Greetings, traders! As we delve into the depths of today's trading affairs, let's review the key events that left their mark on today's financial markets!

Debt Ceiling Update 🏛️🎉

The House passed a bill to raise the U.S. debt ceiling on Wednesday, which sparked a positive response in the stock market on Thursday. The bill, which could prevent a U.S. debt default, now awaits Senate approval. With the bill's passing in the House, the focus of investors is shifting to other issues such as Friday's job report and the Federal Reserve's upcoming policy meeting.

May Jobs Report 📅💼

The U.S. May jobs report is showing a slowdown, with an expected gain of 190,000 jobs, the smallest since December 2020. Unemployment remains low, but a 6% decrease in leisure and hospitality job openings has been noted. The Federal Reserve's interest rate hikes have yet to bring inflation under the 2% target. Wages are forecasted to rise by 0.3% this month and 4.4% year-on-year, but small and medium-sized businesses saw a 0.2% wage decrease in May. The Fed may pause rate hikes to evaluate their impact. This report will be closely monitored for economic trend shifts.

California's New Tech Legislation 📜🖥️

California is making a considerable push toward regulating the conduct of large tech firms. A new bill presented today aims to require these corporations to be more transparent in their operations. The bill suggests that large companies such as Google and Meta will be required to share insights into their advertising earnings with California media companies, with journalists receiving 70% of the shared revenue. The market is closely observing the bill's implications on tech stocks as it has the potential to be a game-changer for the industry.

