Hi, Traders! As the day comes to an end, we are excited to have you here for an insightful recap of the noteworthy events that have influenced the financial markets today.

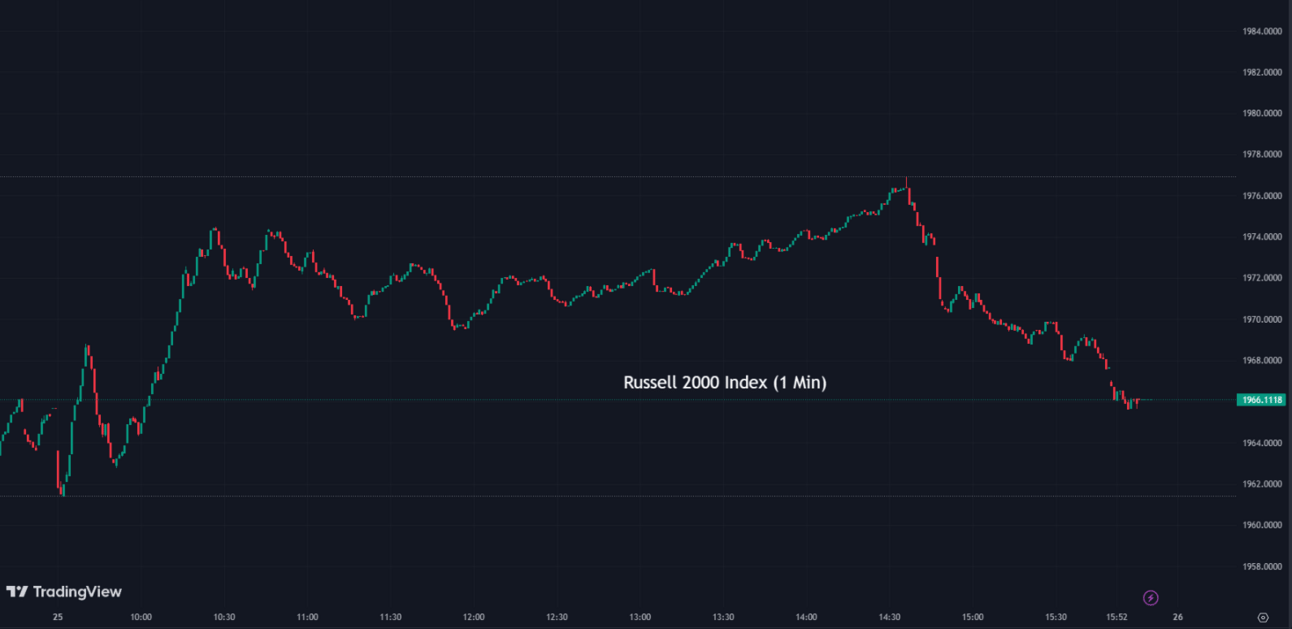

Indexes

All of the indices concluded with gains today. This came as traders carefully assessed the most recent earnings reports. Now, let's explore how the market performed today...

