Hello, traders! As we wind down for the evening, let's take a deep dive into the noteworthy events that have shaped the financial markets today!

The Federal Reserve Hits Pause on Rate Hikes, But Eyes Future Increases 💵🛑

After 10 consecutive rate hikes, the Federal Reserve announced its intention to pause interest rate increases. They maintained the target range for the federal funds rate at 5 to 5.25 percent, marking the first time rates have remained unchanged since January 2022. This decision allows the Federal Open Market Committee to evaluate new information and its implications for monetary policy.

However, the Fed's projections indicate that rate hikes will resume later this year, with a forecasted rate of 5.6 percent by the end of 2023. If the quarter-point increments are followed, two more rate hikes are expected this year. The Fed also revised its forecast for annual core consumer price growth to 3.9 percent and GDP growth to 1.0 percent in 2023. Additionally, they lowered their forecast for the unemployment rate to 4.1 percent.

The Fed emphasized the importance of addressing rising inflation and reiterated its commitment to achieving the 2% objective. The next monetary policy meeting is scheduled for July 25-26.

Treasury Yields React to Fed's Decision on Rate Hikes and Market Expectations ⚖️💲

Following the Federal Reserve's decision to pause rate hikes but signal two more to come later this year, Treasury yields fluctuated. The 2-year Treasury yield rose slightly to 4.705%, while the 10-year Treasury yield dropped by over 4 basis points to 3.8%. The Fed stated that it would assess the impacts of its previous 10 rate increases before its next meeting, scheduled for July 25-26. As of now, market predictions suggest a near 60% likelihood of a rate hike at the July meeting, according to the CME FedWatch Tool.

