Hi, Traders! As the day comes to an end, we are excited to have you here for an insightful recap of the noteworthy events that have influenced the financial markets today.

National Association of Manufacturers Criticizes SEC's ESG Investing Guidelines 🗣️🚫

The National Association of Manufacturers (NAM), representing 14,000 companies, has criticized recent regulatory moves by the SEC related to ESG investing guidelines. NAM claims these changes are harmful to manufacturers, and is urging House lawmakers to rein in proxy voting and limit the shareholder proposals that companies need to disclose. NAM's request is set against the backdrop of ongoing GOP inquiries into ESG investing, as well as upcoming hearings on the influence of proxy voting firms like Institutional Shareholder Services and Glass Lewis.

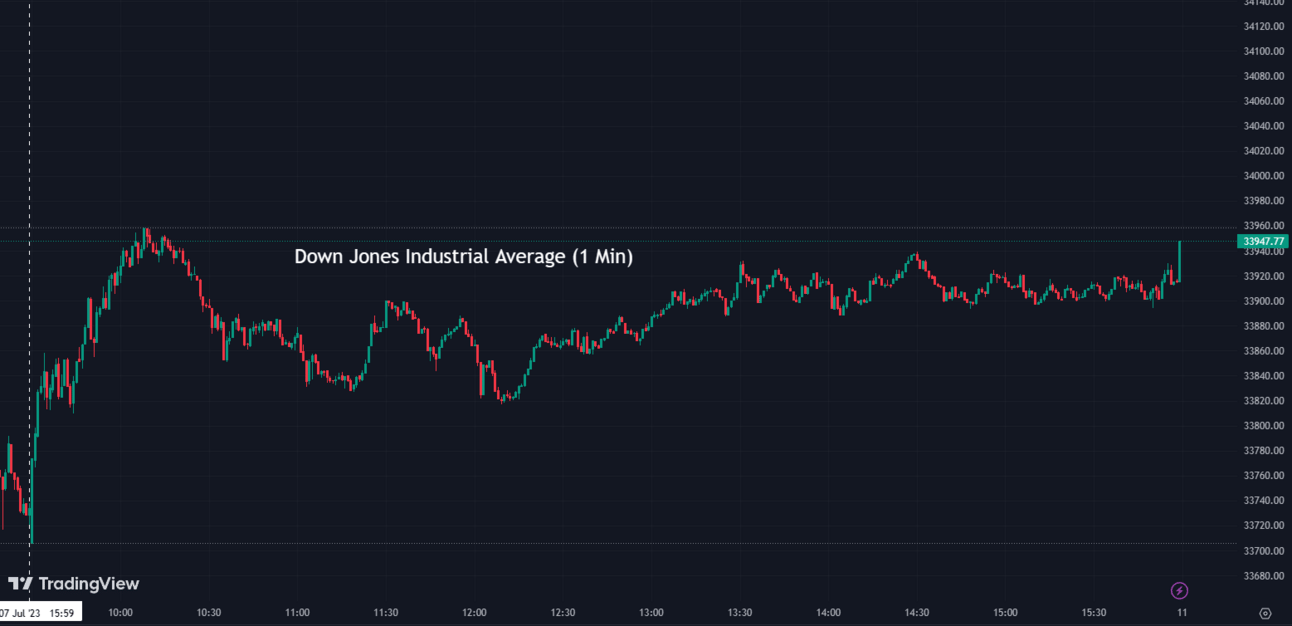

Indexes 📈🔥

The indices experienced an upward trajectory as Wall Street aimed to rebound from a week of losses. This optimistic turnaround occurred as investors readied themselves for upcoming inflation data and anticipated the commencement of the second-quarter earnings season. Now, let's explore how the market performed today...

The S&P 500 (SPX) was up +0.24% coming to a conclusion at 4,409

The Nasdaq Composite (IXIC) escalated by +0.18% to settle at 13,685

The Dow Jones Industrial Average (DJI) climbed +0.62% to finish at 33,944

The Russell 2000 (RUT) increased by +1.64% ending the day at 1,895

The Nasdaq-100 (NDX) rose +0.06% to conclude at 15,045

Hello, everyone! 👋 We wanted to kindly remind you about our exciting news. We're absolutely delighted to present a remarkable newsletter specially curated to help you navigate the world of finance. And don't worry if it slipped your mind, because as a gesture of our gratitude, we have a special offer for all of you. Take advantage of an exceptional 20% lifetime discount on your subscription! This is our humble way of expressing appreciation for your ongoing support. Feel free to click the link below to explore the countless benefits that await you.

