Anticipated CPI Report Impact on Interest Rates and Economic Stabilization 💱💰

Tuesday's consumer price index (CPI) will be released at 8:30 a.m. ET. Analysts anticipate a 0.1% increase in overall inflation for May, corresponding to a 4% annual rate. Core inflation, on the other hand, is expected to go up. This report is anticipated to encourage Federal Open Market Committee officials not to raise interest rates during their meeting this week. The May report is expected to show a lessening of the price increases that have plagued consumers over the past two years. It is uncertain if this deceleration will be sufficient to persuade Federal Reserve officials to halt interest rate hikes and allow the US economy to stabilize.

Indexes 📈🔥

All of the indices closed up today due to the upcoming inflation data, coupled with the optimism that the Fed will skip the rate hike this week. Now, let's explore how the market performed today…

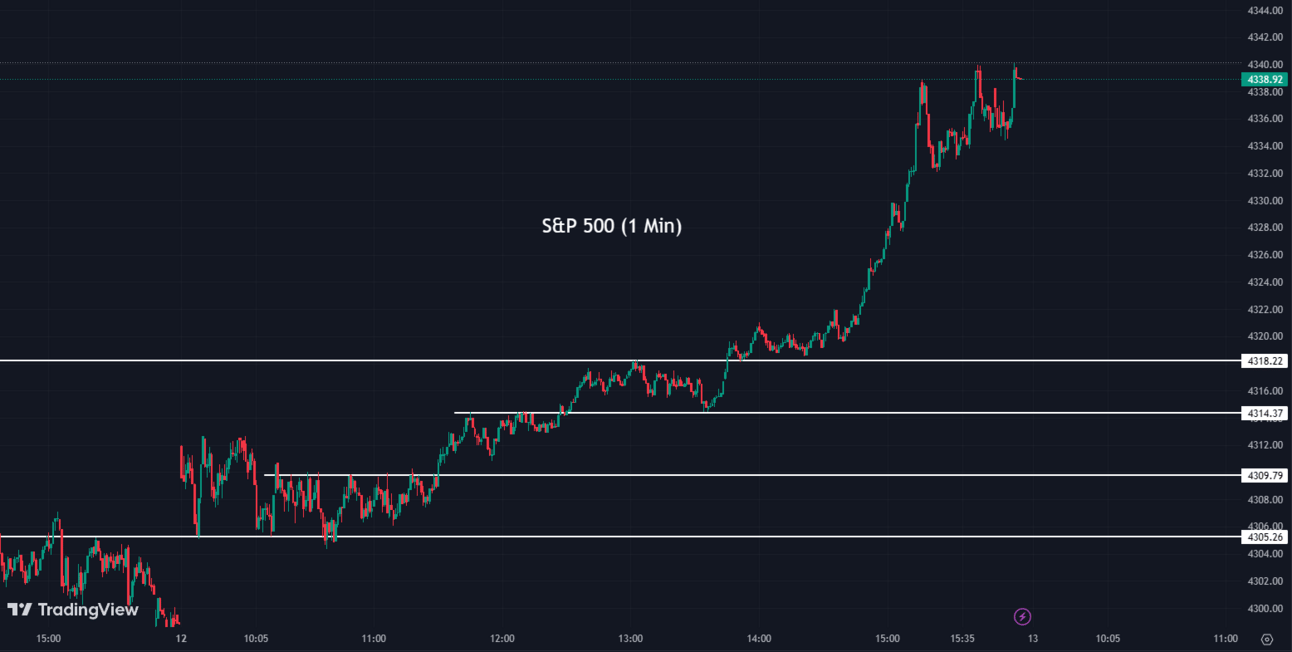

The S&P 500 (SPX) was up +0.93% coming to a conclusion at 4,338

The Nasdaq Composite (IXIC) escalated by +1.53% ending the day at 13,461

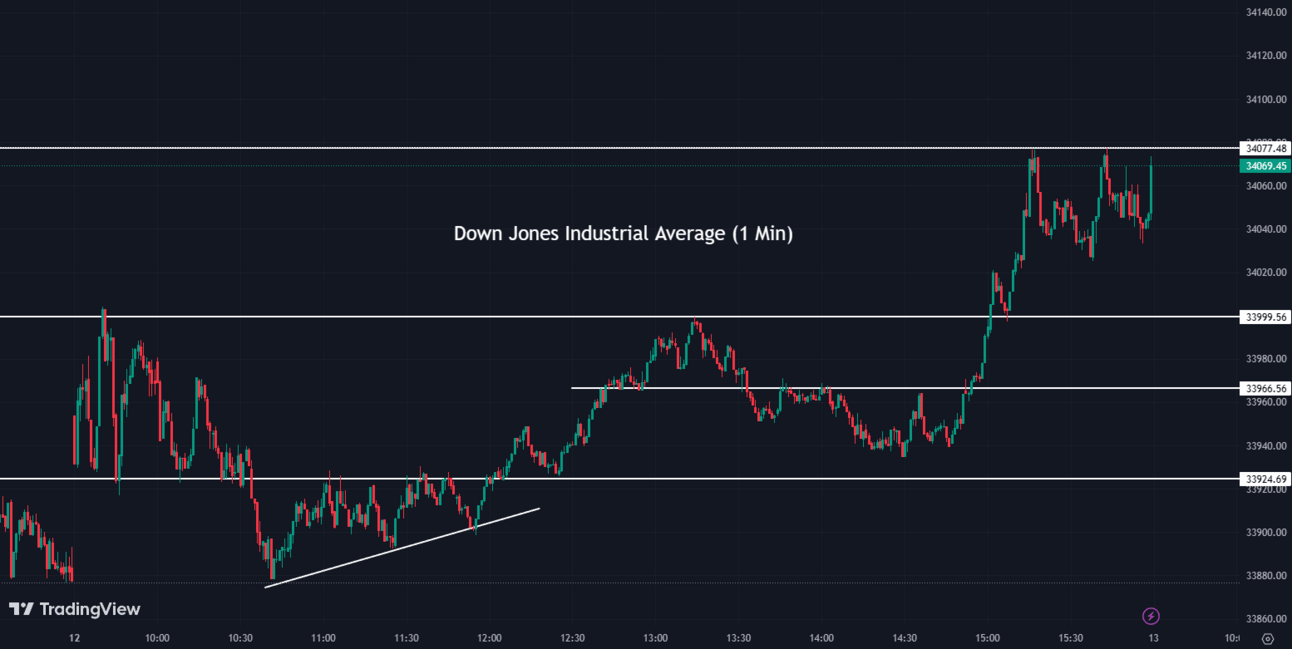

The Dow Jones Industrial Average (DJI) climbed +0.56% to settle at 34,066

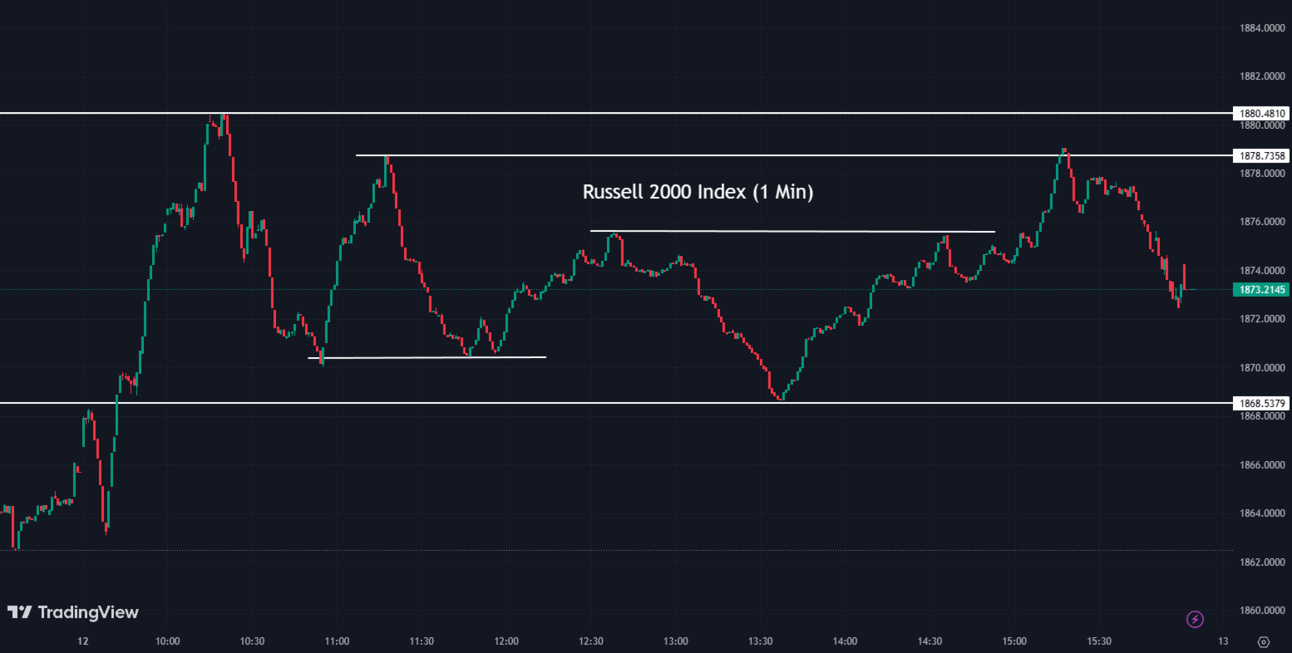

The Russell 2000 (RUT) increased by +0.40% to finish at 1,873