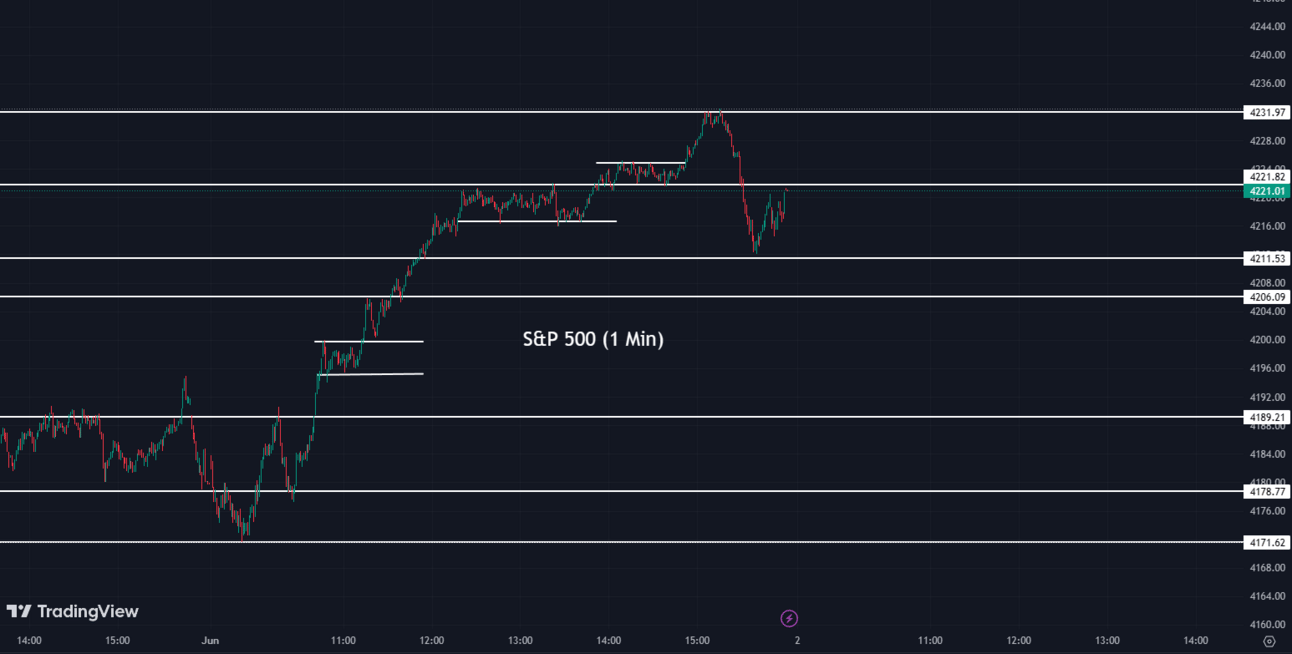

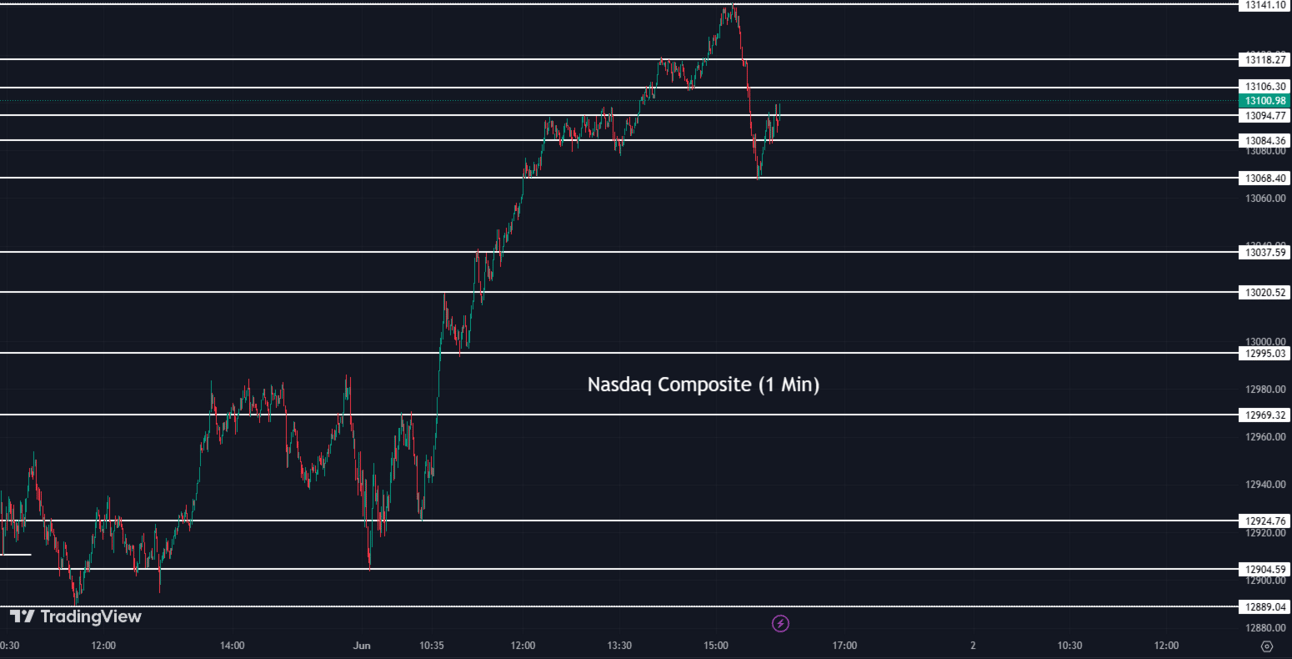

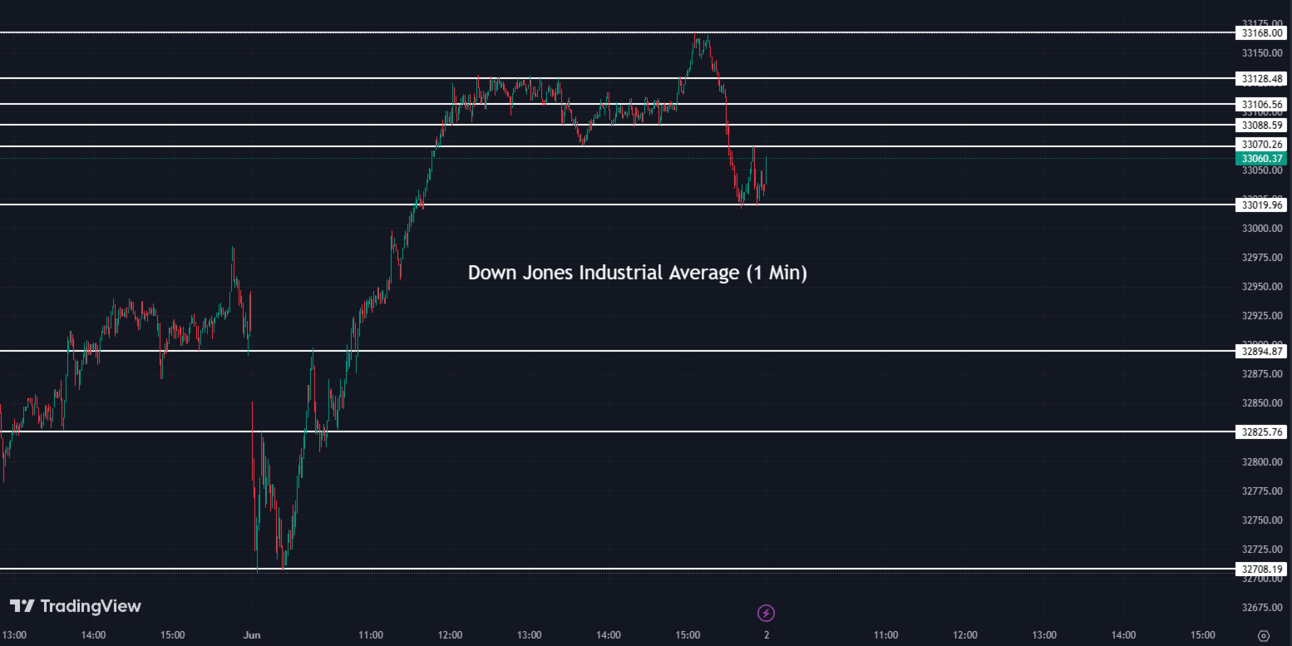

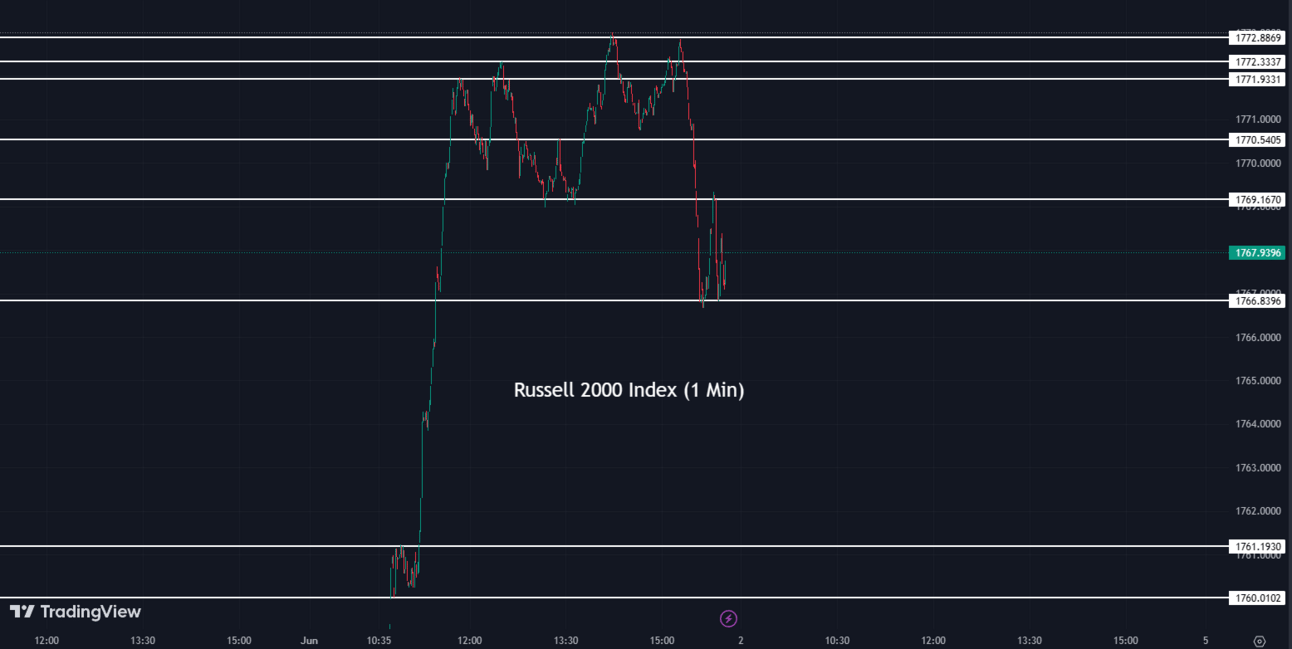

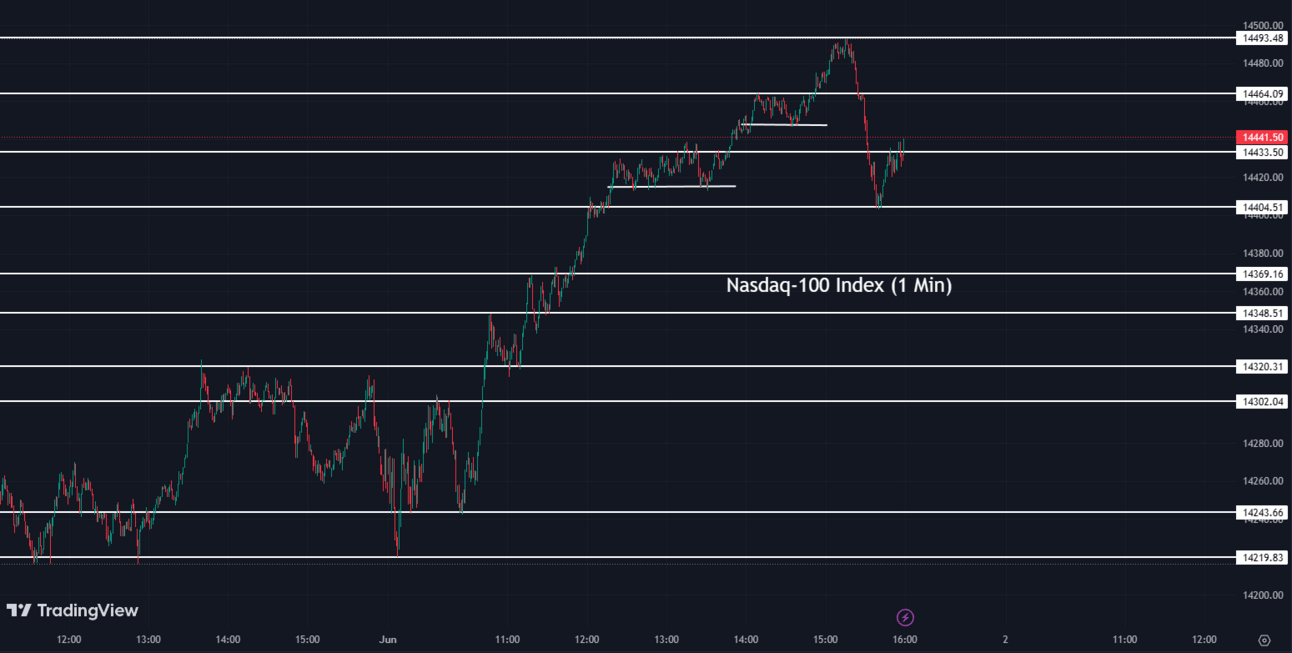

Indexes 📈💸

The stock market indices closed higher today after the United States House of Representatives approved a bill addressing the debt ceiling. This significant step was taken to avoid a potential default. Now, let's take a look at the final prices of the day...

The S&P 500 (SPX) was up 0.99% coming to a conclusion at 4,221

The Nasdaq Composite (IXIC) surged 1.28% ending the day at 13,100

The Dow Jones Industrial Average (DJI) popped up 0.47% to finish at 33,061

The Russell 2000 (RUT) increased by 1.05% to settle at 1,767

The Nasdaq-100 (NDX) was up 1.31% to conclude at 14,441

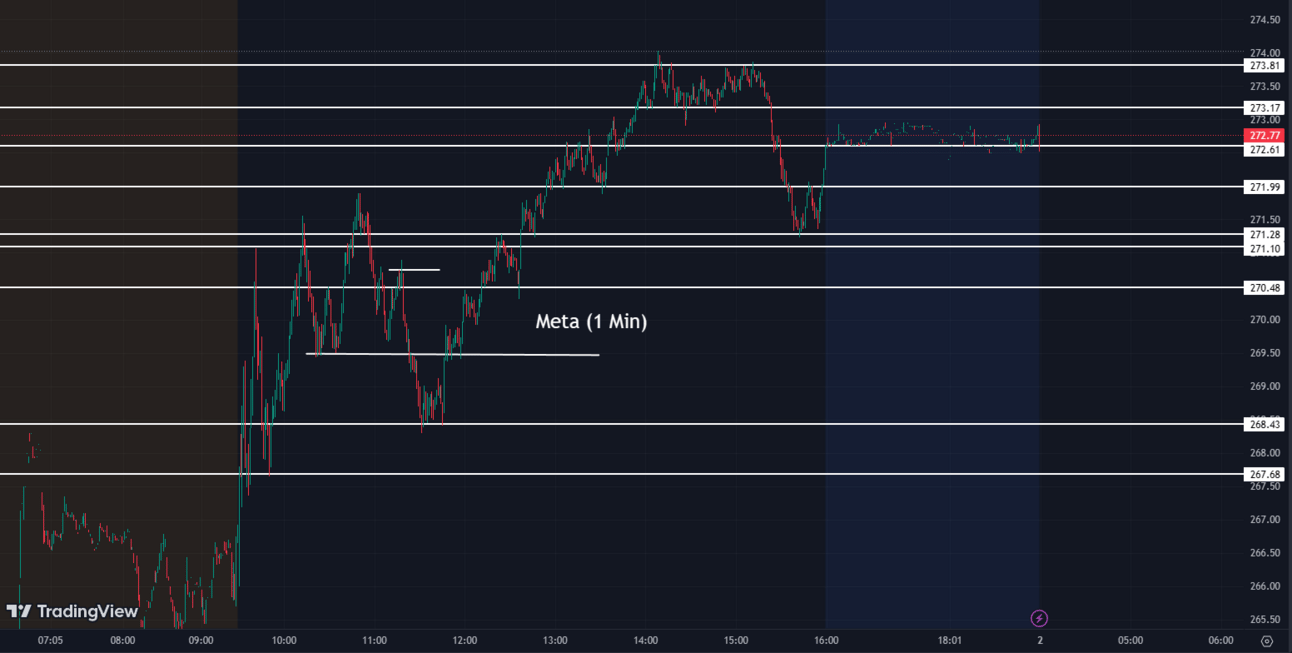

Meta Debuts Quest 3 VR Headset 🎮👓

Meta Platforms Inc (META), previously known as Facebook, has made a significant leap into the future of virtual reality. Just days before Apple's expected VR headset debut, Meta announced the Quest 3 VR headset for $499. This proactive move has stirred significant anticipation and competition within the VR tech market, making it a key topic of interest for investors.