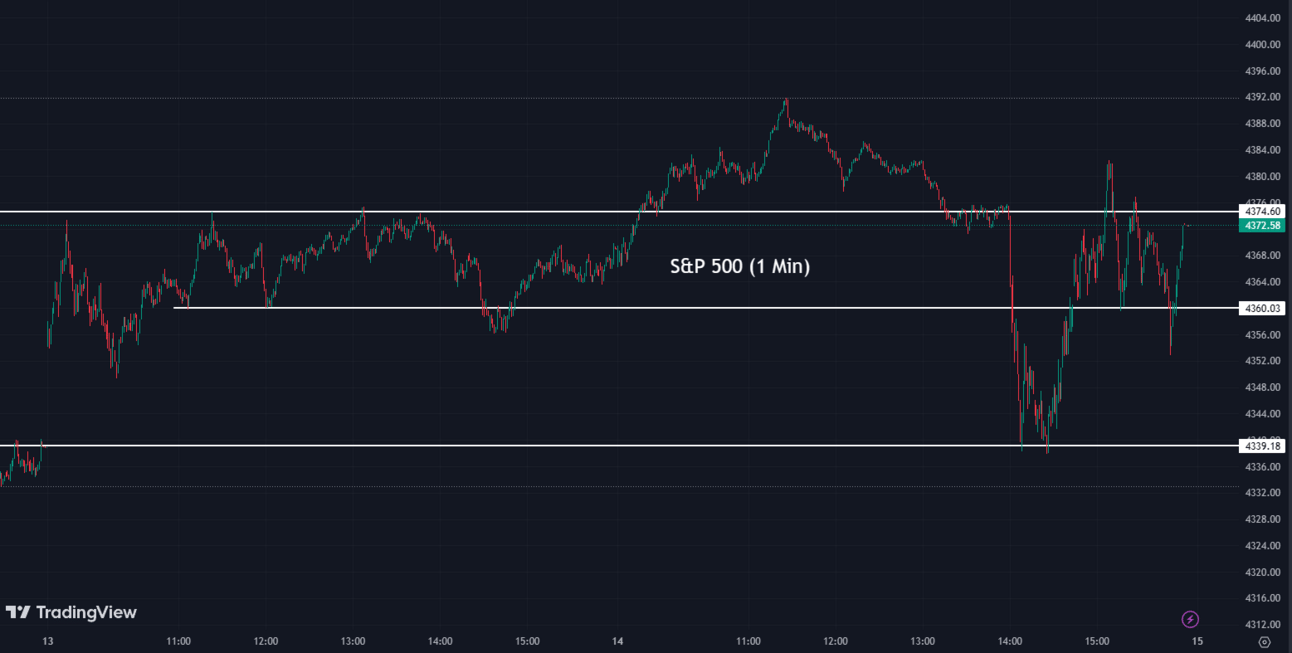

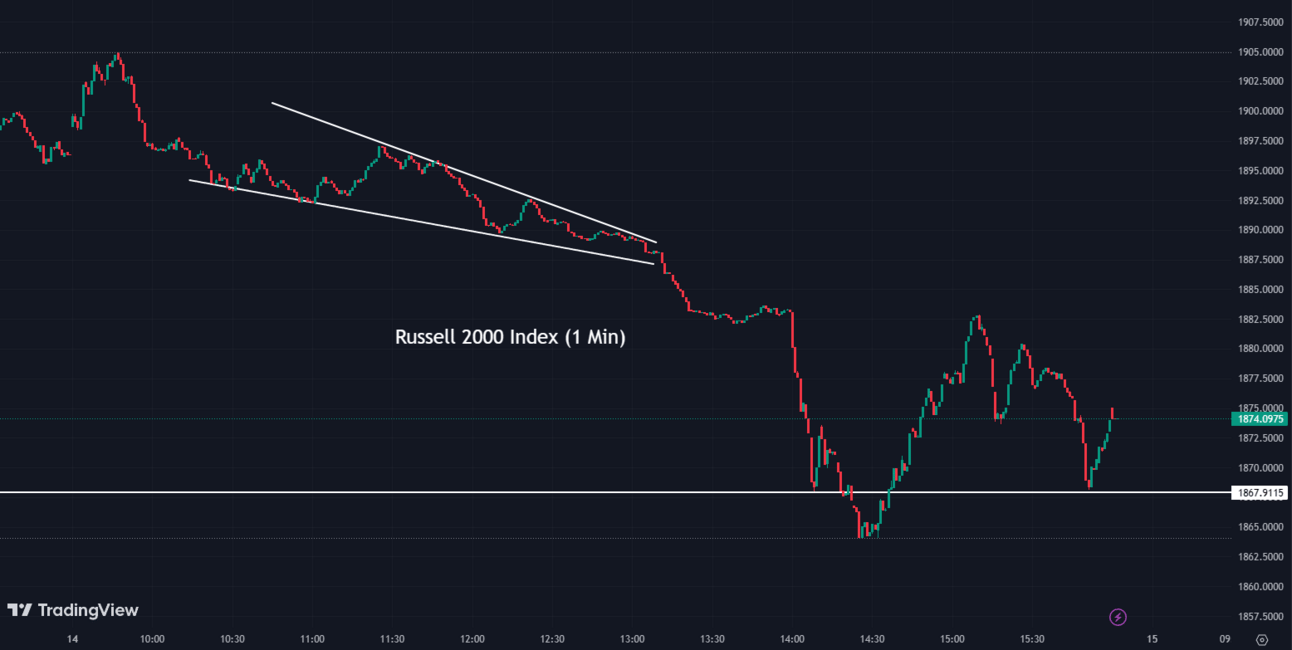

Indexes 📈📉

Most indices were up at the closing bell as a result of the Fed's decision to skip a rate hike. Initially, the indices dropped after the news of the Fed's rate hike pause, but some regained stability and closed higher. Now, let's explore how the market performed today...

The S&P 500 (SPX) was up +0.08% coming to a conclusion at 4,372

The Nasdaq Composite (IXIC) escalated by +0.39% to settle at 13,626

The Dow Jones Industrial Average (DJI) fell -0.68% ending the day at 33,979

The Russell 2000 (RUT) dropped by -1.17% to finish at 1,874

The Nasdaq-100 (NDX) rose +0.70% to conclude at 15,005

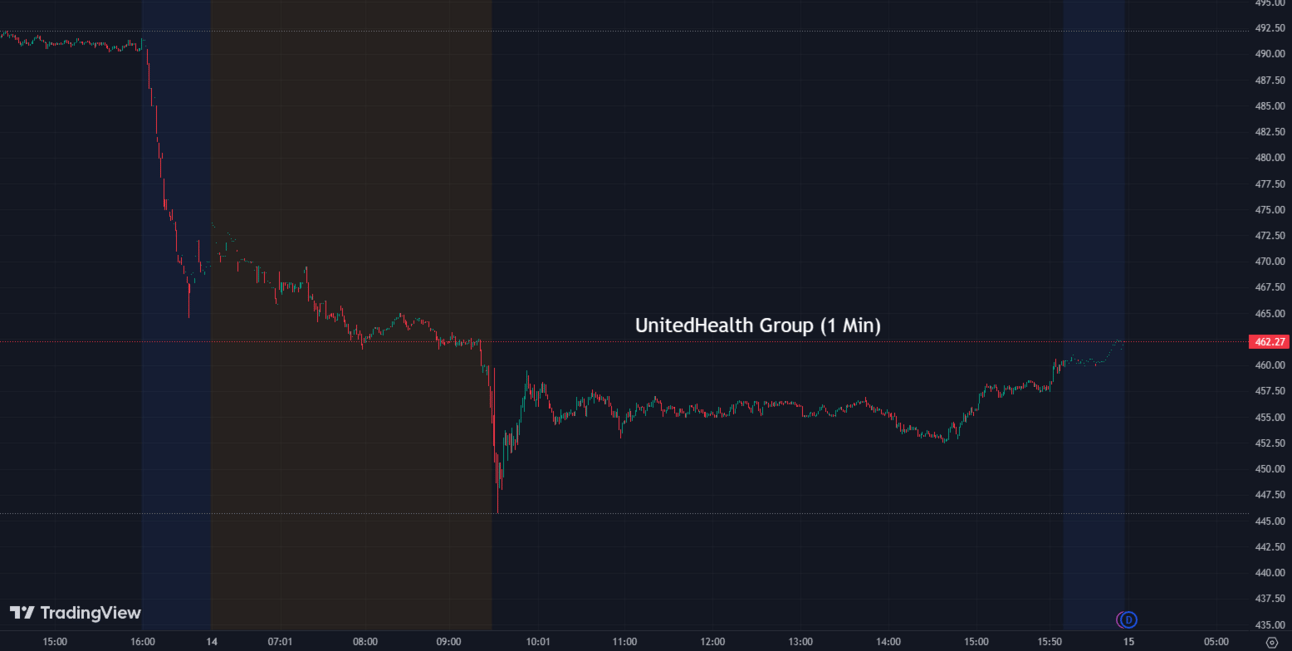

Health Insurer Stocks Drop as UnitedHealth Warns of Higher Medical Costs from Delayed Surgeries 🚑🔻

