chase customers. J.P. Morgan Securities has consented to the SEC sanction, which also mandates the firm to prevent future violations of securities laws regarding the retention of original communications for at least three years. This is the third time the firm has faced penalties for failing to preserve electronic records, following a $125 million penalty in 2021 for not preserving text messages and electronic communications between January 2018 and November 2020, and a $700,000 penalty in 2005 for similar offenses.

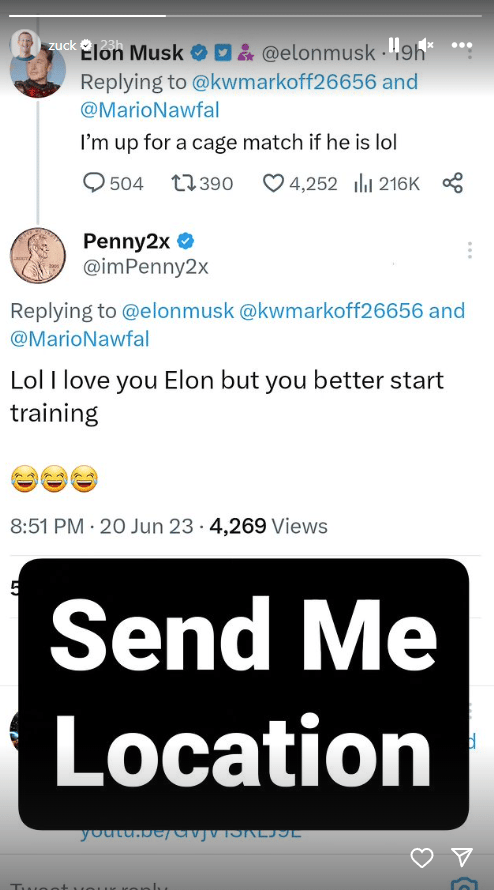

Elon Musk and Mark Zuckerberg Engage in Playful 'Cage Match' Banter Amidst Social Media Rivalry 🤼♂️🔥

In some silly news, Elon Musk and Mark Zuckerberg, have jokingly proposed a "cage match" against each other, prompted by business rivalry and competition in the social media space. The friendly spat was sparked when Musk responded with a jest to news about Facebook’s parent company, Meta, developing a new social network app called THREADS, which could rival Twitter. Musk showed readiness for a cage match against Zuckerberg, who is known to train in Brazilian jiu-jitsu. While the tech giants exchanged banter, it remains unclear whether these plans will actualize or if they were simply part of a playful exchange. Regardless, the episode has added a dash of humor to the competitive landscape of social media platforms.

Surf Air Mobility Set to Soar on NYSE with Direct Listing 🏄♂️✈️

Surf Air Mobility, a company specializing in electric aviation and regional air travel, plans to go public through a direct listing on the New York Stock Exchange (NYSE). The company expects its shares to trade under the ticker "SRFM" starting July 11. Unlike a traditional IPO, a direct listing allows existing shareholders to directly sell their shares to the public on the listing day, with the opening price determined by incoming orders on the exchange. This decision comes after the company's unsuccessful attempt to go public through a $1.42 billion Special Purpose Acquisition Company (SPAC) deal last year.

