Hi, Traders! As the day comes to an end, we are excited to have you here for an insightful recap of the noteworthy events that have influenced the financial markets today.

Jobs Data Heightens Investor Anxiety and Questions Interest Rate Outlook 📊💼

On Thursday, stocks saw a decline after the release of better-than-expected jobs data, which stoked investor anxiety around the state of the economy and the potential trajectory of interest rate hikes. According to data from payroll processing firm ADP, private sector jobs saw an increase of 497,000 in June, marking the largest monthly gain since July 2022. This surge was significantly higher than the Dow Jones consensus estimate of 220,000. The ADP data, known for its unreliability and higher volatility compared to other employment data, precedes the official June payroll report scheduled for Friday. According to Dow Jones, economists anticipate that there were 240,000 non-farm payrolls added last month, indicating a slowdown from the 339,000 jobs added in May. However, this anticipation of an even stronger jobs number may lead to the Federal Reserve resuming its rate-hiking campaign this month. Traders are now pricing in a roughly 92% chance of a rate hike at the central bank's meeting later this month. Conversely, a Labor Department report indicated that job openings fell more than expected in May.

Mortgage Rates Rise 🏠💰

In the mortgage market, the average rate on the popular 30-year fixed mortgage has risen to 7.22%, the highest point since early November. This surge in rates is driven by a stronger-than-expected employment report from ADP and indications from Federal Reserve Chairman Jerome Powell that the central bank might continue raising interest rates after a pause in June.

China Launches OpenKylin, Homegrown Open-Source Operating System to Reduce Reliance on U.S. Technology 🖥️🌐

China has unveiled OpenKylin, its first homegrown open-source desktop operating system, as part of a broader effort to reduce reliance on U.S. technology. This independent operating system, developed by a community of approximately 4,000 developers, is already being utilized in China's space program and several key industries, signifying its immediate importance. The introduction of OpenKylin coincides with increased domestic efforts to create an independent operating system, thus bolstering a burgeoning domestic tech industry in a market that was worth 15.5 billion yuan ($2.1 billion) last year.

Indexes 📉📉

The indices experienced a decline on Thursday due to heightened investor concerns about the economy's condition and the trajectory of interest rates, sparked by an unexpected positive outcome in the jobs data. Now, let's explore how the market performed today...

The S&P 500 (SPX) was down -0.79% coming to a conclusion at 4,411

The Nasdaq Composite (IXIC) fell by -0.82% to settle at 13,679

The Dow Jones Industrial Average (DJI) dropped by -1.07% ending the day at 33,922

The Russell 2000 (RUT) slid by -1.64% to finish at 1,842

The Nasdaq-100 (NDX) declined by -0.75% to conclude at 15,089

Greetings, everyone! 👋 We wanted to kindly remind you about our exciting news. We're absolutely delighted to present a remarkable newsletter specially curated to help you navigate the world of finance. And don't worry if it slipped your mind, because as a gesture of our gratitude, we have a special offer that you won't want to miss. Take advantage of an exceptional 20% lifetime discount on your subscription! This is our humble way of expressing appreciation for your ongoing support. Feel free to click the link below to explore the countless benefits that await you.

Amazon CEO Andy Jassy Highlights AI Competitive Edge 💪🤖

In a recent interview with CNBC, Amazon CEO Andy Jassy emphasized Amazon's competitive position in the artificial intelligence (AI) race. While Microsoft and Google have integrated chatbots into their consumer products, Jassy argued that Amazon's advantage lies in its custom chips, services for developers, and potential for enhancing "virtually every customer experience." A significant component of Amazon's AI strategy includes Amazon Web Services' generative AI service, Bedrock, which allows clients to utilize language models from Amazon and other startups to create their own chatbots and image-generation services. Additionally, Amazon has developed AI-specific chips—Inferentia and Trainium—which are aimed at facilitating the running of large AI language models in the cloud, a move that directly competes with Nvidia's dominant position in the AI chips market. Amidst a backdrop of cost-cutting measures and layoffs, Jassy underscored AI as a key investment area for Amazon's future growth.

