Hey, traders! As we approach the end of the week, let's take a breather and dive into the exciting events that unfolded today!

Inflation Shows Signs of Cooling as Core PCE Index Increases by 0.2% in June, Marking Lowest Annual Rate Since September 2021 🔽🌡️

In June, signs of inflation cooling were apparent as the Federal Reserve's closely followed personal consumption expenditures price index (excluding food and energy) increased by only 0.2% from the previous month. This rise was consistent with the Dow Jones estimate, according to the Commerce Department. Year on year, core PCE increased by 4.1%, marking the lowest annual rate since September 2021 and a decrease from the 4.6% rate observed in May. Additionally, the headline PCE inflation, including food and energy costs, also increased 0.2% on the month, yielding an annual rise of 3%, the lowest since March 2021. As consumer spending continued to rise by 0.5% on the month, goods prices decreased by 0.1% while services costs increased by 0.3%. Meanwhile, personal income grew slightly slower than expected, at 0.3%. The employment cost index, another Fed measure, rose 1% during the second quarter, slightly less than the anticipated 1.1%. These numbers reinforce the belief that inflation pressures are easing, potentially allowing the Fed to pause future interest rate increases. This data arrives shortly after the Fed's decision to raise interest rates by a quarter percentage point, leading to the central bank's key borrowing rate reaching a range of 5.25%-5.5%, the highest in more than 22 years.