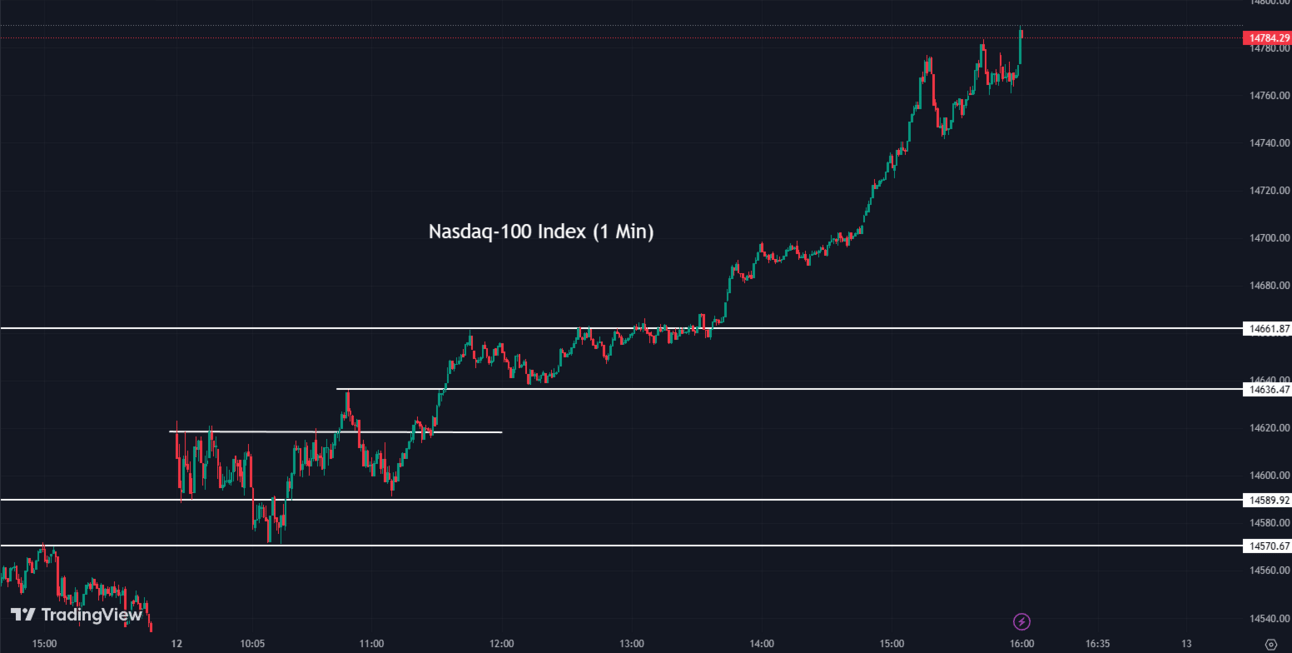

The Nasdaq-100 (NDX) rose +1.76% to conclude at 14,784

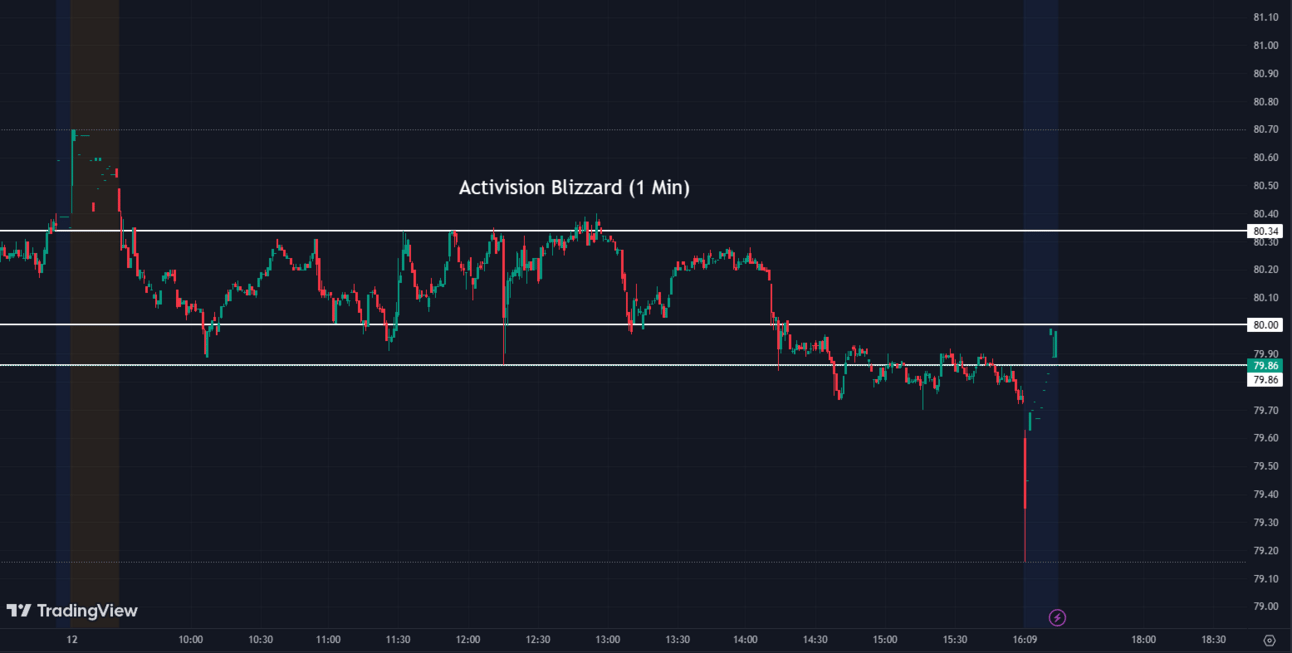

FTC Lawsuit Threatens Microsoft's Activision Blizzard Acquisition ⚖️��️

Federal Trade Commission (FTC) opposes the planned acquisition of Activision Blizzard (ATVI) by Microsoft (MSFT) and is preparing to file a lawsuit to halt the deal. The FTC argues that the $68.7 billion acquisition could give Microsoft the ability to stifle competition in gaming consoles, subscription content, and cloud gaming. The lawsuit will prevent Microsoft from completing the acquisition until the legal proceedings are concluded. The Competition and Markets Authority in the UK has also expressed concerns about Microsoft's increased dominance in the gaming industry, adding to the opposition against the deal.

ATVI:

79.77 ▼ -0.61 (-0.76%) Today

80.03 ▲ +0.26 (+0.33%) After Hours

MSFT:

331.85 ▲ +5.06 (+1.55%) Today

332.60 ▲ +0.75 (+0.23%) After Hours

Palantir Surges with AI Software and Expanding Market Presence 🌐📊

Palantir Technologies (PLTR) has been attracting attention in the artificial intelligence sector. Despite experiencing eight consecutive quarters of stagnant or slowing growth, Palantir's stock has surged by 133% in 2023. Optimists view the AI software as a potential driver