Hey there, fellow traders! As the week draws to a close, let's take a breather and dive into the exciting events of the day. Buckle up, because today was nothing short of extraordinary!

May Jobs Report Update 🚀💼

In May 2023, the US economy significantly surpassed predictions, adding 339,000 jobs as opposed to the expected 190,000. This marks the 29th consecutive month of promising job market expansion and the largest monthly increase since January. The job growth was broad-based, with substantial contributions from professional and business services, the government sector, healthcare, and leisure and hospitality, including 33,000 jobs from food services and drinking places alone. Despite this, the unemployment rate rose to 3.7%, and hourly wages decelerated.

A New High for Tech Stocks 📈💪

For the first time since January 2020, tech stocks have experienced a sustained rally for six consecutive weeks. The rally is not specific to one sector but is widespread across multiple tech industries. This positive sentiment surrounding tech stocks has investors and traders excited about what could come next.

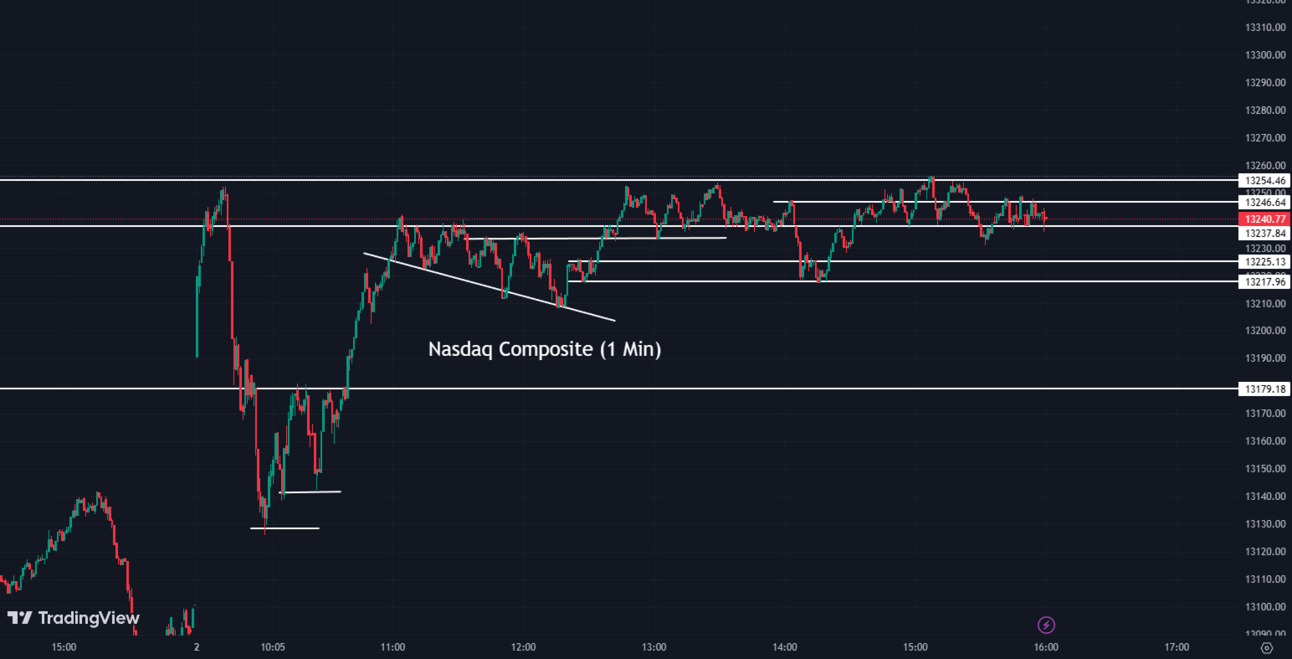

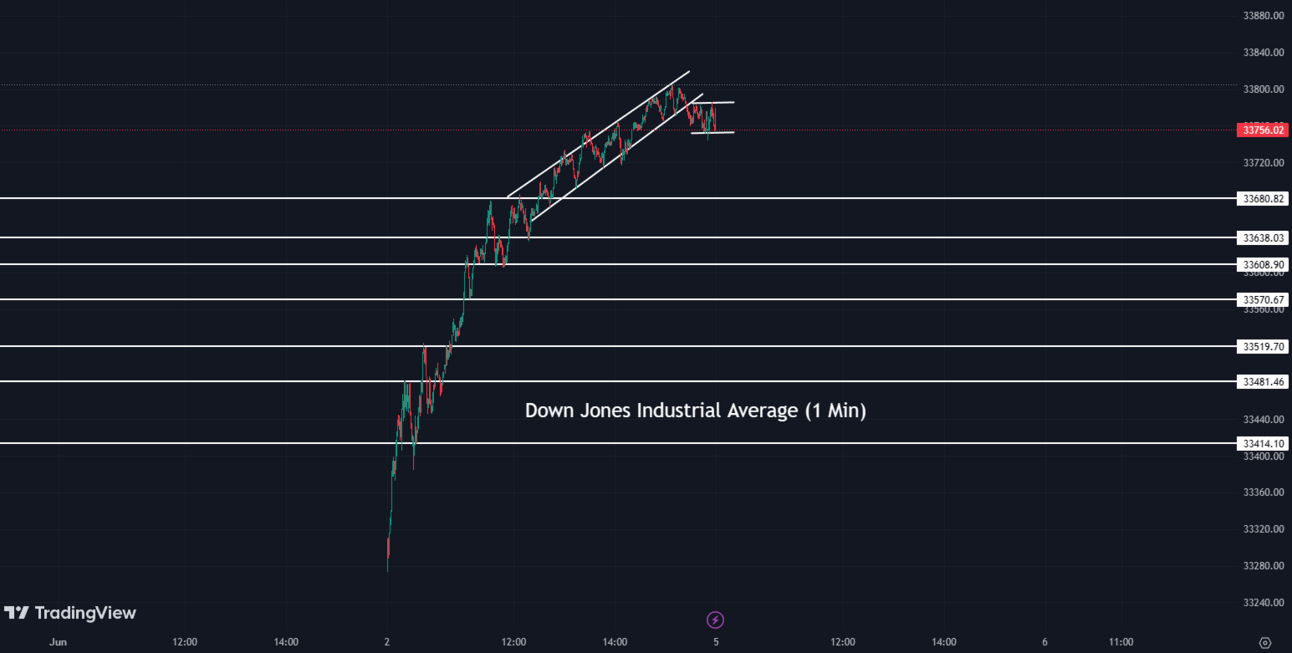

