Hi, Traders! As the day comes to an end, we are excited to have you here for an insightful recap of the noteworthy events that have influenced the financial markets today.

FTC and DOJ Release New Merger Guidelines, Prioritizing Competition for Workers and Impact of Acquisitions 📄🖊️

The Federal Trade Commission (FTC) and the Department of Justice (DOJ) released new guidelines for evaluating mergers. The guidelines focus on the impact of mergers on competition for workers and how a series of acquisitions, rather than one-offs, could result in harmful effects on the market. The guidelines apply to both vertical and horizontal mergers. They include 13 points that the agencies will use to decide whether to block a merger. The FTC and DOJ said that the guidelines reflect their updated approach to enforcing merger law, emphasizing that the law itself has not changed. They said that the agencies assessed the more than 5,000 comments they received when embarking on the project. The public has until Sept. 18 to submit comments on the draft guidelines. The agencies will then review those comments as they consider revisions ahead of final publication. Once they're finalized, the longevity of the new guidelines could depend on political power dynamics after the next presidential election in 2024.

Indexes 📈💹

The indices experienced an upward trend with the corporate earnings season progressing. Now, let's explore how the market performed today...

The S&P 500 (SPX) was up +0.24% coming to a conclusion at 4,565

The Nasdaq Composite (IXIC) escalated by +0.03% to settle at 14,358

The Dow Jones Industrial Average (DJI) climbed +031% to finish at 35,061

The Russell 2000 (RUT) increased by +0.45% ending the day at 1,984

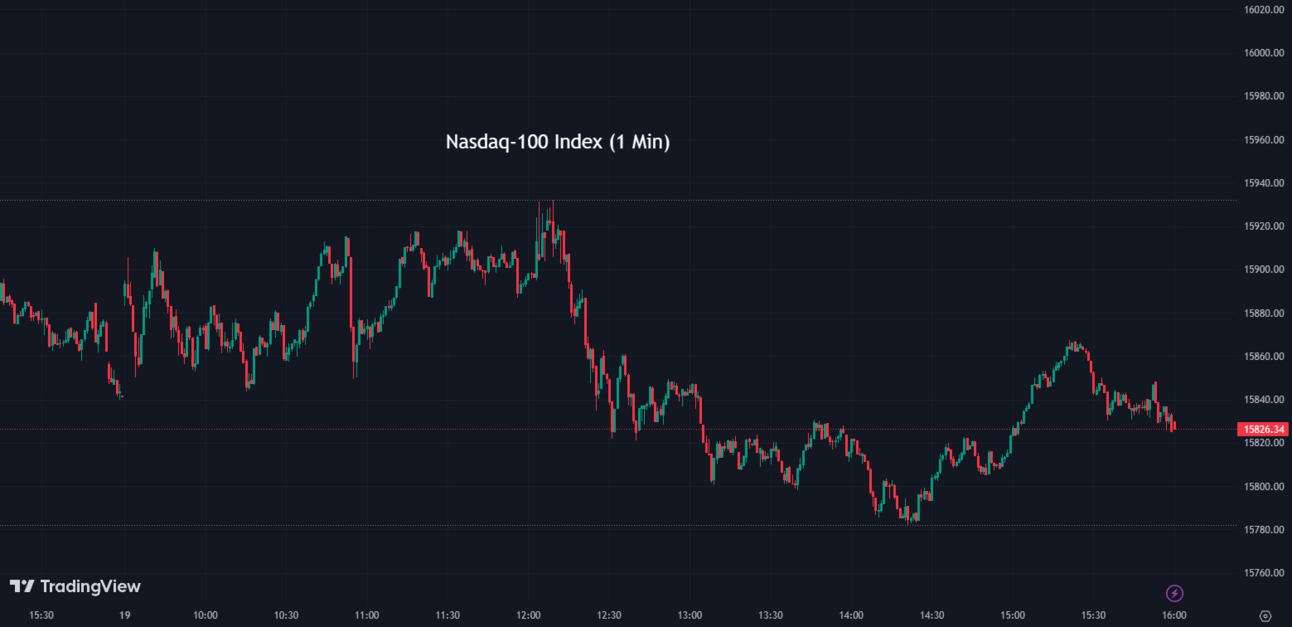

The Nasdaq-100 (NDX) slipped -0.09% to conclude at 15,826

Hello, everyone! 👋 We wanted to kindly remind you about our exciting news. We're absolutely delighted to present a remarkable newsletter specially curated to help you navigate the world of finance. And don't worry if it slipped your mind, because as a gesture of our gratitude, we have a special offer for all of you. Take advantage of an exceptional 20% lifetime discount on your subscription! This is our humble way of expressing appreciation for your ongoing support. Feel free to click the link below to explore the countless benefits that await you.

