Hey, fellow traders! As we approach the end of the week, let's take a breather and dive into the exciting events that unfolded today!

Indexes 📉🔻

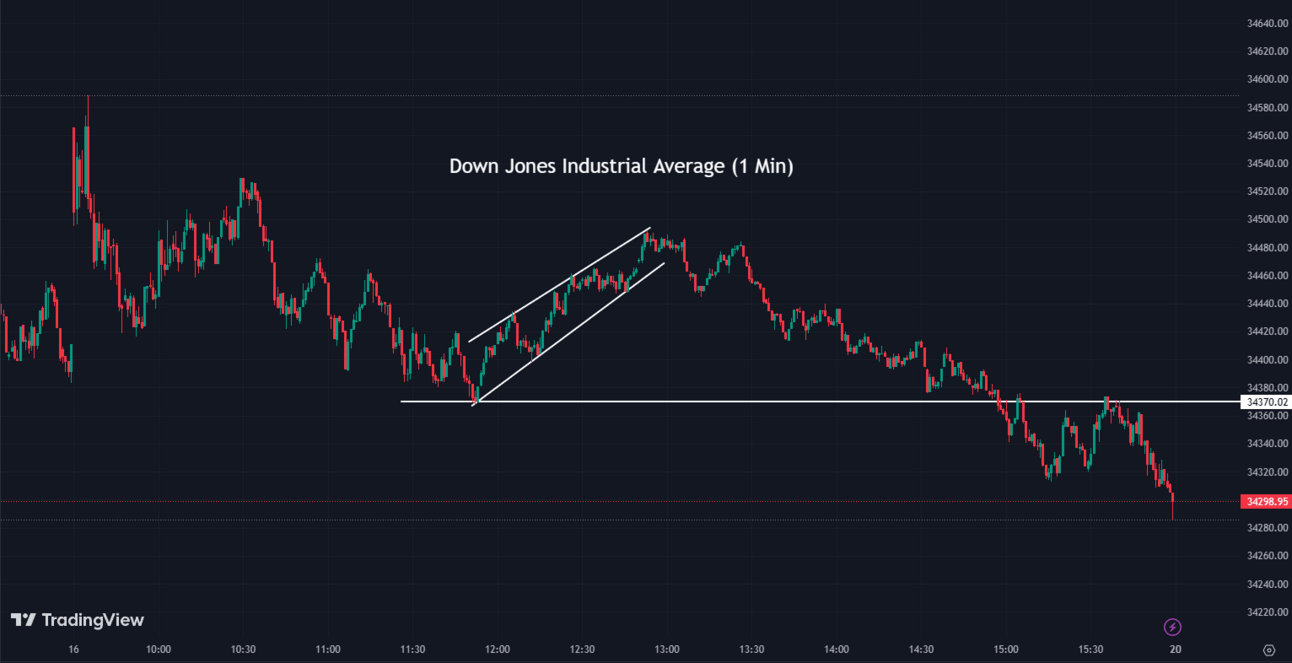

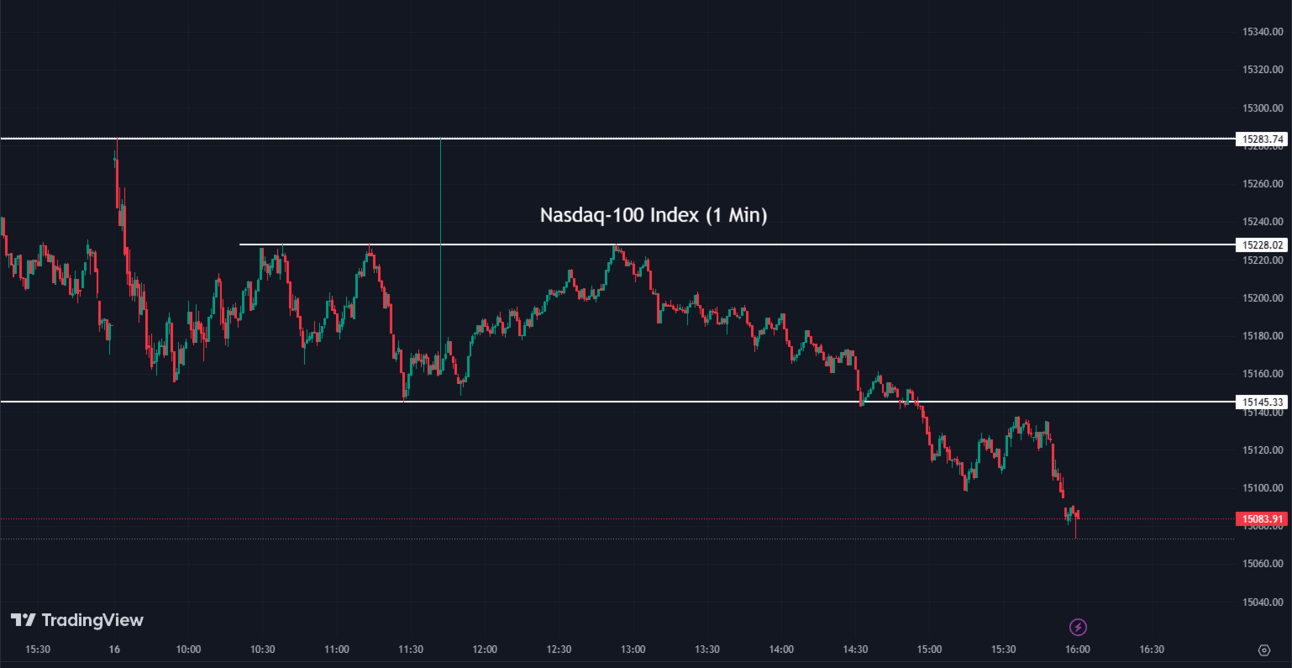

The Indices were down today, although it has been a notable week with the Fed pausing a rate hike and encouraging inflation data. The S&P 500 had its fifth positive week in a row, and the Dow Jones Industrial Average had its third straight week of gains. Now, let's explore how the market performed today...