META:

272.61 ▲ +7.89 (+2.98%) Today

272.77 ▲ 0.16 (+0.059%) After Hours

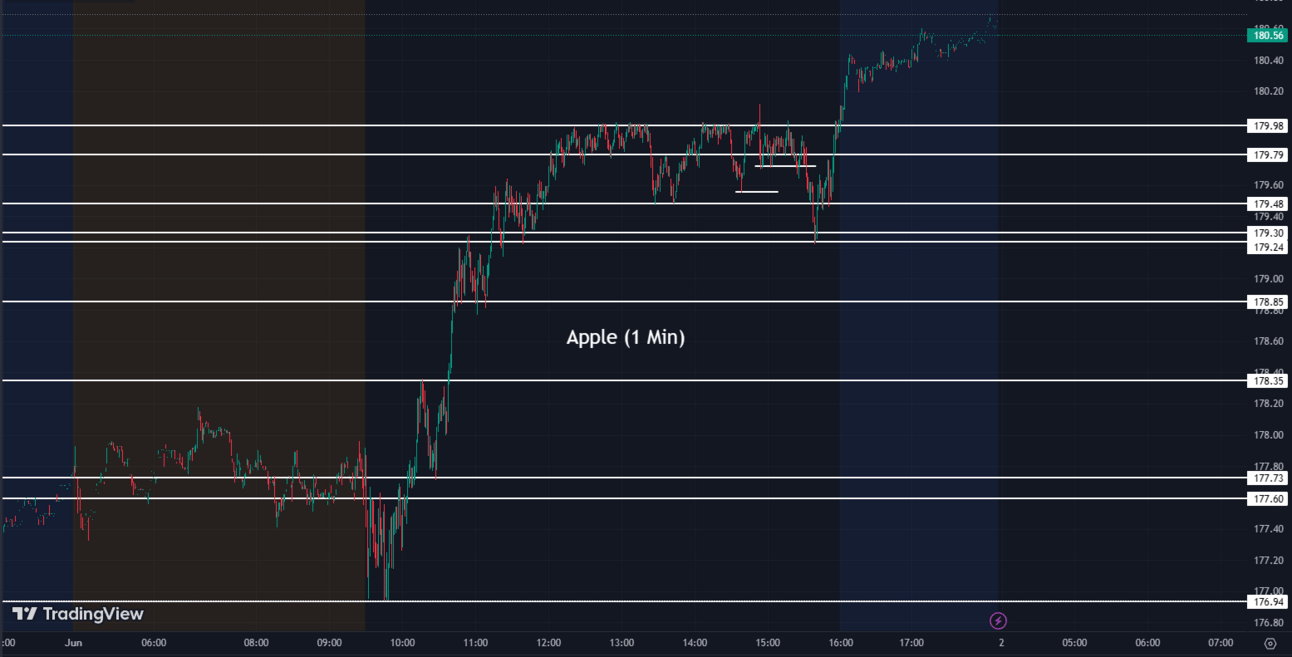

Apple's Potential VR Success Story 🎮🍏

Apple (AAPL) is on the brink of entering the Virtual Reality (VR) market with its upcoming headset. Experts anticipate this product could be the first VR success story given Apple's track record of popularizing new technologies, its vast and loyal consumer base, and its well-integrated ecosystem of devices and services. Furthermore, Apple's VR headset is expected to benefit from advancements in ARKit and RealityKit. However, Apple will face stiff competition from existing players like Meta and will need to address potential barriers such as high price points.

AAPL:

180.09 ▲ +2.84 (+1.60%) Today

180.50 ▲ 0.41 (+0.23%) After Hours

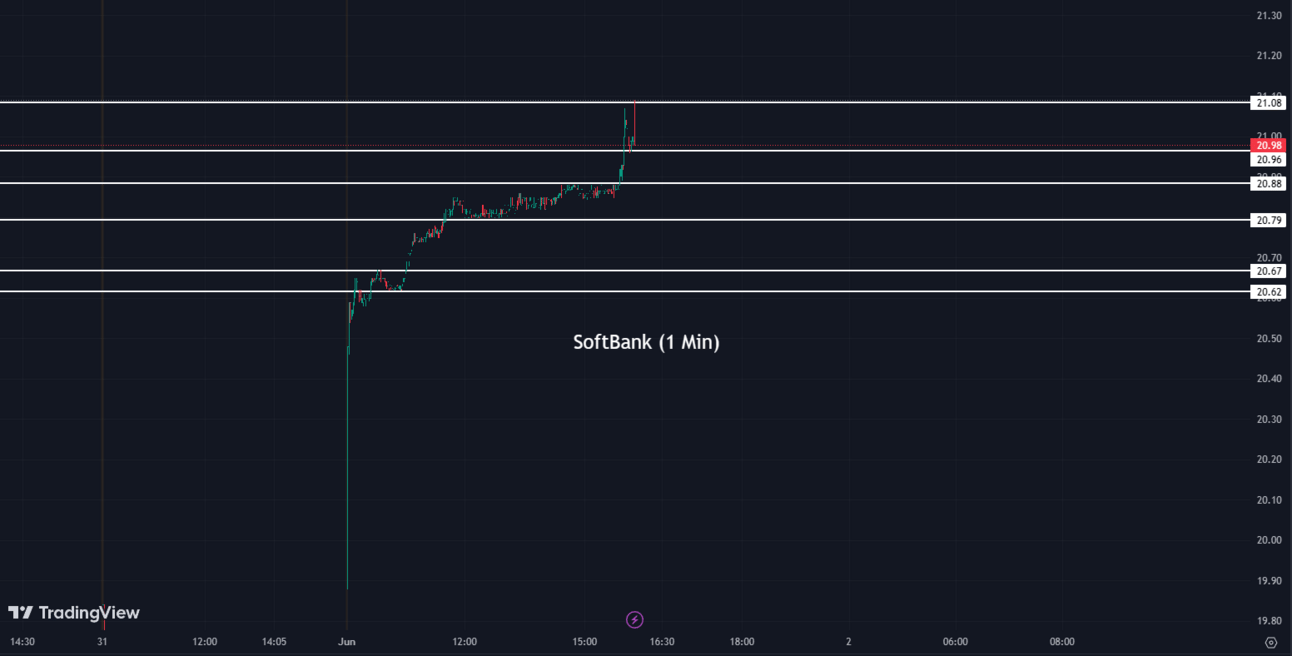

SoftBank's Market Surge 🚀💪

Japanese multinational conglomerate SoftBank (SFTBY) is experiencing an optimistic upturn in its shares, with the company reporting an increase of more than 5% in its stock value. Currently, SoftBank is on track to have its best week in three years. In addition, there have been reports that SoftBank will list its Arm Ltd. chip design on Nasdaq. Moreover, the company is eager to increase its investments in the exciting field of AI.

SFTBY:

20.98 ▲ +1.30 (+6.61%) Today

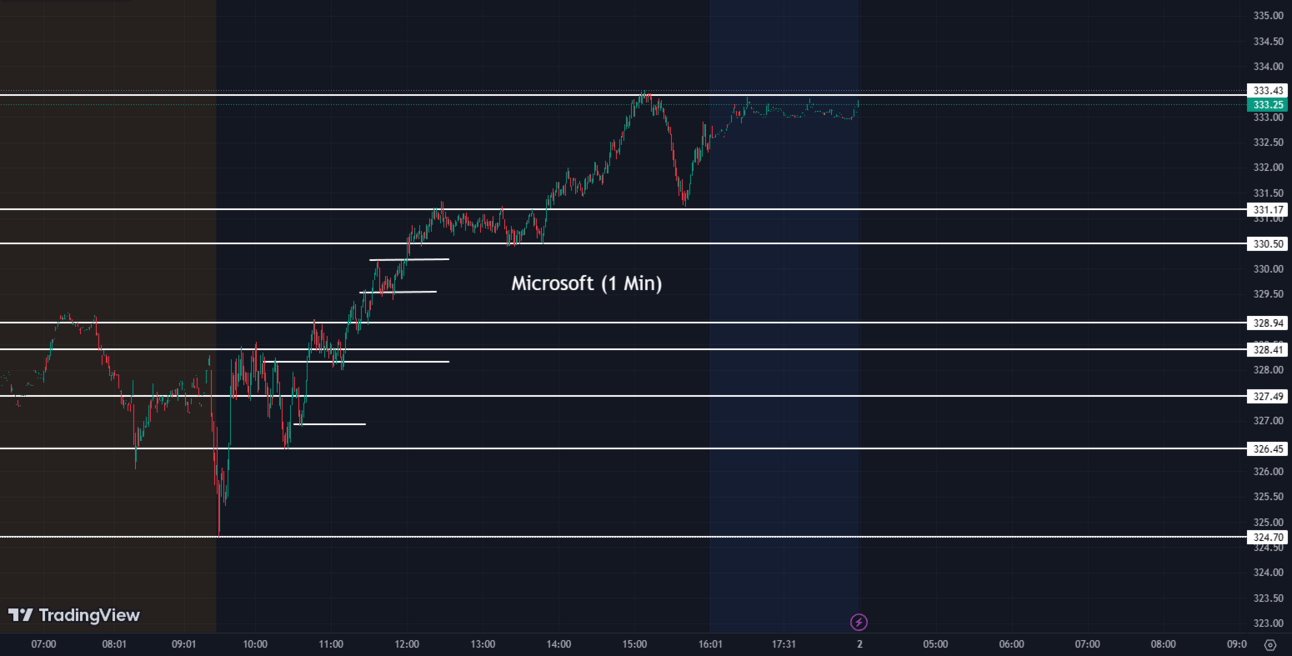

Microsoft's Partnership with CoreWeave 🤝🔗

In an effort to keep pace with the growing demand for cloud computing, Microsoft (MSFT) has announced a strategic partnership with CoreWeave. This collaboration is designed to meet the cloud demand of OpenAI, an emerging force in the artificial intelligence sector. This development could significantly strengthen Microsoft's presence in the AI field.