of growth for the company, as Palantir has already leveraged AI for its government clients. The introduction of the 'Artificial Intelligence Platform' during Palantir's Q1 earnings release is expected to expand the company's market presence, particularly in healthcare, energy, and manufacturing. The platform's demand is reportedly unprecedented, creating the possibility of significant growth for Palantir's stock.

PLTR:

15.65 ▲ +0.63 (+4.19%) Today

15.65 ▲ +0.0001 (+0.00064%) After Hours

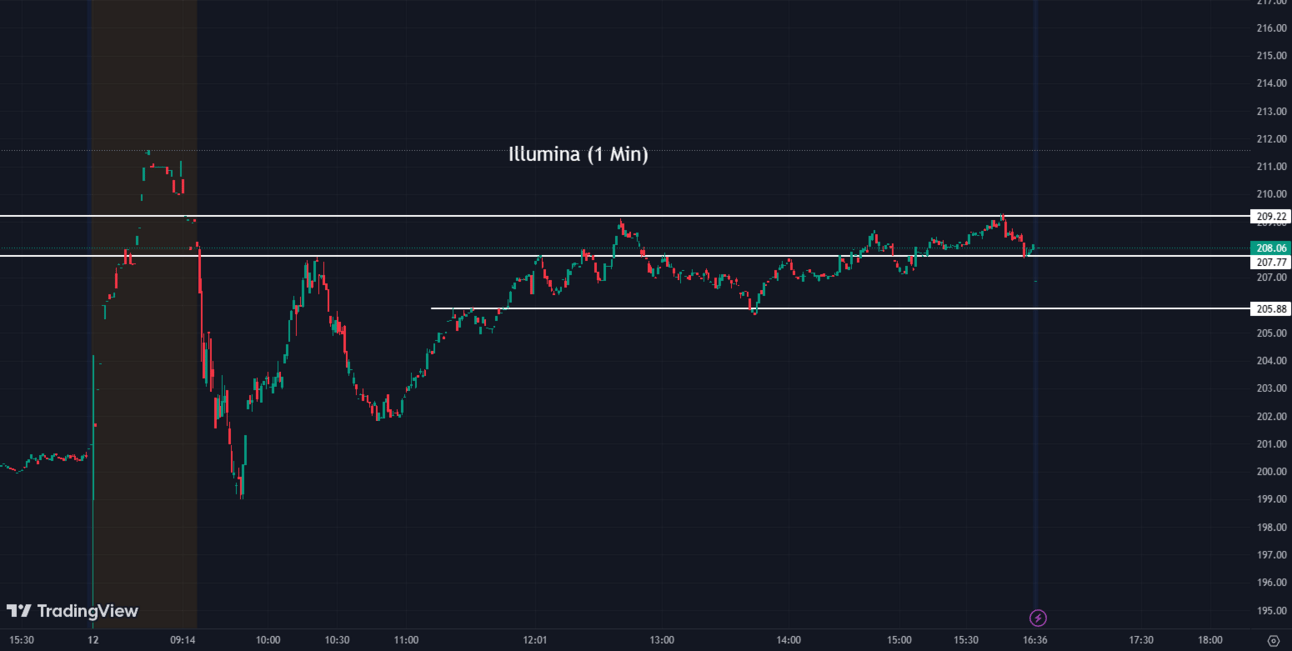

CEO of Illumina Steps Down After Activist Pressure 👨💼⬇️

The CEO of Illumina (ILMN), Francis deSouza, has resigned in response to activist investor Carl Icahn's request for his ouster. Despite having survived an onslaught by Icahn at a recent board election, deSouza elected to resign. While the business seeks a replacement, Charles Dadswell, senior vice president and general counsel, has been named temporary CEO. Icahn had chastised Illumina's board and management for their activities in connection with the sale and buyback of cancer-detection business Grail Inc., as well as their disregard for European regulators' concerns. Hindenburg Research has filed a lawsuit against Icahn, and the US Attorney's Office for the Southern District of New York is looking into his investment business.

