Hello, Traders! As the day draws to a close, we are thrilled to welcome you here for an engaging overview of the significant events that have left their impact on the financial markets today.

Federal Reserve Pauses Rate Hikes, Citing Need for Evaluation and Divergence of Opinions 💰💬

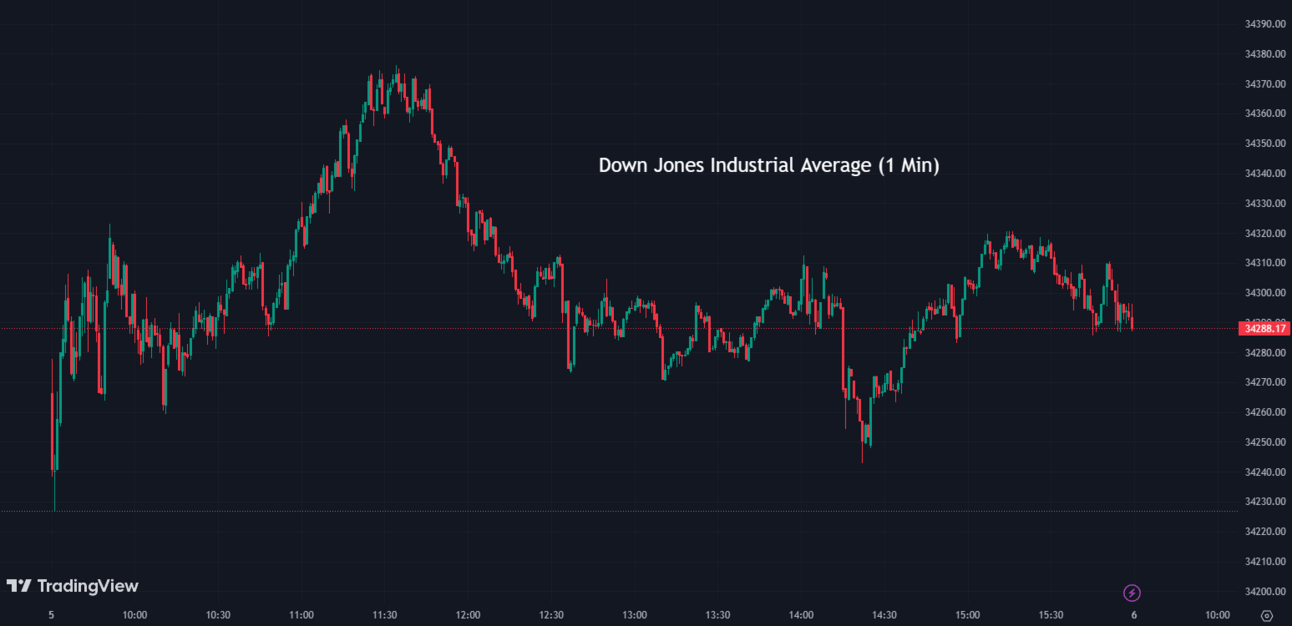

During the Federal Reserve's June meeting, officials elected to halt the process of raising interest rates, taking a moment to evaluate the ramifications of the previous 10 consecutive rate hikes. While most members are expecting future rate hikes, they are projected to occur at a slower rate, reflecting a more cautious approach to monetary policy. Notably, the meeting minutes revealed a divergence of opinions, with a faction advocating for rate increases to curb persistently high inflation. The majority, however, agreed to keep rates steady due to concerns about economic growth and the potential lagged impact of prior policy decisions. The market remained relatively stable, with the Dow Jones Industrial Average only losing about 120 points and Treasury yields rising marginally.

