Hello, traders! As we wind down for the evening, let's take a deep dive into the noteworthy events that have shaped the financial markets today!

Retail Sales Overview 💰🛍️

Despite rapid interest rate hikes and economic uncertainty, US retail sales continue to demonstrate resilience. Last month, retail sales at physical stores, online, and in restaurants grew 0.3% from April, surpassing economists' expectations of a 0.1% decline, as reported by the Commerce Department. Spending growth spanned all categories, excluding gasoline stations and miscellaneous stores, with building materials and gardening items seeing the largest surge of 2.2%. Overall, retail sales rose 1.6% in May year over year. However, experts anticipate a decline in consumer spending as increased interest rates, tighter credit conditions, and the resumption of student loan payments could impact Americans' financial stability.

Import Prices 📦🌍

Import prices in the United States declined 0.6% in May, the largest yearly drop in three years. This achievement is just another feather in the Federal Reserve's crown in its fight against inflation. The decline was mostly due to decreasing energy and food prices. Import prices fell 5.9% year on year, the largest drop since May 2020. Prices for imported capital goods increased by 0.1%.

European Central Bank Raises Interest Rates Amid High Inflation 🏦💰

The European Central Bank (ECB) has communicated its decision to raise the main rate by 25 basis points, reaching 3.5%. This choice diverges from the U.S. Federal Reserve's move to pause its own rate hikes and aims to tackle the region's notably high inflation levels. Recent data reveals a more rapid decline in inflation than anticipated, with headline inflation in May at 6.1%. Despite this trend, the ECB has raised its core and headline inflation projections upward for this year and the next. The latest forecasts predict headline inflation to reach 5.4% this year, followed by a decrease to 3% in 2024 and a further decline to 2.2% in 2025. Additionally, the ECB has made adjustments to its growth forecasts for the upcoming years, indicating a more pessimistic economic perspective. As a consequence, the euro has strengthened against the U.S. dollar, while European bond yields have witnessed an increase.