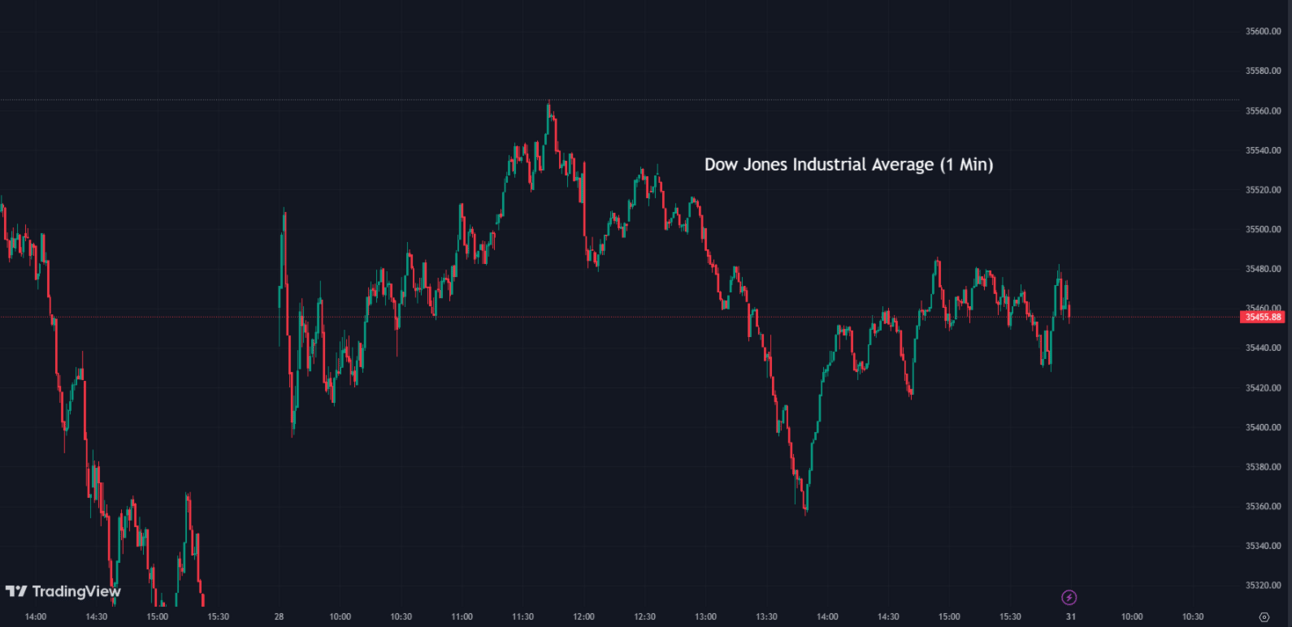

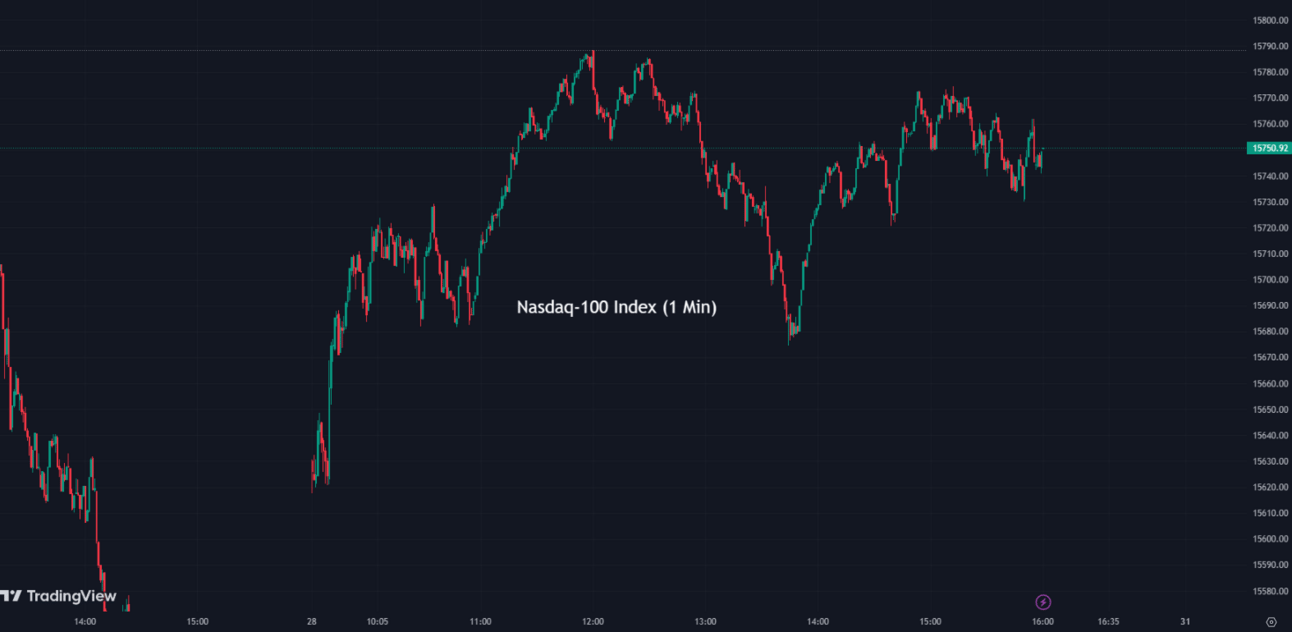

Indexes 📈💲

The Dow Jones Industrial Average and S&P 500 experienced gains, securing their third consecutive winning weeks. This upswing occurred alongside a closely monitored inflation measure, which registered its lowest reading in nearly two years, garnering the attention of the Federal Reserve. Now, let's explore how the market performed today...

The S&P 500 (SPX) was up +0.99% coming to a conclusion at 4,582

The Nasdaq Composite (IXIC) fell by -0.55% to settle at 14,050

The Dow Jones Industrial Average (DJI) climbed +0.50% to finish at 35,459

The Russell 2000 (RUT) increased by +1.36% ending the day at 1,981

The Nasdaq-100 (NDX) rose +1.85% to conclude at 15,750

Hello, everyone! 👋 We wanted to once again remind you about our exciting news. We are pleased to present a remarkable newsletter that has been specially curated to help you navigate the world of finance. As a way of expressing our gratitude for your ongoing support, we would like to offer you a special discount. You can now take advantage of an exceptional 20% lifetime discount on your subscription. Feel free to explore the countless benefits that await you by clicking the link below. Thank you for being a valued part of our community.

Ford Plans to Introduce New Hybrid Models Amid Surprising Popularity of F-150 Hybrid 🚗🔋

Ford Motor (F) is planning to introduce a series of new hybrid models, contrary to the industry's prevalent focus on all-electric vehicles. CEO Jim Farley stated that the company has been pleasantly surprised by the popularity of its hybrid systems, particularly for the F-150 pickup. He further noted that 10% of F-150 customers and 56% of Maverick pickup buyers are choosing the hybrid models. The company is not turning away from its electric vehicle (EV) endeavors, but sees hybrid systems as an efficient, desirable intermediate option for many consumers. Hybrid models also offer additional benefits such as Ford's "Pro Power Onboard" system, allowing users to utilize the truck's battery power for external appliances and tools. Despite billions being spent on EV production, Farley suggested the adoption rate for EVs is slower than anticipated, thereby emphasizing the importance of hybrids in Ford's lineup.