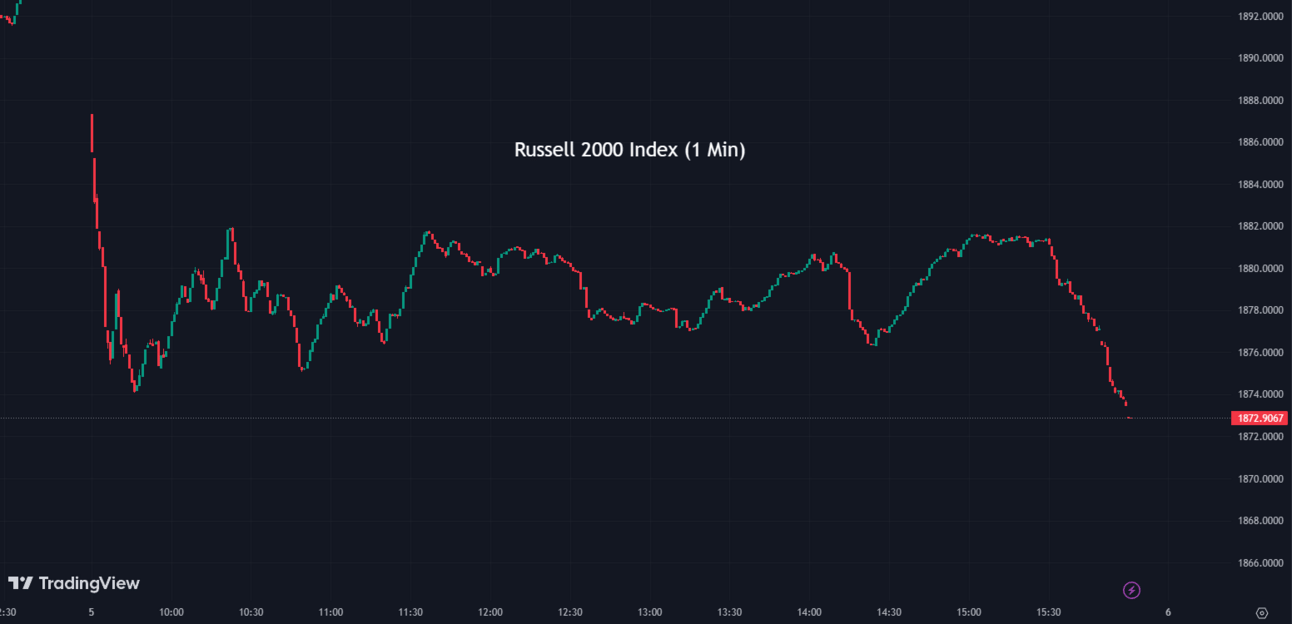

Indexes 📉🔻

The indices concluded the day with declines following the release of data indicating that China's services sector experienced slower-than-anticipated growth. Additionally, the minutes from the Federal Reserve's June meeting were made public.

The S&P 500 (SPX) was down -0.20% coming to a conclusion at 4,446

The Nasdaq Composite (IXIC) fell by -0.18% to settle at 13,791

The Dow Jones Industrial Average (DJI) dropped by -0.38% ending the day at 34,288

The Russell 2000 (RUT) slid by -1.26% to finish at 1,872

The Nasdaq-100 (NDX) declined by -0.03% to conclude at 15,203

Hello, everyone 👋! Just a friendly reminder: we're thrilled to introduce an incredible newsletter exclusively tailored to assist you on your journey toward financial independence. In case you forgot, as a token of our appreciation, we're offering an exclusive limited-time deal that you simply can't pass up. Enjoy an outstanding 20% lifetime discount on your subscription! It's our way of expressing gratitude for your continued support. Please feel free to click the link below to discover the numerous benefits that are waiting for you.

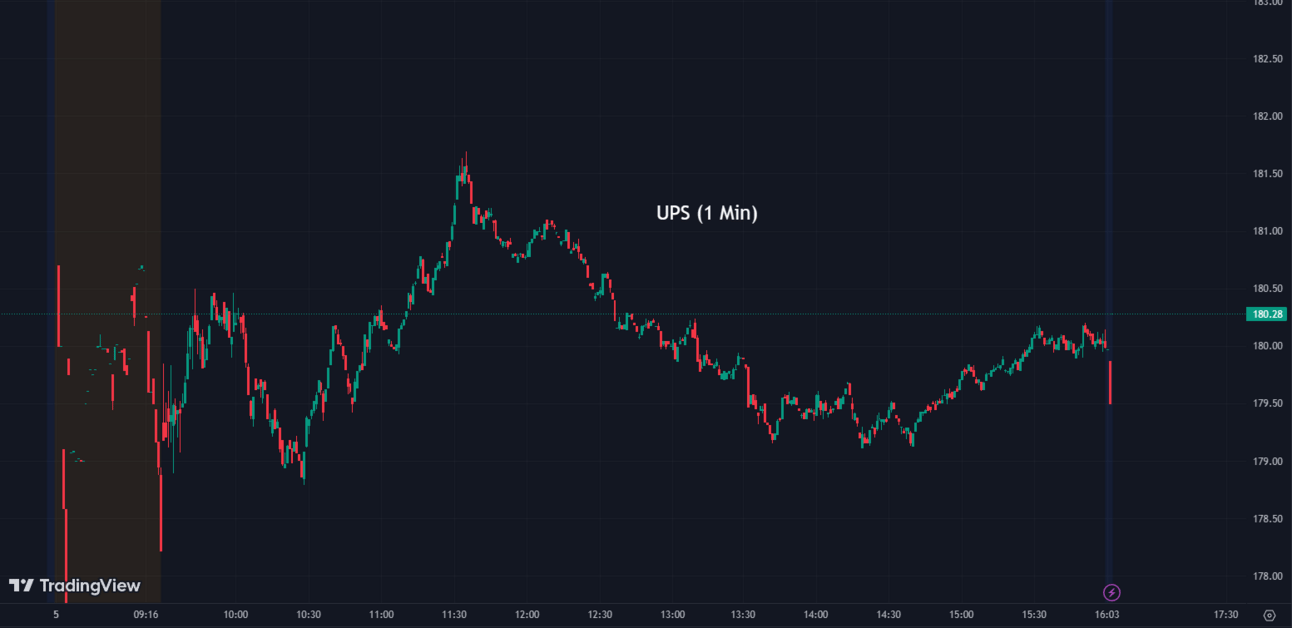

Deadlock in UPS Labor Negotiations Raises Concerns of Potential Strike ⚠️🚚

Negotiations between delivery giant UPS (UPS) and its American workforce have reached a deadlock, leading to fears of the first strike at the firm in over 25 years. Workers, represented by the Teamsters Union, are demanding better pay and better working conditions. Workers say they are due a better contract following the surge in workload during the pandemic. UPS, handling goods worth about 6% of the US economy and delivering over 24 million packages daily worldwide, could significantly disrupt the economy if a strike ensues. Despite reaching a consensus on issues like air conditioning in vans and eliminating two-tier pay systems for part-timers, wage increases remain contentious. As the current contract expires on July 31, UPS workers have authorized a strike if a deal is not reached by then.