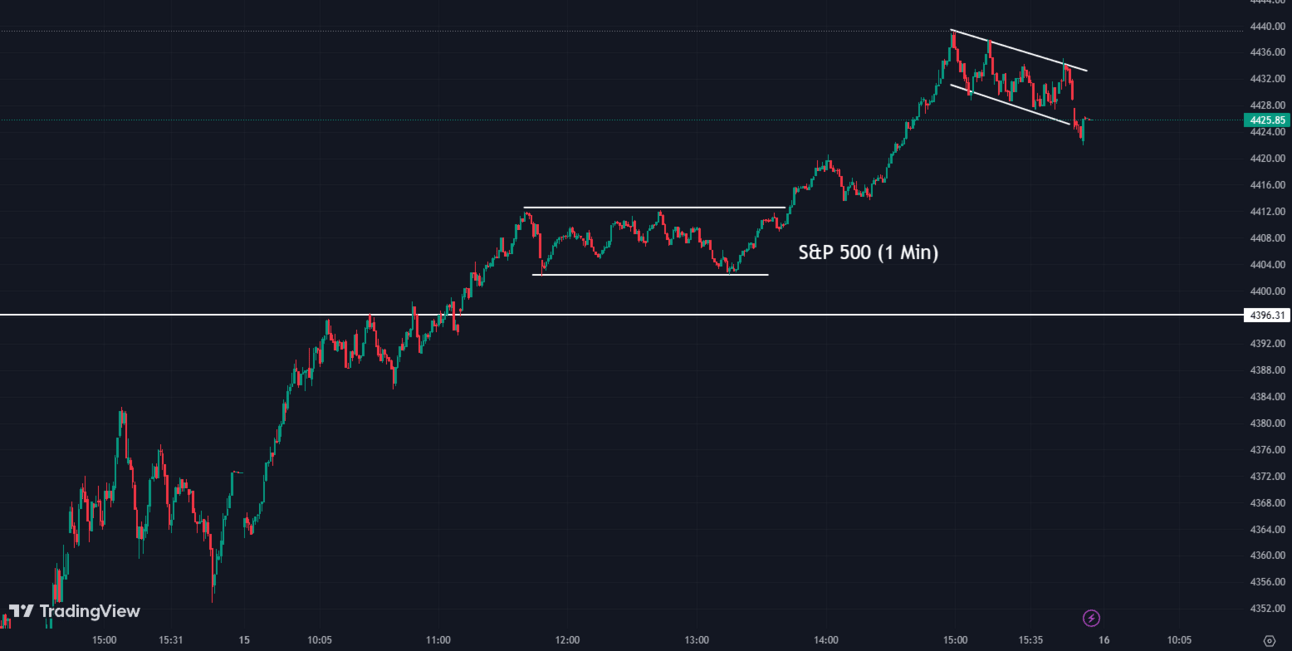

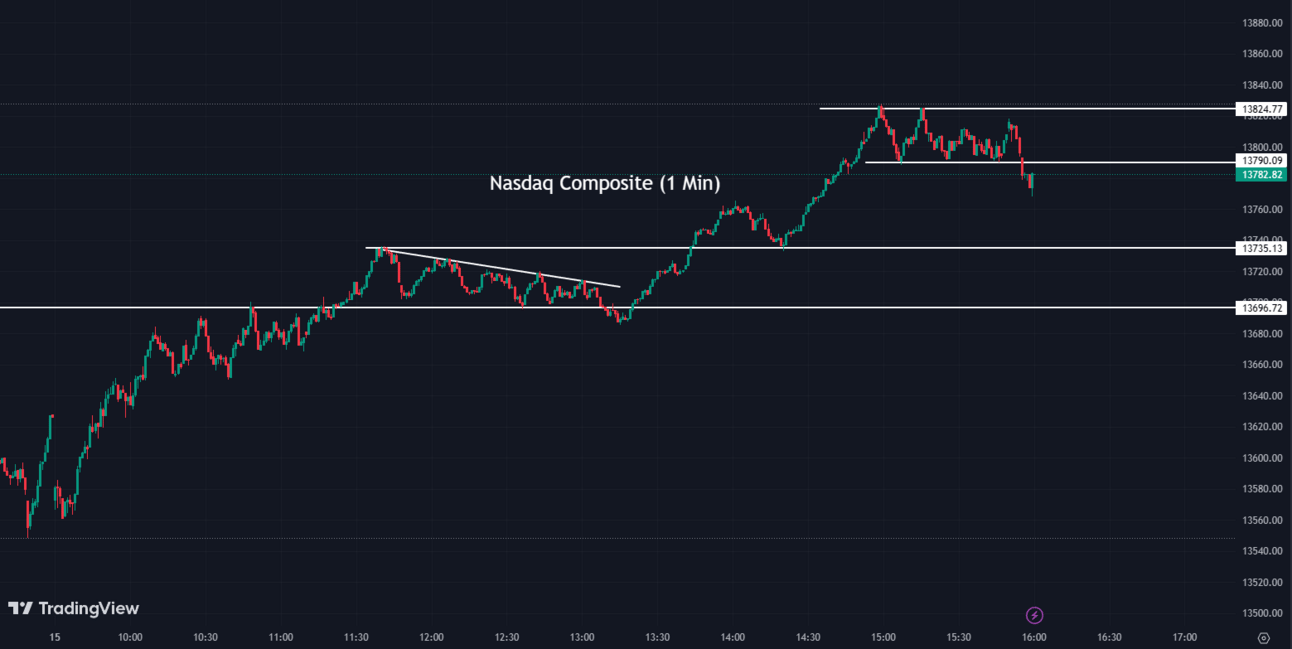

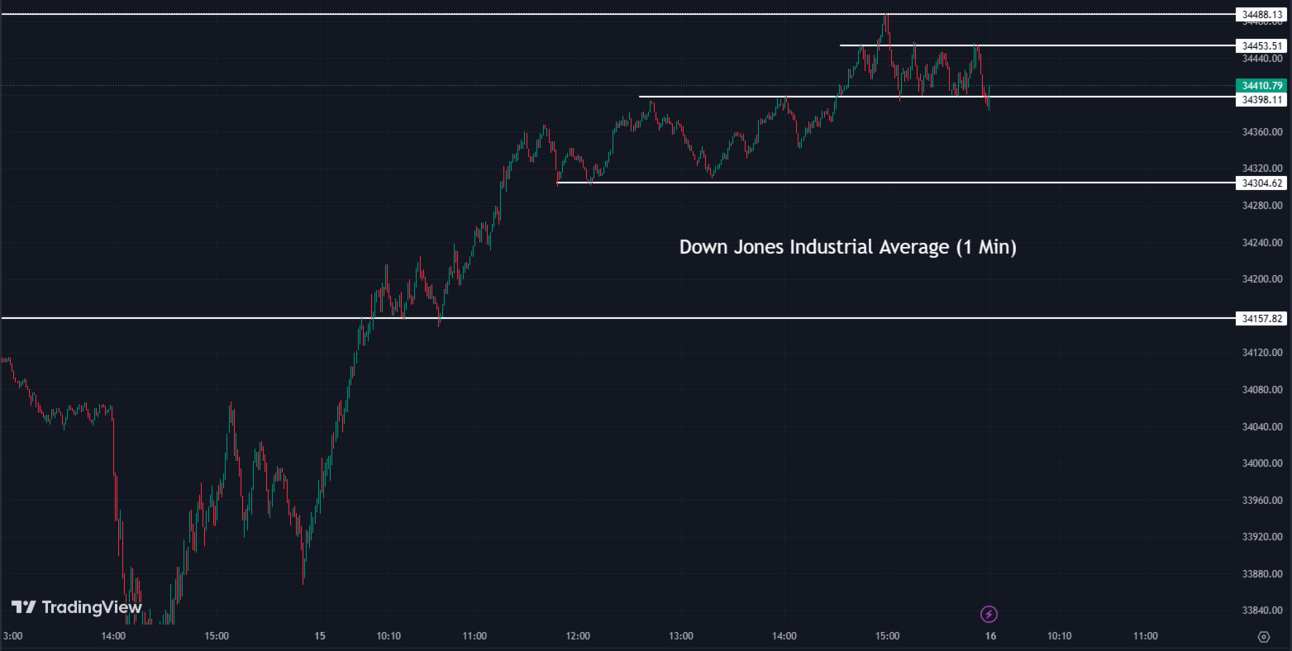

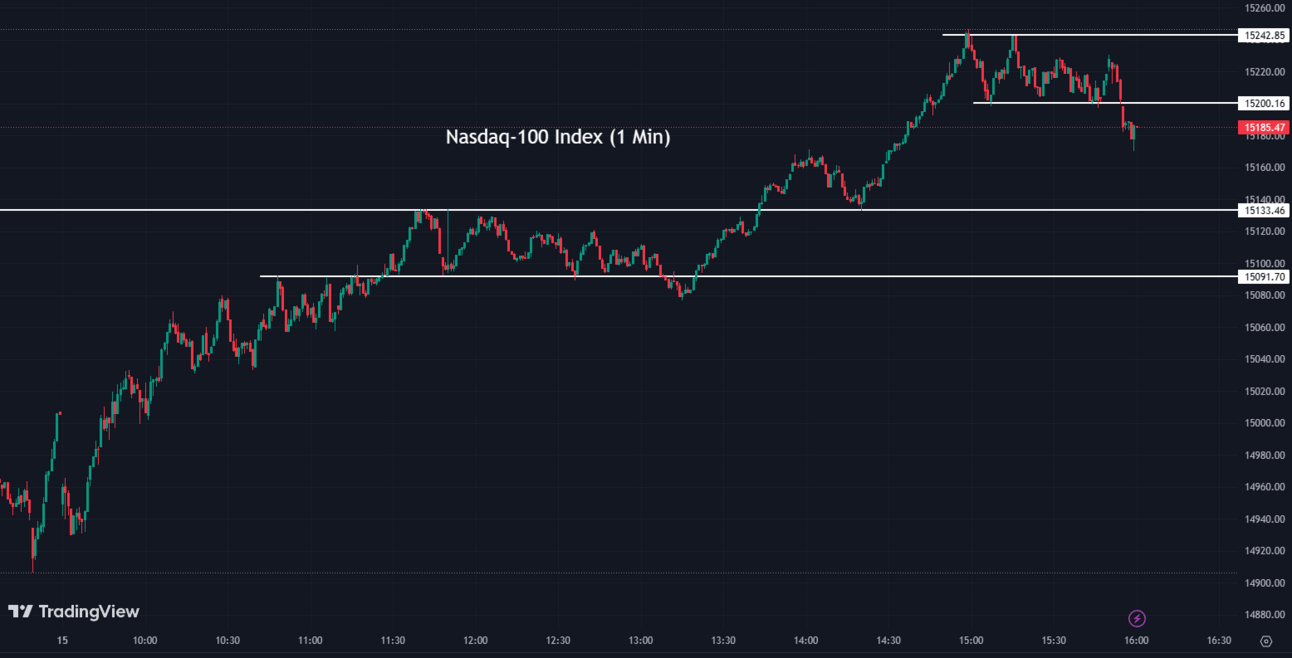

Indexes 📈📈

The Indices rose as it appeared that the Federal Reserve was nearing the end of its rate-raising endeavors, as the central bank decided to halt its campaign of raising rates this week, having completed a sequence of 10 consecutive increases. Now, let's explore how the market performed today...

The S&P 500 (SPX) was up +1.22% coming to a conclusion at 4,425

The Nasdaq Composite (IXIC) escalated by +1.15% to settle at 13,782

The Dow Jones Industrial Average (DJI) rose +1.26% ending the day at 34,408

The Russell 2000 (RUT) increased by +0.81% to finish at 1,889

The Nasdaq-100 (NDX) escalated by +1.20% to conclude at 15,185

Mercedes-Benz & Microsoft In-car ChatGPT Partnership 🤝🚗

Mercedes-Benz and Microsoft (MSFT) have announced a partnership to test in-car ChatGPT AI, extending to over 900,000 vehicles in the U.S. The technology will enhance the "Hey Mercedes" voice assistant for audio requests, significantly broadening its capabilities. Starting from Friday, U.S. customers can join an optional beta program via the Mercedes me app or directly from the vehicle. The AI system improves natural language understanding and widens the range of topics it can respond to.