AT&T Stock Rises as Analysts Estimate Potential Cost of Lead-Clad Cables Exposure 💰🔍

AT&T's stock (T) rose over 8% after a court filing detailed the company's lead-clad cables exposure, providing insight into the potential removal cost. Analysts from Goldman Sachs and Morgan Stanley estimate this could cost AT&T up to $4 billion, with the company's market cap having fallen nearly $15 billion. AT&T, Verizon (VZ), and Frontier Communications (FYBR) shares all rallied following this disclosure. Both Goldman Sachs and Morgan Stanley based their calculations on the removal cost for about 60,000 miles of lead-clad cables not buried or in conduits, assuming the cost per mile listed in the court filing would be more expensive as those cables are underwater. The report follows the Wall Street Journal revealing that these cables have contaminated many parts of the country, prompting several firms to downgrade the telecom stock due to the "unquantifiable" potential liability.

T:

14.59 ▲ +1.14 (+8.48%) Today

14.62 ▲ +0.03 (+0.21%) After Hours

Apple Stock Rises Amid Reports of Internal Development of AI-Language Model 🍎📈

Apple's (AAPL) stock increased following a report that the company is developing its own AI large language model internally. Referred to as "Apple GPT" by some, this move suggests that Apple is seriously considering integrating recent advances in AI technology into future products. The company has already built a chatbot via an internal AI foundation called Ajax, with limited access within Apple. There is speculation that the company might announce a significant AI-related development next year. Apple's engagement with AI tech signals the company's intention to stay abreast of trends, despite competitors like Microsoft, Google, Amazon, and Meta already having integrated similar technology into their products.

AAPL:

195.10 ▲ +1.37 (+0.71%) Today

194.78 ▼ -0.32 (-0.16%) After Hours

Carvana Stock Surges as Company Announces Debt Reduction and Capital Raise Plan 🚗📈

Carvana (CVNA) has negotiated a deal with noteholders to cut its total outstanding debt by over $1.2 billion. The used car retailer also plans to sell up to $1 billion in shares to raise capital and restructure its operations. This news led to a significant increase in the company's stock price. The agreement will reduce Carvana's required cash interest expense by over $430 million per year for the next two years and eliminate over 83% of its 2025 and 2027 unsecured note maturities. Carvana's CFO, Mark Jenkins, stated that the agreement would significantly increase the company's financial flexibility.

CVNA:

55.91 ▲ +16.11 (+40.48%) Today

60.00 ▲ +4.20 (+7.53%) After Hours

Netflix Discontinues Most Affordable, Ad-Free Subscription Option to Encourage Ad-Supported Plan Adoption 📺💲

Netflix (NFLX) has ceased offering its most affordable, ad-free subscription option to new subscribers in both the U.S. and the U.K. This move closely follows the launch of Netflix's less expensive, ad-supported subscription plan. The new strategy aims to encourage more customers to opt for the ad-supported package, providing an affordable entry point while generating ad revenue for the streaming giant. The company's Basic plan, previously priced at $9.99 with no advertisements, no longer appears as an option on Netflix's subscription plans and pricing page. This shift is also in conjunction with the company's efforts to discourage password-sharing among users who don't live in the same household. With this two-pronged approach of driving subscribers towards the ad-supported plan and curtailing password sharing, Netflix seems to be focusing on expanding its customer base while maximizing revenue potential.

