Hello, traders! As the day draws to a close, join us for a comprehensive review of the noteworthy events that have shaped the financial markets today.

Indexes 📉📉

The indices fell today as the Federal Reserve Chairman, Jerome Powell, stated that more interest rate increases are likely in response to persistently high inflation. Powell acknowledged that bringing inflation back down to the Federal Reserve's target of 2% will take time. He also commented on the labor market, noting signs of loosening conditions such as increased labor force participation in the prime 25-to-54 age group and moderate wage growth. However, there is still a significant imbalance between the number of open jobs and available labor. Now, let's explore how the indices performed today...

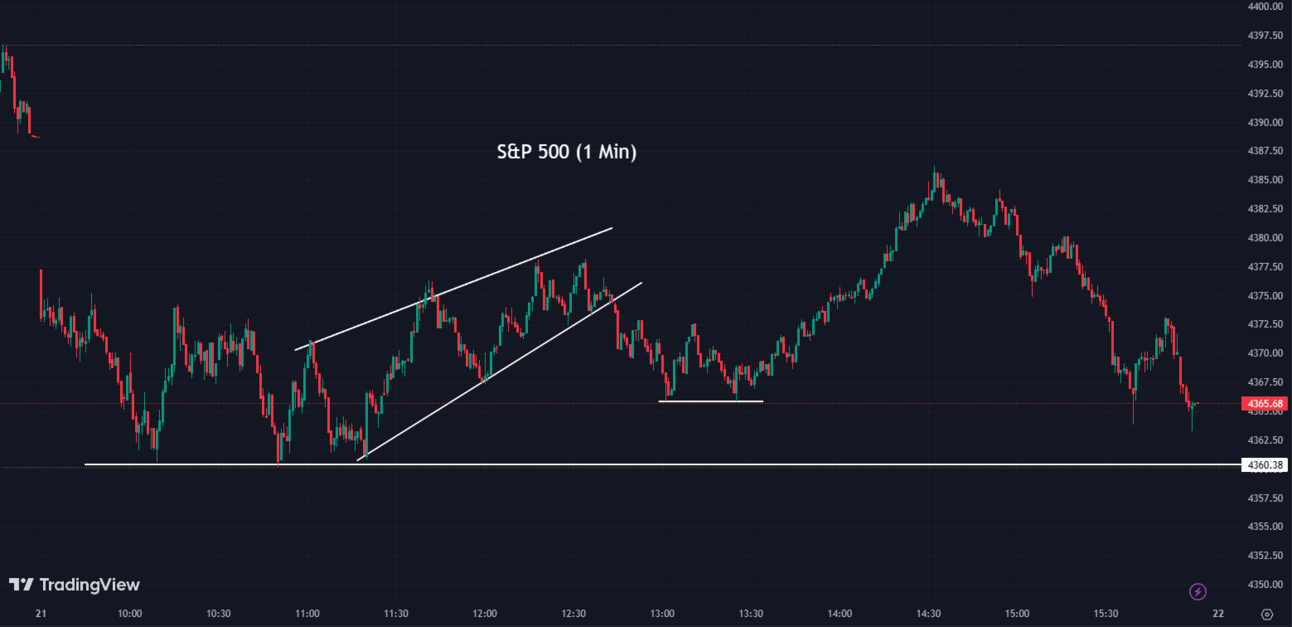

The S&P 500 (SPX) was down -0.52% coming to a conclusion at 4,365

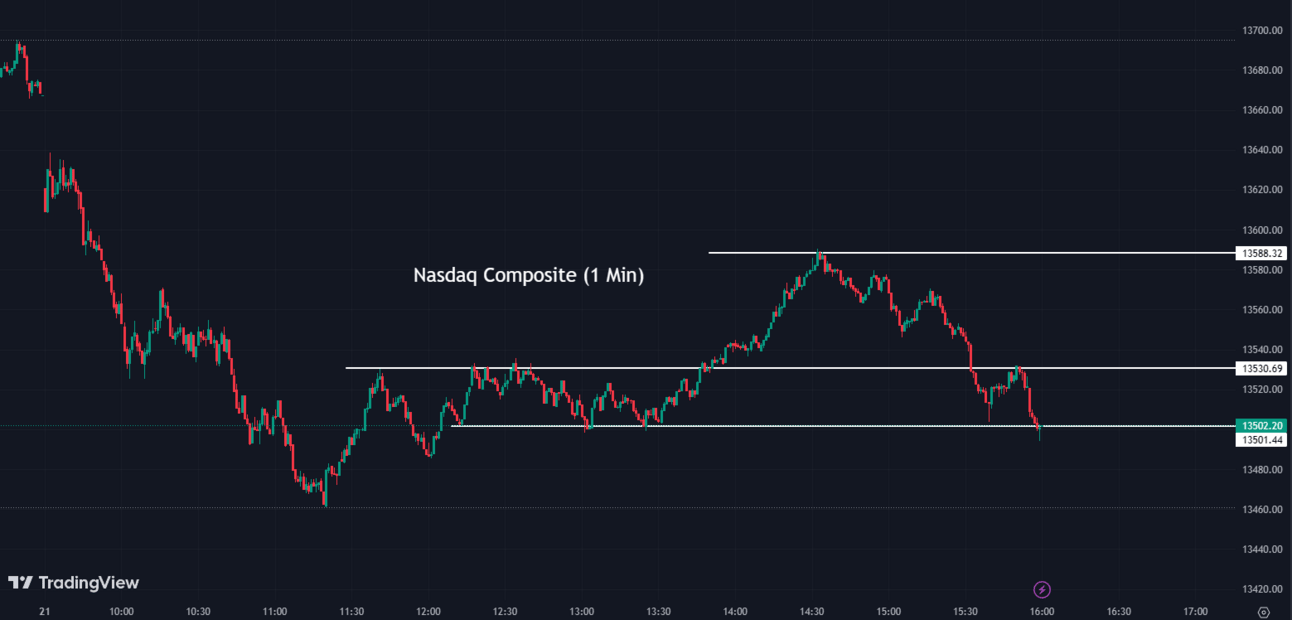

The Nasdaq Composite (IXIC) fell by -1.21% to settle at 13,502

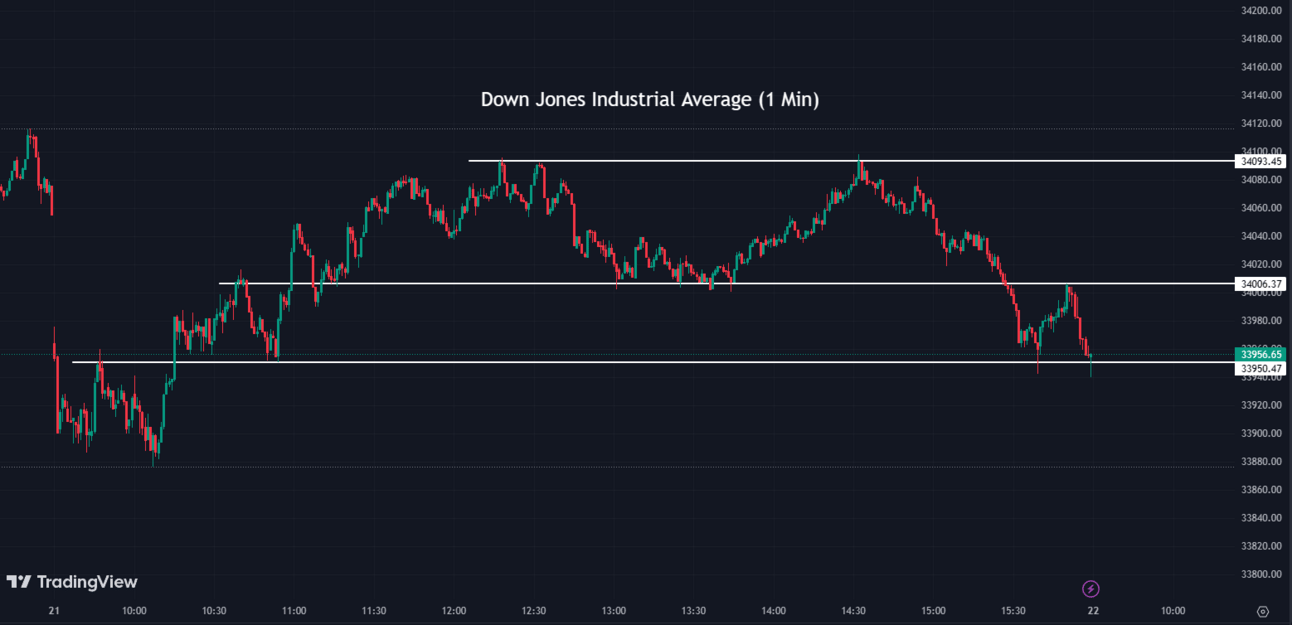

The Dow Jones Industrial Average dropped by -0.30% ending the day at 33,951

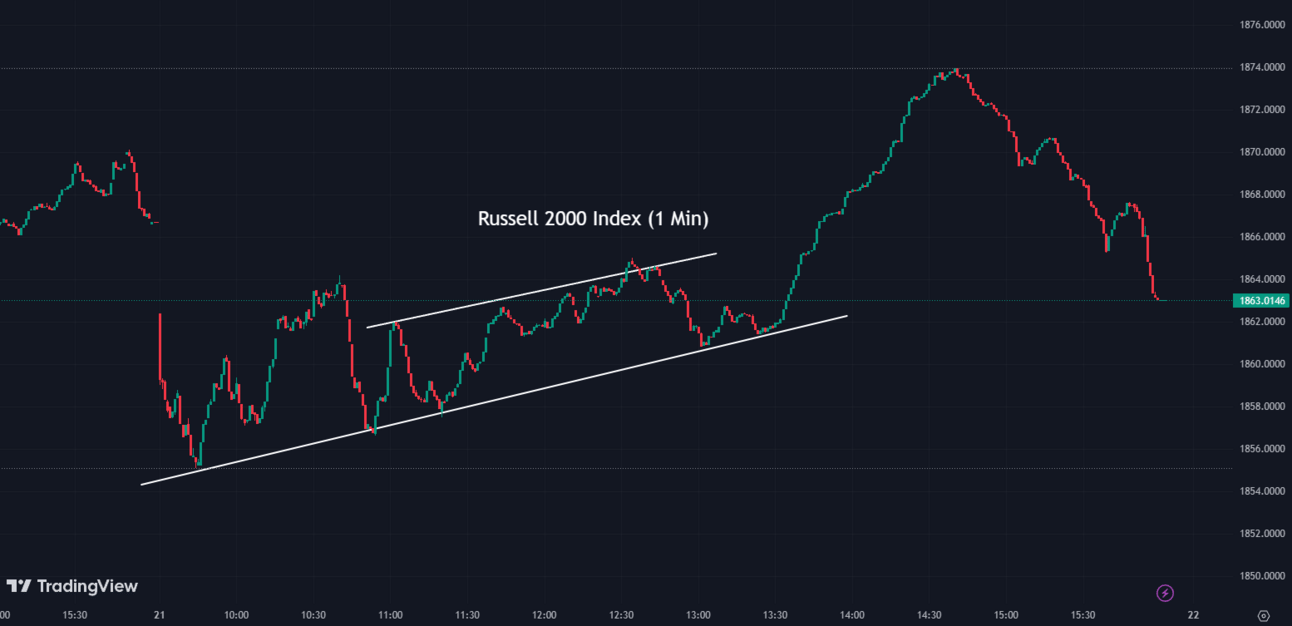

The Russell 2000 (RUT) slid by -0.20% to finish at 1,863

The Nasdaq-100 (NDX) declined by -1.35% to conclude at 14,867

Hello Traders, before you dive fully into tonight’s recap, I would like to quickly inform you all of the new edition of our newsletter! We are currently offering a limited-time lifetime discount of 20% when you sign up now.

