Hey, traders! As we approach the end of the week, let's take a breather and dive into the exciting events that unfolded today!

Nasdaq Announces Rebalancing of Nasdaq 100 Index to Mitigate Concentration Risk from Dominant Companies 💻📊

Nasdaq has announced a rare rebalancing of the Nasdaq 100 index, which will take effect prior to the market opening on July 24, to mitigate the concentration risk from seven dominant companies. With over half its value derived from Nvidia (NVDA), Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Tesla (TSLA), Meta Platforms (META), and Alphabet (GOOGL), the index's reshuffling aims to curb their substantial influence. Some analysts said the rebalancing on Monday is helping to turbocharge interest in Friday’s monthly options expiration, which will see some $2.3 trillion in contracts expiring, according to Goldman Sachs. While the specifics will only be unveiled later, there are suggestions that the index's aggregate weighting for top stocks will be capped below 40%. Experts speculate that the impending reconstitution may not impede the U.S. stock market rally.

AI Giants Voluntarily Pledge to Manage AI Risks, White House Reveals 🤝🤖

The White House has revealed that leading AI companies, including Amazon (AMZN), Anthropic, Google (GOOGL), Inflection, Meta (META), Microsoft (MSFT), and OpenAI, have voluntarily agreed to manage the risks of the fast-paced AI technology development. The Biden administration expects these firms to ensure product safety before public introduction, adopt a security-first approach, and build public trust. The agreement also includes commitments to internal and external security testing, sharing information to reduce AI risks, and investment in cybersecurity to protect AI models.

Indexes 📈📉

The Indices saw a mixed performance today as traders evaluated the latest corporate earnings reports. Despite this, the Dow Jones Industrial Average managed to close in positive territory. Now, let's explore how the market performed today...

The S&P 500 (SPX) was up +0.03% coming to a conclusion at 4,536

The Nasdaq Composite (IXIC) dropped -0.22% to settle at 14,032

The Dow Jones Industrial Average (DJI) gained +0.01% to finish at 35,227

The Russell 2000 (RUT) fell -0.35% ending the day at 1,960

The Nasdaq-100 (NDX) fell by -0.26% to conclude at 15,425

Amazon to Invest $120 Million in Satellite Processing Facility for Project Kuiper at NASA's Kennedy Space Center 🛰️📡

Amazon (AMZN) plans to invest $120 million in a satellite processing facility at NASA's Kennedy Space Center in Florida. The facility, integral to Amazon's Project Kuiper, will prepare 3,236 satellites for launch to create a global high-speed internet network. Construction is set to be completed by the end of 2024, with the first production satellites being processed early in 2025. Despite delays, Amazon hopes to launch the first two Kuiper prototype satellites soon and continues to explore all available launch options.

AMZN:

130.00 ▲ +0.04 (+0.031%) Today

129.98 ▼ -0.02 (-0.015%) After Hours

Sirius XM Shares Decline 📉🔽

Sirius XM (SIRI) experienced a 9.35% decline in shares, wiping out previous gains due to a short squeeze and a rebalance of the Nasdaq 100. The short squeeze was triggered by short sellers betting on the reformulation of Liberty Media's tracking stocks related to the spin-off of the Atlanta Braves. Analysts, including Neil Macker of Morningstar, attributed the short squeeze to a large number of shares held short and a relatively small float. The volatility was not believed to be due to any fundamental change in the business, but rather the upcoming Nasdaq 100 rebalance and related options trading.

SIRI:

7.08 ▼ -0.73 (-9.35%) Today

6.99 ▼ -0.09 (-1.27%) After Hours

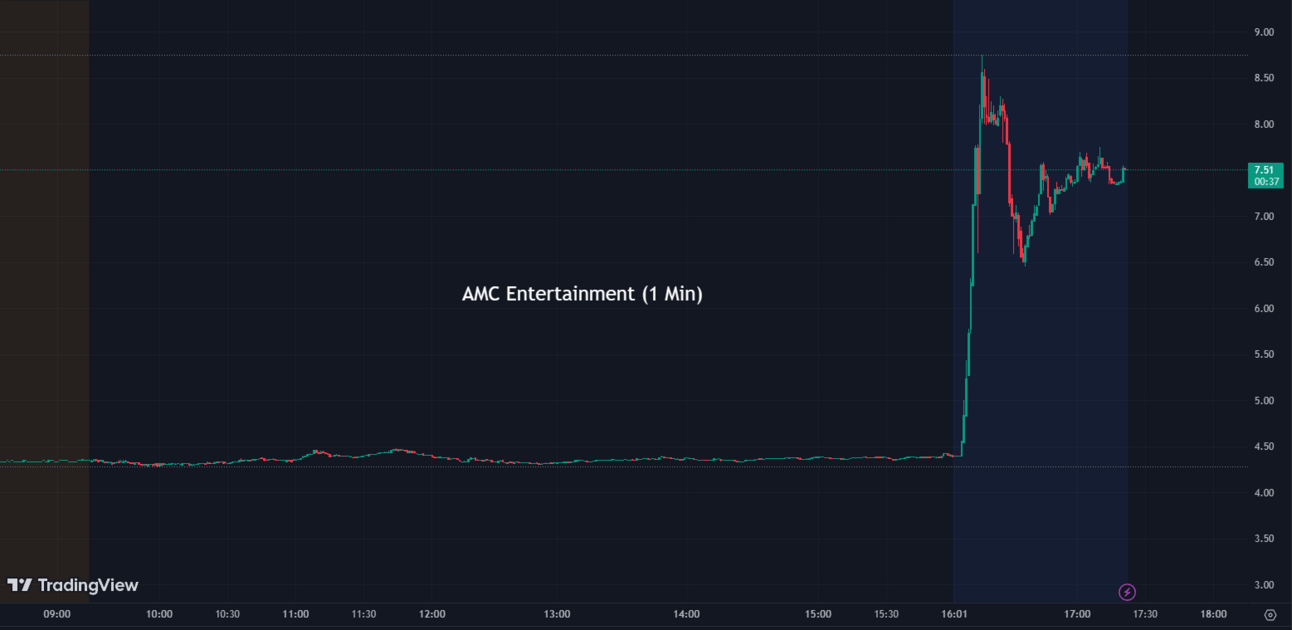

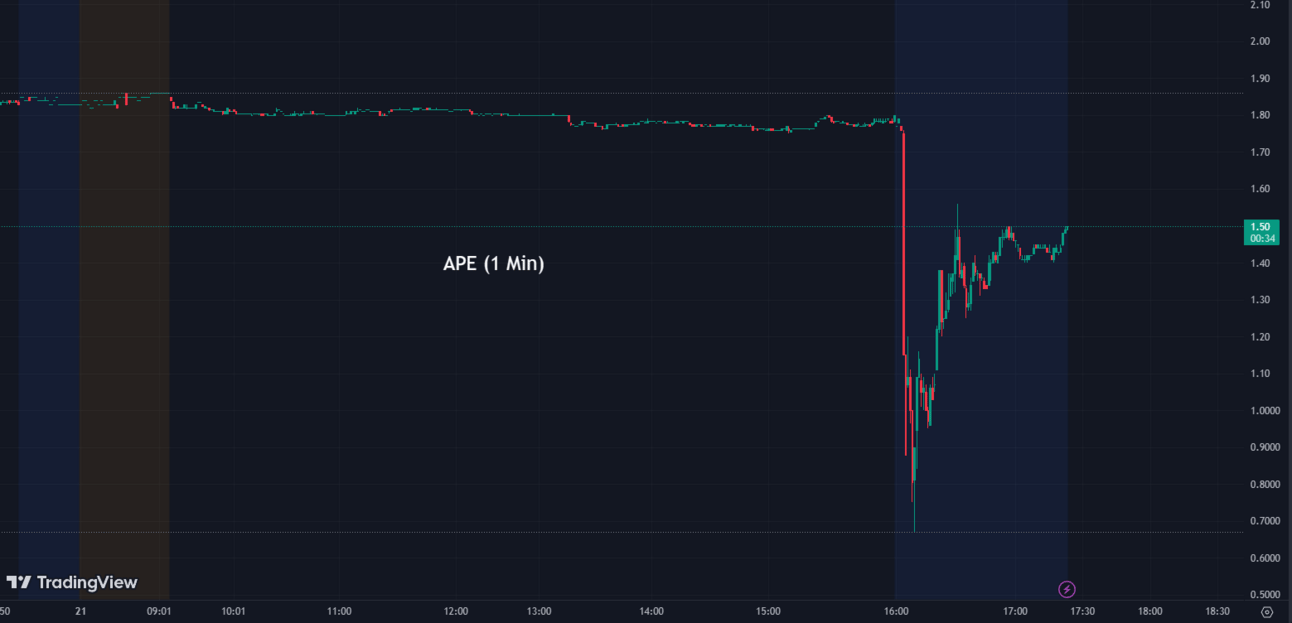

Delaware Judge's Ruling Halts AMC's Plan to Convert APE Units ⚖️🛑

A Delaware judge has halted AMC Entertainment (AMC) plan to convert its controversial APE (APE) preferred units into common stock, sparking a 75% surge in the company's class A shares after-hours. Vice Chancellor Morgan T. Zurn rejected a settlement that would have allowed the conversion and issued extra stock to limit dilution. This decision sends AMC, which is keen to recapitalize, back to the drawing board as it grapples with the increased interest rates affecting its loan financing. The ruling has defied the expectations of many investors who were banking on the conclusion of the contentious legal battle over the APEs, a fight which has embroiled AMC and its retail investors.