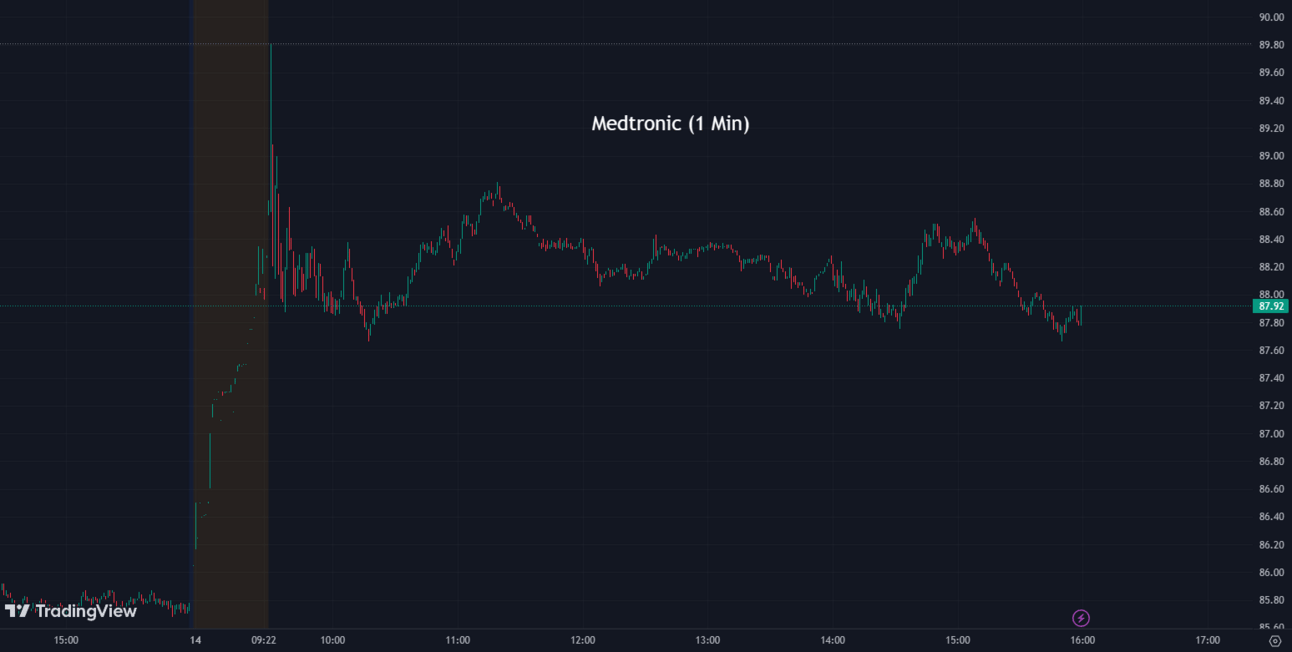

Health insurer stocks experienced a decline after UnitedHealth Group (UNH) issued a warning about higher medical costs resulting from older Americans undergoing surgeries they had delayed due to the Covid-19 pandemic. UnitedHealth (UNH), Humana (HUM), Elevance Health (ELV), and CVS Health (CVS) all saw their shares drop. In recent years, insurance companies benefited from a delay in nonurgent procedures, but this trend appears to be reversing. UnitedHealth indicated an increase in outpatient care, particularly among Medicare enrollees seeking heart procedures and hip and knee replacements. This shift in healthcare utilization has led to concerns about higher-than-expected spending on care for the second quarter. Conversely, medical device manufacturers such as Medtronic (MDT) and Stryker (SYK) saw their shares rise, while hospital operators like HCA Healthcare (HCA) and Tenet Healthcare (THC) experienced modest gains.

Health Insurers

UNH:

460.11 ▼ -31.20 (-6.35%) Today

461.01 ▲ +1.15 (+0.25%) After Hours

HUM:

454.91 ▼ -57.72 (-11.26%) Today

454.85 ▼ -0.15 (-0.033%) After Hours

ELV:

436.32 ▼ -32.31 (-6.89%) Today

439.29 ▲ +2.96 (+0.68%) After Hours

CVS:

66.64 ▼ -5.62 (-7.78%) Today

67.00 ▲ +0.35 (+0.53%) After Hours

Medical Device Manufacturers

MDT:

87.89 ▲ +2.14 (+2.50%) Today

88.74 ▲ +0.83 (+0.94%) After Hours

SYK:

293.57 ▲ +11.83 (+4.20%) Today

294.99 ▲ +1.42 (+0.48%) After Hours

Hospital Operators

HCA:

284.20 ▲ +4.35 (+1.55%) Today

287.94 ▲ +3.74 (+1.32%) After Hours

THC:

77.48 ▲ +1.91 (+2.53%) Today

78.96 ▲ +1.48 (+1.91%) After Hours

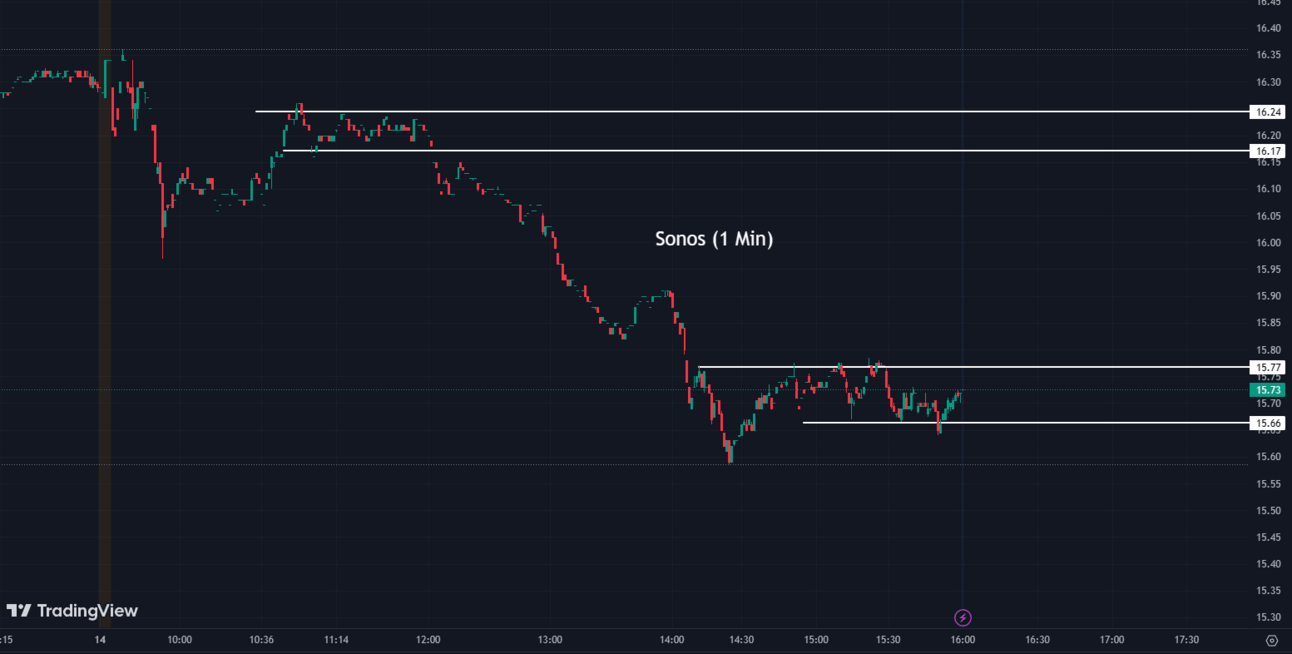

Sonos Announces Workforce Reduction 📢🔻

Sonos, (SONO) the wireless speaker company, has announced that it will lay off approximately 7% of its workforce, about 130 employees. The decision was shared in an SEC filing on Wednesday. Sonos CEO Patrick Spence cited continued economic headwinds for this tough decision. The company expects to incur $11 to $14 million in restructuring costs during the third quarter. Recent financials revealed a 23.9% YoY decrease in revenue for the period ending April 1, 2023, dropping to $304.2 million. The company had previously reduced its workforce by 12% in 2020 due to the impact of the COVID-19 pandemic.

SONO:

15.70 ▼ -0.59 (-3.62%) Today

There was no movement in the stock's price after hours.

Analyst Raises Price Target on Meta Shares, Citing AI's Profit Potential 🚀🎯

Deepak Mathivanan, a Wolfe Research analyst, has raised the price target on Meta's (META) shares to $330 from $300, highlighting the company's potential to profit from the AI revolution. According to Mathivanan, Meta can utilize AI to increase user engagement on its platforms like Facebook and Instagram. The integration of AI into WhatsApp and Messenger chat assistants also holds considerable potential. Generative AI can "meaningfully" boost Meta's advertising products and increase rates over time. Mathivanan stated that very few companies have all the necessary components to create and deploy generative AI experiences that significantly drive revenue and free-cash-flow growth, and Meta is one of them.

META:

273.35 ▲ +2.03 (+0.75%) Today

274.19 ▲ +0.84 (+0.31%) After Hours

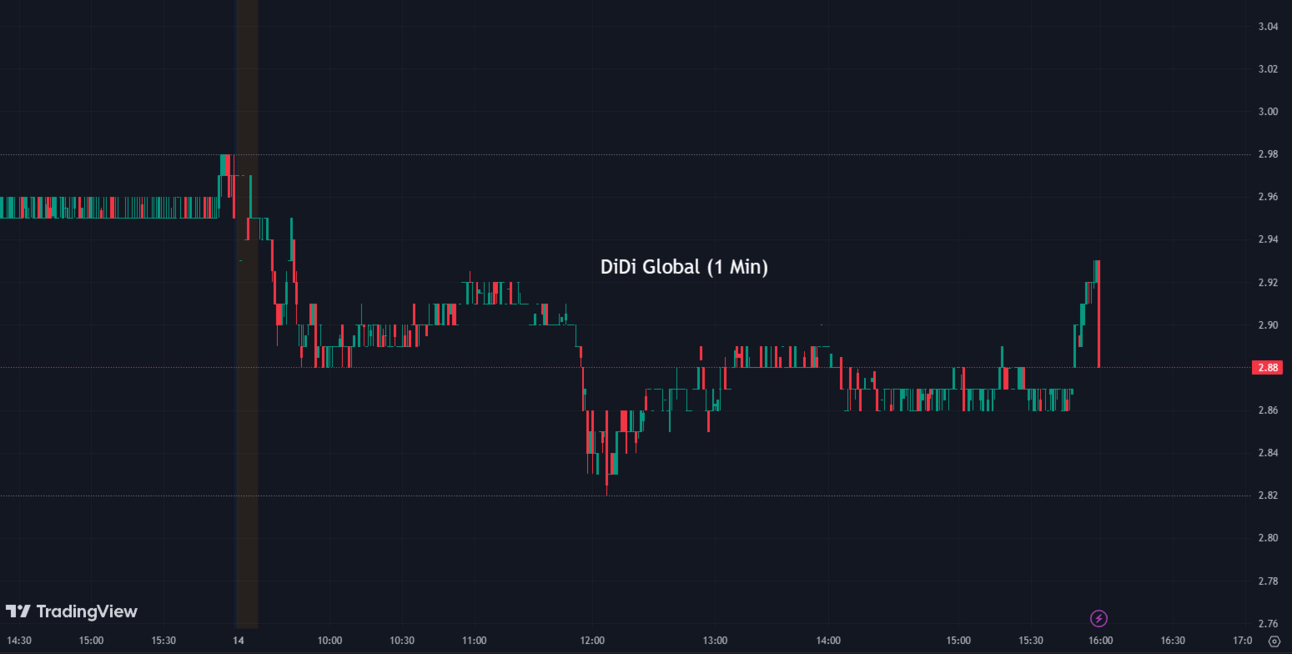

Didi Global Thrives 📈📈

Despite its delisting from the NYSE due to Beijing’s tech crackdown, Chinese ride-hailing giant, Didi Global (DIDIY), now boasts a market value of approximately $14 billion. The company continues to attract institutional investors, with Davis Selected Advisers, Macquarie Group, and France’s Carmignac among the key stakeholders. Didi's stock has also increased nearly 20% since its NYSE exit, outperforming the Nasdaq Golden Dragon Index. The company has maintained a significant market share in China’s ride-hailing market. It is anticipated that a Hong Kong listing may be in the company’s future.

