Hi, Traders! As the day comes to an end, we are excited to have you here for an insightful recap of the noteworthy events that have influenced the financial markets today.

Federal Reserve Raises Interest Rates 🏦🔼

The Federal Reserve has announced a significant interest rate hike, raising the benchmark borrowing costs to their highest in over two decades. The quarter-point increase sets the federal funds rate at a target range of 5.25%-5.5%. Despite indications from the June meeting suggesting two further rate hikes this year, market sentiment hints at the likelihood of no more increases this year. Chairman Jerome Powell emphasized the Fed's data-driven approach, indicating rates could be held steady or raised again in September depending on economic data. This latest hike, which was unanimously approved by voting committee members, is the 11th of its kind since the tightening process began in March 2022. The decision reflects ongoing concerns over elevated inflation and the Fed's efforts to moderate the economy.

Indexes 📈📉

The indices were mixed today as traders processed both a Federal Reserve rate hike and significant corporate earnings. Now, let's explore how the market performed today...

The S&P 500 (SPX) was down -0.02% coming to a conclusion at 4,566

The Nasdaq Composite (IXIC) dropped -0.12 to settle at 14,127

The Dow Jones Industrial Average (DJI) climbed +0.23% to finish at 35,520

The Russell 2000 (RUT) increased by +0.72% ending the day at 1,980

The Nasdaq-100 (NDX) fell -0.40% to conclude at 15,499

Hello, everyone! 👋 We wanted to once again remind you about our exciting news. We are pleased to present a remarkable newsletter that has been specially curated to help you navigate the world of finance. As a way of expressing our gratitude for your ongoing support, we would like to offer you a special discount. You can now take advantage of an exceptional 20% lifetime discount on your subscription. Feel free to explore the countless benefits that await you by clicking the link below. Thank you for being a valued part of our community.

Boeing's Q2 Performance Beats Expectations, Commercial Aircraft Deliveries Surge 🌐✈️

Boeing's (BA) Q2 performance beat expectations, showing a narrower loss and higher sales, mainly driven by a surge in commercial aircraft deliveries. Despite these positive indicators, losses in its defense, space and security unit led to an overall loss for the quarter. Boeing delivered 136 planes in Q2, up from 121 in the same period last year, and is planning to increase the production of its bestselling Max aircraft and 787 Dreamliner. However, issues within the defense and space businesses resulted in a net loss of $149 million. CEO Dave Calhoun emphasizes the importance of stable execution and supply chain management in meeting customer commitments.

BA:

232.89 ▲ +18.77 (+8.77%) Today

232.61 ▼ -0.19 (-0.082%) After Hours

AWS Launches HealthScribe: AI-Powered Clinical Documentation Service for Healthcare Software Providers 🩺🤖

Amazon Web Services (AWS) has announced a new service called AWS HealthScribe for healthcare software providers. Using generative artificial intelligence and speech recognition, this service automatically drafts clinical documentation to save healthcare workers' time. AI-generated transcripts and summaries of patient visits can be easily incorporated into electronic health record systems. HealthScribe is HIPAA compliant, does not retain any customer information, and allows customers to choose their clinical documentation storage location. The service is currently available in a private preview capacity, with costs varying based on the audio processed per month.

AMZN:

128.15 ▼ -0.98 (-0.76%) Today

127.91 ▼ -0.24 (-0.19%) After Hours

Coca-Cola Holds Off Further Price Hikes in Developed Markets Amid Consumer Shift to Private Label Drinks 🥤🛒

Coca-Cola (KO) has announced it won't be increasing prices any further this year in developed markets like the U.S. and Europe, following two years of consistent price hikes in response to higher costs. This decision comes after the beverage giant experienced a 10% increase in prices in the second quarter compared to the same period last year. However, consumer demand has not dropped as much as anticipated despite these increases. Interestingly, Coke's CEO James Quincey revealed that customers in the U.S. and Europe are shifting to private label bottled water and juices. Quincey attributed this shift to consumers becoming more cost-conscious and looking for value in their purchases. Nevertheless, Coca-Cola plans to continue raising prices in line with inflation in developing markets like Latin America.