ILMN:

208.14 ▲ +7.61 (+3.79%) Today

208.00 ▼ -0.14 (-0.067%) After Hours

Oracle's Stock On An Upward Trajectory 📈🔝

Oracle (ORCL) reported strong Q4 earnings that exceeded expectations, leading to a rise in its stock price in after-hours trading. The company's cloud revenue showed significant growth, contributing to a positive outlook for the upcoming year. Oracle's net income for the quarter reached $3.32 billion, or $1.19 per share, with revenue increasing by 17% to $13.84 billion. Adjusted earnings per share came in at $1.67, surpassing analysts' predictions. The company's cloud software and infrastructure services experienced a remarkable 54% revenue increase. Oracle's partnership with Nvidia was also confirmed during the earnings release, highlighting its involvement in the AI infrastructure space. With an 81.7% rise in its stock price over the past year.

ORCL:

116.50 ▲ +6.65 (+6.05%) Today

120.26 ▲ +3.83 (+3.29%) After Hours

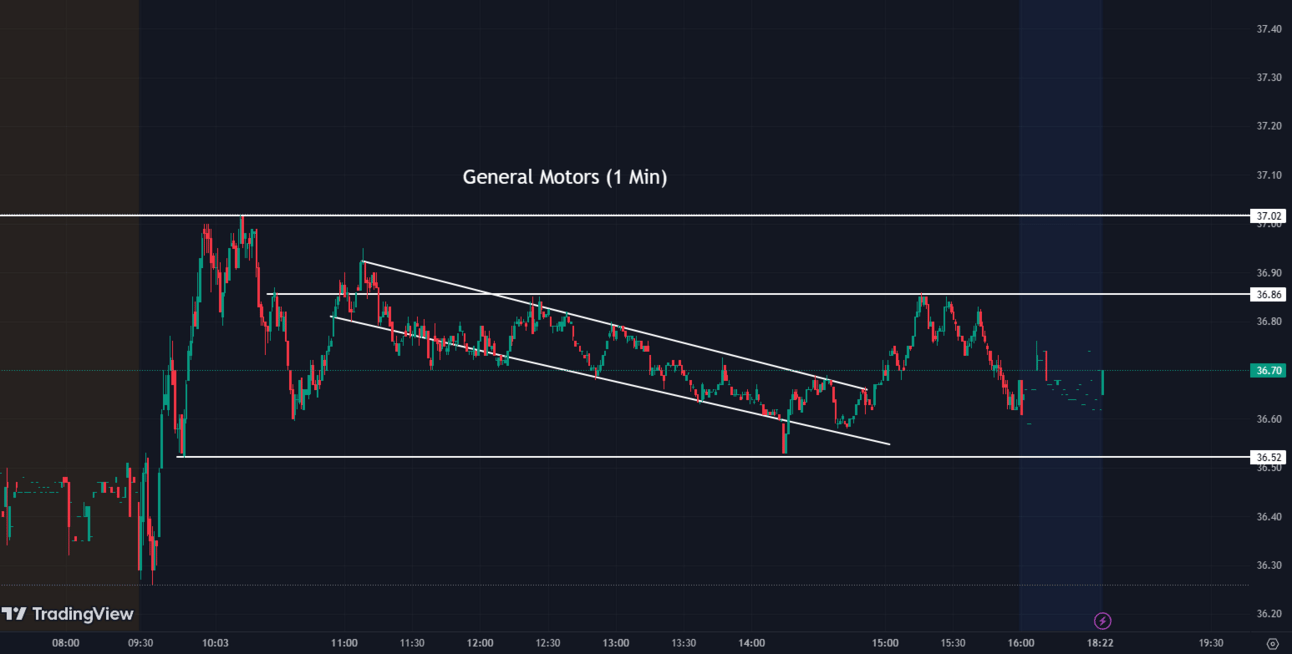

General Motors to Invest $632 Million in Indiana Plant 🏭💲

General Motors (GM) has unveiled plans to invest $632 million in its Indiana plant for the production of next-generation full-size pickup trucks. This marks the third investment announcement by GM related to its next-generation large trucks and SUVs, bringing the total investment to over $2.1 billion. The Indiana investment signals GM's ongoing commitment to its traditional operations to help fund its burgeoning electric vehicle (EV) business. GM aims to exclusively offer consumer EVs by 2035, with new all-electric versions of the Silverado and Sierra Denali slated to be released later this year and in early 2024.

GM:

36.69 ▲ +0.46 (+1.27%) Today

36.75 ▲ +0.08 (+0.22%) After Hours

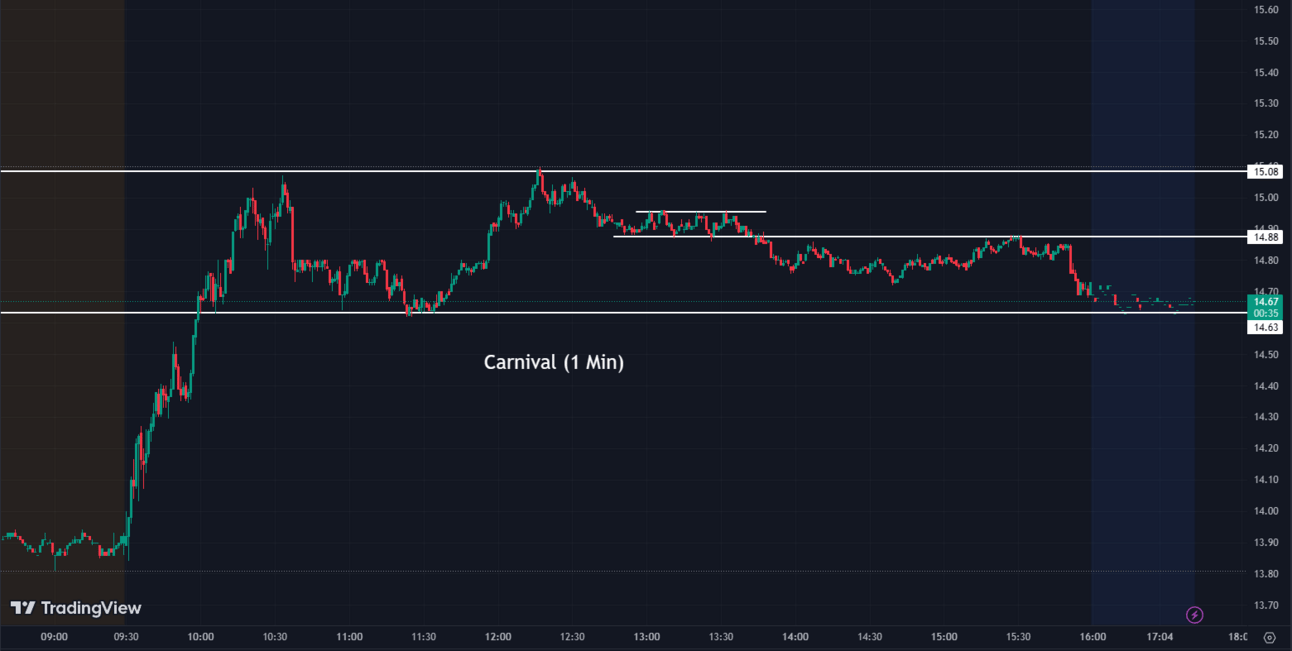

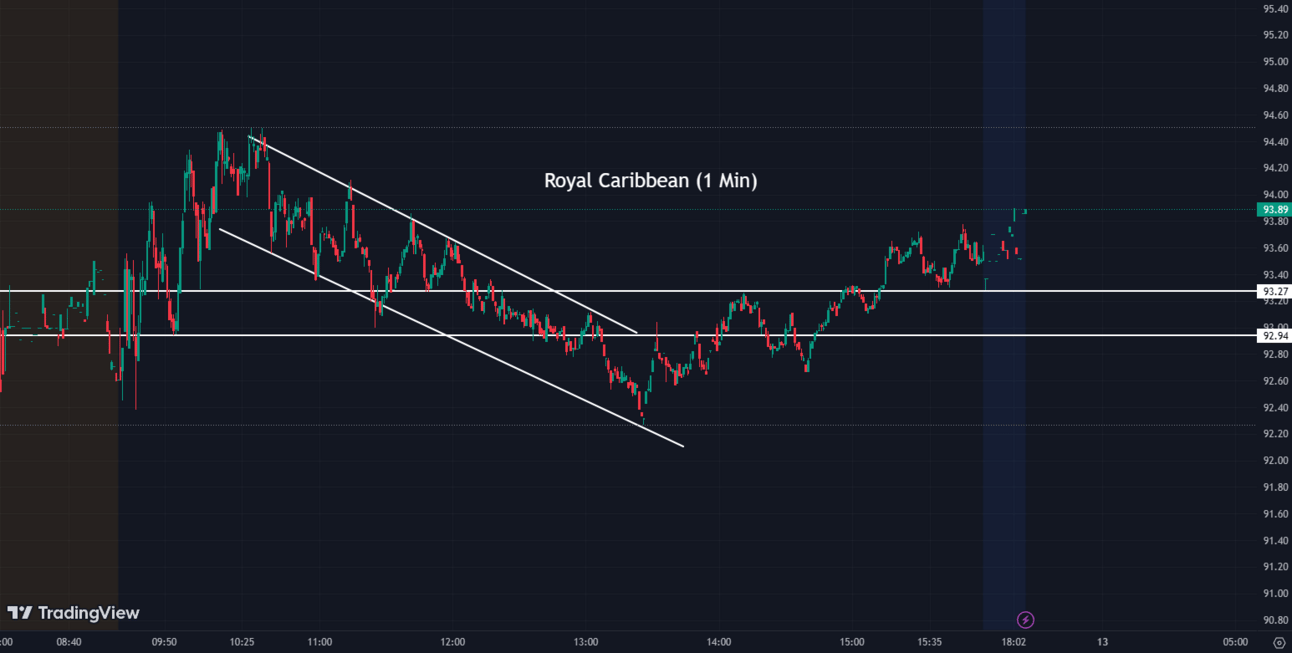

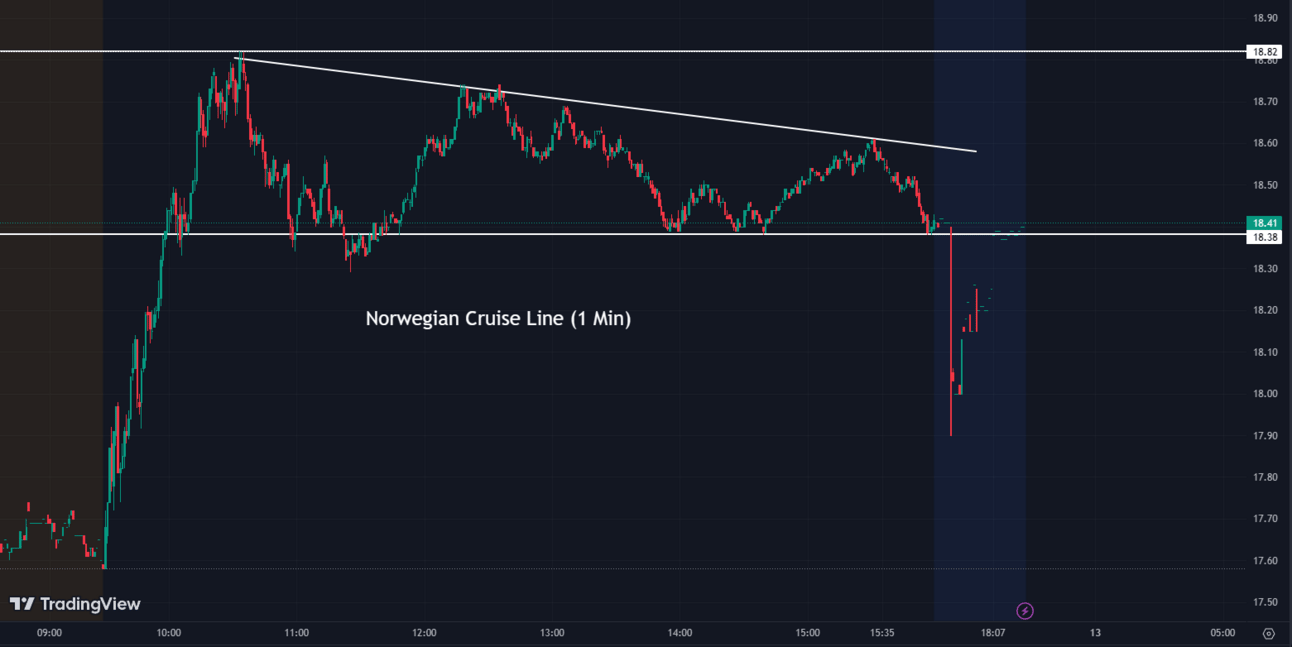

Carnival Stock Rises on Increased Demand and Upgrade 🚢📈

Carnival's stock (CCL) experienced a boost, leading the cruise line industry, after receiving an upgrade from Bank of America (BAC) due to higher demand that has even exceeded pre-pandemic levels in some cases. Bank of America analyst Andrew Didora upgraded Carnival from "Neutral" to "Buy" and raised its price target from $11 to $20. According to Didora, the cruise recovery is now considered stable. In 2023, all three major cruise stocks, including Royal Caribbean (RCL) and Norwegian Cruise (NCLH), have seen a rally, although they still trade at a significant discount to pre-pandemic levels. Bank of America's data reveals an increase in cruise spending, with travelers spending 17.3% more on cruises in May compared to the same month in 2019. Despite Carnival's current lower price-to-earnings ratio and its reduced balance sheet risk, which includes rising debt, the company's stock shows promise.

CCL:

36.75 ▲ +0.08 (+0.22%) After Hours

14.88 ▲ +0.16 (+1.09%) After Hours

RCL:

93.52 ▲ +2.30 (+2.52%) Today

93.93 ▲ +0.37 (+0.40%) After Hours

NCLH:

18.41 ▲ +1.24 (+7.22%) Today

18.40 ▼ -0.01 (-0.054%) After Hours

SoFi Technologies Receives Favorable Price Target 🎯📈

SoFi Technologies (SOFI) has been accorded a favorable price target by analysts, signaling a bullish sentiment among investors. This positive price target is underpinned by the company's strong financial performance, strategic initiatives, and growing influence in the fintech sector.

SOFI:

9.16 ▲ +0.98 (+11.98%) Today

9.23 ▲ +0.07 (+0.76%) After Hours

Apple Hits Record High as Stock Surges Following Vision Pro Headset Launch 🍎🚀