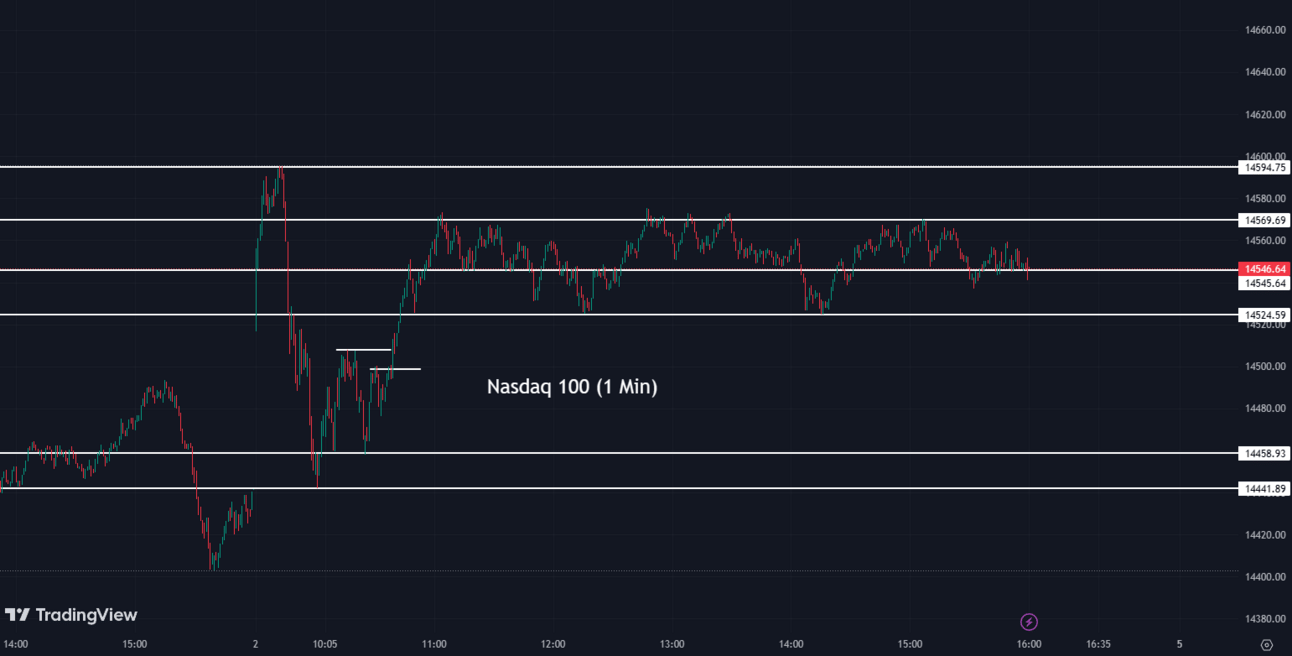

Indexes 🏋️♂️📈

Friday was a significant day for the stock market with the jobs data pushing the market to new limits. The Dow Jones Industrial Average had its best day since January, along with Nasdaq finishing up its sixth straight week higher. Let’s now take a look at the closing prices of the day…

The S&P 500 (SPX) was up 1.45% coming to a conclusion at 4,282

The Nasdaq Composite (IXIC) surged 1.07% ending the day at 13,240

The Dow Jones Industrial Average (DJI) escalated by 2.12% to finish at 33,762

The Russell 2000 (RUT) skyrocketed by 3.56% to settle at 1,830

The Nasdaq-100 (NDX) heightened by 0.73% to conclude at 14,546

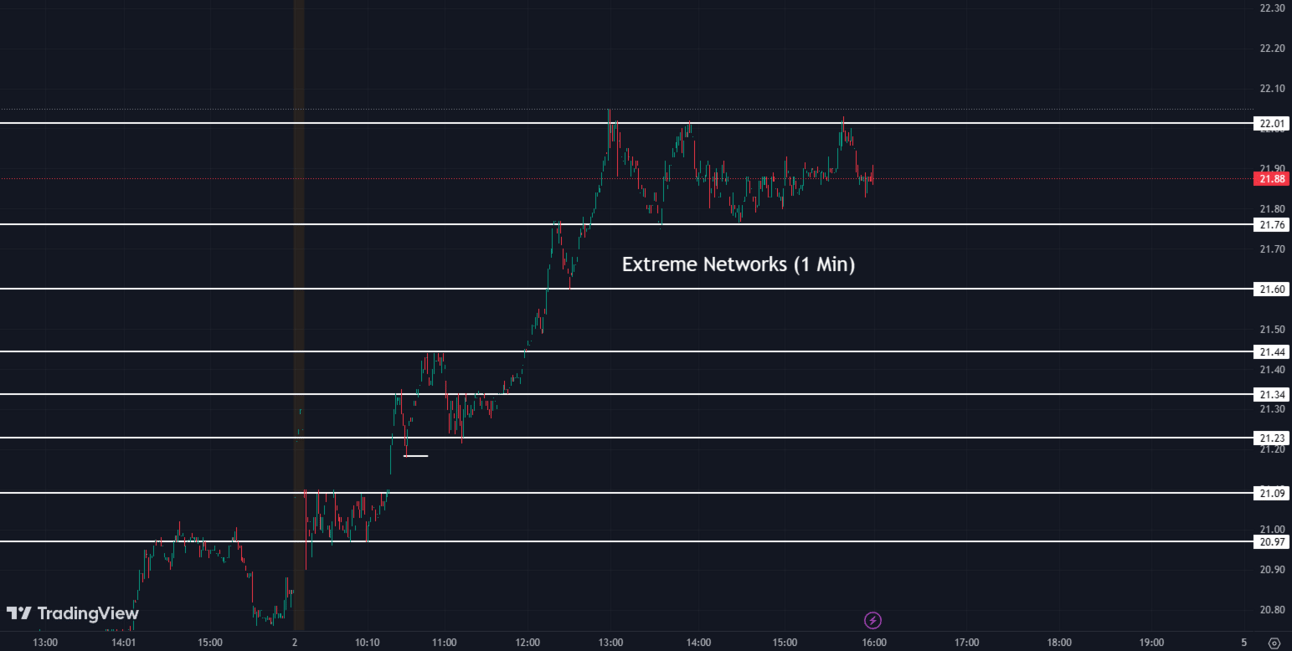

Extreme Networks' Skyrocketing Shares 🤑💰

Extreme Networks (EXTR), a leading player in network infrastructure and services, saw their shares reach an all-time high today. The company's robust financials and the ever-growing need for strong network infrastructure are credited for this significant surge. Analysts have turned extremely bullish, and the market seems to agree, marking a successful day for Extreme Networks' investors.

EXTR:

21.87 ▲ +1.02 (+4.89%) Today

22.02 ▲ +0.15 (+0.69%) After Hours

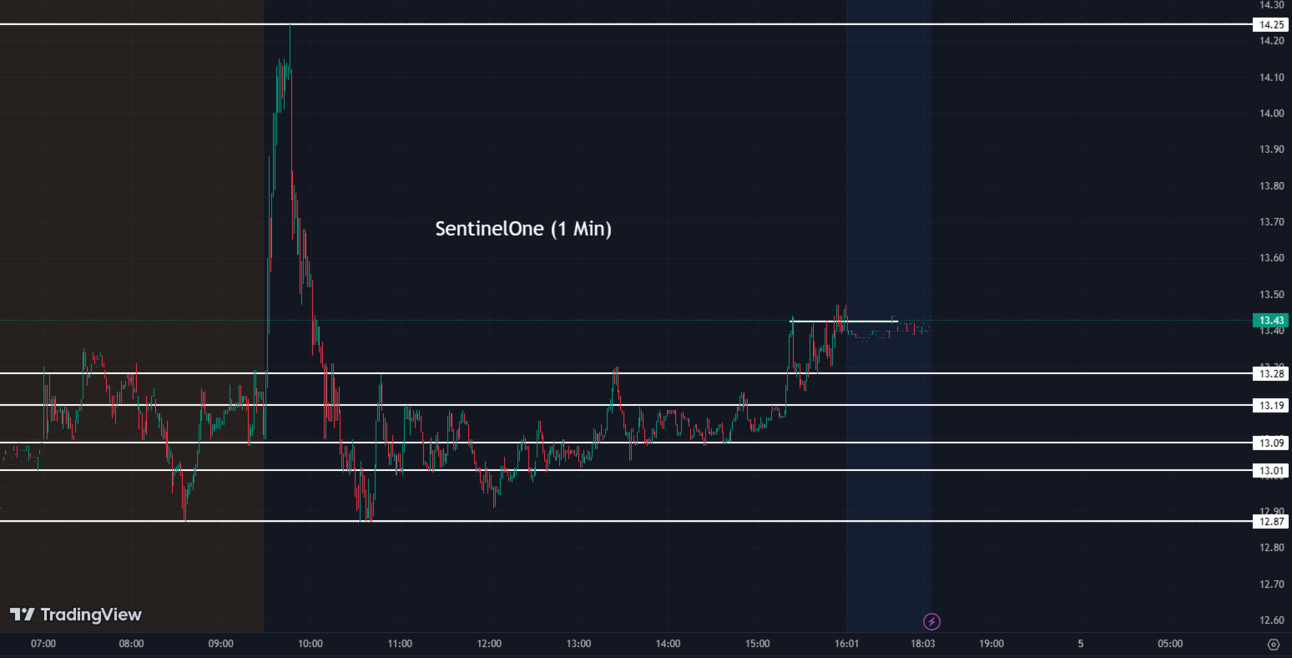

SentinelOne's Revised Revenue Guidance 💡📊

Cybersecurity firm SentinelOne (S) has been in the spotlight today, but not for good reasons. They revised their revenue guidance downward and posted lower-than-expected revenues for the recent period. The news led to a significant drop in their share price, causing some concern among their investors. Despite this setback, the company remains a significant player in the cybersecurity industry.

S:

13.44 ▼ -7.28 (-35.14%) Today

13.44 (0.00%) After Hours

Amazon's Potential Prime Wireless Service 📶🌐

Reportedly, Amazon (AMZN) is engaging in discussions with wireless carriers, including Verizon, T-Mobile, and Dish, with the intention of launching a mobile service exclusive to its Prime members. Bloomberg suggests that these ongoing negotiations might lead to Amazon reselling mobile services to Prime members, offering them at a reduced cost or even for free. As a consequence of this news, telecom stocks such as AT&T and Verizon experienced a decline of over 3%, while T-Mobile saw a decrease of over 7%. Amazon, however, clarified that they presently have no intentions of entering the wireless market. Nevertheless, if this venture comes to fruition, it could potentially attract a greater number of Prime subscribers and position Amazon as a significant player in the mobile virtual network operator domain. As a result, both the telecom sector and Amazon's standing within it could undergo significant transformations.

AMZN:

124.25 ▲ +1.48 (+1.21%) Today

124.14 ▼ -0.10 (-0.085%) After Hours

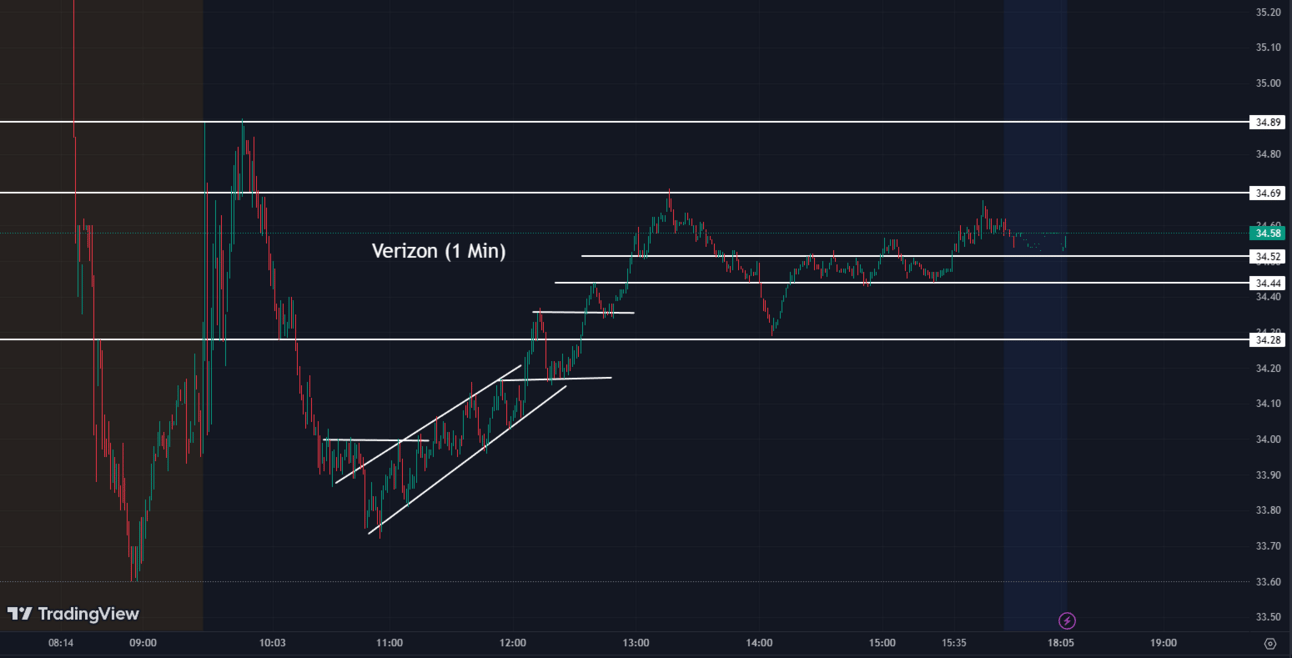

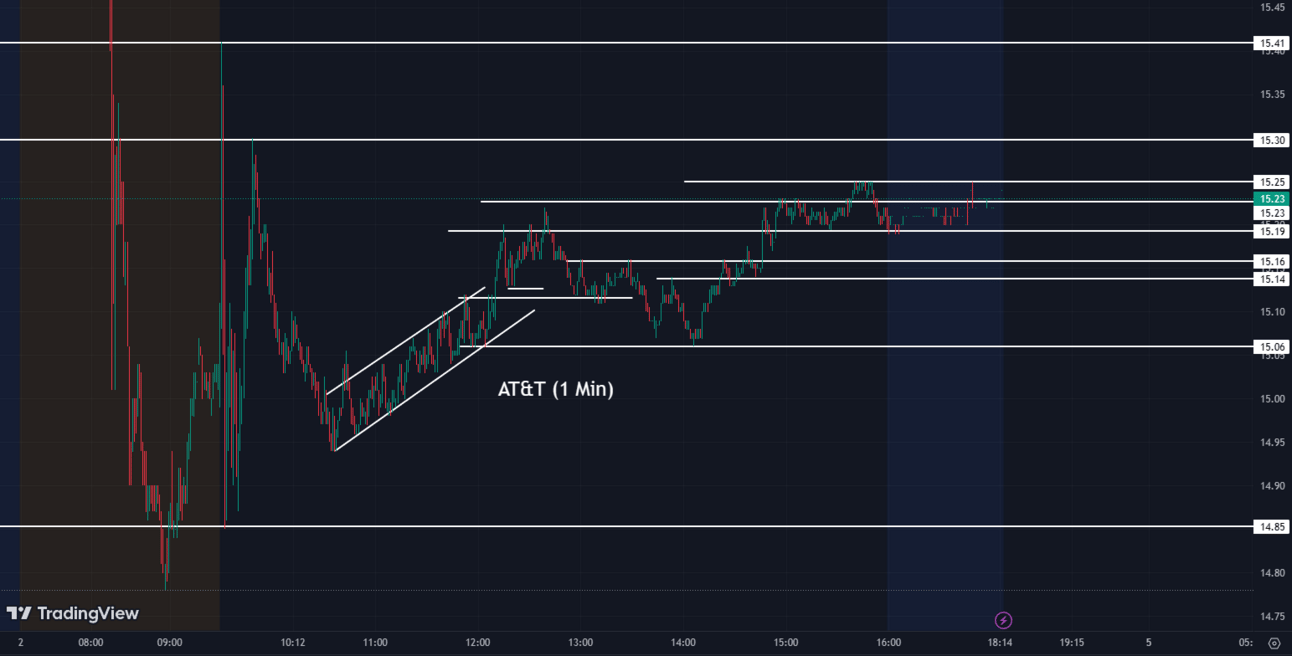

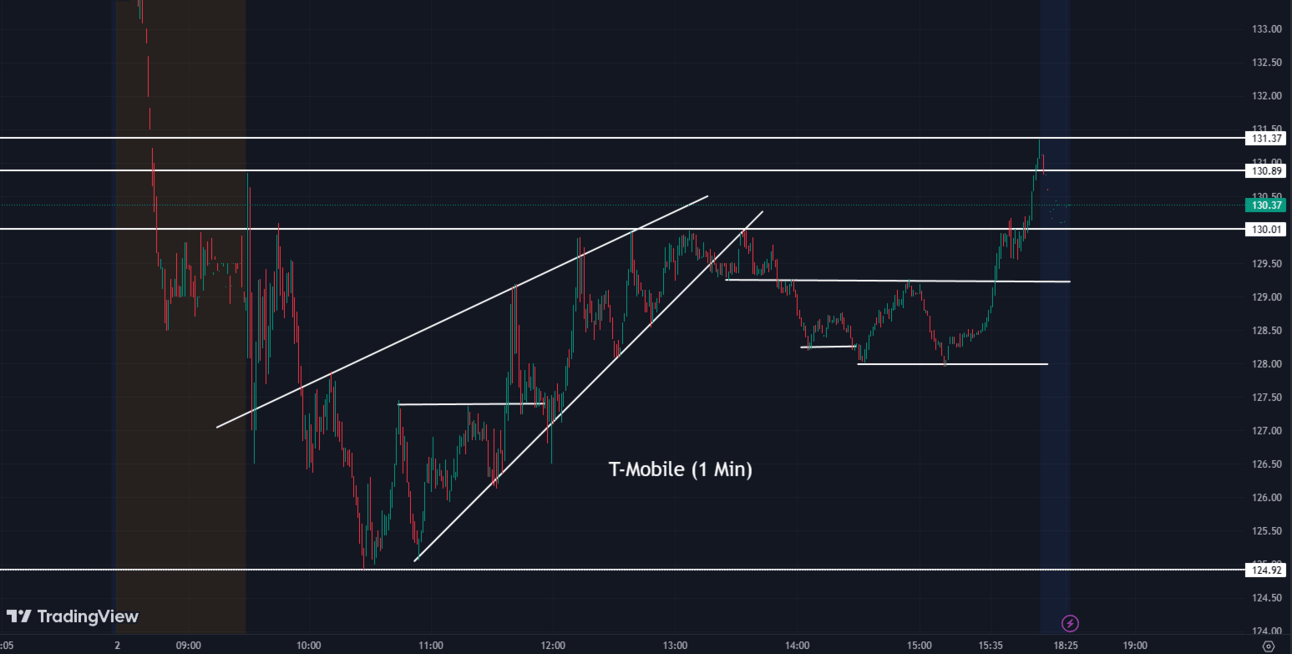

Telecom Stocks React to Amazon Rumors 📡📱

After reports surfaced about Amazon's potential discussions with Verizon Communications (VZ), AT&T (T), and T-Mobile (TMUS) regarding wireless services for Prime members, the stocks of these telecom companies sharply declined. Verizon shares hit a 12-year low, while AT&T and T-Mobile also experienced significant losses. In contrast, Dish Network Corp. (DISH) saw its stock experience its largest rally in 22 years, following talks about selling its wireless plans through Amazon's website.

VZ:

34.58 ▼ -1.14 (-3.19%) Today

34.59 ▲ +0.01 (+0.029%) After Hours

T:

15.21 ▼ -0.60 (-3.83%) Today

15.24 ▲ +0.03 (+0.20%) After Hours

TMUS:

131.19 ▼ -7.72 (-5.56%) Today

130.20 ▼ -0.99 (-0.75%) After Hours

DISH:

7.30 ▲ +1.02 (+16.24%) Today

7.00 ▼ -0.30 (-4.11%) After Hours

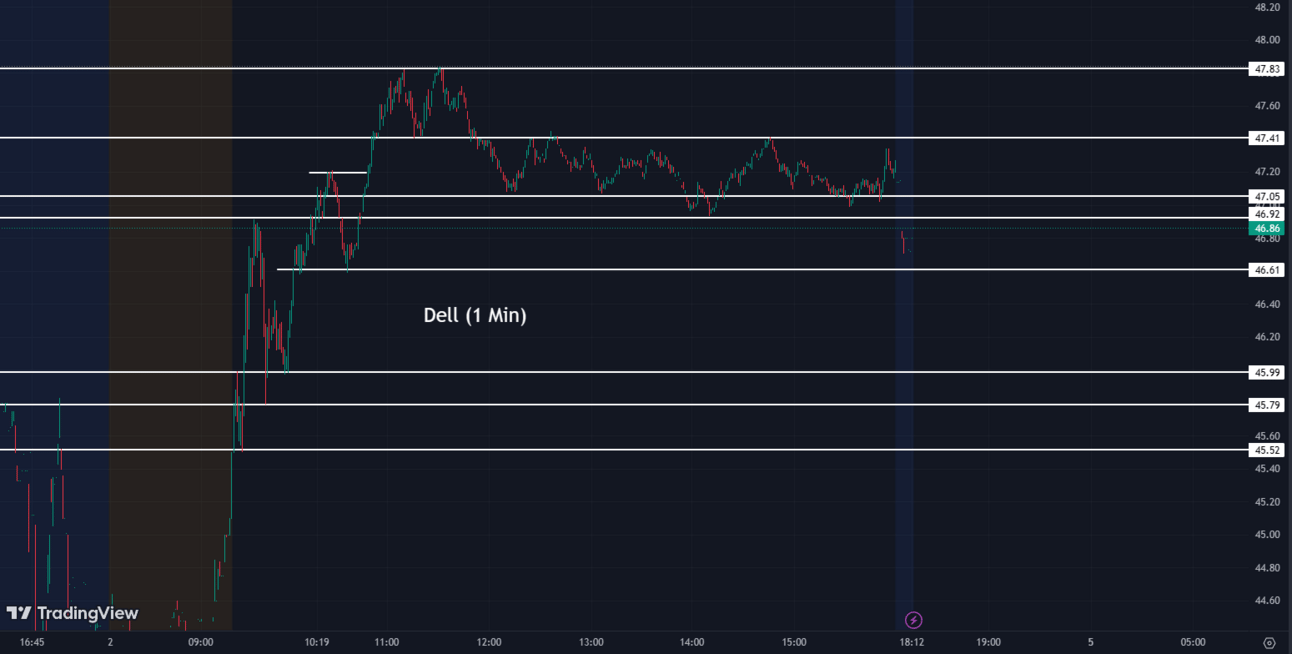

Significant Stock Updates 📈💼

Dell (DELL) - The tech stock climbed 4% after reporting quarterly earnings and revenue that exceeded Wall Street expectations.