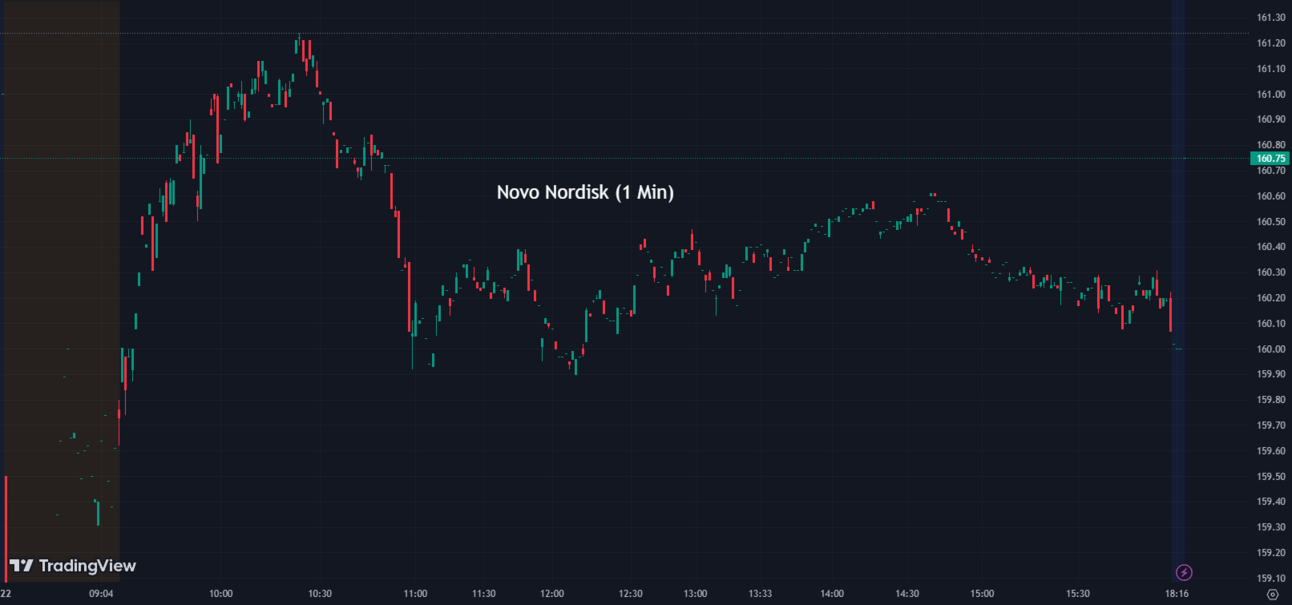

Novo Nordisk Faces Stock Decline Amidst EMA Investigation into Ozempic's Potential Link to Thyroid Cancer 📉💊

Novo Nordisk (NVO), a leading global healthcare company, experienced a decline in its stock value following the announcement by the European Medicines Agency (EMA) of an investigation into a potential link between Ozempic, Novo Nordisk's Type 2 diabetes drug, and thyroid cancer. The EMA's action was based on a safety signal identified in a 2022 study. Novo Nordisk countered by highlighting the limitations of the study and maintaining that no direct link between GLP-1 drugs, like Ozempic, and cancer risk had been established. The company underlined the safety track record of drugs like Ozempic and Wegovy, which have been used in treating type 2 diabetes and obesity. Despite the controversy, Novo Nordisk pledged to continue complying with the EMA's information requests and to perform ongoing surveillance of its clinical trials and real-world use data. The EMA has also requested continuous updates on the drug class from Eli Lilly (LLY), AstraZeneca (AZN), and Sanofi (SNY). Additionally, the FDA has been aware of potential connections between this drug class and thyroid cancer risks and established a monitoring program following the approval of Novo Nordisk's Saxenda in 2010.

NVO:

160.08 ▼ -0.46 (-0.29%) Today

No Movement in After Hours Trading

Hello again! Before we proceed any further with tonight's recap, I wanted to take a moment to inform you all about our exciting new personalized newsletter. Yes, that's right—it's tailored specifically for each and every one of you. And here's the best part: for a limited time only, we're offering a special deal—a 20% lifetime discount on the newsletter subscription.

Shein and Temu Under Congressional Scrutiny for Import Violations and Human Rights Concerns 🔍🏢

Shein and Temu, Chinese retail giants, are facing scrutiny from a U.S. House committee for multiple import violations. The companies are accused of exploiting trade loopholes to evade import duties and avoid human rights reviews on imported goods. These loopholes also enable them to provide less comprehensive data to U.S. Customs and Border Protection, including compliance screening with the Uyghur Forced Labor Prevention Act. These violations, combined with previous allegations of forced labor, raise concerns about the companies' successful businesses.

Amazon Web Services Invests $100 Million in Generative AI Center 🤖💡

Amazon (AMZN) Web Services has announced a $100 million investment to establish a center aimed at helping companies leverage generative artificial intelligence (AI). This investment underscores the significance of the current AI era. The move demonstrates AWS's intention to be a prominent player in the generative AI field, alongside competitors Microsoft (MSFT) and Google (GOOGL). The center will hire data scientists, engineers, and solutions architects and is already collaborating with companies like Highspot, Twilio, RyanAir, and Lonely Planet. Despite fierce competition, AWS CEO, Adam Selipsky, expressed confidence in Amazon's customer-centric approach and long-term vision for AI development.