KO:

63.07 ▲ +0.82 (+1.32%) Today

63.10 ▲ +0.05 (+0.079%) After Hours

GlaxoSmithKline Optimistic About Newly Approved RSV Vaccine, Expects Positive Sales Contribution 🌟💊

GlaxoSmithKline (GSK) is optimistic about the future success of its newly approved Respiratory Syncytial Virus (RSV) vaccine, despite CEO Emma Walmsley's expectations of a slower uptake than the company's blockbuster shingles shot. The RSV vaccine, the first of its kind approved for adults 60 and older in the U.S. and European Union, is set to be rolled out in the fall, coinciding with the season when the respiratory disease typically starts to spread at a higher level. RSV usually results in mild, cold-like symptoms, but it can be deadly for seniors and children. Walmsley anticipates that the RSV shot will contribute significantly to future sales, although she did not provide specific revenue estimates for the vaccine this year. The company's full-year forecast, however, expects overall vaccine revenue to increase by a "mid-teens" percentage from last year.

GSK:

35.87 ▲ +0.17 (+0.48%) Today

35.76 ▼ -0.11 (-0.31%) After Hours

Volkswagen and Xpeng to Jointly Develop Electric Vehicles for the Chinese Market, VW to Invest $700 Million in Xpeng 🚗🤝

In a significant move to expand its presence in the electric vehicle market, Volkswagen (VWAGY) has signed a deal with Chinese EV maker, Xpeng (XPEV), to jointly develop two new VW-brand electric vehicles specifically for the Chinese market. As part of the deal, Volkswagen will also invest around $700 million in Xpeng and acquire a 4.99% stake in the company. The new EVs will be built on the platform that supports Xpeng’s G9 SUV and will also incorporate Xpeng's advanced driver-assist software. The new models, which will only be sold in China and are anticipated to launch in 2026, mark a crucial step in Volkswagen's efforts to leverage its partnerships to accelerate its product development and optimize development and procurement costs. This agreement also coincides with a separate deal signed by Volkswagen's subsidiary, Audi, with its Chinese joint venture partner, SAIC Motor, to develop new Audi-branded EVs for the Chinese market.

VWAGY:

16.63 ▼ -0.08 (-0.48%) Today

XPEV:

19.45 ▲ +4.09 (+26.66%) Today

19.57 ▲ +0.11 (+0.57%) After Hours

California Attorney General Investigates Tesla Over Autopilot Safety and False Advertising Complaints 🔍🚙

The California Attorney General's office is currently investigating Tesla (TSLA) over customer and former employee complaints regarding safety issues with the Autopilot feature and allegations of false advertising. The investigation came to light after customers and ex-employees were contacted for information by the AG's office. Tesla customers who have expressed dissatisfaction with the Autopilot and Full Self Driving (FSD) features have demanded a full refund. "Phantom braking" has been a recurring issue with Tesla vehicles, which raises safety concerns and accusations of misleading marketing by the company. Tesla's vehicles are still not completely autonomous as promised, remaining at a "level 2" of automation which requires constant driver attention. The investigation by the AG's office remains undisclosed in Tesla's quarterly financial filings.

TSLA:

264.35 ▼ -0.93 (-0.35%) Today

264.11 ▼ -0.24 (-0.091%) After Hours

Tilray Reports Strong Q4 Revenue Growth and Trims Losses, Aims to Lead U.S. Cannabis Market 🌿💰

Tilray Brands (TLRY), a notable name in the cannabis industry, has managed to trim down its fourth-quarter losses compared to the previous year, leading to a significant surge in its stock value. Reporting record-breaking revenue growth of 20%, Tilray’s revenue rose from $153.3 million in the prior-year quarter to $184.2 million, surpassing analysts expectations. The company, despite being Canadian, is actively positioning itself to lead the U.S. adult-use cannabis market, leveraging its recent acquisition of Canadian rival HEXO in June for around $56 million. This acquisition helped Tilray secure a dominant position in the Canadian cannabis market. The company also witnessed impressive growth in its beverage alcohol and distribution businesses, boasting year-over-year increases of 43% and 19% respectively. Looking ahead, Tilray's optimistic forecast for fiscal year 2024 predicts adjusted EBITDA between $68 million to $78 million, indicating a growth of 11% to 27% over fiscal year 2023.