DELL:

47.27 ▲ +1.81 (+3.98%) Today

46.92 ▼ -0.35 (-0.74%) After Hours

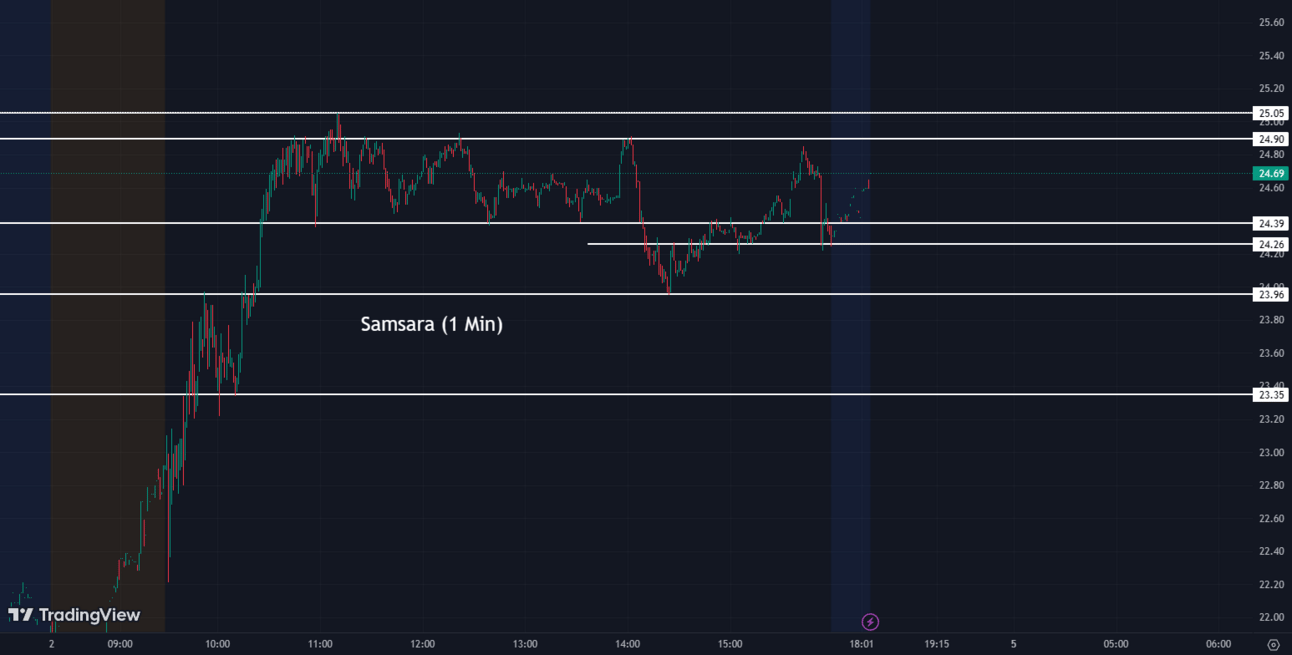

Samsara (IOT) - The cloud company experienced a significant surge of nearly 28% due to a smaller-than-expected loss in the first quarter and raised full-year sales guidance.

IOT:

24.28 ▲ +5.27 (+27.72%) Today

24.69 ▲ +0.38 (+1.56%) After Hours

FibroGen (FGEN) - Shares rose by 3.2% following an upgrade to "buy" from "hold" by Stifel, citing FibroGen's focus on the development of two potentially groundbreaking drugs.

FGEN:

17.88 ▲ +0.56 (+3.23%) Today

18.33 ▲ +0.45 (+2.52%) After Hours

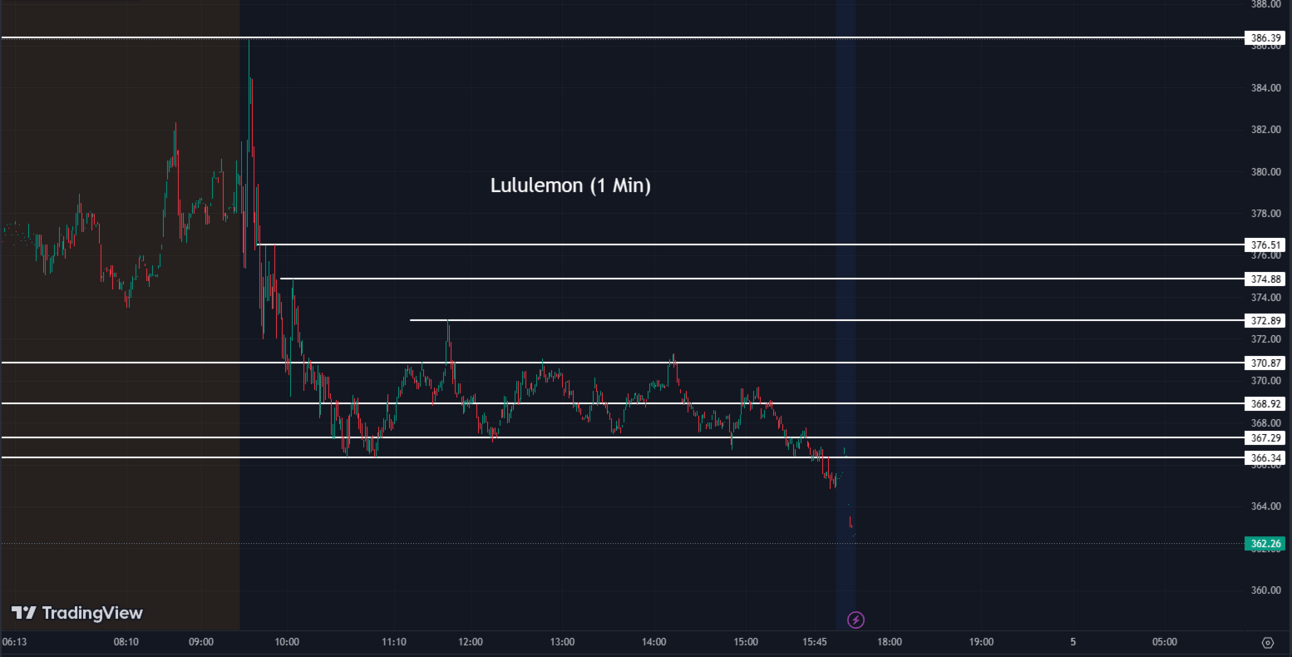

Lululemon (LULU) - The athleisure apparel company experienced a strong surge of 11.30% in its stock price due to impressive first-quarter earnings and raised full-year guidance.

LULU:

365.44 ▲ +37.09 (+11.30%) Today

362.68 ▼ -2.76 (-0.76%) After Hours

MongoDB (MDB) - The data developer's stock price skyrocketed by 28% following an optimistic forecast for its fiscal first-quarter earnings and an upward revision of its full-year guidance.

