Hello, traders! As the day winds down, we're delighted to have you here for a captivating rundown of the key happenings that have made their mark on the financial markets today.

US Manufacturing Contracts 🏭📉

US manufacturing has been on a downward trend, reaching the weakest level in more than 3 years. This is marked by the decline of several key indicators - production, employment, and input prices. The manufacturing gauge slipped from 46.9 to 46, falling below the critical 50 mark. The decline in the ISM production gauge, which also fell to its lowest level in 3 years, suggests demand for merchandise remains weak. High inflation and a shift in consumer spending from merchandise to services are also contributing to this downturn. Industries such as plastics and rubber products, wood products, and textile mills were among the hardest hit. The report highlighted that factory inventories and customer stockpiles were at their lowest since 2014.

China Imposes Export Restrictions on Key Metals 🔒🔧

In a move seen as retaliation against U.S. restrictions on high-end chip sales to China, China announced restrictions on the export of gallium and germanium, metals crucial to semiconductors, 5G base stations, and solar panels. Both nations are competing for technological dominance, with the U.S. aiming to hinder China's advancements in areas deemed critical to national security. Consequently, the U.S. has urged its allies to adopt similar measures. Beijing argues these measures aim to curb China's economic growth, responding with countermeasures like blacklisting Lockheed Martin and an arm of Raytheon Technologies, and prohibiting critical information-infrastructure firms from utilizing products from U.S. semiconductor manufacturer, Micron Technology. The restrictions, to be effective from August 1st, will require exporters to apply for licenses and report buyer details to the Ministry of Commerce. As China dominates the production and refining of these metals, this measure could severely impact the semiconductor industry and further exacerbate the ongoing tech trade war.

Indexes 📈🔝

The indices experienced a slight increase today during a shortened trading session preceding the July 4th holiday. Now, let's explore how the market performed today...

The S&P 500 (SPX) was up +0.12% coming to a conclusion at 4,455

The Nasdaq Composite (IXIC) escalated by +0.21% to settle at 13,816

The Dow Jones Industrial Average (DJI) increased by +0.03% ending the day at 34,418

The Russell 2000 (RUT) rose +0.43% to finish at 1,896

The Nasdaq-100 (NDX) climbed +0.19% to conclude at 15,208

Hello, everyone👋! Just in case you didn't catch it, we're thrilled to introduce an incredible newsletter specifically crafted to assist you in your quest for financial independence. But wait, there's more! As a token of our appreciation, we're offering an exclusive limited-time deal that you simply can't pass up. Enjoy an outstanding 20% lifetime discount on your subscription! It's our way of expressing gratitude for your continued support. Click the link below to uncover the multitude of advantages that await you.

Bank of America Seeks Clarification on Stress Test Results Amid Variances with Federal Reserve 🔎❓

Bank of America (BAC) is seeking clarification from the Federal Reserve concerning differing results between the central bank's stress test and the bank's own under the Dodd-Frank Act. While the central bank's stress test outcomes showed that banks, including Bank of America, could survive a severe economic slump, enabling them to issue share buybacks and dividends, Bank of America is keen to understand the variances in a category named "other comprehensive income" over a nine-quarter period. Bank of America’s own analysis suggested a more negative result compared to the Fed's test, creating some uncertainty, but the hope remains that the bank's results will meet key regulatory requirements. Interestingly, while competitors like JPMorgan Chase (JPM), Wells Fargo (WFC), Goldman Sachs (GS), and Morgan Stanley (MS) have already increased their dividends, Bank of America has made no announcements regarding dividends or share repurchases following the stress test results.

BAC:

29.18 ▲ +0.49 (+1.73%) Today

29.18 ▼ -0.02 (-0.07%) After Hours

Cboe's Collaboration with Coinbase Boosts Shares, Aims to Launch Bitcoin ETF 💪💰

Coinbase's (COIN) share value rose by 11% on news that Cboe Global Markets plans to collaborate with the crypto firm on its endeavor to launch a bitcoin exchange-traded fund. The exchange operator has refiled an application with the U.S. Securities and Exchange Commission (SEC), naming Coinbase as the platform that would assist in detecting manipulation within the ETF. Despite the SEC's previous rejection of several spot bitcoin ETF applications due to concerns of failing to meet fraud and investor protection standards, the announcement has positively affected Coinbase, causing its shares to close 11.7% higher at $79.93. The ETF industry continues to explore ways to address the SEC's concerns, as the development of such a product could significantly impact the market.