MSFT:

332.58 ▲ +4.19 (+1.28%) Today

333.33 ▲ 0.75 (+0.23%) After Hours

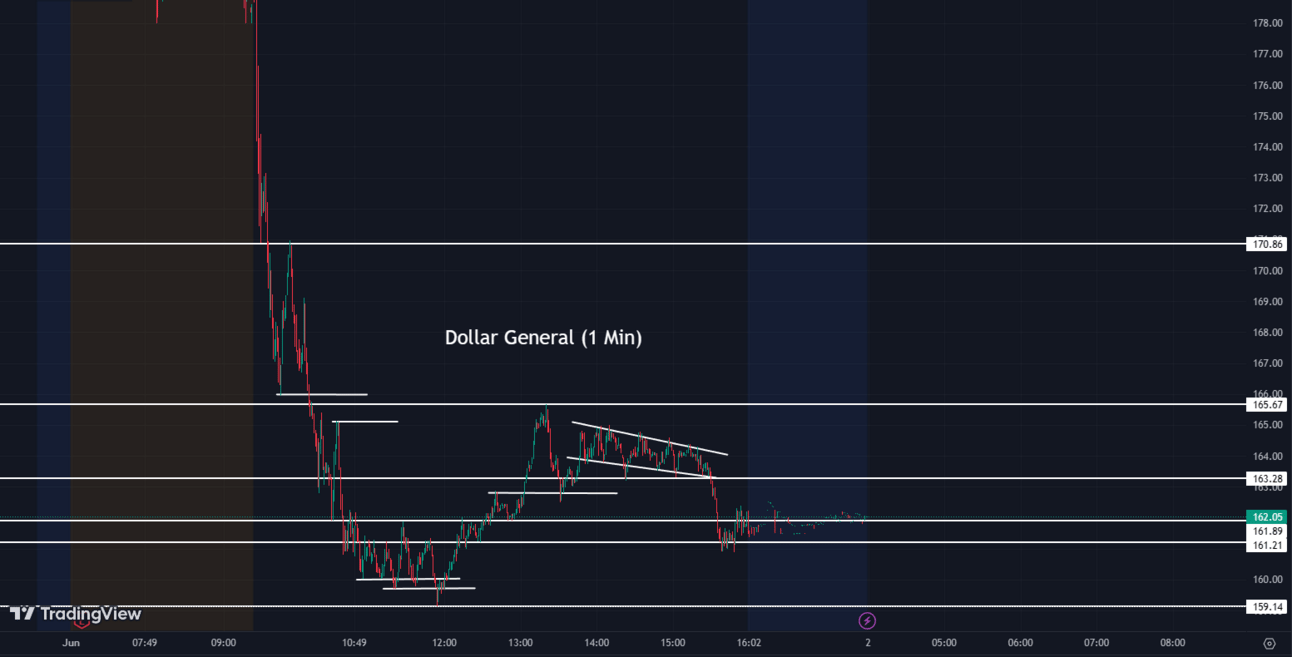

Dollar General's Q1 Earnings 💲📉

The popular retail chain, Dollar General (DG), presented its Q1 earnings with a less optimistic outlook for customer spending. The financial report hinted at customers pulling back on spending, causing concerns for future sales and income figures. It remains to be seen how Dollar General will respond to this challenging customer behavior. However, the effects are already visible, with the stock's performance taking a hit in the market today down 19%.

DG:

161.86 ▼ -39.23 (-19.51%) Today

162.06 ▲ 0.20 (+0.12%) After Hours

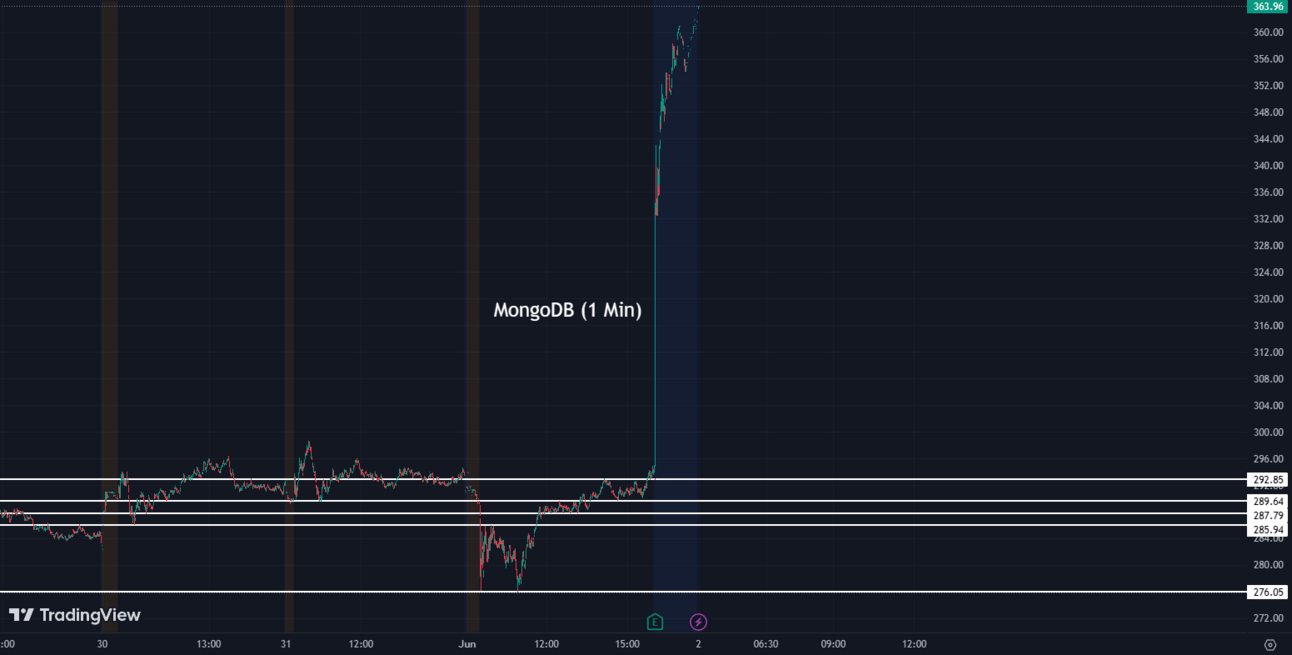

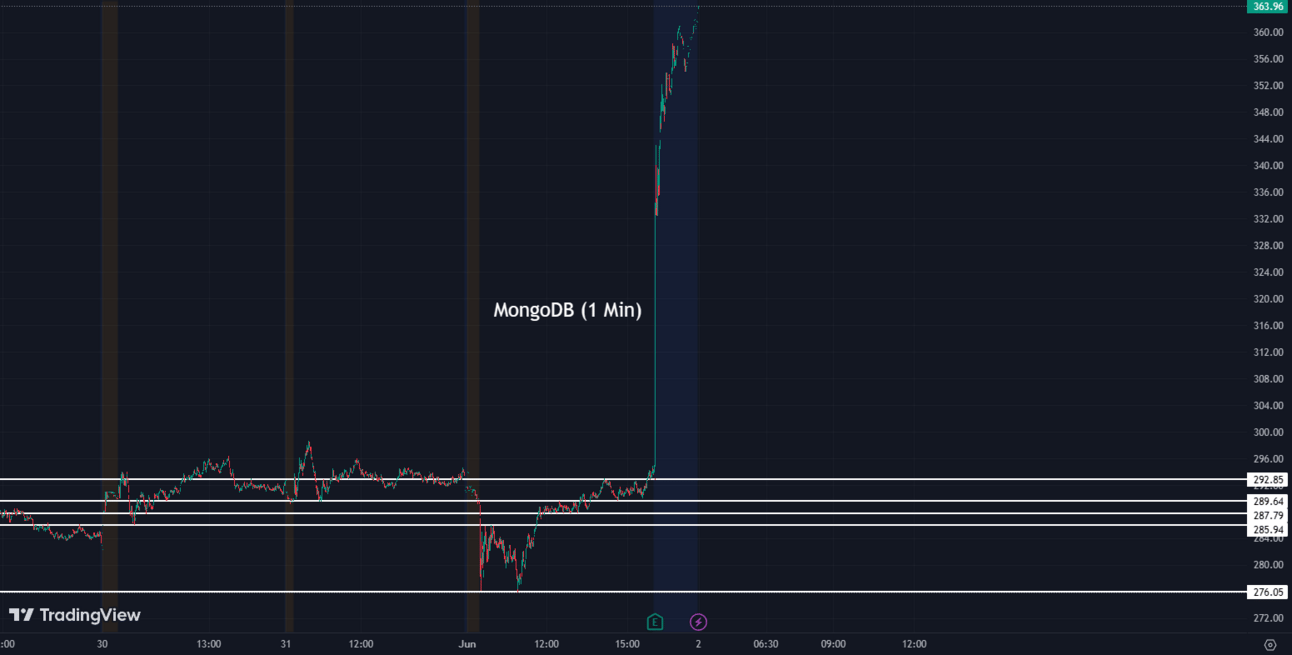

MongoDB Q1 Earnings Report 📊📆

MongoDB (MDB), the cross-platform document-oriented database program, has unveiled its Q1 earnings. The company has continued to show growth, contributing to the positive sentiment among investors. The stock jumped up more than 20% after-hours due to these positive earnings.