AMC:

4.39 ▲ +0.065 (+1.50%) Today

7.69 ▲ +3.29 (+74.77%) After Hours

APE:

1.79 ▼ -0.045 (-2.45%) Today

1.50 ▼ -0.30 (-16.71%) After Hours

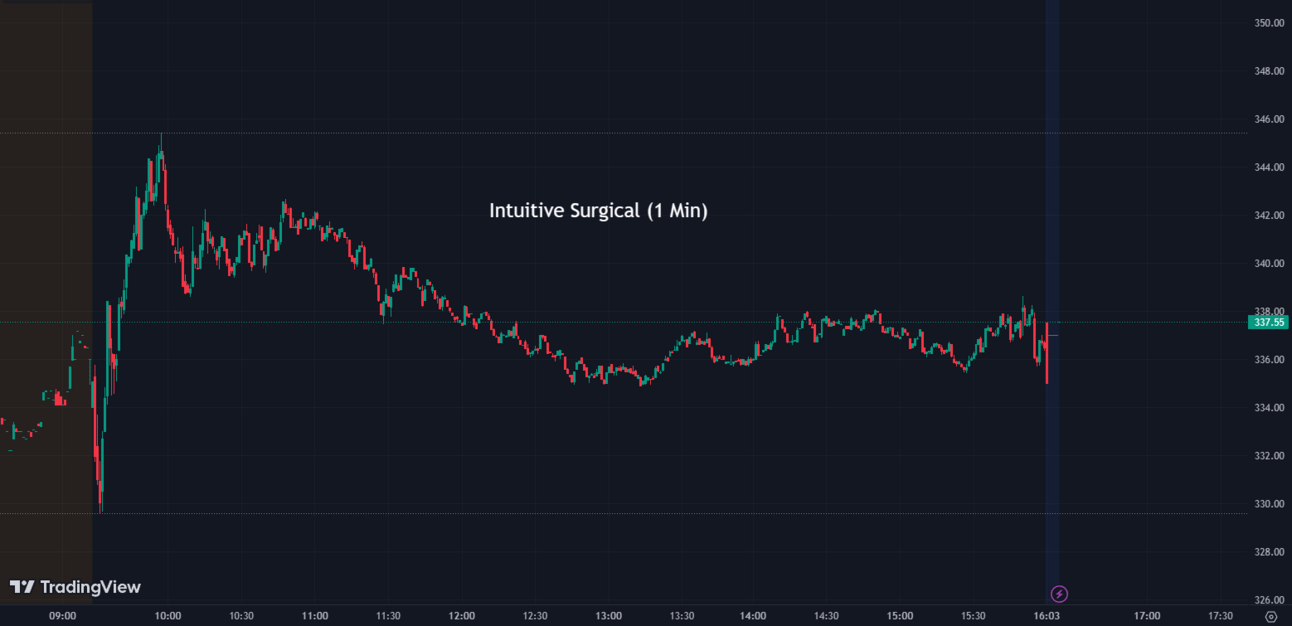

Intuitive Surgical Beats Estimates but Stock Falls on Moderating Procedure Volumes and Weight-Loss Drug Impact 💊💼

Intuitive Surgical (ISRG) exceeded Wall Street's sales and profit estimates for the quarter, however, its stock fell due to moderating procedure volumes and new weight-loss drugs impacting bariatric surgery. The number of procedures using the company's da Vinci robotic surgery system grew by 22%, but it represented a slowdown from the 26% growth in the previous quarter. The total installed da Vinci systems were less than expected, leading to a shortfall in system revenue, causing the stock price to drop by 3%.