NFLX:

477.59 ▲ +2.79 (+0.59%) Today

450.70 ▼ -26.89 (-5.63%) After Hours

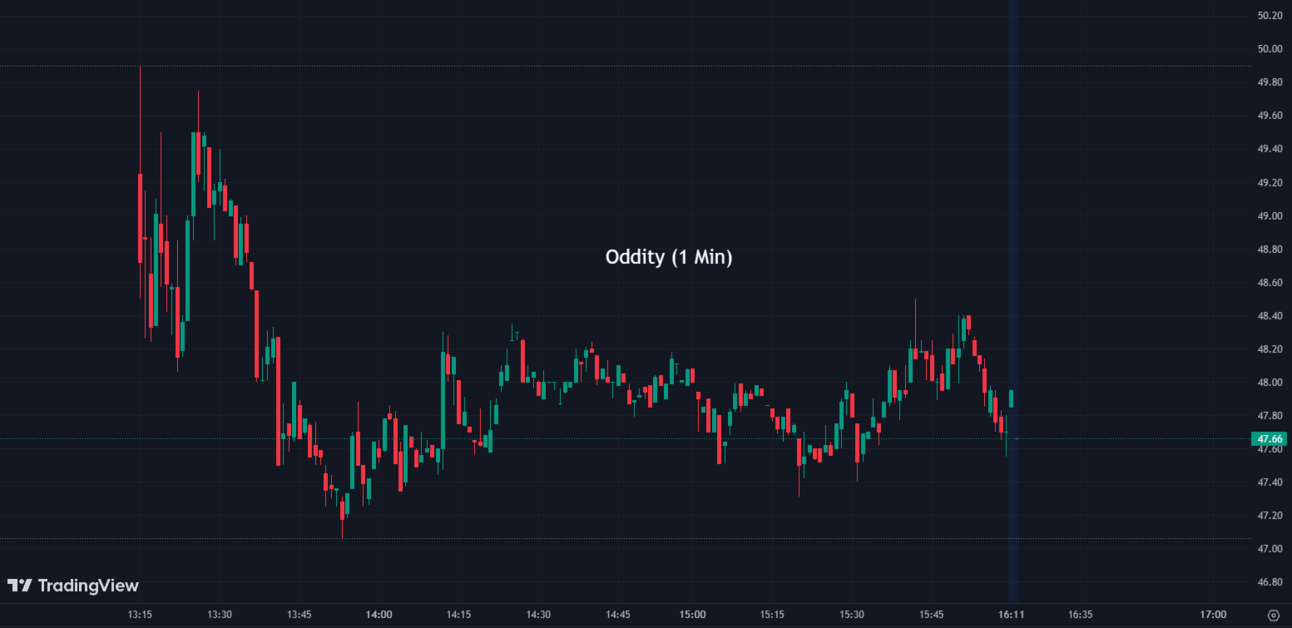

Oddity Tech Makes Successful IPO Debut with 35% Stock Surge 🎉💼

Oddity Tech (ODD), an innovative beauty and wellness firm known for employing AI to develop cosmetics, had a successful debut on the public markets, with its stock closing 35% higher. This close gave the company, which stands behind the Il Makiage and Spoiled Child brands, a market valuation of approximately $2.7 billion. The company and its shareholders, including private equity firm L Catterton, raised about $424 million through the IPO, which saw the company sell 12.1 million shares. Founded by siblings Oran Holtzman and Shiran Holtzman-Erel in 2018, Oddity differentiates itself from other direct-to-consumer retailers that went public in 2021 by not only growing but also achieving profitability. The company, which utilizes proprietary technology to collect data from its millions of users and develop brands, has plans to launch more brands and use the proceeds from its IPO to invest more in data, technology, and product development.

ODD:

47.53 ▲ +12.53 (+35.80%) Today

47.60 ▲ +0.07 (+0.15%) After Hours

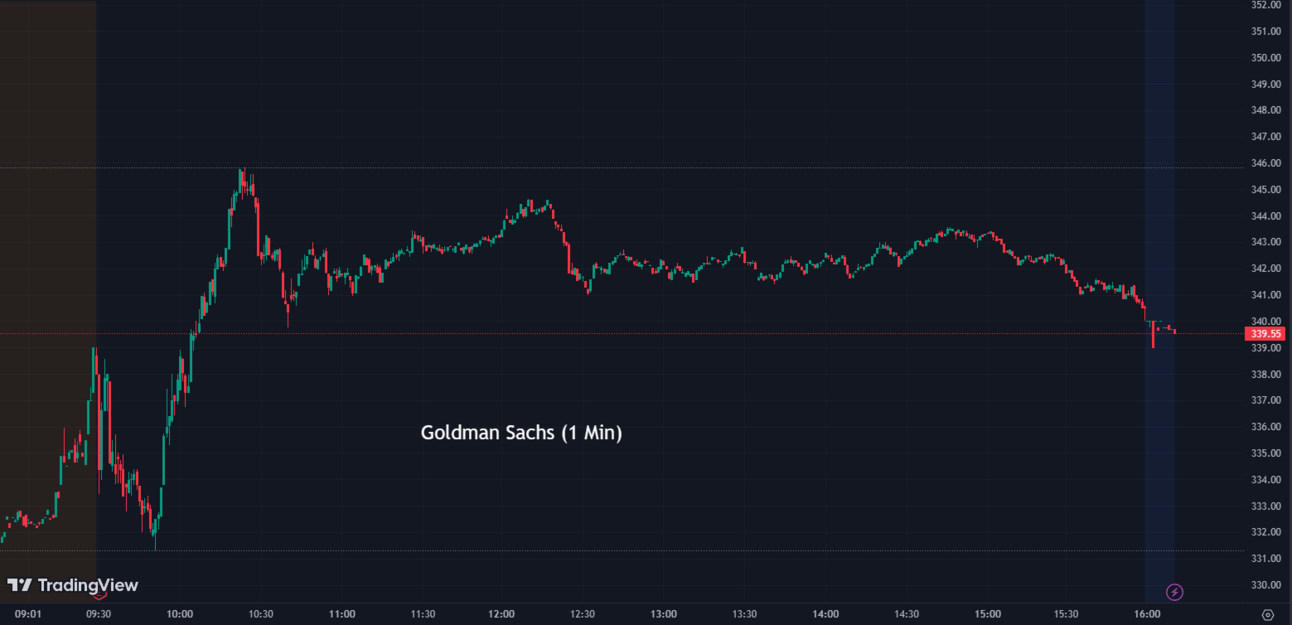

Goldman Sachs Q2 Earnings Fall Short, Impacted by Impairments and Real Estate Write-Downs 💼📉

Goldman Sachs (GS) reported a disappointing Q2, with earnings of $3.08 per share, falling short of the expected $3.18. This was attributed to a $504 million impairment connected to GreenSky, along with $485 million in real estate write-downs. Despite this, there remains $625 million in intangible value within GreenSky, which could potentially be marked down in future quarters. Quarterly profit fell 58% to $1.22 billion, with the bank facing challenges due to decreases in trading and investment banking. Additionally, the company's revenue dropped 8% to $10.9 billion. CEO David Solomon is navigating a difficult landscape with a slump in key business areas and forewarned write-downs on commercial real estate and impairments related to the proposed sale of the GreenSky lending unit. The bank has been reeling back from consumer banking, incurring expenses linked to the downsizing of the business. However, Solomon affirmed his confidence in the bank's strategic execution and its ability to provide value for shareholders.

GS:

340.46 ▲ +3.19 (+0.95%) Today

339.50 ▼ -1.05 (-0.31%) After Hours

Big Stocks Earnings 📆💵

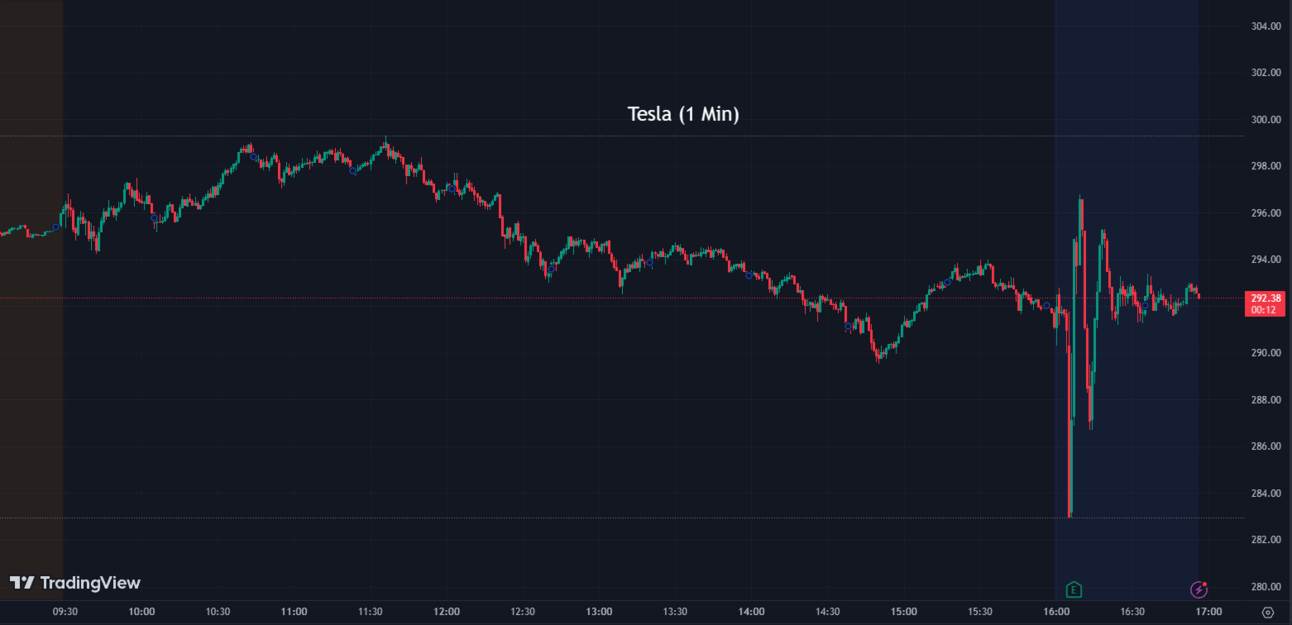

Tesla (TSLA) reported all-time high quarterly revenue, reaching $24.93 billion, which exceeded expectations. However, the company's operating margin dropped to 9.6% due to price cuts and incentives. Net income (GAAP) increased by 20% from the previous year to $2.70 billion, while operating income decreased by 3% to $2.40 billion compared to the year-ago quarter. Tesla's lower margins were attributed to reduced average sales prices, the cost of ramping up production of in-house-designed battery cells, and other factors. Revenue from Tesla's automotive business increased by 46% year-over-year to $21.27 billion, while energy generation and storage revenue rose by 74% to $1.51 billion. Tesla's research and development costs increased to $943 million, with a focus on AI development and the production of Dojo "training computers." The company also provided updates on its Cybertruck production, battery cell development, humanoid robot, and plans for a new factory in Mexico.

TSLA:

291.26 ▼ -2.08 (-0.71%) Today

289.26 ▼ -2.00 (-0.69%) After Hours

IBM (IBM) reported better-than-expected earnings for the second quarter, with adjusted earnings per share of $2.18, exceeding the expected $2.01. However, revenue fell short of consensus estimates, coming in at $15.48 billion compared to the expected $15.58 billion. Net income for the quarter rose 13% to $1.6 billion. IBM's adjusted gross margin of 55.9% exceeded expectations, driven by a more profitable mix of products and productivity initiatives. The software division was the company's fastest-growing segment. IBM reiterated its outlook for 3% to 5% revenue growth for the year and expects around $10.5 billion in free cash flow in 2023. The consulting segment grew nearly 6%, while the infrastructure division, including mainframe sales, declined 14.6% due to lower revenue from Z Systems servers.

IBM:

135.48 ▲ +0.12 (+0.089%) Today

134.60 ▼ -0.88 (-0.65%) After Hours

Netflix (NFLX) impressed Wall Street with a surprising increase of 5.9 million subscribers in the second quarter, surpassing analysts' average estimate of 1.82 million. The company reported fiscal second-quarter net earnings of $1.49 billion, or $3.29 a share, compared to $3.20 a share in the same period last year. However, lighter-than-expected revenue and sales projections led to a nearly 7% drop in the company's shares during after-hours trading. Netflix's free cash flow for the quarter was an impressive $1.3 billion, compared to nearly breakeven in the previous year. The company recently ended its basic streaming plan in the U.S. and U.K. and is focusing on adding more subscribers to its ad-supported service. Netflix is also cracking down on password sharing and plans to expand its ad-supported plan to more countries to boost revenue growth in the second half of 2023.