The S&P 500 (SPX) was up +0.28% coming to a conclusion at 4,567

The Nasdaq Composite (IXIC) escalated by +0.61% to settle at 14,144

The Dow Jones Industrial Average (DJI) climbed +0.08% to finish at 35,438

The Russell 2000 (RUT) increased by +0.02% ending the day at 1,966

The Nasdaq-100 (NDX) rose +0.73% to conclude at 15,561

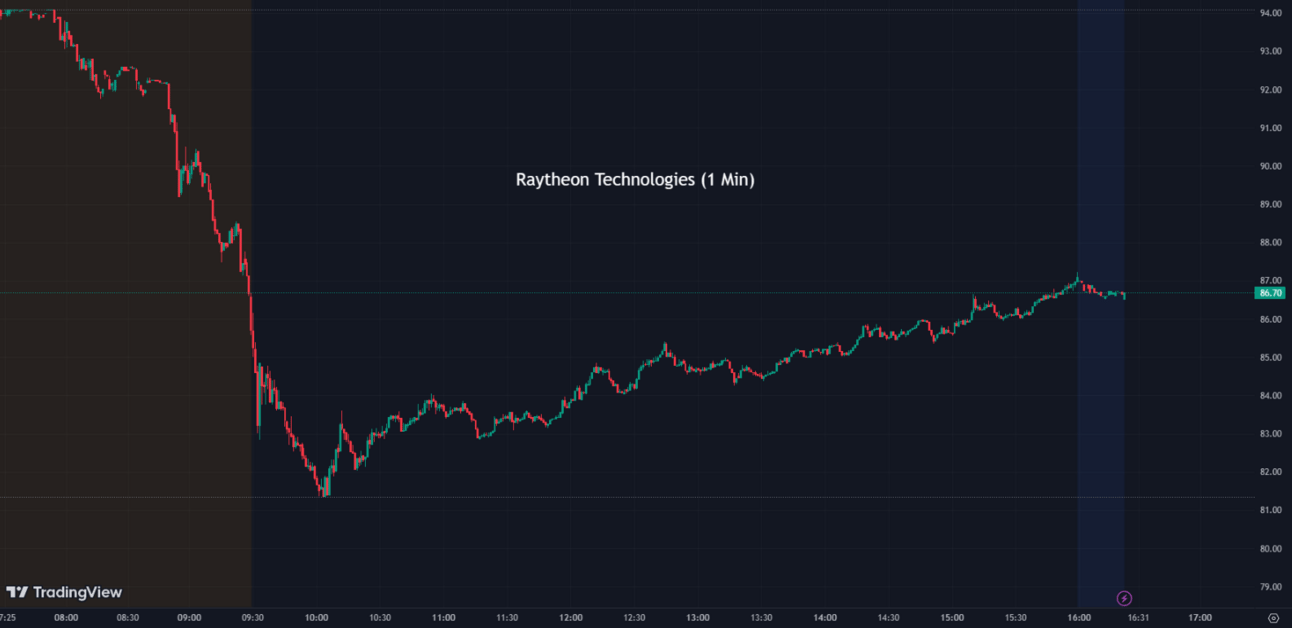

Raytheon Technologies Faces Setback in Pratt & Whitney Unit, Slashes 2023 Cash Flow Outlook 🔻🛠️

RTX, also known as Raytheon Technologies, has faced a significant setback due to a manufacturing problem in its Pratt & Whitney unit's popular engines. This issue has led to the company slashing its 2023 free cash flow outlook by around $500 million. Approximately 200 engines will require "accelerated" inspections due to this problem which originated from powdered metal used to make certain engine parts. However, current engines under production remain unaffected. Furthermore, the problem is set to impact some Airbus A320neos, prompting the Federal Aviation Administration (FAA) to liaise with Pratt & Whitney and affected airlines to ensure appropriate action is taken.

RTX:

87.09 ▼ -9.92 (-10.23%) Today

86.80 ▼ -0.30 (-0.34%) After Hours

UPS and Teamsters Reach Preliminary Labor Agreement, Averting Potential Strike ✅🤝

United Parcel Service (UPS) and the Teamsters union have reached a preliminary labor agreement averting a potential strike. The tentative deal, worth $30 billion, includes pay raises for both full- and part-time UPS workers. However, ratification by over 300,000 workers is still required for the agreement to be fully implemented. The deal brings an end to mandatory overtime on drivers' days off, according to the Teamsters. The potential labor stoppage could have significantly impacted industries like retail that heavily depend on the package delivery giant. However, workers still need to ratify the agreement.

UPS:

184.83 ▼ -3.51 (-1.86%) Today

183.75 ▼ -0.94 (-0.51%) After Hours

Spotify Shares Drop After Weak Second-Quarter Results and Revenue Miss 🎵📉

Spotify (SPOT), the music streaming giant, experienced a fall in shares following the release of its second-quarter results. The report showed weaker-than-expected guidance and missed analysts' estimates for revenue. Although the company recorded an 11% year-over-year increase in revenue to $3.51 billion, it was less than the predicted 3.21 billion euros. Spotify forecasts total revenue of $3.54 billion for its third quarter, a dip from the $3.75 billion expected by analysts. Despite the increase in monthly active users and paid subscribers, the company reported a net loss of $333 million, widening from the $138 million loss in the year-ago quarter. Spotify expects recent price increases to have a "minimal impact" on the company’s total revenue in the third quarter.