COIN:

79.93 ▲ +8.38 (+11.71%) Today

80.63 ▲ +0.13 (+0.16%) After Hours

Monster Beverage to Acquire Bankrupt Bang Energy 💼🤝

Monster Beverage (MNST) is set to acquire bankrupt beverage maker Bang Energy for $362 million, subject to bankruptcy court and regulator approval. The deal includes Bang’s assets and its production facility in Phoenix. The purchase comes as Monster, a prominent player in the energy drink sector, grapples with increasing competition and the effects of consumer inflation. Should the transaction clear the review of the Federal Trade Commission, it will solidify Monster's considerable market share while potentially offering a wider product range to consumers.

MNST:

56.95 ▼ -0.49 (-0.85%) Today

57.21 ▲ +0.26 (+0.46%) After Hours

Tesla Surges on Strong Q2 Performance and Exceeding Delivery Expectations 🚀📈

Tesla's stock (TSLA) enjoyed a considerable surge, rising more than 7% in the wake of strong Q2 performance. Deliveries and production numbers exceeded expectations, with the automaker reporting global production of 479,700 units, with deliveries of 466,140 vehicles against an anticipated 445,925. This success can be attributed to various factors, including incentives and discounts offered to buyers, and a substantial $7,500 federal tax credit offered under the U.S. Inflation Reduction Act. It's a significant turnaround for the company, which is recovering from a challenging performance in 2022, where shares plummeted but have since rebounded significantly.

TSLA:

279.82 ▲ +18.05 (+6.90%) Today

278.75 ▲ +0.24 (+0.09%) After Hours

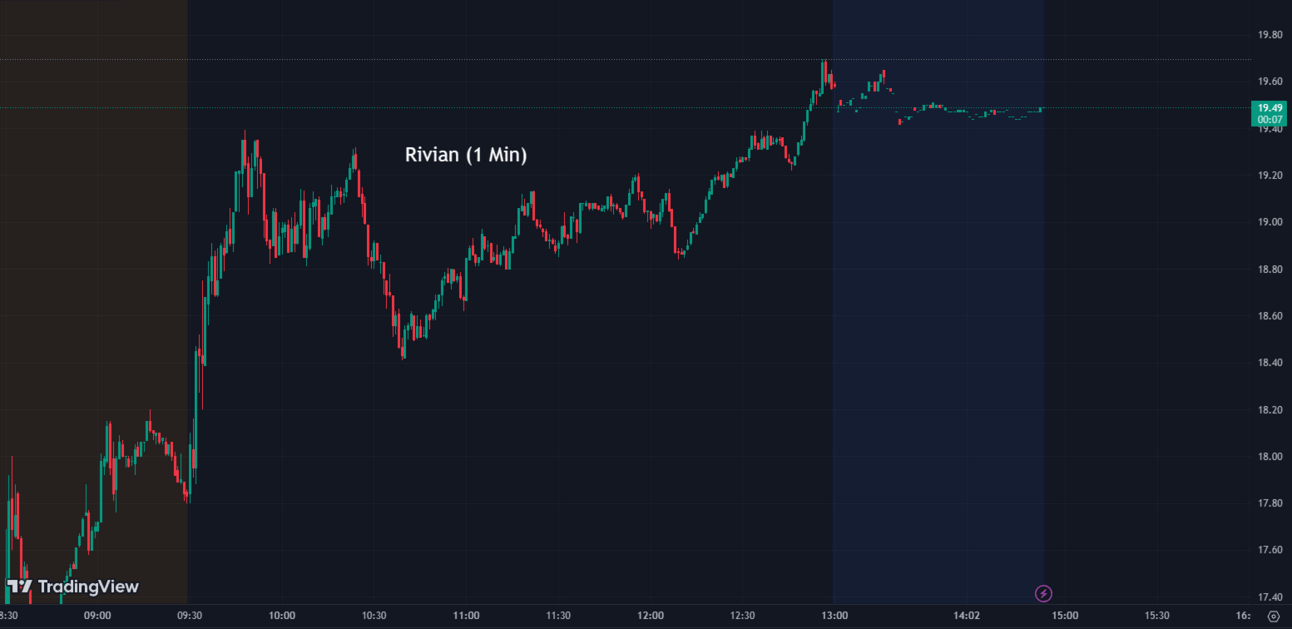

Rivian Surges on Exceeding Q2 Delivery Expectations and Reaffirming Annual Production Goal 💯👏

Rivian Automotive (RIVN) also celebrated a noteworthy jump in shares, soaring 17.4% after outperforming Wall Street's quarterly delivery expectations. The electric vehicle manufacturer reported 12,640 vehicle deliveries for Q2, a 59% increment from the preceding quarter, and well beyond the projected 11,000 vehicles. Notably, the company reasserted its annual production goal of 50,000 units. Rivian produced approximately 23,400 vehicles through Q2, including electric delivery vans and consumer models. The better-than-expected delivery results not only led to increased optimism for Rivian but also influenced other struggling EV startups, like Lucid (LCID) and Canoo (GOEV), which experienced an uptick in share prices.

RIVN:

19.56 ▲ +2.90 (+17.41%) Today

19.63 ▲ +0.07 (+0.36%) After Hours

LCID:

7.39 ▲ +0.50 (+7.26%) Today

7.33 ▼ -0.06 (-0.81%) After Hours

GOEV:

0.54 ▲ +0.061 (+12.64%) Today

0.5374 ▼ -0.0026 (-0.48%) After Hours

Chinese EV Stocks Surge on Positive Sentiment and Strong June Delivery Numbers 🔋🚗

Chinese electric vehicle (EV) manufacturers experienced significant stock surges thanks to positive sentiment in the sector and robust vehicle delivery numbers for June. Companies like Li Auto (LI), and Nio (NIO), saw their stocks increase, propelled further by Tesla's (TSLA) record quarterly deliveries. The recent uptick in Chinese deliveries comes after several months of sluggish sales and also reflects the escalated competition in the market due to a price war earlier this year. The industry's revival could hint at a stronger, more competitive Chinese EV market that might influence global EV trends.

LI:

36.30 ▲ +1.20 (+3.42%) Today

36.50 ▲ +0.20 (+0.55%) After Hours

NIO:

10.03 ▲ +0.34 (+3.46%) Today

9.99 ▼ -0.04 (-0.40%) After Hours

XPeng Experiences Quarter-on-Quarter Delivery Growth, Surpassing Forecasts 💥📊

Chinese electric vehicle maker, XPeng (XPEV), reported a 27% quarter-on-quarter rise in vehicle deliveries for the second quarter of 2023, surpassing its forecast of 21,000 to 22,000 units, with a total of 23,205 cars delivered. Despite this achievement, the delivery number was still lower than the 34,422 cars delivered in Q2 of the previous year. This increase marks a return to growth for XPeng after several quarters of declining deliveries due to challenging macroeconomic conditions in China and intense competition from other domestic EV manufacturers, as well as Tesla. However, XPeng has responded to these challenges, launching its new G6 Ultra Smart Coupe SUV at the end of Q2, with the company expecting this to boost sales in the coming quarters.

XPEV:

13.98 ▲ +0.56 (+4.17%) Today

13.90 ▼ -0.08 (-0.57%) After Hours

BYD Expands Lithium Processing Operations in Chile, Achieves Record Sales in Q2 ⚡️🌟

BYD (BYDDY), a Chinese electric vehicle (EV) juggernaut, is undertaking a strategic project to process lithium in Chile, which is known to house the world's largest lithium reserves. This initiative marks a significant move as most of BYD's processing operations are concentrated in China. With this endeavor, BYD plans to construct a $290 million lithium cathode factory in northern Chile, set to commence production of lithium iron phosphate for cathodes by 2025 end. In April, the Chilean government granted BYD preferential prices for lithium carbonate owing to the company's commitment to build the plant. The project comes at a time when the Chilean government is adopting a new model for lithium extraction, which includes state participation and encourages downstream investments. BYD has expressed its readiness to collaborate with Chilean authorities, even offering its technology to the government.