UPS:

180.06 ▼ -3.71 (-2.02%) Today

180.00 ▲ +0.03 (+0.017%) After Hours

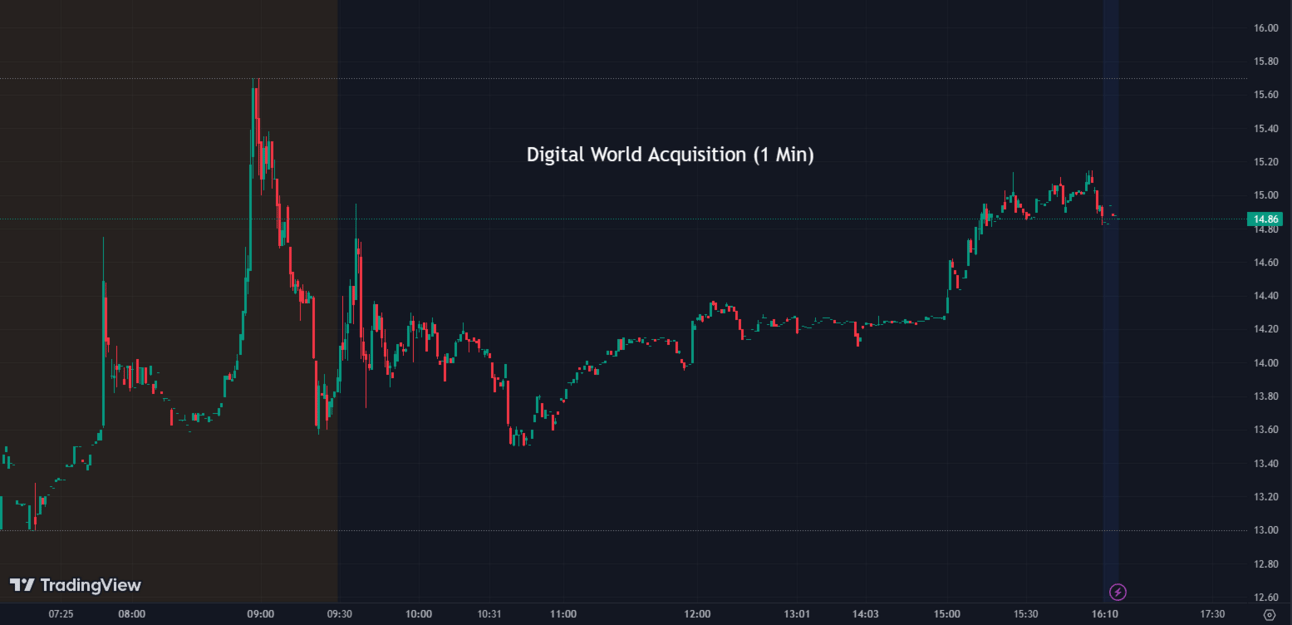

Digital World Acquisition Stock Surges on "Settlement in Principle" with SEC 🚀💼

Digital World Acquisition (DWAC), the special purpose acquisition company (SPAC) merging with former President Trump's media ventures, saw a 17% rally after announcing a "settlement in principle" with the SEC. This follows an SEC investigation into potential violations of anti-fraud laws related to the IPO filings of the proposed deal with Trump's media company, Trump Media & Technology Group, which manages the social platform, Truth Social. If the SEC approves the settlement, DWAC will pay an $18 million civil penalty post the deal's closure, provided necessary revisions to the IPO filings are made.

DWAC:

14.83 ▲ +2.18 (+17.23%) Today

14.90 ▲ +0.072 (+0.48%) After Hours

Apple Loses Appeal in Patent Infringement Case Filed by Optis Cellular Technology ⚖️🍎

Apple (AAPL) has lost an appeal in London's Court of Appeal over alleged patent infringements. In a lawsuit initiated by Optis Cellular Technology LLC in 2019, Apple was accused of overstepping two telecommunications patents used in its devices such as iPhones and iPads. The Court upheld the 2022 High Court ruling that identified the two of Optis' 4G patents as standard-essential and that Apple had infringed upon them. Despite Apple's arguments that the patents weren't essential to 4G standards, the Court dismissed the tech giant's appeal, marking yet another development in this ongoing legal dispute which has prompted six separate trials and several appellate hearings in Britain alone.

AAPL:

191.33 ▼ -1.13 (-0.59%) Today

191.32 ▼ -0.01 (-0.0052%) After Hours

Moderna Forms Partnership with Chinese Officials for mRNA Medicine Development 🧬🤝

Moderna (MRNA) has entered an agreement with Chinese officials to research, develop, and manufacture messenger RNA (mRNA) medicines in China, despite the ongoing geopolitical tensions between the U.S. and China. The Massachusetts-based biotech firm aims to utilize the success of its mRNA-based Covid-19 vaccine, creating medications exclusively for the Chinese market. Although Moderna and other U.S.-based companies have been largely excluded from the Chinese market, this deal signifies the firm's first significant inroad into the country.