MSFT:

348.10 ▲ +10.76 (+3.19%) Today

348.69 ▲ +0.59 (+0.17%) After Hours

Microsoft Shares Eyeing Record High On AI Optimism 💹🔥

Microsoft Corp's shares are poised to achieve a new all-time high, driven by positive sentiment surrounding the potential of AI. Recognized as a frontrunner in AI technology implementation within the software industry, Microsoft has made significant investments in OpenAI, a San Francisco-based startup known for its widely used chatbot ChatGPT. Recently, Microsoft has integrated AI enhancements, including ChatGPT, into its Azure cloud services and search engine Bing, as a means to challenge Google's dominance. J.P. Morgan analysts have responded to this AI-driven demand for Microsoft's products by raising their price targets on the company's stock.

MSFT:

348.10 ▲ +10.76 (+3.19%) Today

348.69 ▲ +0.59 (+0.17%) After Hours

Toyota's Stock Peaks Following Electric Vehicle Plans 🏎️🔌

Toyota's (TM) shares were up today, following the company revealing plans for its next-generation electric vehicles and shareholders approving the new leadership. Toyota's announcement, including the launch of its next-generation EVs scheduled for 2026 and vehicles with solid-state batteries by 2027 or 2028, have stimulated investor confidence.

TM:

168.18 ▲ +2.61 (+1.58%) Today

169.89 ▲ +1.71 (+1.02%) After Hours

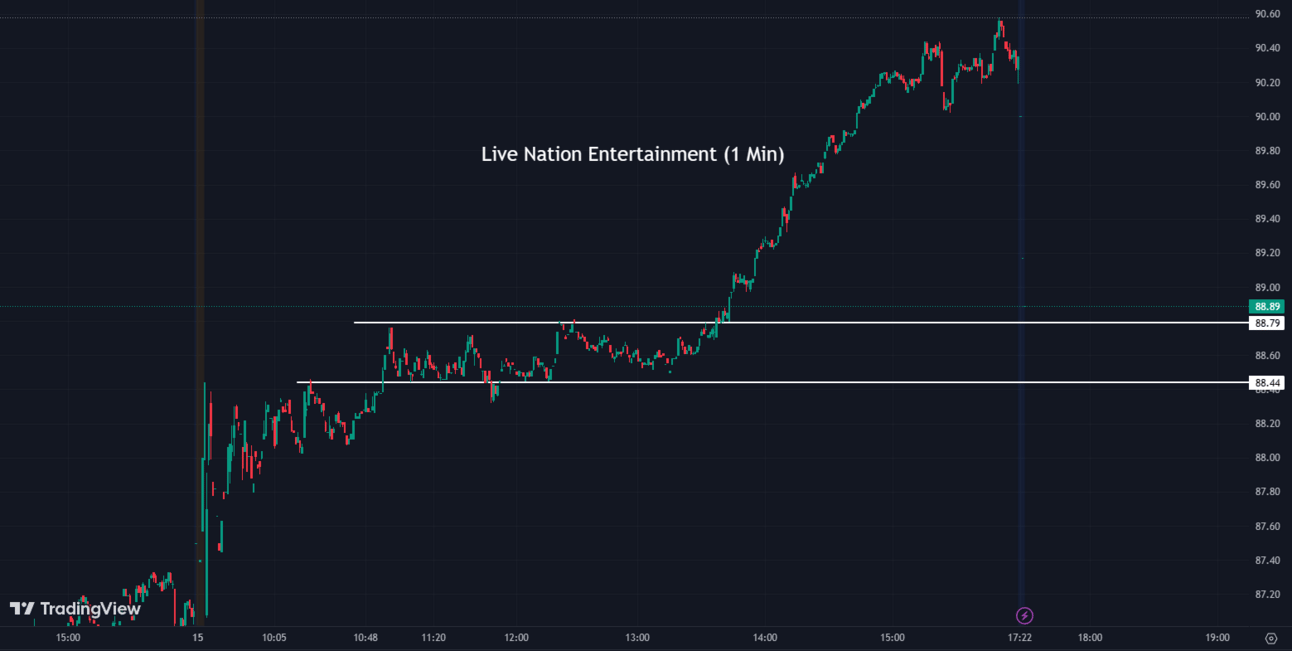

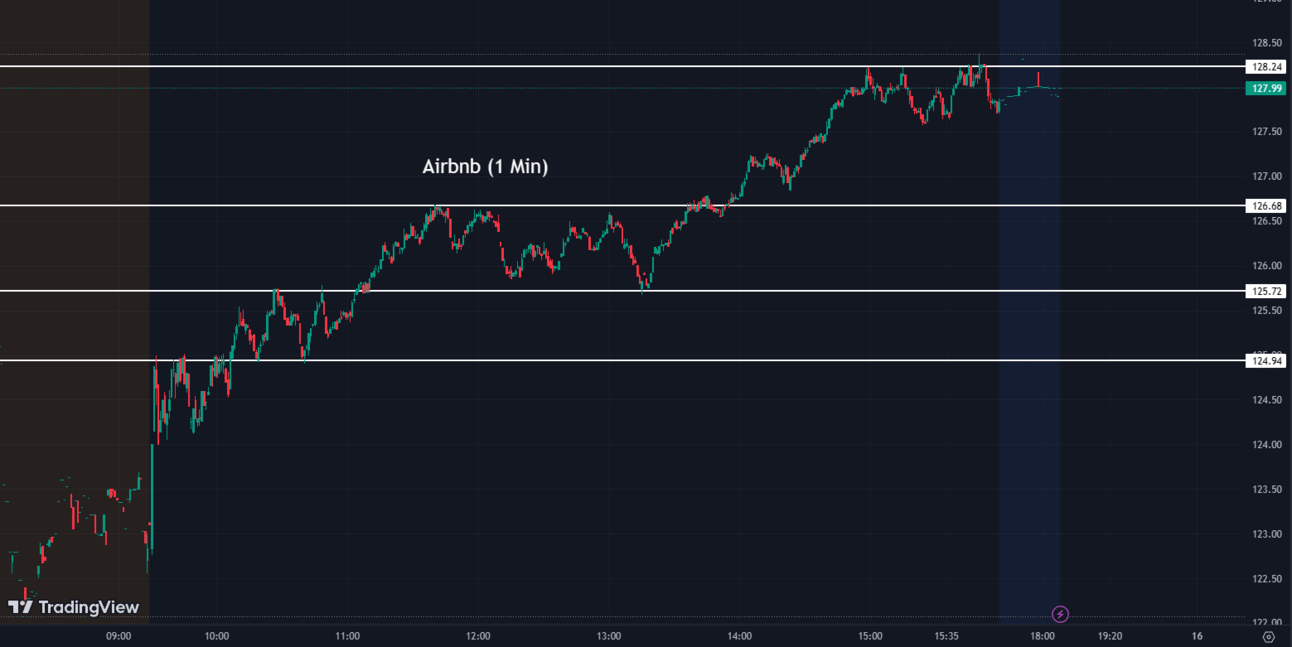

Ticketing Companies Pledge to End Surprise "Junk Fees" After Push from Biden Administration 🎟️💥

Ticketmaster parent Live Nation (LYV), has pledged to end the practice of surprise "junk fees" (extra costs added at the end of purchases), following pressure from the Biden administration. President Joe Biden is scheduled to meet with representatives from Live Nation, Airbnb (ABNB), SeatGeek, and more to meet with him Thursday. Both Live Nation and SeatGeek have predetermined to show all fees upfront for ticket purchases. The issue became highly prominent in November when fans faced exceedingly high prices for Taylor Swift's Eras tour tickets. This commitment from major ticketing platforms is hailed as a win for consumers and marks a significant step towards addressing “junk fees” in the economy.

LYV:

90.34 ▲ +3.26 (+3.74%) Today

90.30 ▼ -0.04 (-0.044%) After Hours

ABNB:

127.85 ▲ +2.71 (+2.17%) Today

127.93 ▲ +0.08 (+0.063%) After Hours

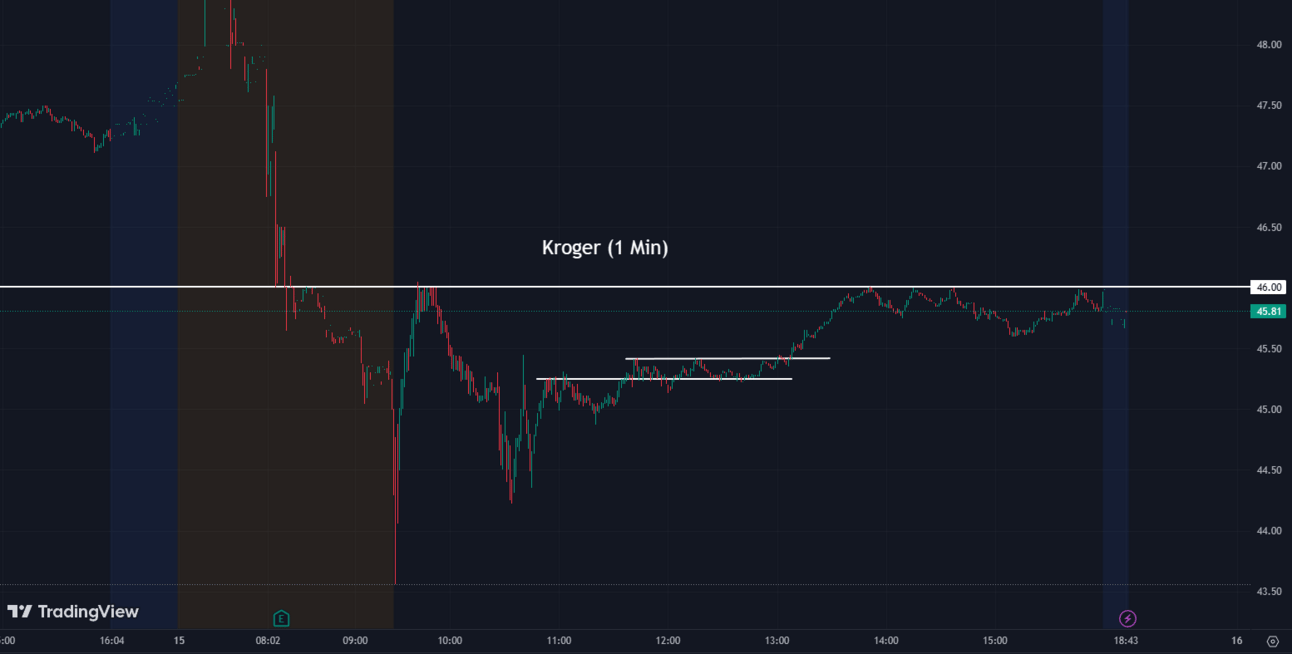

Kroger Faces Revenue Growth Slowdown 🛒📉

Kroger (KR) witnessed a decline in its stock value as a result of a deceleration in revenue growth, signaling the conclusion of the sales upswing driven by the pandemic. Customers, contending with inflation and economic instability, have reduced their spending, while increased promotional activities by the company have impacted sales and profits. This stands in stark contrast to Kroger's remarkable sales surge throughout the pandemic, which played a significant role in their $24.6 billion acquisition of Albertsons Cos. Currently, the deal is undergoing a thorough antitrust review. Despite these challenges, the grocer has maintained its annual profit forecast.

KR:

45.95 ▼ -1.26 (-2.67%) Today

45.90 ▼ -0.04 (-0.087%) After Hours

Nvidia and AMD Stocks Dip Amid Legal Changes 🔽💻

Shares of NVIDIA (NVDA) and Advanced Micro Devices (AMD) experienced a decline in trading today following reports of proposed US legislation that would eliminate Section 230 immunity for AI companies. The new law aims to enable legal action against social media companies regarding claims related to emerging generative AI technology. Both Nvidia and AMD were negatively impacted by this development, with Nvidia shares experiencing a 0.80% decrease and AMD shares falling by 2.43% at the close.

NVDA:

426.53 ▼ -3.44 (-0.80%) Today

426.45 ▼ -0.08 (-0.019%) After Hours

AMD:

124.24 ▼ -3.09 (-2.43%) Today

124.03 ▼ -0.21 (-0.17%) After Hours

Senate Democrats Call for Enhanced Fraud Protections on PayPal and Cash App 🏛️��

A group of prominent Democratic senators has urged peer-to-peer payment platforms such as PayPal (PYPL) and Cash App (SQ) to enhance their fraud prevention measures. The senators have expressed concerns that the current policies employed by these platforms have not kept up with the rapid surge in their usage and have proven ineffective in curbing fraudulent activities. In a letter, the lawmakers have requested comprehensive information regarding fraud incidents spanning the past five years, as well as detailed insights into the platforms' fraud detection and prevention policies. The senators have set a deadline of June 30th for the platforms to provide their comprehensive responses.

PYPL:

65.85 ▲ +2.25 (+3.54%) Today

65.71 ▼ -0.14 (-0.21%) After Hours

SQ:

66.20 ▲ +2.52 (+3.95%) Today

66.21 ▲ +0.02 (+0.03%) After Hours

CAVA Makes a Strong IPO Debut 🎉📈

The Mediterranean restaurant chain, Cava (CAVA), has achieved a remarkable entrance into the stock market. The initial public offering (IPO) exceeded expectations, with shares priced at $22 each, surpassing the targeted range of $17 to $19 per share. This valuation positioned the company at $2.5 billion. CAVA's triumphant debut has the potential to inspire other restaurant chains, such as Fogo de Chão and Gen Restaurant Group, to explore public offerings. CAVA's robust performance, including a 28% increase in same-store sales during the first quarter, highlights the opportunity for high-quality restaurant chains to thrive in the public market. While CAVA remains unprofitable, it is steadily narrowing its losses and appears to be closer to reporting more net income compared to its competitor, Sweetgreen, which went public in 2021. All in all, CAVA's impressive IPO underscores the market's appetite for restaurant chains and presents a positive outlook for the industry.