MDB:

293.96 ▲ +0.17 (+0.058%) Today

363.90 ▲ 69.94 (+23.79%) After Hours

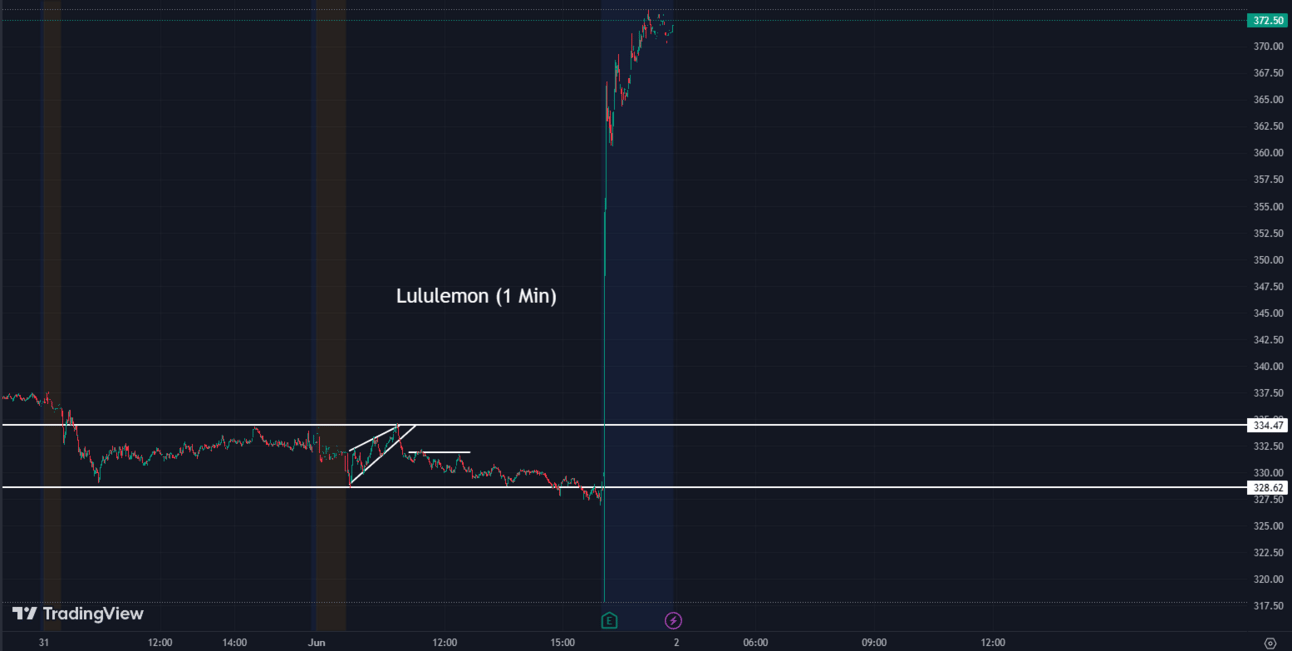

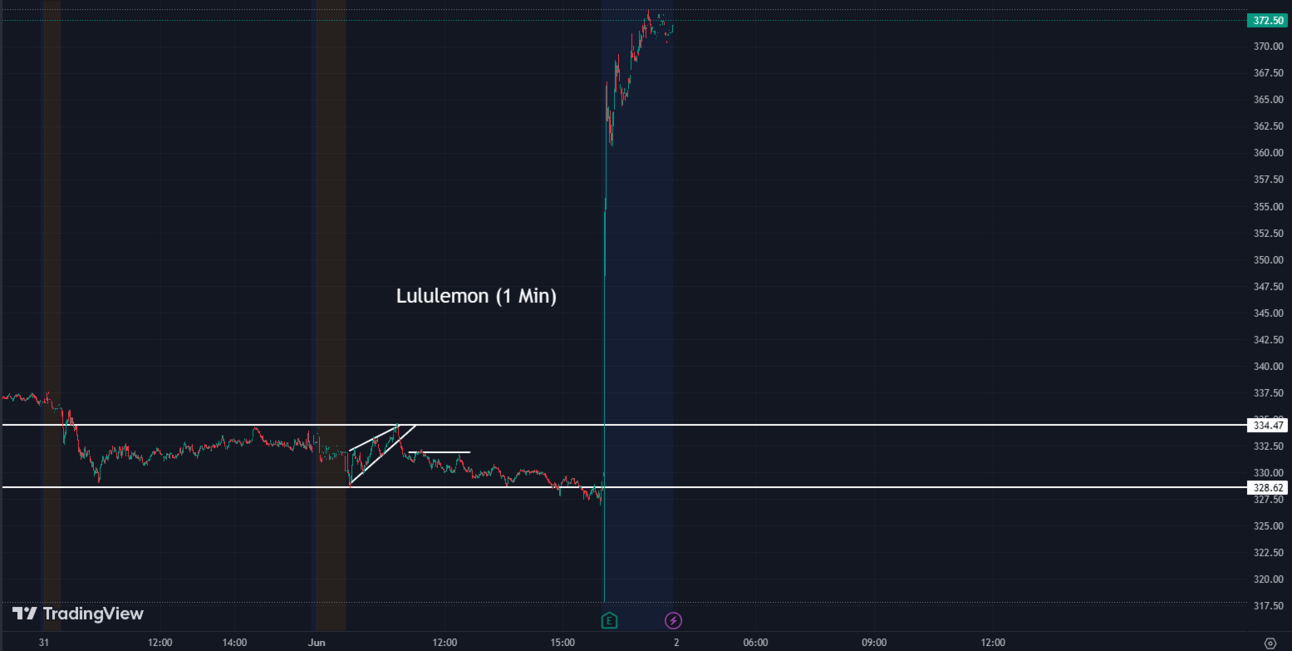

Lululemon's Q1 Earnings 📈👚

Lululemon Athletica (LULU), the athletic apparel retailer, announced its Q1 earnings, with a stronger performance than anticipated. The company had an increase in sales and a rise in digital revenue.

LULU:

328.35 ▼ -3.58 (-1.08%) Today

372.00 ▲ 43.65 (+13.29%) After Hours

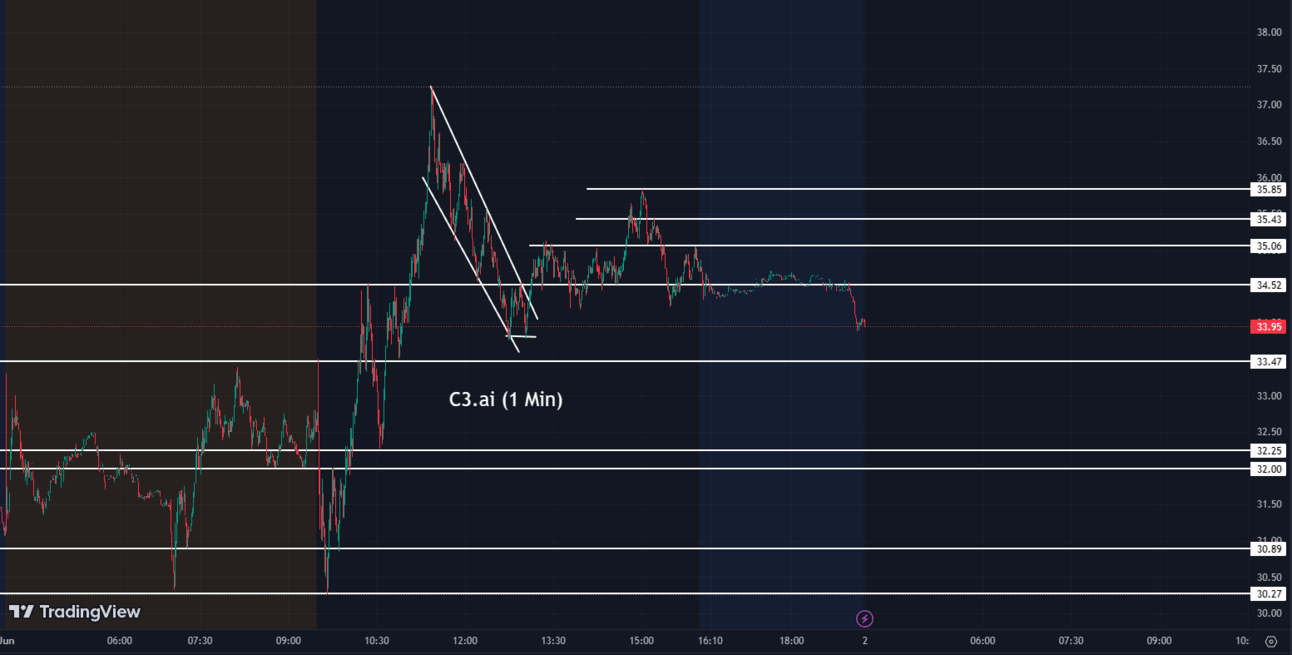

C3.ai's Market Plunge 📉🖥️

C3.ai (AI), a leading enterprise AI software provider, experienced a significant drop in stock value despite beating Q4 earnings expectations. The company's disappointing revenue projections for the next quarter resulted in a negative market reaction, causing a sharp decline in the stock price. While other AI companies such as Nvidia and Marvell have experienced significant increases and raised their predictions of a sharp rise in demand, it appears that C3.ai is being subject to a tough evaluation.

