Hi Traders-

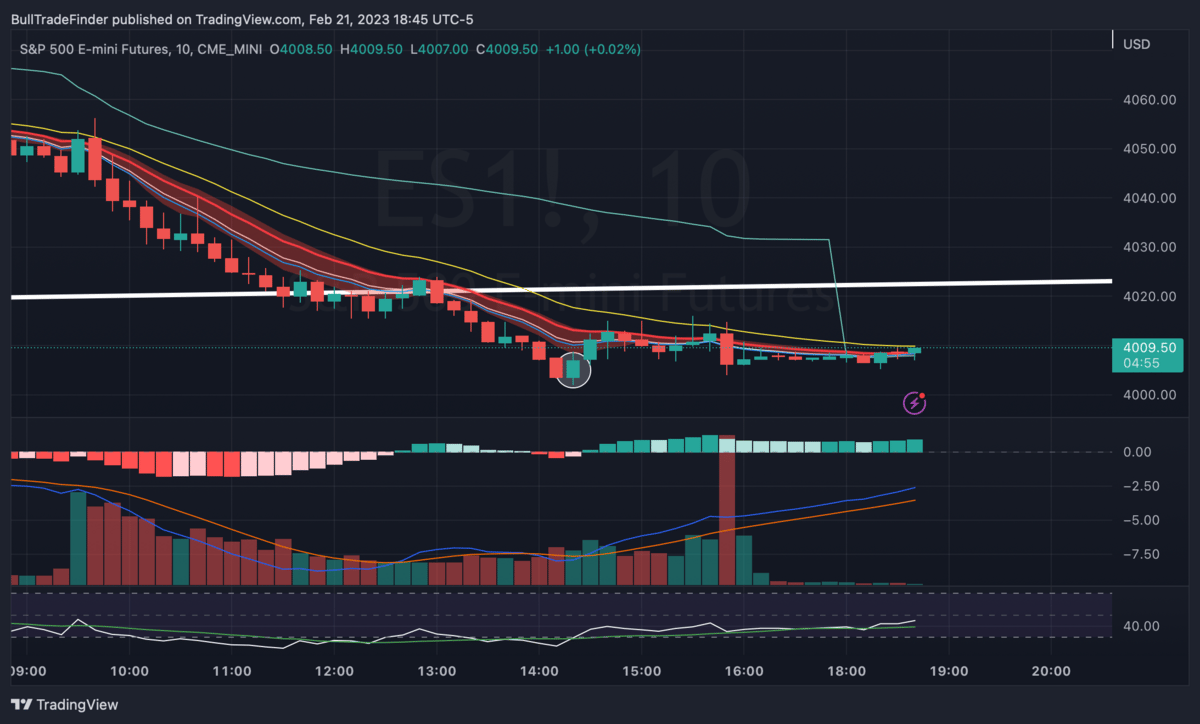

Today was a perfect but slow downtrend day until we came into $3994-$4003 and saw some support that lifted us up 15-16 points from there and just chopped until the rest of the day.

Market is still leaning bearish but does not mean there won’t be some bounces and slick movement in-between.

Key Example Of Tweezer Bottom at $4000 Key Area.

All my levels are associated with $ES_F (S&P 500 Futures for $SPY)

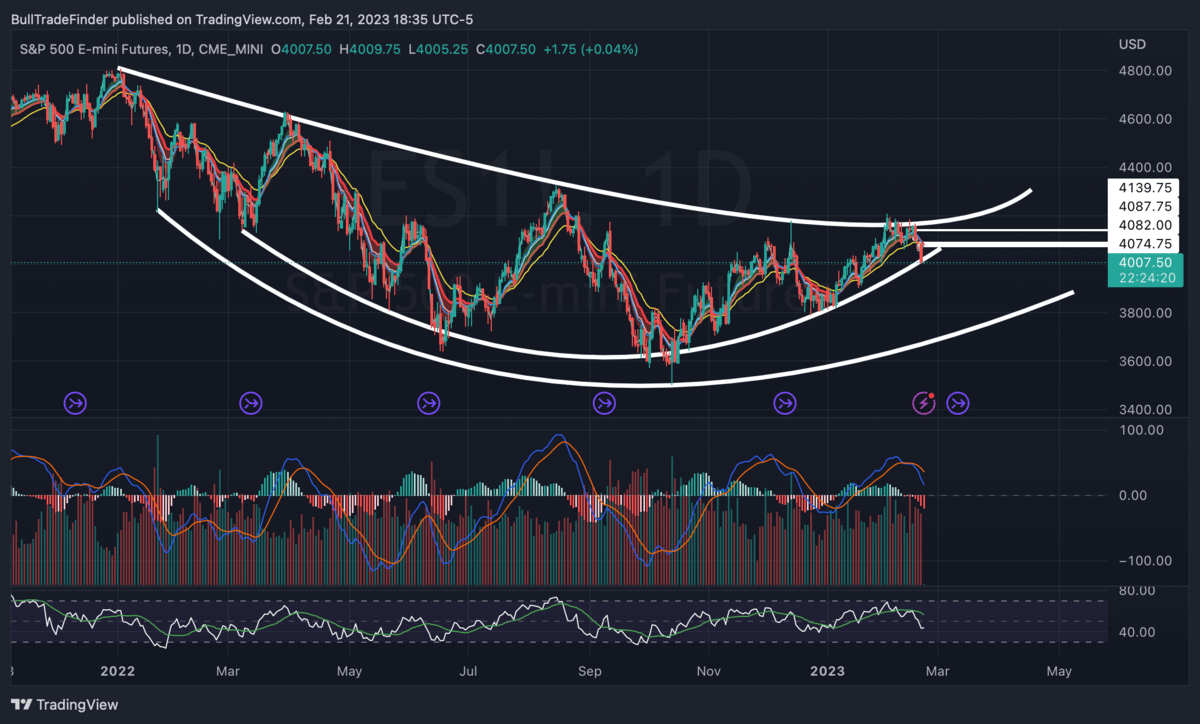

Here is a fun chart I was playing with showing the curvatures of the market we are in now and we are at a key line here around that $4,000 area how funny is that?

Interesting chart with “Possible Curled Supports & Resistances”

SCENARIOS FOR TOMORROW:

Open or offer below $3994 can lead to a larger drop into $3970-$3976 levels. Initial balance will play a big part in this.

Initial Balance is the first hour of trading for example 9:30 to 10:30 A.M. EST.

If we can bid above $4021 and support $3994-$4003 I think we can have a little inside day with some resistances above around 4042-4047 possibly 4054 before 2PM hits when #FOMC minutes are released that should entail a 20-40 point move on the futures.

Thank you all for signing up!

Will only work to do better for you all going forward. Our only goal is to add value to everyone’s trading with key levels and the ability of learning charts and price action.