Hey, traders! As we approach the end of the week, let's take a breather and dive into the exciting events that unfolded today!

Job Growth Slows in U.S. Labor Market 📉💼

The latest June jobs report hints at a slowdown in the U.S. labor market after substantial growth earlier in the year. However, notable job increases were seen in health care and social assistance, with 65,200 jobs added, and in government, with 60,000 jobs added. Construction also added 23,000 jobs for two months in a row, showcasing resilience in the face of higher interest rates affecting prospective homebuyers. Nevertheless, retail trade and transportation, along with warehousing sectors, experienced a loss of about 18,000 jobs in total.

Indexes 📉📊

The indices experienced a decline today and concluded the week with a lower performance, as Wall Street grappled with apprehensions regarding the possibility of the Federal Reserve initiating rate hikes later this month. Now, let's explore how the market performed today...

The S&P 500 (SPX) was down -0.29% coming to a conclusion at 4,398

The Nasdaq Composite (IXIC) fell by -0.13% to settle at 13,660

The Dow Jones Industrial Average (DJI) dropped by -0.55% ending the day at 33,734

The Russell 2000 (RUT) was up +1.22% to finish at 1,864

The Nasdaq-100 (NDX) declined by -0.35% to conclude at 15,036

Hello, everyone! 👋 We wanted to take a moment to remind you about some exciting news. We are excited to introduce a fantastic newsletter that has been carefully crafted to assist you in navigating the realm of finance. As a way of expressing our heartfelt thanks, we have a special offer for you. If you happened to forget about it, no worries! You can now enjoy an incredible 20% lifetime discount on your subscription. This is our humble expression of appreciation for your continuous support. Feel free to click the link below and discover the numerous benefits that await you.

FDA Approves Leqembi, First Drug to Slow Early-Stage Alzheimer's ✅💊

The Food and Drug Administration has approved the Alzheimer's drug, Leqembi, the first medicine proven to slow the progression of early-stage Alzheimer's. Developed by Eisai (ESAIY) and Biogen (BIIB), its approval marks a significant advancement in Alzheimer's treatment. However, analysts predict that initial sales may be slow due to logistical challenges, but could pick up in 2024. These challenges include the construction of a patient registry, the requirement for genetic testing for ApoE4 mutation before treatment, and extensive MRI monitoring. Despite the hurdles, Medicare coverage for the drug has been announced, making it more accessible to patients who couldn't afford its hefty annual price tag.

ESAIY:

16.80 ▼ -0.28 (-1.67%) Today

16.90 ▲ +0.10 (+0.60%) After Hours

BIIB:

275.07 ▼ -9.92 (-3.48%) Today

275.69 ▲ +0.62 (+0.23%) After Hours

China's Ant Group Faces $1.1 Billion Fine, Alibaba Shares Surge 💰🐜

Shares of Alibaba (BABA) soared after a report surfaced that China is likely to impose a fine of more than $1.1 billion on Alibaba's fintech affiliate, Ant Group Co., signaling a possible conclusion to the years-long investigation into Jack Ma's empire. The fine will enable Ant Group to apply for a financial holding company license, revive growth, and resurrect its plans for an initial public offering (IPO). Despite the severe scrutiny that led to accusations of monopolistic behavior and a record fine against Alibaba, and a significant reduction in Ant Group's size, market observers see the fine as manageable and appreciate the probable end of the investigation. Alibaba is currently splitting into six primary businesses, and since the beginning of the Ant Group incident, its shares have significantly decreased in value, shedding over $600 billion. However, the conclusion of this probe could potentially kindle hopes for the revival of China's private sector amidst its flagging economy. Regulatory approval is still awaited for Ant Group to begin the review of its application to establish a financial holding company and eventually resume its IPO plans. Despite the numerous regulations and changes, including Ma giving up his controlling rights over Ant Group, the company's future strategies remain under consideration.

BABA:

90.61 ▲ +6.77 (+8.07%) Today

91.11 ▲ +0.56 (+0.62%) After Hours

DISH Network Contemplates Merger of Dish and EchoStar 📡💼

DISH Network (DISH), under Chair Charlie Ergen, is reportedly considering the merger of its two telecom businesses, Dish and EchoStar (SATS). The companies, both founded by Ergen, have engaged advisors to explore this option. This decision comes at a time when Ergen is keen on selling some of Dish's non-core assets to alleviate the company's financial stress, with speculation of possible bankruptcy on the horizon.

DISH:

7.28 ▲ +0.47 (+6.90%) Today

7.24 ▼ -0.04 (-0.55%) After Hours

Cronos Group Explores Potential Sale 💲🏷️

Cronos Group (CRON), a Canadian cannabis producer supported by cigarette maker Altria Group (MO), is reportedly exploring various options, including a potential sale following acquisition interest. Cronos is addressing interest from many companies, including Curaleaf Holdings (CURLF). The discussions, however, are confidential, and there's no guarantee of a transaction.