AMZN:

130.15 ▲ +5.32 (+4.26%) Today

130.74 ▲ +0.59 (+0.45%) After Hours

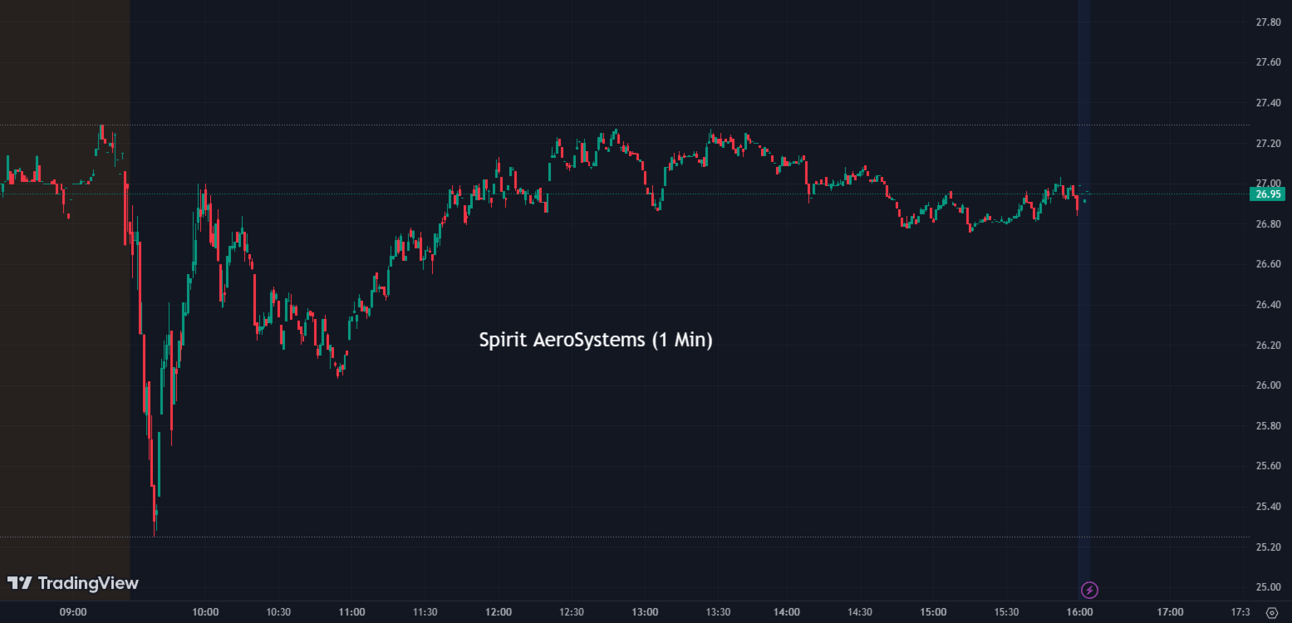

Spirit AeroSystems Plant Halt Poses Potential Setbacks for Boeing's 737 Max Production 🛩️💥

Boeing (BA) faces potential setbacks as its supplier, Spirit AeroSystems (SPR), halted operations at a plant in Wichita, Kansas, following a worker vote against a new contract and in favor of a strike. The plant plays a crucial role in manufacturing fuselages for Boeing's 737 Max aircraft and producing parts for other aerospace manufacturers. The impact of the production halt on Boeing's output is uncertain. Both Boeing and Spirit AeroSystems experienced a drop in their share prices after the announcement. According to the International Association of Machinists and Aerospace Workers, which represents the plant's employees, the strike is scheduled to commence just after midnight on Saturday.

BA:

205.63 ▼ -6.45 (-3.04%) Today

206.39 ▲ +0.78 (+0.38%) After Hours

SPR:

26.88 ▼ -2.81 (-9.45%) Today

27.00 ▲ +0.12 (+0.45%) After Hours

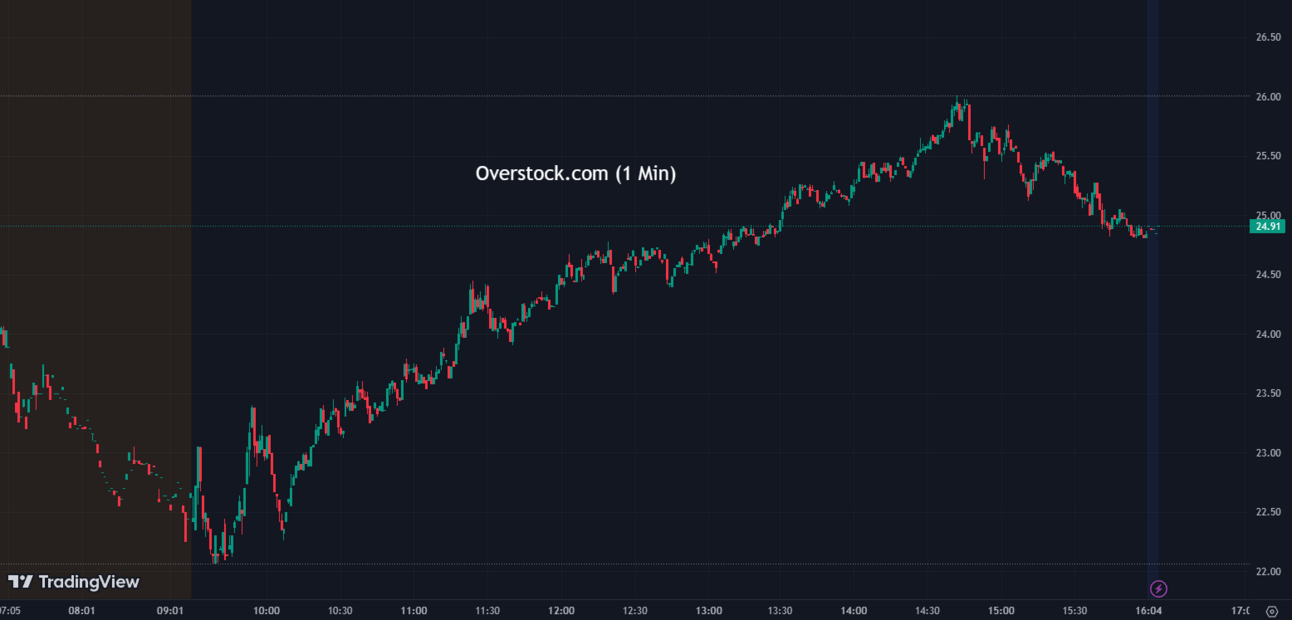

Overstock's Successful Bid for Bed Bath & Beyond Assets 🤝🛍️

Bed Bath & Beyond's intellectual property and digital assets were sold to Overstock.com (OSTK) in a bankruptcy-run auction for $21.5 million. Unfortunately, this sale does not mean the preservation of Bed Bath & Beyond's physical stores, marking the end of its brick-and-mortar presence. The acquisition includes the retailer's brand name, business data, and online assets. Bed Bath & Beyond chose to run a separate auction for its Buy Buy Baby chain. The aim is to find a buyer who would retain the physical stores of Buy Buy Baby without dealing with the liabilities of Bed Bath & Beyond's assets. The acquisition of Bed Bath & Beyond's assets marks a significant move for Overstock.com, providing a potential boost to its online retail presence.

OSTK:

24.84 ▲ +3.66 (+17.28%) Today

24.94 ▲ +0.10 (+0.40%) After Hours

Tesla Shares Recover, Rise 2% Despite Initial Downgrade and Valuation Concerns 📈🚀

Tesla (TSLA) shares managed to climb 2%, despite falling earlier in the day. The early selloff came in response to a downgrade from Morgan Stanley from overweight to equal weight due to concerns about Tesla's valuation and the expectation that the electric vehicle giant will continue to lower prices amid rising competition. This follows a recent one-day percentage decline in Tesla's stock after a downgrade at Barclays, again reflecting valuation concerns after the stock had more than doubled year to date.

TSLA:

264.61 ▲ +5.15 (+1.98%) Today

265.45 ▲ +0.84 (+0.32%) After Hours

Challenges Mount for Lithium Producers as Demand Surges ⚡️🔋

Lithium producers are becoming increasingly concerned about potential hurdles, including mine permitting delays, staffing shortages, and inflation, in meeting the escalating demand for the metal due to the rapid electrification worldwide. Once used predominantly in ceramics and pharmaceuticals, lithium is now crucial for the battery industry, particularly electric vehicles. However, challenges, such as power supply and logistical issues, are causing project delays and there are growing fears of a looming lithium shortage. Additionally, there are not enough facilities to produce specific types of lithium used in batteries, which may result in the use of lower-quality lithium, reducing EV battery range. As these issues persist, they pose a significant challenge to the transition to green energy and the growth of the electric vehicle industry.