On the sales front, BYD has experienced a significant surge. Between April and June, the company sold over 700,000 vehicles, nearly doubling the number sold in the same quarter of the previous year, and marking a new quarterly record. While it currently trails Tesla in terms of global pure EV sales, BYD has made significant strides in China, rapidly emerging as the top EV brand. In June alone, the company, backed by Warren Buffet, sold 253,046 new energy vehicles (NEVs), marking an 89% increase year-on-year, and setting a record for the best monthly sales ever. NEVs encompass both battery-powered EVs and plug-in hybrids. This trend indicates a promising future for BYD in the domestic and potentially the global EV market.

BYDDY:

66.12 ▲ +1.97 (+3.07%) Today

There is no change in the stock price after hours

Stellantis Reports Moderate Sales Growth in Q2, Fueled by Strong Performance of Key Models 💪💼

Stellantis (STLA) saw a 6.4% year-over-year increase in second-quarter U.S. new vehicle sales, driven by robust performance from its Chrysler Pacifica minivan, Jeep Compass, and Dodge Durango SUVs. However, this sales growth was lower than industry expectations, with forecasters predicting a 16% to 18% rise for the overall auto industry. Despite this, the increase in sales signals a strong demand for new vehicles, as stock levels recuperate from the severe shortages experienced during the COVID-19 pandemic. Sales of the Durango, Pacifica, and Compass increased significantly, up by over 300%, 40%, and 28%, compared to subdued results from the second quarter of 2022. Stellantis reported total Q2 sales of 434,648 vehicles, an increase from 408,521 a year earlier. Despite these gains, Stellantis' sales increase lagged behind other automakers, such as Honda and Nissan, who reported Q2 sales increases of approximately 45% and 33%.

STLA:

17.82 ▲ +0.28 (+1.57%) Today

17.76 ▼ -0.05 (-0.28%) After Hours

Apple Adjusts Vision Pro Headset Production Targets Due to Design Challenges 🍎👓

Apple (AAPL) is cutting its production targets for the Vision Pro headset due to challenges associated with the gadget's complex design. The company now aims to produce fewer than 400,000 units of the $3,499 headset in 2024, a significant reduction from its previous target of 1 million units within the first year of production. Design complexities involve the creation of high-resolution inward displays while projecting the wearer’s eyes to the outside world. This reduction, however, doesn't hamper Apple's vision for the device as a step towards mainstreaming mixed-reality technology.

AAPL:

192.46 ▼ -1.51 (-0.78%) Today

192.39 ▼ -0.03 (-0.02%) After Hours

Sectors 🛍️🩺

Out of the 11 sectors, 9 closed in positive territory today, with Consumer Discretionary leading the way with a gain of +1.07%, while Health saw a decline of -0.82%.

Conclusion 👋

To wrap it up, the US manufacturing sector is experiencing a downward trend, with various indicators showing weakness, including production, employment, and input prices. China has imposed export restrictions on key metals in response to US restrictions on high-end chip sales, intensifying the ongoing tech trade war between the two nations. Meanwhile, the stock market showed slight gains across various indices, and Bank of America seeks clarification on stress test results. In the automotive industry, Tesla and Rivian reported strong Q2 performance, while Chinese EV manufacturers like Li Auto and Nio saw stock surges. BYD expanded its lithium processing operations in Chile and achieved record sales in Q2. Stellantis reported moderate sales growth in Q2, driven by key models, and Apple adjusted production targets for the Vision Pro headset due to design challenges. Hope you all have a good July 4th!

Thank you all for signing up!

Will only work to do better for you all going forward. Our only goal is to add value to everyone’s trading with key levels and the ability of learning charts and price action.

Please Share Our Newsletter it will be much appreciated!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of TradingView. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.