MRNA:

123.54 ▲ +1.81 (+1.49%) Today

123.72 ▲ +0.18 (+0.15%) After Hours

GM Reports Increase in Q2 U.S. Vehicle Sales, Shows Growth in Electric Vehicle Segment 📈🚗

General Motors (GM) reported an 18.8% increase in U.S. vehicle sales in Q2 2023 compared to the previous year. The automaker sold 691,978 new vehicles from April through June, reflecting steady demand for new vehicles amidst improving inventory levels, which were previously impacted by the Covid-19 pandemic and supply chain issues. Despite criticisms for a relatively slow ramp-up in EV production, GM managed to sell over 36,300 electric vehicles during the first half of this year, accounting for 2.8% of the company’s total sales.

GM:

39.41 ▲ +0.45 (+1.16%) Today

39.50 ▲ +0.08 (+0.20%) After Hours

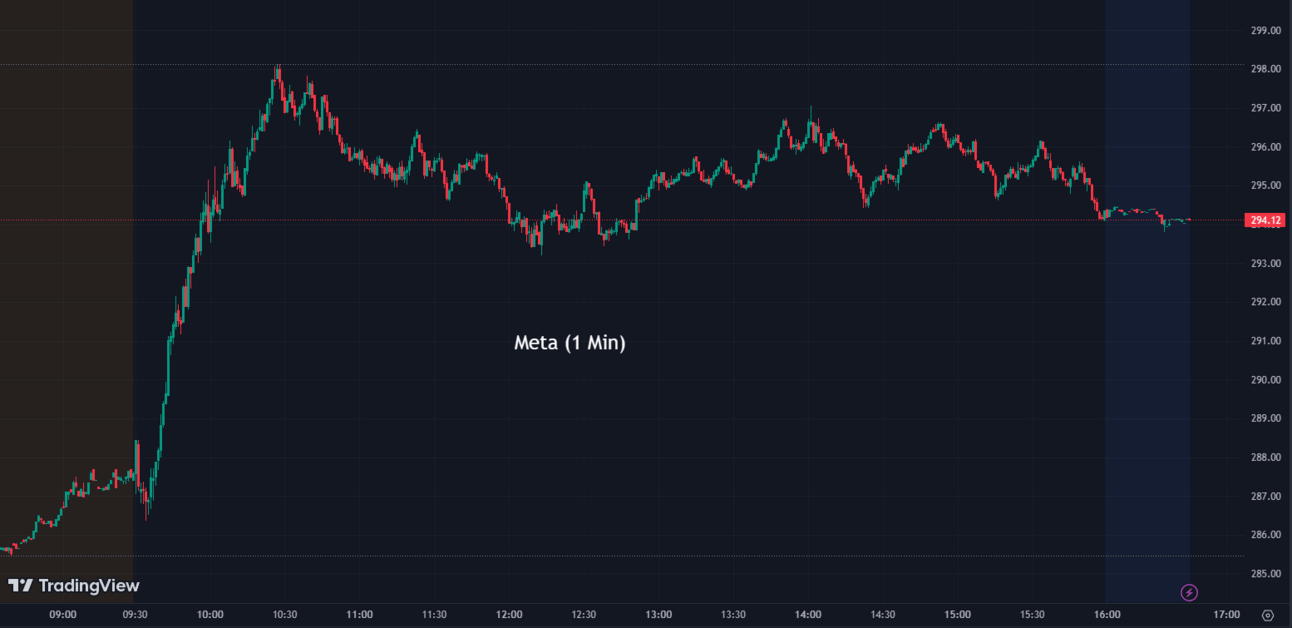

Meta CEO Faces Criticism in China over Quest Sales, Launches Threads as Twitter Competitor 💼📱

Meta (META) CEO Mark Zuckerberg has been accused by Chinese state media of essentially "shooting himself in the foot" regarding his efforts to sell Quest headsets in mainland China. This criticism follows reports that Meta was exploring sales opportunities in China, despite Zuckerberg's past public denouncements of China's industrial espionage efforts. The CEO's open criticism of China's cyber-espionage activities in his 2020 congressional testimony stood out among his tech counterparts and appears to have created challenges for Meta's expansion in the Chinese market.

Additionally, Meta Platforms lost its fight against a German data curb order that strikes at the heart of its business model as Europe’s top court backed the German antitrust watchdog’s power to also investigate privacy breaches. The case started in 2019 when Meta, owner of Facebook, Instagram, and WhatsApp, was ordered by the German cartel office to stop harvesting user data without consent, deeming it an abuse of market power. The latest ruling potentially offers more flexibility for antitrust authorities in Big Tech investigations. Notably, the verdict also obligates competition regulators to consider any decisions or investigations by the competent supervisory authority related to data regulation. Despite the victory, some legal experts remain cautious about the extent to which antitrust authorities will delve into privacy law details.

In more news, Meta, has launched Threads, its innovative answer to Twitter. The new social platform, currently available for pre-order on the iOS App Store and also partially previewed via a web version leak, is aimed at promoting in-depth discussions and fostering communities. Interestingly, Threads leverages Instagram as its foundation rather than Facebook, a strategic decision considering Instagram's popularity and growth among younger demographics.

