Hello, traders! As we wind down for the evening, let's take a deep dive into the noteworthy events that have shaped the financial markets today!

May CPI Report: Overall Inflation Declines, but Core CPI Remains High 📉📈

According to the U.S. Bureau of Labor Statistics, the consumer price index (CPI) grew by 4% annually in May, marking the lowest level in over two years. Despite decreased overall inflation, the core CPI remained high, excluding volatile food and energy costs. Notably, shelter, automobile insurance, amusement, household furniture and operations, and new automobiles experienced significant yearly increases. Conversely, airline tickets, vehicle and truck rentals, citrus fruits, fresh whole milk, and used automobiles and trucks witnessed deflation over the past year. The slowing of inflation doesn't necessarily indicate a decrease in aggregate household spending, but rather a slower rate of increase. Despite the reduced inflation, underlying pressures persist, with housing being a significant expense for consumers and contributing significantly to the core CPI in May.

U.S. Treasury Yields Rise as Inflation Slows Down 💲⬆️

On Tuesday, U.S. Treasury yields climbed following a key inflation report that showed a slowing pace of price increases, which may bolster the Federal Reserve's case to skip a rate hike this week. The 10-year Treasury yield added 7 basis points to 3.835%, and the 2-year Treasury yield was higher by 10 basis points at 4.698%. The May consumer price index indicated an annual increase of 4%, the lowest since 2021, and only 0.1% month over month. Traders are currently predicting over a 90% chance of no rate hike this week following the CPI report.

Indexes 📈💹

The indices rose following the announcement of inflation data, showing that prices slowed again in May, along with continuing optimism that the Fed could skip a rate hike in its upcoming policy decision this week. Now, let's explore how the market performed today…