AI:

34.72 ▼ -5.29 (-13.22%) Today

34.00 ▼ 0.72 (-2.07%) After Hours

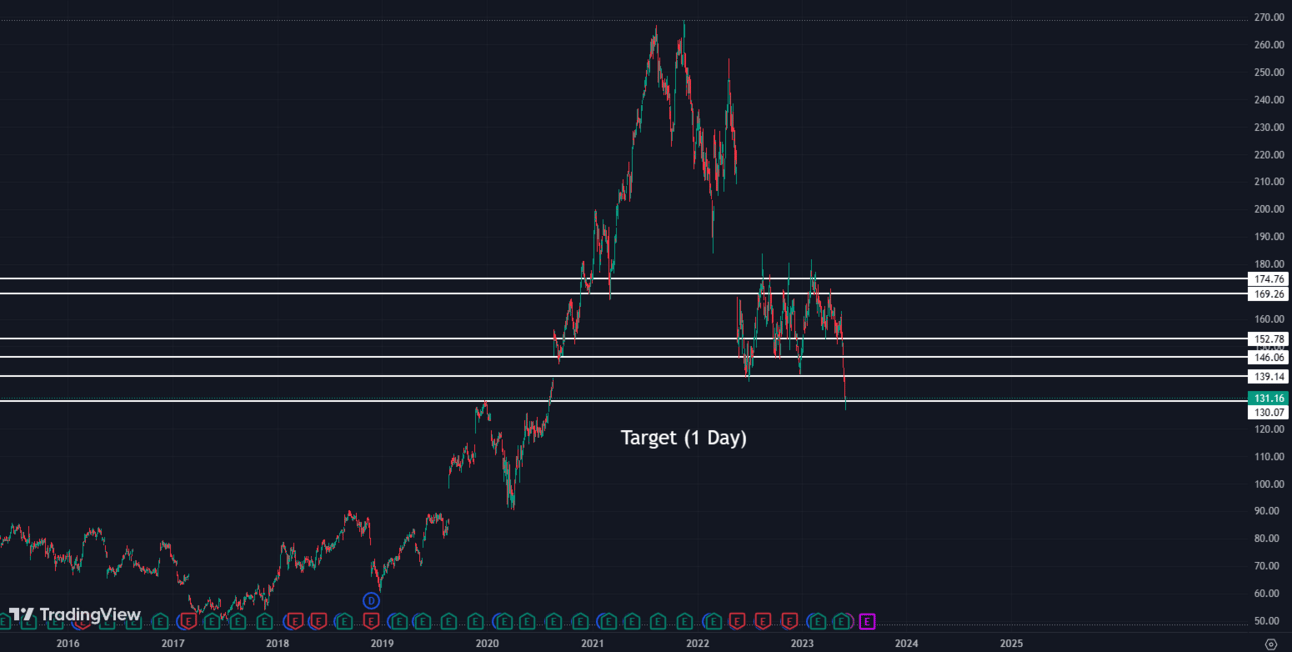

Target's Stock Downgrade 📉🏬

Retail giant Target Corporation (TGT) experienced a setback today as JP Morgan downgraded the stock from 'overweight' to 'neutral'. The stock has been experiencing a prolonged decline for several weeks and is approaching its three-year low.

TGT:

131.16 ▲ +0.23 (+0.18%) Today

131.10 ▼ 0.06 (-0.046%) After Hours

After Hours 🌙💰

Lululemon's (LULU) stock surged 13% following a favorable fiscal first-quarter earnings report and elevated full-year guidance, coupled with a 24% increase in sales from last year.

LULU:

328.35 ▼ -3.58 (-1.08%) Today

372.00 ▲ 43.65 (+13.29%) After Hours

MongoDB's (MDB) shares jumped by 23% as the company gave a stronger than expected guidance, forecasting a higher second-quarter revenue than analysts' predictions.

MDB:

293.96 ▲ +0.17 (+0.058%) Today

363.90 ▲ 69.94 (+23.79%) After Hours

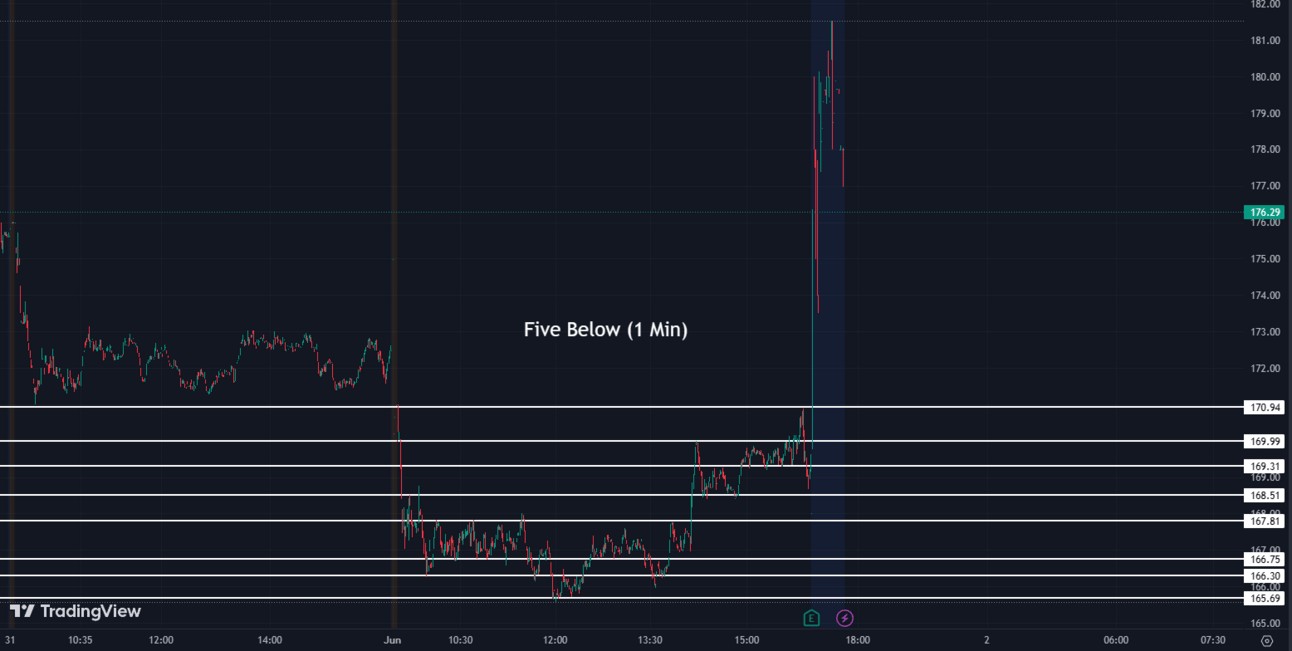

Five Below's (FIVE) shares increased by 6% in extended trading. The uptick came despite the company's revenue and second-quarter guidance falling slightly short of Wall Street's expectations.

FIVE:

169.35 ▼ -3.17 (-1.84%) Today

179.00 ▲ 9.65 (+5.70%) After Hours

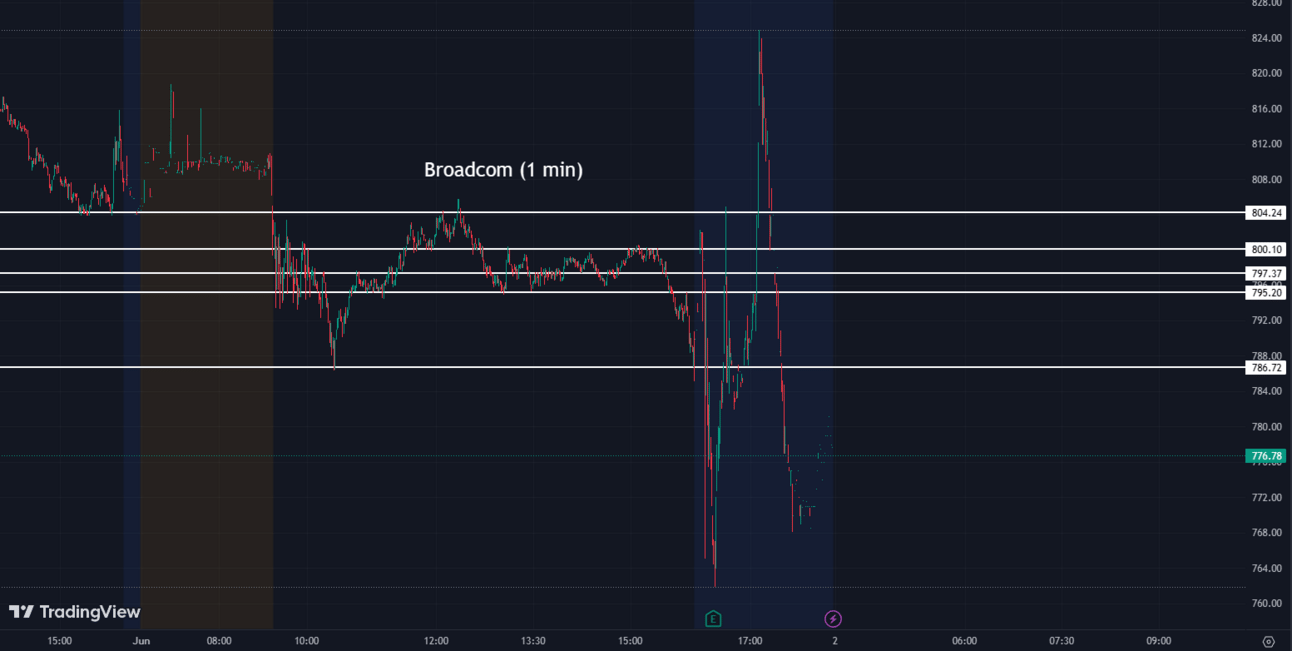

Broadcom's (AVGO) shares dipped about 1% in extended trading, notwithstanding the company beating top and bottom lines for the second quarter and issuing a fiscal third-quarter revenue forecast that slightly outpaced Wall Street's predictions.