Apple's (AAPL) stock surged more than 1.5% to reach a record high of $183.79 per share on Monday, marking a significant milestone for the tech giant. The new peak comes a week after Apple launched its Vision Pro headset during the Worldwide Developers Conference (WWDC), the company's first entirely new product line since 2014. The innovative headset, priced at $3,499, has been touted for its design, brand loyalty, and advanced technology, potentially setting a new standard in the VR industry. Despite CFO Luca Maestri's warning of a potential 3% decline in Apple's annual revenue, the company's market capitalization sits at an impressive $2.89 trillion, though not an all-time high due to share buybacks.

AAPL:

183.79 ▲ +2.83 (+1.56%) Today

184.05 ▲ +0.26 (+0.14%) After Hours

After Hour Movers 💤🕒

Oracle (ORCL) has reported quarterly revenue of $13.8 billion, surpassing analysts' estimates and indicating that the company's cloud business is benefiting from increased demand for artificial intelligence workloads. The company's sales increased by 17% in the fiscal fourth quarter, with cloud infrastructure revenue rising by 76% to $1.4 billion and cloud application sales jumping by 45% to $3 billion. Oracle's focus on expanding its cloud infrastructure business has positioned it to compete with major players like Amazon (AMZN), Microsoft (MSFT), and Alphabet Inc.'s Google (GOOGL). The company's stock rose by 3% in after-hours trading following the announcement.

ORCL:

116.50 ▲ +6.65 (+6.05%) Today

120.26 ▲ +3.83 (+3.29%) After Hours

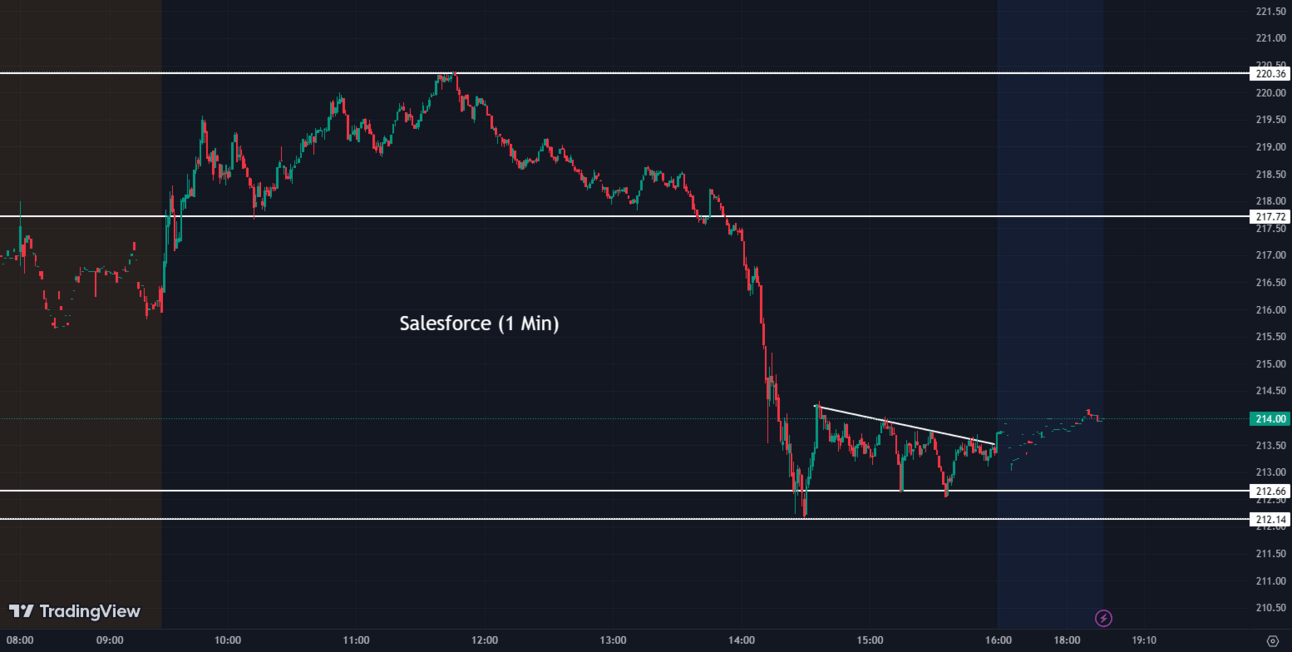

Salesforce (CRM) is expanding into generative AI with the launch of AI Cloud, a customer-relationship-management software that uses AI to generate personalized content. The company's Generative AI Fund, supporting startups focused on responsible generative AI, is also doubling in size to $500 million. Salesforce's research highlights concerns among employees about the security risks associated with generative AI, with many lacking knowledge of data protection measures.