Carl Icahn's Amended Loan Agreements Provide Reprieve from Collateral Pressure on Icahn Enterprises Shares 📜💼

Carl Icahn has managed to secure amended agreements with banks that disconnect his personal loans from the trading price of his company’s shares (Icahn Enterprises LP - IEP), increase his collateral, and set up a plan to fully repay the borrowings in three years. This comes over two months after a short-selling report by Hindenburg Research. Approximately 60% of Icahn's shares in IEP had been pledged as collateral for personal loans, with his lenders urging him to pledge more as the stock declined. Icahn, who has $3.7 billion in loans, agreed to supply extra collateral and set up a repayment schedule with his banks.

IEP:

34.69 ▲ +5.83 (+20.20%) Today

34.69 ▼ -0.0001 (-0.00029%) After Hours

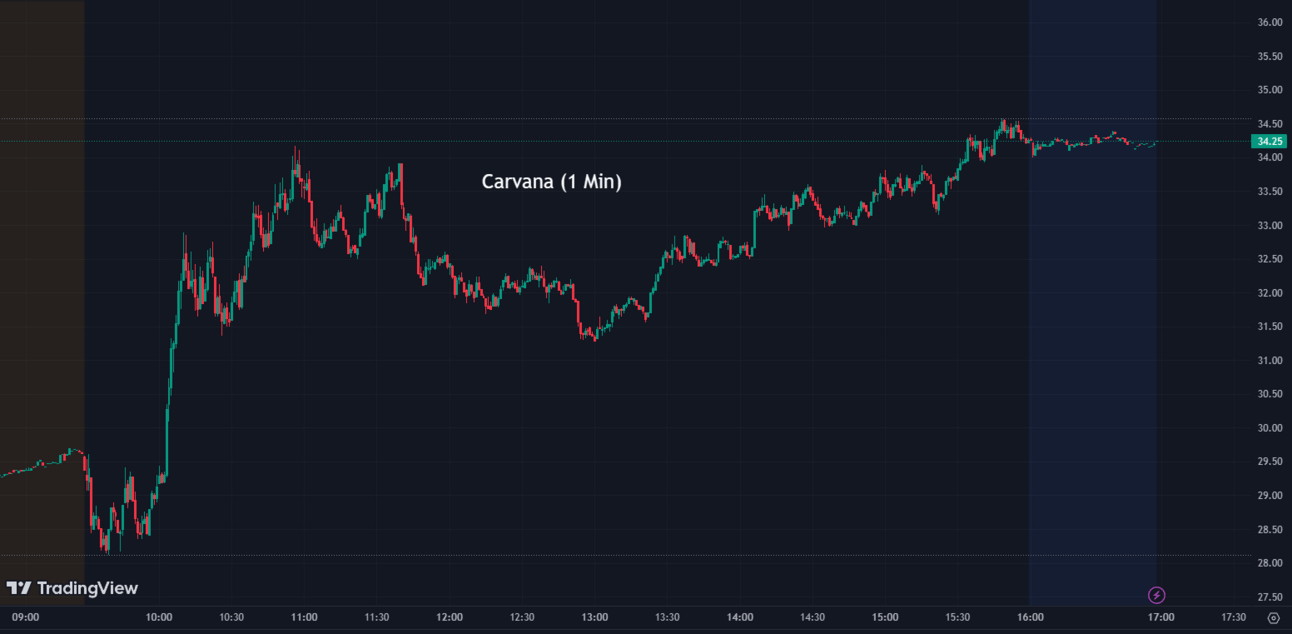

Carvana Sees Exponential Growth in Used EV Sales 🚗📈💥

Online used car retail pioneer Carvana (CVNA) has released its top ten best-selling electric vehicles (EVs) for the first half of 2023, revealing an exponential growth in used EV unit sales. According to the data, Carvana's total EV unit sales have skyrocketed by 786% in the past five years, with the Tesla Model 3 leading as the most sold EV. Other popular models include the Nissan LEAF, BMW i3, and Chevrolet Volt. In addition, a Cox Automotive Study from June 2023 highlights that 87% of new EV buyers are open to a fully online purchasing experience, a domain where Carvana excels. Kevin Fitzgerald, Carvana's Director of Inventory Purchasing, emphasized that the company offers over 46 EV makes and models, with over 40% of their EV options priced under $25,000. Carvana's customer-centric digital approach, coupled with its expansive variety of affordable EVs, positions it to cater to America's growing interest in electric vehicles.