Here is what the premium newsletter includes: Daily and Weekly Market Analysis & Insights + In-Depth Analysis on Financial News/Events

Explore comprehensive guidance on: - Money management strategies - Intelligent investing techniques - Personal finance principles - Real estate opportunities

Dive into past newsletter editions & enjoy top-notch support and responses to your burning questions and comments.

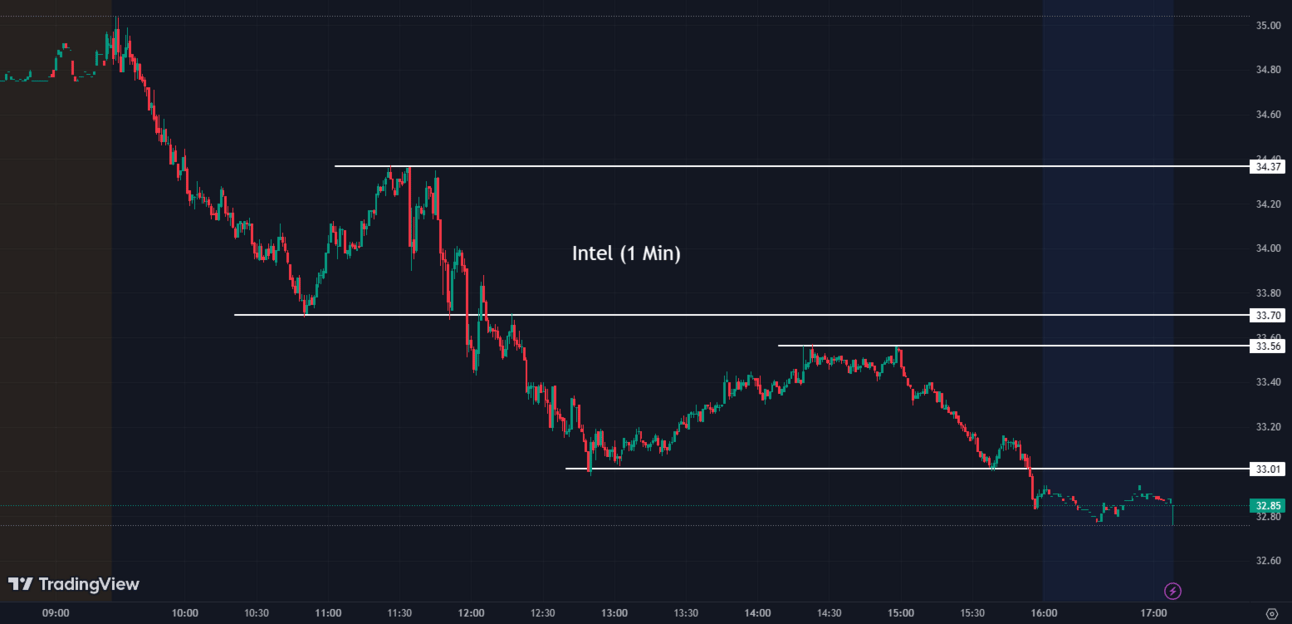

Intel Shares Drop 6% as Turnaround Plan Reveals Ambitious Goals and Cost-Cutting Measures 📉💻

Intel (INTC) shares dropped 6% after the company revealed an update to its turnaround plan, aimed at transforming it into a significant competitor against Taiwan Semiconductor Manufacturing Company (TSMC). The plan includes a new reporting structure, with a dedicated profit-and-loss statement for its foundry business, known as IFS, to better control costs and improve the transparency of manufacturing margins. Intel is also seeking to trim $10 billion in costs over the next three years. Its ambitious "five nodes in four years" plan aims to rival TSMC's manufacturing technology by 2026, with the eventual goal of securing contracts from companies like Apple, Nvidia, and Qualcomm that currently outsource their chip production. In separate news, Intel disclosed its intention to sell a 20% stake in its Austrian subsidiary, IMS Nanofabrication, to Bain Capital, placing the unit's value at $4.3 billion.

INTC:

32.90 ▼ -2.10 (-6.00%) Today

32.95 ▲ +0.045 (+0.14%) After Hours

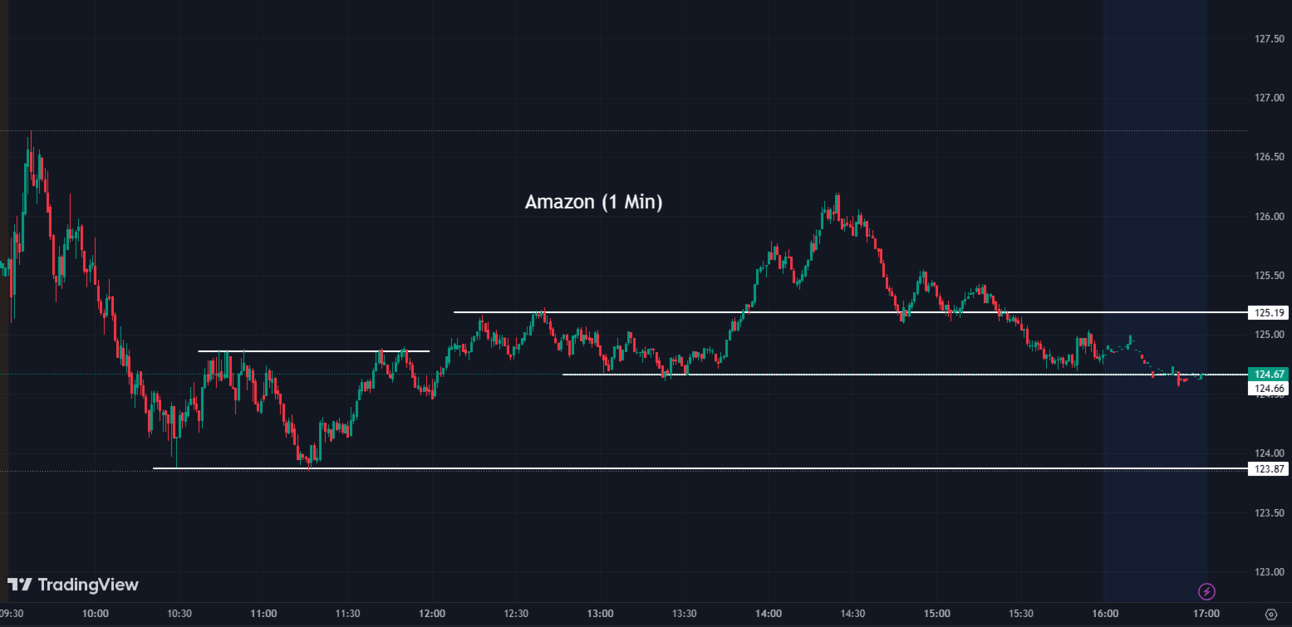

FTC Files Lawsuit Against Amazon Over Alleged Deceptive Practices in Prime Subscriptions 🛍️⚖️

The Federal Trade Commission (FTC) has filed a lawsuit against Amazon (AMZN), alleging that the company engaged in deceptive practices to sign up customers for its Prime subscription service and made it difficult for them to cancel. The FTC claims that Amazon used deceptive design tactics, known as "dark patterns," to manipulate users into enrolling in Prime without their explicit consent. Amazon, however, maintains that it has always provided clear and simple options for customers to sign up for or cancel their Prime membership.

AMZN:

124.83 ▼ -0.95 (-0.76%) Today

124.71 ▼ -0.12 (-0.096%) After Hours

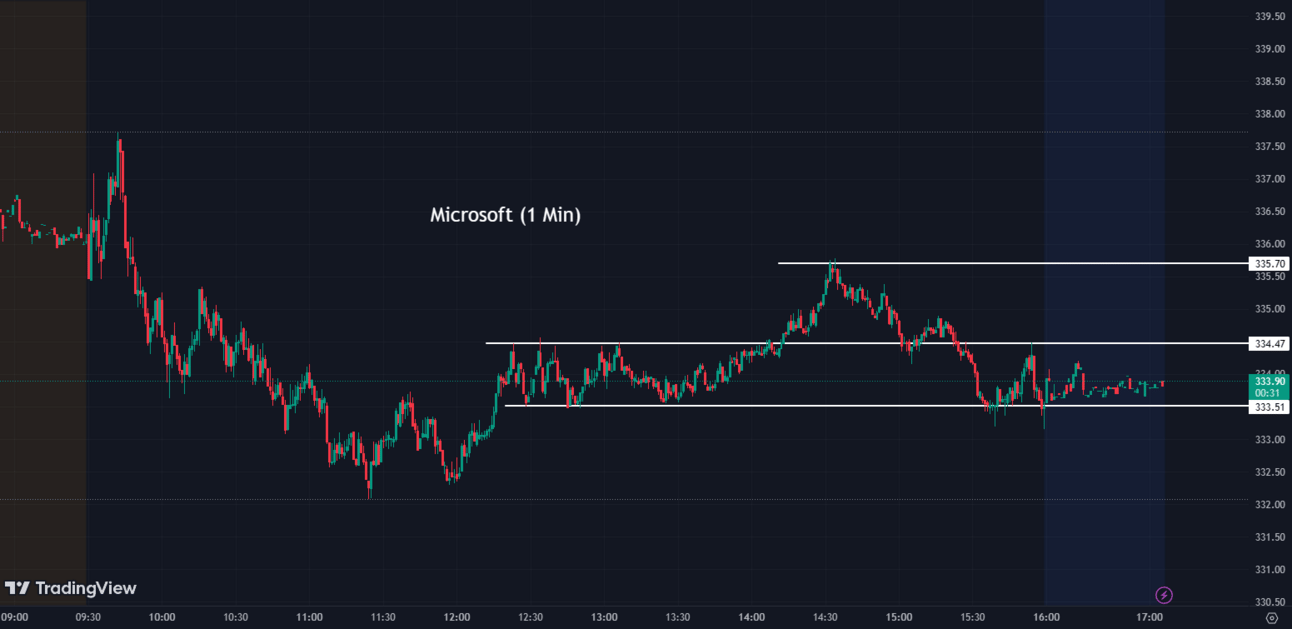

Google Files FTC Complaint Against Microsoft, Citing Anti-Competitive Practices in Cloud Computing Market 📜🔍

In a surprising development, Google (GOOGL) has filed a complaint with the FTC against Microsoft (MSFT), accusing the company of engaging in anti-competitive practices. Google alleges that Microsoft uses unfair licensing terms to control the cloud-computing market, limiting competition and hindering businesses from diversifying their software vendors. Google also raises concerns about national security and cybersecurity risks resulting from Microsoft's dominance in the cloud market. Notably, Google itself is facing legal challenges from the Department of Justice and the FTC over its own alleged anti-competitive practices.

GOOGL:

120.55 ▼ -2.55 (-2.07%) Today

120.32 ▼ -0.23 (-0.19%) After Hours

MSFT:

333.56 ▼ -4.49 (-1.33%) Today

334.48 ▲ +0.92 (+0.28%) After Hours

Bitcoin Surges Amid Institutional Interest and ETF Optimism 💥🚀

Bitcoin experienced a large rally, reaching a high of $30,621.80, its best performance since April. This bullish trend is driven by significant institutional interest, particularly from BlackRock (BLK), which recently applied for a Bitcoin exchange-traded fund (ETF).