DIDIY:

2.88 ▼ -0.09 (-3.03%) Today

2.93 ▲ +0.05 (+1.74%) After Hours

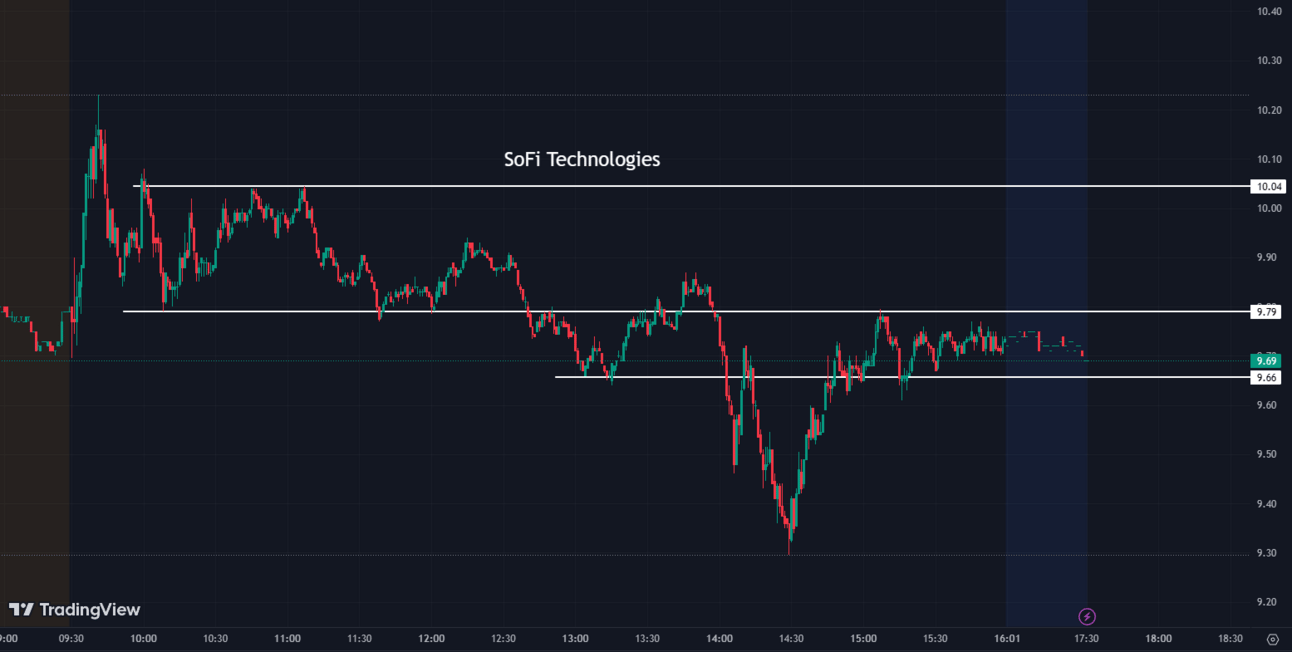

SoFi Technologies' Stock Soars on Optimistic Outlook for Student Loan Payments 🎓💼

Online personal finance company, SoFi Technologies (SOFI), is experiencing significant gains in its stock value. The record run of gains is a result of the optimistic outlook regarding the plans to resume student loan payments, which will boost SoFi's student loan refinancing business.

SOFI:

9.74 ▲ +0.20 (+2.10%) Today

9.70 ▼ -0.04 (-0.41%) After Hours

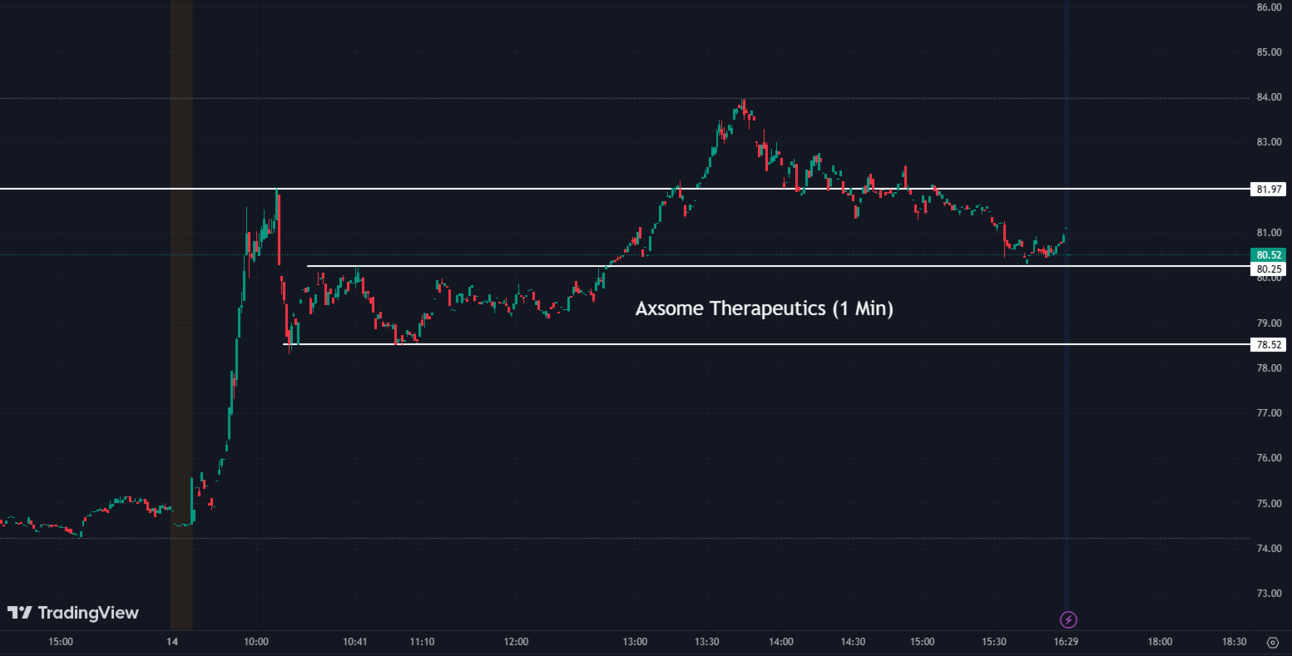

Axsome Therapeutics Beats Sales Forecasts, Drives Stock Surge 📈🎉

Axsome Therapeutics (AXSM) provided its first guidance on its suite of eight products, forecasting that it could generate up to $5.8 billion to $11.5 billion in peak sales, significantly surpassing analysts' estimates of $2.4 billion to $4.5 billion. This news drove AXSM stock higher. Among the products, Axsome expects Auvelity, a depression treatment, also being studied for Alzheimer's disease agitation and smoking cessation, to bring in substantial sales. The company also confirmed plans to launch four new products by 2025, addressing conditions like migraine, narcolepsy, fibromyalgia, and Alzheimer's disease agitation.

AXSM:

80.91 ▲ +6.03 (+8.05%) Today

81.95 ▲ +1.04 (+1.29%) After Hours

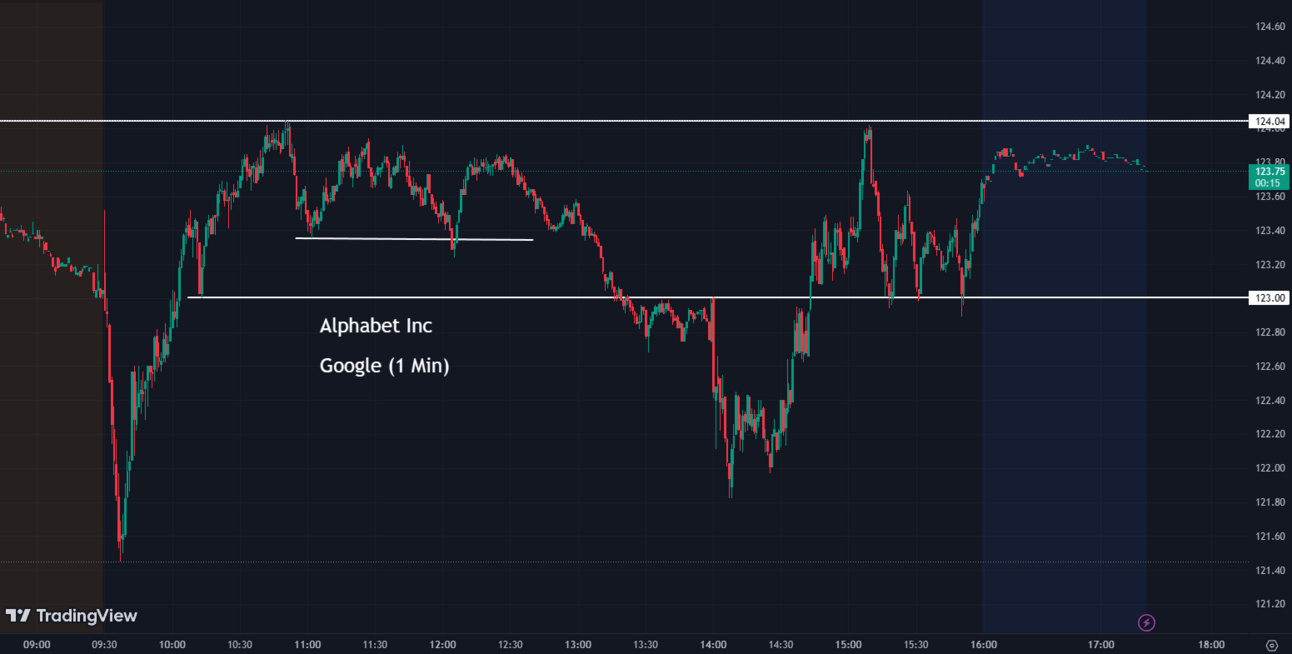

EU Antitrust Watchdog Calls for Google to Sell Part of its Ad Business 🚫🔍

The European Union's antitrust watchdog has taken a significant step against Google (GOOGL) by asking the tech giant to sell part of its online ad business. This move implies that Google now faces regulatory challenges on both sides of the Atlantic. The European Commission argues that Google's dominance in the ad tech business is distorting market competition. Google disagrees with the EC's view and intends to respond accordingly. Notably, Google's ad sales accounted for about 80% of the approximately $224.5 billion in revenue in 2022. These legal challenges pose a significant threat to a large part of Alphabet's business operations.