TLRY:

1.93 ▲ +0.25 (+14.88%) Today

1.92 ▼ -0.01 (-0.52%) After Hours

Mattel Executive Richard Dickson Named Gap's New CEO to Revive Sales and Relevance in Fashion Industry 👔🛍️

Richard Dickson, an influential executive from Mattel (MAT), has been appointed as Gap's (GPS) next CEO following a year-long search. Dickson, who is known for reviving the Barbie franchise at Mattel and has a strong track record with other leading brands, will be transitioning from his role at Mattel to Gap in August, with a generous base salary of $1.4 million. Gap anticipates that Dickson's appointment will bring a fresh perspective to the company and help reverse the ongoing sales slump while re-establishing its relevance in the fashion industry.

GPS:

9.92 ▲ +0.71 (+7.71%) Today

9.95 ▲ +0.03 (+0.30%) After Hours

MAT:

21.32 ▲ +0.15 (+0.71%) Today

21.34 ▲ +0.02 (+0.094%) After Hours

Google Shares Surge After Strong Q2 Earnings and Cloud Revenue Growth 🚀☁️

Google's (GOOGL) shares experienced a substantial rise of over 5% today following a stronger-than-expected earnings report and significant growth in its cloud computing unit. The second quarter brought a 28% year-over-year increase in Google's cloud revenue, which reported operating income for the second quarter in a row. These impressive financial results indicate Google's promising trajectory in the competitive cloud computing space, where it continues to challenge industry heavyweights Amazon Web Services and Microsoft Azure. In a significant announcement, Google also disclosed that the current CFO, Ruth Porat, will transition into a newly created role as President and Chief Investment Officer, remaining in her current role until a successor is appointed.

GOOGL:

129.27 ▲ +7.06 (+5.78%) Today

129.50 ▲ +0.23 (+0.18%) After Hours

AT&T Expands Cost-Cutting Initiative by $2 Billion After Strong Q2 Earnings and Reassures on Lead-Clad Cables Concerns 📞💵

AT&T (T) has announced plans to expand its cost-cutting initiative by $2 billion, following encouraging results from the most recent quarter that surpassed free cash flow estimates. The telecom giant has been under scrutiny due to concerns around lead-clad cables potentially contaminating water and soil. CEO John Stankey reassured stakeholders by citing independent experts and longstanding science, asserting that these cables pose no public health risk. AT&T's proactive approach to cost management, achieving a $6 billion cost-cutting goal ahead of schedule, has significantly reduced operating expenses, with measures such as reducing office locations. With its significant net debt of $132 billion, these cost-cutting measures are critical for AT&T to ensure a stable cash flow for servicing its debt and supporting its high-yielding dividend. AT&T's free cash flow for the three months ended in June came in at $4.2 billion, beating estimates, signaling a positive outlook for the company's financial health.

T:

14.90 ▲ +0.10 (+0.68%) Today

14.87 ▼ -0.02 (-0.13%) After Hours

After Hour Movers 💤🔥

Meta Platforms (META) reported a Q2 revenue rise of 11%, marking its first double-digit growth since Q4 2021. Earnings exceeded expectations, coming in at $2.98 per share on $32 billion in revenue. The company also outperformed projections in Daily Active Users (DAUs), Monthly Active Users (MAUs), and Average Revenue per User (ARPU). An optimistic Q3 forecast anticipates a 15% YoY growth, with revenues between $32 billion to $34.5 billion. Amidst an ongoing cost-savings plan, the total headcount was reduced by 14%, although total costs and expenses increased by 10% YoY. Despite significant losses in Meta's Reality Labs unit, CEO Mark Zuckerberg expressed satisfaction and enthusiasm for future projects.

META:

298.57 ▲ +4.10 (+1.39%) Today

316.84 ▲ +18.27 (+6.12%) After Hours

Chipotle Mexican Grill's (CMG) recent quarterly report revealed earnings that surpassed expectations, but the company fell short in terms of sales, leading to an over 9% drop in stock value in extended trading. The company reported a net income of $341.8 million, up from $259.9 million a year earlier. Although Chipotle experienced a 13.6% increase in net sales to $2.51 billion in the second quarter, its same-store sales growth of 7.4% fell short of estimates. The chain expects same-store sales growth in the low to mid-single-digit range for the next quarter. Chipotle also opened 47 new locations in Q2, including 40 with drive-thru lanes for digital order pickups.