The S&P 500 (SPX) was down -0.37% coming to a conclusion at 4,409

The Nasdaq Composite (IXIC) fell by -0.68% to settle at 13,689

The Dow Jones Industrial Average dropped by -0.32% ending the day at 34,299

The Russell 2000 (RUT) slid by -0.73% to finish at 1,875

The Nasdaq-100 (NDX) declined by -0.67% to conclude at 15,083

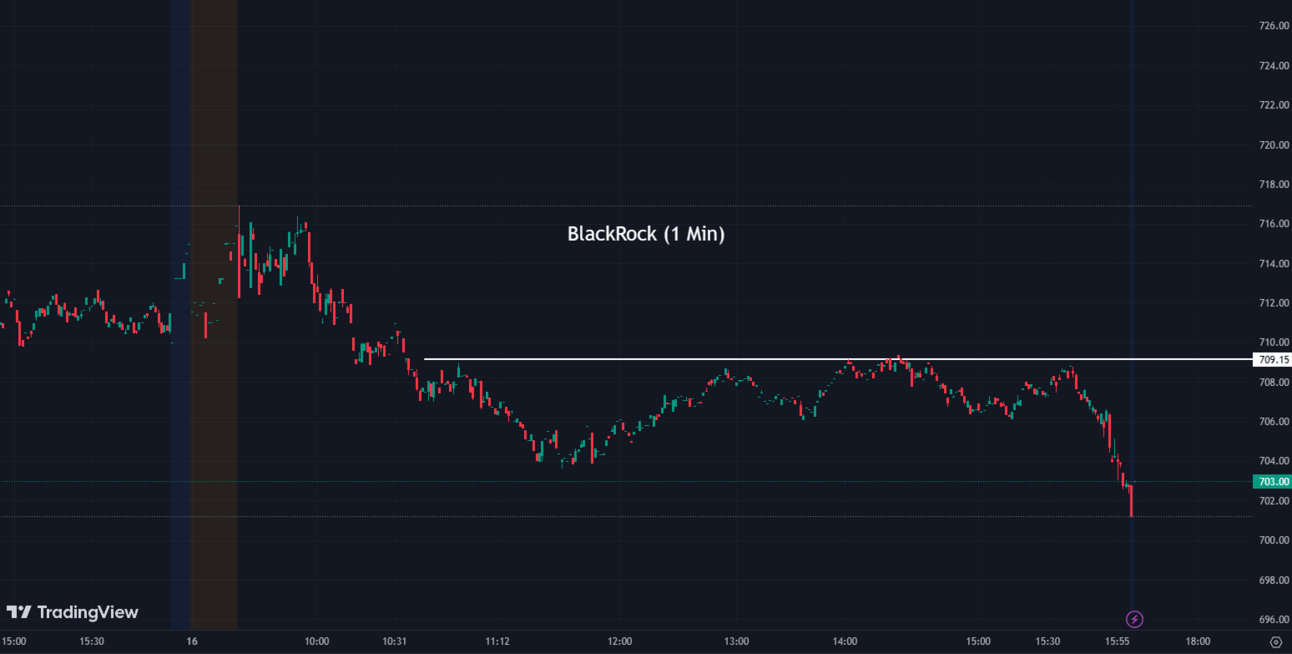

BlackRock's Bitcoin ETF Filing Boosts Cryptocurrency Prices 💰🔗

Cryptocurrency prices rose after BlackRock (BLK), the world's largest asset manager, filed to launch the first spot bitcoin exchange-traded fund (ETF) in the U.S, resulting in Bitcoin and Ether up. The ETF, dubbed iShares Bitcoin Trust, would be the first to directly track the price of bitcoin instead of futures contracts tied to the cryptocurrency. The filing's timing is notable as it comes a week after the SEC sued Coinbase for violating securities laws.

BLK:

703.55 ▼ -7.64 (-1.07%) Today

709.00 ▲ +6.22 (+0.89%) After Hours

Microsoft Hits All-Time High on AI Surge 🚀💥

Microsoft's stock (MSFT) reached an all-time high today before falling back, propelling the company's market capitalization to an astounding $2.59 trillion. This surge is largely driven by the investor frenzy around AI technology, where Microsoft is recognized as a leading adopter. The company's growth trajectory is expected to continue as AI innovations permeate its diverse range of applications.