CVNA:

34.26 ▲ +4.81 (+16.33%) Today

34.20 ▼ -0.07 (-0.20%) After Hours

Cava Stock Surges as Wall Street Provides Positive Coverage and Highlights Growth Potential 🌱🚀

Cava (CAVA), a fast-casual Mediterranean restaurant chain, saw its stock rise by nearly 11% today, with initial coverage on Wall Street showing six Buys, three Holds, and zero Sells. The company, which debuted publicly on June 15, reached a valuation of $4.8 billion. Analysts highlight Cava's strong annual unit volume, unit growth opportunity, and potential for substantial operating momentum. The company plans to expand its drive-thru facilities and is projected to hit bottom-line profitability and positive free cash flow by 2026.

CAVA:

44.00 ▲ +4.38 (+11.06%) Today

44.64 ▲ +0.64 (+1.45%) After Hours

Mattel Stock Surges as Investors Anticipate "Barbie" Movie Success 💃📽️

Mattel (MAT) stock has seen a surge of 13% over the past month. The spike in Mattel's value is primarily driven by the anticipation around its upcoming "Barbie" movie. Mattel's COO, Richard Dickson, says Barbie is now a cultural conversation, and the company hopes to capitalize on this via various means such as licensing of the Barbie name to merchandise and revenues from the movie itself. Analyst Drew Crum predicts that the movie could gross $400 million at the box office. A successful Barbie debut could also open doors for Mattel's other 14 content projects in development.

MAT:

20.99 ▲ +0.51 (+2.49%) Today

21.39 ▲ +0.40 (+1.91%) After Hours

Foxconn Withdraws from $19.5 Billion Semiconductor Joint Venture with Vedanta, Hindering India's Chipmaking Plans 🦊🏭

Foxconn has withdrawn from a $19.5 billion semiconductor joint venture with Indian conglomerate Vedanta (VEDL), disrupting chipmaking plans for India. The decision to terminate the joint venture is mutual, with Foxconn removing its name from the Vedanta entity. Foxconn's move challenges Prime Minister Modi's drive to bolster domestic electronics manufacturing and attract foreign investors for local chip production.

VEDL:

282.25 ▲ +1.70 (+0.61%) Today

HCA Healthcare Faces Major Data Breach with Patient Information Up for Sale 📰👨💻

HCA Healthcare (HCA) has reported that patient data has been hacked and stolen and is now being offered for sale on a data breach forum. Despite the company's claim that no clinical data was compromised, an industry analyst reports a received sample set indicating the contrary, undermining HCA's initial statement. With approximately 27 million rows of data, the breach contains personal information and specific visit records of patients across nearly two dozen states, impacting numerous facilities in Florida and Texas. Although HCA has stated that the breached data originated from an "external storage location used to automate the formatting of email messages," concerns remain high due to the sheer volume and potential sensitivity of the breached data.

HCA:

295.74 ▲ +4.25 (+1.46%) Today

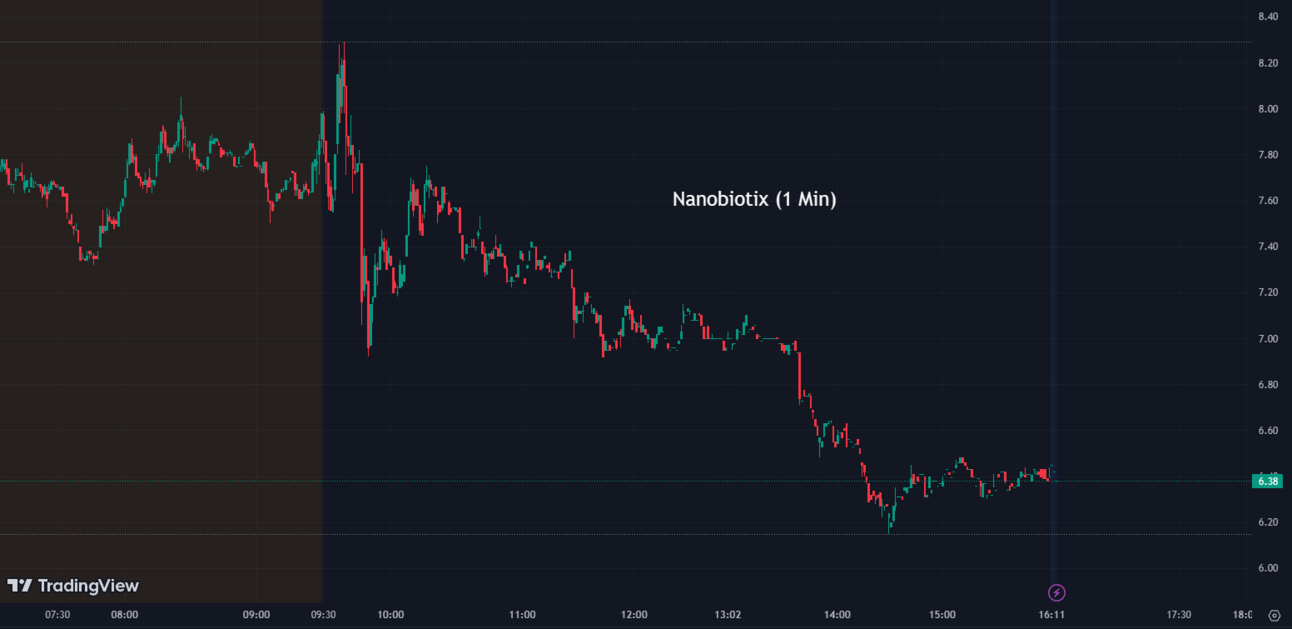

Nanobiotix Enters Licensing and Development Agreement with Janssen for NBTXR3 🧬🤝

Nanobiotix (NBTX) has entered into a global licensing, co-development, and commercialization agreement with Janssen Pharmaceutica, a unit of Johnson & Johnson (JNJ), for the investigational radio enhancer NBTXR3. Under the agreement, Janssen will pay $60 million upfront and pledge up to $1.8 billion in milestones for NBTXR3, a drug designed to enhance radiotherapy for solid tumors. The deal could yield up to $650 million in additional payments for five new indications and up to $220 million per indication that Nanobiotix develops in alignment with Janssen.

NBTX:

6.45 ▲ +1.42 (+28.23%) Today

6.37 ▼ -0.08 (-1.24%) After Hours

JNJ:

159.54 ▲ +0.29 (+0.18%) Today

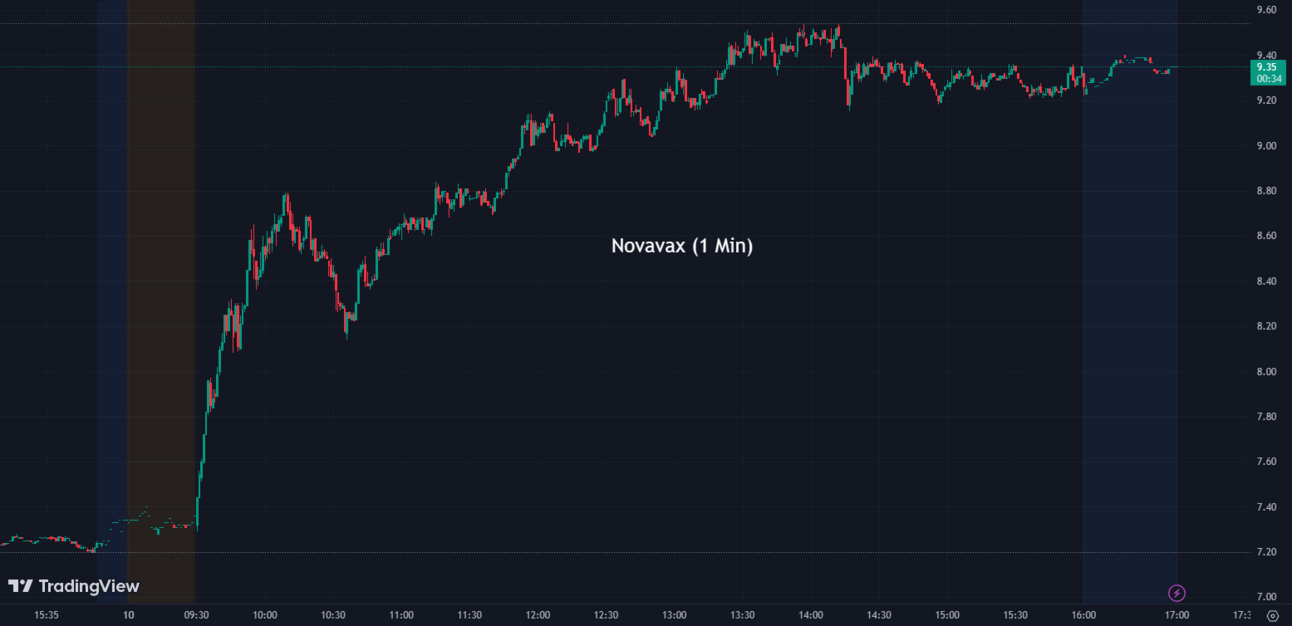

Canada to Pay Novavax $350 Million for Forfeited Covid Vaccine Doses 💰💉

Novavax's (NVAX) stock price saw a significant increase following the announcement that Canada will pay $350 million to the company for forfeiting Covid vaccine doses previously set for delivery. This settlement comes as part of an amended purchase agreement between Novavax and the Canadian government. The funds will be delivered in two equal installments in 2023. While the precise number of unused doses is unclear, Novavax will provide Canada with fewer vaccine doses on a revised schedule under the amended agreement. However, should Novavax fail to gain regulatory approval for vaccine production at a Canadian government biomanufacturing facility by the end of 2024, Canada has the right to terminate the contract. The announcement has bolstered investor confidence, following earlier concerns about Novavax's financial stability.

NVAX:

9.36 ▲ +2.13 (+29.46%) Today

9.39 ▲ +0.03 (+0.32%)After Hours

Twitter Sees User Traffic Slow Down as Meta's Threads Gains Momentum 🚦🐦

User traffic on Twitter has reportedly slowed down following the launch of Meta’s (META) text-based platform Threads. Threads has already gained over 100 million sign-ups since its launch last week. Described as a more positive “public square” for communities by Meta executives, Threads appears to be well-received by users. According to web analytics data from Similarweb, Twitter's web traffic has decreased by 5% in the first two full days of Threads being widely available. Threads' growth has been aided by its connection to Instagram, allowing users to sign up with their existing Instagram handles. Despite not having launched in Europe yet, Threads' rapid user base growth poses a potential challenge to Twitter, which reported nearly 238 million monetizable daily active users in its last quarterly earnings report.

META:

294.10 ▲ +3.57 (+1.23%) Today

293.40 ▼ -0.70 (-0.24%) After Hours

Fisker Stock Rises After Announcing $340 Million Convertible Note Offering 📈💰

Electric vehicle manufacturer Fisker's (FSR) stock rose by 17% following the company's announcement of a $340 million convertible note offering. Fisker intends to use the capital raised for general corporate purposes, including the installation of an additional battery pack line and the development of new products.

FSR:

7.03 ▲ +1.03 (+17.17%) Today

6.97 ▼ -0.06 (-0.85%) After Hours

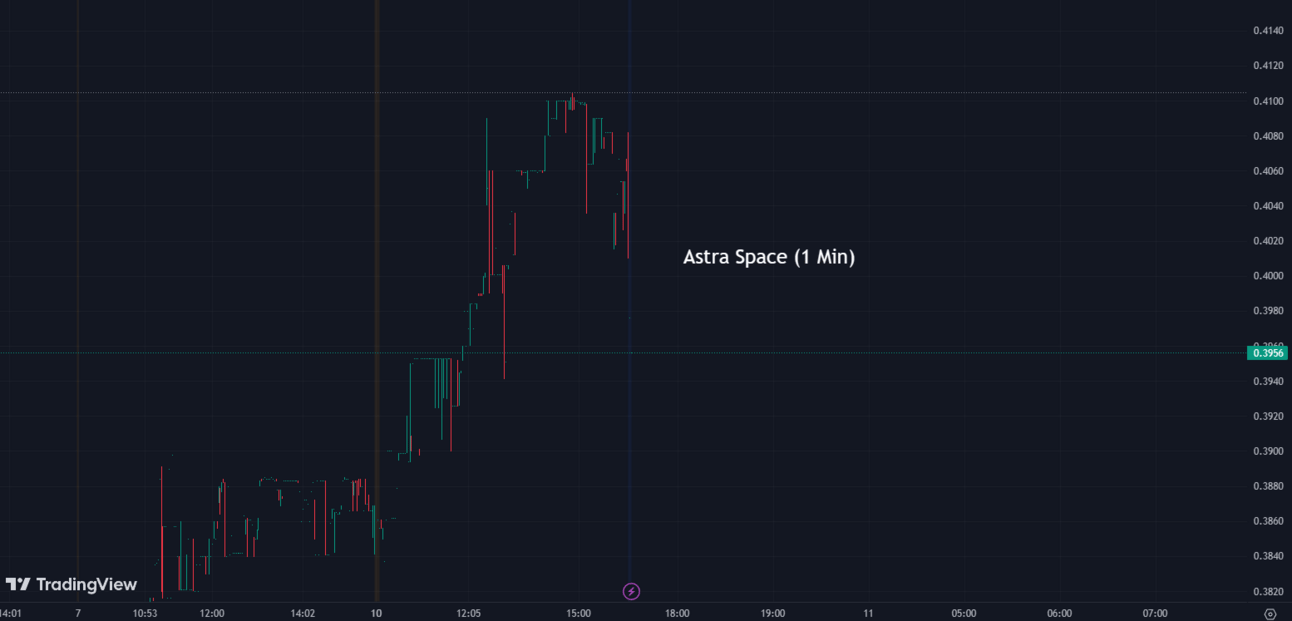

Astra Plans Reverse Stock Split and Common Stock Offering to Avoid Delisting by Nasdaq 🔄💼

Astra (ASTR), a spacecraft engine manufacturer and small rocket builder, plans to conduct a reverse stock split at a 1-to-15 ratio, according to a securities filing. The company is also seeking to raise up to $65 million through an "at the market" offering of common stock. The decision for a reverse stock split is part of Astra's plan to avoid delisting by the Nasdaq exchange, a move expected to take place on or before October 2. Although a reverse stock split doesn't impact the company's fundamentals or valuation, it serves to increase the stock price by combining shares. It's important to note that such a move can be perceived as an attempt to artificially boost a company's stock price when in distress or as a strategy for a viable company with a troubled stock to continue operations on a public exchange.

ASTR:

0.40 ▲ +0.016 (+4.25%) Today

0.40 ▼ -0.002 (-0.50%) After Hours

After Hour Movers ⏰🌙

WD-40 (WDFC) has announced its fiscal third-quarter earnings, reporting a profit of $18.9 million, or $1.38 per share. The San Diego-based maintenance and cleaning product company posted revenue of $141.7 million for the quarter. WD-40 expects its full-year earnings to be in the range of $4.80 to $5 per share, with revenue projected to be between $535 million and $560 million.

WDFC:

193.80 ▲ +3.94 (+2.08%) Today

202.80 ▲ +9.00 (+4.64%) After Hours

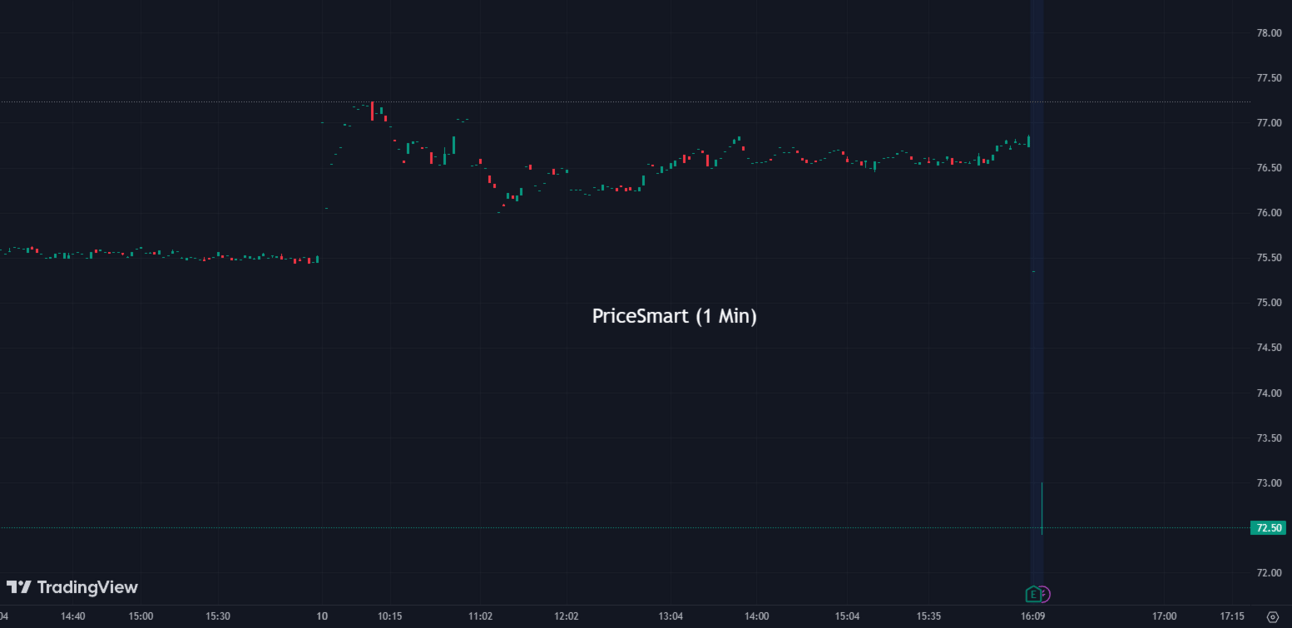

PriceSmart (PSMT) has released its fiscal third-quarter earnings, reporting a net income of $29.6 million, or 94 cents per share. After adjusting for non-recurring costs, the company's earnings per share came to $1.02. PriceSmart posted revenue of $1.1 billion for the quarter.

PSMT:

76.89 ▲ +1.40 (+1.85%) Today

73.00 ▼ -3.89 (-5.06%) After Hours

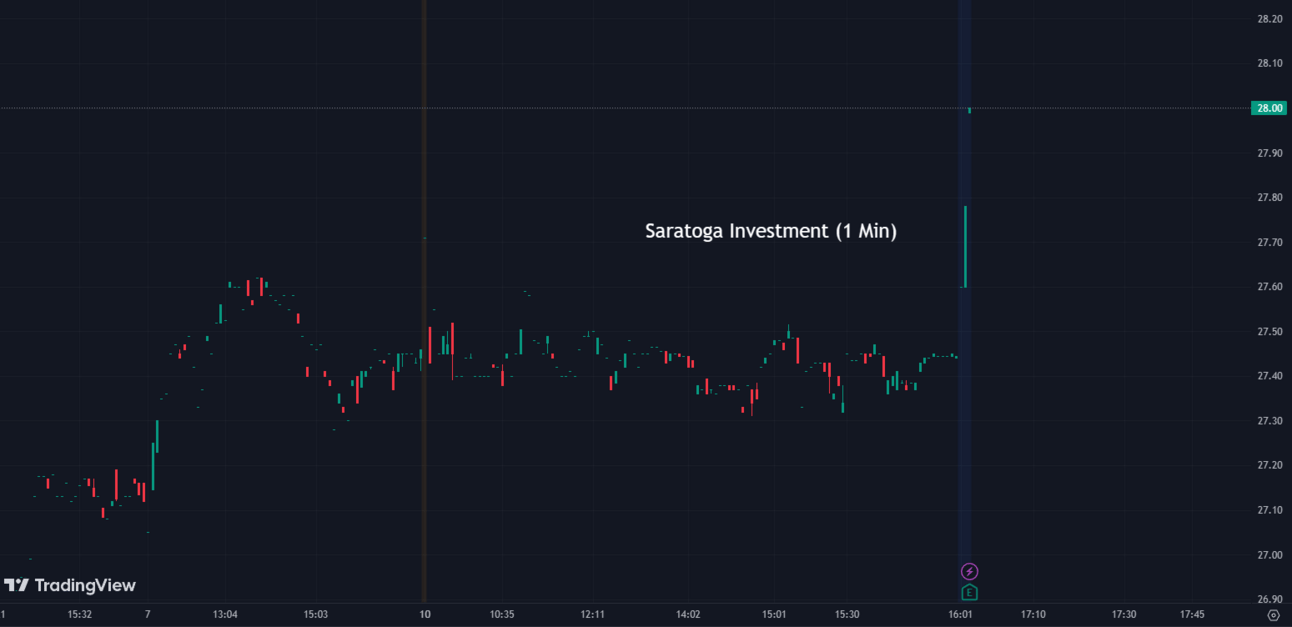

Saratoga Investment (SAR) has announced its fiscal first-quarter earnings, reporting a loss of $213,000, or 2 cents per share. However, after adjusting for one-time gains and costs, the company's earnings per share were $1.08. The results surpassed Wall Street expectations, with analysts estimating earnings of 91 cents per share, according to Zacks Investment Research.