Bitcoin:

BLK:

689.04 ▼ -1.91 (-0.28%) Today

698.47 ▲ +9.43 (+1.37%) After Hours

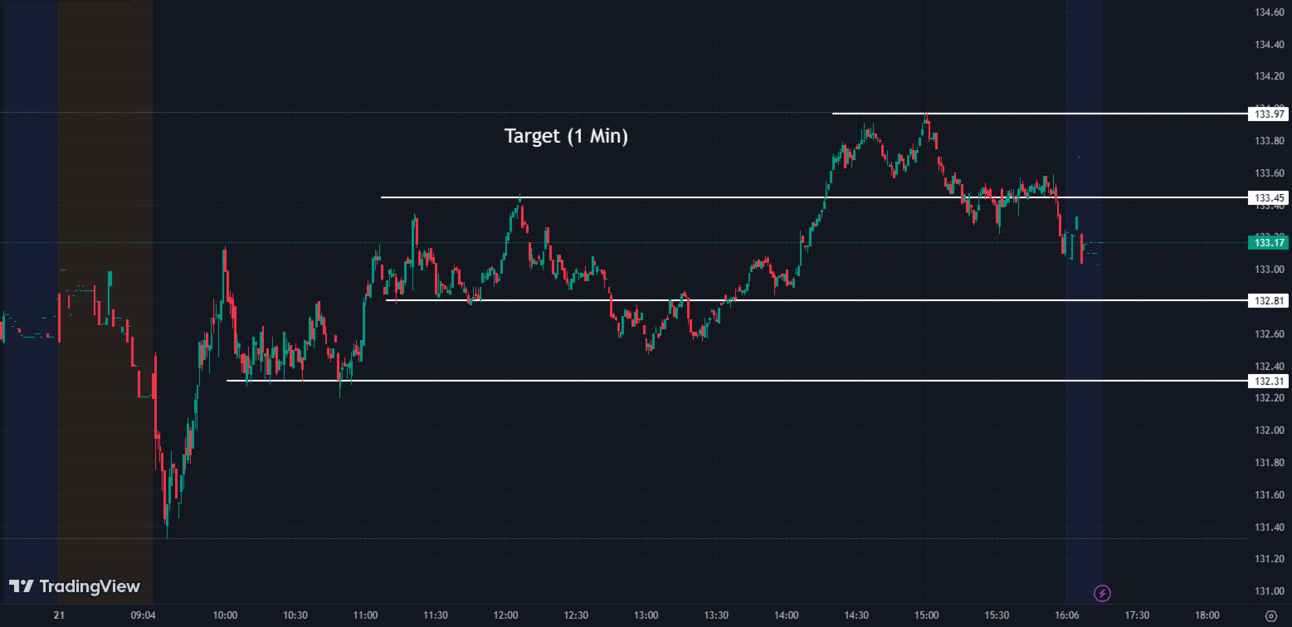

Target Expands Delivery Options with New Extension Facility to Boost E-commerce Sales 🚚🌐

Target (TGT) is testing a new extension facility to expedite online orders to customers, especially those in distant suburbs and neighborhoods of major cities. This initiative aims to address the decline in the company's e-commerce sales. By extending its next-day delivery service, Target anticipates that it will reach a much larger customer base.

TGT:

133.25 ▲ +0.53 (+0.40%) Today

133.14 ▼ -0.08 (-0.06%) After Hours

GSK's RSV Vaccine Shows Extended Efficacy in Seniors, May Require Biennial Administration 🧪🔬

GlaxoSmithKline (GSK) announced that its respiratory syncytial virus (RSV) vaccine remains effective for two seasons in adults aged 60 and above. Phase three clinical trial results indicate that seniors may only need to receive the vaccine every other year. GSK presented these findings to the CDC advisory committee, which will consider the frequency and timing of administering the vaccine.

GSK:

35.15 ▲ +0.53 (+1.52%) Today

35.05 ▼ -0.10 (-0.28%) After Hours

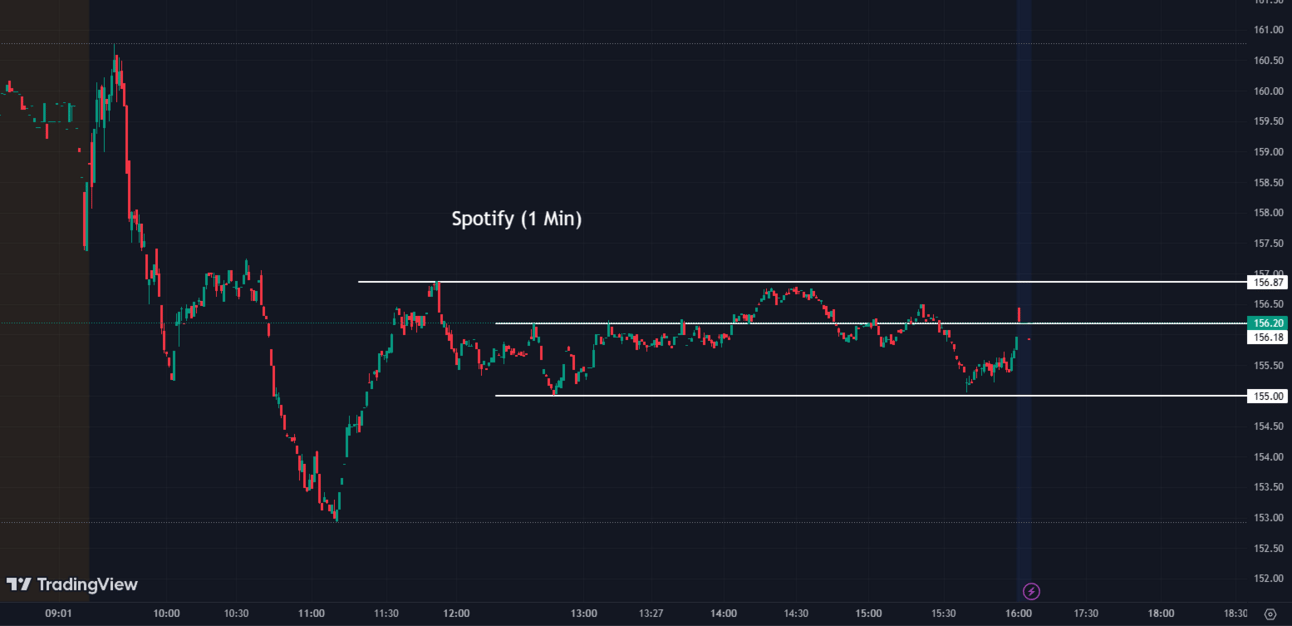

Spotify Stock Reacts to Wall Street Upgrade, Optimistic Outlook for Growth and Profitability 🎶👀