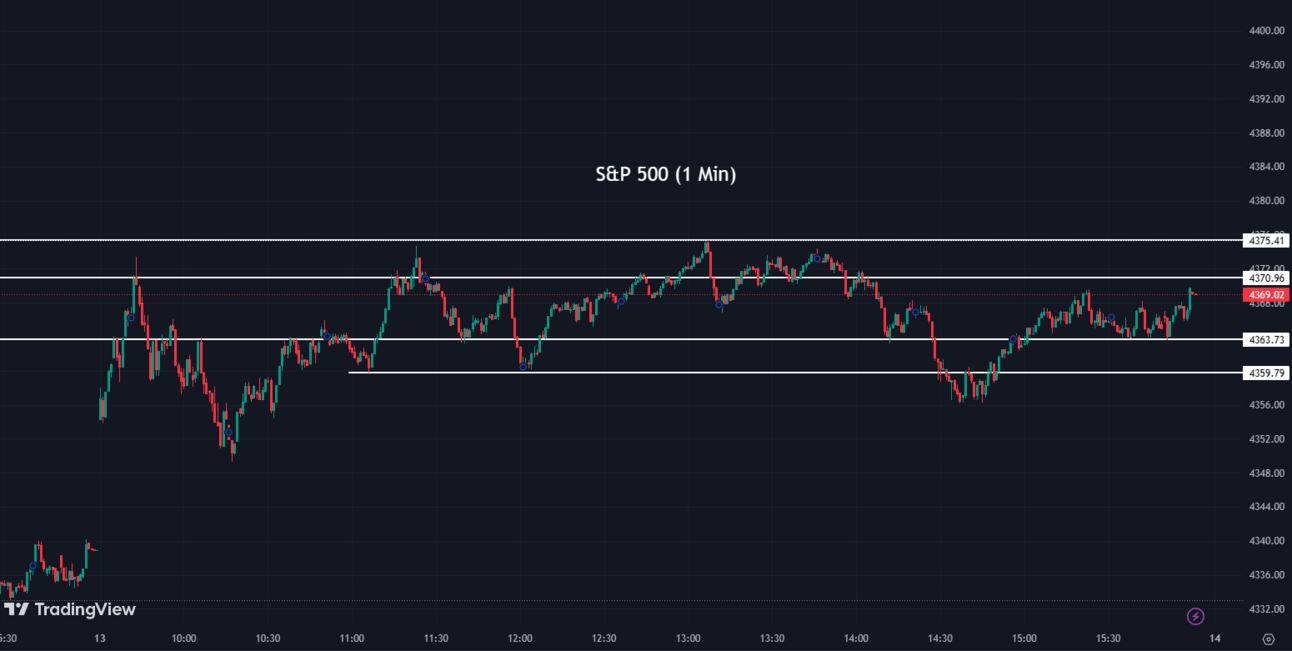

The S&P 500 (SPX) was up +0.69% coming to a conclusion at 4,369

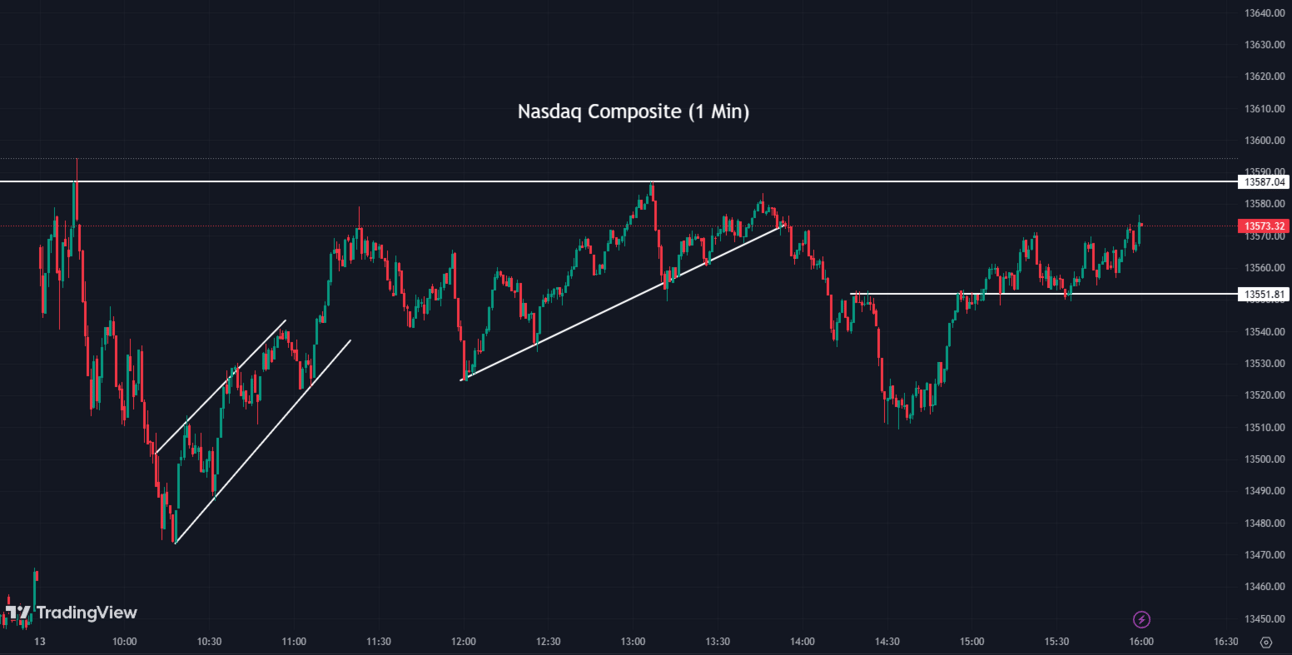

The Nasdaq Composite (IXIC) escalated by +0.83% to settle at 13,573

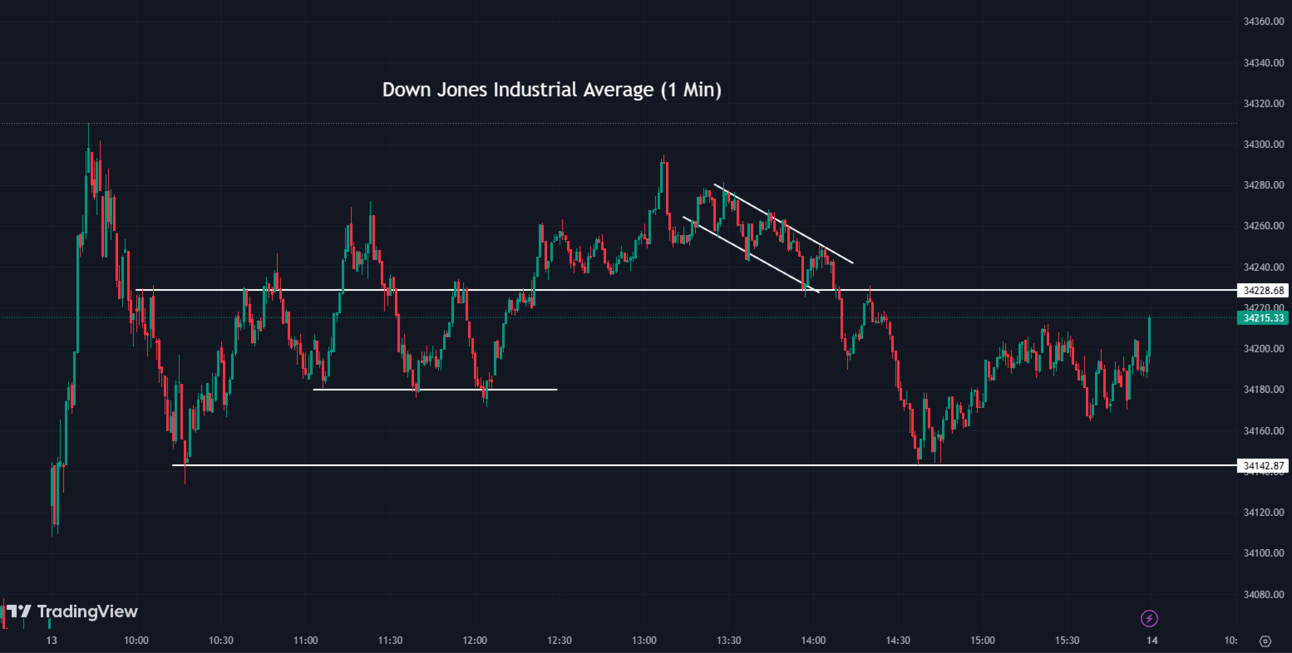

The Dow Jones Industrial Average (DJI) climbed +0.43% ending the day at 34,212

The Russell 2000 (RUT) ascended by +1.23% to finish at 1,896

The Nasdaq-100 (NDX) rose +0.79% to conclude at 14,900

AMD's MI300X GPU to Challenge Nvidia in AI Chip Market 🤖🧩

AMD is making significant advancements in AI hardware with the upcoming release of its MI300X GPU. This poses a major challenge to Nvidia (NVDA), the current leader in the AI chip market. The MI300X, capable of utilizing up to 192GB of memory, surpasses competitors in handling larger AI models. AMD’s CEO Lisa Su, sees AI as the company's primary growth opportunity, predicting the market for data center AI