SAR:

27.44 ▲ +0.01 (+0.036%) Today

28.06 ▲ +0.61 (+2.22%) After Hours

EzFill (EZFL) has reported record-high deliveries in the second quarter, leading to an increase in its stock price during after-hours trading. The company stated that it delivered approximately 1.58 million gallons during the quarter, representing the sixth consecutive quarter of increasing deliveries. Furthermore, second-quarter deliveries were 20% higher than the previous quarter and 100% higher compared to the same period last year.

EZFL:

2.20 ▲ +0.02 (+0.92%) Today

2.32 ▲ +0.12 (+5.45%) After Hours

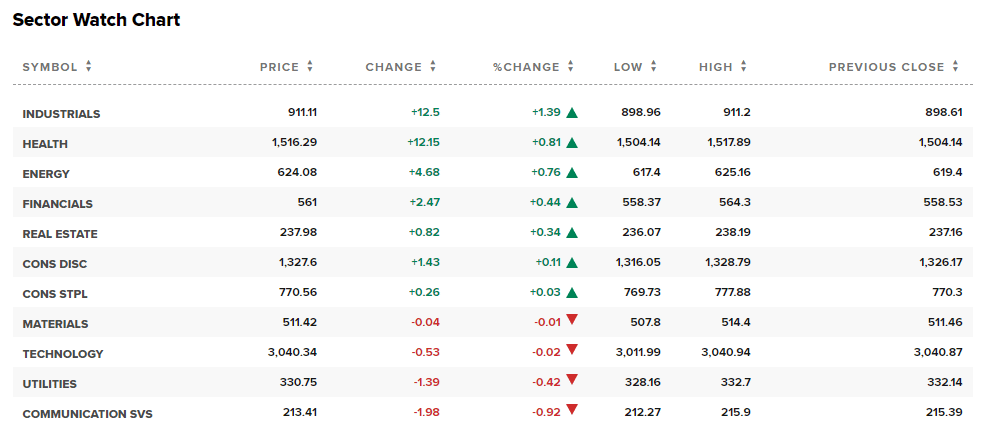

Sectors 🔧📱

Out of the 11 sectors, 7 closed in positive territory today, with Industrials leading the way with a gain of +1.39%, while Communication Services saw a decline of -0.92%.

Conclusion 👋

To wrap it up, today's market activity featured a diverse range of news and developments across various sectors. The National Association of Manufacturers' criticism of the SEC's ESG investing guidelines highlights ongoing debates surrounding proxy voting and shareholder proposals. Meanwhile, indices experienced an upward trajectory as investors prepared for upcoming inflation data and the start of the second-quarter earnings season. Notably, Carl Icahn secured amended loan agreements, providing relief from collateral pressure on Icahn Enterprises shares. Carvana witnessed exponential growth in used EV sales, capitalizing on the growing interest in affordable electric vehicles. Additionally, positive coverage and growth potential propelled Cava's stock, while Mattel's stock surged in anticipation of the success of the upcoming "Barbie" movie. On the other hand, Foxconn's withdrawal from a semiconductor joint venture hindered India's chipmaking plans, and HCA Healthcare faced a major data breach with patient information up for sale. Nanobiotix entered a significant licensing and development agreement with Janssen for NBTXR3, and Canada agreed to pay Novavax $350 million for forfeited COVID vaccine doses. User traffic on Twitter slowed down as Meta's Threads gained momentum, and Fisker's stock rose following a convertible note offering. Astra announced plans for a reverse stock split and common stock offering to avoid delisting by Nasdaq. Finally, several companies reported their earnings, including WD-40, PriceSmart, and Saratoga Investment. Overall, the market exhibited positive sentiment, with the majority of sectors closing in positive territory.

Thank you all for signing up!

Will only work to do better for you all going forward. Our only goal is to add value to everyone’s trading with key levels and the ability of learning charts and price action.

Please Share Our Newsletter it will be much appreciated!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of TradingView. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.