ISRG:

336.66 ▼ -11.00 (-3.16%) Today

338.49 ▲ +1.83 (+0.54%) After Hours

EV Battery Plants and Their Impact on Labor Talks between UAW and Major Automakers 🔋⚡

In the contentious labor talks between the United Auto Workers union and major automakers, multibillion-dollar EV battery plants and their impact on the automotive industry's future and domestic manufacturing emerge as significant issues. Although these plants, currently established as separate joint ventures, aren't part of the negotiations, UAW leadership has prioritized a "just transition" to EVs, which includes the battery plants. The battery facilities could indirectly affect the negotiations by influencing future protections for EV workers. General Motors (GM) is currently the only Detroit automaker with a unionized joint venture battery plant, where wages are lower than traditional assembly jobs. UAW president, Shawn Fain, criticized the use of federal tax dollars for these facilities without a commitment to better wages and benefits for workers.

GM:

38.53 ▼ -0.73 (-1.86%) Today

38.50 ▼ -0.05 (-0.13%) After Hours

Ford's Deal with CATL Under Scrutiny by U.S. Lawmakers Over Concerns on Jobs, Tax Funding, and Human Rights 🚘💼

U.S. lawmakers are scrutinizing a licensing deal between Ford (F) and China-based Contemporary Amperex Technology (CATL), aimed at developing a $3.5 billion battery cell plant in Michigan. Congressional chairs have requested Ford provide the agreement and related communication details with both CATL and the Biden administration. Critically, the deal's implications for American versus Chinese employment, potential tax funding, CATL's potential forced labor practices, and the impact on U.S. dependence on China for electric vehicle parts are under examination. Ford, having revealed the Michigan plant's aim to manufacture new lithium iron phosphate batteries by 2026, asserts this deal will boost U.S. job creation and insists the partnership is beneficial for customers, the country, and the company. Critics of the Ford-CATL deal include Republican lawmakers concerned about CATL's possible ties to human rights abuses in China.

F:

13.92 ▼ -0.11 (-0.78%) Today

13.95 ▲ +0.015 (+0.11%) After Hours

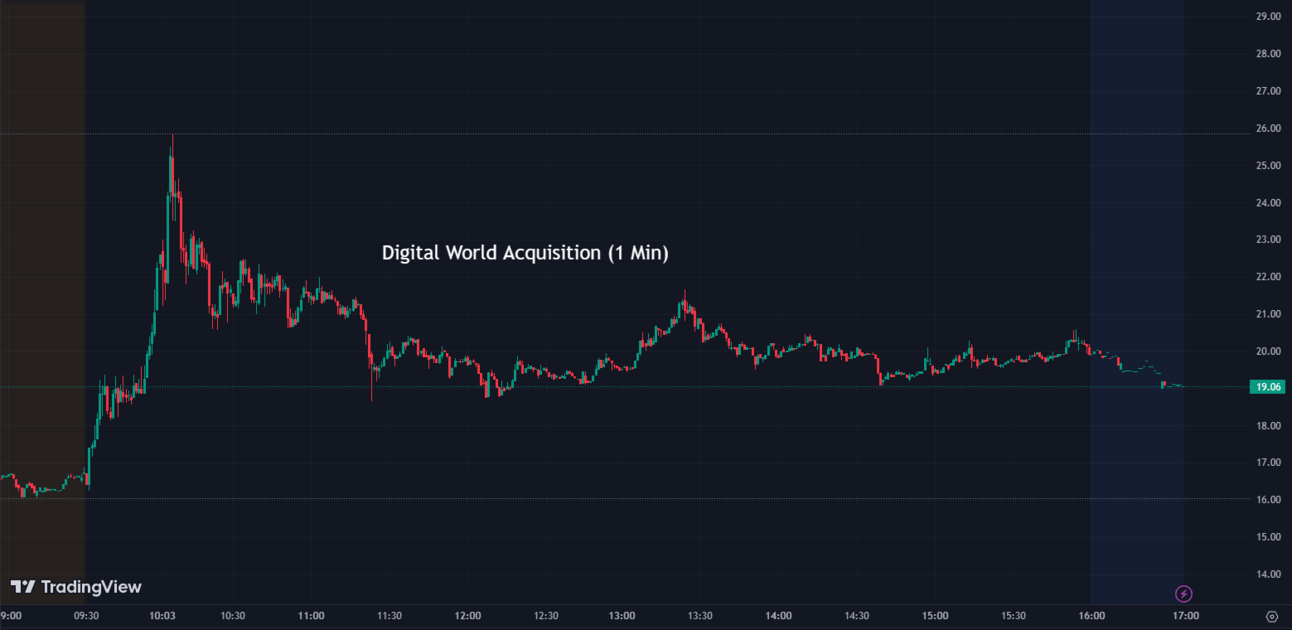

Digital World Acquisition Shares Surge on $18 Million SEC Fraud Settlement Over Truth Social Merger Discussions 💹🚀

Shares of Digital World Acquisition (DWAC) soared over 50% following the announcement of an $18 million fraud settlement with the SEC. DWAC, the SPAC slated to take former President Trump's social media platform, Truth Social, public, has been scrutinized for improper merger discussions. The settlement requires DWAC to pay an $18 million civil penalty fee if it merges with Trump Media & Technology Group and takes the company public.

DWAC:

20.08 ▲ +6.72 (+50.30%) Today

19.10 ▼ -0.98 (-4.88%) After Hours

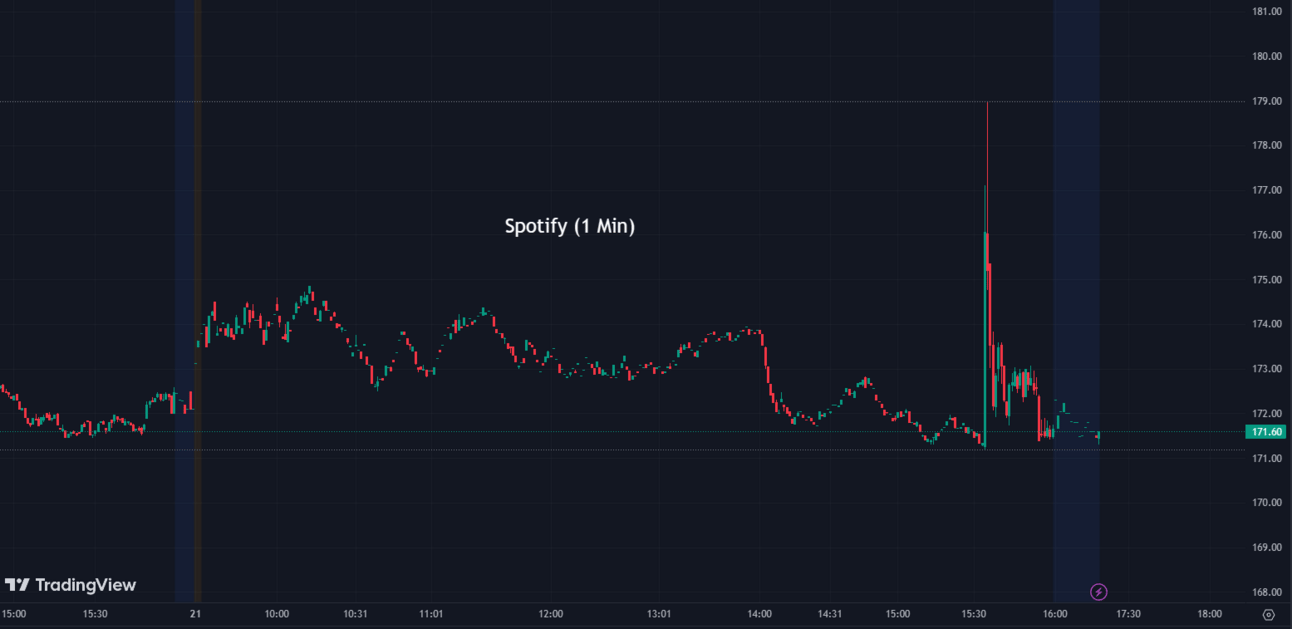

Spotify to Raise Premium Subscription Price in the US by $1 to $10.99 per Month to Improve Profitability 🎶💰