CRM:

213.73 ▼ -1.58 (-0.73%) Today

214.09 ▲ +0.40 (+0.19%) After Hours

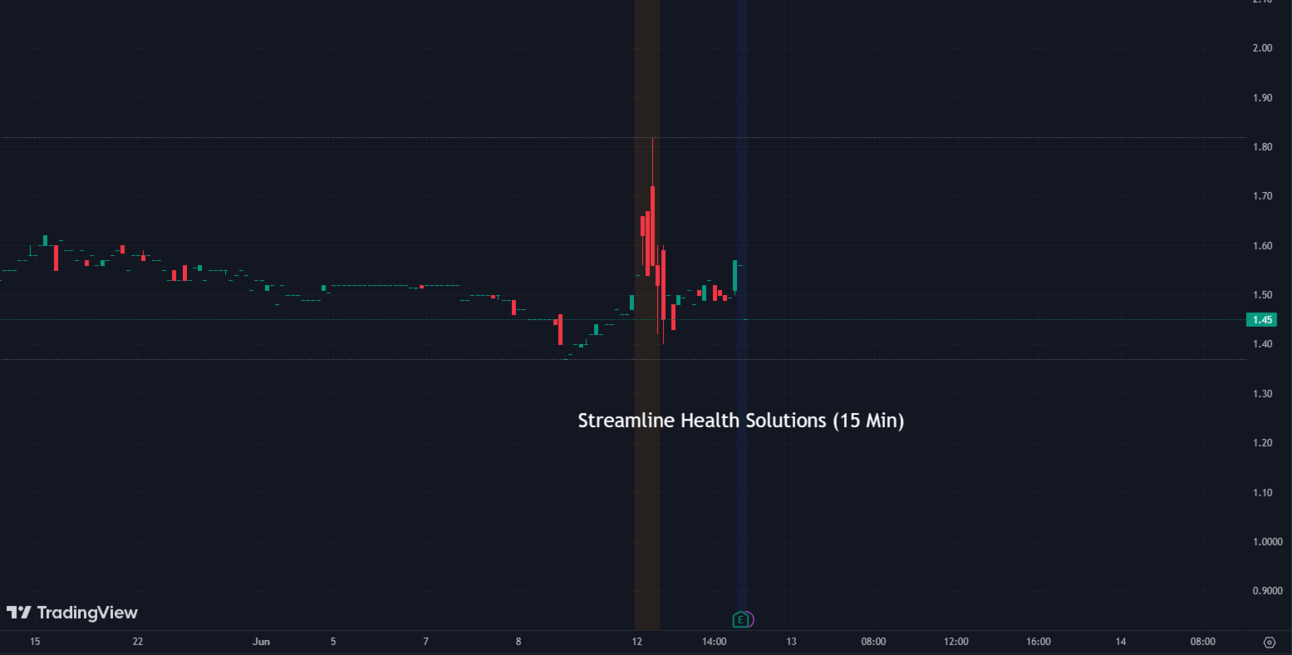

In the first quarter of fiscal 2023, Streamline Health Solutions (STRM) reported a 12% increase in SaaS revenue compared to the same time in fiscal 2022. Total revenue was $5.3 million for the quarter, down from $5.9 million the prior year, mostly owing to reduced professional services revenue. For the quarter, the company's net loss was ($2.9) million. Streamline Health Solutions also updated its Booked SaaS Annual Contract Value (ACV), which was $17.8 million as of April 30, 2023. In the third quarter of fiscal 2023, the firm hopes to attain breakeven adjusted EBITDA.

STRM:

1.60 ▲ +0.13 (+8.84%) Today

1.47 ▼ -0.13 (-8.12%) After Hours

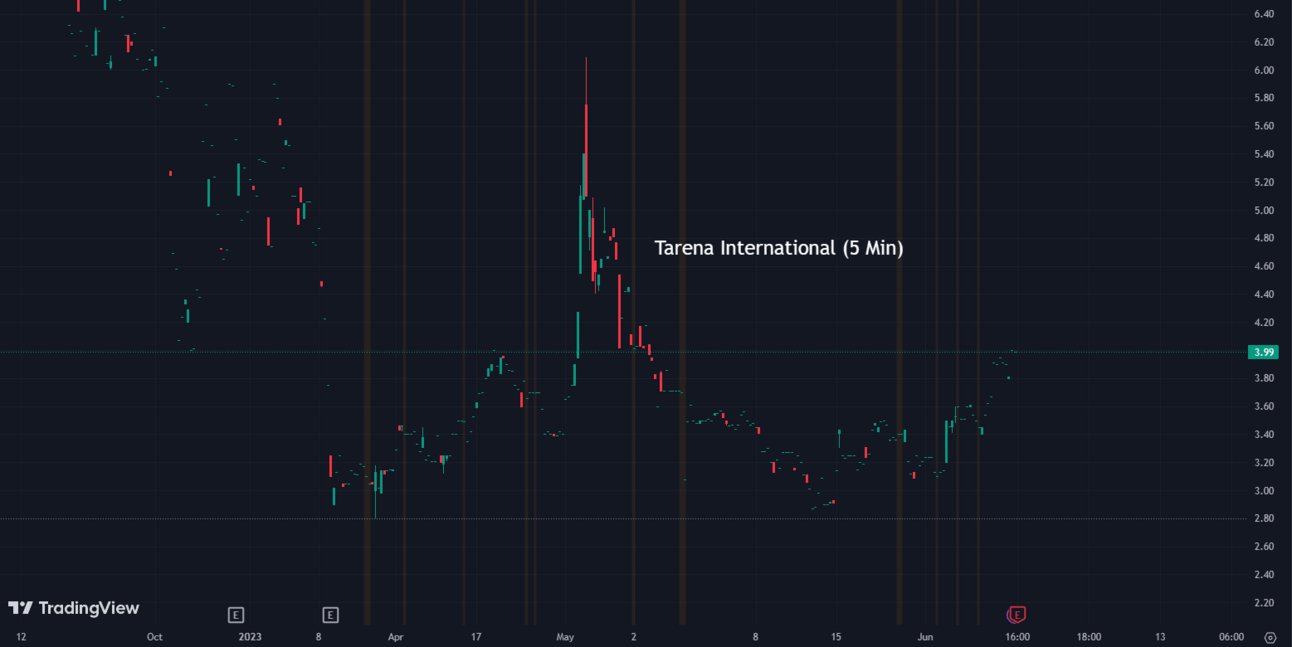

Tarena International (TEDU) is set to have its earnings conference call on June 13, 2023, at 8:00 a.m., with analysts estimating an EPS of $-1.93. Investors will be eager to see if the company can surpass this estimate and provide positive guidance for the next quarter, as the guidance often has a significant impact on stock prices.