AVGO:

789.95 ▼ -18.01 (-2.23%) Today

775.50 ▼ 14.45 (-1.83%) After Hours

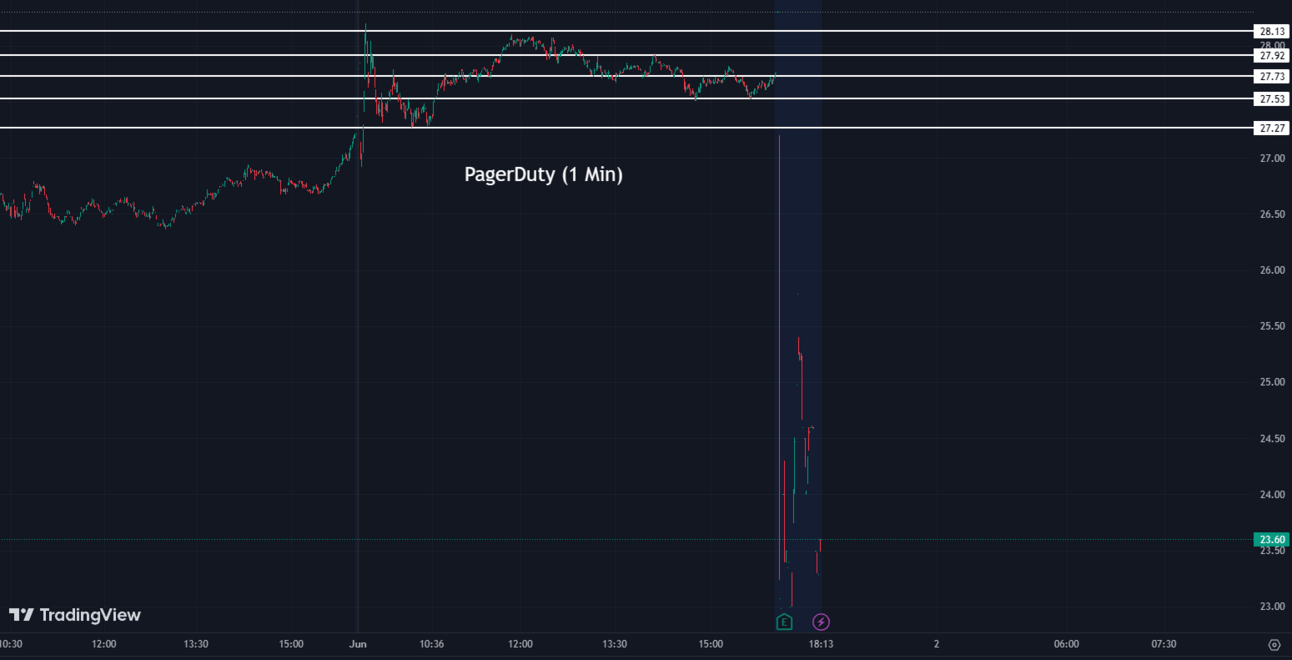

PagerDuty (PD) shares declined over 11% after-hours due to a weaker-than-expected revenue guidance, despite the adjusted earnings per share surpassing Wall Street's estimates.

PD:

27.75 ▲ +0.54 (+1.98%) Today

24.39 ▼ 3.36 (-12.11%) After Hours

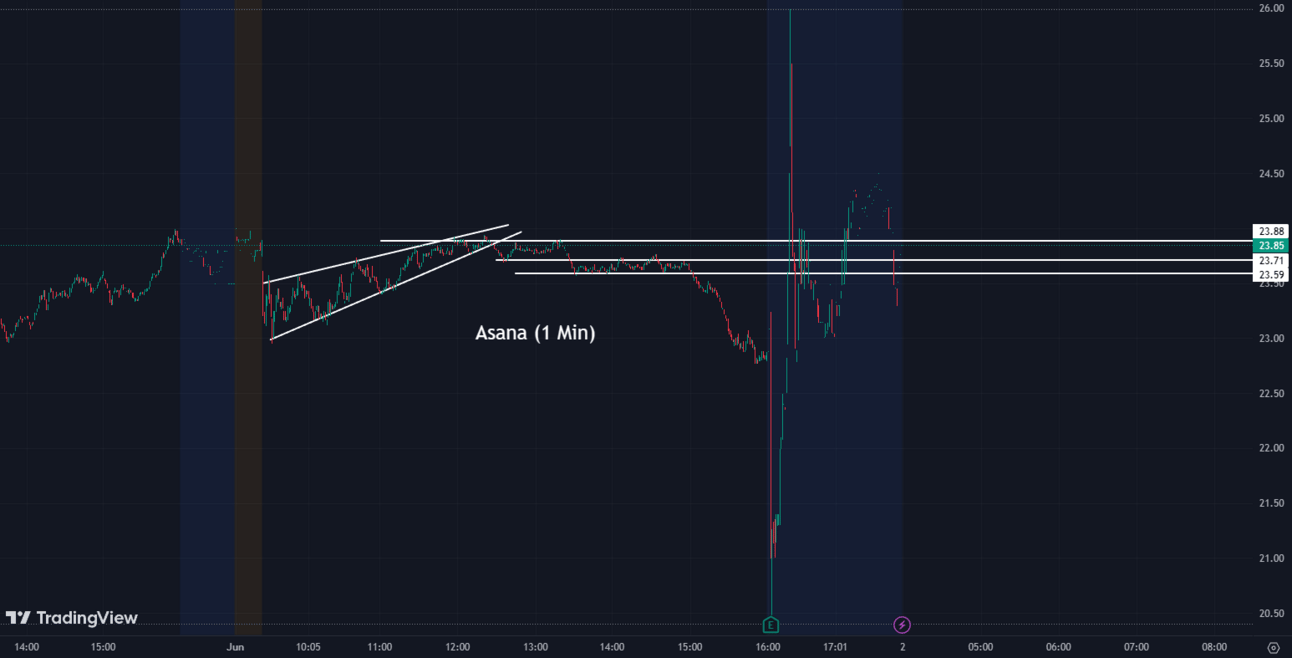

Asana's (ASAN) shares rose 4% after the market closed. The company reported lower-than-expected losses and revenue that surpassed analysts' forecasts in the first quarter.

ASAN:

22.85 ▼ -1.03 (-4.31%) Today

23.85 ▲ 1.00 (+4.38%) After Hours

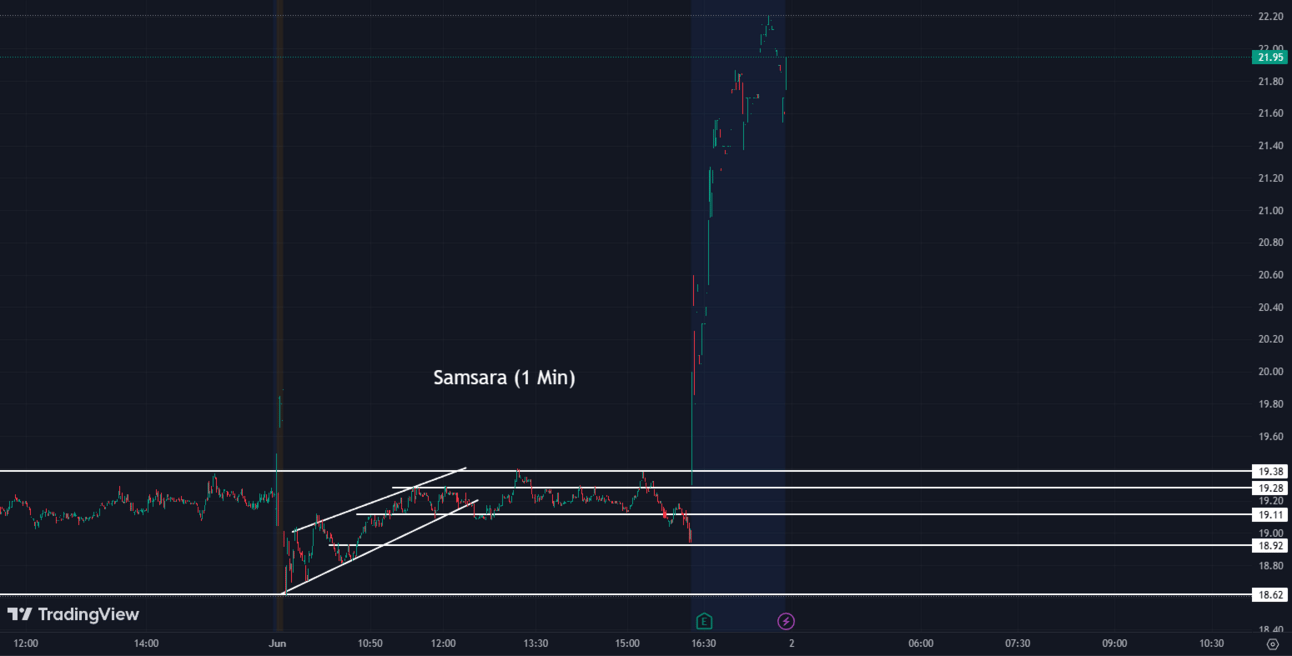

Samsara (IOT) shares rose 15% in after-hours trading after reporting a smaller-than-expected first-quarter loss, better-than-expected revenue, and an expanded full-year sales forecast.