CAVA:

43.78 ▲ +21.78 (99.00%) Today

44.75 ▲ +0.97 (2.22%) After Hours

Domino's Pizza Stock Upgraded to Buy by Stifel 🍕🚀

Domino's Pizza (DPZ) stocks have risen as Stifel upgraded the rating from Hold to Buy. The upgrade reflects Domino's strategic initiatives to enhance its ordering app and loyalty program, which are anticipated to drive improvements in sales performance, order conversion rates, and marketing effectiveness. Furthermore, the expectance of reduced commodity costs and recent efforts to enhance service quality and prioritize customer satisfaction is expected to bolster franchisee profitability. The analysts also noted that the company's carry-out channel presents a substantial growth prospect, and the stabilization of delivery sales after the COVID-19 pandemic will serve as a pivotal catalyst for the company's stock.

DPZ:

325.46 ▲ +19.74 (+6.46%) Today

325.65 ▲ +0.19 (+0.058%) After Hours

After Hour Movers ⏳🚀

Adobe (ADBE) reported strong earnings results, driving its stock price above $500 per share. The company's stock rose over 3% in after-hours trading following the release of quarterly results that surpassed analysts' revenue and earnings expectations. Adobe's shares have experienced significant growth, increasing by 46% since early May, as investors respond positively to the company's focus on generative AI. In the fiscal second quarter, Adobe achieved net earnings of $1.3 billion, or $2.82 per share, compared to $1.2 billion, or $2.49 per share, in the same quarter of the previous year. Adjusted earnings were $3.91 per share, while revenue saw a 10% increase to $4.82 billion. The company's CEO, Shantanu Narayen stated, “Adobe’s ground-breaking innovation positions us to lead the new era of generative AI given our rich datasets, foundation models, and ubiquitous product interfaces.” Adobe's strong demand across Creative Cloud, Document Cloud, and Experience Cloud demonstrated record Q2 revenue.

ADBE:

490.91 ▲ +11.38 (+2.37%) Today

508.30 ▲ +17.39 (+3.54%) After Hours

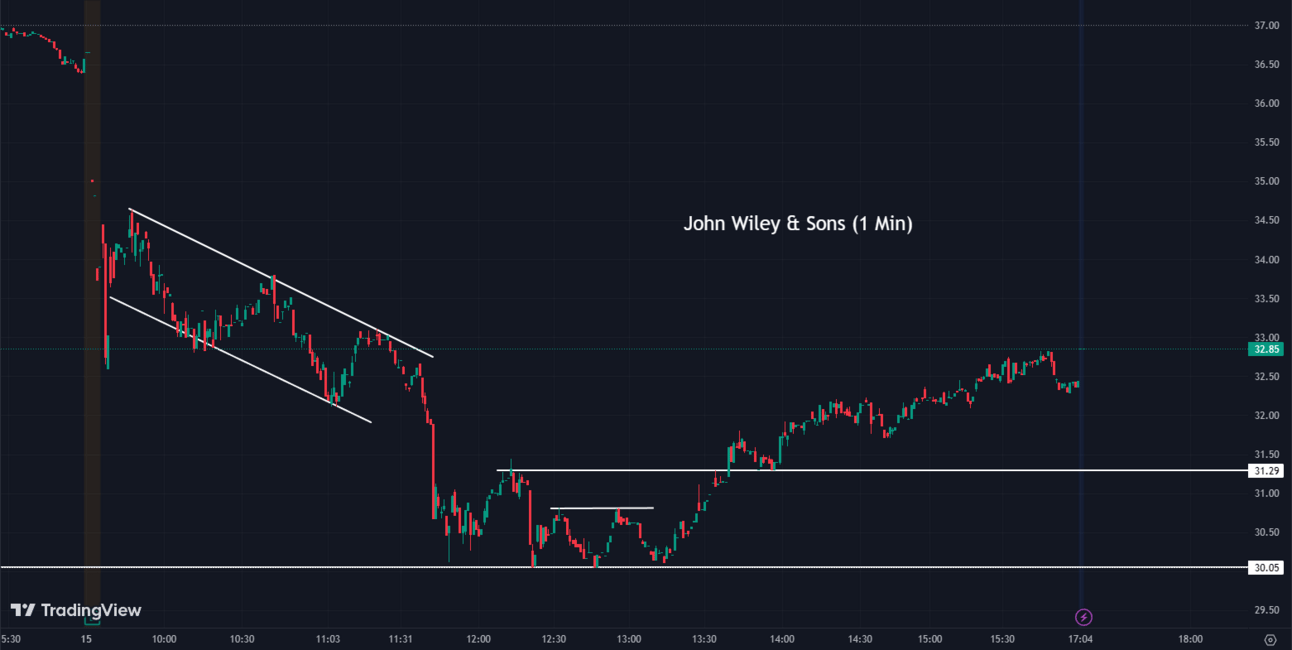

John Wiley & Sons (WLY) reported an increase in profit for its fourth quarter compared to the previous year. The company's bottom line reached $68.344 million, or $1.22 per share, compared to $43.146 million, or $0.76 per share, in the same quarter last year. After excluding certain items, John Wiley & Sons reported adjusted earnings of $1.45 per share for the period. However, the company's revenue for the quarter declined by 3.6% to $526.127 million from $545.653 million last year.