MSFT:

342.33 ▼ -5.77 (-1.66%) Today

342.67 ▲ +0.34 (+0.099%) After Hours

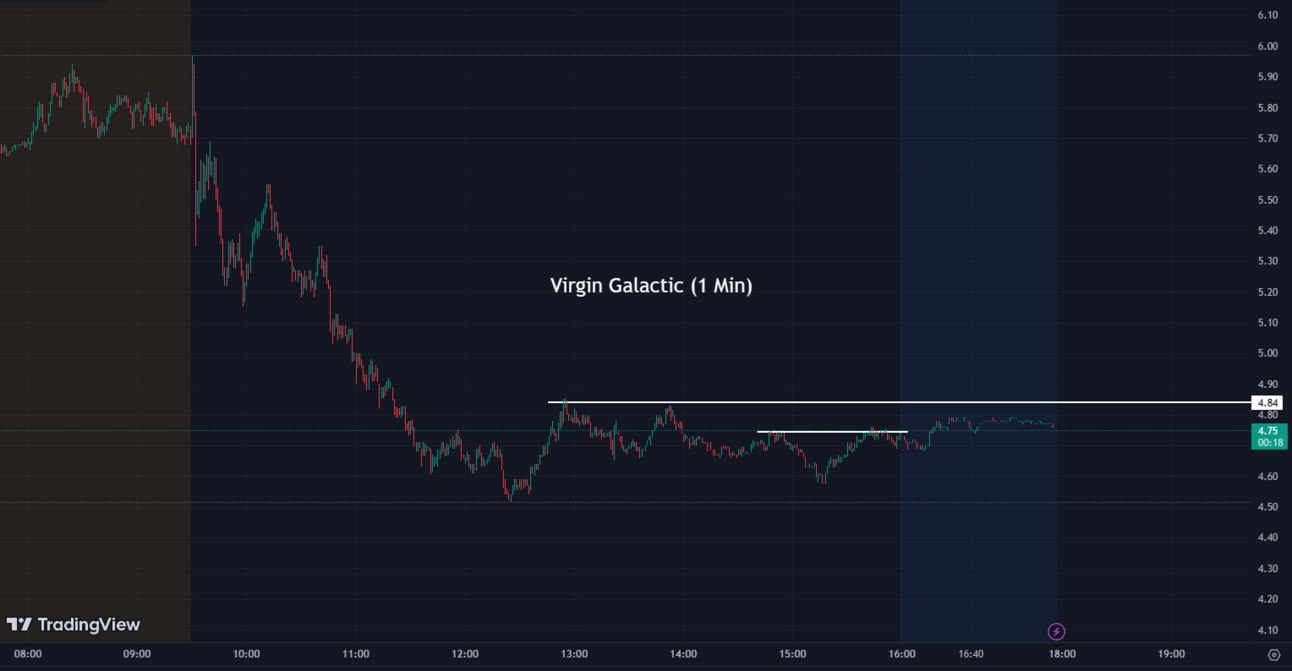

Virgin Galactic Soars as Commercial Spaceflight Launch Nears 🌌🛰️

Virgin Galactic (SPCE) has announced the official launch of its suborbital business, with plans to conduct its first commercial flight by late June. This development follows the successful suborbital test flight of the VSS Unity spaceplane in May. The revelation of Virgin Galactic's commercial spaceflight service has significantly boosted the company's shares. Despite previous challenges, Virgin Galactic is now in a prime position to spearhead the advent of commercial space tourism.

SPCE:

4.74 ▲ +0.68 (+16.63%) today

4.74 ▲ +0.01 (+0.22%) After Hours

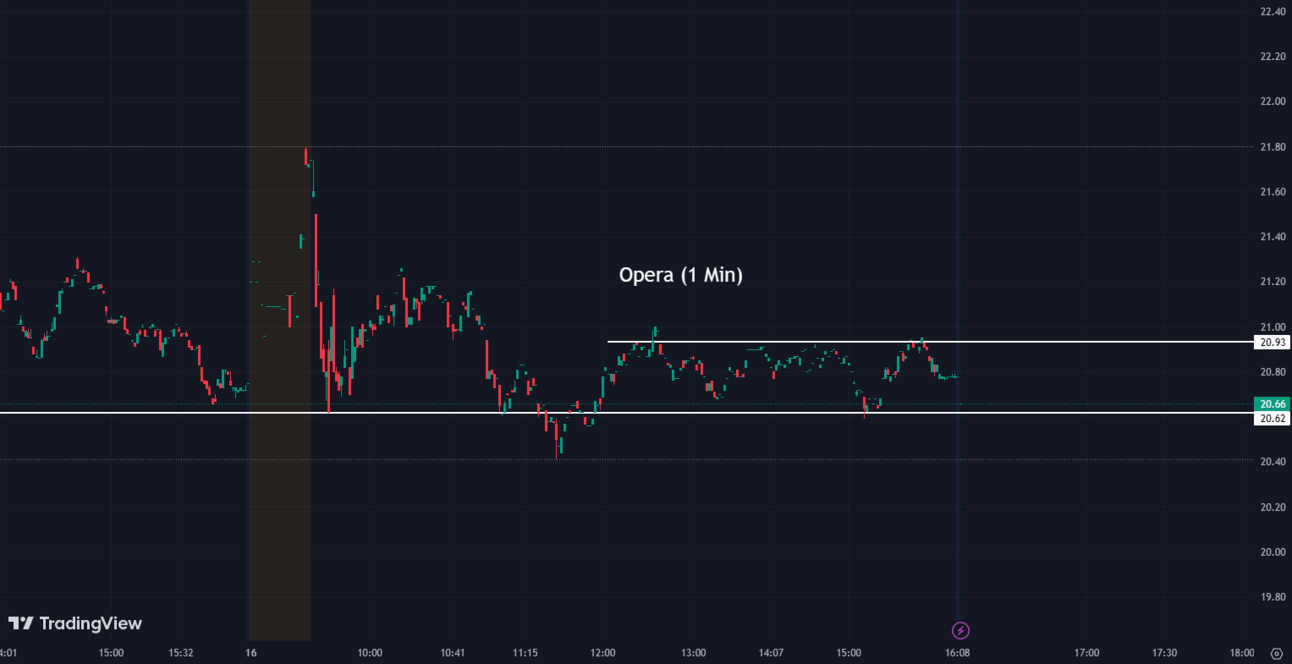

Opera Surges on Dividend Program and AI-Powered Innovation 💼💰

Opera (OPRA), the renowned web browser maker, has achieved record-breaking heights subsequent to unveiling a shareholder dividend program. The company's profitability has witnessed substantial improvement over the course of the year, primarily driven by its rapid innovation in web browsers and internet services, including the integration of AI capabilities. With the implementation of AI tools and the introduction of Aria, a new browser AI, Opera's stock is poised to remain highly appealing.

OPRA:

20.80 ▲ +0.07 (+0.34%) Today

20.90 ▲ +0.10 (+0.48%) After Hours

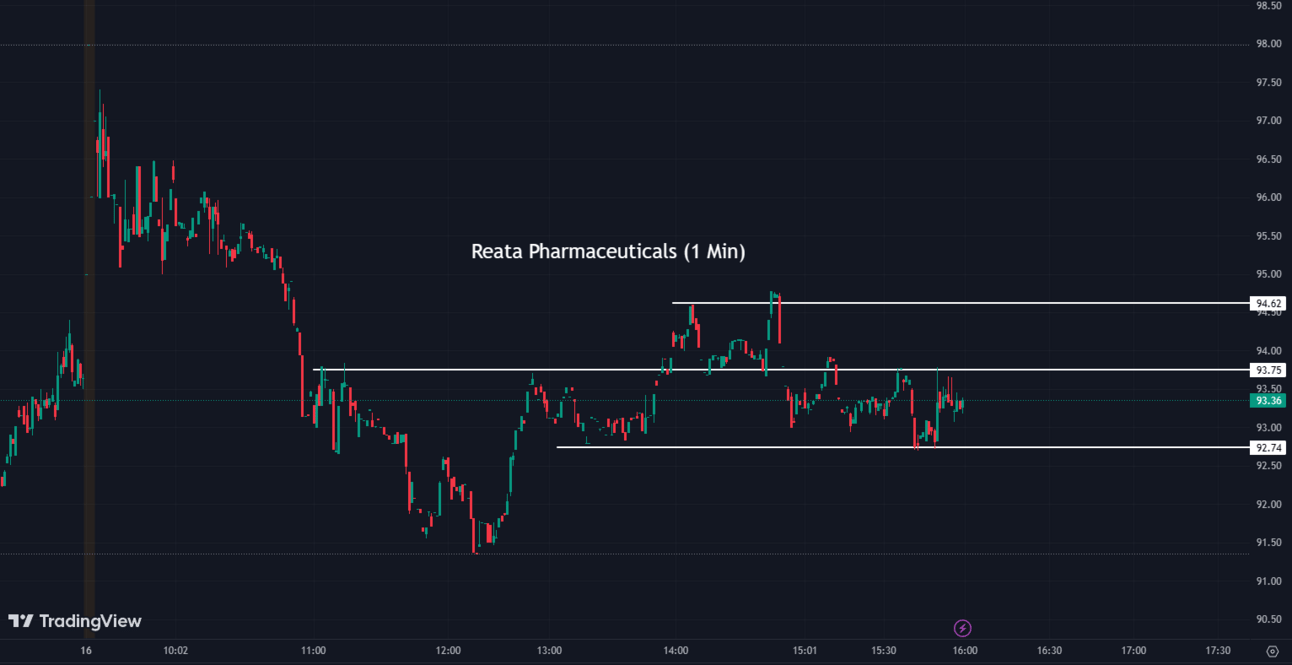

Reata Pharmaceuticals Navigates FDA Hurdles for Skyclarys Launch 💊✅

Reata Pharmaceuticals (RETA) has taken a significant stride toward launching Skyclarys, its drug for Friedreich's ataxia, following a recent FDA filing related to the drug's manufacturing process. While the initial launch faced obstacles due to the presence of a drug substance impurity, Reata is currently seeking FDA approval to raise the impurity limit.

RETA:

93.38 ▼ -0.23 (-0.25%) Today

93.28 ▼ -0.10 (-0.11%) After Hours

Disney’s CFO is Stepping Down 🎬🔻

Disney's (DIS) long-serving CFO, Christine McCarthy, will step down temporarily due to a family medical leave of absence, presenting an unexpected challenge for CEO Bob Iger as he nears the end of his two-year company restructuring plan. Kevin Lansberry, the current CFO of Disney Parks, Experiences, and Products, will serve as her temporary replacement, but he faces numerous obstacles in 2023, including a parks growth slowdown due to inflation, an uncertain timeline for Direct-to-Consumer margin improvements, and the acquisition of Hulu's minority stake. This transition introduces further complexities to the company's situation, compounded by operational challenges related to ESPN and Disney+.

