2/28/ Recap

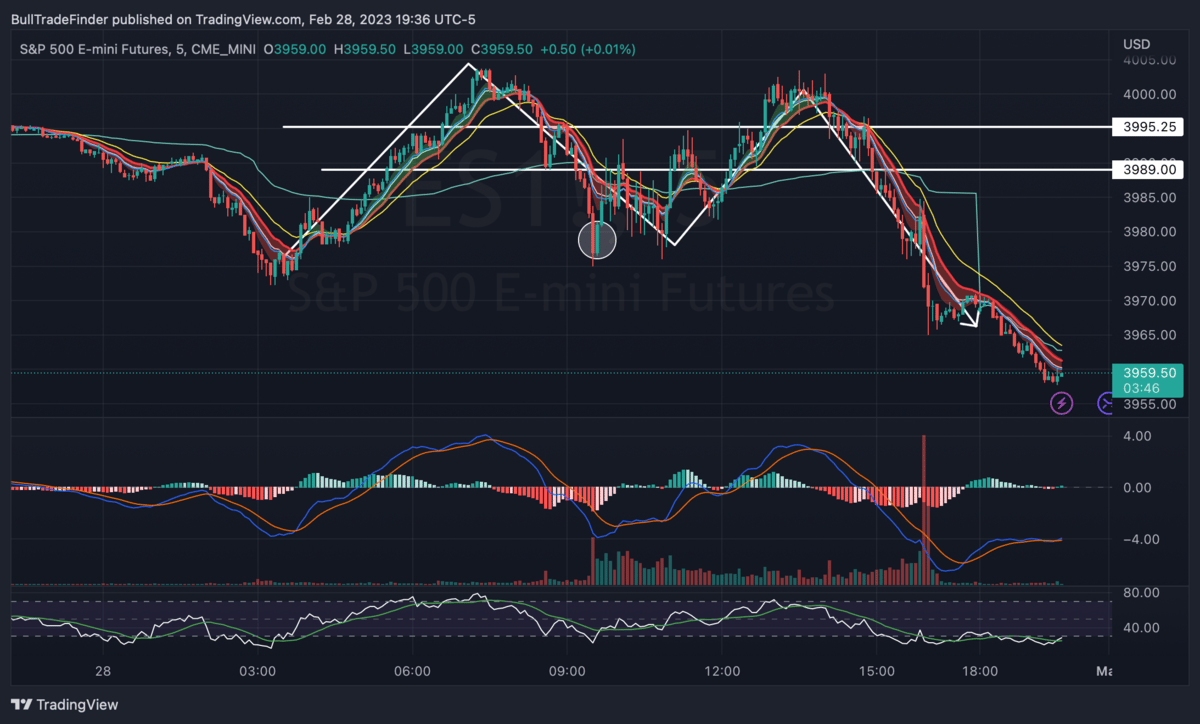

$3970-$3976 held as support all day and we formed a massive M shape setup on the 5 min and all day it played out perfectly.

$4000 and $4003 rejected and we have lower highs repeatedly usually day after day now.

M Pattern $SPY $SPX

3/1 Daily Plan

This is going to be a big day, bears are taking control line in the sand is recent lows at $3947. Under that a water fall effect begins.

Scenario 1 - If bulls let go of $3947 and $3954 it is a free fall to $3930 and $3921. That would be last line before a lower movement if $3917 is breached.

Scenario 2 - Bulls need IB close over $3976 to test a little higher into $3986, $3994 and try to break $4000-$4003 again.

IB close is Initial Balance Close (First Hour Of Trading)

Thank you all for signing up!

Will only work to do better for you all going forward. Our only goal is to add value to everyone’s trading with key levels and the ability of learning charts and price action.

Please Share Our Newsletter it will be much appreciated!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of TradingView. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.