Canadian Senate Passes Bill Requiring Tech Giants to Pay for News Content 📰💰

Canada's Senate has passed a bill necessitating tech giants like Google (GOOGL) and Meta (META) to pay media outlets for news content displayed on their platforms. Despite being perceived as threats from Google and Facebook to remove journalistic content from their platforms, Canadian authorities believe the law will even the field between online advertising behemoths and the diminishing news industry. In response, Meta confirmed its plan to comply by halting the availability of news on Facebook and Instagram for its Canadian users before the law's enforcement. While traditional media companies appreciate the bill for promising enhanced fairness in the digital news market, tech companies have previously faced criticism for dominating and disrupting the advertising industry. The new law, the Online News Act, expects these tech companies to form payment agreements with news publishers for content that generates income on their platforms.

META:

284.88 ▲ +3.24 (+1.15%) Today

285.07 ▲ +0.19 (+0.067%) After Hours

GOOGL:

123.87 ▲ +2.61 (+2.15%) Today

124.20 ▲ +0.33 (+0.27%) After Hours

Fortress Investment Group Emerges as Winning Bidder for Vice Media in Bankruptcy Sale 🏰💼

Fortress Investment Group has emerged as the winning bidder for Vice Media, marking the next step in the latter's plan to come out of bankruptcy. Fortress was leading a group of lenders that initially proposed a $225 million bid when Vice entered bankruptcy protection but later increased this offer to $350 million. Although multiple bids were made for Vice, none were deemed superior to the Fortress bid. There were concerns about the funding of another bid submitted by GoDigital, which proposed a valuation of $300 million. The acquisition by Fortress marks the end of a chapter for Vice, a digital media company that once commanded a valuation of $5.7 billion.

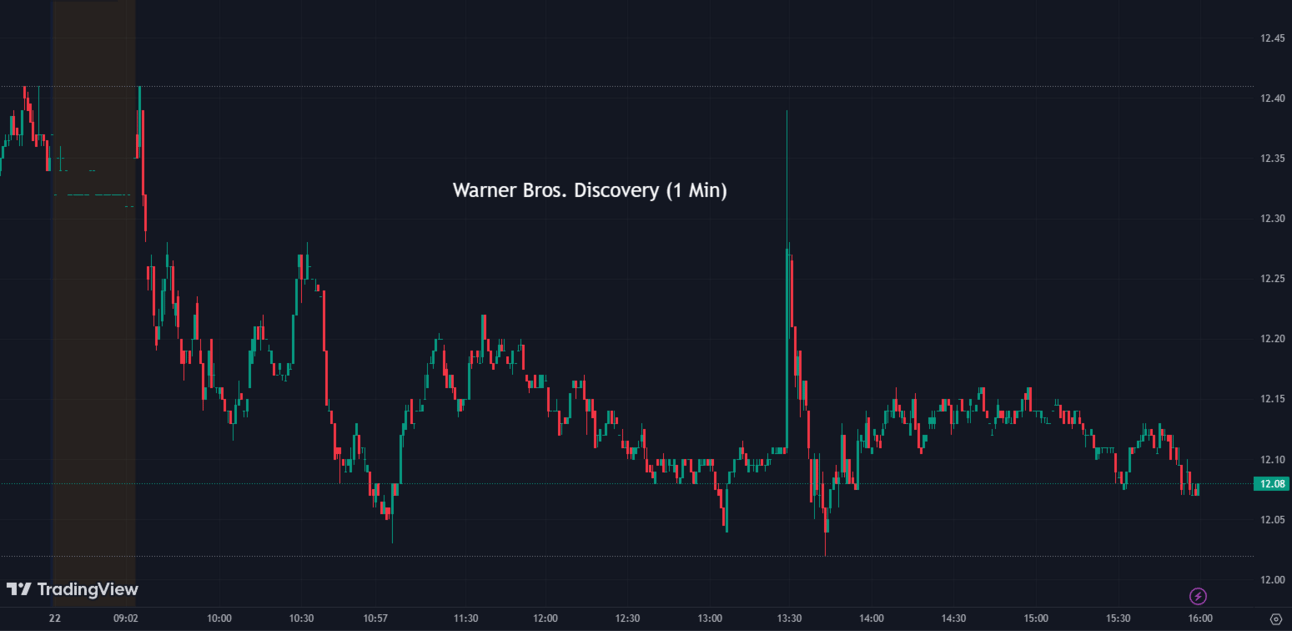

Warner Bros. Discovery Implements Layoffs and Leadership Changes at TCM 🎥📺

Warner Bros. Discovery (WBD) has initiated another round of layoffs and a leadership shuffle taking place at Turner Classic Movies (TCM). However, Warner Bros. Discovery CEO David Zaslav, personally reassured eminent filmmakers like Martin Scorsese, Steven Spielberg, and Paul Thomas Anderson that TCM would continue in its current form. This news comes amid an industry-wide transition towards streaming services and Warner Bros. Discovery's efforts to manage its debt load stemming from the merger.