GOOGL:

124.38 ▼ -0.05 (-0.04%) Today

124.34 ▼ -0.035 (-0.028%) After Hours

After Hour Movers 🌙🏃

Lennar (LEN) reported fiscal second-quarter earnings of $871.7 million, equivalent to $3.01 per share. Adjusted for non-recurring gains, the earnings were $2.94 per share, surpassing the average estimate of $2.32 per share by analysts surveyed by Zacks Investment Research. The company also exceeded revenue expectations, posting $8.05 billion in revenue for the quarter, compared to the forecasted $7.28 billion.

LEN:

114.74 ▼ -1.27 (-1.09%) Today

117.34 ▲ +2.59 (+2.26%) After Hours

AMMO (POWW) shares jumped initially 20% in after-hours trading after the company exceeded revenue estimates for Q4. Despite missing earnings per share estimates by $0.01, the Arizona-based manufacturer reported a revenue decline of 37.7% year over year to $43.68 million, surpassing estimates by $6.48 million. GunBroker Marketplace’s revenue rose to $16.7 million, and the company expressed confidence in its ability to navigate market challenges. AMMO ended the quarter with a cash balance of $39.1 million and $54.34 million in inventories.

POWW:

2.04 ▼ -0.06 (-2.86%) Today

2.18 ▲ +0.14 (+6.86%) After Hours

High Tide (HITI) announced its financial results for the second fiscal quarter of 2023. The company reported a revenue increase to $118.1 million, a gross profit of $31.6 million, and an adjusted EBITDA of $6.6 million. General and administrative expenses decreased to 5% of revenue, and same-store sales grew by 30% year-over-year. High Tide captured 9.5% of the Canadian cannabis retail market share outside of Quebec. The company remains focused on its business fundamentals and aims to achieve positive free cash flow by the end of 2023.

HITI:

1.30 ▲ +0.01 (+0.78%) Today

1.35 ▲ +0.05 (+3.85%) After Hours

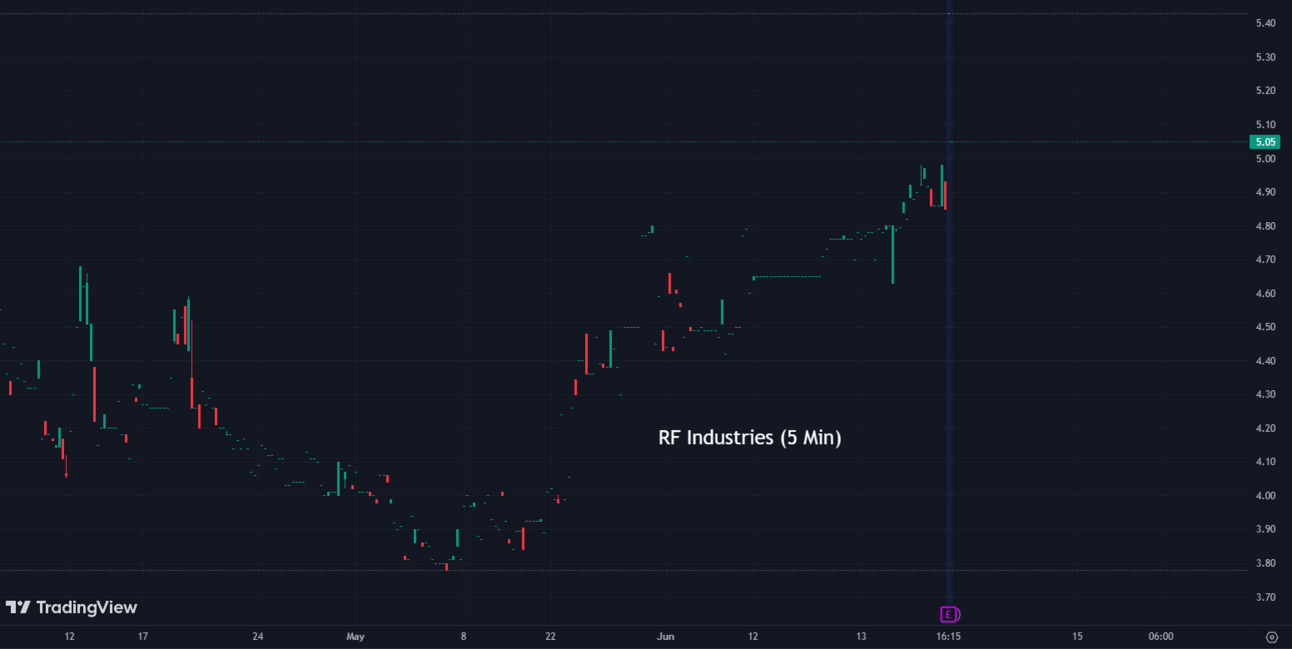

RF Industries (RFIL) announced its second fiscal quarter results for 2023. Net sales increased by 3.7% to $22.3 million compared to the same quarter last year. The company reported a gross profit margin of 27.4%, down 90 basis points from the previous year. Operating income was $489,000, and consolidated net income reached $581,000, or $0.06 per diluted share. Non-GAAP net income was $1.3 million, or $0.13 per diluted share. RF Industries faced challenges in the small cell and Direct Air Cooling markets due to cautious carrier capex spending. However, the company is optimistic about future improvements and expects increased gross margins and profitability in the coming fiscal years.