accelerators to exceed $150 billion by 2027. AMD is also developing an Infinity Architecture that combines multiple accelerators into one system, similar to Nvidia and Google. Additionally, AMD's proprietary software, ROCm, further solidifies its position in the AI technology sector.

AMD:

124.53 ▼ -4.66 (-3.61%) Today

125.06 ▲ +0.53 (+0.43%) After Hours

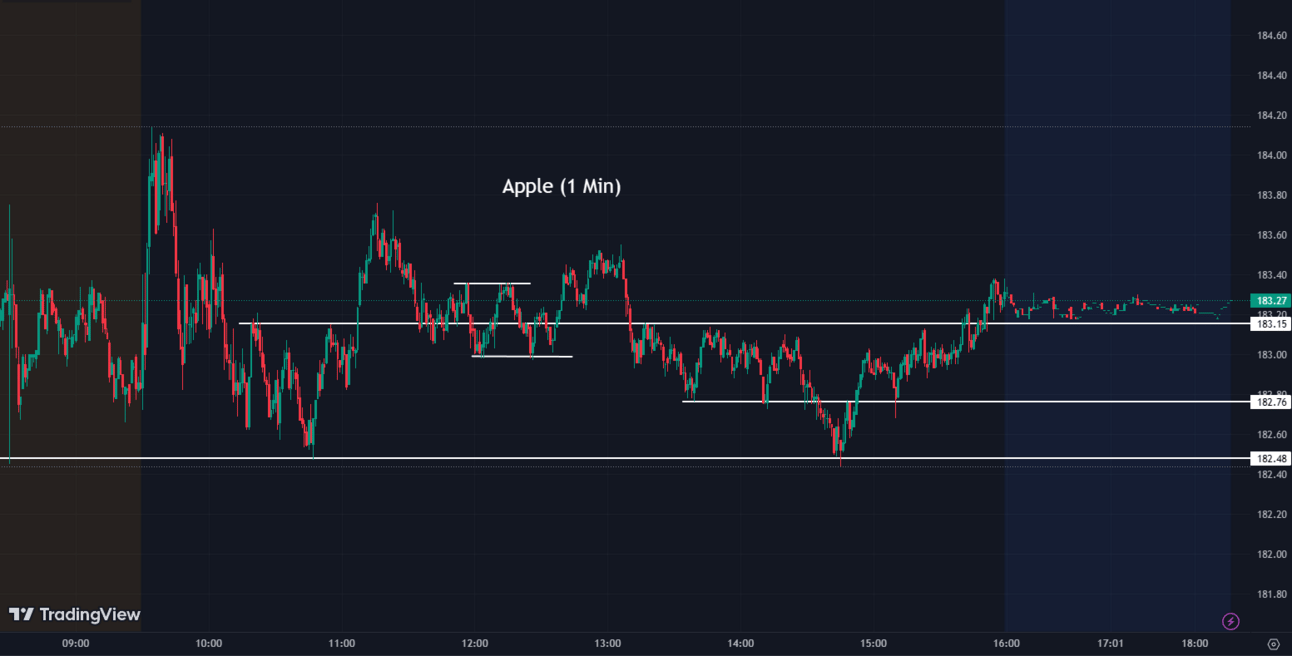

Apple Stock Hits Record High, But UBS Analyst Downgrades Due to Growth Concerns 🏆📱

Apple stock (AAPL) was down today as a result of UBS analyst David Vogt downgrading it due to softness in developed markets and concerns about growth pressure. Apple's valuation is high compared to its historical average and the S&P 500. iPhone sales have shown minimal growth and are projected to decline, raising concerns about long-term growth. However, other analysts remain optimistic about strong demand for the upcoming iPhone 15 release.