META:

39.41 ▲ +0.45 (+1.16%) Today

39.50 ▲ +0.08 (+0.20%) After Hours

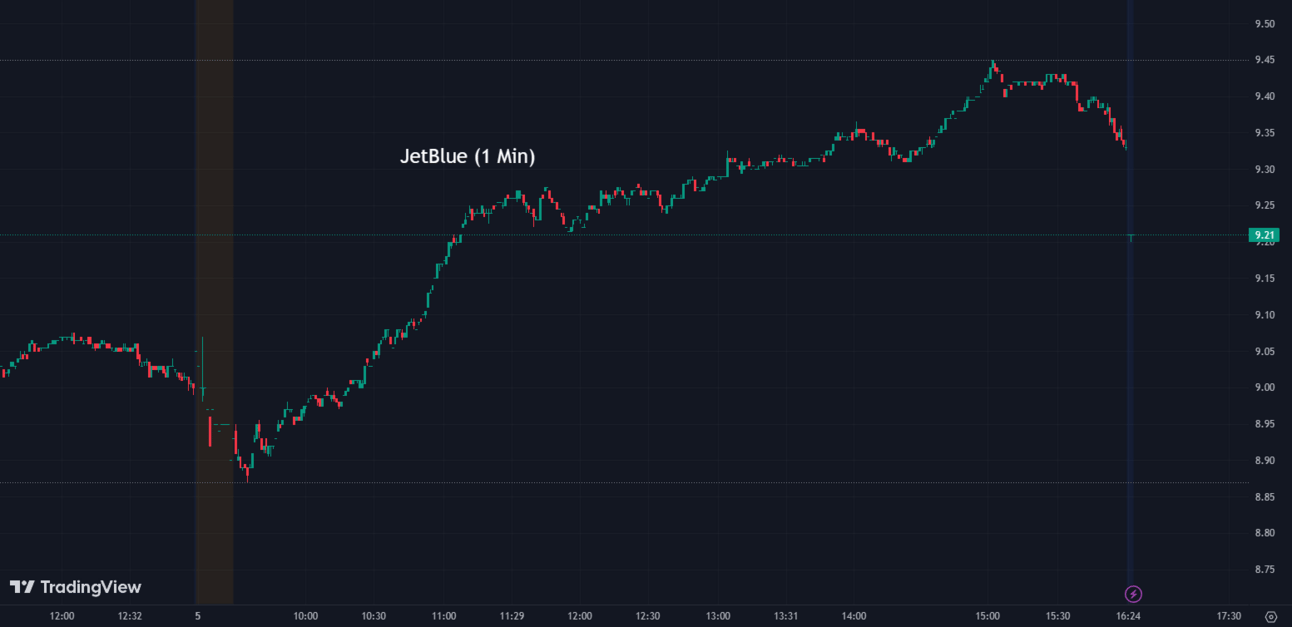

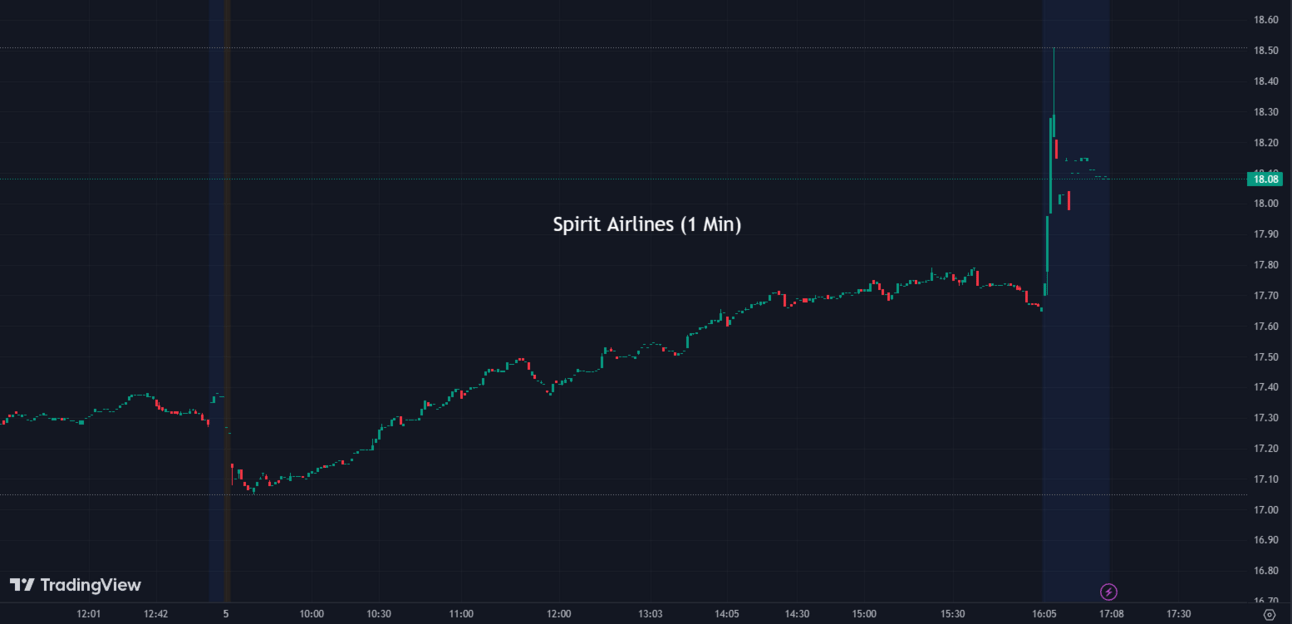

JetBlue to Terminate Northeast Alliance Partnership with American Airlines Following Anti-Competitive Ruling; Focus Shifts to Spirit Airlines Acquisition ✈️💼