CMG:

2,085 ▼ -6.62 (-0.32%) Today

1,897.50 ▼ -190.36 (-9.12%) After Hours

Align Technology (ALGN) saw its shares pop 12% after it posted adjusted earnings of $2.22 per share for the second quarter, beating estimates of $2.03 per share, according to Refinitiv. Revenue for the quarter also topped estimates, and revenue guidance for the year was above analyst expectations.

ALGN:

339.85 ▲ +7.71 (+2.32%) Today

382.30 ▲ +42.45 (+12.49%) After Hours

Imax (IMAX) shares added 4% after reporting better-than-expected quarterly results. The entertainment technology company reported adjusted earnings of 26 cents a share, surpassing the 16 cents expected by analysts, per Refinitiv. Revenue came in at $98 million, above the $86.6 billion expected.

IMAX:

17.36 ▲ +0.46 (+2.72%) Today

18.11 ▲ +0.73 (+4.20%) After Hours

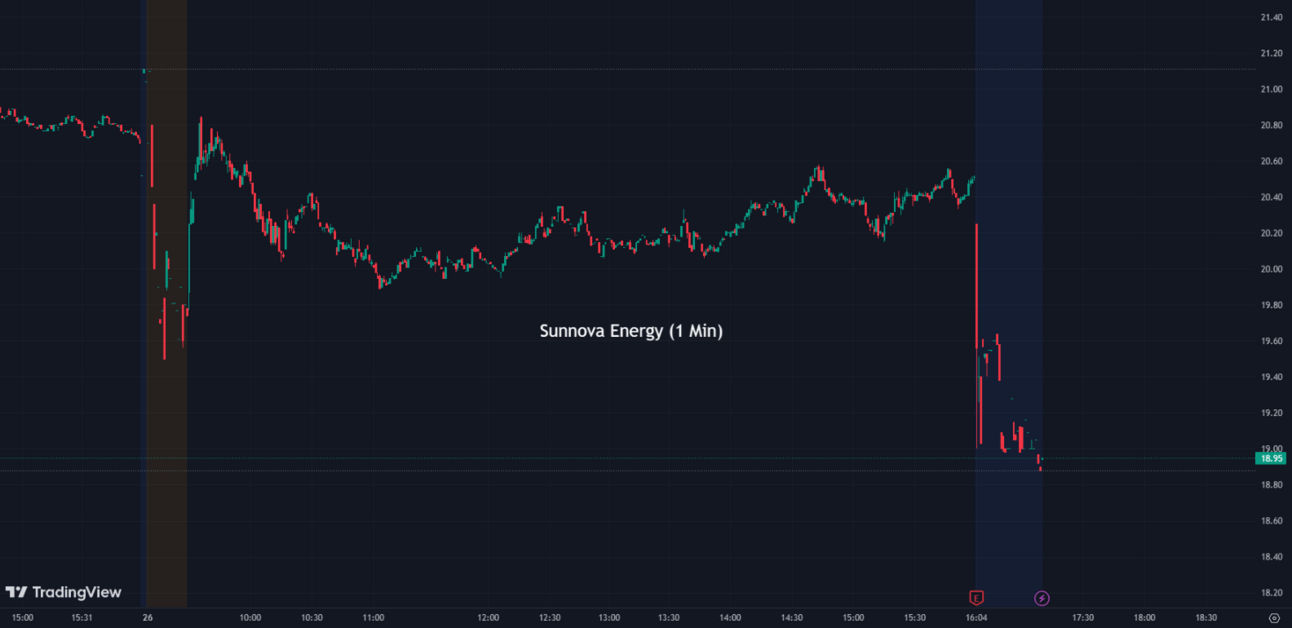

Sunnova Energy’s (NOVA) shares plummeted more than 7% after hours following weaker-than-expected financial results for the second quarter. Sunnova posted a wider-than-expected loss of 74 cents per share, while analysts expected a loss of 42 cents per share, according to FactSet. Revenue came in at $166.4 million compared to expectations of $195.5 million.

NOVA:

20.50 ▼ -0.20 (-0.97%) Today

18.97 ▼ -1.53 (-7.46%) After Hours

Lam Research’s (LRCX) shares got a more than 2% boost after the company reported a strong quarter. Lam posted adjusted earnings of $5.98 per share, beating estimates by 91 cents per share, per Refinitiv. Revenue of $3.21 billion beat expectations of $3.13 billion. Financial guidance topped estimates as well.