NFLX:

477.59 ▲ +2.79 (+0.59%) Today

450.70 ▼ -26.89 (-5.63%) After Hours

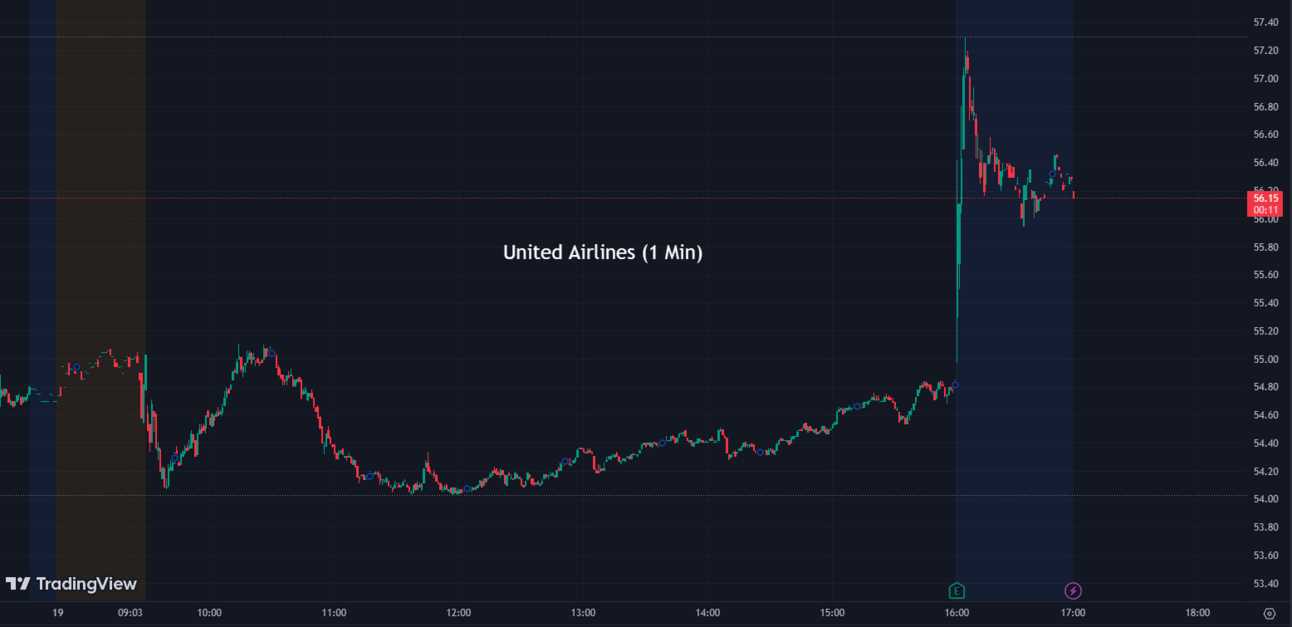

United Airlines (UAL) reported record quarterly earnings for the second quarter and provided a strong forecast for the third quarter, driven by a travel boom and a return of international travel. Despite capacity loss at its Newark hub due to flight disruptions, United surpassed analysts' expectations due to strong demand. The airline's revenue from international flights accounted for about 40% of total sales and is growing faster than domestic sales. United reported adjusted earnings per share of $5.03, higher than the expected $4.03, and total revenue of $14.18 billion, surpassing the expected $13.91 billion. The company's net income was $1.08 billion, compared to $329 million in the same period last year. United expects to grow capacity by 16% in the third quarter and post adjusted earnings per share of $3.85 to $4.35. The airline recently reached a preliminary labor deal with its pilots' union, offering raises of up to 40% over four years.

UAL:

54.80 ▲ +0.01 (+0.018%) Today

56.22 ▲ +1.42 (+2.59%) After Hours

Crown Castle (CCI), a real estate investment trust (REIT) based in Houston, reported strong second-quarter results that exceeded Wall Street expectations. The company's funds from operations (FFO), a key measure of profitability in the REIT industry, were $891 million, or $2.05 per share, surpassing the average analyst estimate of $1.99 per share. FFO is calculated by adding back items such as depreciation and amortization to net income. Crown Castle also reported net income of $455 million, or $1.05 per share. The company's revenue for the quarter was $1.87 billion, higher than the expected $1.86 billion. For the full year, Crown Castle expects FFO to be $7.54 per share.