RFIL:

4.86 ▲ +0.18 (+3.85%) Today

5.01 ▲ +0.15 (+3.09%) After Hours

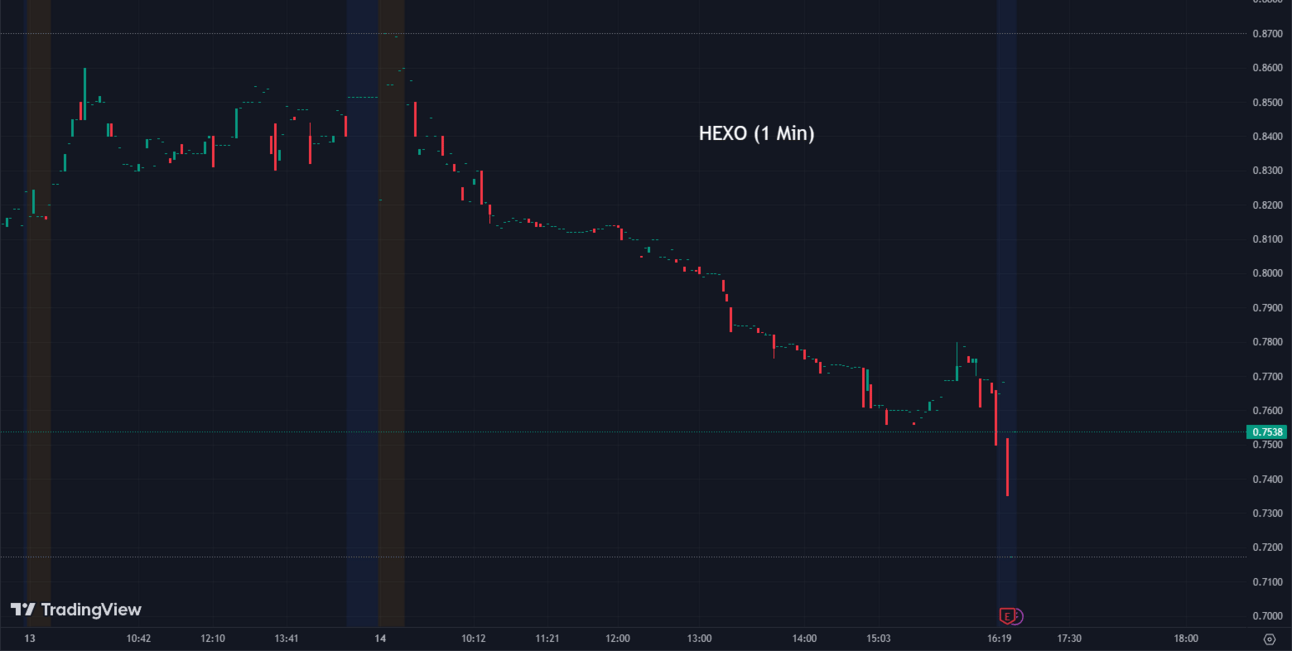

Hexo (HEXO) announced its fiscal third-quarter earnings and reported a loss of $86.4 million, equivalent to a loss of $1.94 per share. Adjusted for asset impairment costs and costs related to mergers and acquisitions, the losses amounted to 70 cents per share. The reported results were below the expectations of Wall Street analysts, who had estimated a loss of 7 cents per share, according to a survey conducted by Zacks Investment Research.

HEXO:

0.77 ▼ -0.089 (-10.38%) Today

0.75 ▼ -0.021 (-2.69%) After Hours

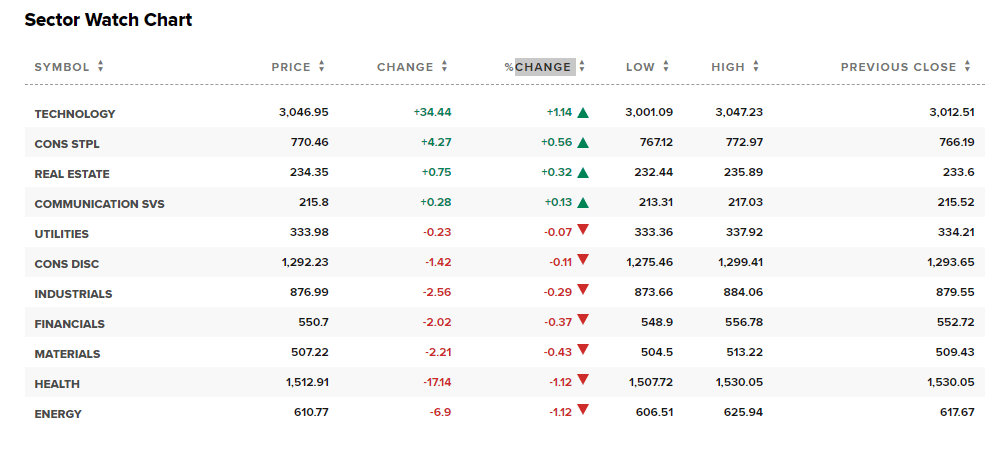

Sectors💻⚡️

Out of the 11 sectors, 4 closed in positive territory today, with Technology leading the way with a gain of 1.14%, while Energy saw a decline of -1.12%.

Conclusion👋

Today's financial market was marked by notable events that influenced various sectors and investor sentiment. The Federal Reserve's decision to pause interest rate hikes after 10 consecutive increases caught traders' attention, while Treasury yields fluctuated in response. Health insurer stocks faced a decline due to a warning about higher medical costs, while medical device manufacturers saw their shares rise. Sonos announced workforce reduction amidst economic headwinds. Meta's shares received a price target raise, and Didi Global demonstrated resilience despite its delisting. SoFi Technologies gained value due to an optimistic outlook on student loan payments, and Axsome Therapeutics exceeded sales forecasts. Additionally, the European Union's antitrust watchdog called for Google to divest part of its online ad business.

Thank you all for signing up!

Will only work to do better for you all going forward. Our only goal is to add value to everyone’s trading with key levels and the ability of learning charts and price action.

Please Share Our Newsletter it will be much appreciated!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of TradingView. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.