LRCX:

642.37 ▼ -7.87 (-1.21%) Today

654.80 ▲ +12.43 (+1.94%) After Hours

ServiceNow (NOW), Despite reporting a beat on the top and bottom lines, shares dropped 3%. The cloud computing company posted second-quarter adjusted earnings of $2.37 per share on revenue of $2.15 billion. Analysts had expected per-share earnings of $2.05 on revenue of $2.13 billion. The company also unveiled new generative artificial intelligence tools.

NOW:

577.48 ▼ -4.90 (-0.84%) Today

556.50 ▼ -20.77 (-3.60%) After Hours

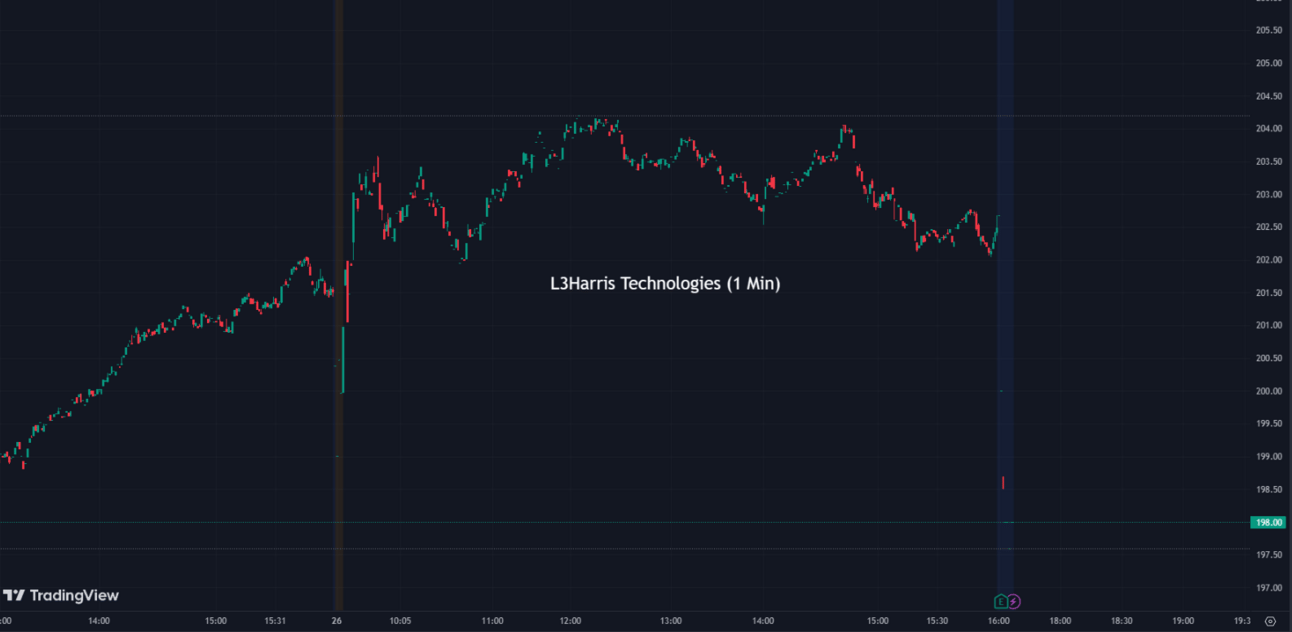

L3Harris Technologies (LHX) stock fell more than 2% even after earnings came in above expectations. L3Harris reported adjusted earnings of $2.97 a share on $4.69 billion in revenue and lifted earnings and revenue guidance. Analysts anticipated $2.94 in EPS on revenue of $4.37 billion for the latest quarter, according to Refinitiv. Aerojet Rocketdyne shares added more than 1% on news the Federal Trade Commission will not block its acquisition by L3Harris.

LHX:

202.80 ▲ +1.25 (+0.62%) Today

198.00 ▼ -4.56 (-2.25%) After Hours

Aerojet Rocketdyne (AJRD) saw a modest increase of more than 1% in its shares following the news that the Federal Trade Commission (FTC) will not block its acquisition by L3Harris. This positive development has likely contributed to the rise in stock value, signaling progress toward the completion of the acquisition deal between the two companies.