CCI:

113.45 ▲ +2.89 (+2.61%) Today

112.49 ▼ -1.01 (-0.89%) After Hours

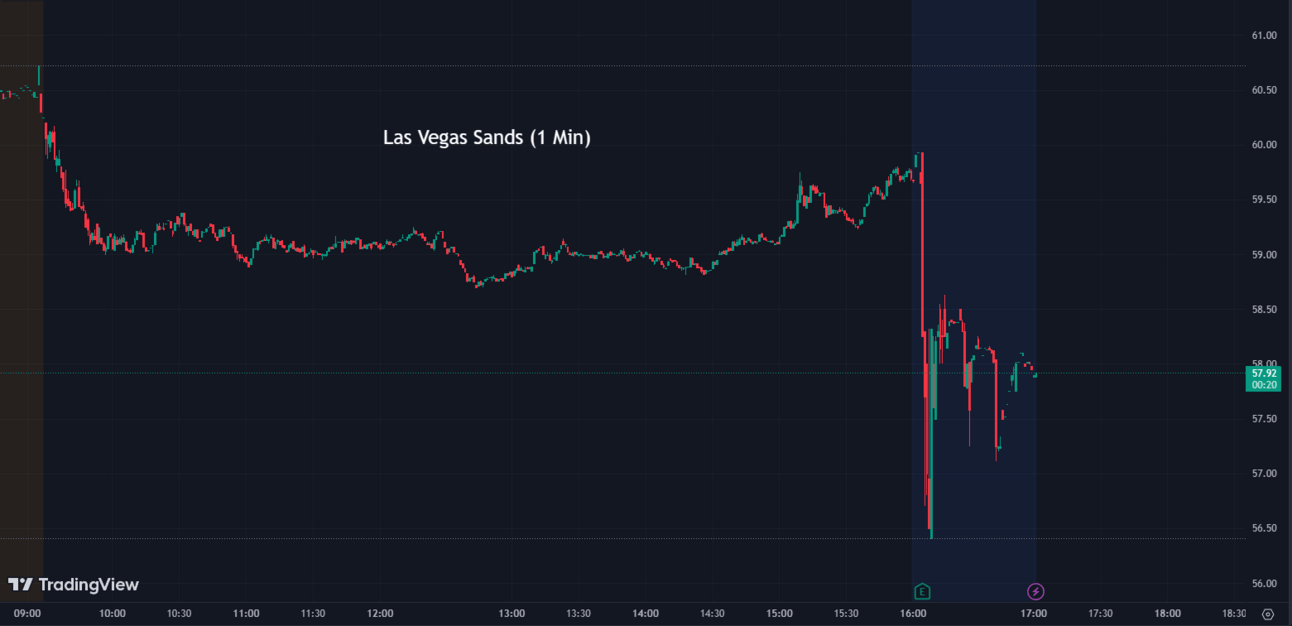

Las Vegas Sands (LVS) beat earnings estimates for the second quarter, but shares fell 2% in after-hours trading due to a still-weak Macau market. The casino company announced the resumption of its dividend at $0.20 per common share and reported a non-GAAP EPS of $0.46, exceeding expectations. Despite visitation to Macau reaching 68% of pre-pandemic levels, investors remained cautious. LVS is considered the best way to play the Macau market and is viewed as a top pick among casino and gaming companies. The company's strong financial position and ongoing investments support future growth opportunities and the return of capital to stockholders.

LVS:

59.67 ▼ -0.33 (-0.55%) Today

58.09 ▼ -1.57 (-2.63%) After Hours

Zions Bancorp (ZION), a regional bank, experienced a 6% rally in its stock following its earnings results that exceeded analysts' estimates. The company reported earnings per share of $1.11 for the second quarter, surpassing the consensus analysts' estimate of $1.08 according to FactSet.