WBD:

12.09 ▼ -0.28 (-2.26%) Today

12.11 ▲ +0.02 (+0.17%) After Hours

After Hour Movers 💰🌃

Smith & Wesson Brands (SWBI), reported a significant drop in profit for the fourth quarter. The company's profit fell to $12.8 million, or 28 cents per share, compared to $36.1 million, or 79 cents per share, in the same quarter a year ago. Sales also declined by 20% to $144.8 million, although it exceeded analysts' expectations. The decline in profit and sales was attributed to the company's efforts to address bloated firearm inventory at retailers and distributors. CEO Mark Smith noted that focused consumer promotions have helped reduce inventory significantly, and the company expects stable consumer demand for firearms in the coming year. To benefit stockholders, Smith & Wesson's board of directors approved an increase in the quarterly dividend to 12 cents per share.

SWBI:

11.24 ▼ -0.46 (-3.93%) Today

11.65 ▲ +0.41 (+3.65%) After Hours

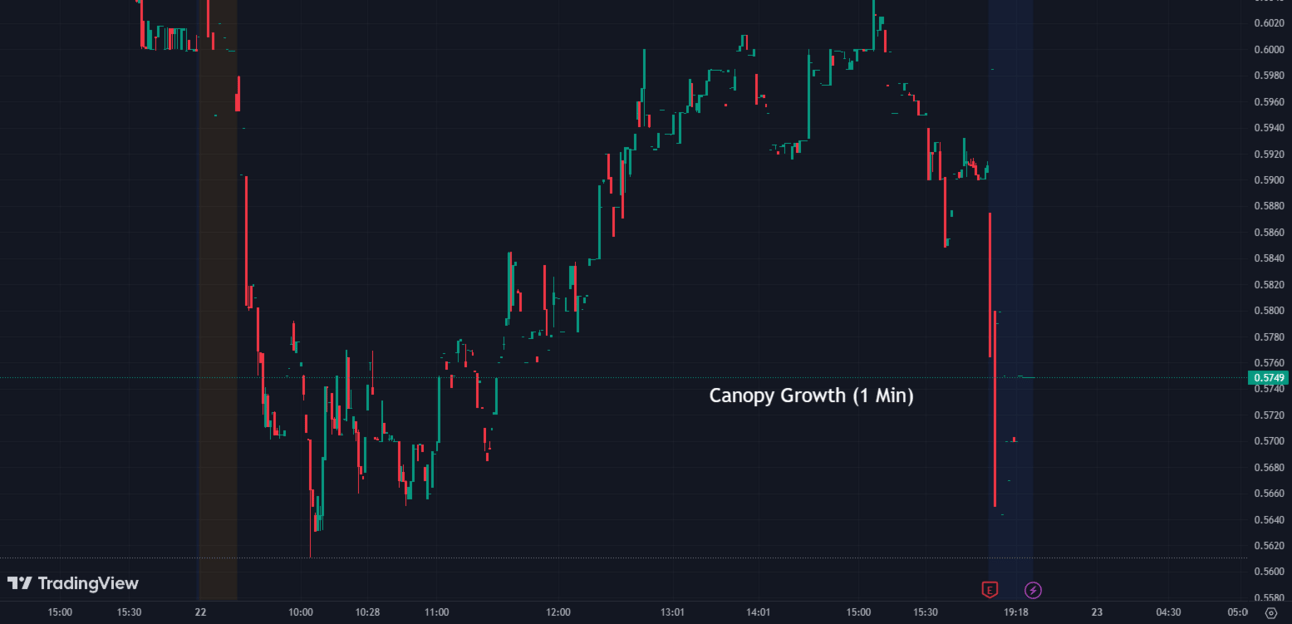

Canopy Growth Corporation (CGC), a cannabis producer, reported a quarterly loss of $0.23 per share, missing the Zacks Consensus Estimate of a loss of $0.12. The company's quarterly report showed an earnings surprise of -91.67%. Revenue for the quarter was $64.74 million, missing estimates by 10.75%.