MDB:

376.30 ▲ +82.34 (+28.01%) Today

376.85 ▲ +0.55 (+0.15%) After Hours

SentinelOne (S) - The cybersecurity stock experienced a significant decline of over 35% as its revenue fell short of expectations. The company attributed the slowdown in sales growth to macroeconomic pressure and subsequently lowered its full-year revenue guidance.

S:

13.44 ▼ -7.28 (-35.14%) Today

13.44 (0.00%) After Hours

Broadcom (AVGO) - The chipmaker's shares rose by 2.8% on the back of better-than-expected quarterly results. Bank of America also reiterated a buy rating for the stock, increasing its price target and highlighting the undervalued artificial intelligence segment as a factor.

AVGO:

812.00 ▲ +22.05 (+2.79%) Today

811.00 ▼ -1.00 (-0.12%) After Hours

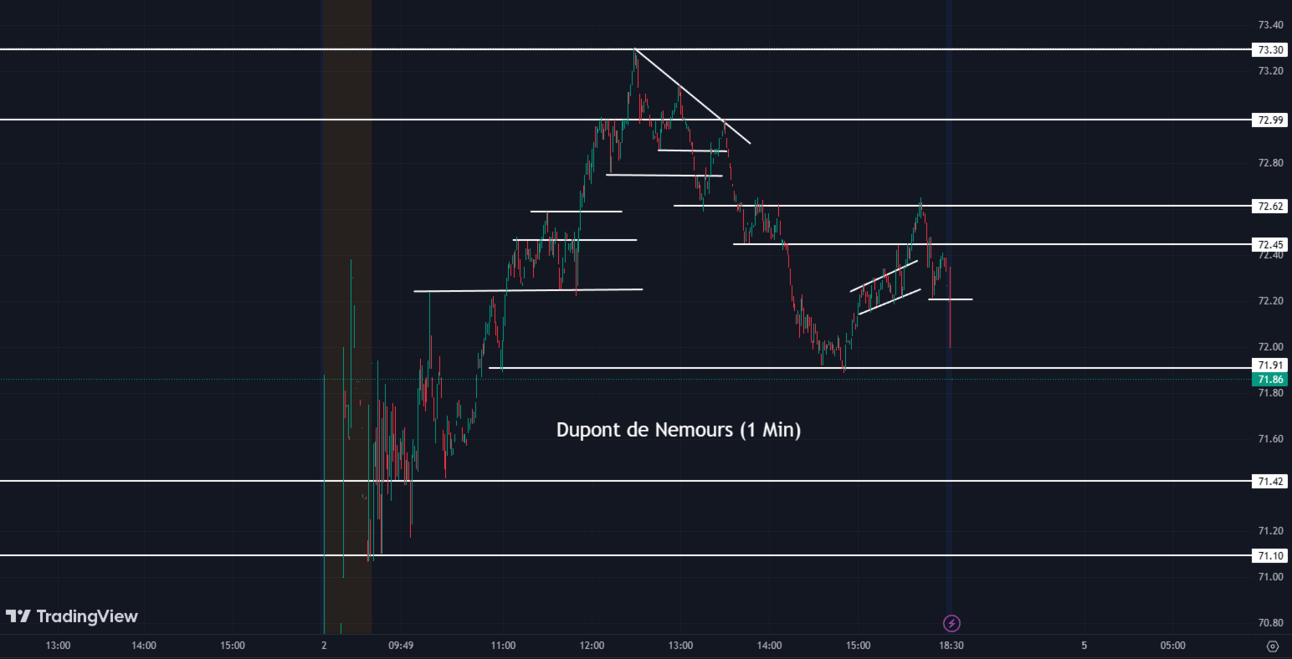

Dupont de Nemours (DD) - The chemicals products stock experienced a gain of 7.3% following a settlement reached by DuPont with the U.S. Water Systems regarding PFAS-related claims in drinking water.

DD:

72.34 ▲ +4.90 (+7.27%) Today

71.90 ▼ -0.47 (-0.65%) After Hours

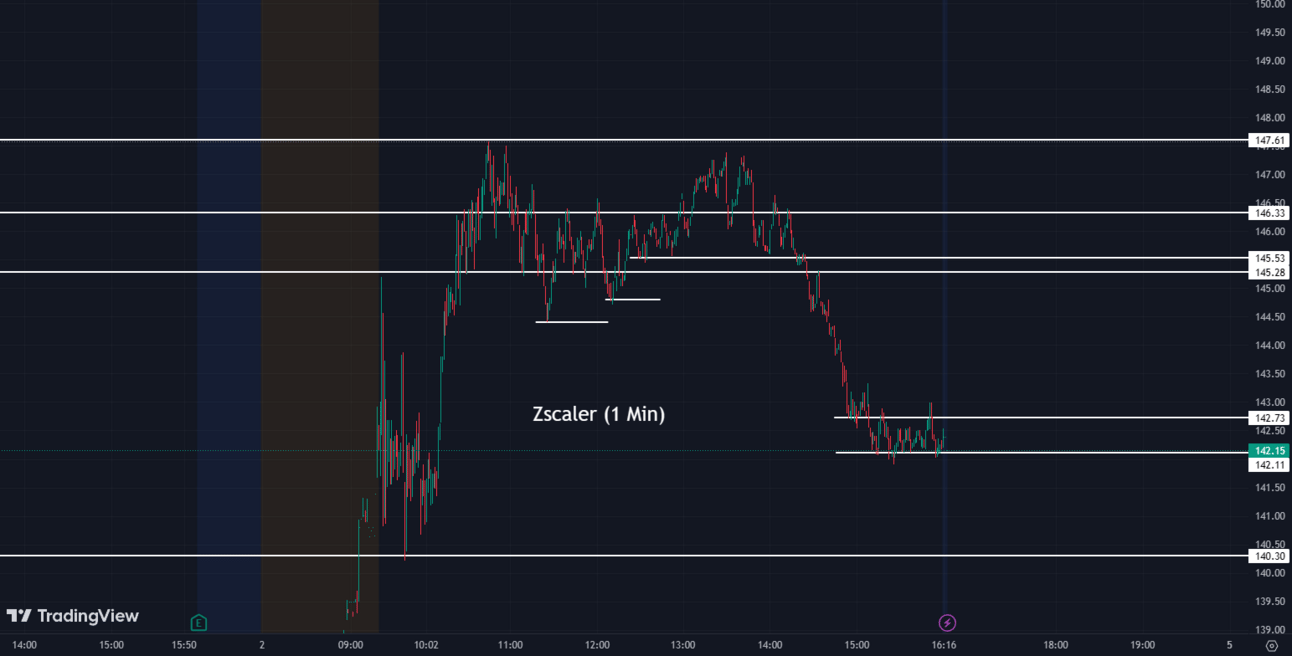

Zscaler (ZS) - Zscaler shares rose by 5.40% after the company's fiscal third-quarter results exceeded Wall Street's expectations, along with better-than-anticipated guidance.