Spotify's stock (SPOT) initially rose following a positive Wall Street upgrade but ended up falling. Wolfe Research analyst Zach Morrisey upgraded the shares to 'Outperform' due to the platform's potential for revenue acceleration, margin expansion, and ability to outperform Wall Street estimates in the coming year. Spotify has witnessed significant growth in subscribers and monthly active users, indicating that it has not yet reached market saturation. After investing heavily in the podcast market, the company is now focusing on profitability and cost-efficiency, leading to an optimistic outlook for its future.

SPOT:

155.93 ▼ -0.89 (-0.57%) Today

155.00 ▼ -0.93 (-0.60%) After Hours

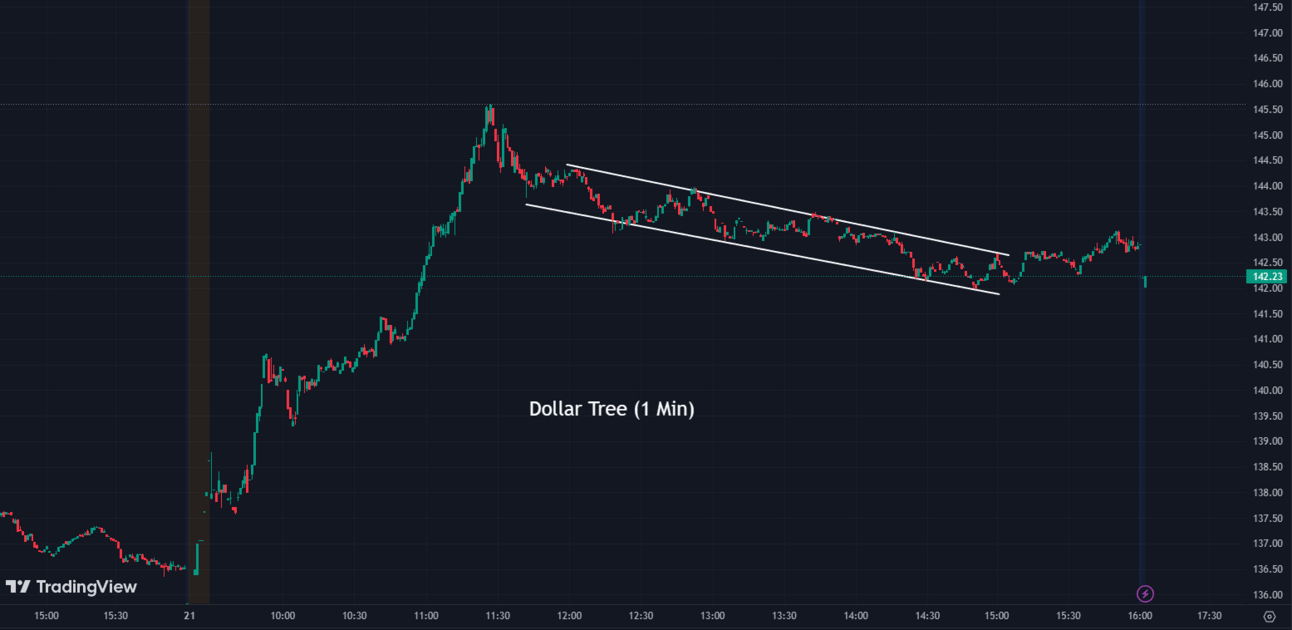

Dollar Tree Shares Surge on Strong Investor Backing for Turnaround Strategy 💲🌳

Dollar Tree (DLTR) shares experienced a surge after executives shared plans to intensify a turnaround strategy, which has been backed by activist investors after years of subpar performance. The overhaul strategy, led by CEO Rick Dreiling, includes improvements to supply-chain capabilities, wages, and technology systems, as well as significant upgrades to underinvested store facilities. This initiative was primarily driven by Mantle Ridge, an activist investor who bought a stake in Dollar Tree in late 2021. The plan is designed to revive the company's fortunes and cater more effectively to its low-income customer base, with earnings predicted to rise to over $10 a share by January 2027.

DLTR:

142.77 ▲ +6.23 (+4.56%) Today

143.07 ▲ +0.30 (+0.21%) After Hours

Increased Treasury Bill Issuance Raises Concerns of Bond Market Disruption and Potential Rate Surge 🔔📊

The expected increase in Treasury bill issuance could disrupt bond markets, potentially leading to a rapid unwinding of significant short-leveraged positions in Treasuries futures held by hedge funds. Analysts warn that this could cause a surge in rates in short-term funding markets, prompting bond pressure or intervention from the Federal Reserve. With the resolution of the U.S. debt ceiling debate, Treasury bill sales may surge to approximately $1 trillion by the end of the year. This increase in government borrowing could result in a spike in rates in the repurchase agreements market, similar to the scenario in September 2019.