AMZN:

128.36 ▼ -2.02 (-1.55%) Today

128.28 ▼ -0.075 (-0.058%) After Hours

Bank of America Upgrades Sweetgreen Stock 🌱🥗

Bank of America's upgrade of Sweetgreen (SG) stock resulted in a 15% increase due to a rise in foot traffic, positive same-store sales, and long-term automation plans. Bank of America also nearly doubled its price target for Sweetgreen, indicating increased optimism about the company's future performance. A key factor in this positivity is Sweetgreen's automation plans, specifically its Sweetgreen Infinite Kitchen pilot store in Naperville, Illinois. Bank of America believes this venture holds a "meaningful" opportunity for Sweetgreen to narrow the profit margin gap with its chief competitor, Chipotle. Additionally, the new loyalty program, Sweetpass, and effective operational improvements all point towards continued upward momentum for the company.

SG:

15.06 ▲ +2.02 (+15.49%) Today

15.11 ▲ +0.05 (+0.33%) After Hours

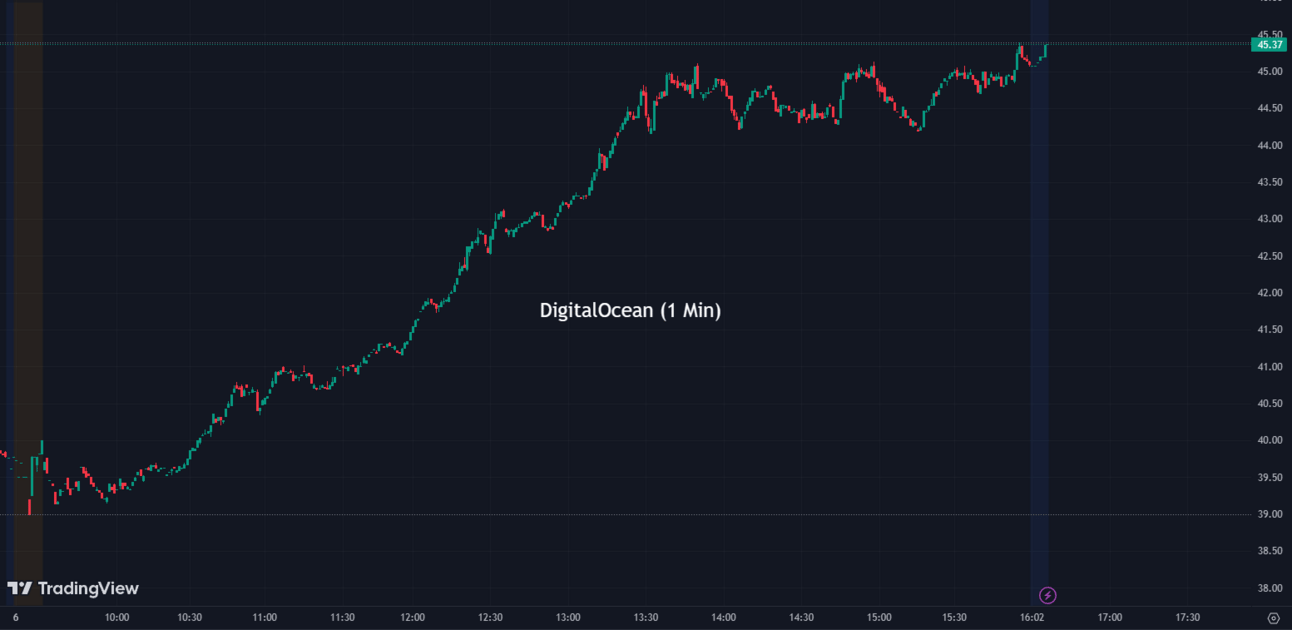

DigitalOcean Surges on Acquisition of Paperspace, Expanding AI Offerings 🚀🤖

Shares of DigitalOcean (DOCN), a cloud services provider, surged over 13% following the company's acquisition of privately held Paperspace for $111M. This strategic move is intended to enhance DigitalOcean's artificial intelligence (AI) offerings. Paperspace, a platform providing cloud infrastructure with high-performance GPU tools for small and medium-sized businesses to test and scale AI models, will now be integrated into DigitalOcean's platform. This move, regarded as a "significant milestone", will allow businesses to more readily incorporate AI and machine learning into their operations. While the acquisition's impact on DigitalOcean's financial results this year is projected to be immaterial, revenue growth is anticipated in the subsequent years. Further details will be revealed in the company's Q2 earnings call on August 3. As of now, analysts predict earnings of 41 cents per share on $169.92M in revenue for DigitalOcean.