DIS:

91.36 ▼ -1.58 (-1.70%) Today

91.35 ▲ +0.03 (+0.033%) After Hours

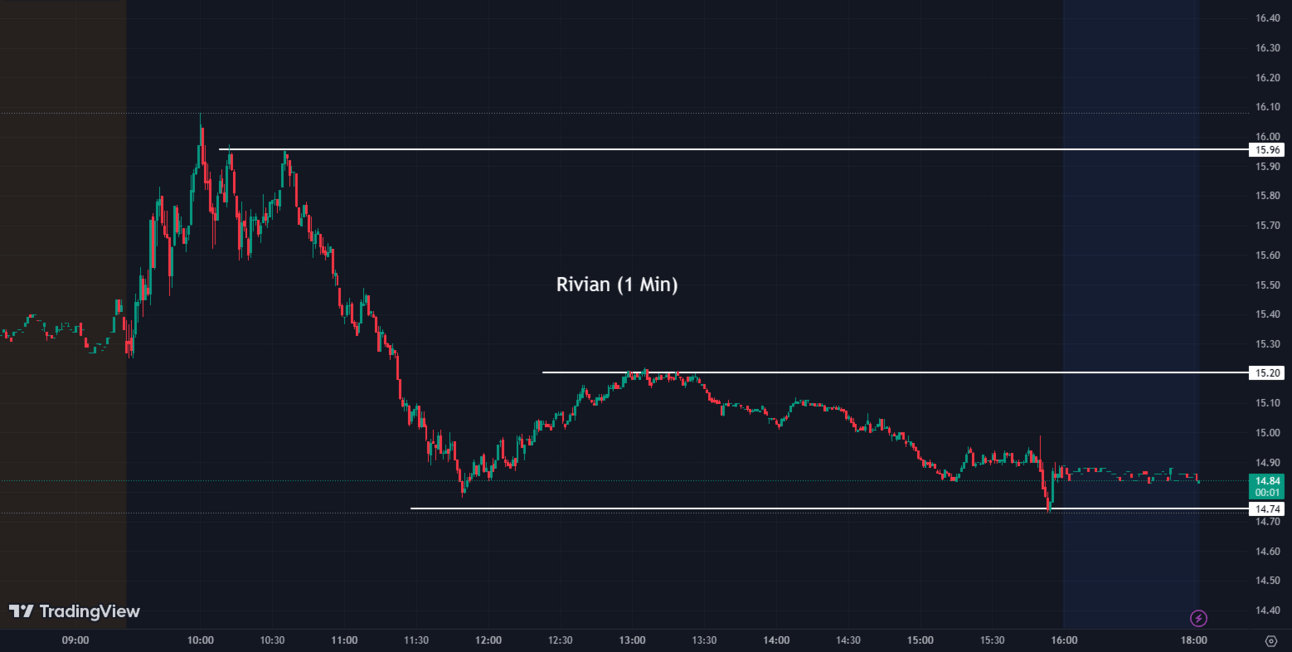

Rivian Aims to Drive Sales with Innovative Spaces Concept 🚗💡

Rivian (RIVN), the electric vehicle manufacturer, has set a target of delivering 50,000 vehicles this year and has introduced its Spaces concept to enhance sales. These Spaces, located in key cities like New York, Chicago, Vancouver, and Seattle, offer a physical experience of Rivian vehicles, along with dedicated areas for relaxation and merchandise purchases. Serving as hubs for potential buyers, current owners, and community events, the Spaces aim to attract and educate customers about the brand and its products. Rivian hopes that the increased brand exposure and product showcasing will significantly impact customer attraction.

RIVN:

14.88 ▼ -0.36 (-2.36%) Today

14.82 ▼ -0.06 (-0.40%) After Hours

Odey Asset Management Suspends More Funds Amidst Crisis 🔒📉

Odey Asset Management has taken the decision to suspend withdrawals from two additional funds due to heightened redemption pressure, which emerged following sexual assault allegations against its founder, Crispin Odey. The Special Situations and Odey Portfolio funds join the previously suspended Brook Developed Markets and Brook Absolute Return funds, deepening the crisis at the firm. The combined value of the suspended funds amounts to approximately $1 billion. Since the allegations came to light, the firm's operations have been in turmoil, with Odey being removed from the partnership, the closure of one fund, and the suspension of others, indicating a likely end to the firm's existence.