CRON:

2.01 ▲ +0.13 (+6.91%) Today

2.01 ▲ +0.0013 (+0.065%) After Hours

MO:

45.98 ▼ -0.11 (-0.24%) Today

46.18 ▲ +0.20 (+0.43%) After Hours

Costco Stock Drops After Reporting Decline in Same-Store Sales for June 📉🛒

Costco’s (COST) stock fell 2.29% after it reported another month of same-store sales decline in June, blaming the move on a lower price for gasoline and not stress on inflation-weary consumers. Same-store sales dropped 1.4% overall and 2.5% in the U.S., more significant than May's 0.3% fall. However, total sales slightly increased to $22.86 billion from $22.78 billion the previous year. When excluding gas and foreign exchange, same-store sales rose by 3% in June. Despite lower average transaction size and weaker sales in some categories, foot traffic rose, particularly in the U.S. D.A. Davidson analysts warned that softening comps might pause the stock, but Truist analysts remained positive, stating that Costco's value proposition should allow it to gain more market share. Oppenheimer analysts also retained an optimistic outlook, citing consistent multi-year U.S. sales trends and potential future catalysts like a membership fee increase and a special dividend.

COST:

525.05 ▼ -12.32 (-2.29%) Today

525.38 ▲ +0.33 (+0.063%) After Hours

TikTok Music Launches Premium Streaming Service, Introducing Potential Disruption to the Music Industry 🎵🔊

The unveiling of TikTok's new streaming music service, TikTok Music, heralds a potential shake-up in the music industry, offering millions of songs and unique features not currently provided by competitors like Spotify (SPOT). Initially only available in Indonesia and Brazil, TikTok Music, a premium-only service, contrasts with ad-supported, free-access platforms like Spotify and YouTube. The paid subscription model can inject more money into the music industry, as demonstrated in 2022 when revenue from such subscriptions in the U.S. alone surpassed $10 billion, according to the Recording Industry Association of America (RIAA). With the advent of TikTok Music, artists, record labels, and the entire music ecosystem could benefit from an additional revenue stream, potentially reshaping the industry or at least continuing its current upward trajectory. However, it remains to be seen how many users will sign up for TikTok Music and what its long-term impact on the music industry will be.

SPOT:

156.99 ▲ +0.37 (+0.24%) Today

157.49 ▲ +0.52 (+0.33%) After Hours

Tesla Joins Automakers in Pledge to Support Fair Competition and Socialist Values in China 🚗🤝

Tesla (TSLA), along with 15 other automakers, promised to support China's "core socialist values" and avoid disrupting fair competition with abnormal pricing at the China Auto Forum. The pledge, though nonbinding, signaled a pause in the fierce price war between Tesla and its Chinese competitors. Nevertheless, Tesla, a day after the pledge, announced a new cash rebate for some Chinese customers. The role of China is significant for Tesla, with its Shanghai plant producing over half of Tesla's cars in 2022 and China being a major market for Tesla's business. Despite the rough competition, Tesla has managed to maintain its foothold in the country's thriving EV market.

TSLA:

274.43 ▼ -2.11 (-0.76%) Today

274.60 ▲ +0.17 (+0.062%) After Hours

Notable Movers of the Day 🔥📊

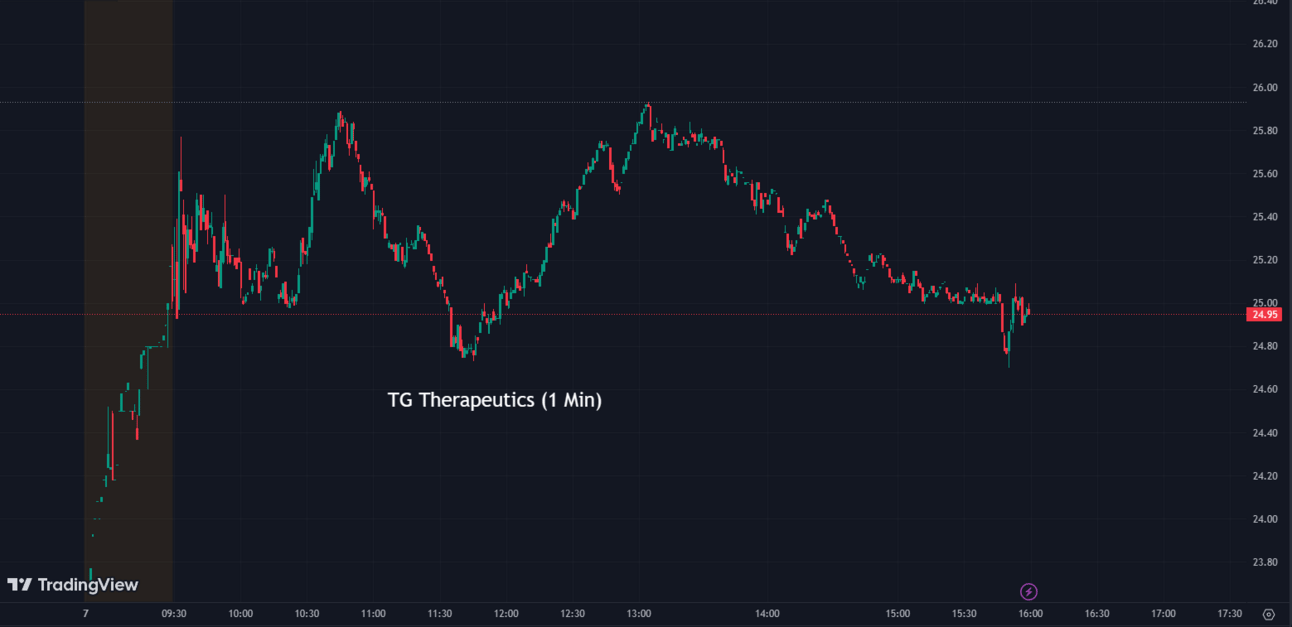

TG Therapeutics (TGTX), soared more than 8% after Cantor Fitzgerald reiterated an overweight rating on the stock. The firm said it sees sales of TG Therapeutics’ treatment for relapsing forms of multiple sclerosis, Briumvi, coming in above expectations for the second quarter.

TGTX:

24.96 ▲ +1.92 (+8.33%) Today

25.00 ▲ +0.04 (+0.16%) After Hours

First Solar (FSLR), climbed 3% after receiving a five-year revolving line of credit as well as a guarantee for a $1 billion facility. JPMorgan will serve as the lead arranger for First Solar.

FSLR:

189.14 ▲ +6.00 (+3.28%) Today

189.25 ▲ +0.11 (+0.058%) After Hours

Levi Strauss (LEVI), witnessed a 7.8% slump in shares after the company cut its full-year profit forecast on Thursday. Levi Strauss now expects an adjusted $1.10 to $1.20 per share, compared to the previous range of $1.30 to $1.40.

LEVI:

13.12 ▼ -1.11 (-7.80%) Today

13.15 ▲ +0.02 (+0.15%) After Hours

Rivian Automotive (RIVN), experienced a surge of more than 14% after Wedbush raised its price target on shares to $30 from $25, citing an improved outlook. This new target price implies shares rallying almost 39% from Thursday’s close.

RIVN:

24.70 ▲ +3.08 (+14.25%) Today

24.88 ▲ +0.18 (+0.73%) After Hours

DraftKings (DKNG), the sports betting platform, added 5% today. A day earlier, Jefferies included the stock as one of the stocks the firm is forecasting is set for gains as the company turns the profit corner.

DKNG:

26.65 ▲ +1.42 (+5.63%) Today

26.69 ▲ +0.04 (+0.15%) After Hours

Sectors ⚡🍞

Out of the 11 sectors, 5 closed in positive territory today, with Energy leading the way with a gain of +2.06%, while Consumer Staples saw a decline of -1.34%.

Conclusion 👋

To wrap it up, the June jobs report indicates a slowdown in the U.S. labor market, although certain sectors like health care, social assistance, and government experienced notable job increases. The stock market indices saw a decline, influenced by concerns over potential rate hikes by the Federal Reserve. The approval of Leqembi, the first drug to slow early-stage Alzheimer's, marks a significant advancement in Alzheimer's treatment, although logistical challenges may impact initial sales. The fine imposed on Ant Group could potentially revive its growth and IPO plans, signaling a possible conclusion to the investigation into Jack Ma's empire. DISH Network is considering a merger of Dish and EchoStar to address financial stress, while Cronos Group explores potential sale options following acquisition interest. TikTok Music's premium streaming service introduces potential disruption to the music industry, offering a new revenue stream for artists and reshaping the industry. Tesla joins other automakers in pledging support for fair competition and socialist values in China, maintaining its position in the country's EV market. TG Therapeutics, First Solar, Levi Strauss, Rivian Automotive, and DraftKings were notable movers of the day. Energy led the positive sectors, while Consumer Staples experienced a decline. Have a good weekend!

Thank you all for signing up!

Will only work to do better for you all going forward. Our only goal is to add value to everyone’s trading with key levels and the ability of learning charts and price action.

Please Share Our Newsletter it will be much appreciated!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of TradingView. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.