DOCN:

45.09 ▲ +5.32 (+13.38%) Today

44.99 ▼ -0.10 (-0.22%) After Hours

Twitter Plans Lawsuit Against Meta Over Threads App, Alleges Intellectual Property Misappropriation ⚖️🕊️

Twitter is reportedly planning to sue Meta (META) over its newly launched Threads app, which has rapidly gained millions of users since its launch. A legal firm representing Twitter has alleged that Meta "engaged in systematic, willful, and unlawful misappropriation of Twitter’s trade secrets and other intellectual property," mainly by hiring its former employees. The Threads app, considered a potential "Twitter killer," was launched as an Instagram companion by Meta this week. In response, Meta has denied any impropriety, asserting that no former Twitter employees were part of the Threads engineering team. As the dispute unfolds, Threads has surpassed 30 million signups, according to Meta CEO Mark Zuckerberg.

META:

291.99 ▼ -2.38 (-0.81%) Today

291.00 ▼ -0.99 (-0.34%) After Hours

EU Launches Antitrust Probe into Amazon's Acquisition of iRobot, Citing Competition Concerns 🔎🧹

The European Commission has recently launched an "in-depth" antitrust investigation into Amazon's (AMZN) proposed $1.7 billion acquisition of iRobot (IRBT), a leading manufacturer of smart vacuum cleaners. The EU's probe was initiated after the acquisition received approval from the UK's top antitrust regulator. The Commission is set to assess whether the deal would restrict competition in the robot vacuum cleaner market, and strengthen Amazon's position as a dominant online marketplace provider. One of the key concerns raised by the Commission is the possibility of Amazon manipulating search results to favor iRobot products over its competitors, such as Shark and Dyson. The probe also looks into Amazon's potential use of iRobot user data, which could provide a significant advantage for Amazon over its competitors and increase the barriers to entry for new or existing competitors in the market.

AMZN:

128.36 ▼ -2.02 (-1.55%) Today

128.28 ▼ -0.075 (-0.058%) After Hours

IRBT:

45.10 ▼ -0.04 (-0.089%) Today

45.76 ▲ +0.66 (+1.46%) After Hours

Ford's Q2 Sales Soar on Strong F-Series Truck Performance 🚗💨

Ford Motor's (F) second-quarter sales increased 9.9% from a year earlier, spurred by significant sales gains for its F-Series trucks. The Detroit-based automaker reported sales of 531,662 vehicles from April through June, a marked increase from the 483,688 cars and trucks sold in the same period the previous year, which were negatively impacted by supply chain issues. Sales of Ford’s F-Series trucks experienced a noteworthy surge of 34% during the second quarter compared with the same period the previous year. Notably, the sales of an all-electric version of the F-150 more than doubled to 4,466 units. Ford’s overall truck sales, a key driver of the company’s profits, were up 23% in the first half of the year from the same period in 2022. Despite a 2.8% decline in EV sales due to a supply shortage of the Mach-E model, Ford is optimistic about the future of its electric vehicle business, aiming to significantly boost its electric vehicle production and turn a profit on its EV business by the end of 2026.