AAPL:

183.31 ▼ -0.48 (-0.26%) Today

183.24 ▼ -0.07 (-0.038%) After Hours

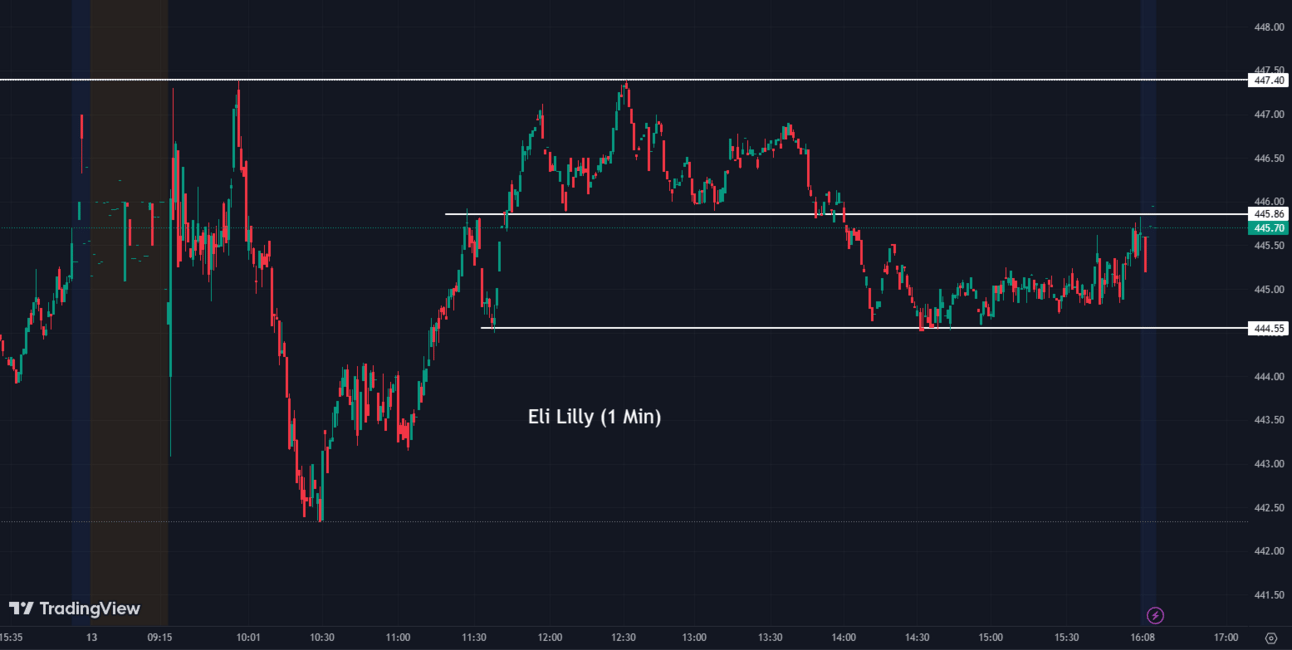

Eli Lilly CEO Warns of Medicare Price Negotiations' Impact on Drug Development ⚠️💊

Eli Lilly (LLY) CEO David Ricks warns that Medicare price negotiations may hinder drug development. He criticizes a provision in the Inflation Reduction Act that allows Medicare to negotiate prices on costly prescription drugs. Ricks highlights concerns about the discrepancy in negotiating timelines between small-molecule drugs and biologics, which could discourage investment in small-molecule drugs. The IRA also requires drug companies to refund Medicare through rebates if drug prices exceed the inflation rate.

LLY:

445.74 ▲ +0.43 (+0.097%) Today

445.06 ▼ -0.66 (-0.15%) After Hours

Boeing's Rising Deliveries Amid Production Issues 🛫🚁

Boeing (BA) experienced a rise in aircraft deliveries in May, delivering 50 airplanes to customers, compared to 35 in April. However, the company still lags behind its competitor Airbus, and production challenges continue to pose a problem. Recently, Boeing disclosed another flaw in its 787 Dreamliners, which may impact future deliveries. This flaw comes at a critical time as the demand for wide-body planes has surged with the recovery of international travel. Despite these setbacks, Boeing has delivered a total of 206 planes this year, while Airbus has delivered 244 planes. Both companies plan to increase production to meet the heightened post-pandemic demand.

BA:

220.39 ▼ -1.17 (-0.53%) Today

220.55 ▲ +0.17 (+0.077%) After Hours

Fanatics Gearing Up For Possible IPO 🏈💼

Fanatics, the well-known sports merchandise firm, had its second investor day, indicating that it is preparing for a future initial public offering (IPO). Over 100 institutional investors, including Goldman Sachs and Barclays executives, met in New York at the NBA Players Association offices to hear from Michael Rubin, the founder and CEO of Fanatics. A total of 300 people joined the conference electronically through Zoom. Tom Brady, NFL star and firm investor, made a surprise appearance to talk business and leadership. Fanatics has undergone fast expansion, bolstered by savvy acquisitions, and is now valued at $31 billion. In May, it entered the sports betting market by acquiring PointsBet's U.S. assets for around $150 million.