In a bid to improve its profitability, Spotify (SPOT) plans to increase its ad-free premium subscription price in the US by $1 to $10.99 a month, with similar hikes in other markets to be implemented in the coming months. This move aligns with Spotify's 'balanced portfolio approach' to its pricing strategy, and follows price increases by other music streaming platforms, such as Apple Music, Amazon Music, and YouTube Music. The announcement of the price increase is expected during Spotify's quarterly earnings report next week. Despite spending heavily on the podcast market, the company has undertaken cost-cutting initiatives, including layoffs and reconfiguration of its podcast division, in an attempt to fulfill its profitability commitment.

SPOT:

171.79 ▼ -0.69 (-0.40%) Today

168.80 ▼ -2.91 (-1.69%) After Hours

Notable Movers of the Day 🔥💯

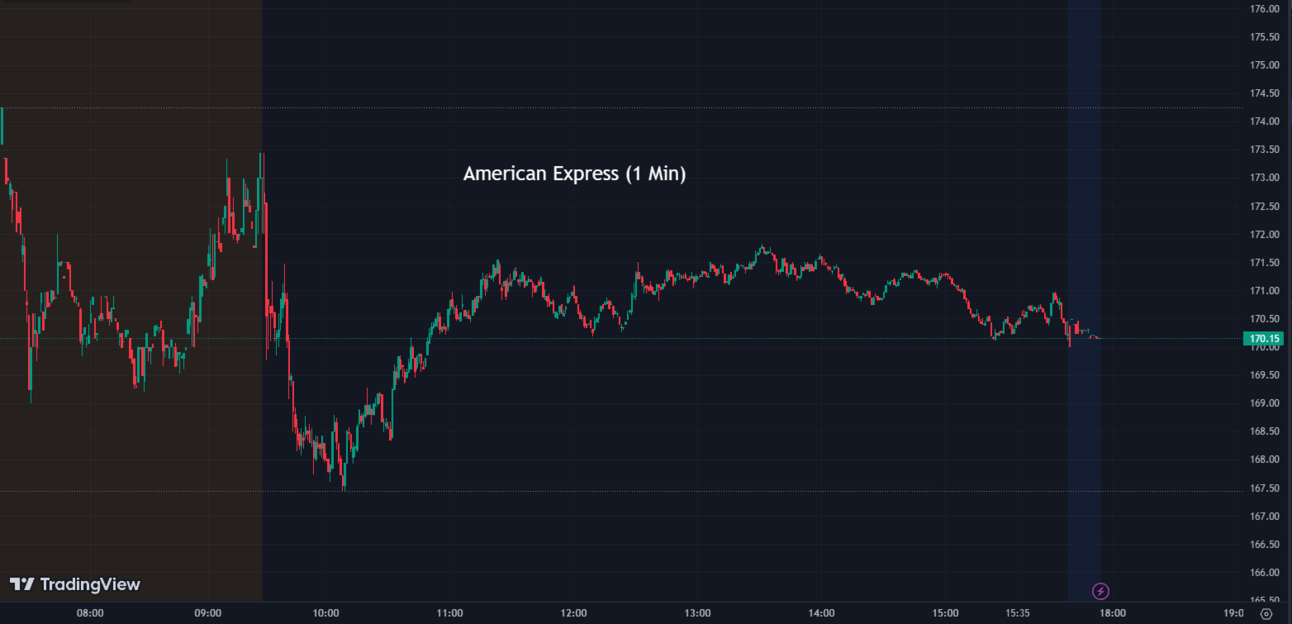

American Express (AXP) experienced a decline of almost 4% in its shares after reporting second-quarter revenue of $15.05 billion, falling short of the expected $15.48 billion from analysts. However, American Express managed to beat expectations in terms of earnings per share.