WLY:

32.45 ▼ -4.17 (-11.39%) Today

32.90 ▲ +0.45 (+1.39%) After Hours

Aurora Mobile (JG) reported a loss of $2.2 million in its first quarter. On a per-share basis, the company recorded a loss of 2 cents. The Shenzhen, China-based company, which provides mobile data services, generated revenue of $9.5 million during the period.

JG:

0.28 ▼ -0.029 (-9.36%) Today

0.29 ▲ +0.011 (+3.96%) After Hours

Jabil (JBL) reported impressive third-quarter fiscal 2023 results, surpassing the Zacks Consensus Estimate for both revenue and earnings. The company achieved year-over-year top-line growth due to solid execution in a dynamic operating environment, a diverse end-market portfolio, and strong demand for its engineering, manufacturing, and supply chain solutions. On a GAAP basis, net income for the quarter was $233 million or $1.72 per share, while non-GAAP net income was $269 million or $1.99 per share, exceeding expectations. Quarterly revenues increased to $8,475 million, driven by a comprehensive product portfolio and positive demand trends. Jabil expects the healthy momentum to continue, raising its revenue expectation for fiscal 2023 to $34.7 billion with $8.5 in core earnings per share.

JBL:

104.64 ▲ +4.95 (+4.97%) Today

104.50 ▼ -0.14 (-0.13%) After Hours

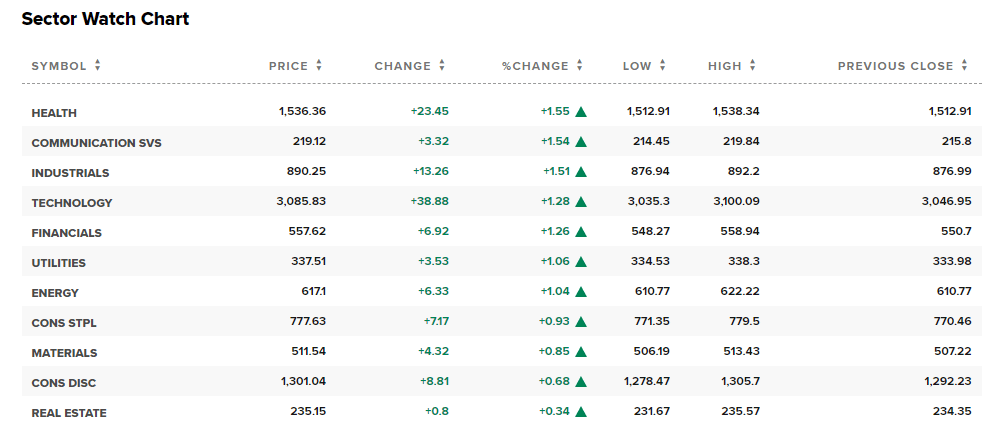

Sectors 🌡️🏘️

Every sector saw an increase, with Health leading the way, up 1.55%, while real estate had the smallest increase, up 0.34%.

Conclusion👋

Today's financial market updates provided a comprehensive overview of various sectors and companies. US retail sales displayed resilience despite economic uncertainties, with a notable surge in spending on building materials and gardening items. The European Central Bank's decision to raise interest rates aimed to tackle high inflation levels, resulting in a strengthened euro and increased European bond yields. The stock market indices showed positive gains, driven by the Federal Reserve's decision to pause rate hikes. Partnerships between Mercedes-Benz and Microsoft, as well as Microsoft's AI advancements, fueled optimism surrounding AI technology. Toyota's stock rose following its announcement of next-generation electric vehicle plans. Ticketing companies pledged to end surprise "junk fees" after pressure from the Biden administration, while Kroger faced a revenue growth slowdown. Nvidia and AMD experienced stock declines due to proposed legislation impacting AI companies, while Senate Democrats called for enhanced fraud protections on payment platforms. ELF Beauty saw significant growth in its stock price, while Cava made a successful IPO debut. Domino's Pizza received an upgrade in its rating, and Adobe reported strong earnings results. John Wiley & Sons reported an increase in profit, Aurora Mobile reported a loss, and Jabil surpassed revenue and earnings expectations. Overall, today's updates highlight both the opportunities and challenges faced by various sectors and companies in the dynamic financial landscape.

Thank you all for signing up!

Will only work to do better for you all going forward. Our only goal is to add value to everyone’s trading with key levels and the ability of learning charts and price action.

Please Share Our Newsletter it will be much appreciated!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of TradingView. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.