Google and OpenAI Clash on AI Regulation 🤖⚖️

In a recent filing, Google (GOOGL) and OpenAI, two U.S. leaders in artificial intelligence, revealed opposing ideas about how AI technology should be regulated by the government. Google expressed its preference for a “multi-layered, multi-stakeholder approach to AI governance,” contrasting with OpenAI CEO Sam Altman’s call for a new government agency focused on AI. Google stated its support for a central agency, like the National Institute of Standards and Technology (NIST), which could inform sectoral regulators overseeing AI implementation. Others in the AI space, including researchers, have expressed similar views, stating that government regulation of AI may protect marginalized communities better.

GOOGL:

124.43 ▲ +0.08 (+0.064%) Today

124.54 ▲ +0.11 (+0.088%) After Hours

Netflix Explores Live Sports with Celebrity Golf Match; Stock Rises on Crackdown Success 🎥📺

Netflix (NFLX) is reportedly planning a live-streamed celebrity golf match, marking its first foray into live sports. This move follows a technical snag during the live streaming of a reunion special for its hit reality show 'Love Is Blind.' The upcoming golf event is expected to feature professional golfers from the Netflix docuseries 'Full Swing' and players from its Formula 1 racing series 'Drive to Survive.' This move could be seen as Netflix's attempt to refine its live capabilities before diving deeper into sports rights, following its successful docuseries around sports such as Formula 1, professional golf, and professional tennis. On the contrary, Netflix's stock rose after Bank of America raised its price target due to positive third-party data regarding the company's crackdown on password sharing. The company saw an uptick in US sign-ups following the implementation of this policy, creating an estimated $2 billion incremental annualized revenue opportunity.

NFLX:

435.73 ▲ +11.76 (+2.77%) Today

436.27 ▲ +0.55 (+0.13%) After Hours

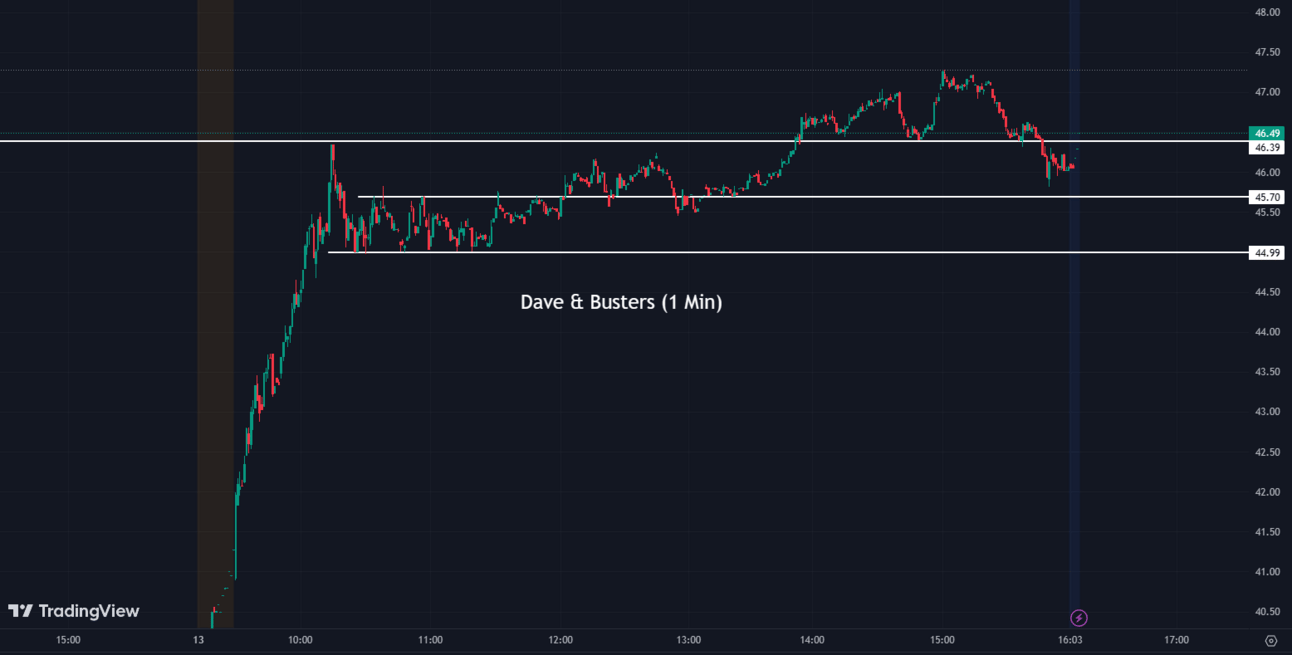

Dave & Buster's Surges on Earnings Growth Plan 🎮📈

Shares of Dave & Buster's (PLAY) surged 19.22% to reach a 13-month high as the company unveiled its plan to increase earnings. The strategy includes revamping its marketing approach, raising game prices, enhancing food offerings, and expanding its special events business. The stock's rally follows a strong fiscal first-quarter profit report, which led to an 18.3% increase on June 7. CEO Chris Morris emphasized that the stock is undervalued compared to its peers and suggested a potential upside of over 100% if the stock is reevaluated.