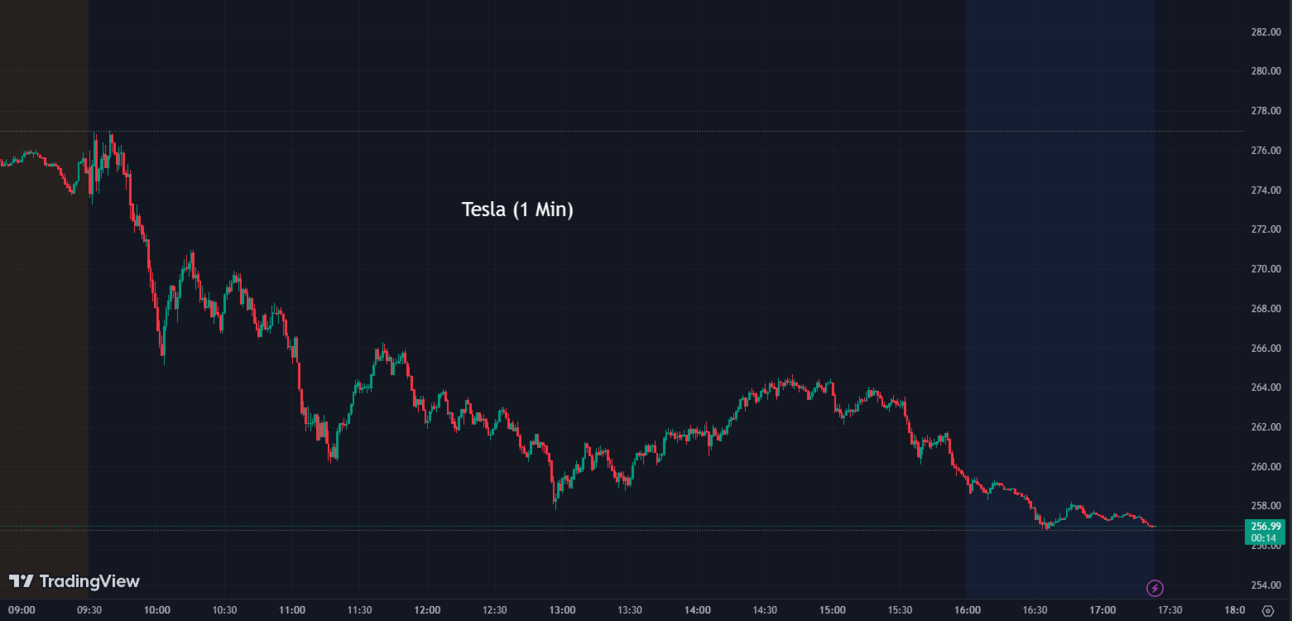

Analysts Recommend Selling Tesla Stock Amidst Rally and Concerns Over Near-Term Fundamentals 📉⚠️

After a significant rise in Tesla's stock (TSLA), Wall Street analysts, including Barclays' Dan Levy, recommended selling some shares to capitalize on profits. Levy suggests that the rally may have overlooked near-term concerns about the stock's fundamentals and has downgraded Tesla shares from Overweight to Equal Weight. Tesla's ventures such as full self-driving, its Dojo supercomputer, and the Optimus robot are considered long-term opportunities rather than immediate valuation boosters. Additionally, Tesla's partnerships with Ford (F), General Motors (GM), and Rivian (RIVN) primarily offer marketing benefits with potential long-term gains. While Levy remains optimistic about Tesla's long-term prospects, he advises caution given its current inflated valuation.

TSLA:

259.46 ▼ -14.99 (-5.46%) Today

257.05 ▼ -2.42 (-0.93%) After Hours

After Hour Movers 🌙📊

KB Home (KBH), reported fiscal second-quarter earnings of $164.4 million, translating to a profit of $1.94 per share. These results exceeded the expectations of Wall Street analysts, who had predicted earnings of $1.28 per share. The company also outperformed revenue estimates, generating $1.77 billion in the period compared to the projected $1.43 billion.

KBH:

52.03 ▲ +0.98 (+1.92%) Today

52.26 ▲ +0.25 (+0.48%) After Hours

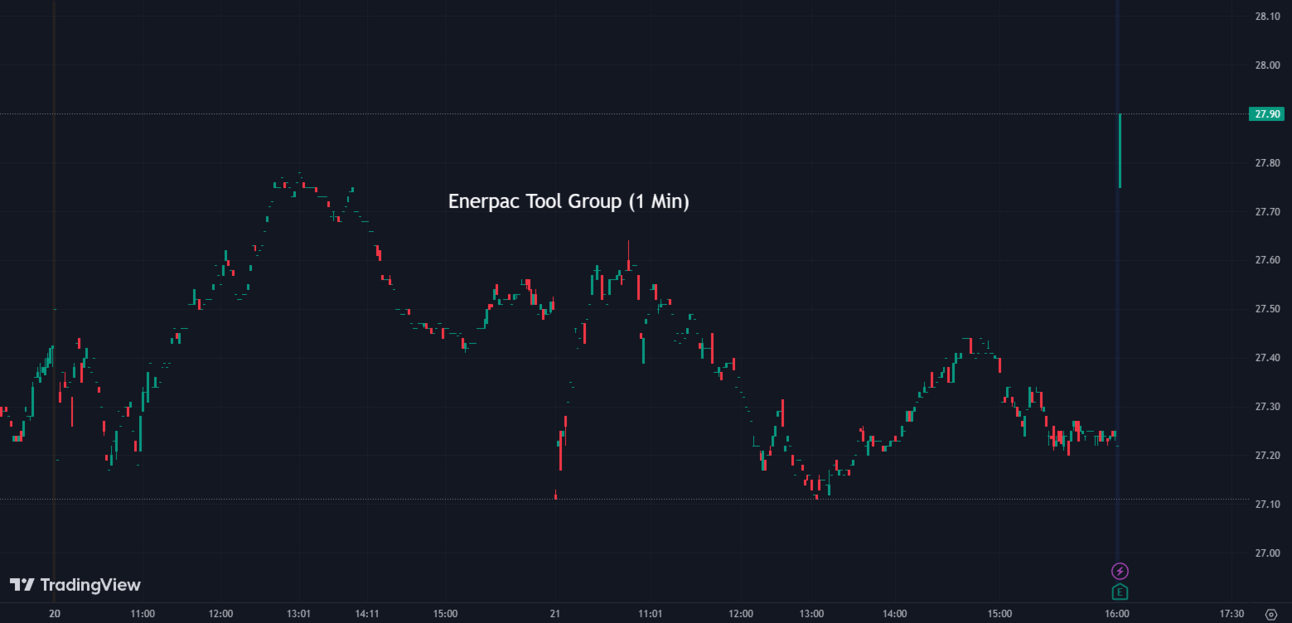

Enerpac Tool Group (EPAC) reported positive results for its third quarter of fiscal 2023, marked by a 4% year-over-year increase in core sales, reaching $156 million. The company achieved record gross profit margins and adjusted EBITDA margins since its launch in 2019, demonstrating strong performance. The GAAP operating margin stood at 16.3%, while the adjusted operating margin was 21.7%. Adjusted EBITDA margin significantly improved to 24.0% compared to 12.0% in the previous year. The company repurchased 0.8 million shares for approximately $21 million, reflecting confidence in management and a balanced capital allocation strategy. The leverage ratio (Net Debt to Adjusted EBITDA) was 1.0x, indicating a healthy financial position. Enerpac Tool Group raised its full-year guidance, expecting revenue at the high end of the range and an increase in adjusted EBITDA, driven by the company's continuous improvement efforts and strong market position.

EPAC:

27.25 ▼ -0.23 (-0.86%) Today

28.00 ▲ +0.79 (+2.90%) After Hours

Avid Bioservices (CDMO), has announced its financial results for the fourth quarter and full fiscal year. The company achieved record-high revenue, with $39.8 million in the fourth quarter and $149.3 million for the full year. They also reported a net new business order of $55 million, resulting in a record-high backlog of $191 million. Avid's mammalian cell manufacturing and process development facility expansions are operational, adding approximately $120 million of annual revenue-generating capacity. The expansion of their cell and gene therapy facility remains on schedule and is expected to be online by the end of the third quarter of 2023. Avid Bioservices has provided revenue guidance of $145 million to $165 million for fiscal year 2024. Despite acknowledging challenging macroeconomic conditions, the company expects its focus on late-phase and commercial projects to benefit its long-term growth prospects. They reported a net loss of $0.3 million for the fourth quarter of fiscal 2023, compared to net income of $115.6 million for the same period in the previous year. Avid Bioservices ended the fiscal year with $38.5 million in cash and cash equivalents.

CDMO:

15.57 ▼ -0.46 (-2.87%) Today

12.11 ▼ -3.46 (-22.22%) After Hours

Steelcase (SCS), has reported a net income of $1.5 million in its fiscal first quarter. The company's earnings per share for the quarter were 1 cent. However, after adjusting for restructuring costs and amortization costs, the earnings per share stood at 9 cents. In terms of revenue, Steelcase posted $751.9 million in the period. Looking ahead, for the current quarter ending in August, the company expects its per-share earnings to range from 19 cents to 23 cents. Additionally, Steelcase anticipates revenue in the range of $815 million to $840 million for the fiscal second quarter.

SCS:

7.24 ▼ -0.14 (-1.90%) Today

7.33 ▲ +0.09 (+1.24%) After Hours

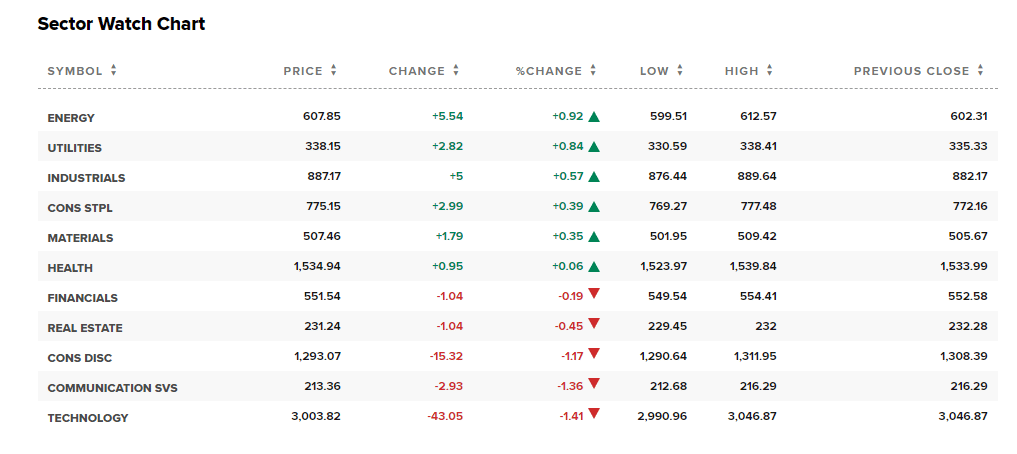

Sectors ⚡📱

Out of the 11 sectors, 6 closed in positive territory today, with Energy leading the way with a gain of 0.92%, while Technology saw a decline of -1.41%.

Conclusion 👋

The stock market experienced a mixed day with various companies making headlines. Intel's shares dropped after revealing its turnaround plan to compete with TSMC, while Amazon faced a lawsuit from the FTC over alleged deceptive practices. Federal Reserve Chairman Jerome Powell indicated the likelihood of more interest rate increases due to high inflation. Google filed a complaint against Microsoft, citing anti-competitive practices. Bitcoin rallied due to institutional interest, and Target tested a new facility to expedite online orders. GlaxoSmithKline announced positive results for its RSV vaccine, and Spotify received a Wall Street upgrade. Dollar Tree saw a rise in shares following plans for a turnaround strategy, and Tesla's stock faced a recommendation to sell some shares. KB Home and Enerpac Tool Group reported strong earnings, while Avid Bioservices achieved record-high revenue. Lastly, Steelcase posted a modest net income for its fiscal first quarter. The market continues to reflect a wide range of developments across industries and companies.

Thank you all for signing up!

Will only work to do better for you all going forward. Our only goal is to add value to everyone’s trading with key levels and the ability of learning charts and price action.

Please Share Our Newsletter it will be much appreciated!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of TradingView. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.