F:

14.98 ▼ -0.36 (-2.38%) Today

14.96 ▼ -0.025 (-0.17%) After Hours

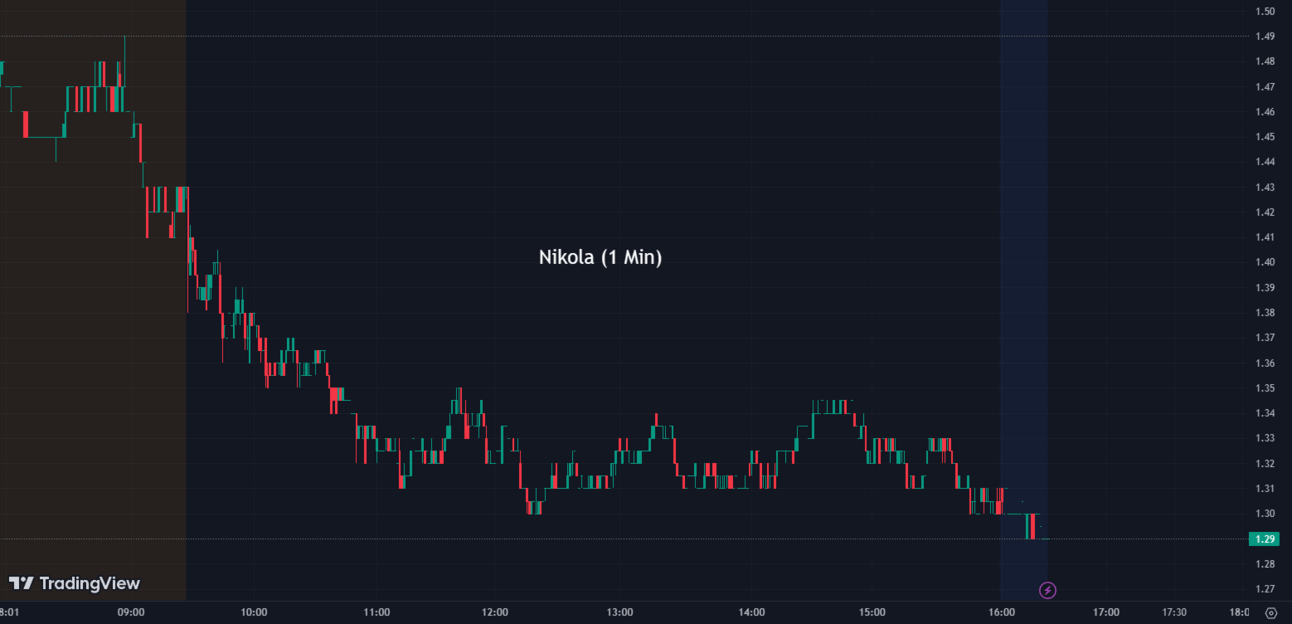

Nikola Seeks Shareholder Approval for Additional Stock Sales 💰📊

Nikola Corporation (NKLA), a promising player in the electric truck industry, is seeking to raise additional capital through stock sales. However, before it can proceed with this plan, it needs the approval of its shareholders to increase its total shares outstanding. The decision to sell more stocks comes at a critical time for the company as it navigates the challenges and opportunities of the burgeoning electric vehicle market. The result of the voting will be announced soon, determining whether Nikola has secured enough votes to proceed with the proposed stock sale. This decision will significantly impact the company's ability to generate the necessary funds for its ongoing operations and future growth.

NKLA:

1.30 ▼ -0.13 (-9.09%) Today

1.29 ▼ -0.01 (-0.79%) After Hours

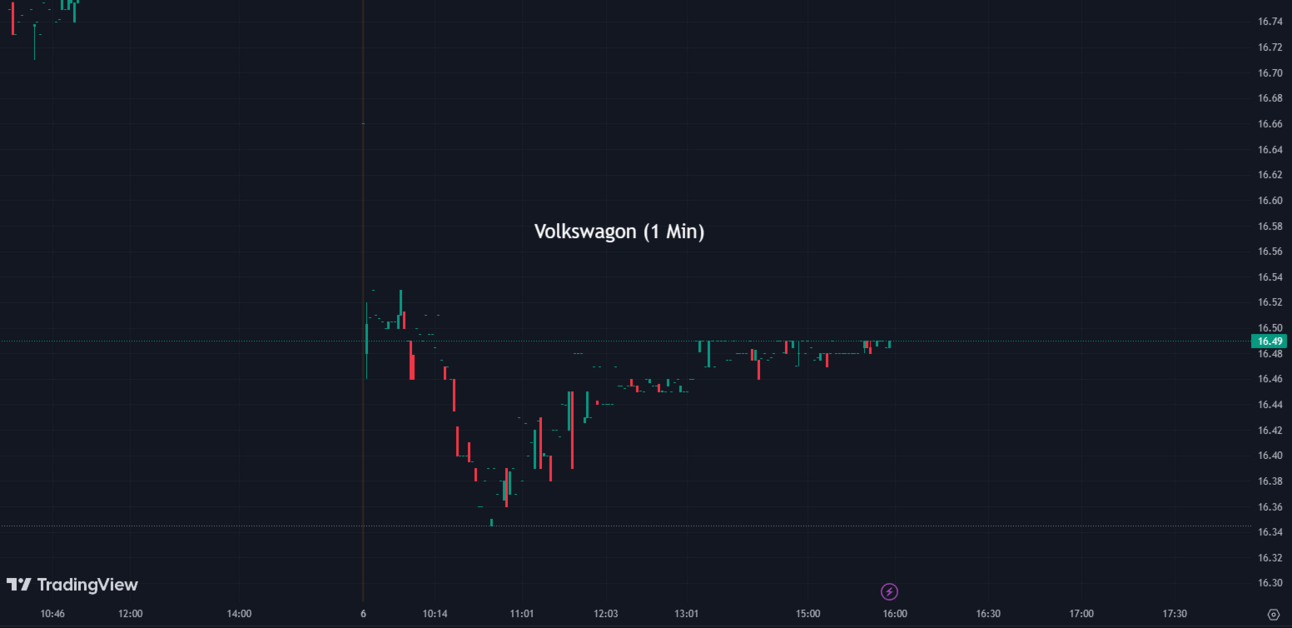

Volkswagen to Test Autonomous ID Buzz Vans in Austin, Texas 🚐🤖

Volkswagen (VWAGY) recently declared its plans to initiate testing for its autonomous, electric ID Buzz vans in Austin, Texas, starting in July 2023. The company aims to deploy around ten of these electric vans, developed in collaboration with Mobileye, by the end of 2023. Initially, all self-driving vehicles will have human safety drivers on board for testing purposes. This strategic move is a part of Volkswagen’s ongoing efforts to revamp its self-driving technology strategy, which also includes an increased partnership with Mobileye and new investments in its Europe-based ride-sharing service, MOIA. Even though Volkswagen harbors ambitions for a robotaxi service in Europe, it does not currently plan to introduce a proprietary ride-sharing service in the U.S. Instead, it plans to provide autonomous ID Buzz vans and fleet management capabilities to other businesses involved in ride-sharing or delivery services. This decision follows the company's previous investment in, and subsequent withdrawal from, the self-driving startup Argo AI.

VWAGY:

16.49 ▼ -0.38 (-2.25%) Today

16.48 ▼ -0.01 (-0.061%) After Hours

Exxon Mobil Warns of Significant Earnings Decline ⚠️📉

Exxon Mobil’s (XOM) stock dropped by almost 4% after the company cautioned that plunging natural gas prices, weakened demand, and reduced margins might drastically cut its second-quarter earnings. According to a regulatory filing, lower natural gas prices and margins could subtract more than $4 billion from Exxon's second-quarter earnings compared to the first quarter. In a worst-case scenario, the company's quarterly earnings could plummet to $6.2 billion, a near 50% decrease from the previous quarter's $11.6 billion. Despite these projections, Exxon returned almost $30 billion to its shareholders last year, with nearly $14 billion in dividends. Meanwhile, energy prices have sharply fallen, with U.S. natural gas futures trading at less than half their 52-week high.

XOM:

102.94 ▼ -3.97 (-3.71%) Today

102.88 ▼ -0.04 (-0.039%) After Hours

Wedbush Securities Forecasts Microsoft's Valuation to Reach $3 Trillion, Citing AI Integration and ChatGPT's Impact 💰🔮

Wedbush Securities recently highlighted the significant market power of tech giant Microsoft (MSFT), suggesting the company could potentially reach a $3 trillion valuation early next year. The growth of artificial intelligence (AI) has been instrumental in this forecast. Specifically, Microsoft's decision to integrate ChatGPT with Azure and Office has added between $40 and $50 to Wedbush's valuation of the company.