PLAY:

46.09 ▲ +7.43 (+19.22%) Today

46.02 ▼ -0.07 (-0.15%) After Hours

GameStop Chairman Ryan Cohen Increases Stake, Shares Surge 🚀💰

GameStop (GME) shares rose as chairman Ryan Cohen increased his stake in the company by adding 443,842 shares. The purchase, valued at around $10 million, will raise Cohen's stake to approximately 12%. This follows the company's first-quarter loss and CEO departure. GameStop shares were up 10.78% today

GME:

26.92 ▲ +2.62 (+10.78%) Today

27.17 ▲ +0.22 (+0.82%) After Hours

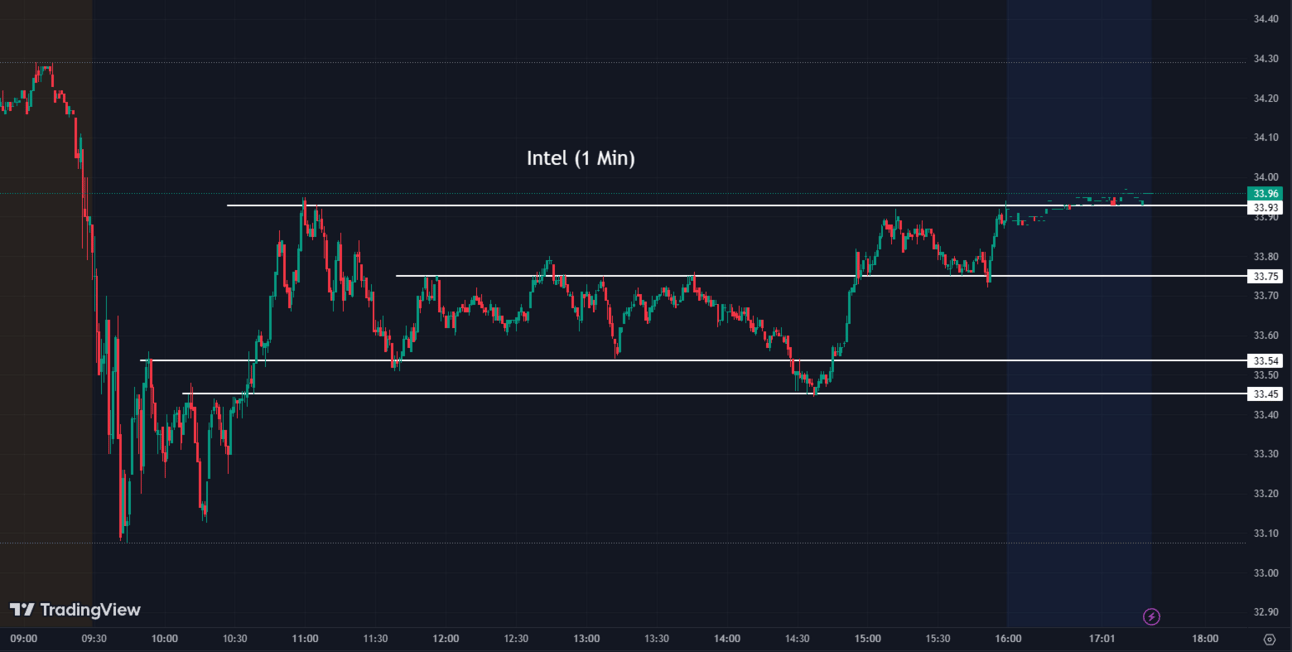

Intel in Talks with Arm for IPO Investment 💻🔗

Intel (INTC) is reportedly in discussions with SoftBank Group Corp's, Arm, to be a significant investor in the latter's upcoming initial public offering (IPO). Arm, a chip designer whose designs are utilized by prominent semiconductor companies such as Intel, AMD, Nvidia, and Qualcomm, aims to raise between $8 billion and $10 billion in its IPO scheduled for later this year.

INTC:

33.91 ▲ +0.84 (+2.54%) Today

33.92 ▲ +0.01 (+0.029%) After Hours

Toyota's Ambitious EV Strategy 🔋🚗

Toyota Motor (TM) has unveiled plans to release a new line of solid-state batteries to increase the range of its electric vehicles (EVs) and reduce production costs. The company aims to sell 1.5 million EVs annually by 2026 and is also heavily investing in hydrogen as an energy source. Despite the promising announcement, Toyota faces scrutiny from investors over its alignment with the goals of the Paris Agreement.