AXP:

170.22 ▼ -6.89 (-3.89%) Today

170.16 ▼ -0.06 (-0.035%) After Hours

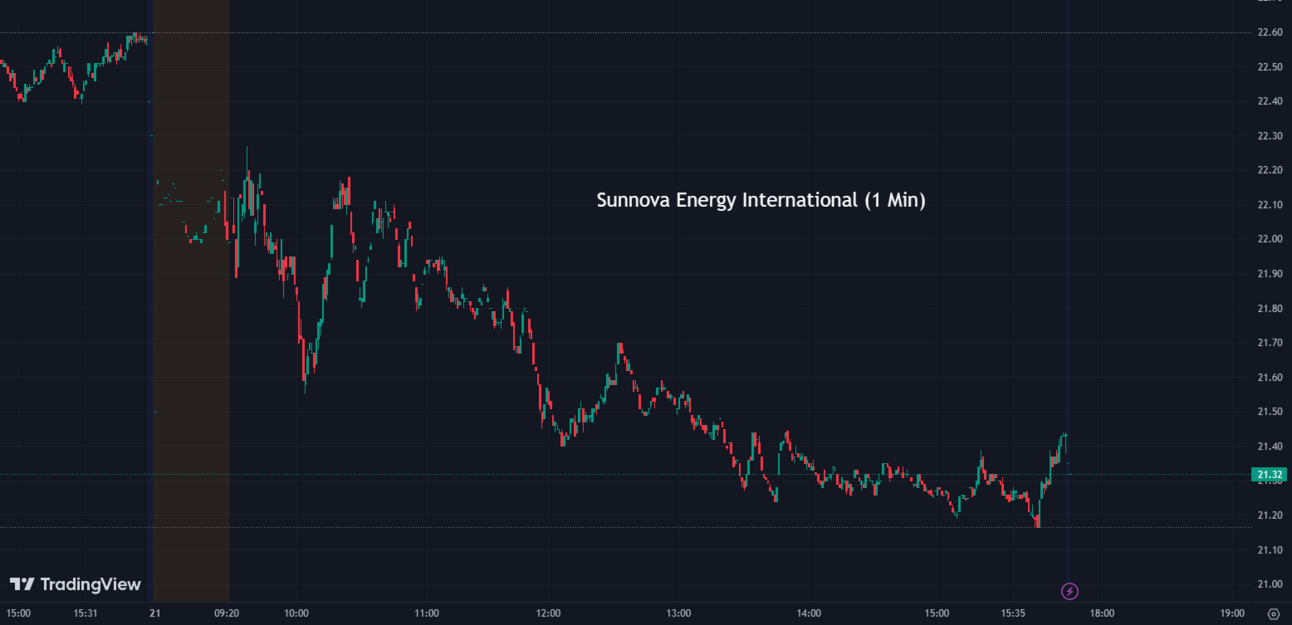

Sunnova Energy International's (NOVA) shares fell over 5% following a downgrade from BMO Capital Markets. While the firm maintains a positive outlook on growth in the long term, it expressed concerns about the challenging macro environment for the residential solar industry in the U.S.

NOVA:

21.44 ▼ -1.14 (-5.05%) Today

21.01 ▼ -0.43 (-2.01%) After Hours

AutoNation (AN) witnessed a 12% tumble, despite reporting second-quarter results that surpassed expectations on both the top and bottom lines. The car dealer posted adjusted earnings of $6.29 per share on revenue of $6.89 billion, outperforming analysts' expectations.

AN:

155.11 ▼ -21.81 (-12.33%) Today

155.89 ▲ +0.78 (+0.50%) After Hours

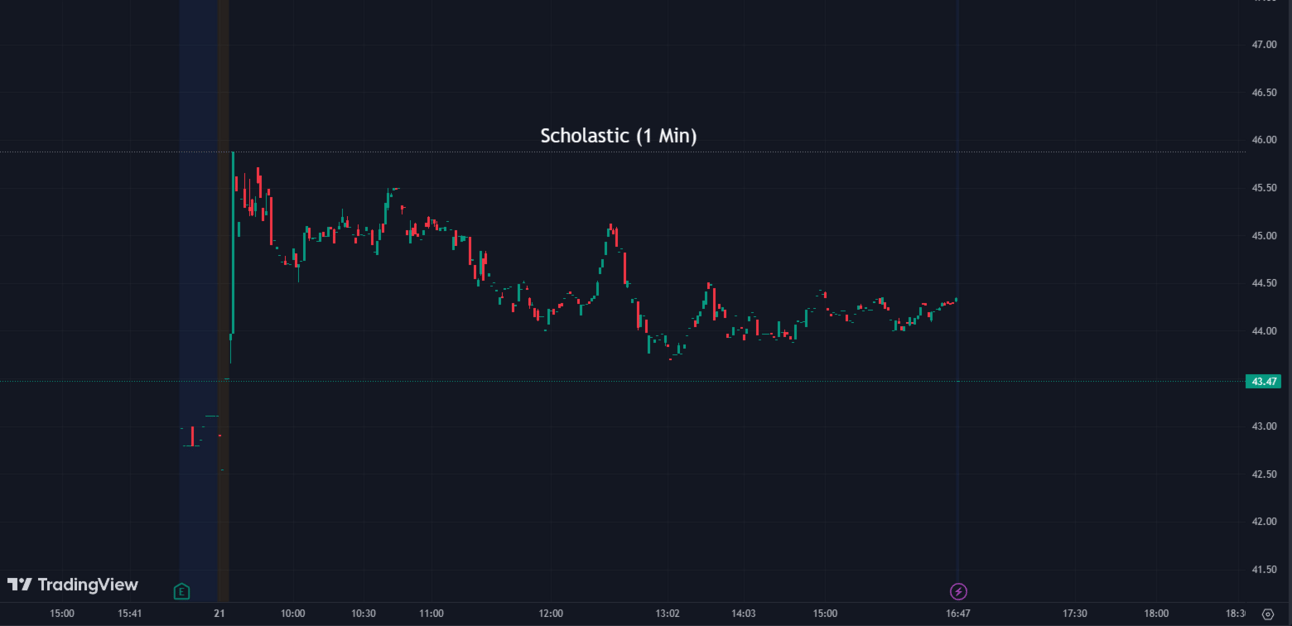

Scholastic (SCHL) saw a remarkable 11.49% increase in its stock price after announcing plans to raise its share repurchase amount by $100 million. Additionally, traders appeared pleased with the company's quarterly performance, where Scholastic reported $2.26 in earnings per share on revenue of $428.3 million.

SCHL:

44.35 ▲ +4.57 (+11.49%) Today

43.47 ▼ -0.88 (-1.98%) After Hours

Sectors 🛢️ 📱

Out of the 11 sectors, 6 closed in positive territory with 1 unchanged today. Utilities led the way with a gain of +1.5%, while Communication Services came in last with a decline of -0.5%.

Conclusion 👋

To wrap it up, Nasdaq's announcement of the rebalancing of the Nasdaq 100 index is a rare move aimed at mitigating concentration risk from dominant companies such as Nvidia, Apple, Microsoft, Amazon, Tesla, Meta Platforms, and Alphabet. With over half of the index's value derived from these seven firms, the reshuffling seeks to reduce their substantial influence and create a more diversified representation of the market. Though the specifics are yet to be unveiled, the reconstitution is expected to cap the aggregate weighting for top stocks below 40%. Despite the impending changes, experts speculate that the rebalancing is unlikely to hinder the overall U.S. stock market rally. On another note, the White House's revelation of leading AI companies' voluntary pledge to manage AI risks reflects a proactive approach toward ensuring responsible and secure AI technology development. Companies like Amazon, Google, Microsoft, and OpenAI are committing to product safety, security, public trust, and investment in cybersecurity to protect AI models. The market's performance has been mixed today, with the Dow Jones Industrial Average closing in positive territory while the Nasdaq Composite and Nasdaq-100 experienced slight declines. Individual stocks like Sirius XM and AMC Entertainment faced notable movements due to various factors, while the establishment of EV battery plants influences labor talks between UAW and major automakers. Amidst these market dynamics, companies like Amazon and Spotify are making strategic moves to expand their services and enhance profitability. Have a good weekend everyone!

Thank you all for signing up!

Will only work to do better for you all going forward. Our only goal is to add value to everyone’s trading with key levels and the ability of learning charts and price action.

Please Share Our Newsletter it will be much appreciated!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of TradingView. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.