ZS:

142.39 ▲ +7.30 (+5.40%) Today

142.00 ▼ -0.39 (-0.27%) After Hours

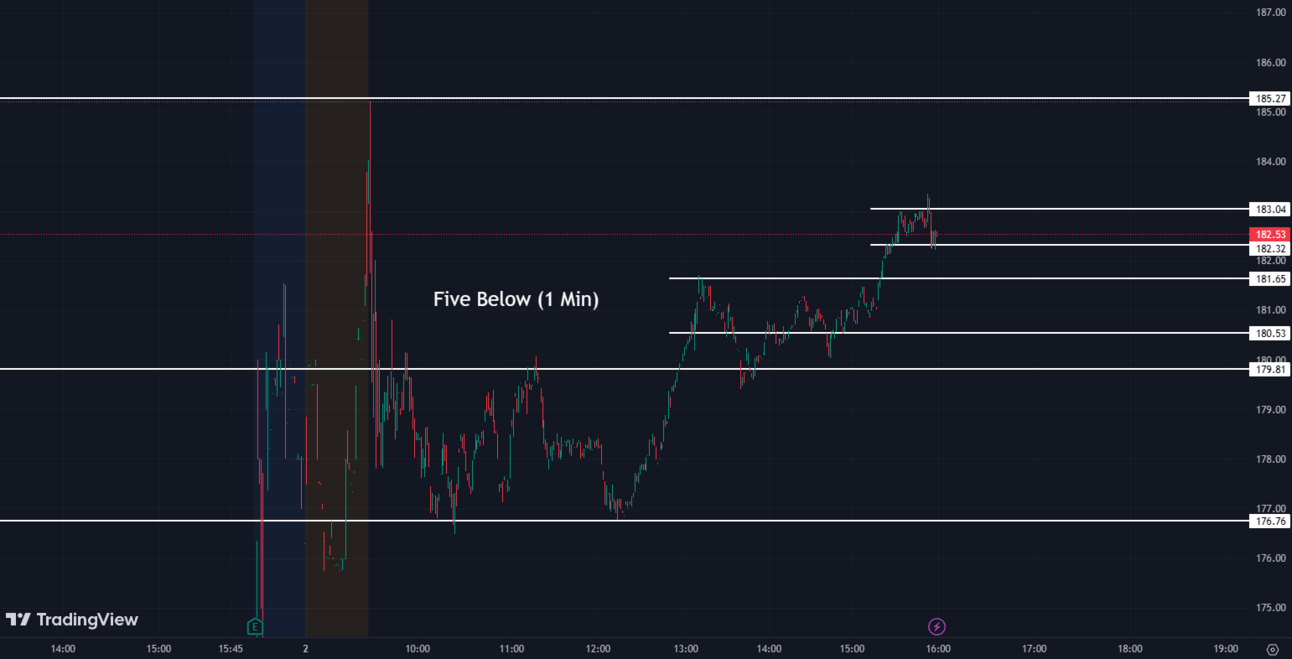

Five Below (FIVE) - The shares of the value retailer surged by 7.8% following a mixed earnings report for the previous quarter. Bank of America reiterated its buy rating for Five Below shares, citing the company's resilience during economic downturns.

FIVE:

182.55 ▲ +13.20 (+7.79%) Today

182.00 ▼ -0.55 (-0.30%) After Hours

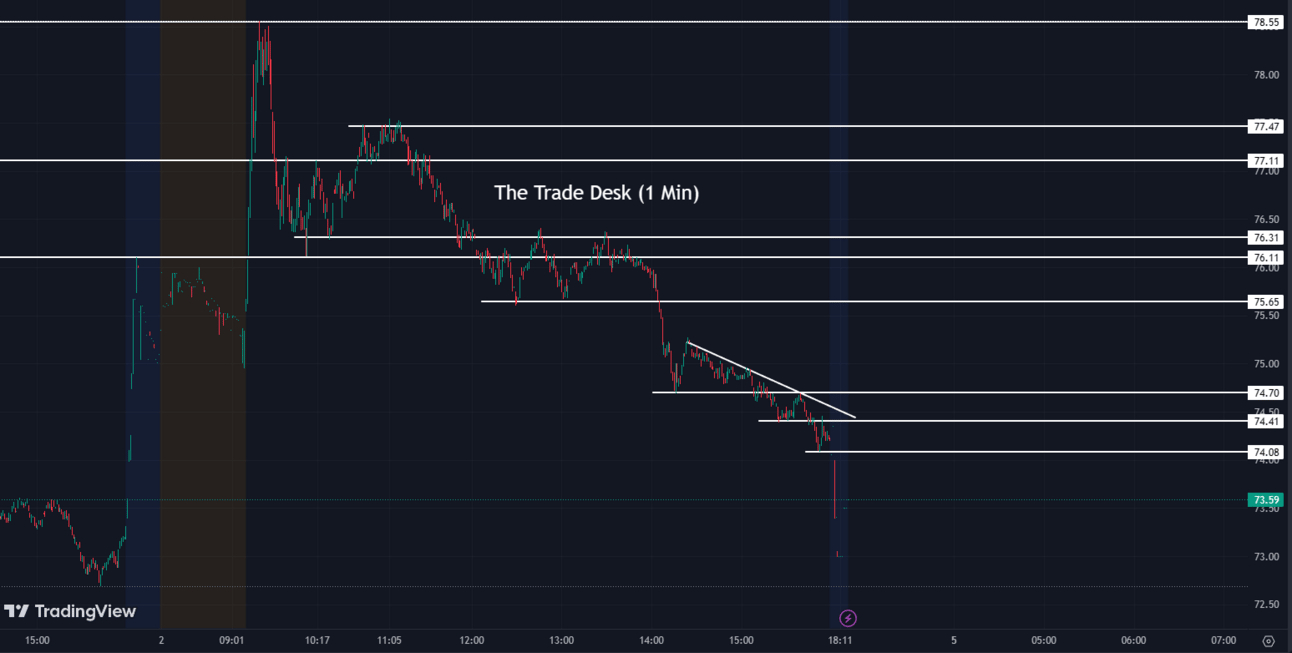

The Trade Desk (TTD) - The online ad company observed a 1% increase in its shares after receiving an upgrade from Morgan Stanley, shifting its rating to overweight from equal weight. The bank stated that The Trade Desk is a top pick poised to thrive in a stabilizing market for sales.

TTD:

74.24 ▲ +0.98 (+1.34%) Today

73.60 ▼ -0.64 (-0.86%) After Hours

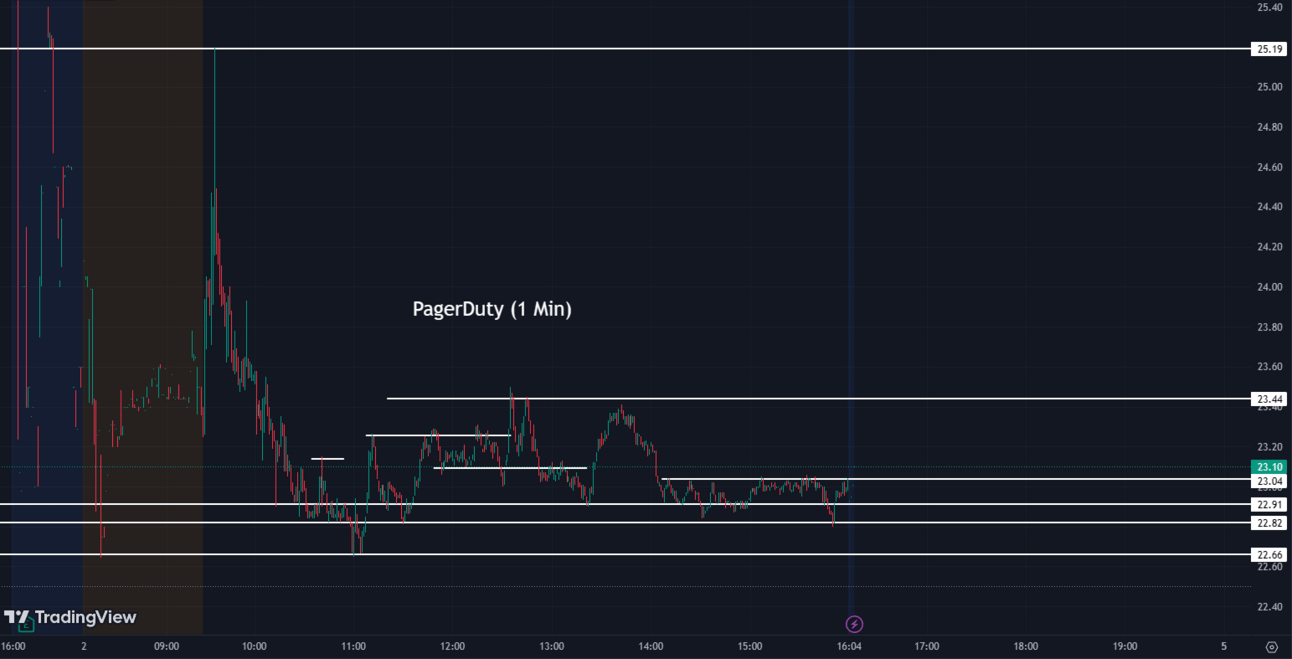

PagerDuty (PD) - Shares of the IT cloud company declined by 17.15% after issuing second-quarter revenue guidance that fell short of expectations.

PD:

22.99 ▼ -4.76 (-17.15%) Today

23.11 ▲ +0.11 (+0.48%) After Hours

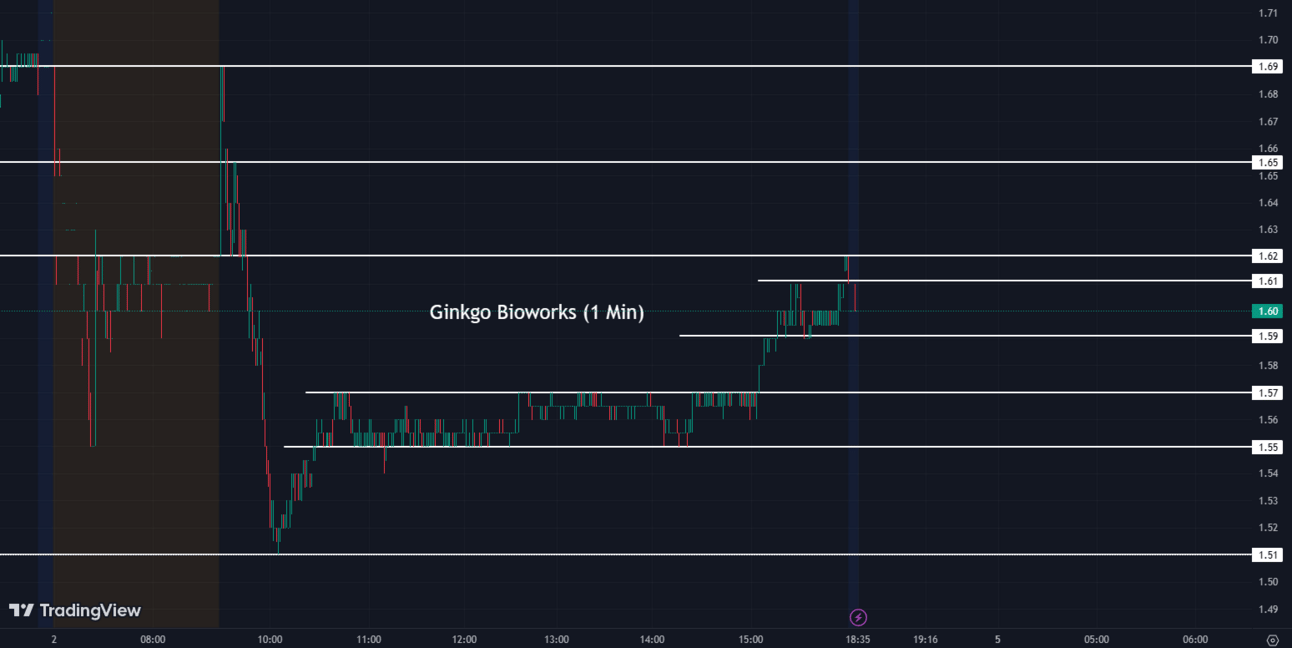

Ginkgo Bioworks - The biotech stock declined by 3.6% after receiving a downgrade to "sell" from "neutral" by Goldman Sachs. Goldman cited the possibility of slower growth in new programs and reduced spending as reasons for the downgrade.

DNA:

1.62 ▼ -0.06 (-3.57%) Today

1.61 ▼ -0.01 (-0.62%) After Hours

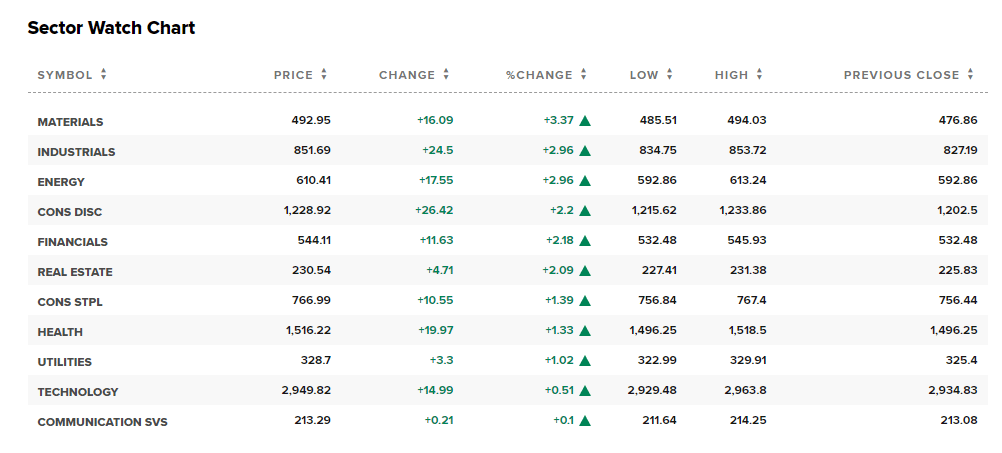

Sectors 🧱📞

11 out of 11 sectors closed green today, with Materials leading the way up 3.37%, and Communication Services in the rear, up 0.1%.

Conclusion 👋

The week finished on a good note with the May Jobs Report exceeding expectations with the addition of 339,000 jobs, showcasing the 29th consecutive month of job market expansion. The stock market experienced significant movements, with tech stocks rallying for six consecutive weeks and the Dow Jones Industrial Average and Nasdaq reaching new highs. Extreme Networks reached an all-time high, while SentinelOne faced setbacks with revised revenue guidance. Amazon's potential entry into the wireless market caused disruptions in the telecom sector. Notable movers of the day included Dell, Samsara, FibroGen, Lululemon, and MongoDB, while SentinelOne experienced a sharp decline. Overall, the market displayed a positive outlook with sectors closing green.

Thank you all for signing up!

Will only work to do better for you all going forward. Our only goal is to add value to everyone’s trading with key levels and the ability of learning charts and price action.

Please Share Our Newsletter it will be much appreciated!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of TradingView. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.