MSFT:

341.27 ▲ +3.12 (+0.92%) Today

341.10 ▼ -0.17 (-0.05%) After Hours

After Hour Movers 🌌💨

Levi Strauss (LEVI), reported a steep drop in U.S. wholesale revenue and slashed its profit outlook for the year. The company expects wholesale revenues in the U.S. to continue falling as it shifts its business towards a direct-to-consumer model. Levi now anticipates adjusted earnings per share of $1.10 to $1.20, compared to the previous range of $1.30 to $1.40. Sales dropped 9% to $1.34 billion in the fiscal second quarter. Levi attributed the decline to a consumer slowdown impacting the retail industry and internal issues resulting in items being out of stock. The company plans to address these challenges and improve its in-stock position. Despite the disappointing results, Levi saw a positive performance in its direct-to-consumer sales and the China market.

LEVI:

14.24 ▲ +0.12 (+0.89%) Today

13.40 ▼ -0.83 (-5.83%) After Hours

Kura Sushi USA (KRUS), reported earnings of $1.7 million, or 16 cents per share, for its fiscal third quarter. The Irvine-based company generated revenue of $49.2 million during the period. Kura Sushi expects full-year revenue to be in the range of $187 million to $189 million.

KRUS:

85.25 ▼ -2.32 (-2.65%) Today

81.25 ▼ -4.00 (-4.69%) After Hours

Gorilla Technology (GRRR, has announced that it has secured a contract with the Government of Egypt to implement a government security convergence solution. The contract is valued at over $270 million and will span a period of three years. As part of the agreement, Gorilla Technology will provide various solutions including access control and identity management, interagency collaboration, cybersecurity measures, and a command and control center, among others.

GRRR:

2.09 ▼ -0.06 (-2.79%) Today

2.94 ▲ +0.85 (+40.67%) After Hours

Sectors 💻⚡

Every sector experienced a decrease, with Technology having the smallest loss of -0.16%, while Energy saw the largest decrease, down 2.45%.

Conclusion 👋

To sum up, today's financial landscape was marked by mixed jobs data that heightened investor anxiety and raised questions about the future trajectory of interest rates. Positive private sector job growth exceeded expectations, leading to concerns that the Federal Reserve might resume rate hikes. Meanwhile, a decrease in job openings indicated a potential easing in the tight job market. Mortgage rates surged to their highest levels in months, driven by strong employment data and indications of continued rate hikes. China launched OpenKylin, its first homegrown open-source operating system, as part of its efforts to reduce reliance on U.S. technology. Market indices experienced declines due to investor concerns, and Bank of America upgraded Sweetgreen stock based on positive operational performance and automation plans. DigitalOcean surged after acquiring Paperspace to expand its AI offerings. The EU launched an antitrust probe into Amazon's acquisition of iRobot, and Ford reported strong second-quarter sales, particularly for its F-Series trucks. Nikola sought shareholder approval for additional stock sales, while Volkswagen announced plans to test autonomous ID Buzz vans in Austin, Texas. Exxon Mobil (XOM) saw its stock drop due to concerns about natural gas prices and reduced margins. Twitter plans to sue Meta (META) over alleged intellectual property misappropriation related to its Threads app. Wedbush Securities predicts Microsoft's (MSFT) valuation could reach $3 trillion, driven by AI integration. Levi Strauss (LEVI) reported a decline in wholesale revenue, while Kura Sushi USA (KRUS) announced its earnings for the fiscal third quarter. Gorilla Technology (GRRR) secured a government contract in Egypt. Overall, sectors experienced decreases, with Energy seeing the largest decline.

Thank you all for signing up!

Will only work to do better for you all going forward. Our only goal is to add value to everyone’s trading with key levels and the ability of learning charts and price action.

Please Share Our Newsletter it will be much appreciated!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of TradingView. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.