TEDU:

4.04 ▲ +0.52 (+14.63%) Today

4.04 ▲ +0.005 (+0.12%) After Hours

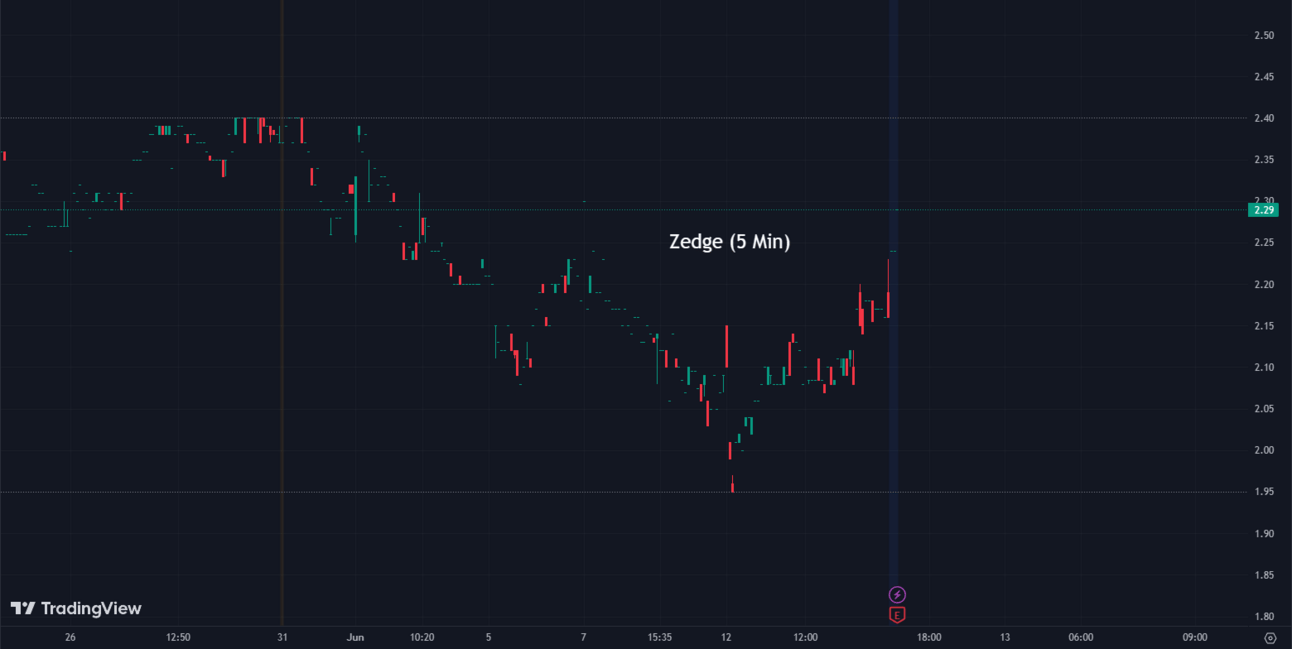

Zedge (ZDGE) announced its third-quarter fiscal year 2023 results, reporting positive cash flow and Adjusted EBITDA. Despite challenges in the GuruShots segment due to geopolitical and economic factors, Zedge's marketplace metrics remained stable. Emojipedia experienced significant year-over-year growth. The company reported an 8.0% increase in revenue to $6.7 million, a GAAP net loss of $7.7 million, and Adjusted EBITDA of $1.7 million. Zedge remains focused on driving long-term growth and profitability by adapting and investing in its business.

ZDGE:

2.23 ▲ +0.17 (+8.25%) Today

2.14 ▼ -0.09 (-4.04%) After Hours

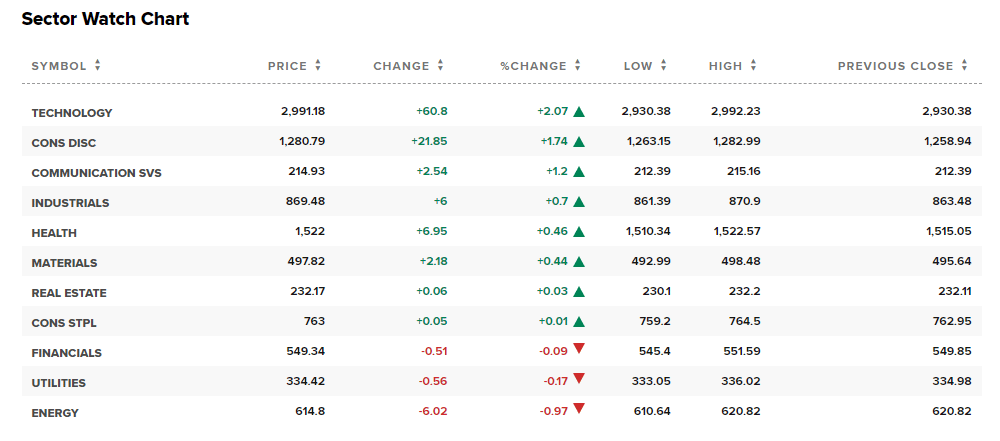

Sectors 🖥️⚡

8 out of the 11 sectors closed in the green today, with Technology leading the way up by +2.07% and Energy falling back by -0.97%.

Conclusion 👋

To wrap it up, the anticipated CPI report on Tuesday is expected to influence interest rates and economic stabilization. Analysts predict a slight increase in overall inflation for May, which may discourage the Federal Reserve from raising interest rates. The stock market reacted positively to the upcoming inflation data, with all major indices closing higher. Meanwhile, the Federal Trade Commission is planning to file a lawsuit against Microsoft's acquisition of Activision Blizzard, citing concerns about competition in the gaming industry. Palantir Technologies is experiencing a surge in its stock price due to the introduction of its AI software platform. The CEO of Illumina has resigned following pressure from activist investor Carl Icahn. Oracle reported strong Q4 earnings, driven by growth in its cloud business and partnership with Nvidia. General Motors announced a $632 million investment in its Indiana plant for next-generation pickup trucks. Carnival's stock rose after receiving an upgrade from Bank of America, reflecting increased demand in the cruise line industry. SoFi Technologies received a favorable price target, indicating positive sentiment among investors. Apple's stock reached a record high following the launch of its Vision Pro headset. Until next time, traders!

Thank you all for signing up!

Will only work to do better for you all going forward. Our only goal is to add value to everyone’s trading with key levels and the ability of learning charts and price action.

Please Share Our Newsletter it will be much appreciated!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of TradingView. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.