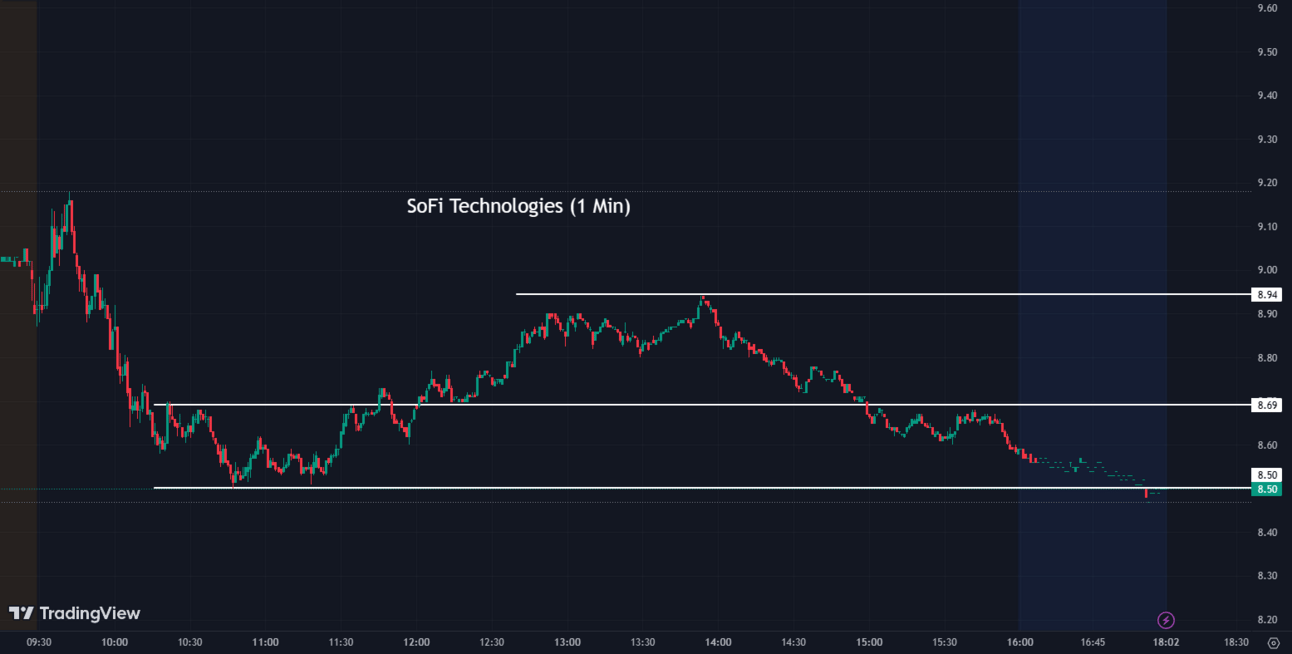

SoFi Technologies Rally Stumbles Amid Overvaluation Concerns 💸📉

SoFi Technologies (SOFI) has experienced an impressive rally so far this year. However, concerns about overvaluation led to downgrades by Piper Sandler, Oppenheimer, and BofA Global Research, resulting in a drop of the stock price. The previous surge was triggered by the resumption of student loan payments following a US debt-ceiling deal, pushing SoFi's shares beyond the target levels set by most Wall Street analysts.

SOFI:

8.60 ▼ -0.95 (-9.95%) Today

8.51 ▼ -0.09 (-1.05%) After Hours

Binance Faces Money Laundering Investigation and Regulatory Challenges🔍💰

French prosecutors have initiated an investigation into Binance, for "aggravated money laundering" and unauthorized operation of a digital asset exchange. Binance France's President, David Prinçay, downplayed the significance of regulatory charges in the US, claiming that Binance.US assets are separate from the international exchange. However, this assertion has been challenged by the US Securities and Exchange Commission (SEC). Binance is currently facing over a dozen charges from the SEC.

PIMCO Settles SEC Enforcement Actions for $9 Million 💼💰

Investment advisor Pacific Investment Management Company (PIMCO) has agreed to pay $9 million to settle two enforcement actions brought by the SEC regarding disclosure and procedure violations. The SEC alleged that PIMCO failed to provide crucial information about the use of interest rate swaps and their impact on the PIMCO Global StocksPLUS & Income Fund's dividend. Additionally, the company was accused of not waiving approximately $27 million of advisory fees.

GoDigital Media Group Poised to Bid for Vice Media in Bankruptcy Sale 💼📺

GoDigital Media Group is preparing to make a bid for Vice Media, which is undergoing a sale process as part of its bankruptcy proceedings. If multiple bids are received, an auction will be held on June 22 to determine the final buyer. GoDigital, known for its ownership of music and video rights and its diverse range of businesses, initially utilized funds from music licensing rights and has since expanded into digital media distribution. Since 2020, the company has been strategically acquiring distressed assets with well-established consumer brands, and the potential acquisition of Vice Media would mark its largest endeavor to date.

DraftKings Makes $195 Million Bid for PointsBet's U.S. Assets 🏀💰

DraftKings (DKNG), the prominent sports betting company, has made an all-cash bid of $195 million to acquire PointsBet's U.S. assets. The offer comes a month after Fanatics agreed to a $150 million deal for the acquisition of the Australian company's U.S. operations, aiming to strengthen its position in sports gambling. Fanatics' CEO, Michael Rubin, views this move as an attempt by DraftKings to impede their competitors' growth in the sports gambling market. PointsBet, the seventh-largest sports betting operator in the United States, is currently facing significant financial losses, which could add complexity to the acquisition process. Nevertheless, DraftKings' CEO, Jason Robins, believes that this purchase has the potential to enhance the company's market share.

DKNG:

24.51 ▼ -0.32 (-1.29%) Today

24.55 ▲ +0.04 (+0.16%) After Hours

Bonobos Reunites with Co-Founder Andy Dunn as Brand Advisor after Sale to WHP Global 👔🤝

Bonobos, a men's clothing company, has welcomed back its co-founder, Andy Dunn, who will serve as a brand advisor. This decision follows Walmart's (WMT) sale of Bonobos to WHP Global in a $75 million deal. WHP Global aims to expand the brand's physical presence internationally while preserving its original values and principles. Dunn's return is expected to bring valuable insights into customer needs and preferences, drawing from his prior experience and perspective during his initial tenure with the company.