JetBlue Airways (JBLU) announced that it will terminate its Northeast Alliance partnership with American Airlines (AAL) in the northeastern U.S. following a federal court ruling that deemed the agreement anti-competitive. Despite American Airlines' intention to appeal this decision, JetBlue will refocus on its acquisition of budget carrier Spirit Airlines (SAVE), a transaction previously contested by the Justice Department for antitrust concerns. As JetBlue initiates the termination process, a future appeal victory by American Airlines may not salvage the partnership. JetBlue's purchase of Spirit, concluded in July 2022 after outbidding Frontier Airlines, seeks to strengthen its position against larger domestic airlines by gaining access to more aircraft and pilot resources. However, this merger faces opposition from the Biden administration and a lawsuit from the Justice Department concerned about decreased competition and higher fares for travelers.

JBLU:

9.33 ▲ +0.33 (+3.67%) Today

9.25 ▼ -0.08 (-0.86%) After Hours

AAL:

18.32 ▲ +0.22 (+1.22%) Today

18.26 ▼ -0.06 (-0.33%) After Hours

SAVE:

17.66 ▲ +0.39 (+2.26%) Today

18.07 ▲ +0.41 (+2.32%) After Hours

Goldman Sachs Upgrades Netflix to "Neutral" on Improved Operational Performance and Content Creation Momentum 📺💪

Netflix's (NFLX) recent operational performance led to an upgrade from "Sell" to "Neutral" by Goldman Sachs' equity research team. The streaming giant's successful crackdown on password sharing and regained content creation momentum contributed to its favorable standing. Despite robust competition from global media companies like Amazon's Prime Video and Disney+, Goldman Sachs expects Netflix to surpass street expectations in its Q2 2023 results due to be released on July 19. However, they caution that increased content spending and high-quality offerings from competitors may challenge Netflix's growth and pricing power in the future.

NFLX:

445.90 ▲ +4.46 (+1.01%) Today

445.46 ▼ -0.44 (-0.099%) After Hours

Samsung Biologics and Pfizer Sign $897 Million Agreements for Long-Term Biosimilar Manufacturing 🧪🔬

South Korean contract development and manufacturing organization Samsung Biologics (XKRX: 207940) and pharmaceutical giant Pfizer (PFE) have signed two major agreements for the long-term manufacturing of Pfizer's biosimilar portfolio. The agreements, worth $897 million, mark Samsung Biologics' most significant single contract since its foundation in 2011. Combined with a $183 million deal signed in March, the total value of Samsung Biologics-Pfizer deals this year reaches an impressive $1.08 billion. As per the agreements, Samsung Biologics will utilize its newest Plant 4 and the upcoming Plant 5 to provide Pfizer with large-scale manufacturing capacity. The deal signifies a notable boost in their strategic collaboration and is expected to run through 2029.

PFE:

36.45 ▼ -0.20 (-0.55%) Today

36.44 ▼ -0.025 (-0.069%) After Hours

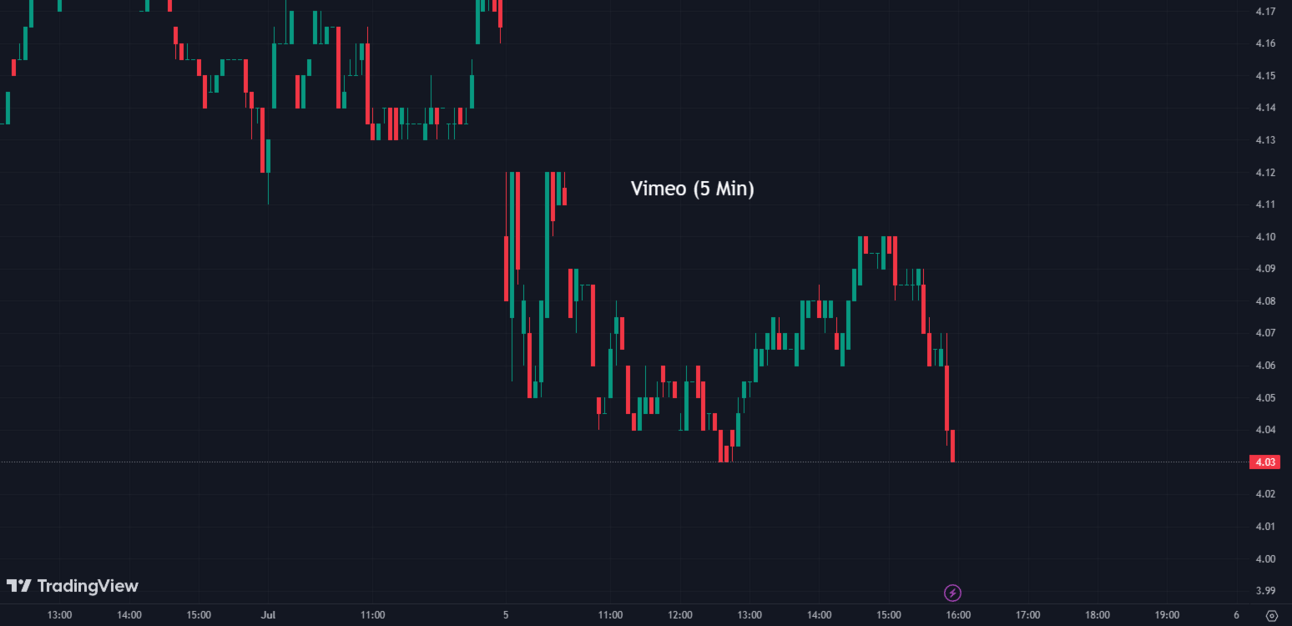

Vimeo CEO Anjali Sud to Depart 👩💼👋

Vimeo Inc. (VMEO) announced that its Chief Executive Officer, Anjali Sud, will be leaving the company at the end of August to pursue a new opportunity. Adam Gross, a board member, will take over as the interim CEO starting September 1 while Vimeo searches for a permanent replacement. Gross expressed his intention to accelerate and streamline the company's strategy to make video a crucial part of business communication. Despite the leadership change, Vimeo confirmed that it is maintaining its sales and adjusted EBITDA outlook for the second quarter and full year.

VMEO:

4.03 ▼ -0.13 (-3.12%) Today

The stock price remained unchanged during after-hours

Analysis Suggests OpenAI's ChatGPT and Microsoft Bing Downloads Slowing, No Serious Challenge to Google's Search Engine Dominance 🔍📉

Despite the hype surrounding artificial intelligence, OpenAI’s language model, ChatGPT, is not currently posing a serious challenge to Google's (GOOGL) dominance as a search engine leader, according to an analysis from Bank of America Securities. The analysts cite recent Sensor Tower data indicating that app downloads for ChatGPT and Microsoft Bing (MSFT) have slowed significantly in recent weeks, with ChatGPT downloads on iPhones in the U.S. experiencing a 38% drop month over month in June. This slowing pace suggests that while technology giants like Google and Microsoft have invested heavily in AI, they may need to explore other applications for these language models beyond disrupting search engine markets. Nevertheless, the ChatGPT app, released in May and currently only available for iPhones, could see increased adoption following a proposed Android version release.

GOOGL:

121.75 ▲ +1.85 (+1.54%) Today

121.78 ▲ +0.03 (+0.025%) After Hours

MSFT:

338.15 ▲ +0.16 (+0.047%) Today

337.90 ▼ -0.25 (-0.074%) After Hours

After Hour Movers 🌙🛌

Mullen Automotive (MULN), led by CEO David Michery, is preparing to begin production of its Class 3 electric vehicle (EV) this month. Michery provided guidance for vehicle production in 2023 and 2024, with plans for 660 Class 1 vehicles and 930 Class 3 vehicles in 2023, and 368 Class 1 one-seaters, 11,000 Class 1 two-seaters, and 3,000 Class 3 vehicles in 2024. The company's facility in Tunica, Mississippi, has undergone upgrades and preparations for production, and Mullen has partnered with NRTC Integration for assistance. Deliveries are expected to commence in August and September, potentially leading to positive revenue in the quarter ending September 30. Mullen has received $279 million in purchase orders from Randy Marion Automotive Group (RMA) for its Class 1 and 3 vehicles, with initial revenues anticipated in August.

MULN:

0.17 ▲ +0.07 (+69.38%) Today

0.18 ▲ +0.013 (+7.49%) After Hours

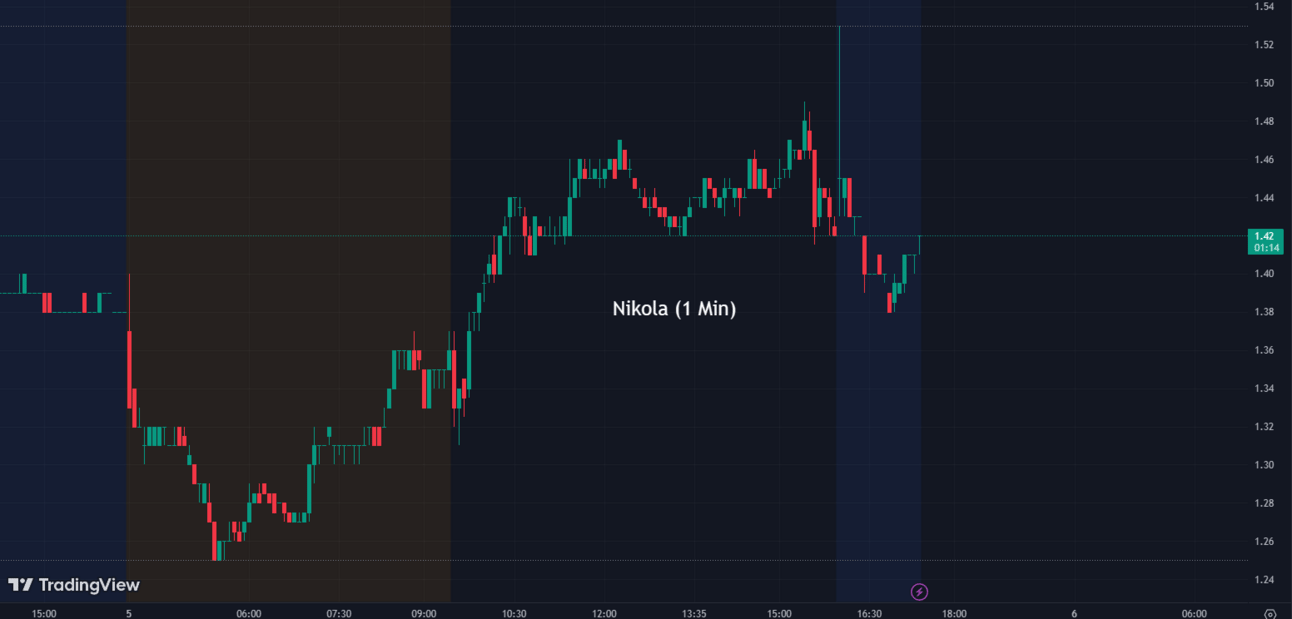

Nikola (NKLA), a manufacturer of heavy-duty commercial battery-electric and fuel-cell electric vehicles, has been awarded a $41.9 million grant from the California Transportation Commission. The grant will be used to build six heavy-duty hydrogen refueling stations in Southern California. Nikola will partner with the state's transportation department to deploy these stations, aligning with California's zero-emission vehicle strategy. The deployment of hydrogen refueling infrastructure is crucial for Nikola's upcoming launch of hydrogen fuel cell electric trucks in July. The grant is expected to support Nikola's efforts to promote clean and sustainable transportation solutions.

NKLA:

1.43 ▲ +0.06 (+4.38%) Today

1.42 ▼ -0.011 (-0.76%) After Hours

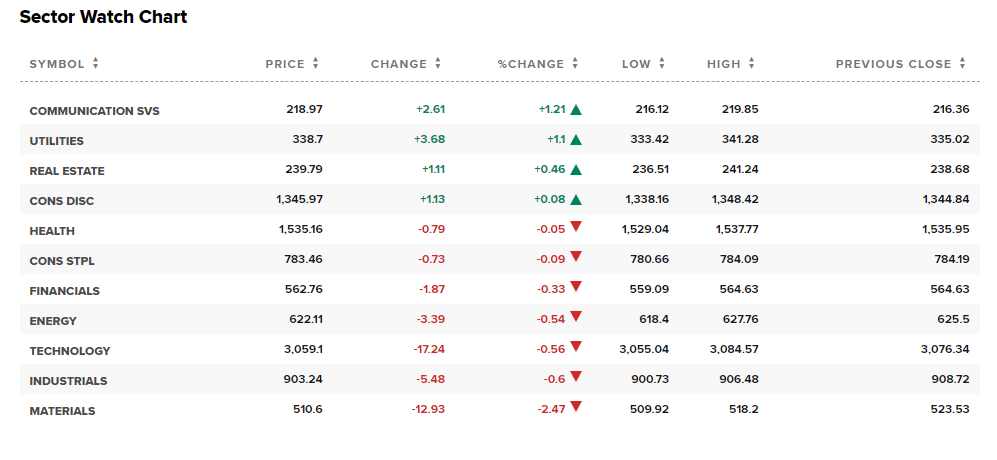

Sectors 📞🧱

Out of the 11 sectors, 4 closed in positive territory today, with Communication Services leading the way with a gain of +1.21%, while Materials saw a decline of -2.47%.

Conclusion 👋

To bring this to a close, today's financial markets were influenced by various significant events. The Federal Reserve's release of the meeting minutes from June, signaling a pause in rate hikes and reflecting a more cautious approach to monetary policy, took into account concerns about economic growth and divergent views on inflation. The market indices experienced declines, attributed to slower-than-expected growth in China's services sector and the release of the Federal Reserve meeting minutes. Additionally, there is mounting apprehension regarding a potential strike at UPS, which could have a significant impact on the economy. On a positive note, Digital World Acquisition's stock experienced a surge after reaching a "settlement in principle" with the SEC, while Moderna forged a partnership with Chinese officials for mRNA medicine development. Apple lost an appeal in a patent infringement case, and General Motors reported growth in both overall vehicle sales and electric vehicle sales. Meta CEO Mark Zuckerberg faced criticism in China, and the company launched Threads as a competitor to Twitter. JetBlue announced the termination of its partnership with American Airlines and shifted its focus to the acquisition of Spirit Airlines. Netflix received an upgrade from Goldman Sachs, owing to improved operational performance and momentum in content creation.

Thank you all for signing up!

Will only work to do better for you all going forward. Our only goal is to add value to everyone’s trading with key levels and the ability of learning charts and price action.

Please Share Our Newsletter it will be much appreciated!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of TradingView. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.