ZION:

34.46 ▲ +2.03 (+6.26%) Today

37.06 ▲ +2.60 (+7.54%) After Hours

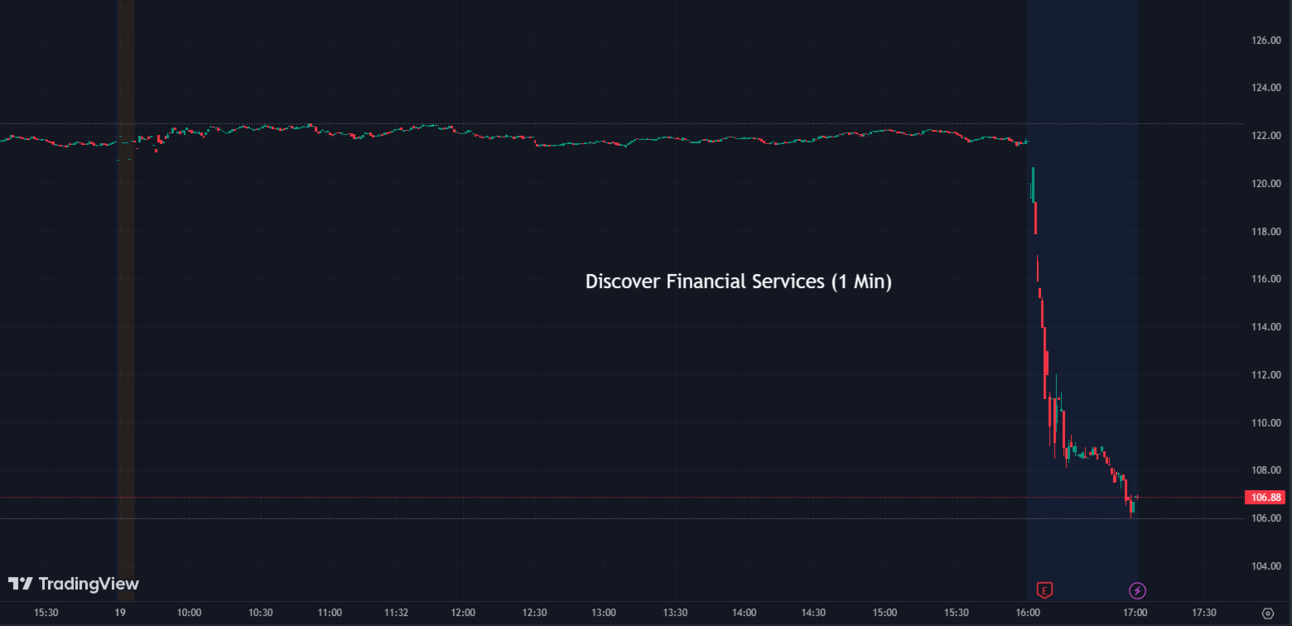

Discover Financial (DFS), a digital banking company, saw a sharp 13% decline in its shares following its second-quarter results, which fell short of analysts' expectations. The company reported earnings per share of $3.54 on revenue of $3.88 billion for the quarter. Analysts had projected earnings per share of $3.67 and revenue of $3.88 billion, according to FactSet. Discover also revealed that it is engaged in discussions with regulators regarding a "card product misclassification" matter and has temporarily halted share buybacks.

DFS:

121.86 ▲ +0.16 (+0.13%) Today

105.98 ▼ -15.87 (-13.02%) After Hours

Sectors

Out of the 11 sectors, 8 closed in positive territory today, with Real Estate leading the way with a gain of +1.12%, while Materials saw a decline of -0.52%.

Conclusion 👋

In summary, today's market recap highlighted the release of new merger guidelines by the FTC and DOJ, with a focus on competition for workers and the impact of acquisitions. The indices showed an overall upward trend, and several stocks, including AT&T, Apple, and Carvana, experienced significant movements driven by various developments and announcements. Netflix's strategic shift to discontinue its most affordable, ad-free subscription option and focus on its ad-supported plan was noteworthy. Additionally, Oddity Tech's successful IPO debut showcased its innovation and profitability in the beauty and wellness industry. Goldman Sachs reported mixed earnings, while Tesla exceeded revenue expectations. IBM reported better-than-expected earnings, and United Airlines achieved record quarterly earnings. On the other hand, Las Vegas Sands faced challenges in the Macau market, and Discover Financial experienced a decline in shares after falling short of analysts' expectations.

Thank you all for signing up!

Will only work to do better for you all going forward. Our only goal is to add value to everyone’s trading with key levels and the ability of learning charts and price action.

Please Share Our Newsletter it will be much appreciated!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of TradingView. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.