IOT:

19.01 ▼ -0.24 (-1.25%) Today

21.96 ▲ 2.95 (+15.52%) After Hours

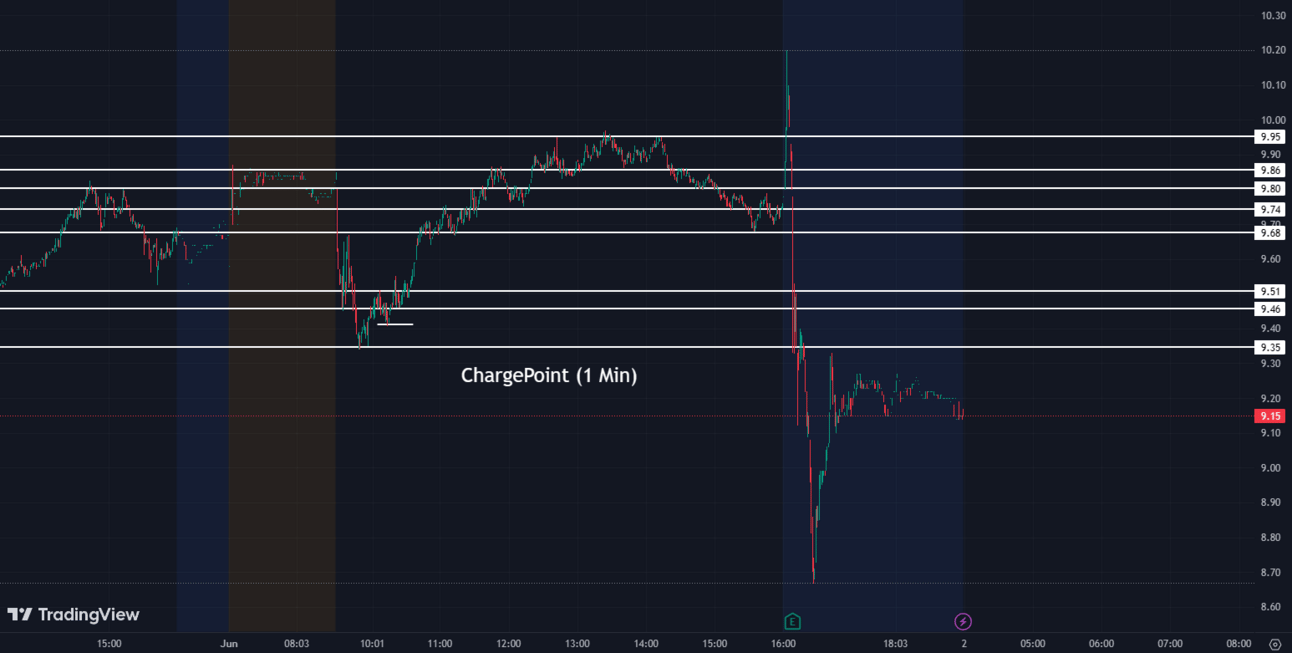

ChargePoint (CHPT) shares fell by over 4% due to lighter guidance for the current quarter, despite the company surpassing Wall Street's earnings expectations.

CHPT:

9.75 ▲ +0.08 (+0.83%) Today

9.18 ▼ 0.57 (-5.85%) After Hours

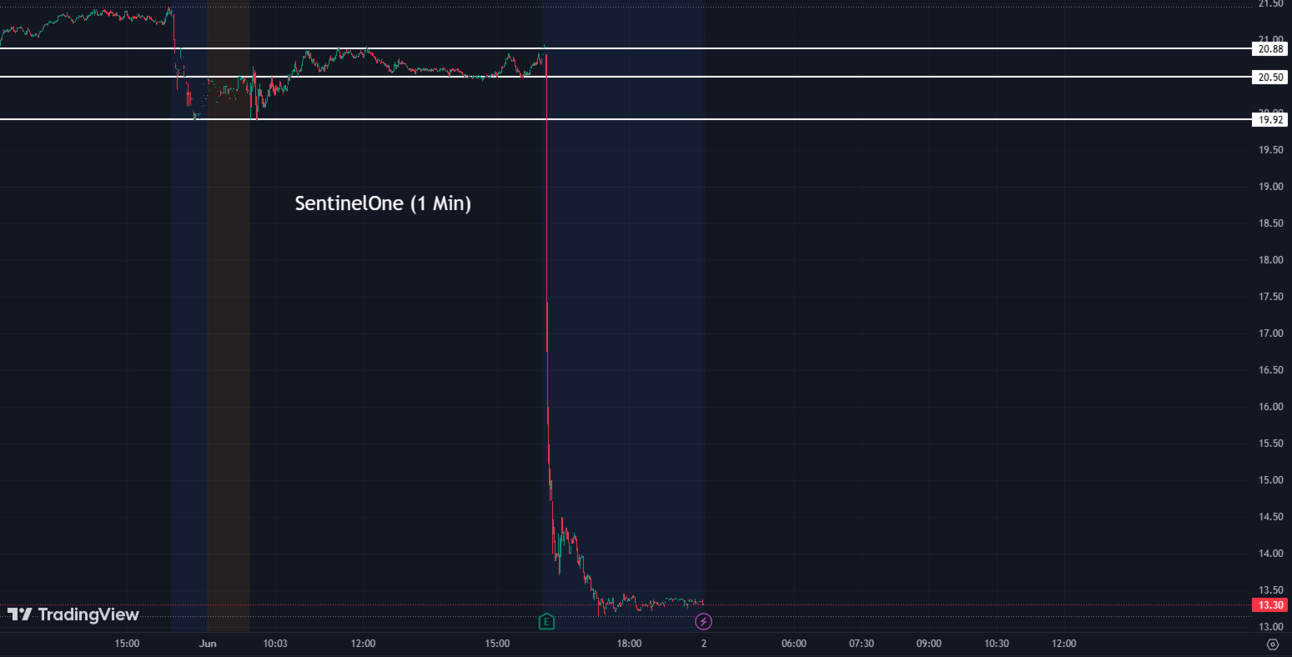

SentinelOne (S) shares plunged 35% after the cybersecurity company lowered its revenue guidance and failed to meet Wall Street's revenue expectations for the recent period.

S:

20.72 ▼ -0.66 (-3.09%) Today

13.32 ▼ 7.40 (-35.71%) After Hours

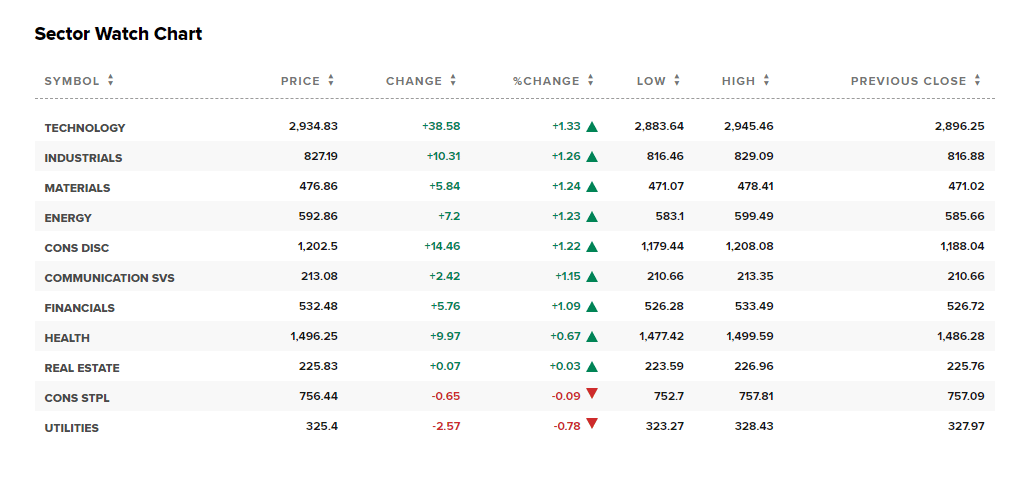

Sectors 🚛💡

Today, 9 out of the 11 sectors closed in the green, with the Technology sector leading the way, and the Utilities sector lagging behind.

Conclusion 👋

The market today witnessed a slew of significant events, influencing stocks across various sectors. Each of these events serves as an insight into the dynamic nature of financial markets. From new product releases to financial reports and policy changes, each development could reshape the market in the days to come.

Thank you all for signing up!

Will only work to do better for you all going forward. Our only goal is to add value to everyone’s trading with key levels and the ability of learning charts and price action.

Please Share Our Newsletter it will be much appreciated!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of TradingView. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.