F:

13.25 ▼ -0.48 (-3.50%) Today

13.22 ▼ -0.04 (-0.30%) After Hours

Microsoft Emphasizes GPUs' Importance in Meeting AI Demand in Annual Report 💻📈

Microsoft (MSFT) has highlighted the significance of graphics processing units (GPUs) in its recently released annual report, underscoring their vital role in meeting the increasing demand for cloud-based artificial intelligence services. The software giant acknowledged that GPUs, along with the availability of permitted and buildable land, predictable energy, and servers, are essential to their data centers. The attention on GPUs reflects a growing demand for the hardware required to deliver artificial intelligence capabilities to smaller businesses. This shift has had a positive impact on GPU manufacturers such as Nvidia and AMD. Moreover, Microsoft has increased its capital expenditures to accommodate the rising need for data centers, CPUs, networking hardware, and GPUs.

MSFT:

338.37 ▲ +7.65 (+2.31%) Today

337.99 ▼ -0.38 (-0.11%) After Hours

Meta Revamps Horizon Worlds VR App with More Video Games, Introduces In-House Studio Ouro Interactive for First-Party Game Development 🏢🎮

Meta (META) is overhauling its Horizon Worlds virtual reality (VR) app to include more video games, with an aim to attract a larger audience. Meta has established an in-house studio, Ouro Interactive, that is focused on developing first-party VR games for Horizon Worlds. The studio's first VR game, Super Rumble, offers improved graphics and complexity compared to other games on the platform. Meta plans to introduce more games as it revamps Horizon Worlds, making it more compelling to users. The company's Reality Labs unit has reportedly lost over $21 billion since the start of 2022, indicating the massive investments required to develop VR and augmented reality technologies to create an engaging metaverse.

META:

325.48 ▲ +13.77 (+4.42%) Today

325.25 ▼ -0.23 (-0.071%) After Hours

Procter & Gamble Reports Strong Quarterly Earnings, Boosted by Price Hikes, but Issues Cautious 2024 Outlook 💹💰

Procter & Gamble (PG) reported higher-than-expected quarterly earnings and revenue, due to price hikes for products like Crest toothpaste and Pampers diapers. However, the company issued a fiscal 2024 outlook that fell short of Wall Street's expectations. Procter & Gamble's shares rose more than 2% despite this announcement. The company reported a fiscal fourth-quarter net income of $3.38 billion, up from $3.05 billion a year earlier, and its net sales rose 5% to $20.55 billion. For fiscal 2024, the company projects its revenue will grow by 3-4%, which is lower than Wall Street’s expected growth of 4.5%. The company’s CFO Andre Schulten mentioned that they are likely to experience more volatility in the year ahead, citing challenges related to supply chains and input costs.

PG:

156.39 ▲ +4.28 (+2.81%) Today

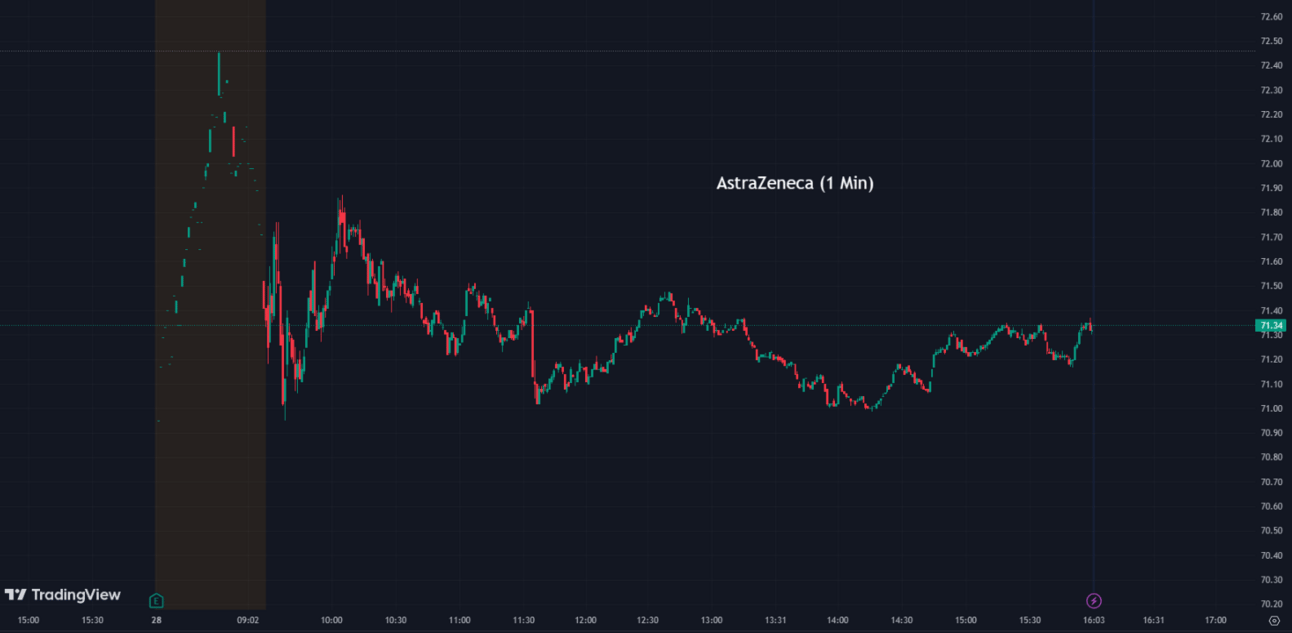

AstraZeneca Reports 4% Revenue Growth in H1 2023, Prioritizes China Market Amid Generic Competition Concerns 💼💰

AstraZeneca (AZN) disclosed a 4% growth with $22 billion in revenue for the first half of 2023, despite a $2 million decline in business from its COVID-19 vaccine and antibody treatments. Excluding these factors, the company reported a 16% revenue increase. Certain drugs such as Symbicort are expected to face generic competition, prompting a cautionary stance on the company's 2023 forecast. Furthermore, AstraZeneca continues to prioritize China, which accounts for $6 billion in annual business, dismissing rumors of a potential spinoff. The company seeks to collaborate with Chinese partners for drug licensing, reinforcing its commitment to innovation in the region.

AZN:

71.33 ▲ +3.19 (+4.68%) Today

71.32 ▼ -0.01 (-0.014%) After Hours

Notable Movers of the Day 📰📊

Intel’s stock (INTC) jumped more than 6% after the company posted better-than-expected second-quarter earnings results. The latest quarter marked a return to profitability after two consecutive losing periods. Intel’s forecast for the third quarter also came in above analyst expectations.

INTC:

36.83 ▲ +2.28 (+6.60%) Today

36.88 ▲ +0.05 (+0.14%) After Hours

Roku’s (ROKU) shares popped 31% after the company reported a smaller-than-expected loss for the recent quarter. The streaming stock posted a loss of 76 cents a share, ahead of the $1.26 loss per share expected by analysts, according to Refinitiv. Revenue came in at $847 million versus the estimated $775 million.

ROKU:

89.61 ▲ +21.42 (+31.41%) Today

90.00 ▲ +0.39 (+0.44%) After Hours

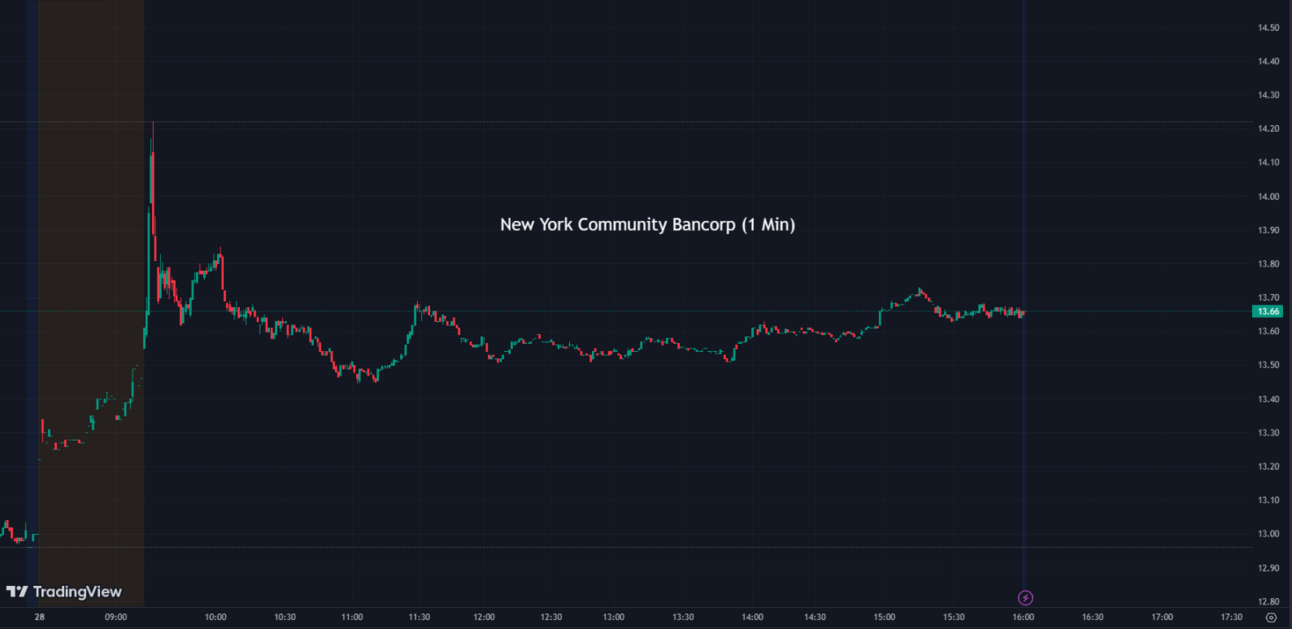

New York Community Bancorp (NYCB), the regional bank stock added 4.9% after JPMorgan upgraded shares to overweight from neutral, calling it a “massive market share taker” in the near and medium term.

NYCB:

13.65 ▲ +0.64 (+4.92%) Today

Biogen (BIIB), the biotech company rose nearly 1% after the company said it’s acquiring Reata Pharmaceuticals for $172.50 per share, in a cash deal valued at about $7.3 billion. Shares of Reata popped 54% following the news.

BIIB:

265.23 ▲ +2.44 (+0.93%) Today

264.90 ▼ -0.33 (-0.12%) After Hours

Exxon Mobil (XOM) saw its shares dip 1.2% after the company posted mixed second-quarter results. The company reported earnings of $1.94 a share, excluding items, lower than the $2.01 estimate by analysts, per Refinitiv. Revenue came in at $82.91 billion, above the expected $80.19 billion.

XOM:

104.11 ▼ -1.31 (-1.24%) Today

104.05 ▼ -0.11 (-0.11%) After Hours

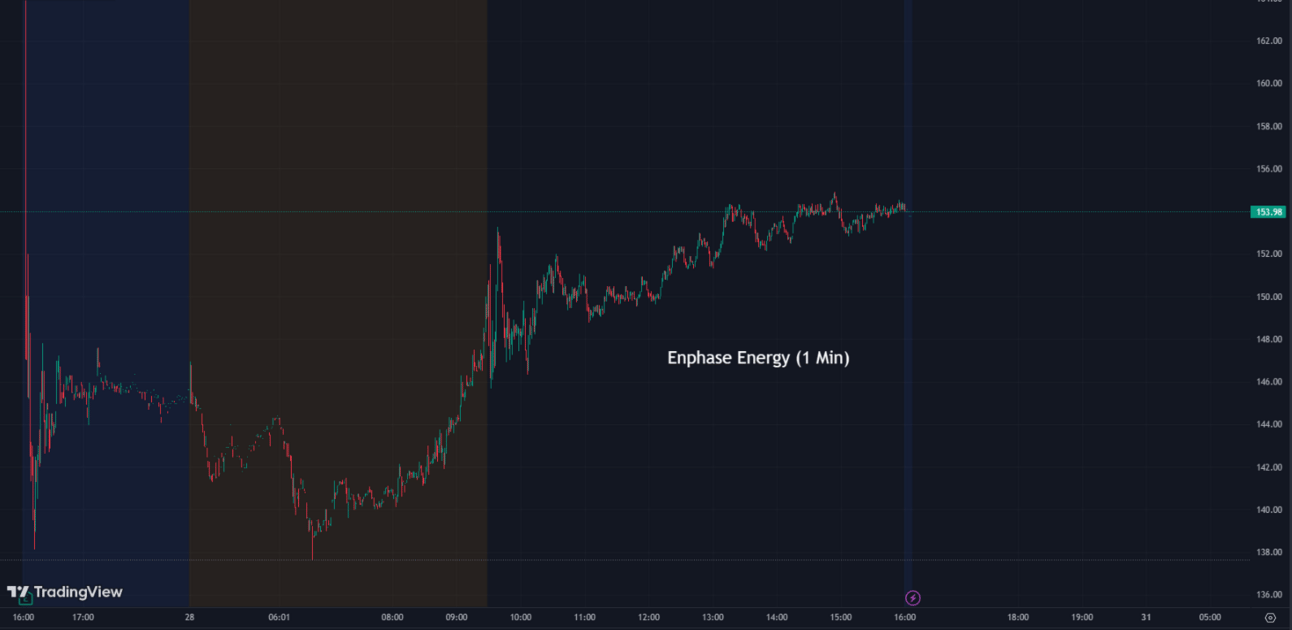

Enphase Energy (ENPH), the solar stock dropped nearly 7% to hit a 52-week low after the company posted a revenue miss. Enphase said its second-quarter revenue reached $711 million, falling short of analyst estimates of $722 million, according to Refinitiv. Deutsche Bank, Wells Fargo, and Roth MKM downgraded the stock following the disappointing report.

ENPH:

154.33 ▼ -12.47 (-7.48%) Today

154.17 ▼ -0.16 (-0.10%) After Hours

Boston Beer (SAM) saw its shares soar more than 16% following a stronger-than-expected quarterly report. Boston Beer posted earnings of $4.72 per share, well above an estimate of $3.38 per share from FactSet. Its revenue also came in above expectations.

SAM:

366.10 ▲ +52.58 (+16.77%) Today

368.00 ▲ +1.90 (+0.52%) After Hours

Sweetgreen’s (SG) shares slid nearly 9% after the company posted weak sales that missed Wall Street expectations in the second quarter and a net loss of $27.3 million, or 24 cents per share. Sweetgreen also reported narrowing losses and raised its forecast for restaurant-level margins. It’s aiming to turn a profit for the first time by 2024.

SG:

14.10 ▼ -1.35 (-8.77%) Today

14.00 ▼ -0.10 (-0.71%) After Hours

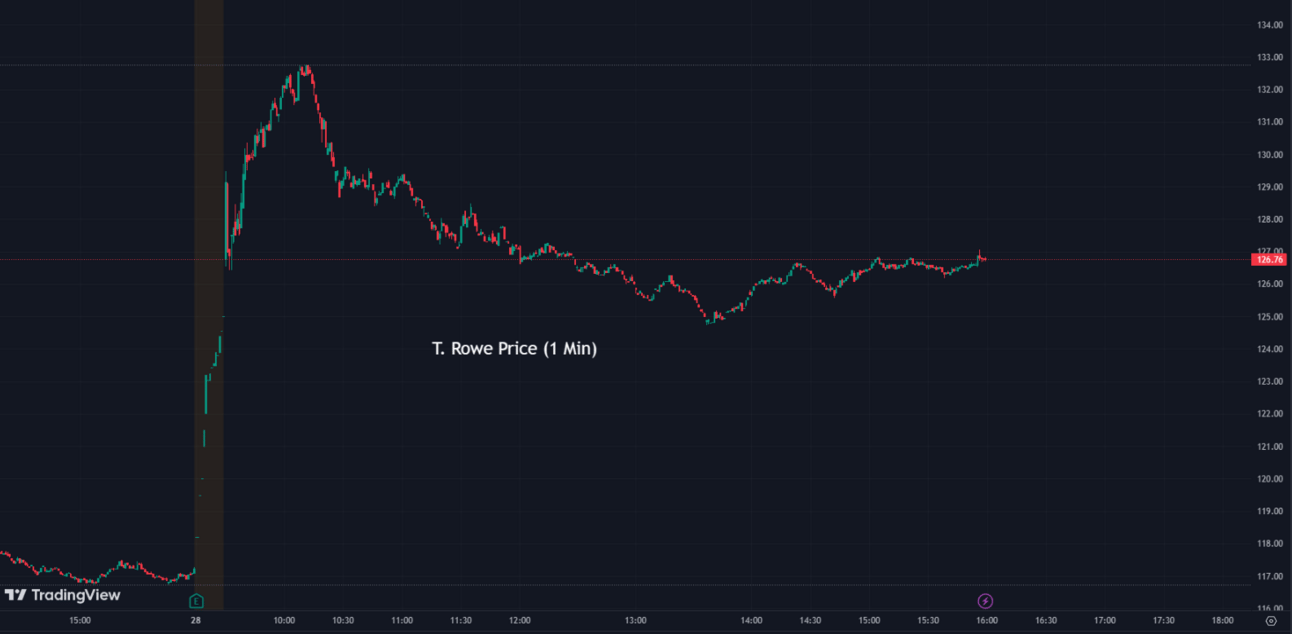

T. Rowe Price’s (TROW) shares jumped more than 8% after T. Rowe Price reported stronger-than-expected earnings for the second quarter. The company earned an adjusted $2.02 per share on $1.61 billion of revenue. Analysts surveyed by Refinitiv were expecting $1.73 per share on $1.6 billion of revenue. CEO Rob Sharps said in a press release that T. Rowe Price has “identified substantial cost savings” that will slow expense growth going forward.

TROW:

126.79 ▲ +9.68 (+8.27%) Today

128.39 ▲ +1.60 (+1.26%) After Hours

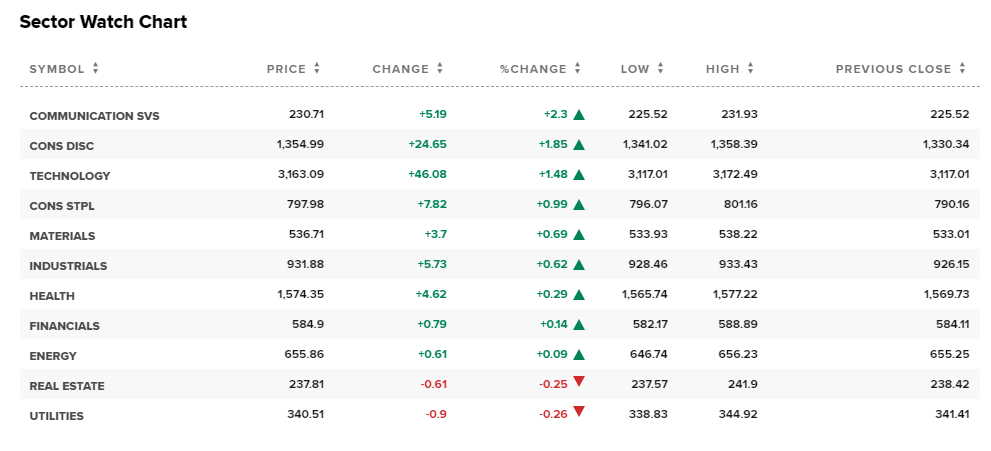

Sectors 📡💼

Out of the 11 sectors, 9 closed in positive territory today, with Communication Services leading the way with a gain of +2.3%, while Utilities saw a decline of -0.26%.

Conclusion 👋

Today's market saw signs of inflation cooling with the core PCE index increasing by 0.2% in June, potentially allowing the Federal Reserve to pause future interest rate increases. This positively impacted the Dow Jones and S&P 500, securing their third consecutive winning weeks. Ford plans to introduce new hybrid models, while Microsoft emphasized the importance of GPUs for AI services, benefiting companies like Nvidia and AMD. Meta is revamping its Horizon Worlds VR app with more video games and an in-house studio for first-party game development. Procter & Gamble reported strong earnings but issued a cautious 2024 outlook due to supply chain challenges. AstraZeneca prioritizes China amid generic competition concerns. Notable movers included Intel, Roku, New York Community Bancorp, Biogen, Exxon Mobil, Enphase Energy, Boston Beer, Sweetgreen, and T. Rowe Price. Have a good weekend!

Thank you all for signing up!

Will only work to do better for you all going forward. Our only goal is to add value to everyone’s trading with key levels and the ability of learning charts and price action.

Please Share Our Newsletter it will be much appreciated!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of TradingView. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.