SPOT:

140.35 ▼ -23.37 (-14.27%) Today

140.80 ▲ +0.42 (+0.30%) After Hours

Wells Fargo Initiates $30 Billion Share Buyback Program 📈💰

Wells Fargo (WFC) has announced a substantial $30 billion share buyback program, causing its stock to rise by more than 3% in extended trading. In addition, the company's board of directors has approved a dividend increase from the previous 30 cents to 35 cents per share, payable on Sept. 1 to shareholders of record on Aug. 4. This significant move demonstrates Wells Fargo's strong financial position and commitment to returning capital to shareholders.

WFC:

45.50 ▼ -0.92 (-1.98%) Today

47.04 ▲ +1.56 (+3.43%) After Hours

General Motors Faces Challenges in EV Production, Increases 2023 Financial Guidance 🚗🔧

General Motors (GM) has been experiencing difficulties in ramping up production of its new electric vehicles (EVs), producing only 50,000 units in the first half of this year. CEO Mary Barra attributed this slower-than-anticipated rollout to issues with an unnamed automation equipment supplier. Despite these issues, GM remains committed to its EV production targets, with plans to produce an additional 100,000 vehicles in the second half of this year. In addition, GM is also planning to upgrade its Chevrolet Bolt EV, incorporating new battery and software technologies known as Ultium and Ultifi, demonstrating its continued commitment to its EV line.

In its second upward revision this year, General Motors (GM) has increased its 2023 financial guidance following robust second-quarter results. The Detroit-based automaker also plans to expand cost-cutting measures through next year, aiming to reduce expenditures by $3 billion, up from an initial target of $2 billion. The earnings report included an unanticipated $792 million charge stemming from new commercial agreements with LG Electronics and LG Energy Solution. Despite the promising financial outlook, GM shares dropped 3.51% today following the announcement. The revised guidance is contingent upon successful labor negotiations with the United Auto Workers and Canadian Unifor unions, hinting at potential issues in light of the auto industry's ongoing production struggles due to the pandemic and semiconductor chip shortages.

GM:

37.92 ▼ -1.38 (-3.51%) Today

37.89 ▼ -0.031 (-0.083%) After Hours

Biogen Plans Cost-Cutting Measures, Including 1,000 Job Layoffs 💵💼

Biogen (BIIB), a leading biotechnology company, is preparing for a significant cost-cutting exercise that includes the elimination of 1,000 jobs, equating to about 11% of its global workforce. This decision is part of a wider strategy to save costs as Biogen gets ready to launch its newly approved Alzheimer’s drug, Leqembi. The company anticipates that these layoffs, along with a more focused approach to its research and development pipeline, will result in approximately $700 million in net operating expense savings by 2025. Part of these savings will be used to invest back into product launches and further research and development programs.

BIIB:

270.31 ▼ -6.69 (-2.42%) Today

268.00 ▼ -2.31 (-0.85%) After Hours

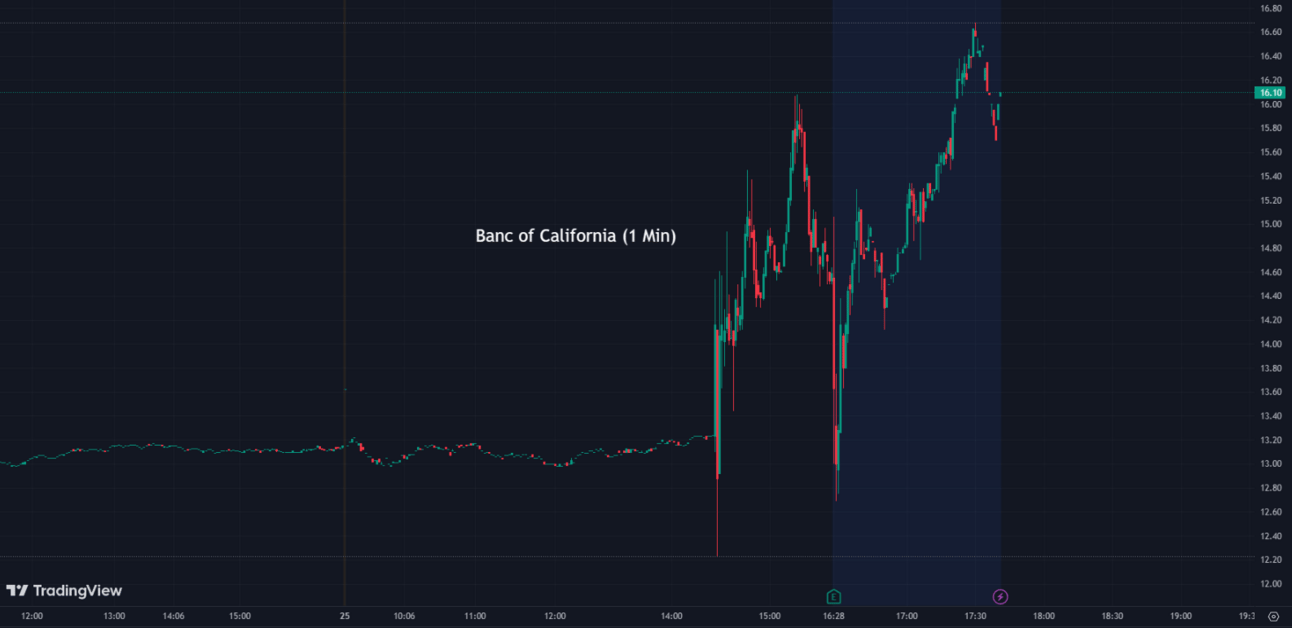

PacWest Faces Potential Sale to Banc of California (BANC), Shares Plummet 📉📉

PacWest (PACW), a regional lender that has been under intense scrutiny since the downfall of Silicon Valley Bank, is reportedly on the verge of being sold to Banc of California (BANC). As news of this potential sale emerged, PacWest's shares fell by 27%, while Banc of California's stock rose 11%. This news has had wider repercussions in the banking industry, as many regional bank stocks took a downturn following the report. These banks face ongoing challenges, particularly around attracting and retaining depositors while maintaining profitability. For PacWest, this rumored sale comes after a period of balance sheet shrinking and "strategic asset sales" in an attempt to improve liquidity and retain depositors.

PACW:

7.69 ▼ -2.85 (-27.04%) Today

7.73 ▲ +0.04 (+0.52%) After Hours

BANC:

14.62 ▲ +1.47 (+11.18%) Today

16.09 ▲ +1.47 (+10.05%) After Hours

After Hour Movers 🌃💫

Alphabet’s Google stock (GOOGL) had second-quarter revenue results reflecting a 7% increase compared to the same period in the previous year, driven largely by the remarkable growth of its cloud-computing unit. Alphabet's cloud revenue alone surged by 28%, marking a significant uptick in its business strategy. Earnings per share stood at $1.44, beating the expected $1.34 per share as projected by Refinitiv. In addition, both YouTube and Google Cloud posted strong results, exceeding analyst expectations with revenues of $7.67 billion and $8.03 billion, respectively. An interesting shift in Alphabet's executive team saw CFO Ruth Porat stepping into a new role as president and chief investment officer, initiating a search for her successor in the finance chief position.

GOOGL:

122.21 ▲ +0.68 (+0.56%) Today

131.90 ▲ +9.69 (+7.93%) After Hours

Microsoft’s (MSFT) fiscal fourth-quarter earnings highlighted a slowdown in Azure cloud revenue growth, which slowed to 26% from the previous quarter’s 27%. Despite the deceleration, the revenue still rose 8% YoY, accumulating a net income of $20.08 billion. A notable portion of this revenue was contributed by the Intelligent Cloud segment, which provided $23.99 billion in revenue, exceeding the analysts' consensus estimate of $23.79 billion. In terms of company policies, CEO Satya Nadella made a significant announcement in May, informing employees that the company will not be offering salary increases this year. Additionally, Microsoft made strides in artificial intelligence during the quarter, leveraging technology from startup OpenAI to introduce a new chatbot that assists in data analysis.