AJRD:

57.18 ▲ +0.63 (+1.11%) Today

57.97 ▲ +0.79 (+1.38%) After Hours

eBay’s (EBAY) stock slid about 5% after eBay issued weak guidance for the current quarter. The company said it anticipates third-quarter adjusted earnings per share of 96 cents to $1.01 per share, while analysts polled by FactSet anticipated $1.02 in earnings. The company posted $1.03 in adjusted earnings per share on revenue of $2.54 billion. Analysts called for earnings of 99 cents per share on revenue of $2.51 billion, according to Refinitiv.

EBAY:

48.80 ▲ +0.49 (+1.01%) Today

46.58 ▼ -2.22 (-4.55%) After Hours

Seagate Technology’s (STX) shares fell about 1% in extended trading. The data storage company posted revenue for the fourth fiscal quarter that came in at $1.60 billion, while analysts called for revenue of $1.68 billion, per FactSet.

STX:

57.97 ▼ -0.27 (-0.46%) Today

57.50 ▼ -0.47 (-0.81%) After Hours

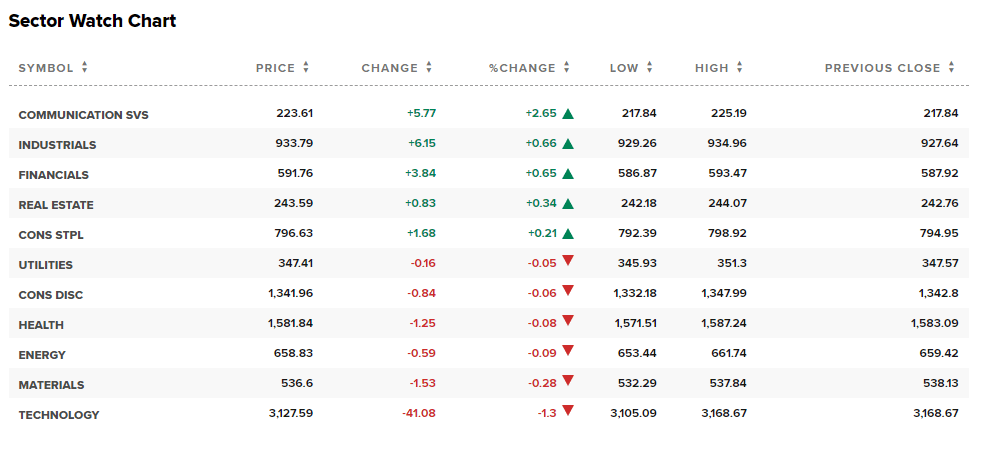

Sectors 💬💻

Out of the 11 sectors, 5 closed in positive territory today, with Communication Services leading the way with a gain of +2.65%, while Technology saw a decline of -1.3%.

Conclusion 👋

In conclusion, today's financial market recap highlighted significant developments across various industries. The Federal Reserve's interest rate hike, driven by inflation concerns, drew attention, while Boeing's impressive performance in commercial aircraft deliveries surpassed expectations. Amazon Web Services launch of HealthScribe for healthcare software providers, Coca-Cola's decision to hold off on price hikes, and GlaxoSmithKline's optimism about their newly approved RSV vaccine all showcased the dynamic nature of the market. Additionally, Volkswagen's partnership with Xpeng to develop EVs for the Chinese market demonstrated the ongoing drive toward sustainable technologies. However, Tesla faced investigations over Autopilot safety and false advertising, underscoring the importance of regulatory compliance in the industry. Google's strong Q2 earnings and cloud revenue growth lifted shares, while eBay's weak guidance caused a decline. Positive earnings reports from Lam Research, Align Technology, and Imax contrasted with Sunnova Energy's falling short. Gap's appointment of Richard Dickson as CEO and Tilray Brands' growth in the cannabis market reflected strategic leadership in the face of evolving consumer preferences. Seagate Technology reported declining revenue, reminding us of the dynamic nature of the market. Hope you all have a goodnight!

Thank you all for signing up!

Will only work to do better for you all going forward. Our only goal is to add value to everyone’s trading with key levels and the ability of learning charts and price action.

Please Share Our Newsletter it will be much appreciated!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of TradingView. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.