TM:

158.14 ▲ +8.55 (+5.72%) Today

158.00 ▼ -0.08 (-0.051%) After Hours

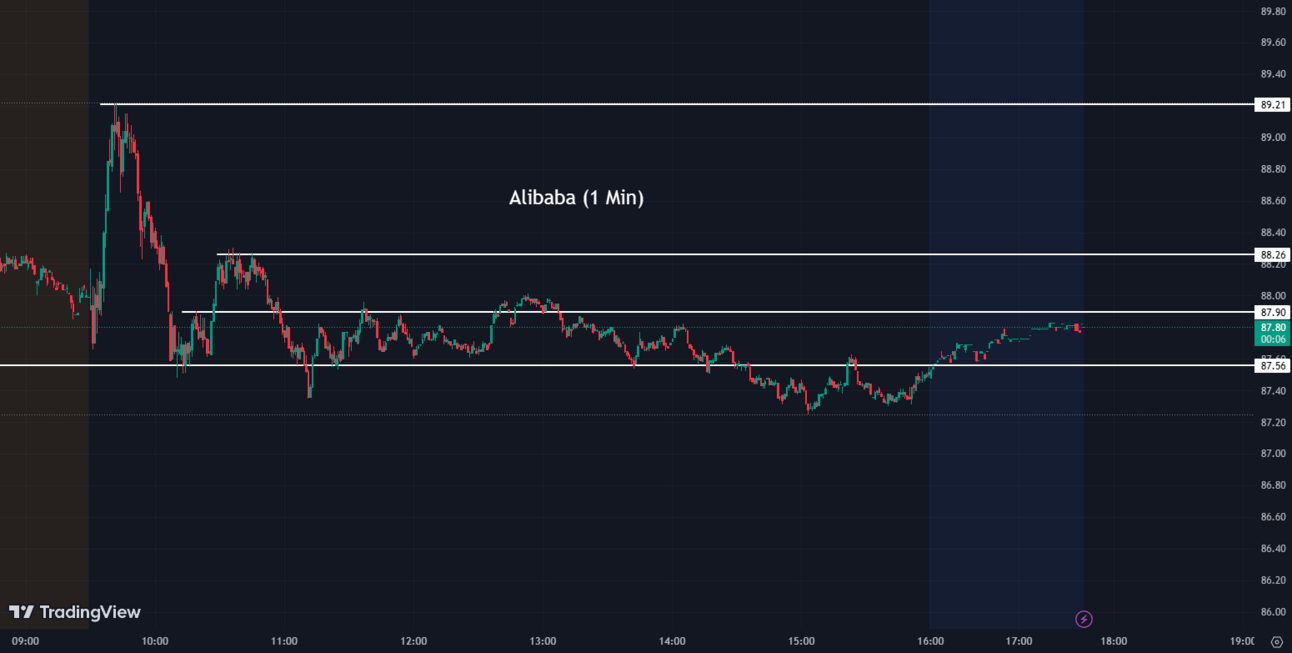

Alibaba Stock Rises After China's Central Bank Reduced a Key Interest Rate 📈✂️

Alibaba stock (BABA) is showed a decent midday gain after China's central bank reduced a key interest rate to stimulate growth. However, the stock is still below its highs following Alibaba's fourth consecutive quarter of declining revenue. The company has announced plans to spin off its cloud intelligence business and is working on a ChatGPT-style AI system. Despite regulatory fears, Chinese regulators are reportedly close to concluding investigations into internet platform operators like Alibaba.

BABA:

87.52 ▲ +1.66 (+1.93%) Today

87.75 ▲ +0.24 (+0.28%) After Hours

After Hour Movers 🏃♀️🌕

MIND Technology (MIND) has reported its financial results for the fiscal 2024 first quarter. Revenues from Marine Technology Products sales were $12.6 million, operating income was $289,000, and the net loss was $240,000. The company's backlog stood at approximately $22.6 million. MIND's CEO expressed satisfaction with the results and noted strong demand growth in key markets. The company aims to become a leading provider of marine technology and products.

MIND:

0.78 ▲ +0.12 (+18.59%) Today

0.71 ▼ -0.077 (-9.79%) After Hours

Iteris (ITI) is set to release its Q4 earnings results on Tuesday, June 13th, after the market closes. The consensus estimate for earnings per share (EPS) is $0.06, reflecting a significant year-over-year increase of 185.7%. The consensus revenue estimate is $40.47 million, representing a year-over-year growth of 18.3%. In the past year, Iteris has failed to meet EPS estimates 0% of the time and has surpassed revenue estimates 50% of the time.

ITI:

4.69 ▼ -0.03 (-0.64%) Today

4.20 ▼ -0.49 (-10.45%) After Hours

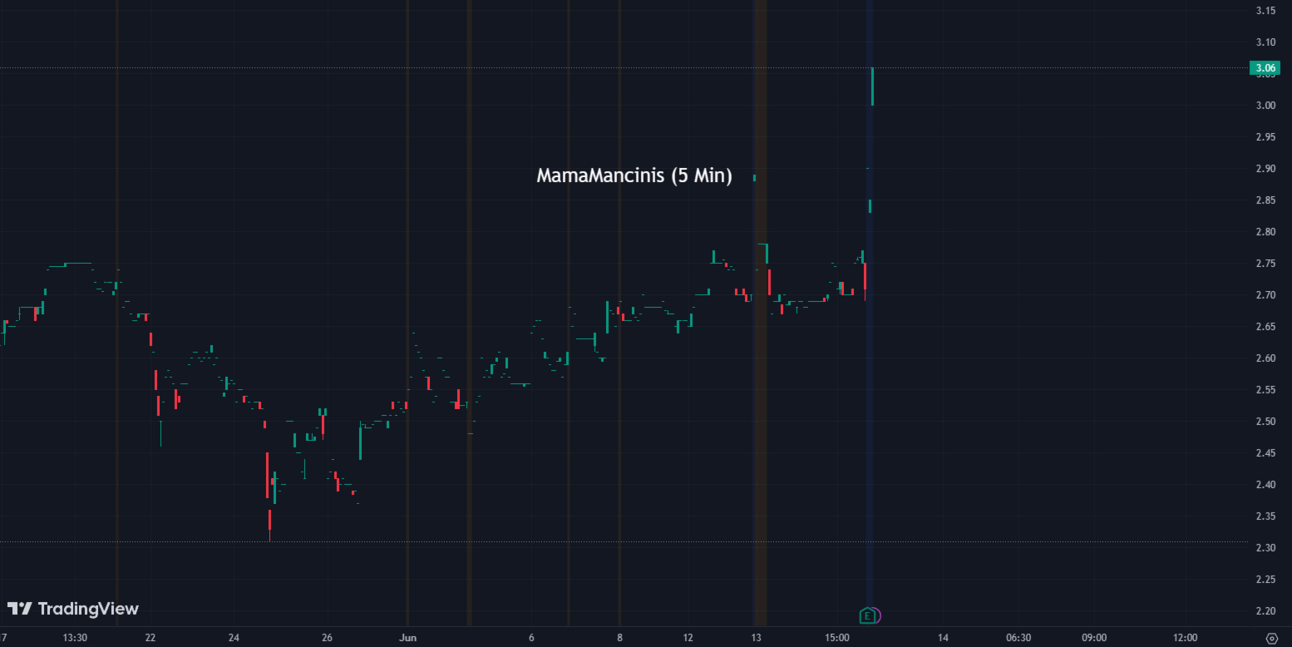

MamaMancini's Holdings, (MMMB) reported strong financial results for Q1 2023. Revenues increased by 6% to $23.1 million, while gross profit grew by 65% to $6.4 million. Net income for the quarter was $1.4 million. The company highlighted the success of margin enhancement initiatives and the launch of the Mama's Creations brand.

MMMB:

2.75 ▲ +0.055 (+2.04%) Today

2.99 ▲ +0.24 (+8.73%) After Hours

Motorcar Parts of America (MPAA) reported strong Q4 earnings, driving a double-digit percentage gain in its shares. The company achieved record quarterly net sales of $194.7 million, exceeding estimates, while adjusted earnings per diluted share improved to $0.07 compared to a loss in the prior-year quarter. The CEO expressed optimism about the business and expects sales between $720 million and $740 million for the fiscal year, surpassing analyst expectations.

MPAA:

6.16 ▲ +0.89 (+16.89%) Today

5.90 ▼ -0.26 (-4.22%) After Hours

Southwest Airlines (LUV) is benefiting from the recovery in air travel demand, particularly in leisure travel. In Q1 2023, revenue passenger miles increased by 11.6%, and available seat miles climbed by 10.7%. The company expects a 14% improvement in available seat miles for Q2 2023 and a capacity increase of 14-15% for the year. Southwest Airlines has a strong liquidity position, with cash exceeding long-term debt. However, rising fuel prices and operating expenses like labor and airport costs remain concerns.

LUV:

32.46 ▲ +1.00 (+3.18%) Today

32.47 ▲ +0.02 (+0.062%) After Hours

Sectors 🔩🚰

Out of the 11 sectors, 10 closed in positive territory today, with Materials leading the way with a gain of 2.33%, while Utilities saw a slight decline of 0.06%.

Conclusion 👋

To wrap it up, today's financial markets were influenced by various factors. The May CPI report showed a decline in overall inflation but highlighted persistent high-core CPI. U.S. Treasury yields rose as inflation slowed down, leading to expectations of no rate hike by the Federal Reserve. Stock indices performed well, buoyed by the inflation data and optimism about the Fed's decision. AMD's new GPU poses a challenge to Nvidia in the AI chip market. Apple stock reached a record high but faced a downgrade due to growth concerns. Eli Lilly's CEO warned of the impact of Medicare price negotiations on drug development. Boeing experienced rising deliveries despite production issues. Fanatics hinted at a future IPO, while Google and OpenAI clashed on AI regulation. Netflix explored live sports and saw its stock rise on successful crackdown efforts. Dave & Buster's surged on its earnings growth plan, while GameStop shares rose as its chairman increased his stake. Intel considered investing in Arm's IPO, and Toyota revealed its ambitious EV strategy. Alibaba's stock rose after China’s Central Bank cut an interest rate, despite concerns about declining revenue. After-hours movers included MIND Technology, Iteris, MamaMancini's Holdings, and Motorcar Parts of America, each reporting positive financial results. Southwest Airlines benefited from the recovery in air travel demand. Overall, these events shaped the financial markets today, impacting various sectors.

Thank you all for signing up!

Will only work to do better for you all going forward. Our only goal is to add value to everyone’s trading with key levels and the ability of learning charts and price action.

Please Share Our Newsletter it will be much appreciated!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of TradingView. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.