MSFT:

350.98 ▲ +5.87 (+1.70%) Today

348.40 ▼ -2.58 (-0.74%) After Hours

Snap’s (SNAP) second quarter saw an overall sales decline of 4% from the $1.11 billion reported in the previous year during the same period. Even though the company exceeded analyst expectations in terms of revenue and global daily active users, the forecast for the current quarter was weaker than analysts' predictions. Snap's efforts to manage its finances were evident in its cost-cutting plan initiated in 2022, which included the layoff of 20% of the company's workforce. As a result, operating expenses were reduced by 8% YoY in the second quarter, reaching $615 million. Despite the challenging circumstances, Snap CEO Evan Spiegel shared optimistic remarks about the company's growth in terms of daily active users and Snapchat+ subscribers, pointing to these metrics as potential indicators of a recovery in the digital advertising market.

SNAP:

12.51 ▼ -0.17 (-1.34%) Today

10.33 ▼ -2.18 (-17.43%) After Hours

Visa (V), the San Francisco-based global payments processor, reported fiscal third-quarter net income of $4.16 billion, with earnings per share at $2 and adjusted earnings per share at $2.16. The results exceeded Wall Street expectations, with analysts estimating earnings per share of $2.11. Additionally, Visa's revenue for the quarter was $8.12 billion, surpassing Street forecasts of $8.06 billion.

V:

238.74 ▼ -2.00 (-0.83%) Today

237.35 ▼ -1.34 (-0.56%) After Hours

Texas Instruments (TXN), reported second-quarter earnings of $1.72 billion, with earnings per share at $1.87, exceeding Wall Street expectations of $1.76 per share. The chipmaker also posted revenue of $4.53 billion for the period, surpassing Street forecasts of $4.36 billion. However, for the current quarter ending in September, Texas Instruments expects revenue in the range of $4.36 billion to $4.74 billion, falling short of analysts' expectations of $4.82 billion.

TXN:

186.08 ▲ +2.19 (+1.19%) Today

179.34 ▼ -6.74 (-3.62%) After Hours

Sectors 🏭🏠

Out of the 11 sectors, 5 closed in positive territory today, with Materials leading the way with a gain of +1.76%, while Real Estate saw a decline of -0.74%.

Conclusion 👋

To wrap it up, it has been an eventful day in the financial markets, with all major indices concluding with gains as traders carefully assessed the latest earnings reports. However, some companies faced challenges during the day. Raytheon Technologies (RTX) encountered setbacks in its Pratt & Whitney unit, resulting in a reduction in its 2023 cash flow outlook. United Parcel Service (UPS) and the Teamsters union reached a preliminary labor agreement, averting a potential strike, but it still awaits ratification by workers. Spotify (SPOT) experienced a drop in shares after weaker-than-expected second-quarter results and revenue miss. On the other hand, Wells Fargo (WFC) made significant moves, initiating a $30 billion share buyback program and approving a dividend increase, showcasing the company's strong financial position. General Motors (GM) faced challenges in EV production but increased its 2023 financial guidance following robust second-quarter results. Biogen (BIIB) planned cost-cutting measures, including job layoffs, in preparation for the launch of its Alzheimer's drug. PacWest (PACW) faced potential sale rumors, leading to a significant drop in its shares, while Banc of California's (BANC) stock rose. In the after-hours market, Alphabet's Google (GOOGL) and Microsoft (MSFT) had notable revenue results, while Snap's (SNAP) sales declined. Visa (V) and Texas Instruments (TXN) exceeded Wall Street expectations in their earnings reports. Have a goodnight!

Thank you all for signing up!

Will only work to do better for you all going forward. Our only goal is to add value to everyone’s trading with key levels and the ability of learning charts and price action.

Please Share Our Newsletter it will be much appreciated!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of TradingView. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.