WMT:

155.52 ▼ -2.21 (-1.40%) Today

155.41 ▼ -0.12 (-0.077%) After Hours

Notable Movers of the Day 🚀🔥

Truist Financial (TFC) shares closed down by 0.99% after being downgraded by Odeon Capital Group from buy to hold, according to FactSet.

TFC:

31.90 ▼ -0.32 (-0.99%) Today

31.85 ▼ -0.05 (-0.16%) After Hours

Micron Technology (MU) dipped 1.69% after the company expressed concerns about a potential China chip ban, stating that a significant portion of its revenue from a specific Chinese customer is at risk, as mentioned in a filing with the SEC.

MU:

67.66 ▼ -1.16 (-1.69%) Today

67.76 ▲ +0.10 (+0.15%) After Hours

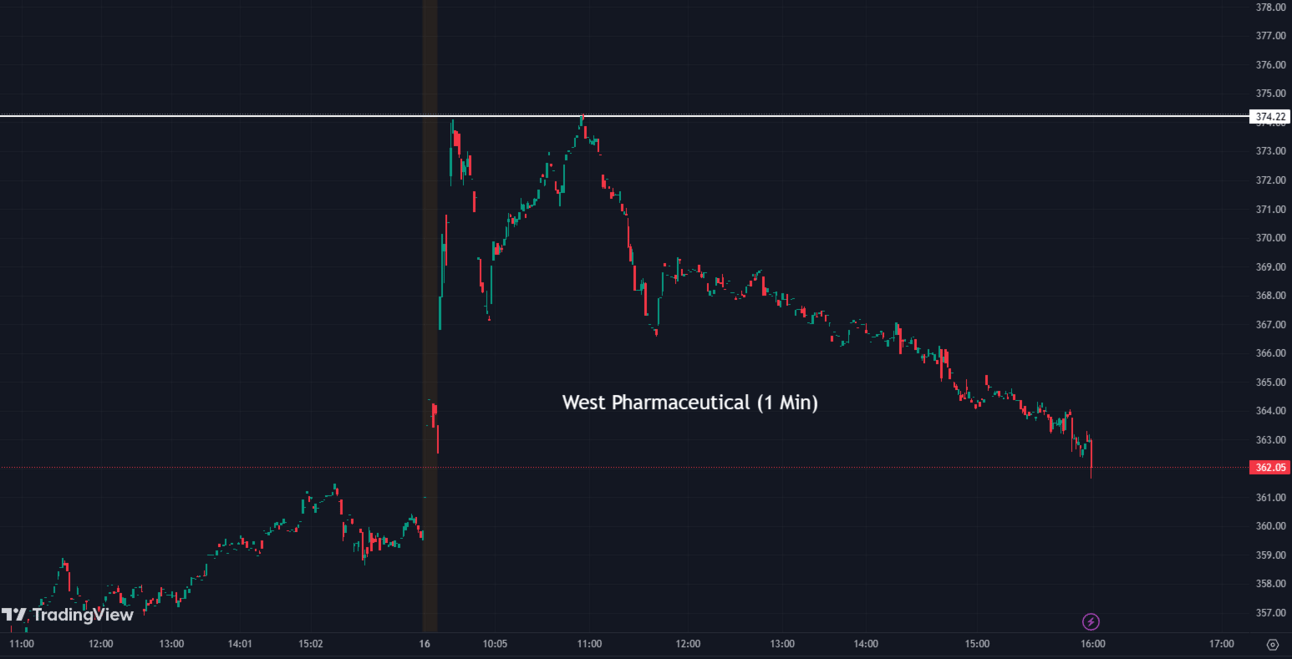

West Pharmaceutical Services (WST) experienced a peak gain of 2.3% after receiving an upgrade from Bank of America, which raised the life sciences stock's rating from neutral to buy. The bank highlighted the company's potential benefits from the increasing demand for drugs targeting weight loss.

WST:

362.04 ▲ +2.24 (+0.62%) Today

The stock showed no movement in after-hours trading

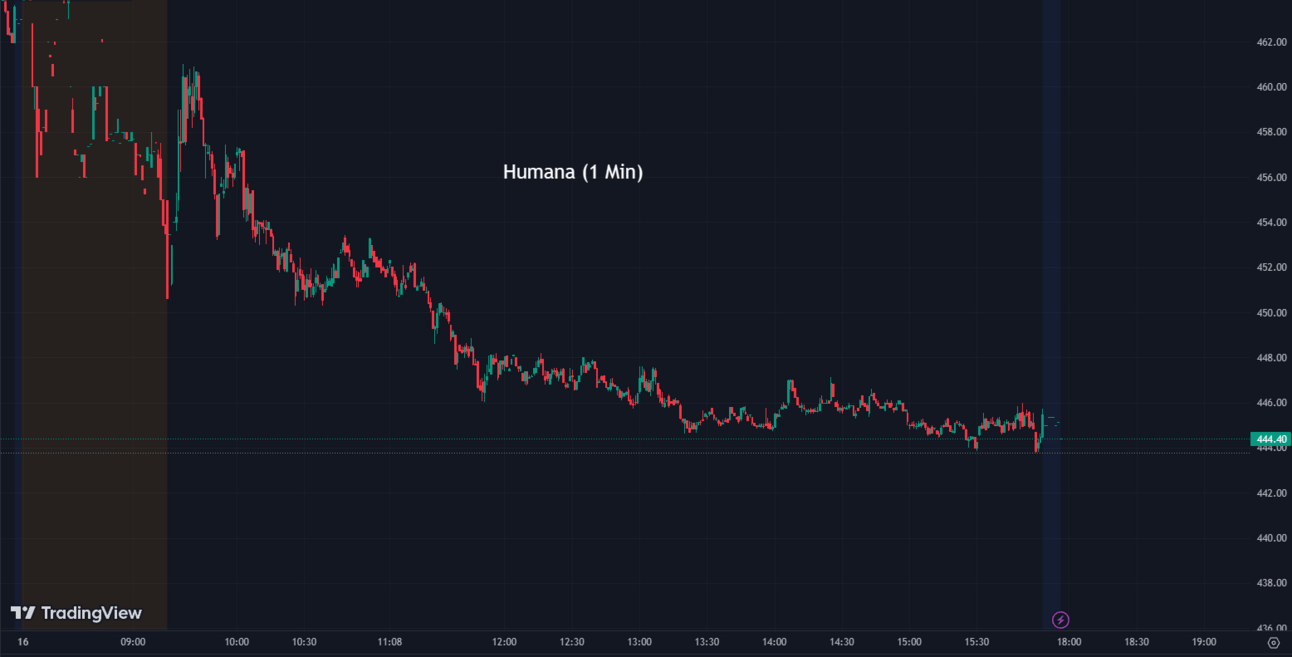

Humana (HUM) shares declined by 3.97% as the company reaffirmed its full-year insurance segment benefit expense ratio guidance. The company expects the ratio to be at the top end of the outlook, citing higher-than-expected utilization trends in non-inpatient services like emergency room visits, outpatient surgeries, and dental services.

HUM:

445.42 ▼ -18.43 (-3.97%) Today

445.20 ▼ -0.45 (-0.10%) After Hours

Adobe (ADBE) shares closed up by 0.87% after the company reported better-than-expected results in its fiscal second-quarter report. The company posted adjusted earnings per share of $3.91 on $4.82 billion in revenue, surpassing analysts' estimates. Adobe also provided positive guidance, stating that its current-quarter and full-year revenue are expected to align with market expectations, with higher adjusted earnings per share.

ADBE:

495.18 ▲ +4.27 (+0.87%) Today

494.61 ▼ -0.57 (-0.12%) After Hours

Nvidia (NVDA) initially jump by over 2% to reach a new record high, before falling back. The move comes after Morgan Stanley analyst, Joseph Moore, named Nvidia as his top pick, replacing AMD (AMD). The analyst emphasized Nvidia's immediate growth potential in the artificial intelligence sector.

NVDA:

426.92 ▲ +0.39 (+0.091%) Today

427.74 ▲ +0.82 (+0.19%) After Hours

AMD:

120.08 ▼ -4.16 (-3.35%) Today

119.62 ▼ -0.46 (-0.38%) After Hours

Cava Group (CAVA) shares declined by 12.86% during Friday's trading, retracing some of its gains from its massive debut on the New York Stock Exchange the previous day. The stock had initially doubled in value during its first day of trading.

CAVA:

38.15 ▼ -5.63 (12.86%) Today

38.26 ▲ +0.11 (0.29%) After Hours

iRobot (IRBT) surged 21.20% following the approval of Amazon's $1.7 billion acquisition of the Roomba vacuum cleaner maker by U.K. regulators. Meanwhile, Amazon's stock (AMZN) experienced a decrease of 1.27%.

IRBT:

51.00 ▲ +8.92 (+21.20%) Today

50.80 ▼- 0.20 (-0.39%) After Hours

AMZN:

125.49 ▼ -1.62 (-1.27%) Today

125.55 ▲ +0.06 (+0.048%) After Hours

Sectors 💧📡

Out of the 11 sectors, 3 closed in positive territory today, with Utilities leading the way with a gain of 0.53%, while Communication Services saw a decline of -1.00%.

Conclusion👋

As we wrap up the week, let’s review what happened for the day. While major indices experienced slight declines, it was still a notable week overall, marked by positive trends in the S&P 500 and Dow Jones Industrial Average. The filing of BlackRock's Bitcoin ETF brought a boost to cryptocurrency prices, and Microsoft reached an all-time high driven by investor enthusiasm for AI technology. Virgin Galactic's announcement of its upcoming commercial spaceflight launch propelled its shares, and Opera's integration of AI-powered innovations led to a surge in its stock. Reata Pharmaceuticals made progress in navigating FDA hurdles, while Disney faced unexpected challenges with the temporary absence of its CFO. Rivian aimed to drive sales through its innovative Spaces concept, and Odey Asset Management faced a deepening crisis amid the suspension of more funds. SoFi Technologies stumbled due to concerns of overvaluation, and Binance faced money laundering investigations and regulatory challenges. PIMCO settled SEC enforcement actions, and GoDigital Media Group prepared to bid for Vice Media in a bankruptcy sale. DraftKings made a bid for PointsBet's U.S. assets, Bonobos welcomed back its co-founder as a brand advisor, and several stocks experienced notable movements throughout the day. Wishing you all a great weekend and looking forward to seeing you all next week!

Thank you all for signing up!

Will only work to do better for you all going forward. Our only goal is to add value to everyone’s trading with key levels and the ability of learning charts and price action.

Please Share Our Newsletter it will be much appreciated!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of TradingView. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.