CGC:

0.60 ▲ +0.0016 (+0.27%) Today

0.57 ▼ -0.026 (-4.41%) After Hours

Beyond Air (XAIR) reported a quarterly loss of $0.67 per share, falling short of the Zacks Consensus Estimate of a loss of $0.44. This resulted in an earnings surprise of -52.27%. The company recorded zero revenues for the quarter, missing estimates by 100%. Beyond Air's shares have declined by approximately 7.7% year-to-date. The company's earnings outlook and estimate revisions will be key factors influencing its future performance. The current consensus EPS estimate for the coming quarter is -$0.40 on $6 million in revenues, and for the current fiscal year, it is -$1.69 on $25.9 million in revenues. The performance of the industry, Medical - Biomedical and Genetics, will also impact the stock.

XAIR:

5.71 ▼ -0.28 (-4.76%) Today

5.20 ▼ -0.51 (-8.86%) After Hours

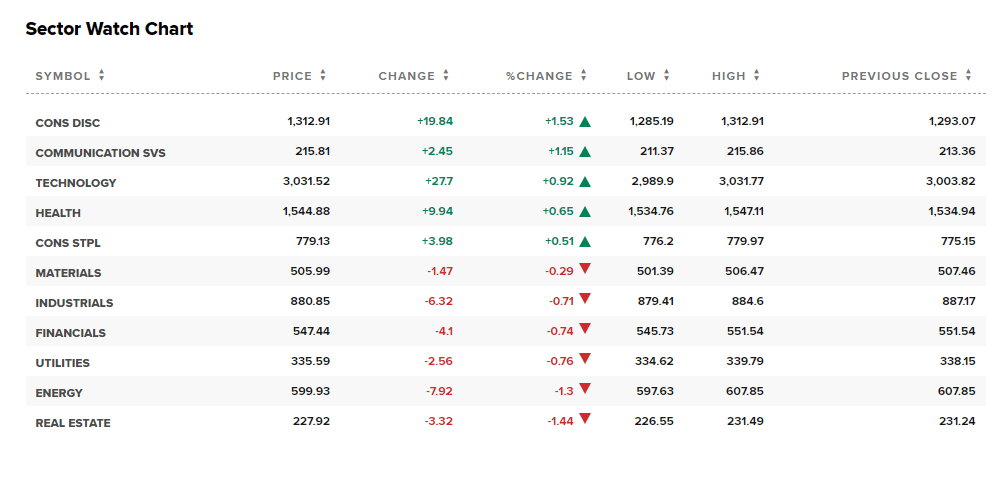

Sectors 🛍️💡

Out of the 11 sectors, 5 closed in positive territory today, with Consumer Discretionary leading the way with a gain of 1.53%, while Utilities saw a decline of -0.76%.

Conclusion 👋

To wrap it up, Federal Reserve Chairman Jerome Powell provided assurance to small banks that new capital requirement regulations will not affect institutions with assets under $100 billion. While larger banks may face changes to meet international standards, Powell emphasizes the importance of these regulations for maintaining stability and preventing unexpected failures. In other news, there were mixed performances in the stock market, with the S&P 500 ending its losing streak, J.P. Morgan Securities was fined for email deletion violations, and tech giants Elon Musk and Mark Zuckerberg engaged in playful banter. Surf Air Mobility plans to go public through a direct listing, Novo Nordisk faces stock decline amidst an investigation into its diabetes drug, and Shein and Temu are under scrutiny for import violations and human rights concerns. Additionally, Amazon Web Services invests in generative AI, Spirit AeroSystems' plant halt poses potential setbacks for Boeing, Overstock acquires Bed Bath & Beyond assets, and Tesla shares recover despite concerns. Challenges mount for lithium producers as demand surges, Root's stock soars on a takeover bid, Canada passes a bill requiring tech giants to pay for news content, Fortress Investment Group acquires Vice Media, and Warner Bros. Discovery implements layoffs and leadership changes at TCM. Finally, Smith & Wesson Brands and Canopy Growth Corporation report quarterly losses, while Beyond Air falls short of earnings estimates.

Thank you all for signing up!

Will only work to do better for you all going forward. Our only goal is to add value to everyone’s trading with key levels and the ability of learning charts and price action.

Please Share Our Newsletter it will be much appreciated!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of TradingView. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.